Subscribe now to get notified about IU Jharkhand journal updates!

Customer's Perception of Organised Retail : A Case Study of Balasore Municipality

Abstract :

Organised Retail sector has been fast developing in India particularly in post reform period. Initially, it was confined to Metro and Big cities. In due course of time this sector has been expanding to small towns. This paper is a modest attempt to study the service management and qualities through customer's perception, particularly in Balasore Municipalty of Odisha.

Keywords :

Retail Management, Service Management, Service Quality.1. INTRODUCTION

Customer Perception is defined as “the process by which the individual selects, organizes and interprets motive into a meaningful and consistent picture of the world”. As individual we come across numerous products and service every day. Thus, different people hold different opinions about the same things and events. This is because each person has a specific way of looking at things. Every individual thus has a “perception” of the world around him or her., Underhill (1999) revealed that, shopping is very distinctive in nature, its more to just purchasing what one wants but it also includes the customer's acceptance of the product, brand or stores as well, using multiple senses like- seeing, smelling, tasting, hearing and even tasting.The word “retail” is derived from the French word “retailer” meaning “to cut a piece off” or “break bulk”. It includes all the activities directly related to the sale of goods and services to the ultimate consumer for personal and non- business use. In simple terms, it implies a firsthand transaction with the customer. Indian Retail industry can be broadly classified into two sectors, namely organised retail and unorganised retail. In the present scenario the organised sector constitutes only 8% and the remaining 92% is left with the unorganised retail sector. India is 3rd largest economy in the world in terms of GDP and fourth largest economy in terms of Purchasing Power Parity. India presents a huge opportunity to be used as a hub to the world.India is the “promised land” for global brands and Indian retailers A “Vibrant Economy”.Retail industry the largest sectors in India and second largest employment provider after agriculture (Zameer, 2011); it plays a significant role in increasing the productivity across a wide range of goods and services.The trading activities undertaken by licensed retailers are categorized as organized retailing. Licensed retailers are those who are registered for sales tax, income tax, etc. Organized retailing comprises mainly of modern retailing with busy shopping malls, multi stored malls and huge complexes that offer a large variety of products in terms of quality, value for money and makes shopping a memorable experience. Previously, customers used to go to kirana/bania Stores to purchase their necessities. This later changed to bigger shops run by one man with a few employees. All the work here was done manually. Gradually more sophistication seeped into this sector and department stores came into being. India is rated the fifth most attractive emerging retail market: a potential goldmine, estimated to be US$ 200 billion, of which organized retailing (i.e. modern trade) makes up 3 percent or US$ 6.4 billion.As per a report by KPMG the annual growth of department stores is estimated at 24%. Ranked second in a Global Retail Development Index of 30 developing countries drawn up by AT Kearney.

