Subscribe now to get notified about IU Jharkhand journal updates!

The Impact of Electronic Payment Innovations on Investor Sentiment: Evidence from SBI

Abstract :

The study examines the factors influencing the adoption of electronic payment Services in the State Bank of India(SBI)using a mixed-methods approach, including surveys, interviews, and data from customers, employees, and managers. A survey of100 bank operations-acquainted respondents found security concerns and ease of use key drivers, emphasizing the need for continuous customer education and personalized banking solutions. SBI should prioritize building customer trust through secure platforms, enhancing user experience, and improving infrastructure for electronic payments, with policy interventions and customer engagement strategies recommended for increased adoption. This study explores the factors influencing the State Bank of India's payments revolution, offering practical insights for banks, regulators, and policymakers promoting fintech adoption in the financial sector.

Keywords :

digital payment methods, Credit cards, electronic wallets, and Commercial banks.JEL Code:

E44, G51,G21

- Introduction:

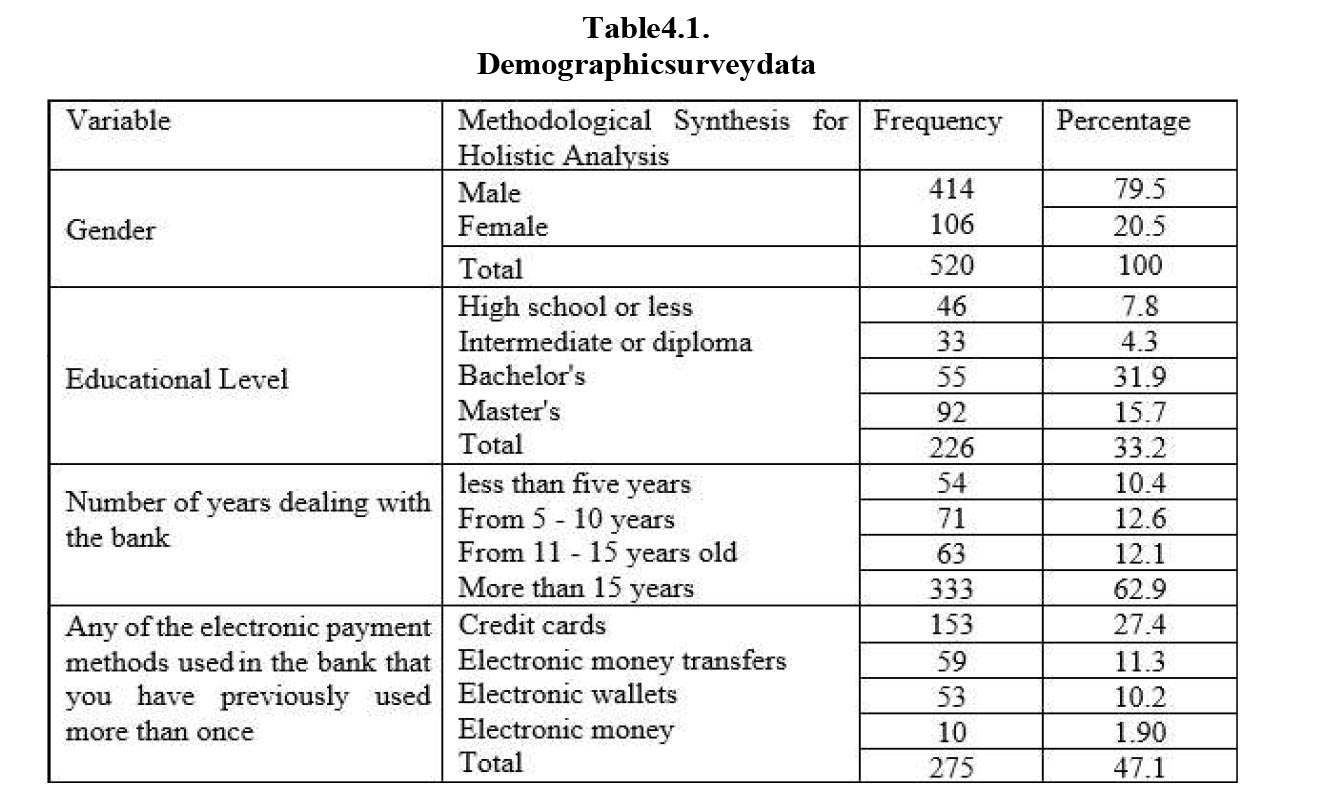

The global technological revolution is significantly impacting various aspects of life, with financial technology emerging as a major advancement area. SBI has embraced this technological change swiftly and is concentrating on building the setup required to facilitate and use these advances. SBI has made significant stridesinthisareaandisnowwell-knownin the Arab world aswellas internationally(Acharya, 2024).The use of digital payment systems, which seek to create a virtual digital landscape by utilizing all available human and material resources, is a critical component of this technological advancement (Rawwash et al., 2020). The goal of this environment is to improve and develop electronic payment systems while addressing concerns about security and trust.

-

Conceptual Framework and Hypotheses Formulation:

