Subscribe now to get notified about IU Jharkhand journal updates!

A Study on Customers' Perception towards E-Wallets in Ahmedabad City

Abstract :

This paper attempts to study and measure the customers' perception regarding E-wallets in Ahmedabad city. A survey has been used to collect primary data and 102 questionnaires were used in final analysis. SPSS and Microsoft Excel have been used to analyze and interpret the data. Graphical Representation, t-test, ANOVAs and chi-square analysis have been used.Study results show thatpeople are aware and willing about the online payments through E-wallets and there is a tremendous increase in growth rate after demonetization. Word to Mouth publicity have higher impact on information spread compare to other methods such as advertisement on social media, Magazine, TV and Government promotion. So companies and government both should create awareness by organising cashless society workshops/seminars. This study set out to enlarge understanding of how consumers evaluate E-wallets services in Ahmedabad city. This paper makes a valuable contribution given the fact that there are only a limited number of comprehensive studies dealing with the E-wallets services in Ahmedabad city.

Keywords :

Factors, Buying Behavior, Customer, Software Product, Software Market.1. Introduction

The payment industry has undergone a drastic shift from barter system to E- wallets. Customers globally are not very comfortable with transferring money through the internet, especially the older generations. Digital wallets give them the sense of security by acting as a wall between the bank and the vendor. Since digital wallets have a limit to the cash that they can hold, any loss—in the event of a security breach—is limited. Further, for all the stakeholders a wallet leaves a money trail that helps in solving disputes. At a time when hacking and data theft is becoming a clear risk, use of wallets will increase going forward . Hence, current research is aimed to investigate the customers' perception regarding E-wallets in Ahmedabad city.

2. Theoretical framework : Types of e-wallets permitted in India

As per the Reserve Bank of India, there are three kinds of ewallets

in India: closed, semi-closed and open2.

Closed e-wallets : These are wallets issued by an entity for

facilitating the purchase of goods and services from it.

These instruments do not permit cash withdrawal or

redemption. As these instruments do not facilitate

payments and settlement for third party services, issue

and operation of such wallets are not classified as payment

systems. Hence, RBI approval is not required for issuing

them. Eg. Cab services, e-commerce and mobile

companies create e-wallets for making payments towards

purchase of products from them /for usage of their

services. They provide cash backs for payments made

through this channel. This is one way of ensuring loyalty

of their customers.

Semi-Closed e-wallets : These are wallets which can be

used for purchase of goods and services, including

financial services at a group of clearly identified merchant

locations/ establishments which have a specific contract

with the issuer to accept them. These wallets do not permit

cash withdrawal or redemption by the holder.

Wallets for amounts upto Rs.10,000/- can be created under

this category by accepting minimum details of the

customer, provided the amount outstanding at any point

of time does not exceed Rs. 10,000/- and the total value of

reloads during any given month also does not exceed Rs.

10,000/-. Amount upto Rs.50,000/- can be created in

wallets by accepting any 'officially valid document' which

is compliant with anti-money laundering rules. Such

wallets are non-reloadable in nature.

Amount upto Rs.1,00,000/- can be created by with full

Know Your Client norms (KYC) and can be reloaded.

Eg.AirTel Money, which is used for making payments for

a range of services like money transfer from Airtel Money

to another bank account or any other Airtel Money Wallet

or paying select utility bills.

Open e-wallets : These are wallets which can be used for

purchase of goods and services, including financial

services like funds transfer at any card accepting merchant

locations [point of sale (POS) terminals] and also permit

cash withdrawal at ATMs / Banking Correspondents

(BCs). However, cash withdrawal at POS is permitted

only upto a limit of Rs.1000/- per day subject to the same

conditions as applicable hitherto to debit cards (for cash

withdrawal at POS). Eg. M-Pesa is an open wallet run by

Vodafone in partnership with ICICI Bank. Axis Bank's e-

Wallet Card', can used for making payments on sites that

accept Visa cards, with a minimum limit of Rs 10, and a

maximum limit of Rs 50,000, and a validity of 48 hours.

3. Review of literature

R.Varsha .Thulasiram(2016) found that E-wallet which are

considered as an hi-tech platform for money transacting

and payments have been perceived to be comfortable and

reliable, indicating high levels of acceptance .The e-wallet

service providers need to strategize targeting not only at

students and the youth, but also other age groups.

