Subscribe now to get notified about IU Jharkhand journal updates!

An Analysis on the Impact of GST on Mining Sector in India

Abstract :

The Indirect tax regime in India provides for a complex tax environment due to multiplicity of taxes, complicated compliance

obligations and tax cascading. Under the GST regime, all the key Indirect tax legislations would be subsumed except for few taxes

such as duty on Electricity, Royalty on the extraction of minerals from mines, etc. In Goods and Service Tax Act, the tax is levied on

the supply of goods and supply of services which is different from the taxable events of the current regime that is manufactured, sale or

provisions of service.

As per Section 9 of the Mines and Minerals Development and Regulation Act(MMDR),1957, the holder of a mining lease granted

before or after the commencement of this act shall pay royalty in respect of any minerals removed or consumed.

Keywords :

GST, Indirect Tax, Coal MinesOverview :

The Indirect tax regime in India provides for a complex tax

environment due to multiplicity of taxes, complicated

compliance obligations and tax cascading. Under the GST

regime, all the key Indirect tax legislations would be

subsumed except for few taxes such as duty on Electricity,

Royalty on the extraction of minerals from mines, etc. In

Goods and Service Tax Act the tax is levied on the supply

of goods and supply of services which is different from the

taxable events of the current regime that is manufactured,

sale or provisions of service.

The minerals and mining sector in India is governed by the

Mines Act, 1952 along with the Mines and Minerals

Development and Regulation Act (MMDR), 1957. The

mines and minerals development and regulation are

undertaken as per the MMDR Act under the control of the

union. As per Section 9 of the MMDR Act, 1957 the holder

of a mining lease granted before or after the

commencement of this act shall pay royalty in respect of

any minerals removed or consumed. The Mines Act,1952

lays down the rules and regulation in relation to the safety

of the labour, regulation for carrying out mining activities

and the management of mines.

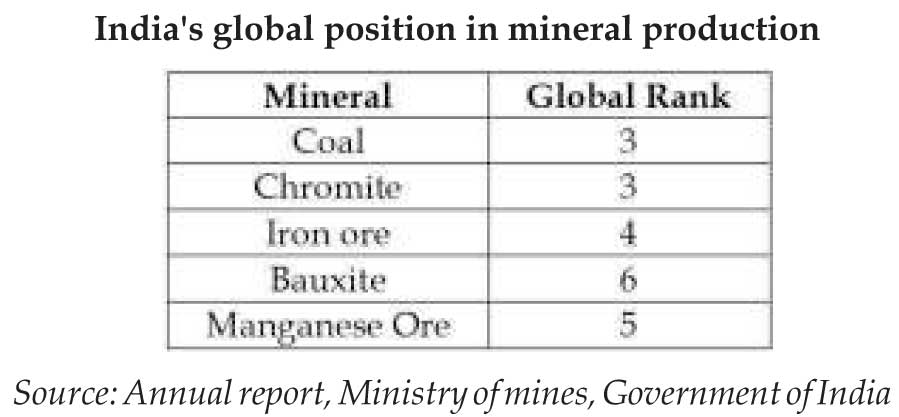

Mining in India

India currently produces around 89 minerals under different groups, with fuel minerals, metallic minerals, non-metallic minerals, atomic minerals and minor minerals. The country has immense potential for mining resources and reserves and is currently among the top 10 global producers of many minerals.

Activities in the mining sector

In general, mining sector involves the following activities :

- Survey and Exploration of minerals

- Excavation of mines

- Demolition of mines

- Earth moving services

- Mining of minerals

- Handling of minerals extracted

- Transportation of minerals.

Taxation system on Mining

Under the GST regime, all the key Indirect tax legislations

would be subsumed (except for few taxes such as duty on

Electricity, Royalty on the extraction of minerals from

mines, etc.).

As per Section 9 of the MMDR Act, 1957 the holder of a

mining lease granted before or after the commencement of

this act shall pay royalty in respect of any minerals

removed or consumed.

