Subscribe now to get notified about IU Jharkhand journal updates!

Awareness Of Mobile Payment System Among Consumers : A Comparative Study In Ranchi And Kolkata

Abstract :

Indian mobile payment landscape has shown incremental growth in the recent past. Government is taking various steps to make India cashless. Recently, our Prime minister has launched BHIM, RuPay and SBI app in Singapore. This can be described as a major step towards internationalization of Indian payment platforms. People also are supporting vision of cashless India as it is evident from the increase in number of mobile payment users in the last three years. Also because smartphone has penetrated so well into the lifestyle of Indians that people now prefer everything that can be done by few taps on their Smartphone. The purpose of this research is to find the difference in level of awareness of Mobile Payment System among consumers of Ranchi and Kolkata. The research used survey method and questionnaire was distributed for primary data collection. Respondent involved customers of Ranchi and Kolkata city. 100 customers from each city were studied.MS Excel was used for data analysis.

Keywords :

Adoption, consumer adoption, mobile payment system, Ranchi, Kolkata.Introduction :

India is becoming one of the world's fastest growing mobile payment market. Number of mobile payment users has increased massively in last three years. With increasing UPI app and payment options in India, there is rapid increase in volume of mobile payment in our country. UPI has revolutionized Indian digital payment scenario attracting more and more users day by day. Only in three years of its launch, UPI based payments have grown tremendously, it has tripled the last years volume every year (according to RBI bulletin). Due to consistent increase in the volume of mobile payment transaction global tech giants such as Google Pay, Paypal and Whatsapp, have entered India's mobile payment market hoping to tap this huge potential. With attractive features such as cashbacks and convenience to use.mobile payment is becoming a good competition to cash and card. People in urban areas have welcomed mobile payment in their lifestyle because of its ease and convenience, and therefore number of users is increasing day by day. So, this research is to find out how well people of Ranchi and Kolkata have adopted mobile payment system in their life.

Literature review :

M-payments are financial transactions that are conducted over mobile devices to conclude the exchange of products and services. The specific definition given by Au and Kauffman is: an m-payment is “where a mobile device is used to initiate, authorize and confirm an exchange of financial value in return for goods and services”. (Au and Kauffman, 2007, p1). Perceived ease of use (PEOU), perceived enjoyment (PE), perceived usefulness (PU) education level, perceived security (PS) and age influenced the use of mobile payment services in Kenya. Sonal1 Dr. Vishal Kumar2 Dr. Kirti R Swain3 Social influence and gender did not influence the use of mobile payment services in Kenya while perceived usefulness was the strongest factor (David Kabata ; 2015). The influence of PEOU and SN differs among the gender of the students, with male students having high perceived ease use (PEOU) over their female counterpart, while social norm (SN) influences female students more than their male counterpart in adopting mobile payment. No significant difference was found in the general adoption of the mobile payment system among gender(AminuHamza&Asadullah Shah ; 2014 ). Factors that influence current users'intentions to use m-payment services are compatibility, subjective norms, perceived trust, and perceived cost. Subjective norms, compatibility, ease of use, and perceived risk influenced potential users'intentions to use m-payment. Subjective norms and perceived risk had a stronger influence on potential users, while perceived cost had a stronger influence on current users, in terms of their intentions to use m-payment services. (Chanchai Phonthanukitithaworn Carmine, Sellitto, and Michelle W.L. Fong; 2016). The relative advantages of mobile payments include time and place independence, availability, possibilities for remote purchases, and queue avoidance. mobile payments was mostly compatible with digital content and service purchases and to complement small value cash payments. Interestingly, the findings suggest that the relative advantages of mobile payments depend on certain situational factors such as lack of other payment methods or urgency (Niina Mallat; 2006). There are two possible solutions to promote the further development of mobile payment: developing a generally accepted mobile payment integrative solution or merge different procedures into interoperabi l i ty sys tem via interconnected participants with high-level protocols and regulation when necessary, because different market participants may have separate benefits (Junying Zhong ;2009).

Objective :

- To find, if there exists, any difference in the level of awareness and usage of Mobile Payment System among consumers of Ranchi and Kolkata.