2. PRESENT SCENARIO OF ORGANISED RETAIL IN INDIA

A 2007 report noted that an increasing number of people in India are turning to the services sector for employment due to the relative low compensation offered by the traditional agriculture and manufacturing sectors. The organised retail market is growing at 35 percent annually, while growth of unorganised retail sector is pegged at 6 percent. The Retail Business in India is currently at the point of inflection. As of 2008, rapid changes with investments to the tune of US$25 billion were being planned by several Indian and multinational companies in the next 5 years. It is a huge industry in terms of size and according to India, Brand Equity Foundation (IBEF), it is valued at about US$395.96 billion. Organised retail is expected to garner about 16-18 percent of the total retail market (US$65–75 billion) in the next 5 years. The Indian economy has registered a growth of 8% for 2007.The predictions for 2008is 7.9%.The size of India's retail market was estimated at US$ 435 billion in 2010. Of this, US$ 414 billion (95 percent of the market) was traditional retail and US$ 21 billion (5 percent of the market) was organized retail. India's retail market is expected to grow at 7 percent over the next 10 years, reaching a size of US$ 850 billion by 2020. Traditional retail is expected to grow at 5 percent and reach a size of US$ 650 billion (76 percent), while organized retail is expected to grow at 25 percent and reach a size of US$ 200 billion by 2020. The US-based global management consulting firm, A T Kearney, in its Global Retail Development Index (GRDI) 2011, has ranked India as the fourth most attractive nation for retail investment, among 30 emerging markets. As India's retail industry is aggressively expanding itself, great demand for real estate is being created. The cumulative retail demand for real estate across India is expected to reach 43 million square feet by 2013. Around 46 per cent of the total estimated demand between 2009 and 2013 will be coming from Tier-1 cities. For instance, Pantaloon Retail added 2.26 million square feet (sq. ft.) of retail space during the fiscal 2011 and booked over 9 million sq. ft of retail space to fructify its expansion plans in future Retail business is the largest private industry, ahead even of finance and engineering, and contribute more than 10 percent of Indian GDP (Marketing White Book, 2009-2010). India is having more than 12 million retail outlets and known as a country of shopkeepers. But as far as growth of organized retail is concerned, this is comparatively very low in comparison to other country. For instance, in US share of organized retail is 85 percent, Taiwan 81percent, Malaysia 55 percent, Thailand 40 percent, and Indonesia 30 percent, China 20 percent while in India this is just 5 percent (Marketing White Book, 2009-2010).The Indian government allowed 51% FDI in Multi Brand Retail. 100% FDI in Single Brand Retail was already allowed, but that too with some condition, including 30% local procurement. There had been no specific restrictions on the entry of foreign retailers into the Indian market till 1996. However, in 1997 it was decided to prohibit FDI in retailing into the country. In January 2006, however, a partial liberalization took place in policy in which foreign companies are allowed to own up to 51 per cent in singlebrand retail. In September 2012 the central government of India allow FDI to invest 51% in multi-brand retail and 100% in single brand retail. The foreign players like Tesco,in multibrand retail and Ikea, Nike, investing in single brand retail.As per Technopak Advisers Pvt. Ltd. estimates, investments amounting to approximately US$ 35 billion are being planned for the next five years. Of this, about 70 per cent is expected to come from top seven players including Reliance Industries, Aditya Birla Group, Bharti-Wal-Mart, Future Group and others. Also, it is estimated that about 40 per cent of the total investment will be contributed by foreign players including Wal- Mart, Metro, Auchan, Tesco and many others, signifying the importance that the international community is attaching to the Indian retail opportunity. In short, India is attempting to do in 10 years what took 25–30 years in other major markets in the world and shall bypass many stages of ¯evolution? of modern retail. According to the Economic Census carried out by the CSO in 1998, the country had a total of 10.69 million enterprises engaged in retail trade, of which 5.23 million were in the rural areas and 5.46 million in the urban areas. The total employment in these enterprises in 1998 was 18.54 million of which 7.88 million was in the rural sector and 10.65 million in the urban sector. According to the NSSO 's Employment and Unemployment 2004-05, employment in the retail trade has been 35.06 million, divided between rural (16.08 million) and urban (18.98 million) sectors. 4 This constituted about 7.3 per cent of the workforce in the country (459 million). Wholesale trade, on the other hand, contributed to an employment of 5.48 million, of which only 1.71 million was in the rural sector and 3.77 million in the urban sector. The NSSO data also indicated that retail employment was about 30.62 million in 1999-00 with 12.15 million in rural areas and much higher at 18.47 million in the urban areas. This means that an additional employment of 4.44 million was added in this sector during the five-year period, 2000-05, showing an annual employment growth of 2.7 per cent per annum. However, it is interesting to note that the retail employment growth has been quite large in the rural sector – there has been a massive rise in employment in rural retailing of 3.93 million during 2000-05 – and the urban sector has also shown an employment growth, but only of 0.51 million during this period.The total number of organized retail outlets rose from 3,125 covering an area of 3.3 million sq. ft. in 2001 to 27,076 with an area of 31 million sq. ft. in 2006. Small-sized single-category specialty stores dominated the organized retail in the beginning with almost twothirds of total space in 2001. Departmental stores came next with nearly a quarter of total space and supermarkets accounting for the balance of about 12 per cent of organized retail space. There were no hypermarkets in India in 2001. Specialty stores are still the most common modern retail format with over a half of total modern retail space in 2006. Supermarkets and department stores occupied nearly an equal space of 15-16 percent each in 2006. In 2006, India had about 75 large-sized hypermarkets carrying a tenth of the total modern retail space in the country. The organised retail industry was initially concentrated in metropolitan cities like Bangalore, Mumbai, Delhi, Kolkata and they entered small towns to curb rural population. As the expansion of organized retail outlets was happening in smaller cities and towns, it became imperative to understand the perception of the customer about the retail service quality in such smaller towns in comparison with metros where organized retail outlet across the cities have already been accepted by the customers.Organised retail has various formats like hyper market, super market,department store, speciality store, discount store, malls etc. It has also various segments as clothing, textile and fashion accessories, food and groceries, foot wear, consumer durable, home appliances mobile handset, entertainment, jewellery, watches, pharmaceutical, health and beauty care service etc. Clothing takes highest share (38%) and health takes lowest share (1%) of organised retail.