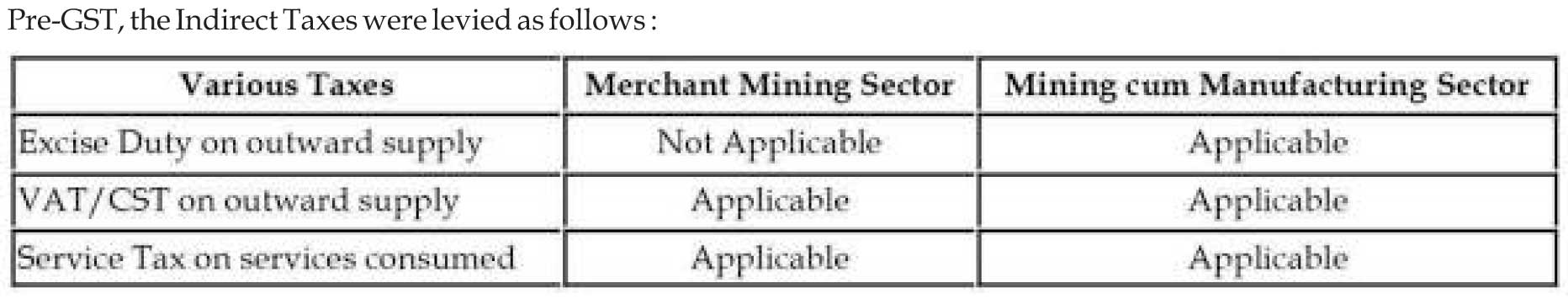

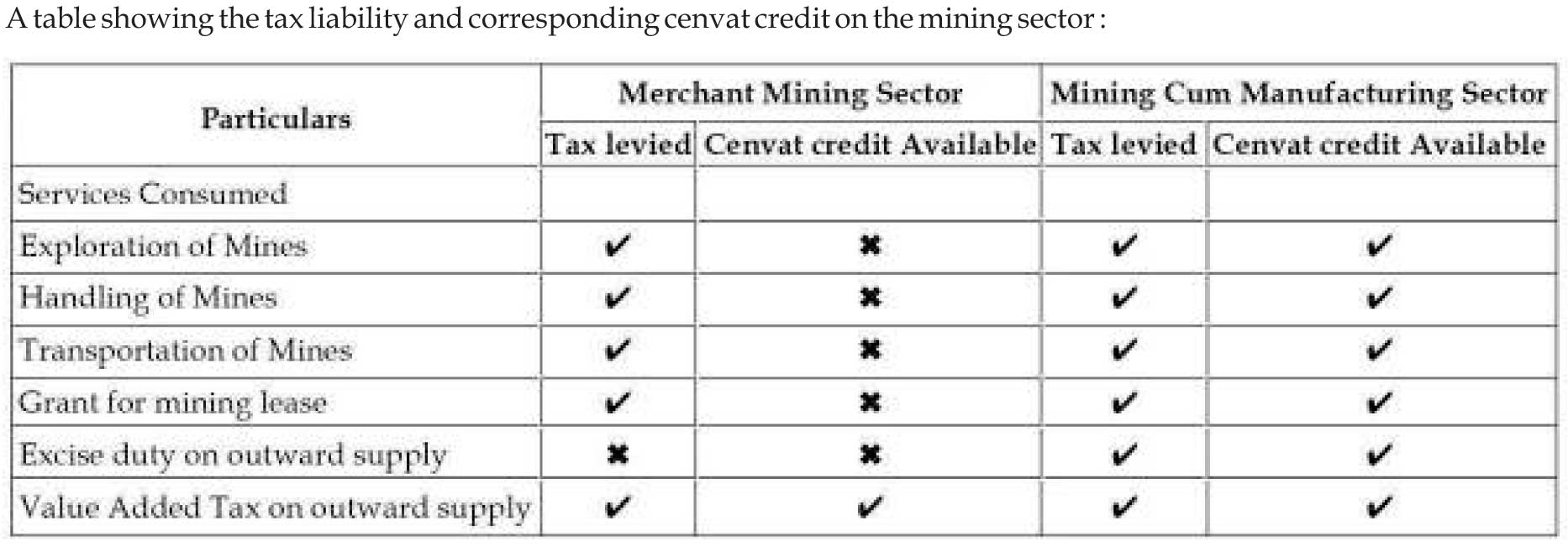

Before the GST :