- To find out, if there exists, any impact of demographic factors (age &gender) on usage mobile payment.

Research methodology :

- Research design- A survey through questionnaire was conducted on customers in Kolkata and Ranchi.

- Research area - The study area is customers in Kolkata and Ranchi.

- Target population- The target population of the study was consumers from various areas of Kolkata and Ranchi city.

- Sample size and sampling technique- Sample size is 100 from each city. Convenience sampling was used here.

- Data collection instrument- A questionnaire was used for primary data collection.

Data analysis :

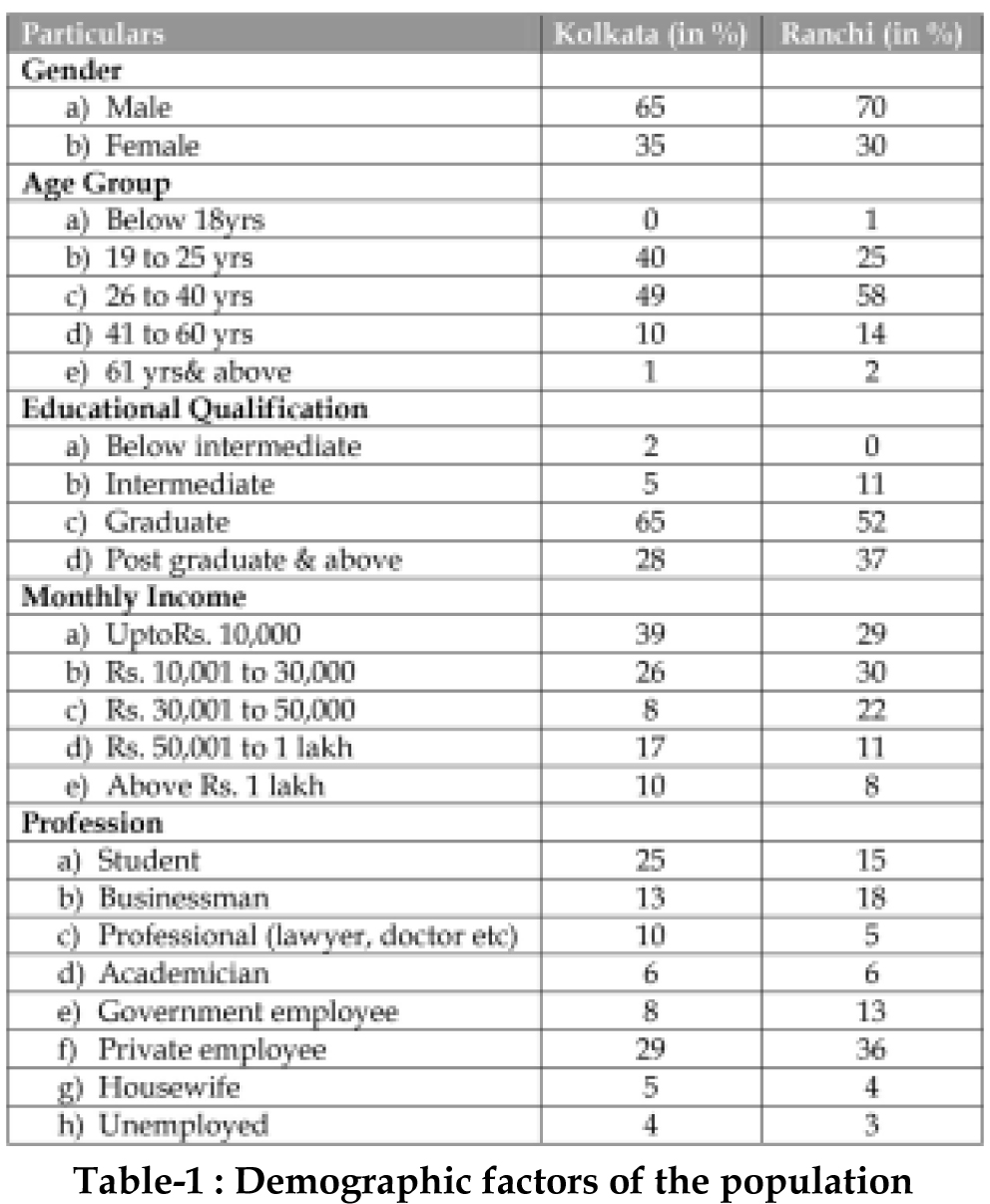

200 responses were used in the analysis. Table1 shows the

detailed demographic profile of the respondents. Majority

of respondents were male and most of the respondents

were below 40 years. Maximum respondents possess

graduate or higher level degree. Most of the respondents

earned below Rs. 30,000 monthly. Most of the respondents

were student or private employee.