Dr. Ramesh Sardar (2016) summarized that M-wallets

have emerged as the most significant contributor in

pushing cashless and electronic payments. Over time

when mobile payments will represent a significant part of

retail sales, there should be inter-operability between

different wallets. As most of respondents are concerned

about the security of mobile payments, the security system

should be strengthening.

Pawan Kalyani (2016) found that Digital wallets which are

popular and associate to the online business company are

more popular and those with the banks are doing fine,

mobile companies' e-wallet is restricted to the mobile

users. People are using a few services mostly for

recharging the DTH and paying bills, Shopping etc. The

awareness and practical Usability of the e-wallet is low,

that should be increased by adding more value added

services to it.

Vidyashree DV, Yamuna N, Nithya Shree G (2015)

concluded that People are more aware about the online

payments through mobile applications and there is a

wider increase in growth rate. Pay tm and Pay u Money is

giving 2 level security authentication to safeguard our

payment details. The digital payment system has to take

necessary steps to overcome delay in processing of

payments.

Alan Cole, Scott Macfaddin, Chandranaraynswami,

AlpnaTiwari (2009) concluded that much of work in this

area has been concerned with use of mobile phones as a

surrogate for a credit card or smart card. There is

numerous application, each ending with one or two

different user interface, each possibly requiring a separate

login, falls far short of what we believe is required to make

mobile phone a viable replacement for physical wallet. He

commented that to accomplish this goal requires a unified

architecture, able to accommodate an open set of content

types. Standards will also be an important aspect of this

work, enabling independently-developed services from

multiple providers to interoperate with one another.

4. Research methodology

4.1 Need/importance of the study

The recent fearless decision of the Indian government to

demonetize all the old currency notes of 500 and 1000rs

has been a burning factor through the country.Due to

these crises, almost 70% of the people's spending capacity

has been reduced and almost it is very hard to pay their

basic needs like medicines, grocery items and Vegetables.

Now the new Indian scenario has made Indians think

3 about the digital payment system. So, the context of this

decision it is extremely significant to study the consumers'

perception towards-wallets.

4.2 Objectives of the study

To Study the customers'

awareness and satisfaction about E-Wallet services.

To know their security concerns about related services.

4.3 Sampling Design

Descriptive research design and

non- probability based convenience sampling method has

been used to get the information about E-wallet.

4.4 Methods of Data Collection

For conducting this

research, a structured questionnaire was prepared and

sample of 102 people was taken for analysis. The

instrument poses a set of 23 questions designed to assess

customers' awareness and satisfaction of service. A fivepoint

Likert-type scale is used in this study, anchored by

“strongly disagree” to “strongly agree”. The data was

collected from the respondents with the help of

Quantitative method via a survey.

4.5 Research Tools

SPSS and Microsoft Excel have been

used to analyze and interpret the data. Multivariate

techniques like ANOVAs, chi-square, t-test have been

used to test the various hypotheses.

4.6 Hypotheses

There is no significant difference between respondent's

occupation and satisfaction level of using E-Wallet

services.

There is no significant difference among different age

groups regarding their satisfaction on E-Wallet Services.

There is no significant difference between gender of the

respondents and awareness of respondents about EWallet

services.

There is no association between the gender of respondents

and sources of awareness about government's initiative of

promoting E-Wallet services.

4.7 Limitation & Scope of the Study

The study is confined to the Ahmadabad city of Gujarat.

So, the conclusion derived from the research cannot be

made applicable as it is for the other parts of the states or

other states. Future researchers are advised to take

diversified samples to arrive at generalisation. Future

researchers can make state wise comparison with larger

sample size. The research is just a small step in

understanding the constructs of awareness and

Satisfaction. The causal relationships between the two

have not been investigated, customer satisfaction and

there effect on fewer complaints, Security aspects, word of

mouth, and switching etc. can be explored by future

researchers. Lot of scope exists for research into the safety

and security issues of E-wallets for its effective adoption.