3. RATIONALITY OF THIS STUDY

A study on this sector on the economy is not only essential but also significant as it has impact on the people in terms the quality of life, changing behaviour for consumption of the goods from the market. Therefore, it is necessary to study the consumer perception of service management in organised retail sector. Veryfew studies have been done in this area particularly in Odisha. The significance of this study is that it is a micro level study confined to Balasore town.

4. OBJECTIVES OF THIS STUDY

The objectives of the study are as follows:

- To study the demographic factors influencing customers buying behaviour in organised retail outlets.

- To study the customers perception regarding service quality in organised retail sector.

- To study the effects of promotional measures on the consumption behaviour of the customers.

5. DATA BASED METHODOLOGY

The present study is based on primary data collected through questionnaires'. Sample sizes of 100 customers were being interviewed by the use of simple random sampling. Before finalising the questionnaires, it was pretested. The questionnaires contain various aspects of service management, consumer behaviour in the retail outlets of Balasore town. Basically percentage method is used for analysis of data.

6. REVIEW OF LITERATURE

Jegan K. &Kanan N. (2017), “Customer expectation and perception towards organised and unorganised retail”. From this study it was find out that customers like to buy fruits and vegetables from air-conditioned supermarkets because of its quality products, but due to the high prices they feel reluctant to buy these kinds of products from the nearest market. It also finds out that due to changes in the disposable income and increased awareness of quality the consumer's perception has changed. Most of the consumers have a good impression about the organised retailers. Chanuvai Narahari Archana and DhimanKuvad(2017), “Customer Behaviour towards Shopping malls-A study in Bhavnagar” published at IJARIIE. It is found that there are no predominant differences between men and women in their shopping experiences, choices and purchasing decisions. Advertisements attracted the customers very much. It also proved by them shopping malls are best locations for socialisation, spend quality time with family, etc. Preplanning and in house advertising together gives clarity and customer can go for better purchasing decisions.Balaji K. and Babu M. Kishore (2016), “A study on consumer shopping patterns in current retail scenario across selected retail stores in Andhra Pradesh,India. From this study it finds out those retail sales of company influenced by promotional schemes like discounts, offers provided by retailers etc. It also finds out that consumer also shifting their purchase patterns towards shopping malls from traditional outlets to purchase mainly grocery and food items but rarely towards electronic items.Sekhar et al.(2016), “Consumer buying behaviour at malls” published at International journal of science technology and management. It finds out those special offers, quality, variety and price are the major determinants which attracted the consumers. Advertisement is the main promotional tool which makes consumers to visit to the outlets.Kumar K. Sontosh(2015), “Organised retailing in India: challenges and opportunities” The major findings of his study are that the organised retailing is beneficial for India because it generate employment, increase agricultural efficiency, enhance shopping experience of consumers, improve local infrastructure. But there are some regulatory and structural constraints for which Indian retail sector is less developed compared to the developed countries.