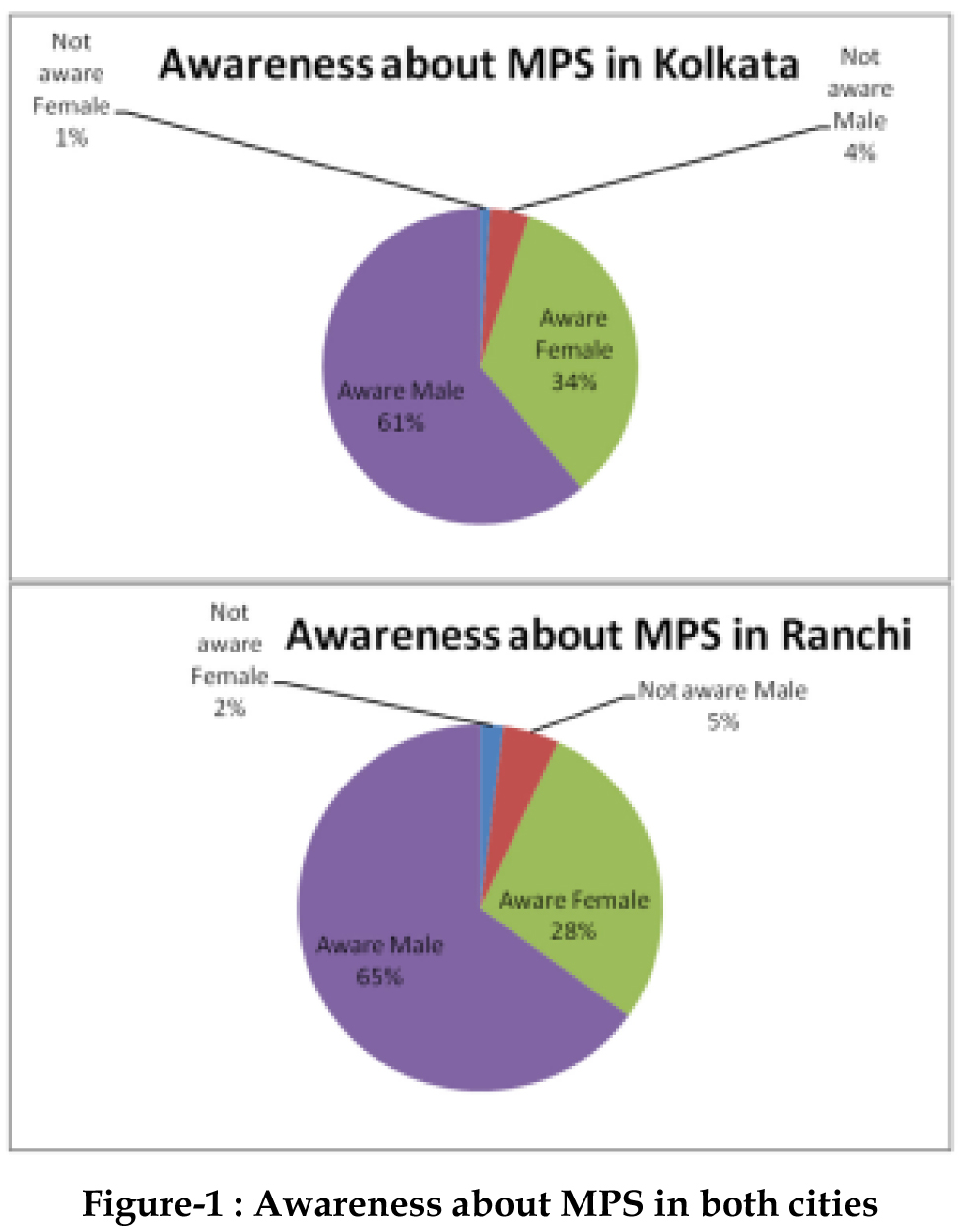

There is very high level of awareness in both the cities.

