Subscribe now to get notified about IU Jharkhand journal updates!

A study on measuring customers' expectation and perception in private and public sector banks

Abstract :

This study attempts to measure service quality of public and private banking sector by measuring expectation and perception of customers. Descriptive Research Design was adopted to determine customers' perception and expectation about the bank. A survey has been used to collect primary data and 239 questionnaires were used in final analysis. SPSS and Microsoft Excel have been used to analyze and interpret the data. Bank service providers should continually monitor the level of fulfilment of personal needs and satisfaction with the organization, if they wish customers to remain loyal.

Keywords :

Customer services quality, Customer satisfaction, Bank service provider, Organization, Customer.Introduction :

The banking industry like many other financial service institutes is facing rapid regulatory, structural and technological changes in market, stiffer competition, new set of challenges, more demanding, more educated and better informed customers. The importance of both service quality and customer satisfaction to service organizations in general and banking in particular has received extensive attention in recent years. Hence, the objective of this study was to examine the level of service quality and customer satisfaction in two major segments of banks i.e. private and public banks.

LITERATURE REVIEW

Tarsem Lal (2018) studied the financial inclusion through

cooperative banks. To meet the objectives, 540

respondents of cooperative banks operating in three

northern states of India, i.e., J&K, Himachal Pradesh (HP)

were studied. The study emphasized that financial

services such as savings, loans, insurance, credit, etc.,

through financial inclusion has generated a positive

impact on the lives of the poor people.

Bedman Narteh (2018) tried to set integration between

SERVQUAL and BSQ models. The researcher modified

the resulting scale by including price to examine service

quality and customer satisfaction in retail bank services in

Ghana. The researcher used questionnaire and surveyed

560 retail bank customers. The authors concluded that

tangibles, reliability, assurance, empathy and price are

positively and significantly predicted customer

satisfaction.

Mohamed AbdulnaserJanahi, Muneer Mohamed Saeed

Al Mubarak, (2017) studied the impact of different factors

of customer service quality on customer satisfaction. The paper presented a model having six constructs namely

Compliance, Assurance, Reliability, Tangibility, Empathy

and Responsiveness and exhibited relationships between

these six factors and customer satisfaction in the Islamic

banking sector. The authors concluded that there is a

strong and positive relationship between the six

constructs of customer service quality and customer

satisfaction.

Chrys i Alexiadou, NikolaosStylos , Andreas

Andronikidis, Victoria Bellou, Chris A. Vassiliadis, (2017)

evaluated perception-based quality in service encounters.

The researchers studied potential mismatches in how

customers and front-line employees perceive quality in

service settings. The survey involved 165 bank branches

and 1,522 respondents (463 front-line employees and

1,059 customers). Results revealed relation between

tangibles, responsiveness and assurance when compared

customers and front-line employees perceptions but also

found mismatches between customers and front-line

employees perceptions of reliability and empathy.

Abhilash Ponnam, Rik Paul, (2017) drafted the situation

for service value expected in various phases of

relationship over time in Indian retail banking context.

The authors explored customer service value dimensions

related to Indian retail banking. The customer intimacy,

product leadership, service equity, perceived sacrifice,

service quality, and operational excellence are the service

value dimensions in context of Indian retail banking. The

authors concluded from inferential statistics that except

for operational excellence and service quality, all the other

value dimensions exhibited variation in importance over

time. Results reveal that customers in the early stages of

relationship value tangible value dimensions and the ones in advanced stages of relationship value intangible

dimensions.

Pichate Benjarongrat, Mark Neal, (2017) done research in

Thai bank and studied the service profit chain (SPC) with

a intention to identify which service features customers

understand to be most important in their customer

satisfaction and engagement. Convenience, courtesy,

competence and internal branding are the key service

features for customers in their satisfaction and

engagement. Convenience, courtesy, competence and

internal branding showed positive relationships with

customer satisfaction/customer engagement.

Hajer Zarrouk, Khoutem Ben Jedidia, Mouna Moualhi,

(2016) compared the factors affecting profitability in

Islamic bank and conventional banking in the Middle East

and North Africa (MENA) region. A panel data model was

used to know the banks' specific determinants and the

macroeconomic factors influencing the profitability. The

authors studied 51 Islamic banks operating in the MENA

region from 1994 to 2012. The authors concluded several

elements of similarities between determinants of the

profitability for Islamic and conventional banks except

inflation rate.

Jennifer Mullan, Laura Bradley, Sharon Loane, (2017)

studied perception of stakeholders for mobile banking

and identified drivers and barriers of bank adoption of

mobile banking.

