Subscribe now to get notified about IU Jharkhand journal updates!

A Study on Corporate Governance Practices followed by Selected PSU and Private Banks of India

Abstract :

The process of liberalization, globalization and opening up the contours of national economies began in the early nineties in many countries including India. The banking industry has been all along responding to such changes. Banks have adopted several strategies to change their policies and processes to ensure that they remain fundamentally strong and manage the reforms related to changes effectively. Millions of depositors keep their hard earned money in banks with the utmost good faith that stability of principal will be ensured. In order to protect the interest of depositors', strict governance mechanism has to be followed in banking sector. The present study is explanatory and empirical research in nature and an attempt to understand the conceptual framework, to analyze the corporate governance practices on the basis of their free float market capitalization listed in the BANKEX [BSE] as on 31st March 2016 followed by some selected public and private sector banks. It also focuses on interdependence of board size, proportion of executive directors in the board, net profit earned, net non-performing asset accumulated and capital adequacy ratio in Indian banks.

Keywords :

Governance, Non-Performing Asset, Bank, Capital Adequacy Ratio.BACKGROUND

According to Confederation of Indian Industries (CII),

'Corporate Governance occupies mind space of the government,

regulators, corporate, boards, markets, employees and investors

- almost the entire society - as one of the most important business

constituents given its all-pervasive characteristic'. The

corporate governance mechanism is much more crucial in

the banking sector due to multifold reasons. Banks serve a

crucial link in the nation's financial system, banks are

highly leveraged as they accept large amount of

uncollateralized public funds as deposits in a fiduciary

capacity and further leverage those funds through credit

creation. Apart from these, banks provide access to

payment systems and a variety of retail financial services

for the economy at large. Interrelatedness of transactions

makes the risk of contagion a reality and consistently poor

decisions by one bank can create serious troubles for other

banks. Banks, more than other corporate have to match

the conflicting interests of different stakeholders.

Modern banking was introduced in India during British

regime with the concept of unlimited liability. General

Bank of India was started in 1787 to act as banker of the

Government.Bank of Hindusthan was founded in 1771 in

Calcutta. Joint stock of banking came into existence in 1860

with limited liability. Seven banks were set up during

1870-1894 with the feature of limited liability clause.

Swadesi movement in 1905 gave up a fill up to

indegeneous banks and during 1906-1913, 5 big banks and

several small banks came into existance. The four big

banks were - Bank of Baroda, Mysore Bank, Indian Bank

and Bank of India (Pathak, 2007). During World war-I and

earlier to that nearly 54 small banks failed and nearly 34%

paid up capital of banking sector was lost. By the end of

1923, total number of bank failures was 143. From the

beginning of 20th century banking has been so developed

that in fact, has come to be called 'life blood' of trade and

commerce (Munjal, 1990). During the post-independence

era, the increasing tempo of economic activity led to the

expansion of scope and direction of banking at a rapid

pace (Naruala, 1992).

LITERATURE REVIEW

Ghosh (2005), highlighted that the linkage between the financial condition of the corporate and banking sector asset quality is modelled at the aggregate level. The asset quality of banks is a function of corporate leverage and a set of control variables. Mahapatra (2012) said that Indian banks will have high common equity capital ratio and it will prove to be a good thing for the Indian banks. More than 50% of the Indian banks have a common equity capital ratio of more than 8% and hence these can implement Basel III even today. Since the Government is holding high stake in the PSUs banks, the dependency of these banks on Government for capital support will go up. Roy (2013) opined that Indian banks have a high capital adequacy as of now and therefore they may not need any additional capital till 2015. But after that, when the capital requirements will increase because of the countercyclical buffer requirements, it would be difficult for the public sector banks to raise money. It will increase the borrowings of the government and will negatively affect the fiscal deficit. Hence the date of implementing the common equity for the public sector banks should be delayed for 2-3 years to cope with the increasing burden on Government. Saibaba (2013) indicated that in the Indian context, the firms with large board size have better valuation. Perhaps the justification needing a larger board size in Indian context is that SEBI's clause 49 of the listing agreement has both mandatory and voluntary requirements for the formation of different committees such as audit committee, nomination committee etc. Larger board size may minimize the overlapping of functions. Satpathy, Behera and Digal (2015) discussed that NPAs in the Indian banking sector have been on rise significantly which is a cause for serious concern for the policymakers, particularly the Government and the RBI.