However, number of males who are unaware about MPS

is far greater than females who are not aware.

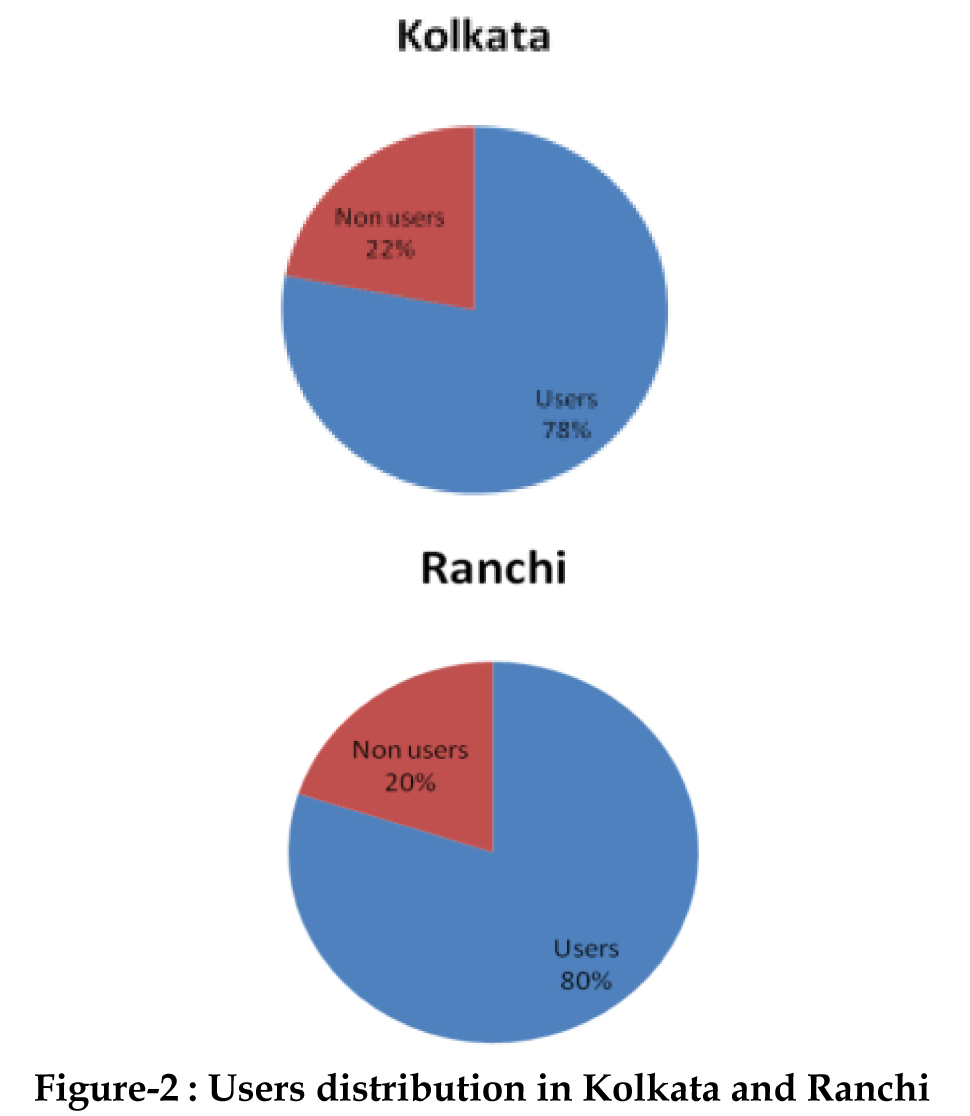

There is not much significant difference in usage of mobile

payment in both the cities. 78% of respondents in Ranchi

use mobile payment, whereas 80% of respondents in

Kolkata use mobile payment system.