The researchers have used two-round modified Delphi

study. The opinion of 72 members from six stakeholder

industries was sought. The authors concluded that global

mobile phone penetration, competitive advantage,

customer convenience, strategic importance, customer

demand, low perceived risk/security concerns and

stakeholder partnerships are the key drivers of bank

selection.

Justin Paul, Arun Mittal, Garima Srivastav, (2016)

compared the private and public-sector to check the

impact of various service quality variables on the overall

satisfaction of customers. Forward stepwise regression

was used by the researchers. The authors surveyed 500

respondents in India; equal proportion of respondents

surveyed both for private and public banks. The authors

concluded that knowledge of products, response to need,

solving questions, fast service, quick connection to the

right person, and efforts to reduce queuing time are

positively associated with overall satisfaction in private

sector context

RESEARCH OBJECTIVES

- To study and measure expectation and perception in private and public Banks.

- To identify and differentiate the best banking sector

RESEARCH HYPOTHESIS

- There is no significant difference between Expectation and Perception of customers towards bank services.

- There is no significant difference between customer expectations and customer perceptions of public banks regarding service quality.

RESEARCH METHODOLOGY

Descriptive Research Design was adopted to determine customers' perception and expectation about the bank. The study has the population base as the public and private banks located in Ahmedabad and Gandhinagar cities of Gujarat State. A convenience Sampling was used to elicit information regarding customer perception and expectation about the service quality and customer satisfaction of the major banks. The questionnaire has been personally administered on sample size of 239 chosen on a convenient basis from the cities of Gujarat State. Modified SERVQUAL instrument with five point likert type scales was used. For the analysis of data statistical methods are applied with the aid of SPSS version 16.0.