OBJECTIVES OF THE STUDY

The objectives of the proposed study are as follows -

- To understand the needs of corporate governance practices in Indian Banking Sector

- To examine the comparative study of corporate governance practices followed by some selected Public and Private sector Banks.

- Finally, to suggest some remedial measures while adopting the corporate governance practices in Indian Banking sector.

RESEARCH METHODOLOGY

The proposed study is explanatory and empirical in nature and the sources of data are secondary data(inclusive of quantitative and qualitative data) which are collected through websites and annual reports related matter.

- Period of the study : Forour study, we have taken the financial year (2015-16) into consideration. So all the data collected is based on the annual reports of this duration only.

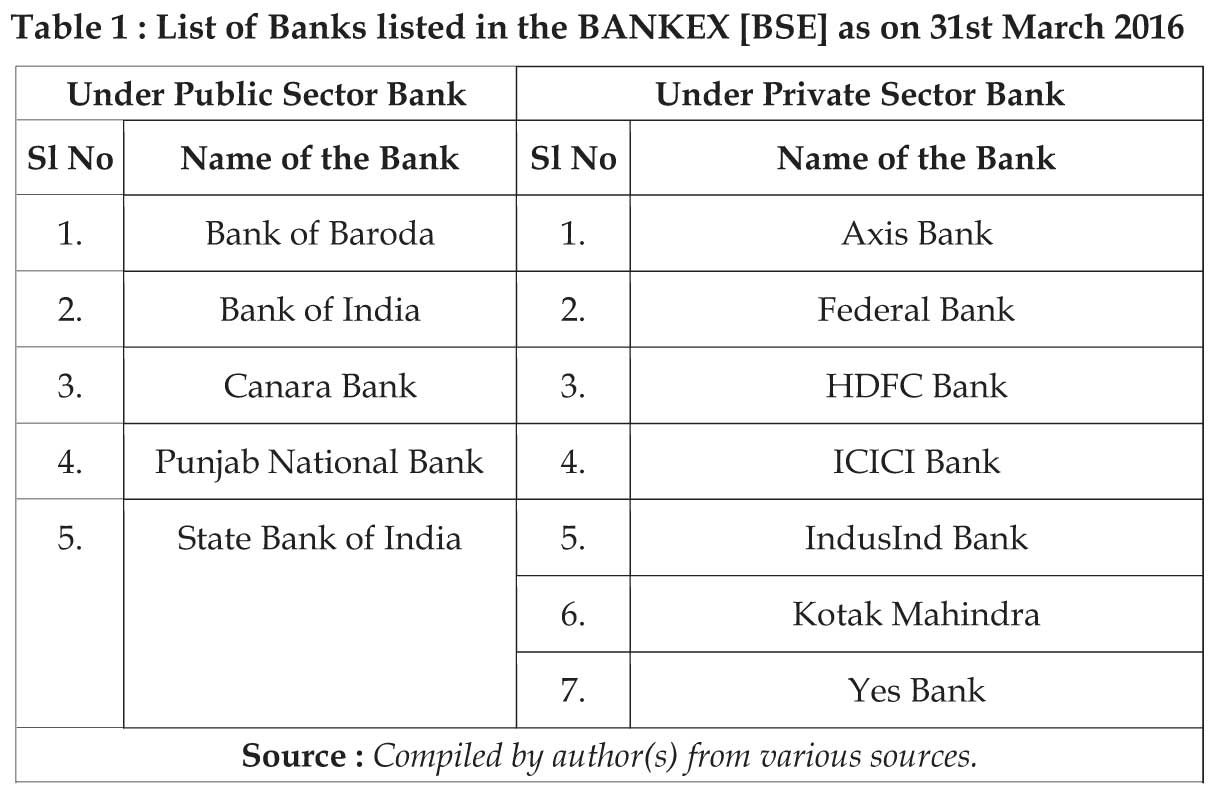

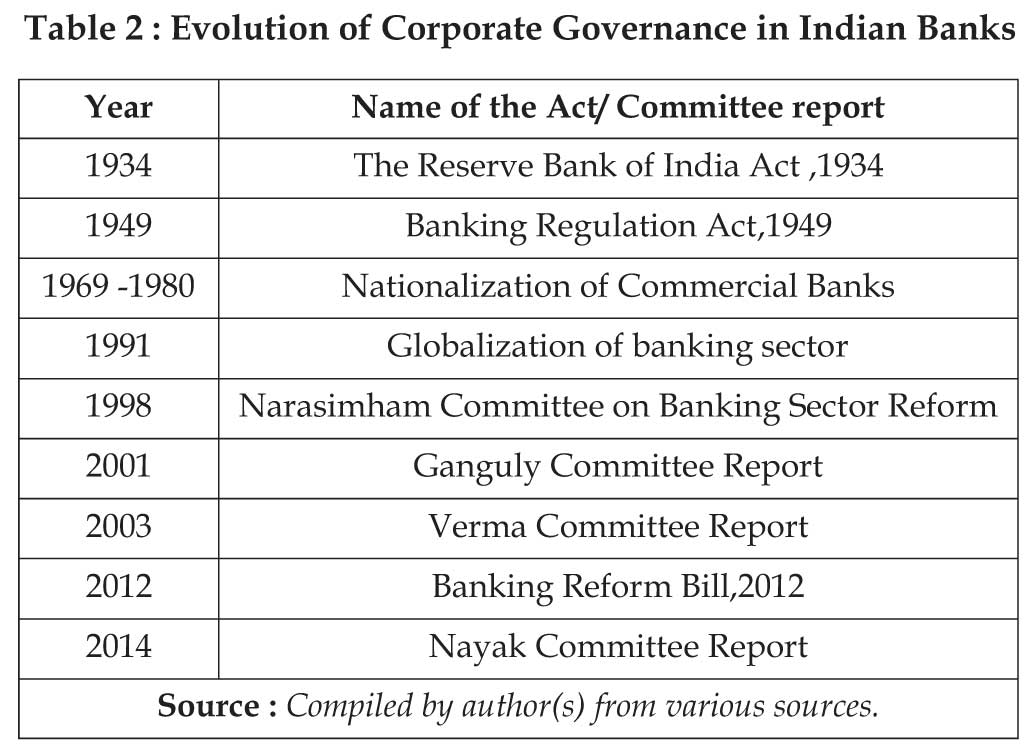

- Samples of the study : Though, corporate governance bind to all type of banks but for precise focus the banking companies listed in the BANKEX [BSE] as on 31st March 2016 are selected on the basis of their free float market capitalization. All the listed banks in BANKEX are divided in two groups -public and private sector banks to study and analyze their corporate governance practices.

- Data Analysis : For analysis part, relevant statistical technique such as correlation coefficient is considered between board size and net profit, proportion of executive directors in board and net profit, board size and capital adequacy ratio, proportion of executive directors in board and capital adequacy ratio as well as the proportion of executive directors in board and Net NPA. Data analysis is done through excel.

NEEDS OF CORPORATE GOVERNANCE PRACTICES IN INDIAN BANKING SECTOR