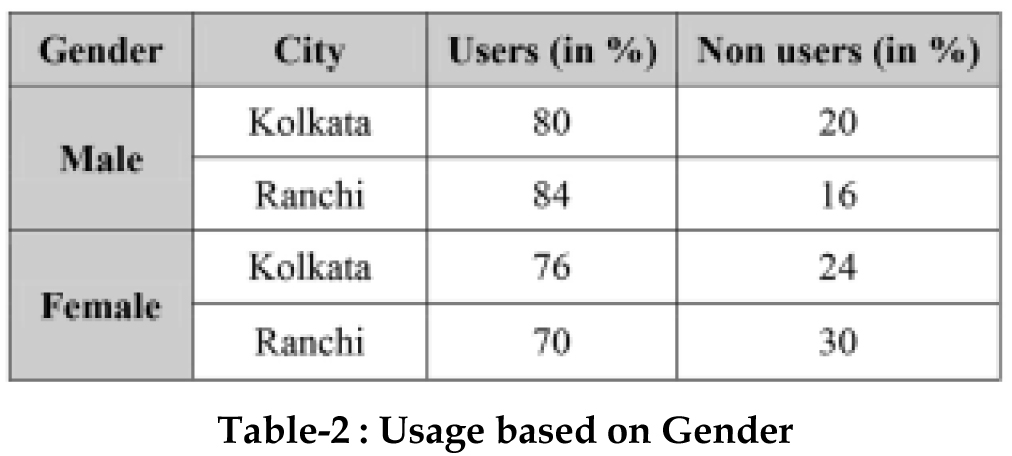

There is no significant difference in adoption of MPS by

gender of both the cities. 84% of male in Ranchi are users,

whereas only 80% males in Kolkata use it, and 70% of

female in Ranchi are users, whereas 76% females in

Kolkata use MPS.

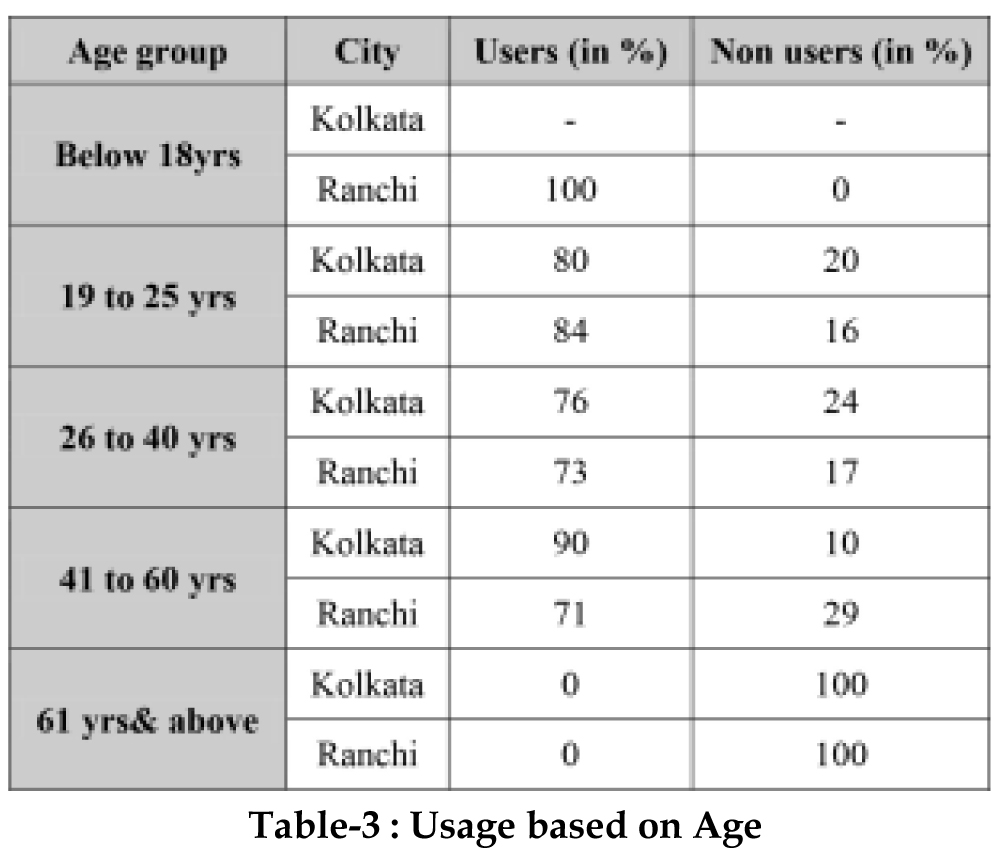

There is not much difference in the use of mobile payment

in age group category of 19 to 40 years in both the city. But,

the 41 to 60 yrs age group of Ranchi, is lagging behind in

using MPS Kolkata city. Whereas, people above 61 years

don't use mobile payment in both the cities.