The mining sector incurs service tax and royalty as the procurement costs :

- The mining companies may attract service tax for the services relevant to the mining industry such as explorat ion, mineral product ion, handl ing, transportation etc. A manufacturer and/or service provider paying service tax on procurement of services are allowed to take credit of same and it is set off against their Service tax or Excise liability. However, no credits are available to primary producers or miners, who are neither service providers nor manufacturers but simply a traders. Exporters are allowed to claim a refund of tax paid on procurement in various forms.

- Royalty on mining is collected by the State Government

from the business entities in relation to the lease of the

mines granted to them.

The Supreme Court, in India, Cement Ltd. v. State of Tamilnadu and others (AIR 1990 SC 85) had held that royalty is a tax and its payment is for the use of land. The judgment had relied on the concept that royalty was attributed to the extracted mineral created due to interaction among land, capital and labour, each of which possesses some definite intrinsic economic value. In this sense, royalty was viewed as a kind of tax linked either directly or indirectly to the intrinsic economic value of a mineral realised through sale by the lessee. Though the Hon'ble Supreme Court subsequently doubted the correctness of the above referred judgements and referred the case as to “whether royalty is tax or not” to a larger bench of nine judges and the same is yet to be pronounced and therefore the judgement of India Cement Limited can be considered as the law as on date. If the Supreme Court decides that royalty is in nature of tax then both excise duty and service tax cannot be levied, since there cannot be taxed on tax. - The grant for the mining lease rights is one of the methods of assignment of rights to use any natural resources and the consideration that is paid by the leaseholder is royalty as fixed by the State Government at the time of grant of lease. This royalty which is in the nature of the annual amount payable to the state government are seemingly subject to service tax.

- The mining industry incurs an excise duty; value added tax and central sales tax as the output tax liability:

- In case of merchant miners as the extraction does not amount to manufacture there is no excise duty liability as output tax. In case of mining cum manufacturing sector if any further processing of the minerals so extracted from the mines is undertaken in order to remove the impurities from the minerals or any other value addition process are being undertaken then the same would attract excise duty.

- The Value Added Tax (VAT) is levied on the sale of goods within the state. The mines output is subject to VAT, miners are allowed to take the credit of the vat paid on their inputs if any. The VAT cost flows from the mining company to the manufacturer and then to the distributor and reseller.