The corporate world in general is following a relentless march towards better corporate governance standards and adoption of uniform accounting standards and disclosure requirements. These twin requirements are particularly relevant to the banking sector where depositors' funds are many times higher than the equity of promoters. For effective governance, it has to be ensured that the conflicts of interest between the stakeholders are mitigated. Proper governance has emerged as an important benchmark for improving competitiveness and enhancing efficiency and thus improving investors' confidence and accessing capital , both domestic as well as foreign. Banks operate on trust and the funds they receive from depositors are on the basis of trust. Last but not the least, in case of public sector banks the importance of governance is further magnified because of their large share of the banking business and also because of the fact that they are government owned entities (Kamath, 2014).

- Supervisory role of the Reserve Bank of India

Reserve Bank of India (RBI) is the apex body of the money market started its operations on 1stApril 1935 in accordance with the provisions of the RBI Act, 1934.Often the institutional change was triggered by a banking crisis which hurt the reputation of the supervisors. Nevertheless it is an ongoing debate whether the supervisory structure should be reformed and if so in what direction. It can be said without any ambiguity that a flawless, efficient and effective supervisory model can be created if regulatory independence ,supervisory independence, institutional autonomy and budgetary independence are free from the political interference and bureaucratic hassles (Masciandaro et al, 2007). The risk based supervision provides major emphasis on risk where risk arises from the asset liability mismatch in the banking sector. A vital issue in the strategic bank planning is Asset and Liability Management (ALM). The objective of ALM is to maximize returns through efficient fund allocation given an acceptable risk structure. ALM is a multidimensional process, requiring simultaneous interactions among different perspectives. If the simultaneous nature of ALM is discarded, decreasing risk in one dimension may result in unexpected increases in other risks (Tektas et al, 2009). The excessive off balance sheet exposure is another area of risk faced by the banks.s - Emergence of Basel Framework