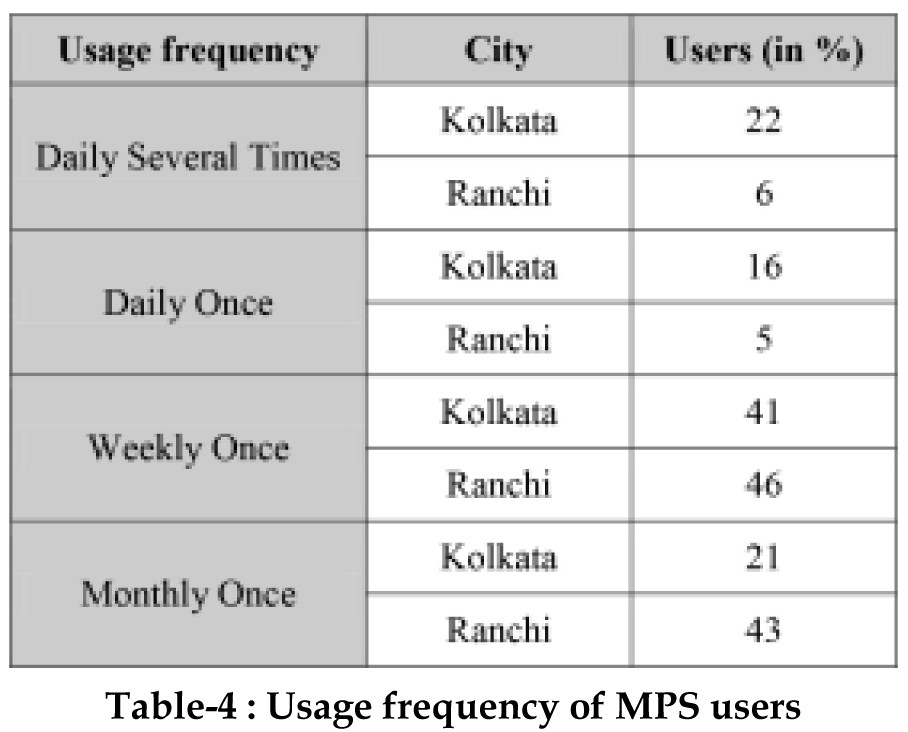

Daily users in Kolkata are triple from Ranchi, whereas,

there is no significant difference in weekly users. Most of

the people in Ranchi are monthly user.