7. RESULT AND DISCUSSION

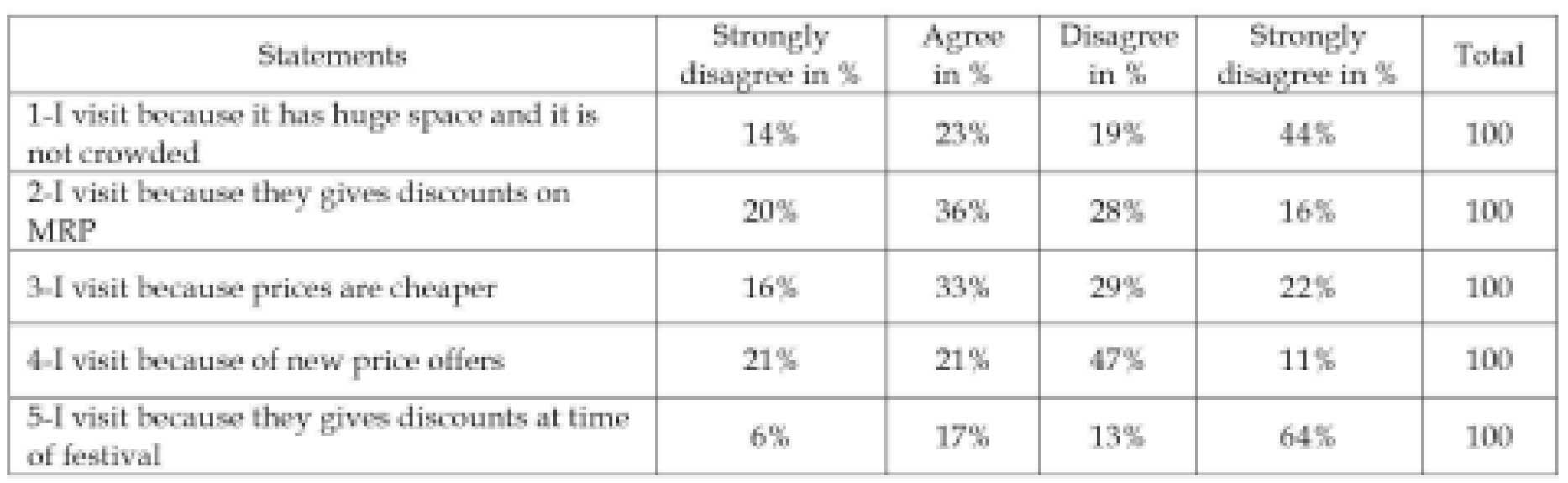

Table .1 : Displays the customer perception with regard to the various statements on Organised Retail Market.

The statement no 1 shows the perception of customer on

the basis of percentage concerning the various statements.

The table revealed that 44% customer which is the highest

percentage customer strongly agree with the statement no

1 from which it can be understood that majority of the

customers say, there is huge space and peace in organised

retail but only14 percent customers which are the lowest

number of people strongly disagree with the statement no

1. Alternatively, it shows less no of people say that the

organised retail store has no huge space and this is fully

crowded. Then 23 % customer says that they agree with

the above statement and say that it has huge space but

sometimes basically at festival time the space is become

small because of display board, new products etc. and it is

not crowded except the festival time because at that time

people come in a large number. 19 % of customer says that

they disagree with it.This means it has reasonably good

space in this retail store.

The statement no 2 revealed that 36 % customers agree

with the statement and say that the organised retail sector

give them discount on MRP while they shopping the

products from this store but sometimes MRP is fixed. 16 %

customers strongly agree with the above statement and

say that they come to this store only because it gives

discount on the entireproduct available in this store and

therefore the prices of organised retails is lower than the

small shops. Than 20 % customers strongly disagree with

the statement which alternatively shows that the

consumer give negative view on the statement that the

organised retail outlets give discount on MRP and they

said that there are always fixed price on product, 28 %

customers were disagreed with this statement because the

organised retail gives discount only on some product of

the shop.