The Basel Committee formulates broad supervisory standards and guidelines and recommends statements of best practice in banking supervision in the expectation that member authorities and other nations' authorities will take steps to implement them through their own national systems, whether in statutory form or otherwise. The purpose of Basel Committee on Banking Supervision (BCBS) is to encourage convergence toward common approaches and standards. The Committee is not a classical multilateral organization, in part because it has no founding treaty. BCBS does not issue binding regulation rather it functions as an informal forum in which policy solutions and standards are developed. The BCBS recommended that capital can be used to absorb losses. Minimum capital requirements set a basic level of resilience against losses and help to protect a bank against insolvency. Hence banks should maintain certain capital adequacy ratio as a safety cushion. - SEBI Clause 49

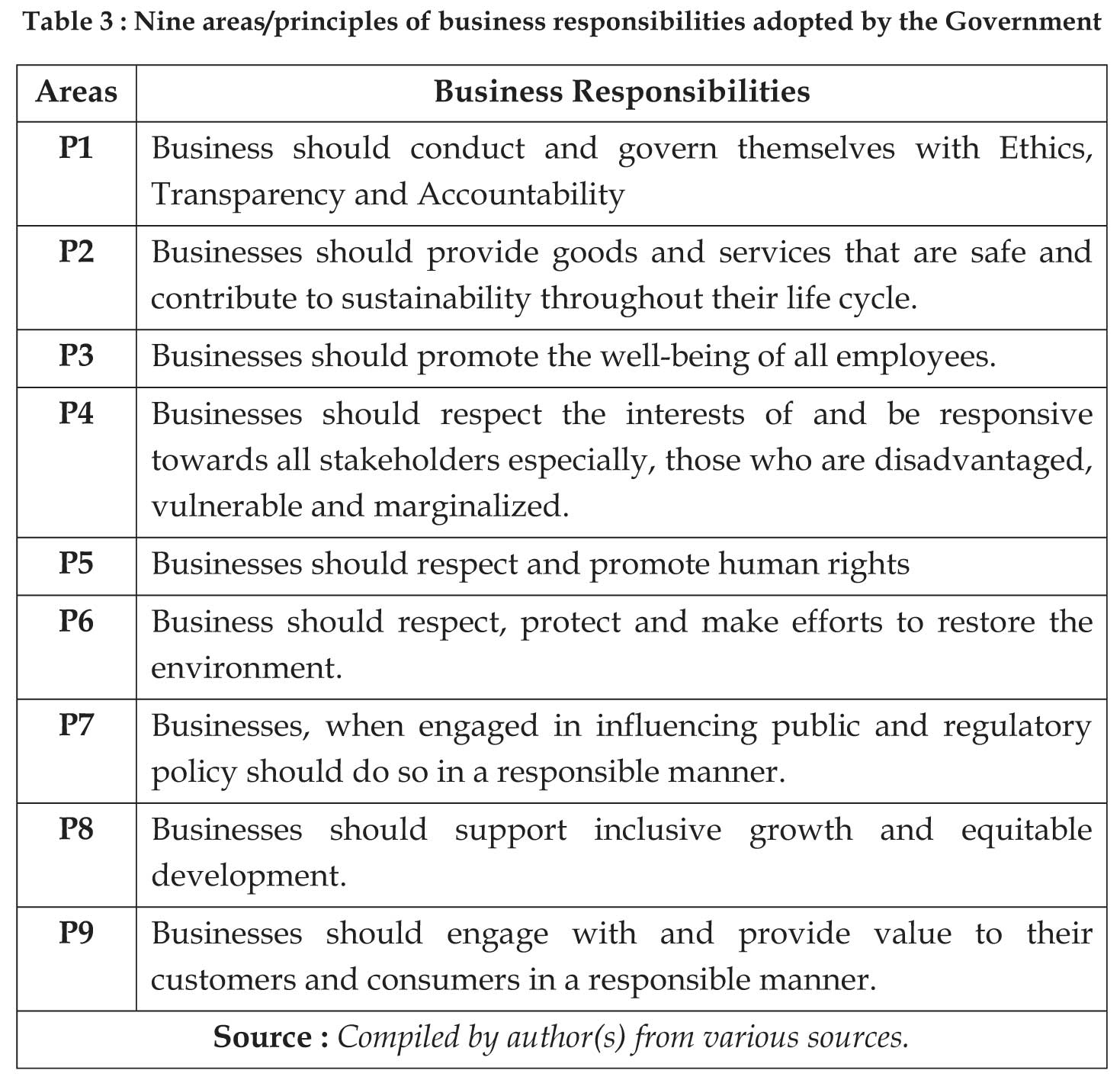

The Security Exchange Board of India was established by a Government resolution in 1988. The SEBI accorded statutory status on 21st February, 1992 as an autonomous, independent and quasi-judicial regulatory body. The SEBI has adopted several strategies to attract the retail investors in Indian capital market. When they are conducting different workshops, seminars through the SEBI certified financial resource persons to increase the awareness of individual investors; simultaneously they are introducing gradually the stringent corporate governance regulations to win the confidence of the layman investors. The Security Exchange Board of India appointed a committee on corporate governance on 7th May, 1999 with a view to promoting and raising the standards of corporate governance. In accordance with the guidelines provided by SEBI, the stock exchanges in India have modified the listing requirements by incorporation in them a new clause (clause 49), so that proper disclosure for ensuring corporate governance is made by the companies. - National Voluntary Guidelines on Business

Responsibilities

The National Voluntary Guidelines on Social, Environmental and Economic Responsibilities of Business released by the Ministry of Corporate Affairs, Government of India in July 2011. - Companies Act. 2013