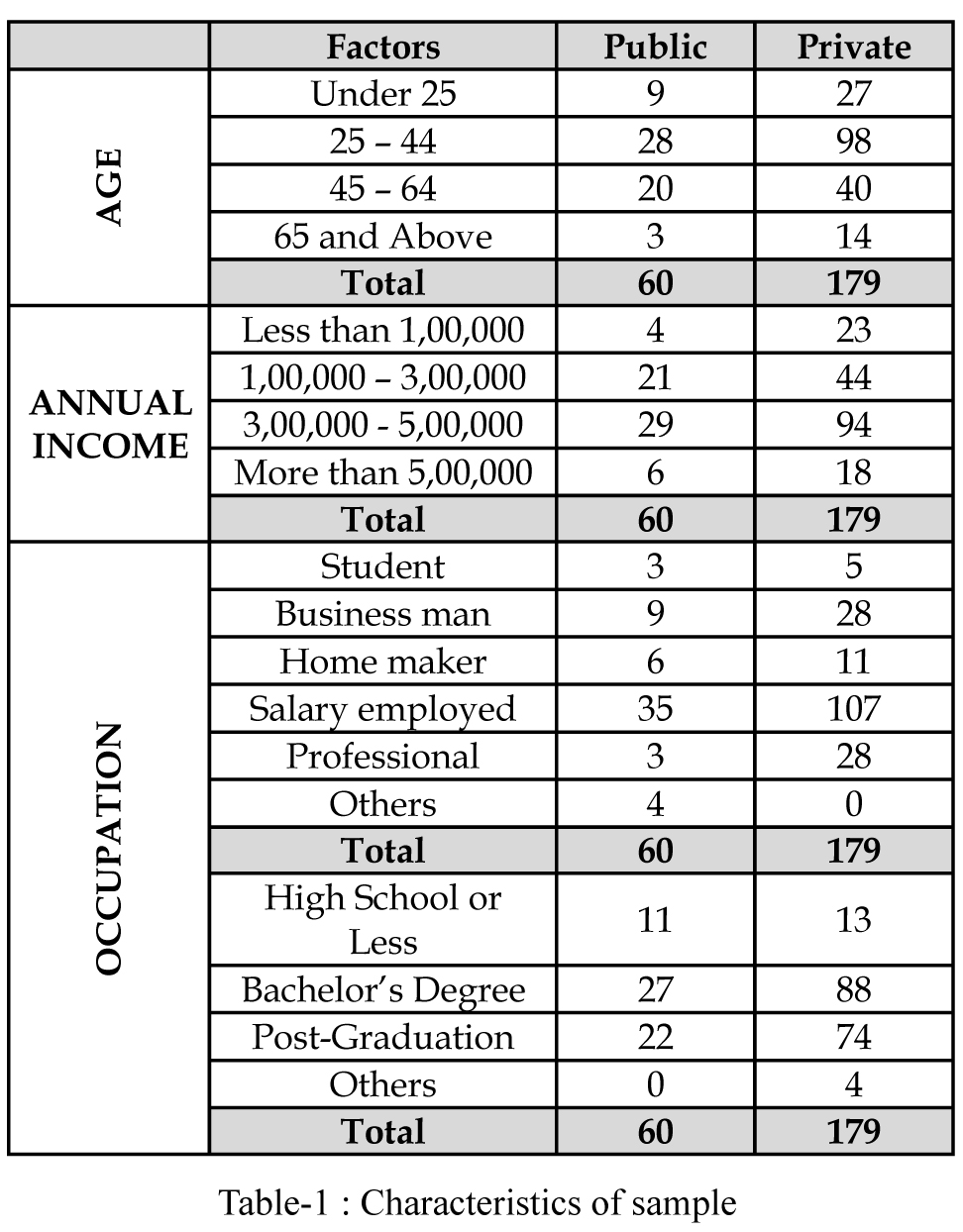

CHARACTERISTICS OF SAMPLE

DATAANALYSIS AND INTERPRETATION

Factor Analysis

KMO (Kaiser – Meyer - Olkin test of sampling adequacy) :

Significance value: - 0.8936.

The KMO is a statistic indicates the proportion of variance in

research variables that might be caused by underlying factors.

High values (close to 1.0) generally indicate that a factor analysis

may be useful. So here the value is 0.8936 and it is closer to 1. So

it can be said that factor analysis is useful for data.