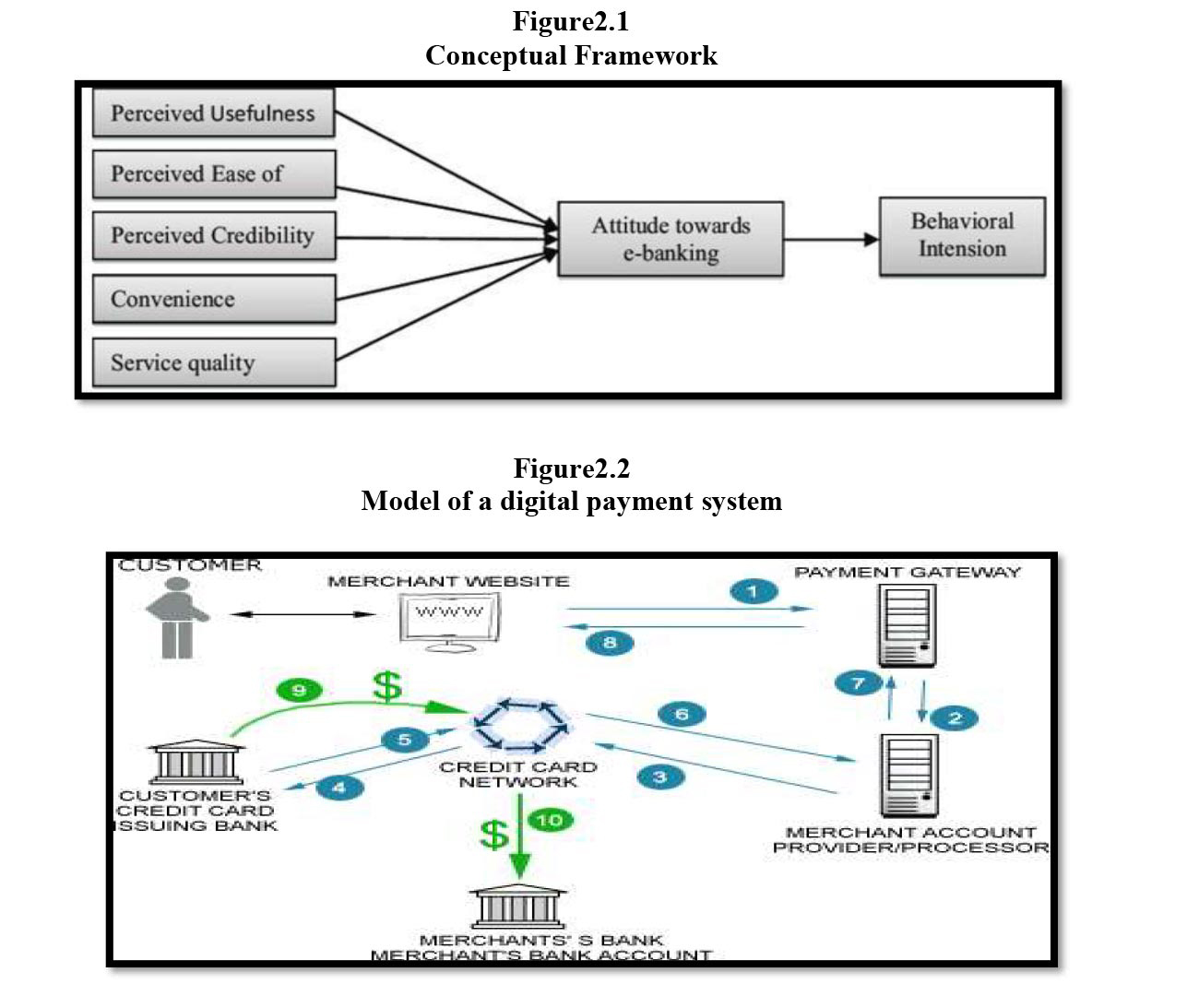

This framework incorporates a few key elements that influence consumers' preparedness for digital payments, as determined by the literature analysis. These elements fall into the categories of obstacles and enablers for consumers' preparedness for digital payments.

- Hypothesis

H1: Usage of electronic payment system is significantly influenced by their customers. Perceived Utility: Perceived utility is crucial for service acceptance, and banks should enhance user experience and streamline transactions through electronic payment applications. Implementingsolutionsshouldalignwithusers'financialobjectives.AstudyinNigeria found that while EPS did not significantly impact banking efficiency, financial institutions should create more electronic payment options to promote commerce.

H2: Applying of digital payment system is significantly influenced by the perceived benefits of using such methods.

Financial Literacy Culture: Central and commercial banks are promoting financial literacy andcultivatinganelectronicfinancialculture.Enhancinginvestors'understandingofelectronic payment methodsand financialinclusioniscrucial.Effectivecommunicationaboutelectronic financial products and services optimizes advantages while fostering security and trust. The Central Bank has launched initiatives to improve financial literacy across sectors.

H3: Usage of electronic banking services is significantly influenced by awareness of digital banking.

Ease of Use and Security: Electronic payment methods are essential in today's society, enablingtransactionslikeonlineshoppingandpurchases.However,users must understand their operation and feel secure while using the system .Central and commercial banks should provide guidance, eliminate barriers, and ensure a user-friendly experience. Research shows that website information, language, and ease of use significantly influence investors' perceptions, affecting electronic banking activities. User-friendliness positively influences adoption of new applications.

H4: utilization of electronic banking services is significantly influenced by their user experience and security.

Cost of Service: The banking industry must prioritize cost reduction for electronic payment methods to increase investor adoption. Factors like user-friendliness, security, and cost efficiency are crucial for successful implementation. Lowering expensesand addressing user- friendliness, security issues, and cost efficiency can also motivate users to adopt digital financial solutions. - Statistical analysis