The Companies Act.2013 added a new dimension in the literature of corporate governance by way of introducing new definition and features like accounting standards, auditing standards, associate company, CEO, CFO, control, deposit, employee stock option, financial statement, global depository receipt, Indian depository receipt, independent director, interested director, key managerial personnel, promoter, one person company, small company, turnover, voting right etc.

COMPARATIVE ANALYSIS

According to the guidelines made by the Security

Exchange of India (SEBI), all listed companies have to

conform to the SEBI clause 49. The Board of Directors of

the company shall have an optimum combination of

Executive and Non-Executive Directors. If the board has a

non-executive chairman, at least one third of the total

number of directors on the board of the company shall

comprise independent directors. If the board has an

executive chairman, at least 50% of the total number of

directors shall comprise of independent directors. All the

listed banks whether PSU or private has to conform to this

guideline. According to listing requirement as per SEBI

clause 49, banks have to mention properly about their risk

management strategies in their corporate governance

report. Banks have to mandatorily maintain certain

minimum capital adequacy ratio as prescribed by

International Basel Norms. As per the Basel III guidelines,

banks have to maintain at least 10.5 % capital adequacy

ratio where the RBI has instructed all Indian banks to

maintain at least 11.5% capital adequacy ratio. Out of that

11.5%, Tier – II capitals should not exceed more than 2%.

The accumulation of Non-Performing Assets (NPA) has

become a major threat for Indian banking sector players.

Initially banks try to restructure their bad loans thorough

the Corporate Debt Restructuring (CDR) cell. Banks

usually offer lenient conditions such as reduction of

interest rate, increase in the time period for repayment so

that debtors can repay their loan. In spite of that if situation

does not improve banks usually write off the bad loans or

sell the same to Asset Reconstruction Companies (ARCs).