5. Analysis

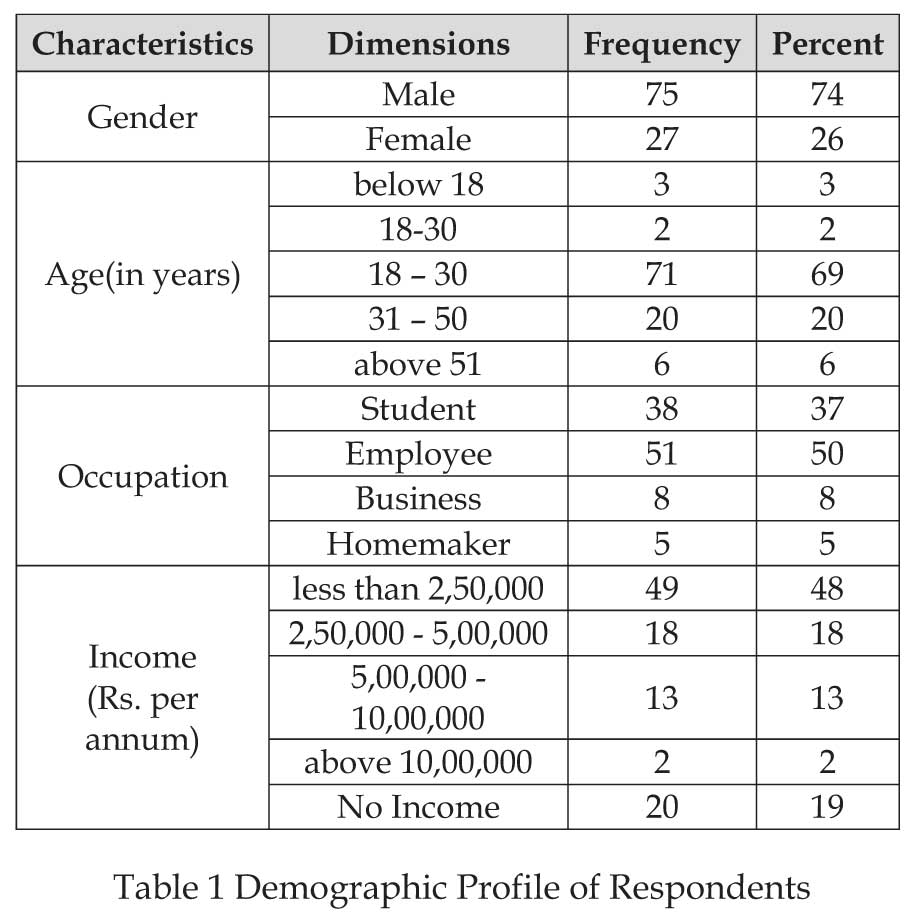

Demographic profile

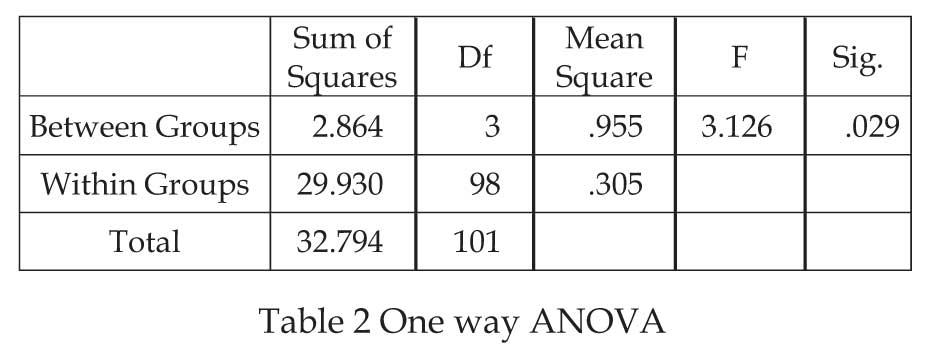

H1:There is no significant difference between respondent's occupation and satisfaction level of using EWallet services.

The significance value obtained is .029 which is smaller

than 0.05, so we reject null hypothesis. Thus it can be

concluded that there is significant difference among

satisfaction level of using E-Wallet Services when

classified by respondent's occupation.