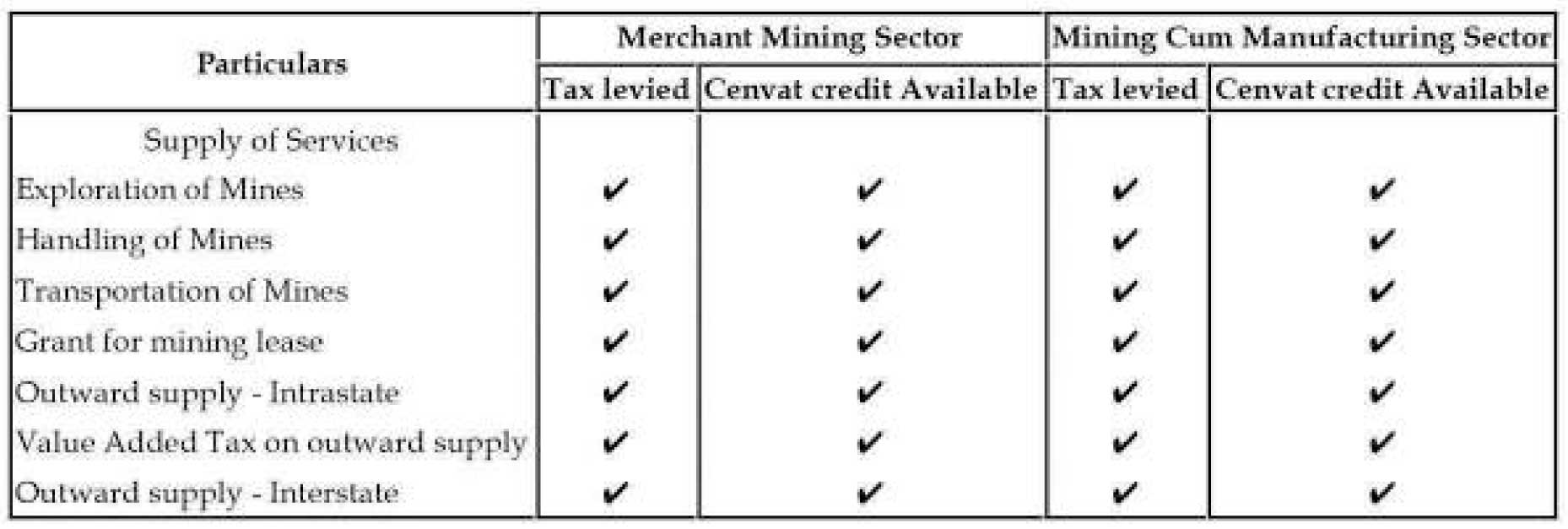

Analysis under the Goods and Service Tax:

The Constitutional Amendment Bill has deleted only the

VAT, Entry Tax and Entertainment Tax from the state lists

and Excise duty and Service Tax from the union list. As per

Section 3, of the GST Model Law, 2016 the Goods and

Service Tax is levied on the supply of goods and services.

Various supplies of services such as exploration, mineral

production, handling, transportation and the supply of the

minerals to consumers would attract GST. Under GST

there would be output taxes at the time of supply of output

of the mines, but at the same time the input tax cost

incurred by the miners would be allowed as credit.

The same can be shown it the help of the following table under the GST regime :

As per schedule IV of the Goods and Service Tax Act, the

consideration paid by the lease holder to the State

Government for the grant of the lease of the mines in form

of royalty would be chargeable to GST. However, as

explained earlier, the matter is to be decided by nine

member bench of Hon'ble Supreme Court as to whether

royalty is a tax or not. Thus, if it concluded that is it in the

nature of tax, GST on same cannot be levied. Thus, as far as

GST laws are concerned, there would be GST on the

amount of Royalty paid but since Royalty itself is not

within the frame work of GST, credit of royalty paid to the

State Government becomes a cost of miner, whether

merchant or manufacturer.

Future of the mining industry in India

- Despite the slowdown, India is still the second-fastest growing economy, after China.

- Demand for minerals, as well as for mining services, is robust in the country.

- Mining in India is becoming more structured, and companies have started outsourcing part of the project to mining service companies.

- The largest mining company in India, i.e., Coal India Limited (CIL), plans to invest around INR254 billion.

- Contract mining could prove to be a solution to the on-going current coal deficit in the country.

- As the industry focuses on adapting international levels of technology, there exists untapped potential in the Indian mining equipment sector.

Conclusion

The various activities of mining which is chargeable to

service tax under the current regime would attract tax at

the rate of 15%, whereas the supply of these services under

GST would be taxed at the rate of around 18% which is

higher than the current tax rate on the same. Thus, there

would be additional cash from of 3%, however, with

seamless credit available all across the net tax cost forming

part of the final product should decrease.

Royalty paid on mineral is not subsumed under the GST,

thus same shall be an additional cost for the business

entity. Thus, it is advisable that the Royalty shall be

considered as part & parcel of GST enabling business

entity to claim its set off against their GST liability to avoid

cascading effect.

References :

- http://gstidea.com/sectorial-impact/2017/mar/impact-analysis-of-gst-on- miningsector. html

- http://shodhganga.inflibnet.ac.in/bitstream/10603 /143726/8/chapter-4.pdf

- https://economictimes.indiatimes.com/markets/stocks/news/gst-impact-here-are-the-real-winnersand- losers/paints/slideshow/58772359.cms

- http://www.ey.com/in/en/industries/mining---metals/ey-emerging-economies-and-indias-miningindustry

- https://taxguru.in/goods-and-service-tax/50-faqson-gst-on-mining-sector-in-india.html