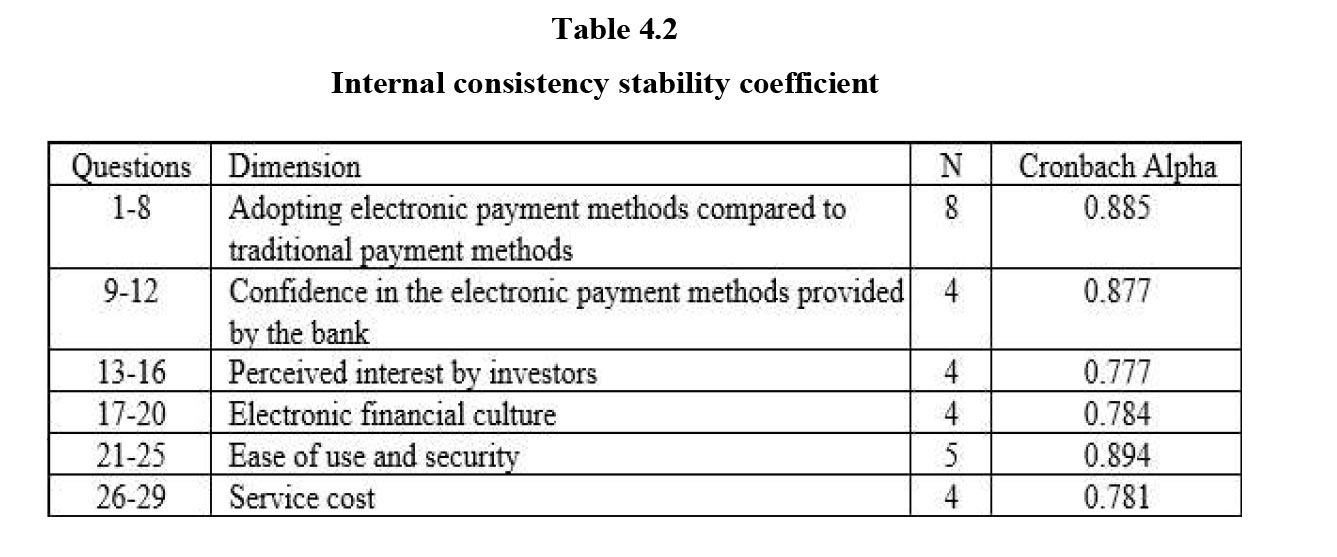

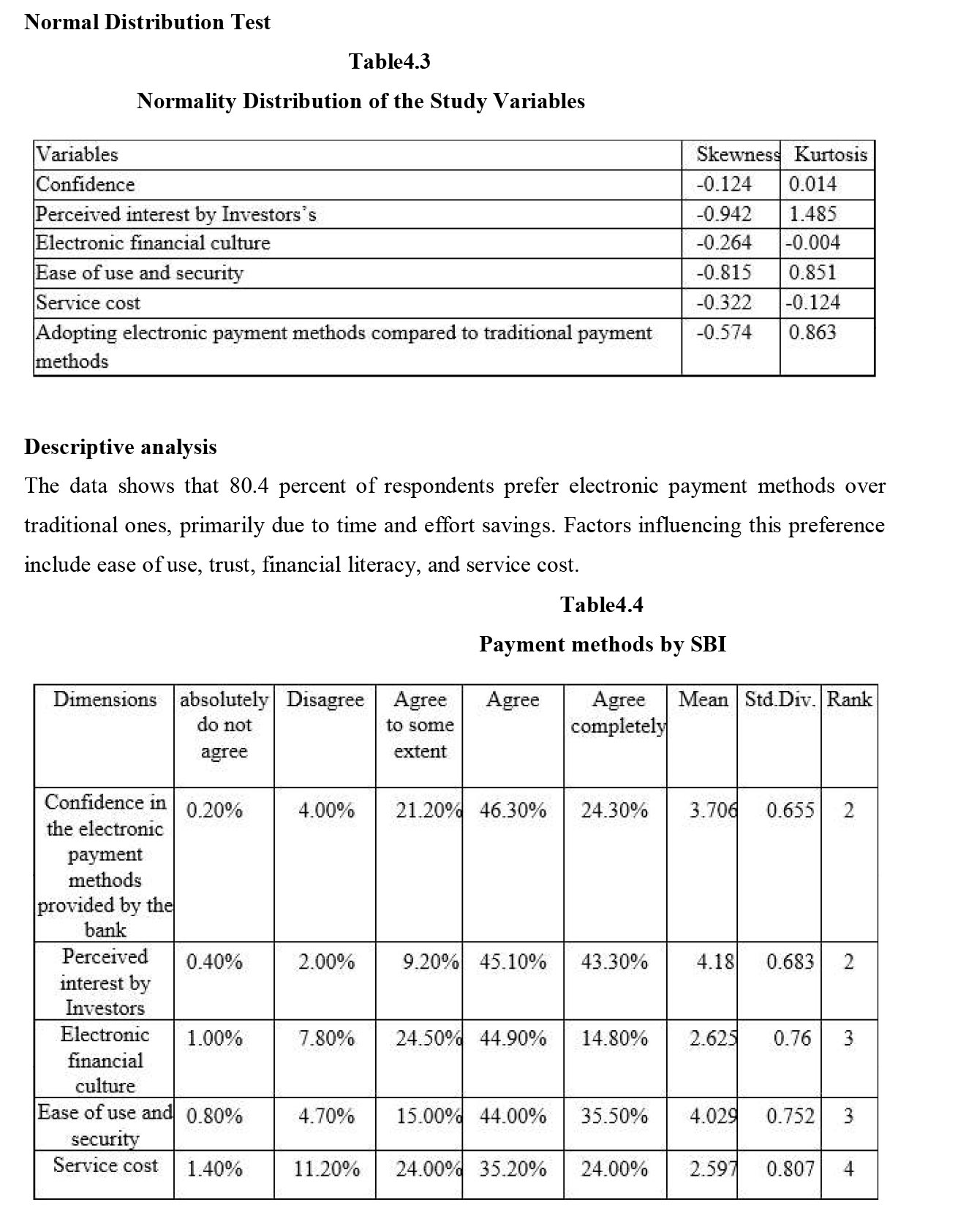

Solidity of the study: The study utilized Cronbach’s Alpha to evaluate reliability, ensuring high internal consistency among scale items, and demonstrating their effectiveness and suitability for subsequent analytical phases.