It is revealed from the above table that 33% of customers

agree with the statement number 3, from which can be

deducedthat a majority of people come to this store to

purchase good quality of product at cheaper price but they

say that sometimes the prices of small shops and

organised retail stores is same.16 % customer strongly

disagree with the statement which shows less number of

people say that they purchase product at a higher price

which is actually low at their nearby shops. 29 % of

customers disagree with the statement and say that the

prices are not cheaper in organised retail store but not

always, only at the time of festival they sell product at

cheaper prices. 22 %customers strongly agree that the

prices are cheaper in organised retail store and they say

products are also good at this price than the small shops.21

% customer say the retail outlets don't give new price

offers and 21 % customers say the organised retail outlets

give new price offers and 47 % customer say the malls are

not giving new price offers and only 11 % strongly agree

with the statement no-4 that is organised retail store give

new price offers.

It can be revealed from statement no-6 that 64 % customers

strongly agree and say that they get variety of product at a

reasonable price at festival time because the organised

retailers give discount at the time of festivals. 6 %

customers strongly disagree with the statement and say

that there is no discount facility at the time of festivals.

Than 17 % customer agree with the statement which

alternatively show that people come to the store at the time

of festival because they want to get good quality of

product at a discounted price but according to them they

don't get discount in all festivals. 13 % customer disagree

with the statement and say they get the discount but the

discounted rate is same with the rate of small shops and

according to them the organised retailers don't give any

discount in actual manner.