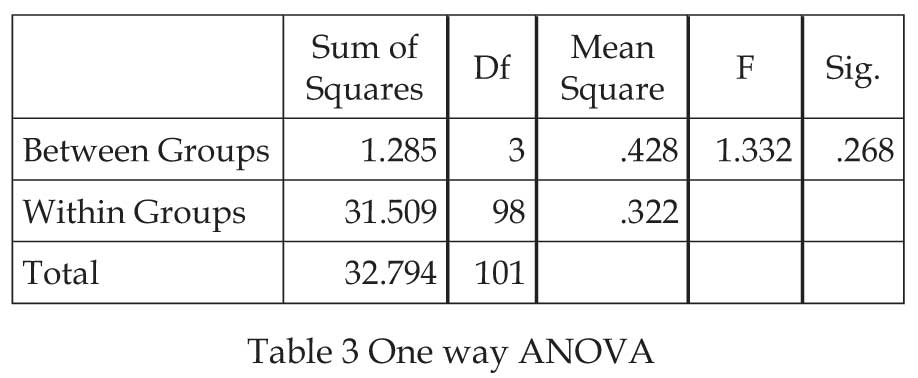

H2: There is no significant difference among different age

groups regarding their satisfaction on E-Wallet Services.

The significance value obtained is .268 which is not smaller

than 0.05, so researcher is fail to reject null hypothesis.

Thus it can be concluded that there is no significant

difference among different age groups regarding their

satisfaction on E-Wallet Services.

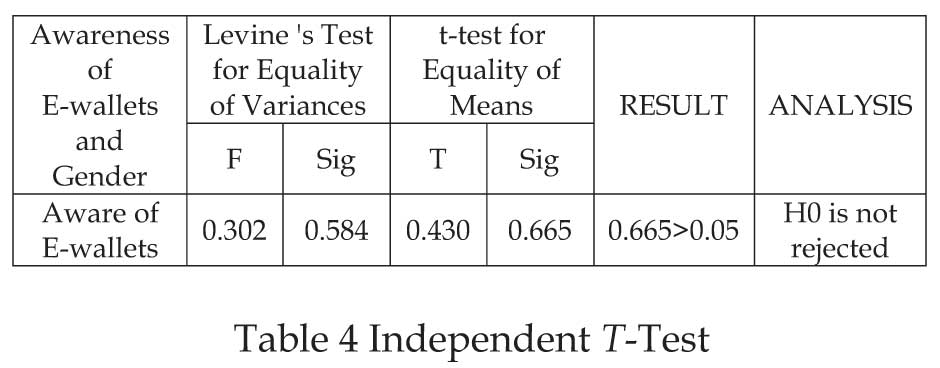

H3:There is no significant difference between gender of the

respondents and awareness of respondents about E-Wallet

services.

It is interpreted from the above table that there is no

significant difference in awareness of respondents

about E-Wallet by when classified by their gender.