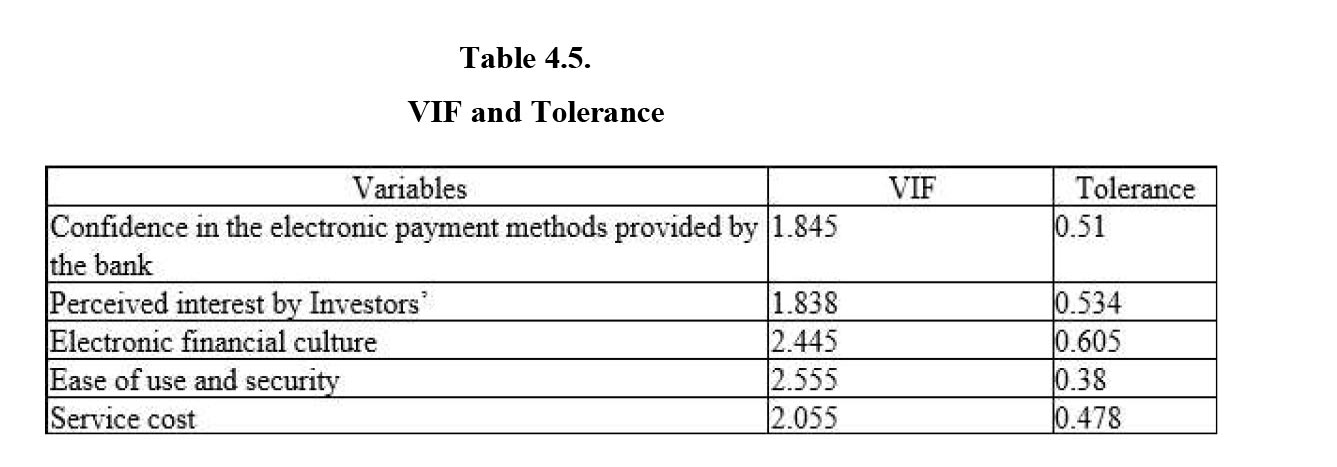

Multicollinearity Test

The study found no significant correlation amongst the independent variables, as specified by variance Inflation Factor (VIF) values.