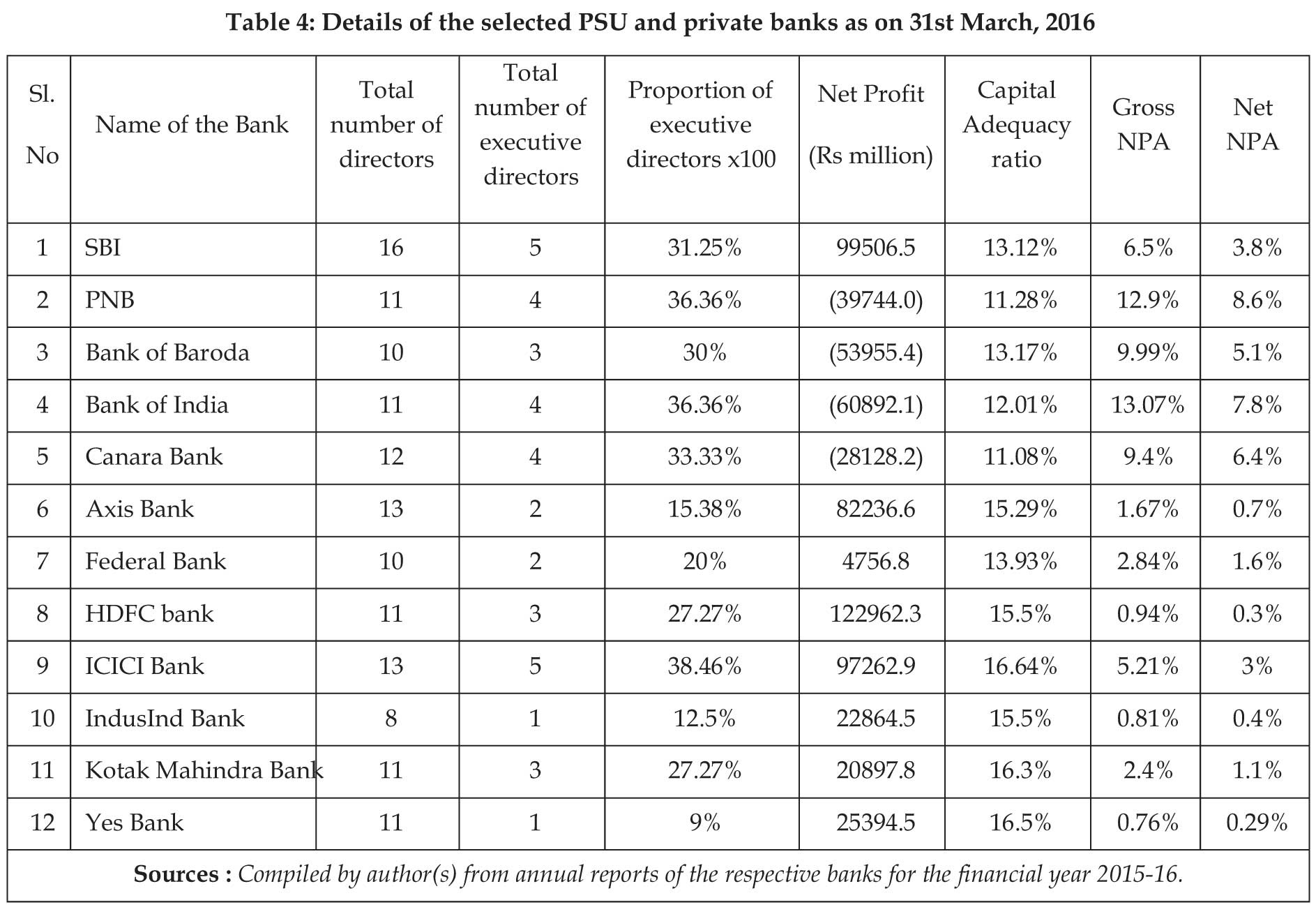

The details of the selected PSU and private banks are

provided in Table 4 below such as board size of bank,

number of executive directors in the board, proportion of

the executive directors in bank's board, net profit, capital

adequacy ratio maintained as well as gross and net NPA

as on 31st March,2016.

CONCLUSION

In order to ensure sound corporate governance, chairman

and CEO should not be same individual. Apart from State

Bank of India and Punjab National Bank, all other banks

have implemented Chairman and CEO Duality. The

correlation coefficient between PSU board size and net

profit is 0.9774. The correlation coefficient between the

private bank board size and net profit is 0.5967. Hence

large board size facilitates to boost up the performance of

the bank. The correlation coefficient between proportion

of dependent directors in PSU board and net profit is -

0.4185. It implies more executive directors in the board

reduce the efficiency of the PSU banks. On the contrary,

the correlation coefficient between the proportion of

dependent directors in the board of private banks and net

profit is 0.5219. It shows more number of executive

directors do not reduce the efficiency of the private bank.