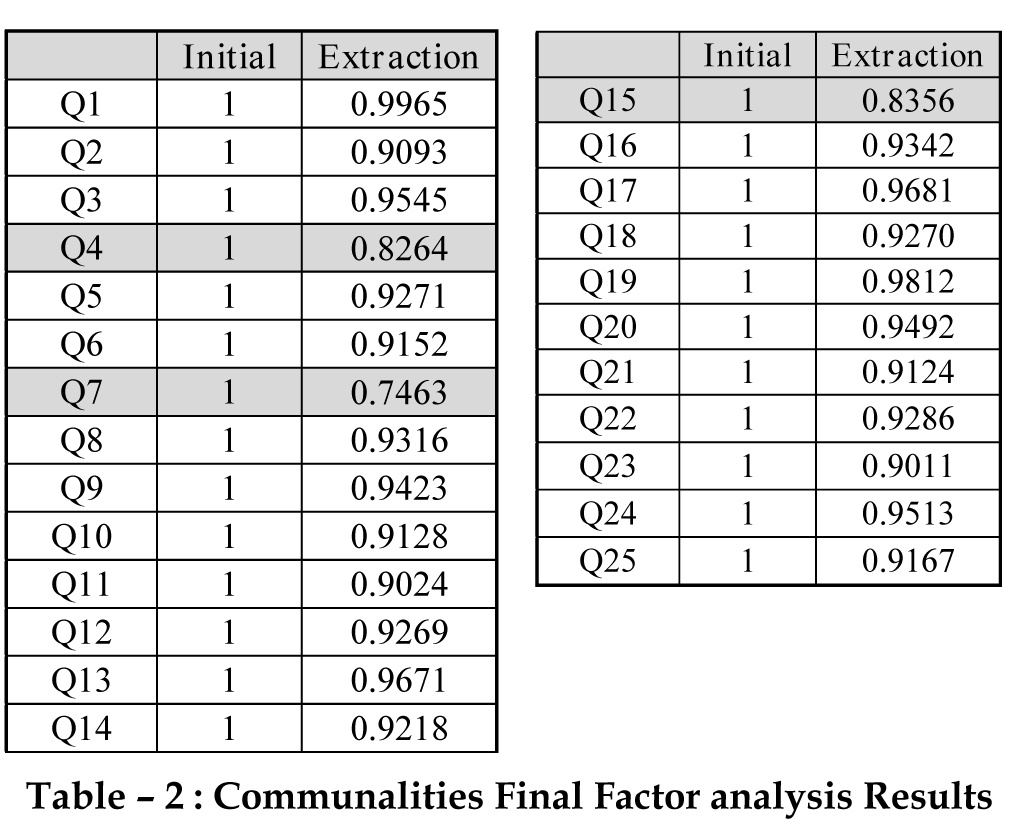

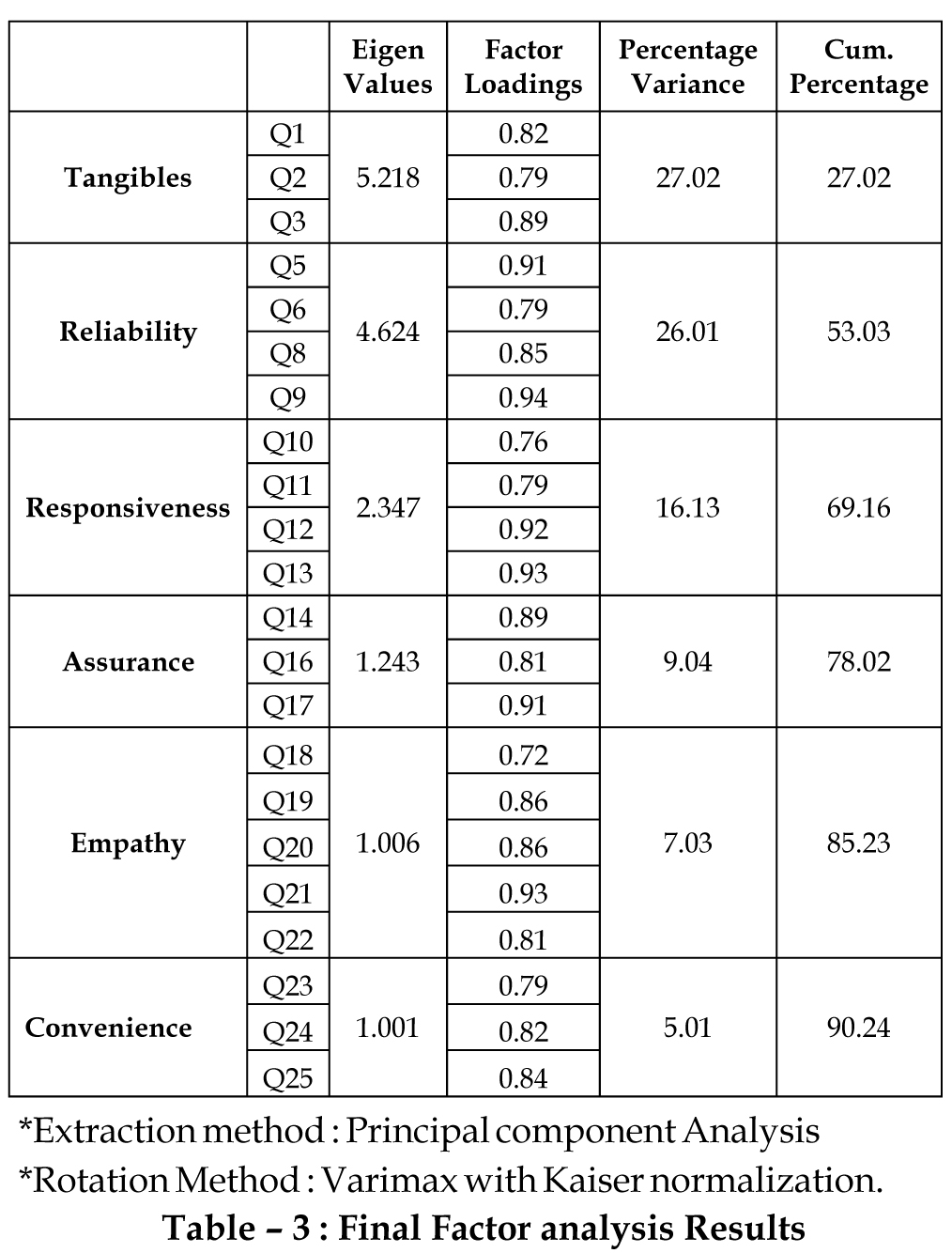

The rotated factor matrix shows that three components

have less than 0.5 Eigen values and 22 components explain

90.24Percent variance of total variance. The components

which have lesser value (less than 0.90) it should be deleted

in factor analysis. From the above two tables it can be said

that 3 components Q4 (Materials Associated with the

service will be visually appealing at bank) from Tangibility

dimension, Q7 (Banks will perform the service right the

first time) from Reliability dimension, Q15 (Customers of

banks will feel safe in transaction) from Assurance

dimension is not important and it is removed for further

survey.

The rotated factor matrix shows that three components

have less than 0.5 Eigen values and 22 components explain

90.24Percent variance of total variance. The components

which have lesser value (less than 0.90) it should be deleted

in factor analysis. From the above two tables it can be said

that 3 components Q4 (Materials Associated with the

service will be visually appealing at bank) from Tangibility

dimension, Q7 (Banks will perform the service right the

first time) from Reliability dimension, Q15 (Customers of

banks will feel safe in transaction) from Assurance

dimension is not important and it is removed for further

survey.