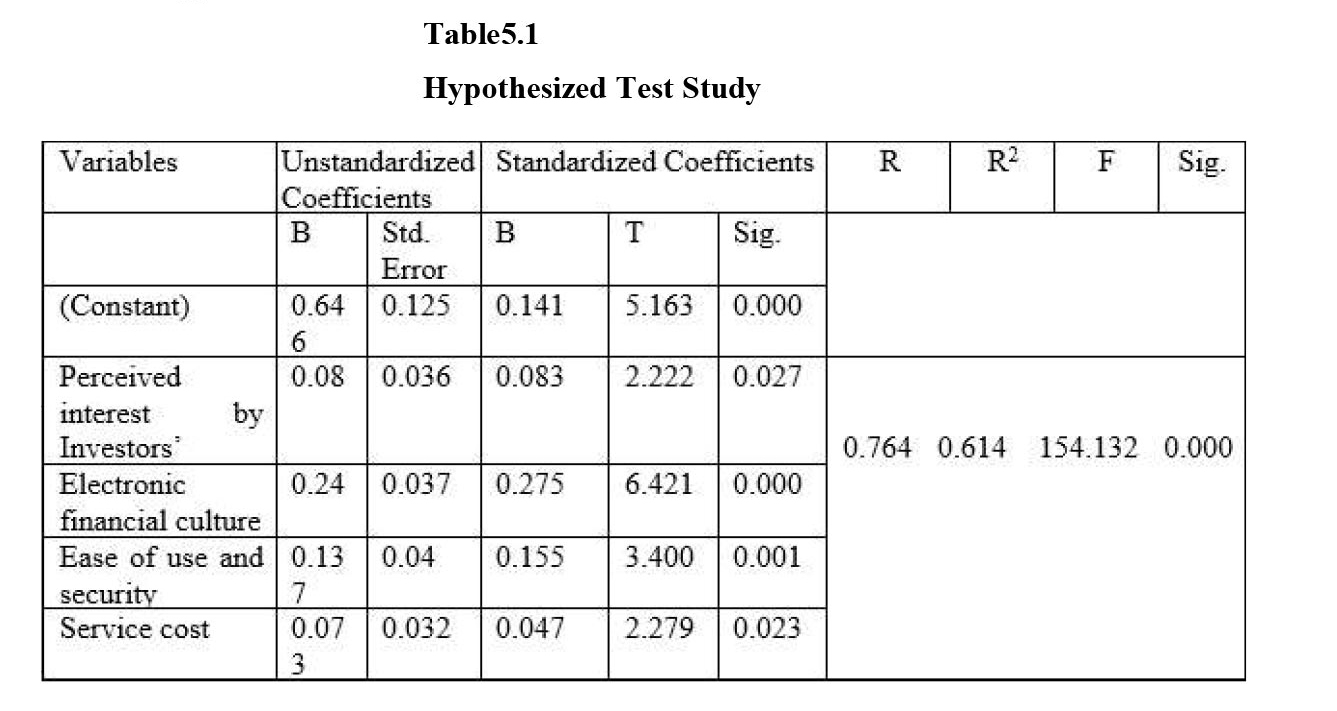

- Hypothesis testing Result

The tests ensure data accuracy and integrity, followed by multiple regression analysis for the first main hypothesis, as detailed in below.

In this study reveals a strong correlation between trust in digital transaction, investor interest, security, and service costs in Indian commercial banks' adoption. - Suggestions

- The government's capacity to ensure that digital payment transactions are free of charge benefits consumers of various transactions by enabling them to make purchases online.

- Through a variety of media outlets, the government can regularly disseminate informationabouttheadvantagesofdigitalpaymentsforbothindividualsandsociety.

- Make customer care channels easily accessible to users so they can receive prompt assistance for any queries or worries they may have regarding digital payments.

- To teach the public how to use digital payments, the government may set up training courses.

- In addition to following the guidelines for digital payment methods, consumers should be able to monitor their electronic payment balance sand promptly report any lossor theft.

- Conclusion

The study explores issues influencing the implementation of electronic payment methods among Indian banking sector investors. It found that subjectivity, confidence, perceived benefits, electronic economic attitude, ease of use, and cost of use significantly influence these decisions. However, factors like gender, banking relationship duration, and frequency did not significantly affect adoption. The findings could inform policymakers to promote innovative electronic payment solutions and assist countries in developing electronic payment systems.

- References:

- Adil, M. H., and Hatekar, N. R. (2020). Demonetisation, Banking and Trust in Bricks‘Or ‗Clicks‘. South Asia Research, 40(2), 181-198.

- Aji, H. M., Berakon, I., and Husin, M. M. (2020). COVID-19 and e-wallet usage intention: A multigroup analysis between Indonesia and Malaysia. Cogent Business and Management, 7(1), 1804181.

- Alkhowaiter, W. A. (2020). Digital payment and banking adoption research in Gulf countries: A systematic literature review. International Journal of Information Management, 53, 102102.

- Ardiansah, M. N., Chariri, A., and Januarti, I. (2019). Empirical study on customer perception of e-commerce: Mediating effect of electronic payment security. JurnalDinamikaAkuntansi, 11(2), 122-131.

- Avital, M., Hedman, J., Albinsson, L., and Design, M. (2017). Smart money: Blockchain-based customizable payments system. Dagstuhl Reports, 7(3), 104-106

- Abrazhevich, D. (2001, August). Classification and characteristics of electronic payment systems. In International conference on electronic commerce and web technologies (pp. 81-90). Berlin, Heidelberg: Springer Berlin Heidelberg.

- Acharya,K.(2024).AstudyonInvestor’spredictionstowardse-bankingwithspecial reference to Ahmedabad city. GLSKALP: Journal of Multidisciplinary Studies,4(1), 13-20.

