Subscribe now to get notified about IU Jharkhand journal updates!

Challenges and Issues in Digitization of Property/House Tax Collection : A Case of SSPL, Jharkhand

Abstract :

Ease of doing transactions is becoming an inevitable part of any service provider irrespective of private, government or semigovernment

players for its smooth operation. Digitization of property/house tax collection has been a major challenge for Government

of Jharkhand since its inception in the year 2000. The current paper sheds insight on the successful operation of Sparrow SoftechPvt.

Ltd. in the state of Jharkhand along with challenges and issues faced by them during initial set up and at present. The unspoken

expectation of ensuring safety and security of data always existed. However major challenge for SSPL was handling online payments

through Debit/Credit Card along with other offline modes and its real-time reconciliation along with integration – searching, locating

properties and generating reports accordingly.

The paper also attempts to discuss the various impediments like automatic calculation of the property tax, arrears calculation and

copy of last payment receipt etc. Gigantic and continuously changing numbers of taxpayers due to the amalgamation of existing

properties into single property and creation of new properties from exiting was another set of issues with incessant updating of data

and information along with its linkage with the payment system. The paper also discusses various operational issues like name

transfer of the property owner and its verification, modification of correspondence details and more importantly communicating the

client about due dates and non-payment of their property/house tax, which is the part of the vision of Government for outsourcing the

entire digitization to SPPL.

Keywords :

Digitization, Online Payments, Secure transactions, Property/House TaxIntroduction :

Technological advancements, in specific digitization have

brought in ease to both to almost all layers in the markets

with focus being customer centric. Anartisan sitting in a

remote location of India is able to sell his/her paintings,

crafts etc. to customers across the globe via direct and

indirect linkages through e – business technologies and eplayers/

service providers.

The approach is aiding in identification of new target

markets and definitely creating an urge to redefine

marketing concepts. On one hand where digitization has

gone beyond geographical boundaries on the other it has

made time constraints demeaning. As a customer, one can

shop from anywhere and at any time. All what's required

is a computer or a mobile phone and an internet

connection. The reason behind continuous up soar in

usage of this concept of business is the ease it provides.

Gradually this concept has found its acceptance in almost

several industries belonging to almost all sectors; be it

private, semi government or government.

Journey of SPPL with Challenges and Issues :

Digitization of property/house tax collection is a step

taken by the Government of Jharkhand towards catering

its services through online mediums. Property tax being

one of the most prominent sources of revenue for any

government across the world in urban regions, calls for an

effortless and user friendly process. The process looked

upon in Jharkhand, had its challenges and constraints.

Overcoming them all and successful implementation is an

target for Government of Jharkhand (GoJ). The GoJ has

outsourced the tax collection and digitization process to

Sparrow Softech Pvt. Ltd. (SSPL) in the year 2014 under the

banner of a project titled“Survey, assessment, collection

and recovery of property tax”. The current paper attempts

to discuss the operational modem of Sparrow SoftechPvt.

Ltd. with focus on challenges and issues faced for and

during the same.

Mr. Deepankar Kumar, Vice President SSPL says

“Security and zero miss-use of consumer data, along with

online payments and its real-time reconciliation along

with GIS integration has always been their major

challenge”.

SSPL had a task to collect information of the properties

using self assessment forms provided by the RMC and

create digital records by developing required and

appropriate software and applications. Based on it carry

out Tax assessment calculation with a calculator for

citizens. Along with online modes of payments being

available but due to technological barriers door to door

collection was also facilitated. Now, the tax collector (TC)

collects the payment through various financial

instruments and prints the receipts using hand held

devices linked with the back office and bank. In case of

online payments the website provides several payment

options like debit/credit cards and various payment

gateways. The payment gateways used are State payment

gateway “Bill-desk” and“CC-Avenue”.As the receipt of

payment is acknowledged by the database a receipt of the

same is printed, SMS is also generated simultaneously and

sent to the tax bearer regarding the receipt of payment, the

amount and mode of payment is also mentioned in the

SMS. It is ensured that the details of payment stored in

digital form are safely protected. A DCB (Demand,

Collection and Balance) format is been adopted and

reported to the RMC. SSPL also acknowledged the

importance of service and the need of public interaction

window for which both Online Helpline and Telephonic

assistance during working hours was initiated. MS-SQL

has been used for database handling and all rights and

authorization is extended to RMC. The application

provides a Web Dashboard for RMC staffs and

management for viewing and generating reports on

appraisal, dues and collection. The application is dynamic

and timely customization is made as and when needed to

meet the requirements. The web application is an in house

product of the SSPL.

The journey was never smooth and several estimated and

unfor e s e en condi t ions eme rged dur ing the

implementation phase and even today. Partial/Non

Payment of tax due to several reasons like non-availability

of people at home, shortage of cash at home, noncooperation

of taxpayers, dishonour of financial

instruments, theft/loot of money from the tax collectors

are some of the issues faced. To overcome these issues

SSPL is encouraging the taxpayers to use online modes.