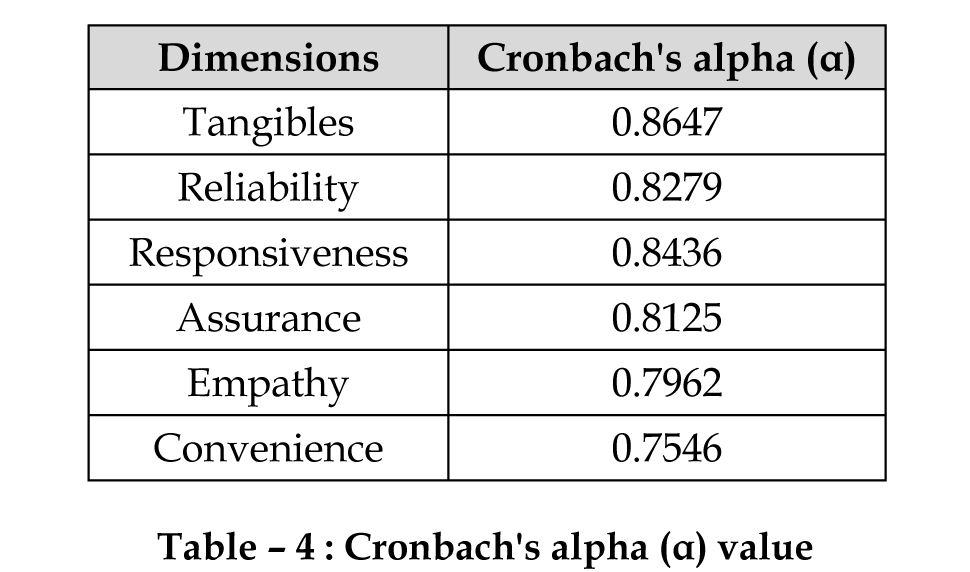

Reliability Testing

A measure of construct reliability (Cronbach's Alpha) was

computed for each dimension to assess the reliability of

the set of items forming that dimension. The coefficients

range from 0.8647 to 0.75462. As a rule 0.70 or more

represent satisfactory reliability of the items measured.