- Al-Sabaawi, M. Y. M., Alshaher, A. A., and Alsalem, M. A. (2023). User trends of electronic payment systems adoption in developing countries: an empirical analysis. Journal of Science and Technology Policy Management, 14(2), 246-270.

- Alzoubi, H., Alshurideh, M., Kurdi, B. A., Alhyasat, K., and Ghazal, T. (2022).The effect of e-payment and online shopping on sales growth: Evidence from banking industry. International Journal of Data and Network Science, 6(4), 1369-1380.

- Achutamba V, Hymavathi CH. Impact of Covid-19 on Digital Payments in India. J Posit Sch Psychol. 2022 Mar 17; 6(3): 4394-400.

- Desai, D. M. (2018).Astudy on Preference of Consumers towards M-Wallets in Surat City. Journal of Modern Management & Entrepreneurship, 8, 6-10.

- Goyal, R., Roongta, P., et al, (2022). Future of Digital Payments in India. BCG and PhonePe. Accessed on February 21, 2024.

- Government of India and Ministry of Electronics and Information Technology. “Digidhan Mission.” Press release, June 8, 2017. Accessed February 20, 2024.

- Kumar, Manojkumar. "An overview of cyber security in digital banking Sector." East Asian Journal of Multidisciplinary Research 2.1 (2023): 43-52.

- Kakadel RB, Veshne NA. Unified Payment Interface (UPI)-a way towards cashless economy. Int Res J Eng Technol. 2017 Nov; 4(11): 762-6.

- Mukhtar, M. (2015). Perceptions of UK Based Customers toward Internet Banking in the United Kingdom. Journal of Internet Banking and Commerce, 20(1), 21-59

- MallatN(2004)TheoreticalConstructsofMobilePaymentAdoption.27thInformation Systems Research Seminar, Scandinavia (IRIS), Falkenberg, Sweden, pp: 34-46.

- Ministry of Finance and PIB Delhi. “Total Digital Payment Transactions Volume IncreasesFrom2,071CroreinFY2017-18to13,462CroreinFY2022-23at aCAGR of 45 per Cent: MoS Finance,” December 19, 2023. Accessed February 20, 2024.

- Pande A, Deshmukh AB, Tambakhe MD. E-Payment GatewayModel. Int J Compute Sci Inf Technol. 2014; 5(2): 2569-73.

- Rajani Gupta, Arvind Kumar. An Analytical Study of Demonetization and Its Impact onIndianEconomy. Inspira:Journal of Commerce, Economics andComputerScience (JCECS). 2017; 03(04): 217-221.

- RamasastriAS. Payment systems inIndia: a silent revolution. HitachiSoukenJournal. 2018; 13(1): 36-39.

- Reddy, Anuradha (2012). A study on consumer perceptions on security, privacy and trust on e-commerce portals. International Journal of Multidisciplinary Management Studies, 2(3), 1-15.

- Radhakrishna, A. K. (2013). Drivers and Inhibitors of Internet Banking Adoption in India. Journal of Internet Banking and Commerce, 10(3)

- SrivastavaJ,RaghubirP(2008)MonopolyMoney:theeffectofpaymentcouplingand form on spending behaviour. Journal of Experiental Psychology Applied 14: 213-225.

- SharmaA,Kansal V.Mobile Bankingas Technology Adoption and Challenges:ACase of M-Banking in India. Int J Sci Res Publ. 2012 Feb; 2(2): 1-3.

- Sekhar,S.Chandra."AStudyonfinancialevaluationofregionalruralbanksinAndhra Pradesh." (2018).

- Sekhar,S.Chandra."AStudyonEffectivenessofElectronicbankingSystem." Sanshodhan(2020): 8-13.

- Tiwari, R., Buse, S., and Herstatt, C. (2006). Mobile banking as business strategy: Impact of mobile technologies on customer behaviour and its implications for banks (Vol. 4, pp. 1935-1946). IEEE

- Williamson,L.&.(2006).Understanding Consumer Adoption of Internet Banking:An Interpretive Study in theAustralian Banking Context. Journal of ElectronicCommerce Research, 7(2), 50-66.

- Yaqub, J. O., Bello, H. T., Adenuga, I. A., and ogundeji, M. O. (2013). The cashless policy in Nigeria: prospects and challenges. International Journal of Humanities and Social Science, 3(3), 200-212.