The project was divided in five stages.

- Preparation of the project

- Preparing Blueprint of the Business

- Realization Phase

- Final Preparation

- Going live Phase

At the first stage proper planning was done through need

assessment. Talks were held with the officials of the RMC

to understand what was expected. Gap between expected

and current scenario was determined and proper planning

was done to fill the gap. Suggestions were made, long

round of discussions was held and finally an outline was

deduced. sBased on the need assessment a blueprint of the

website was designed. Based on the guidelines provided,

the web and mobile applications were developed. Time to

time clarifications was taken and development was done

accordingly. The applications were shown to the officials

of RMC to determine and ensure that the development

was in right path and suggestions provided were

implemented in the application. After the development

stage the application was tested intensively to find the

lacking and to overcome before the final implementation.

After overcoming all these challenges, the project was

good to go live and it was finally launched in September

2014.

The Property Tax Collection module is an online web

based application . Any user can go to

http://ranchimunicipal.com/or

http://ranchimunicipal.net/and check their account. The

web application is user-friendly and easy to operate. The

interactive interface provided is software that is available

to the taxpayers in form of a website and also in form of an

“app” which is strictly for the TC and not the payers. A

taxpayers can visit the website and click on the “Pay

Property Tax” button. He/ She then are asked his ward

number and his name or holding number or house

number. After submitting the details the account of the tax

holder opens where he can check his account details and

make payments. The amount due is automatically

calculated and the taxpayer is required only to make the

payment, which is hassle free and even a layman can

operate it with ease. For the clear understanding of the

taxpayers individual button of “Search Property, View

Property Details, View Dues Details, View Payment

Details” are also added to the website although these

details can been seen under the “Pay Property Tax” button

itself. To make events more comfortable for the property

holders a support system has been set up. The support

system is equipped with Internet Protocol Phone Branch

Exchange (IP-PBX) and integrated with Primary Rate

Interface (PRI) of 100 channels so that citizens are not kept

in queue. A user-friendly IVRS welcomes the users. Every

call made is recorded for quality purpose and future

reference.

When someone purchases or acquires a property it is

mandatory to take a holding number for which filling in an

application form is required. Earlier it was available only

at the office of RMC but today it can be filled online. After

which the RMC completes its verification and follows the

set procedures before allotting a holding number. The

interface provides much more information to the

taxpayers A property holder can track his/her progress on

application along with details of the TC of the ward with

contact credentials. A photograph of the TC is also update

on the website for authentication. The taxpayers have also

been given the option to update their holding address and

contact details in case of a change or if they find an error in

the record updated on the website. To ensure fraud

transactions it is essential to enter the OTP sent to the

property holder's mobile number. The edits done by the

property owner is verified by the backend team before the

edits finally reflect in the system. Security has been a

priority concern since the very inception, be it

safeguarding of property holders data or online payment

options. Although transparency of the system was also

essential, thus finding a right balance between the level of

transparency and data security was tricky. Ones the right

poise was deduced it became easy to develop the

application with right security measures.

The process of tax collection has been kept flexible. The

models offered are door step service and online and both

the processes provide complete service. The rationale

behind the concept was to provide a comfortable platform

to all kinds of users. If someone is technologically

challenged he may opt the door step service model and if

someone is technically sound and wants to avoid long

queues and the lame door step service process he may

chose the online model.