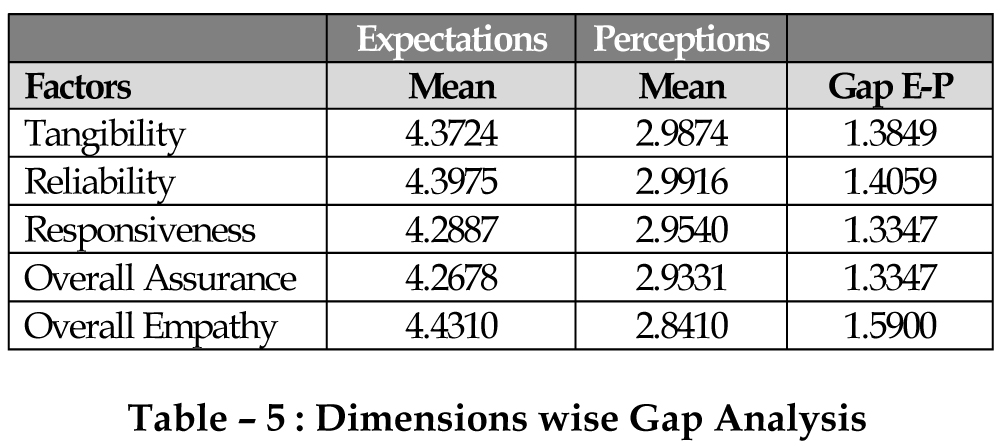

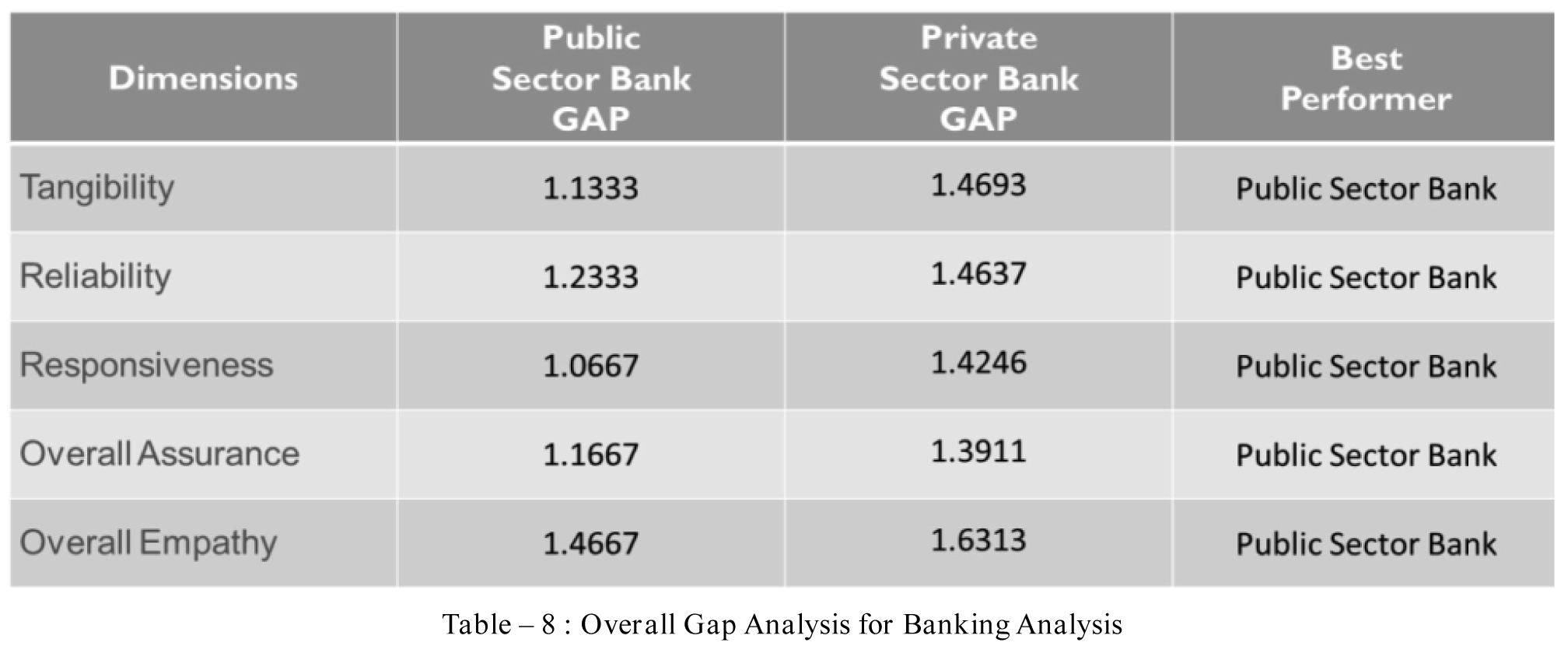

Gap Analysis

The analysis shows that there is a major difference between the servicequality expectations versus perception of the customers for all the banks.It can be seen that the Empathy dimension is having the largest gap, followed by Reliability.