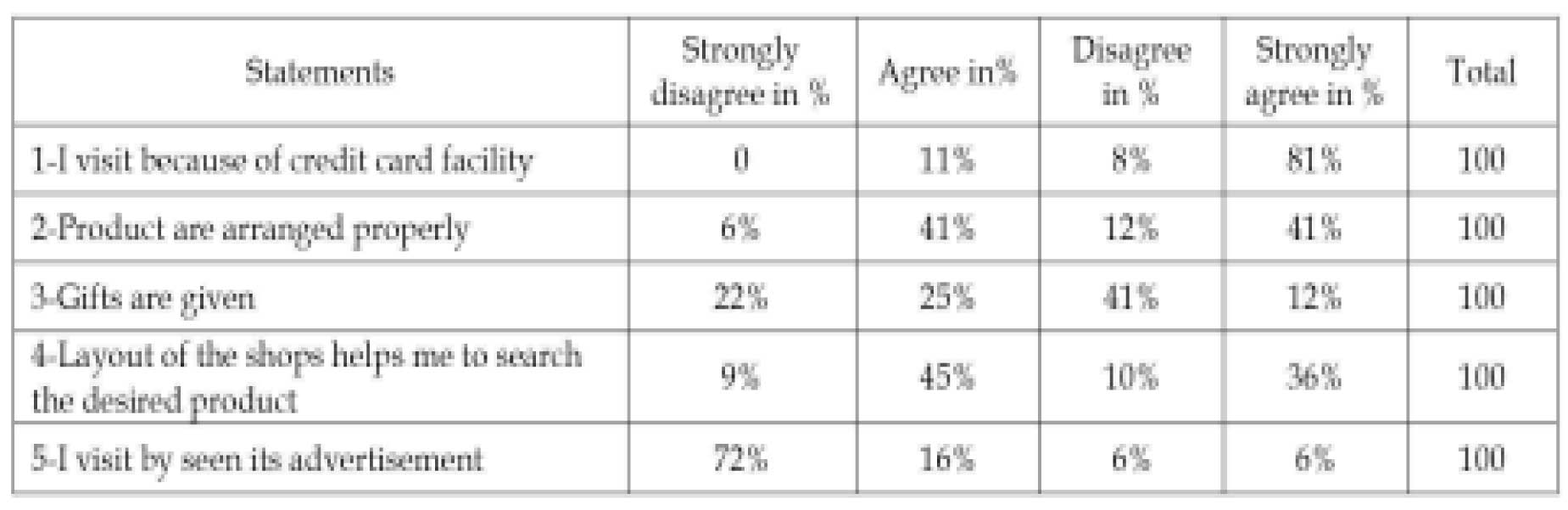

Table. 2 : Displaysthe customer's perceptionregarding the promotional measures

It is revealed from table that customer perceptions relating

to the promotional measures taken by the organised

retailers are significant. The statement no 1 show that 81 %

of customer strongly agree with the statement which

alternatively shows that a major part of people come to the

store for the credit card facility given by the organised

retailers means they want to have cash-less transaction for

shopping. 11 % customers agree with the statement and

say that they get the credit card facility but sometimes they

face problem to use the swipe machine. But there is no one

who says that they don't get the credit card facility because

the organised retailers provide credit card facility. 8 %

customers disagree because they don't know the use and

some say they have no credit card.

The statement no 2 show that 41% customers agree with

the statement and say that products are arranged in a

proper way and they get easily whatever they search but

when new items come to this store there are some change

in the store and at that time they face difficulties to find

some product. Than 41 % customer strongly agree with the

statement and say that the products are arranged

properly. 6% customers strongly disagree with the

statement means according to them products are not

arranged properly. 12% customer disagree with the

statement and say products are not arranged properly and

they get trouble for searching the product but only at the

time of festival the products are arranged properly and the

products are clearly visible to anybody.

The statement no 3 show that 41 % customer disagree with

the statement means gifts are not given by the organised

retail which shows that the customer buy products at a

very small amount of money because gifts are given by the

malls only on purchase of larger amount of products.12 %

customers strongly agree with the statement means the

gifts are given by the store. 22 % customers strongly

disagree with the statement means gifts are not given by

the organised retail store but sometimes they get gift by

some terms and condition. 25 % agree with the statement

means customers give their view as the gifts are given by

the organised store at the time of huge amount of shopping

and by the lottery coupon but they also say that at small

amount of shopping the organised retail don't give any

gift.

The statement no 4 shows that 45 %customer agree and say

the layout of the store help them to search desired product

because there are division of product for men, women, and

children and for home product and grocery. Therefore

they can easily find out the product as they are the regular

customer of this store but some customer are there who are

new or irregular to come to this store and they are face

difficulties to find their desired product. 9 % customer

strongly disagree with the statement means the layout of

the store don't help them to search the desired product. 10

% customers disagree with the statement which say that

the layout of the store don't help them to search the desired

product because most of them are new customer and they

have no knowledge about the shopping malls but at the

time of festival they find their product easily because there

are some pointer and poster which help them to reach at

their desired product. 36 % customer strongly agree with

the statement means that they are very much appreciate

with the layout of the store because it is very good and help

them to find their desired products.

The question no 5 show that 72 % customer strongly

disagree with the statement which means that they aren't

come by seen its advertisements which alternatively tells

that the large number of people have not influenced by the

advertisements and they also say that in Balasore the malls

aren't advertise more like the Big Bazaar. So the customers

come from rural area have not seen its advertisements.

Than only 6 % customer strongly agree that they come to

this store by seen its advertisements means they are very

much influenced by the mall's advertisement. 16 %

customer agrees with that statement that they come to the

store by seen its advertisement but not always which

means the advertisements could not influenced them

more. 6 % customer disagree with the statement that they

have not seen its advertisements except some occasions.

Good customer service means helping customers

efficiently, in a friendly manner. It's essential to be able to

handle issues for customers and do the best to ensure they

are satisfied. Providing good service is one of the most

important things that can set their business apart from the

others of its kind.