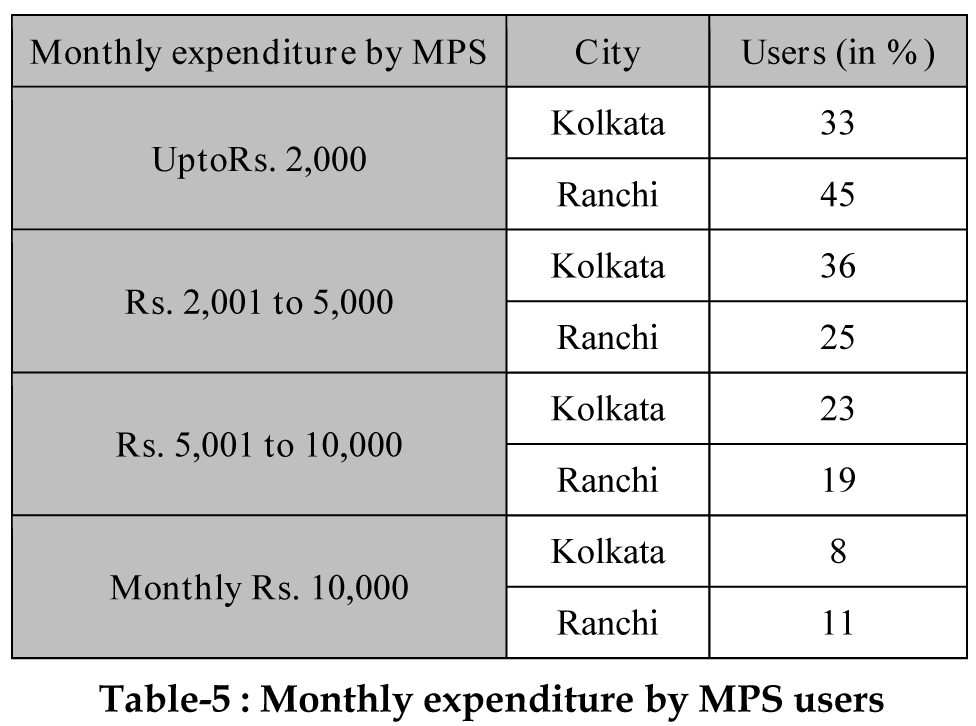

There is not much difference in monthly expenditure on

MPS in both the cities as monthly expenditure of about

70% of people spend less than Rs. 5,000 on average.

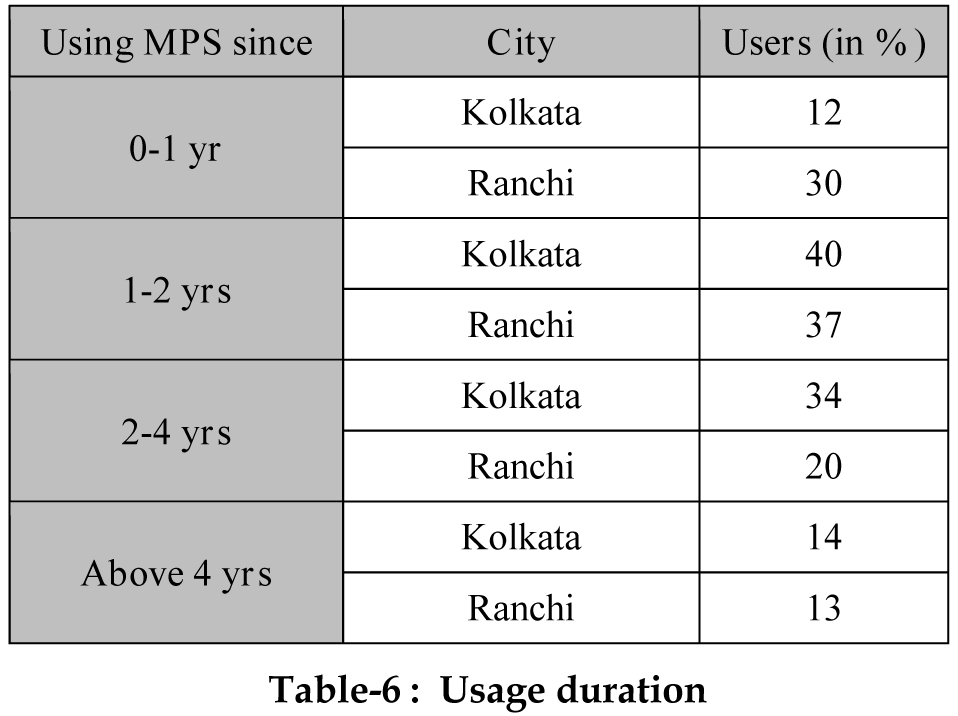

Most of the people in Kolkata have been using mobile

payment for more than 2 years, whereas new users'

percentage is higher in Ranchi.

Findings and Conclusion

The finding of research/study indicates that majority of people are aware about MPS and have adopted mobile payment in their lives. Male users are slightly more in number than females in both the cities. The different age groups of people show similar level of adoption in both the cities, except age group of 41-60 years in Ranchi. People above age of 61yrs are not comfortable with mobile payment in both the cities. The application providers should focus on age group of above 40 yrs to try and get more business from them. Most people of Kolkata use mobile payment on daily basis, whereas most people in Ranchi use mobile payment on monthly basis. Though, monthly expenditure via MPS is similar in both the cities. New adoption rate in Ranchi city is higher, indicating new business opportunities and increase in level of daily usage.