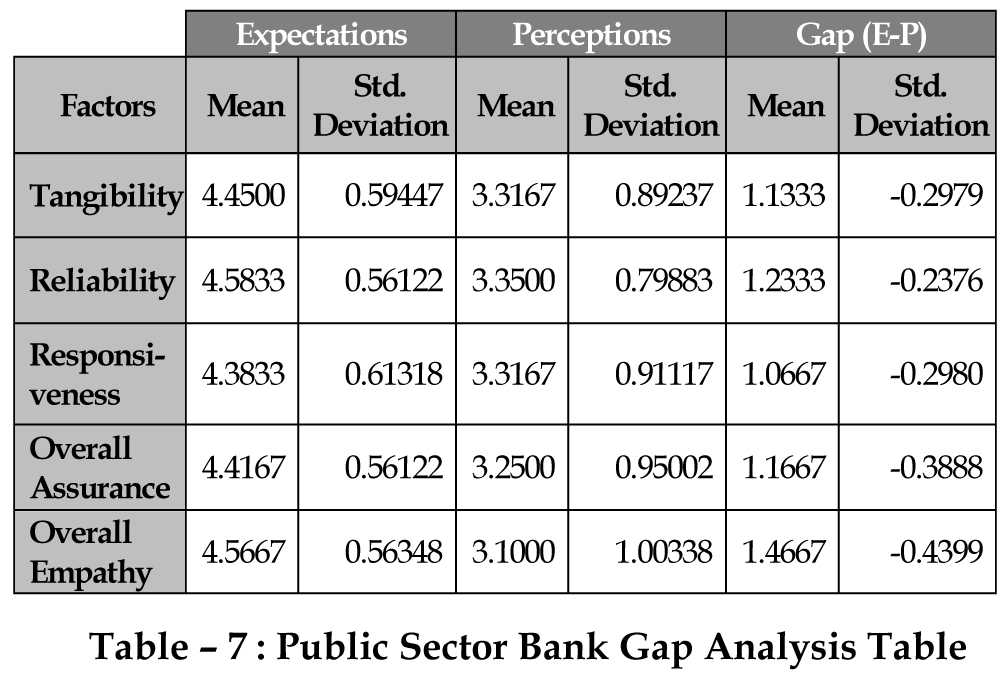

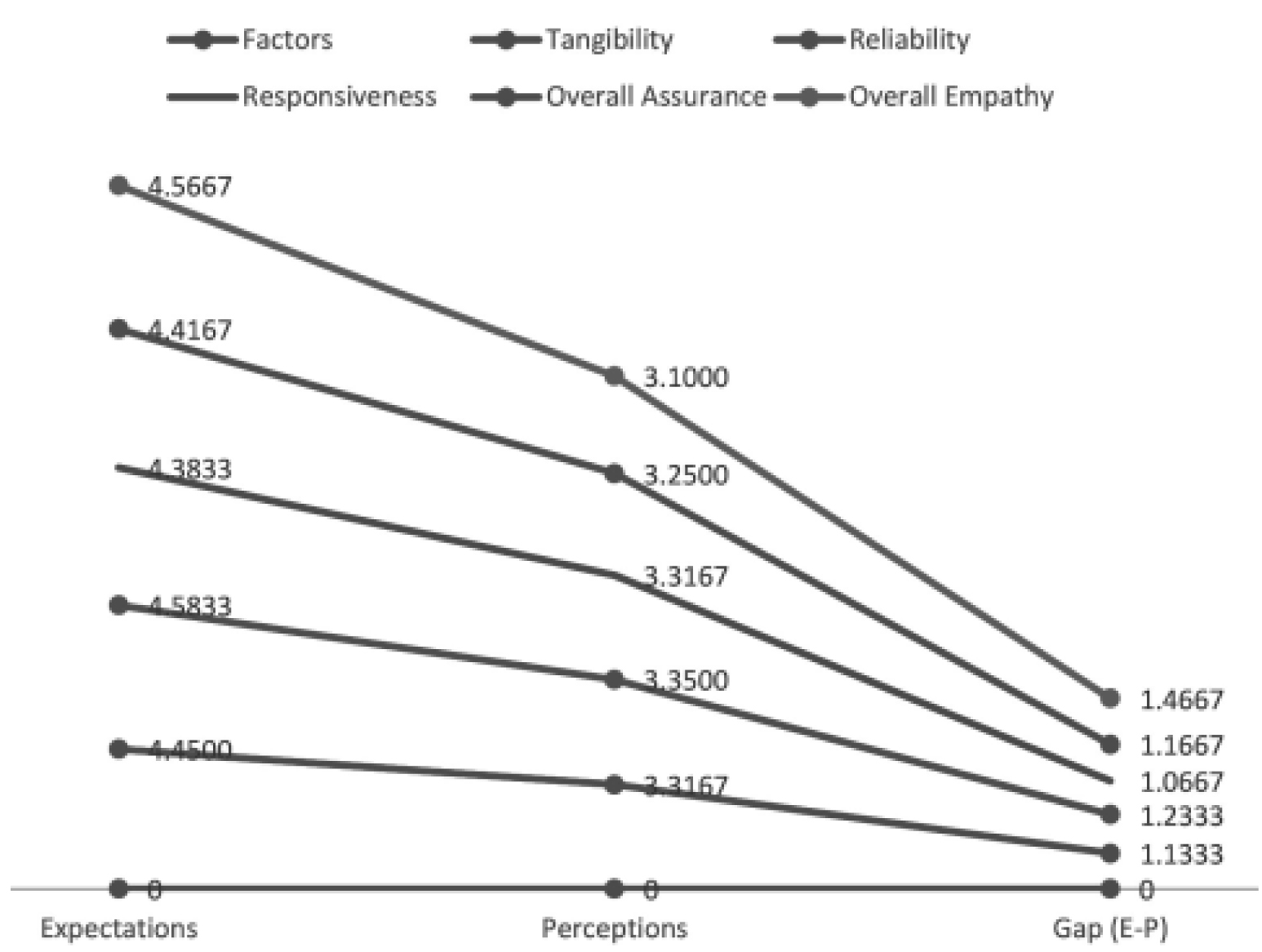

Public Sector Bank :

Hypothesis:There is no significant difference between

customer expectations and customer perceptions of public

banks regarding service quality.