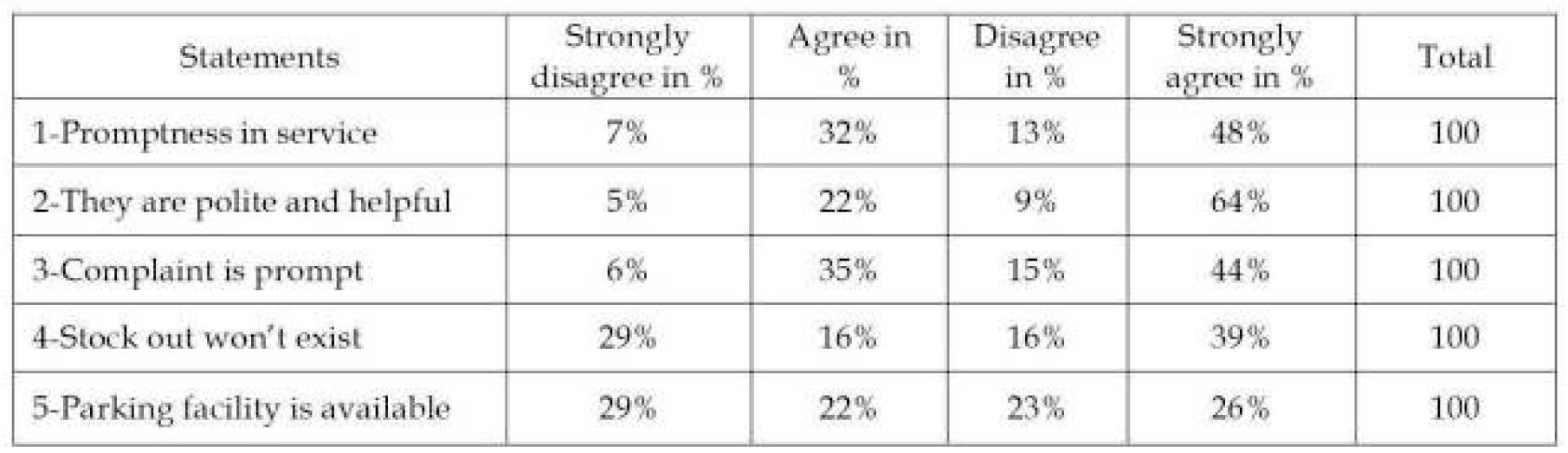

Table-3 Displays % Response of the customers regarding the service quality

The statement no 1 of above table showsthat 48% strongly

agree with that there is promptness in service in retail

outlets as compared to unorganised retail sector.. As the

highest number of customer satisfied with the promptness

of the employee in this retail outlet we can say

alternatively that the people prefer this store to save their

time for other purposes because shopping don't take too

much time here as promptness in service is available.7

percent customers say that there is no promptness in

service. 32 % say promptness in service is there in

organised retail stores but not every time. 13 % customers

disagree with the statement that promptness in service is

available in organised retail outlets.

The statement no 2 shows that 64 % customer strongly

agree with the statement and say they are polite and

helpful means the employee in the mall are very polite and

help them for shopping. 5 % customers say that they are

not polite because they don't get help from the employees

and also the employees are behaving rudely to them. 22 %

customers say they are polite and helpful but not all

employee. 9 % say they are not polite and help but

sometimes they are good.

The statement 3 shows that 44 % customers strongly agree

with the statement and say complaint is prompt. Than 6 %

customers strongly disagree and say complaint is not

prompt. 35 % agree with the statement that complaint is

prompt but not in all cases. 15 % disagree with the

statement and say complaint is not prompt but in some

cases the complaint is prompt.

The statement no 4 shows that 39 % strongly agree as they

say stock out won't exist. 16 % agree with this and say

stock out won't exist but sometimes it happen. 16 %

customer disagree that stock out won't exist but not

always according to them. 29 % customer strongly

disagrees with this and these customers say stock out

would exist.The question no 5 revealed that 29 % customer

strongly disagree and say that parking facility is not

available here. 22 % agree with the statement and say

parking facility is available but it is very difficult to park

the vehicles. 23 % customers disagree and say parking

facility is not here.26 % customer strongly agree with the

statement as they say parking facility is available here or

we can say they come because of good parking facility is

available here.