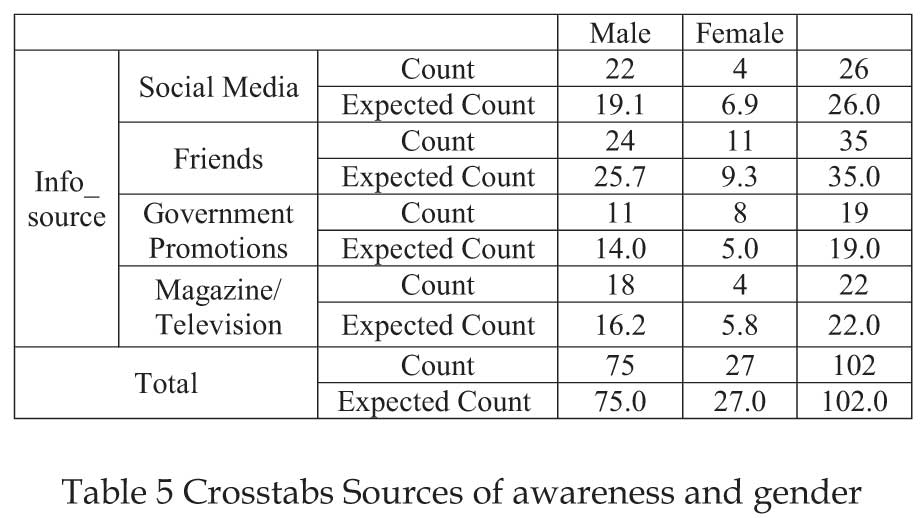

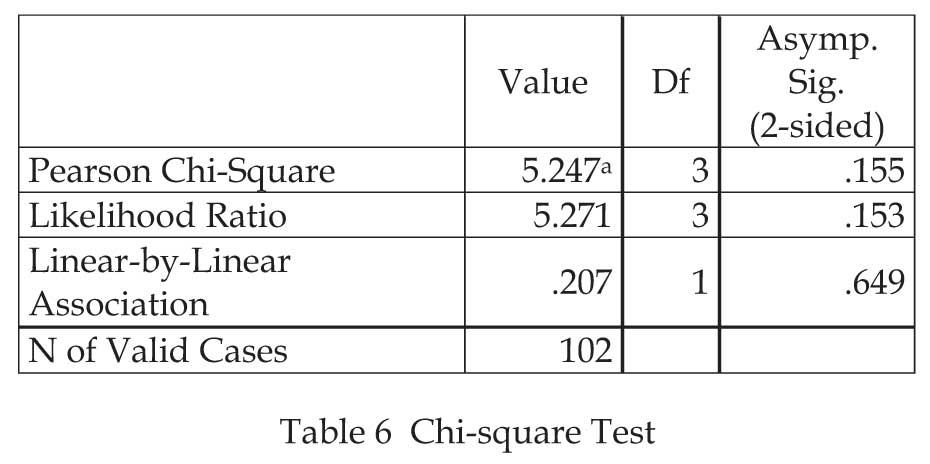

Table 5 Crosstabs Sources of awareness and gender H4 : There is no association between the gender of respondents and sources of awareness about government's initiative of promoting E-Wallet services.

Here, significant value is greater than 0.05 so, researcher is fails to reject null hypothesis means there is no association between the gender of respondents and sources of awareness about government's initiative of promoting E-Wallet services.

Findings

Out of total 102 respondents, majority of them (74%) were male.

More than 50% respondents' age was between 18-30 years.

Approx. 50% of respondents were employee followed by

students (37%).

Nearly 50 % of respondent, such high awareness level of Ewallet

among respondents shows that E-wallet service providers

have successfully advertised the concept of E-Wallet among

general public.

Respondents got the information regarding E-Wallet from

Various sources. Word to Mouth publicity have higher impact

on information spread compare to other methods such as

advertisement on social media, Magazine, TV and Government

promotion.

More than 50% of respondents use single E-Wallet service. This

shows that respondents like to have single service provider for

uniform experience to carry out digital transaction and

payments.Majority of respondents have been using E-wallet for

one year. The concept of E-wallet is not that much old, so

adoption and use of E-wallet services is limited. Researcher can

predict that it.

Out of total respondents 72% were using Paytm. It shows the

penetration of Paytm wallet compare to other wallets. The

second most wallet used by respondents is Freecharge. It can be

can inferred that Paytm and Frecharge wallets have high

adaptation level against their competitors.

Out of Total respondents 55% respondents use E-Wallet more

than twice in a month, followed by twice in a month. This result

shows that respondents are very much inclined to use the EWallet

for various payments and transactions.

Majority of respondents(79%) were aware about government

push for E-transacations. This shows that people areatleast have

clarity on benefits of digital transactions over traditional

payment system.Approx. 87% of total respondents use E-Wallet

for mobile/DTH recharge purpose. The second most option

preferred by users is Utility and bill payment. This shows that

mobile wallets have successfully attractedthe consumers by

different cashback offers and discount.

Out of total respondents 66% respondents were satisfied with

their E-wallet service, followed by 24% users which are highly

satisfied with E-wallet services. 10% of users have neutral

opinion about their satisfaction level.

Majority of respondents(92%) agreed to prefer E-Wallet in place

of conventional payment system. This suggests that in future

adaptation level among people will be considerably high.

Data analysis suggests that respondents are concerned about all

five criteria which are mentioned above. Cashback offers are the

most considered while doing transactions/payment over Ewallet.

More than 50% of respondents agreed that they definitely

consider the all security criteria such as-leak of confidential info,

cyber crime, Malware, Phishing etc. This shows that E-wallet

companies must have to work upon security features to attract

and retain the users on their platform for longer time.

Respondents suggested creating more secure service so that they

can transact over E-wallet safely. More than 50% of users

wanted to have good offers and faster process on E-wallets.

Respondents agreed that E-wallet is attractive choice for

payment over traditional method and it support as of now to

conventional payment during the transition phase. As per the

response near 50% of response were in favor of having E-wallets

which suggests preference of E-wallet over other E-payment

modes.