The analysis shows

that there is a major

difference between the

service quality

expectations versus

percept ion of the

customers for public

sector banks. The

above table reveals that

in the reliability

dimension public

sector performs well.

And there is a high gap

between expectation

and perception in

empathy and

convenience

dimension. Similarly

private banks are

analyzed.

The analysis shows

that there is a major

difference between the

service quality

expectations versus

percept ion of the

customers for public

sector banks. The

above table reveals that

in the reliability

dimension public

sector performs well.

And there is a high gap

between expectation

and perception in

empathy and

convenience

dimension. Similarly

private banks are

analyzed.

MAJOR FINDINGS

Major finding of the research were summarized as follows.

The factor analysis confirms total 22 variables which

explain 90.24 Percent of variance out of total variance and 3

variables get deleted for further survey because they are

not forming part of any grouping variables. Factor analysis

showed that tangible, assurance; empathy, reliability,

responsiveness and convenience dimensions are the

explanatory variables for predicting customer satisfaction

in Gujarat.

The reliability testing reveals that all the values of cronbach

alphas are greater than 0.75 so that it can be concluded that

collected data is reliable.

The statistical analysis shows that there exists a gap

between the customer expectations and perceptions in the

Banking sector.

CONCLUSION

The statistical analysis shows that there exists a gap between the customer expectations and perceptions in the Banking sector. The expectations of bank customers are higher than their perceptions as suggested by Parasuraman et al. (1988). This gap varies across the banking sector.It can be concluded from factor analysis that tangibility, assurance; empathy, reliability, responsiveness and convenience dimensions are the explanatory variables for predicting customer satisfaction in Gujarat.

REFERENCES :

- Al-Tamimi, N. J. (2003). “Measuring perceived service quality at UAE commercial banks”. International Journal of Quality & Reliability Management Vol. 20 No. 4, pp. 458-472.

- Bakar, A.I. (2007). ''Service Quality Gap and Customers' Satisfactions of Commercial Banks in Malaysia”. International Review of Business Research Papers Vol. 3 No.4 , pp.327-336.

- Charles chi cul, B. R. (2003). “Service quality Measurement in the banking sector in south Korea”. International Journal of Bank Marketing, Vol.21 No.4 , pp.191-201.

- Dutta, K.D. (2009). “Customer expectations and perceptions across the Indian banking industry and the resultant financial implications”. Journal of Services Research, Vol. 9, No. 1 , pp.32-49.

- Eugenia Petridou, C.S. (n.d.). “Bank service quality: empirical evidence from Greek and Bulgarian retail customers”. International Journal of Quality &Reliability Management Vol. 24 No. 6 , pp. 568-585.

- Franc¸ois A. Carrillat, F.J. (2007). “The validity of the SERVQUAL and SERVPERF scales-A meta-analytic view of 17 years of research across five continents”. International Journal of Service Industry Management Vol. 18 No. 5 , PP-472-490.

- G.S. Sureshchandar, C.R. (2002). “ Determinants of customer-perceived service Quality : a confirmatory factor analysis approach”. Journal of Service Marketing, vol.16 No.1 , pp. 9-34.

- Huseyin Arasli, S.T. - S. (2005). “A comparison of service quality in the banking industry : Some evidence from Turkish- and Greek-speaking areas in Cyprus”. International Journal of Bank Marketing Vol. 23 No. 7 , pp. 508-526.

- Isa, M. A. (2008). “An examination of the relationship between service quality perception and customer satisfaction - A SEM approach towards Malaysian Islamic banking”. International Journal of Islamic and Middle Eastern Finance and Management Vol 1 No 3 , pp 191-209.

- Jones, A. G. (1994). "Service Quality -Concepts and Models”. International Journal of Quality & Reliability Management, Vol. 11 No. 9 , pp. 43-66.

- Kamal Naser, A. J.-K. (1999). “Islamic banking: a study of customer satisfaction and preferences in Jordan”. International Journal of Bank Marketing Vol.17 No.3 , pp. 135-150.

- Ladhar, R. (2008). “Alternative measures of service quality: a review”. Managing Service Quality Vol. 18, No. 1 , pp. 65-86.

- Marvin E Gonzalez, R. D., & Mack, R. W. (2008). “An Alternative approach in service Quality: An ebanking case study”. The Quality Management Journal, Vol.15 No.1 , pp.41-60.

- Zhou, L. (2004). “A dimension-specific analysis of performance-only measurement of service quality and satisfaction in China's retail banking” . Journal of Services Marketing Vol. 18 No. 7 , pp. 534-546.