8. FINDINGS

— Customers are positively affected by the

demographic factor age and monthly family income

because 35% are under the 20-25 groups and 31% are

falling in the above 25,000 income groups. Which

show that the younger people come more than the

elder people.

— But 42% of customer falling in the undergraduate

group. Therefore, we can say education has no more

importance for shopping.

— The organised retail store provides huge space,

cheaper price and discount at the time of festivals to

attract the customer.

— But the organised retail store doesn't provide

discount on MRP and new price offer.

— The customer prefers to the store because of

promptness in service, polite and helpful employees,

complaint is prompt, stock out won't exist.

— But customers disappointed with the parking facility

as they face problem to park their vehicle.

— The customers prefer the shopping mall because it

provides credit card facility, good arrangements of

the product, attractive lay out of the store.

— According to the respondent the retail store is weak in

case of gifts and advertisements.

9. CONCLUSION

Both modern and traditional retailers will co-exist in India for some time to come, as both of them have their own competitive advantages. The kirana has a low- cost structure, convenient location, and customer intimacy whereas modern retail offers product width and depth and a better shopping experience From this study it was observed that due to change life style, increase awareness of quality products as well as disposable income most of the customers switching to organised retail store form unorganised retail store but at present time unorganised retail also captured a high market share in India, many customer thinks that they local kirana store is the one of the most important factor for their day to day life, they cannot visit organised retail store frequently so we can say that organised retailers have huge opportunities in Indian market but they must open more outlets so that customer visit frequently. Organised retailers provide quality products and lowest cost but due to middle class mentality that the bigger and brighter sales outlet is, the more expensive it will be.The organized retail are having a greater advantage because of the store image, productAvailability, and price discounts. The customers wish for more outlets being opened.The customer perception of retail service quality is an important segment to the emerging and the existing retailers in the market. As the study reveals that perception of service quality is influenced by the various natures among various customers, even some of the general factors like Personal interaction, physical aspects are the dimensions on which customer perception remains constant and common to the entire customer on a majority basis. So the retail outlets have to frame their own strategies in order to attract the customers on a longer basis.

References :

- Narahari Archana Chanuvai and Kuvad Dhiman (2017).Customer Behaviour towards Shopping malls-A study in Bhavnagar, IJARIIE, ISSN.2395-4396, 3(2).

- Sekhar G. Chandra, Srinivas Keshamoni and Prasad N. Hari (2016).Consumer buying behaviour at malls. published on International journal of science technology and management, ISSN.2394-1537,5(5).

- Kumar S. (2015).A study on consumer buying behaviour towards organised retail stores in Erode district, Tamilnadu, India. Published on December 2015 at international journal of management research and review.

- Shenbagasuriyan R. and Balachandar G. (2016). A comparative study on consumer perception towards organised retail sector with unorganised retail sectors.international conference on innovative management practices, ISSN.2395-4396, 1(1).

- Jegan K. And. Kanan N (2017). Customer expectation and perception towards organised and unorganised retail. International journal of management, ISSN. 0976- 6510, 8(3),159-168.

- Balaji K. and Babu M. Kishore (2016). A study on consumer shopping patterns in current retail scenario across selected retail stores in Andhrapradesh, India.” IJER,ISSN.0972-9380.

- Ramya K. (2016). A study on customer perception towards organised retailing in Coimbatore city”, International Journal of Scientific and Research publications, ISSN. 2250-3153, .6(7).

- Kumar K. Sontosh (2015). Organised retailing in India: challenges and opportunities. International Journal of Advance Research in Computer science and Management, ISSN.2321-7782,3(6).

- Alauddin Md. (2016). customer expectation and perception towards retail chain: An evaluative study”, IOSR journal of business and management, ISSN:2319- 7668, 18(7), 15-21.

- Jothilatha S. And KalpanaD. (2015).Customer's perception and satisfaction in organised retail sector in India,1.

- International Journal in Management and social science, ISSN.2321-1784, 3(3).