6. Recommendations/suggestions

Word to Mouth publicity have higher impact on information spread compare to other methods such as advertisement on social media, Magazine, TV and Government promotion. So companies and government both should create awareness by organising cashless society workshops/seminars at school, college, workplace etc. Government can makes it mandatory for all schools/colleges/institutes to have atleast one program in one academic year. E-Wallet are used for mobile/DTH recharge purpose. The second most option preferred by users is online shopping. Authority must make fees payment and filing of IT returns compulsorily with E-wallets only to increase the growth rate of the same.

CONCLUSION

Majority of respondents (92%) agreed to prefer E-Wallet in place of conventional payment clearly illustrates that the adoption image of E- wallet among consumers in Ahmedabad has already crossed the beginning stage, to be successful in E-wallet market now depends heavily on the marketing strategies of E- wallet companies as well as the financial policy makers.

References :

- E-wallet. International Journal of Recent Research and Review, Vol. I, March 2012 ISSN 2277 – 8322.

- Alan Cole, Scott Macfaddin, Chandranaraynswami, AlpnaTiwari(2009).Toward a Mobile digital Wallet.IBM research report October 16, 2009.

- D o n a l d L . Amo r o s o , R émyMa g n i e r - Watanabe(2012).Building a Research Model for Mobile Wallet Consumer Adoption: The Case of Mobile Suica in Japan. Journal of Theoretical and Applied Electronic Commerce Research ISSN 0718–1876 Electronic Version, 7, 1, April 2012 / 94- 110.

- Dr HemShwetaRathore (2016).Adoption of digital wallet by consumers.BVIMSR's Journal of Management Research ,8,1,April : 2016.

- Dr.PoonamPainuly, ShaluRathi (2016), “Mobile Wal let : An upcoming mode of bus ines s transactions”,International Journal in Management and Social Science, Vol.04 Issue-05 (May, 2016) ISSN: 2321-1784.

- Dr. Ramesh Sardar (2016).Preference towards mobile Wallets among urban population Of Jalgaon city. Journal of management (JOM) 3, 2, July–Dec (2016).

- M. Manikandan, Dr. S. Chandramohan(2015).Mobile wallet- a virtual physical wallet to the Customers. Indian journal of research, 4, 9, Sept 2015.

- Mr.Saikalyan Kumar Sarvepalli(2016).A study on the scope of the virtual wallets in indian market -issues and Challenges.international journal of multifaceted and multilingual studies, iii, viii, August 2016.

- Transacting Online.International Journal of Scientific and Research Publications,3, 1.

- N. Supriya, M. S. P. Joshna, T. VasudhaSingh(2016), “Issues and Challenges of Electronic Payment Systems”, international journal of innovative research & development January, 2016, 5, 2.

- PawanKalyani (2016).An empirical study about the awareness of Paperless e-currency transaction like ewallet Using ICT in the youth of India.Journal of management engineering and informat ion technology, 3, 3.

- PinalChauhan (2013).E-Wallet: The Trusted Partner in our Pocket.(IJRMP) ISSN: 2320-0901, 2, 4, April 2013.

- R.Varsha .Thulasiram (2016), “Acceptance Of EWallet Services: A Study Of Consumer Behavior”, International Journal of Innovative Research in Management Studies (IJIRMS)ISSN (Online): 2455- 7188, 1, 4.

- Challenges of Electronic Payment Systems”, (IJRMP) ISSN: 2320- 0901,Vol. 2, Issue 9, December 2013.

- RoopaliBatra, Nehakalra(2016),“Are digital wallets the new currency?”Apeejay journal of management and technology, January 2016 .11 ,1.

- Vidyashree DV, Yamuna N, Nithya Shree G (2015), “A Study on New Dynamics in Digital Payment System – with special reference to Paytm and Pay U Money”, International Journal of Applied Research 2015; 1(10): 1002-1005.

- http://www.moneycontrol.com/news accessed on 10th April 2017.

- http://arthapedia.in/index.php?title=Digital_/ _Electronic_Wallet_(e-wallet) accessed on 14th April 2017.

- ht tps ://www. t e chpr evue . com/e -wal l e t s - importance-indian-scenario accessed on 20th April 2017.