Initially it seems that the results are contradictory though

the same can be logically substantiated. Lack of red tape,

lesser bureaucratic hassles as well as minimum political

intervention in recruitment have provided the private

banks more edge with respect to its PSU peers. Managerial

efficiency, dynamism as well as professional experience

are taken into consideration during the recruitment of

executive directors of private banks.

Correlation coefficient between PSUs board size and

capital adequacy ratio is 0.3076. Correlation coefficient

between private board size and capital adequacy ratio is

0.4895. It implies larger the board size, banks are in a

position to maintain higher amount of capital adequacy

ratio irrespective of the fact whether it is a PSUs or private.

Correlation coefficient between proportion of executive

directors in PSUs bank and capital adequacy ratio is -

0.7382. Correlation coefficient between proportion of

executive directors in private banks and capital adequacy

ratio is 0.3294. It implies proportion of executive directors

in the board of PSU bank and capital adequacy ratio are

inversely related. So PSUs banks having higher proportion

of non-executive/independent directors will have more

likelihood of maintaining higher capital adequacy ratio.

On the contrary, the degree of association between

proportion of executive directors in the board of private

banks and capital adequacy ratio is comparatively low.

Correlation coefficient between proportion of executive

directors in PSUs banks and Net NPA is 0.913. Correlation

coefficient between proportion of executive directors in

Private Banks and Net NPA is 0.7559. Hence it can be said

that there is a strong degree of association between

proportion of executive directors and Net NPA of the bank

irrespective of the fact whether it is a PSUs or private. For

PSUs banks, correlation coefficient is almost close to one.

Since PSUs banks are not driven by profit motive like their

private and foreign peers, often they don't exert their full

effort to recover their NPAs. Few cases loans are

sanctioned due to political compulsion in spite of knowing

the fact that borrowers are not creditworthy enough to

repay the loan. More non-executive directors and

independent directors in the board can reduce the net NPA

of the banks.

It can be concluded from the study that large board size is

preferable for good governance in banks. More and more

non-executive and independent directors in the board are

preferable as the same will help to reduce the NPA of the

bank. The purpose of effective corporate governance will

be fulfilled only when independent directors will act

independently in true sense and utilize their personal and

professional integrity as well as professional skepticism to

the fullest extent to facilitate decision making process at

the board level of the banks.

References :

- Brahmbhatt, M, Patel R and Patel S. (2012).An Empirical Investigation of Corporate Governance Scenario in Public Vs Private Banks in India. International Journal of Marketing, Financial Services and Management Research, 10 (1),12-28

- Das A, Ghosh S (2006). Financial Deregulation and Efficiency: an Empirical Analysis of Indian banks During Post-reforms Period. Review of Financial Economics,15,193–221.

- Gauba, R. (2012). The Indian Banking Industry : Evolution, Transformation & The Road Ahead, Pacific Business Review International, 5 (1), 85-97.

- Ghosh, Saibal. (2005), “Does leverage Influence Banks' Non-performing Loans? Applied Economics Letters, pp.913–918.

- Kalluru SR, Bhat KS (2009).Determinants of Cost Efficiency of Commercial Banks in India. ICFAI University Journal of Bank Management, 8:32–50.

- Kumbhakar SC, Sarkar S (2003).Deregulation, Ownership and Productivity Growth in the Banking Industry: Evidence from India. Journal of Money Credit and Banking. 35:403–424.

- Mahapatra, B. (2012).Implications of Basel III for Capital, Liquidity and Profitability of Bank. Speech Delivered at National Institute of Banking Management, Pune .

- Mahesh HP, Rajeev M (2006).Liberalization and Productive Efficiency of Indian Commercial Banks: A Stochastic Frontier Analysis, Retrieved July 24, 2011, from MPRA Paper No. 827.

- Reddy, AA. (2004). Banking Sector Liberalization and Efficiency of Indian banks. ICFAI Journal of Bank Management, Vol.3, pp.37–53.

- Saibaba, M. D. (2013). Do Board Independence and CEO Duality Matter in Firm Valuation? An Empirical Study of Indian Companies. The IUP Journal of Corporate Governance, 12 (1), 50-67.

- Satpathy, Asish, Behera Samir Ranjan and Digal Sabat Kumar (2015), Macro-Economic Factors Affecting the NPAs in the Indian Banking System: An Empirical Assessment. The IUP Journal of Bank Management, 14 (1), 57-74.