In the door step service model a TC visits the house of a

property holder and assists him in applying for a holding

number if already not generated. He assists him in

calculating his tax by assessing his property based on

annual rental value (ARV) and other fixed standards. Then

he collects the tax in cash or cheque or through other

financial instruments. The tax collectors are also provided

POS machines to receive payment through debit/credit

cards. ICICI bank has been tied up with this project and a

taxpayers can pay the due at any ICICI branch across India

by just providing his holding number. So even if someone

is not willing to or is not able to use the online methods, the

process has been simplified for the taxpayers. And the

results have been overwhelming. A noticeable increase in

revenue has been marked by the RMC not only because the

property holders pay regular tax now but also because

new taxable properties have been added to the system. Tax

collectors of SSPL have reached almost all the properties in

the RMC area and have spread awareness regarding the

drive. Sensitization has also been a major contribution of

SSPL in order to make the project a success. Despite its

success, even till date there are few properties that have

not been traced. Approximately 60,000 properties are still

not having holding numbers. According to the 2011 census

2,10,000 properties have been reported. By 2017 it has been

estimated that there should be 2,40,000 properties but the

current number of taxpayers is 1,81,000 (2016-2017

financial year) of which 1,50,000 paid the property tax and

31,000 defaulters were reported. To identify the non

taxpayers a system has been deduced. Every property that

has been accessed and brought under tax base is tagged on

Geographical Information System (GIS) platform and

marked green. The GIS is regularly updated with satellite

imageries. The properties not having holding number are

marked red making them easily traceable. These non

taxpayers will be sent notice to apply for their holding

number. If the owner applies for his holding he pays the

tax and penalty (Rs.2000/- for residential and 5000/- for

commercial properties). If the owner ignores the notice

then RMC can attach the owner's bank account. After

which the due will be debited from the bank account, after

which on request of the owner the bank account will be

released. If this does not work the property can be sealed

and auctioned. Finally RMC can even take legal actions

and body warrant can be issued. All these procedures are

as per the Jharkhand Municipal Act 2011.

There are several working households and no one is

present at the house during the office time, or many a

times the taxpayers are outstations and there are few

people who do not trust the tax collectors. For them the

online process is the best. All the services provided in the

door step service model are available on the online

p l a t f o r m . A t a x p a y e r s n e e d s t o v i s i t

http://ranchimunicipal.net and chose the action he wants

to operate from the various options available.

Safeguarding property holder's information and financial

transactions were the greatest of issues. In case of physical

transactions where the collectors gather information and

relevant documents and also cash/cheque in person a

thorough background and reference check is done before

hiring to avoid any kind of misuse and since the start of

the project till date no such incidences have been reported.

Even if a TC collects the tax from an owner and does not

report it to SSPL in that case on presentation of the

payment slip given by the TC to the owner it is the liability

of SSPL to pay the tax to RMC. But the greater threat was

ensuring digital safety. For which safe protocols for data

and file transfers are used. Secure Socket Layer (SSL)

Protocol is used for browsing. SSL is a safety protocol

which allows a browser or a clients system to

communicate with a web server through encrypted links.

When a taxpayers communicates with the Data Centre of

RMC the data transferred is encrypted by SSL. A SSL

certificate has been acquired for the website and public

key, private key cryptography is used for exchange of

data. SSL certification ensures the end users that the

date/information shared is safe and that a certification

agency has authenticated the web application thus

building reliability in the minds of users.

The web application is also protected with Firewall. The

firewall provides protections against Denial of Service

(Dos) and Distributed Denial of Service (DDoS) attacks

and ensures shield against spoofing and pissing. Being a

web application that allows users to pay online it is

important to eliminate the threat of spoofing. The firewall

protects dynamic IP settings like the WiFi, an interface

where maximum threat exists and at the same time

facilitates sheltered hosting of servers. The firewall also

secures Software as a Service (SaaS) and cloud

environments of the website. The firewall provides faster

uptime to the website and reduces latency. It also

supports real time applications which are essential for the

website. SSPL uses 2 servers, one is the Application Server

and the other is the Database Server. The application

server serves as the frontend and database server supports

the backend. The application server is attached to the

firewall which works as an intermediary between the

server and the network. To increase security the server has

2 hard disks. One HDD stores data and the second HDD is

used for scheduled backup. Other than the scheduled

automatic backup a manual backup is taken 3 times a day

using external storage devices. The data centres used by

SSPL are located at Ranchi for data storage and 2 other

data centres in different states used as Disaster Recovery

(DR) sites.

The work of SSPL in the field is commendable. Calculation

of property tax can be done instantly. The TC feeds the

following details in his handheld device or his mobile

phone having the app installed, “build up area/carpet

area, type of construction (RCC/ACC/others), type of use

(residential/non-residential), type of road(Primary main

road >40ft, main road between 20 to 40 ft and others <20ft)

and occupancy type (self/tenanted). After these data have

been fed to the device ARV (annual rental value) is gained

and 2% of ARV is the annual property tax. The handheld

device or the app is linked with the server and the tax

calculated immediately is updated in the server. The

system also shows the arrears (amount due) to be paid.

Certain cases have been reported where a property owner

had paid the tax before the digitization of RMC, the owner

had the receipt of payment but the payment was not

updated in the register. In that case the receipt with the

owner is considered as the last payment receipt and that

information is updated into the system.

Another issue that is inevitable is amalgamation,

bifurcation and name transfers. In case of amalgamation of

properties the new property is attached to the existing

property. In case the new property already has a holding

number then that holding is deactivated and only one

holding number exists. Whereas in case of bifurcation of

properties the earlier holding numbers is allotted to one

part of the property, here if the ownership changes then

the same holding number is transferred to the new owner

and a new holding number is generated for the other part

of the property(s). In case of name transfer due to change

of ownership the same holding number is allotted to the

new owner.

On arrival of due date of payment and non payment on

due date an automated SMS is sent on the registered

mobile number and an e-mail is also sent informing the

owner about the details. The TC also makes a visit to

inform and collect the payment.