Limitations and Area of Further Studies

The scope of this research was limited to customers only so in future this research can be extended to multiple stakeholders. Secondly comparison between two cities of same country was done, so in future researcher can focus on cities of different countries to see the acceptance globally. Thirdly, this research used Excel so SPSS and other tools could be used by researchers. And lastly, the number of respondent could be increased in future research as to get a clearer picture, here it was limited to 100 respondents from each city.

References :

- Amoroso, Donald L ,2010.Mobile Payment Industry :Toward a Comprehensive Research Model ,Annual Conference of Japan Society for Management Information 2010 Autumn.

- Au, Y. A., Kauffman, R. J., 2008. The economics of mobile payments: Understanding stakeholder issues for an emerging financial technology application. Electronic Commerce Research and Applications 7 (2), 141–164.

- Dahlberg, T., Mallat, N., Ondrus, J., Zmijewska, A., 2008b. Past, present and future of mobile payments research: {A}literature review. Electronic Commerce Research and Applications 7 (2), 165–181.

- Dahlberg, T., Öörni, A., 2007. Understanding changes in consumer payment habits: Do mobile payments and electronic invoices attract consumers? In: Proceedings of the 40th Annual Hawaii International Conference on System Sciences. IEEE Computer Society Press, Washington, DC.

- Dahlberg, T., Mallat, N., Öörni, A., 2003. Trust enhanced technology acceptance model: Consumer acceptance of mobile payment solutions. The Stockholm Mobility Roundtable 2003, Stockholm, Sweden.

- Dai, Hua; Palvi, P.C, 2009 . Mobile commerce adoption in China and the United States: A cross- cultural study. ACM SIGMIS Database.

- Dai, Hua; Singh, Rahul; Iyer, Lakshmi,2007.Intention to Use Mobile Commerce: A Demographic Analysis of the Chinese Market . In: Proceedings of AMCIS 2007.

- De Albuquerque, J. P., Diniz, E. H., Cernev, A. K., 2014. Mobile payments: A scoping studyof the literature and issues for future research. Information Development, 1–27.

- E H Diniz, F G Vargas, and J P Albuquerque, "Mobile Money and Payment: a literature review based on academic and practitioner-oriented publications (2001- 2011)," in Proceedings of SIG GlobDev Fourth Annual Workshop, Shanghai, China, 2011, Available from Ho, Henry; Fong, Simon; Yan, Zhuang , 2008.User Acceptance Testing of Mobile Payment in Various Scenarios. 2008 IEEE International Conference on e- Business Engineering

- Lee, KS; Lee, HS ,2007. Factors influencing the adoption behavior of mobile banking: a South Korean perspective. Journal of Internet Banking and Commerce

- Li, Yunhong; Luo, Siwen ,2008 . Research on mobile payment in the e-commerce . 2008 International Conference on Management of e-Commerce and e- Government

- Olga Morawczynski, 2009. Examining the usage and impact of transformational M-bankinginKenya . In Proceedings of Internationalization, Design and Global Development: Third International Conference, IDGD 2009, Held as Part of HCI International 2009, San Diego, CA, USA, July 19-24, 2009.

- Mallat, N., 2007. Exploring consumer adoption of mobile payments;;A qualitative study. The Journal of Strategic Information Systems 16 (4), 413–432.

- M Mbogo, "The Impact of Mobile Payments on the Success and Growth of Micro-Business: The Case of MPesa in Kenya," vol. 2, no. 1, 2010, Available fromhttp://www.ajol.info/index.php/jolte/article/v iew/51 998.

- Ondrus, J., Lyytinen, K., Pigneur, Y., 2009. Why mobile payments fail? towards a dynamic and multiperspective explanation. In: Proceedings of the 42nd Annual Hawaii International Conference on System Sciences (HICSS). IEEE Computer Society Press, Washington, DC.

- Sophie PERNET- LUBRANO, 2010. Mobile Payments: Moving Towards a Wal let in the Cloud? Communications & strategies.