CONCLUSION

Digitization process has helped in improving the image of

RMC and Jharkhand Government. It is a big milestone

aiding e-governance. Not only has digitization made life

of the taxpayers easy but has also helped the government

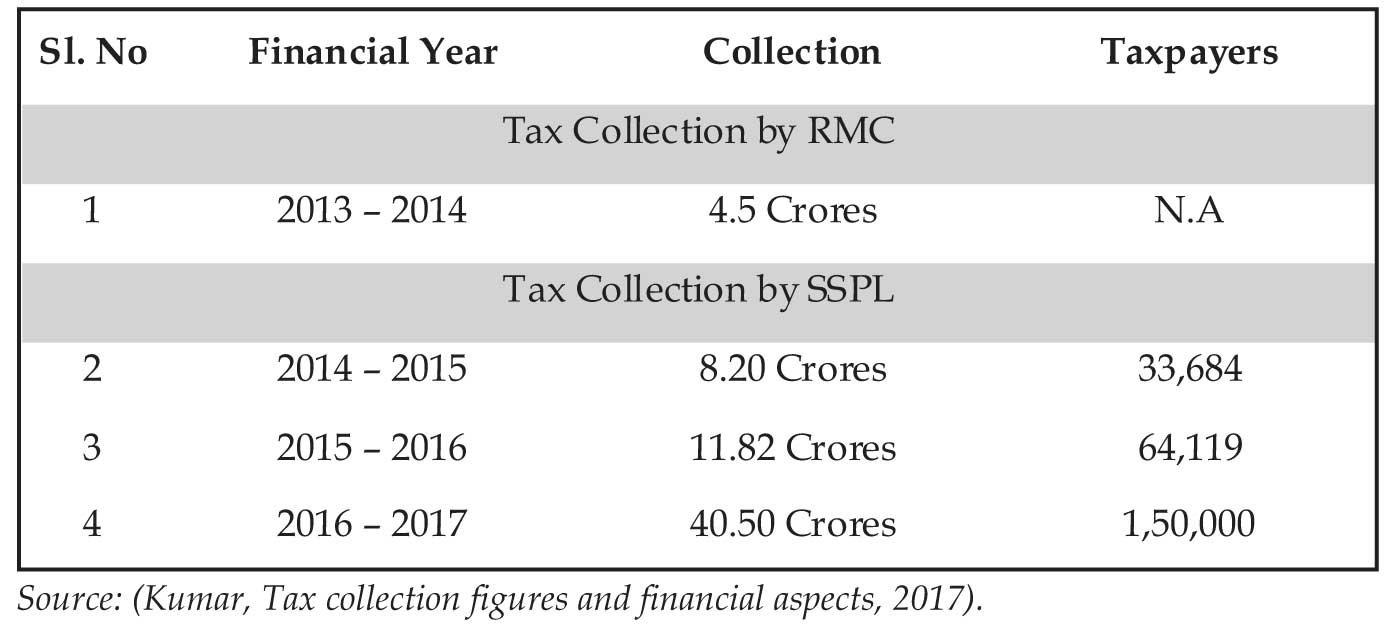

to increase its revenue. The following table suggests the

revenue generated by RMC 2013 onwards.

It is clear that after digitization number of taxpayers has

increased and revenuer has increased 10 times. The

successful implementation and wide acceptance of digital

application by both government agencies and households

has proved the importance of online model. SSPL has done

an excellent work in gaining trust of the citizens across

Ranchi by providing a secure and foolproof system. Such

modules must be adopted in other government sectors as

well.

References :

- Kumar, D. (2017, September 18), Inception of Sparrow Softech Pvt. Limited. (N. Bhatia, & S. M. Vipul, Interviewers).

- Kumar, D. (2017, November 03), Tax collection figures and financial aspects. (N. Bhatia, & S. M. Vipul, Interviewers).

- Ranchi Municipal Corporation. (2017). Retrieved October 20, 2017, from http://ranchimunicipal.net/ citizen/search_property.aspx?fwd_url=due_details.a spx.

- Ranchi Municipal Corporation. (n.d.). www.Ranchimunicipal.com. Retrieved November 05, 2017, from http://www.ranchimunicipal.com/ Downloads/1010201719100829_DownloadFiles.pdf

- The Telegraph. (2017, April 01). Tax defaulters need to pay fine . Ranchi, Jharkhand, India.

- Times of India. (2014, JULY 23). Ranchi hires private firm to collect taxes from August. Ranchi, Jharkhand, India.

- Times of India. (2016, May 16). Now pay holding taxes to RMC through ICICI Bank. Ranchi, Jharkhand, India. Retrieved from https://timesofindia.indiatimes.com /city/ranchi/Now-pay-holding-taxes-to-RMCthrough- ICICI-Bank/articleshow/ 52295695 cms.