Subscribe now to get notified about IU Jharkhand journal updates!

Effect Of Gender, Age And Income On Investors' Risk Perception In Investment Decision : A Survey Study

Abstract :

The present research focuses on the behavioural aspect of investment, which tells that the investment decision varies with the uncertainty of the situation and the perception of the individual at different risk level. The risks are categorised by different class of people of sex differences, age differences and different income groups. These individual groups directly or indirectly associated with the perception of individual risk level in decision making. Based on this the present study tries to investigate the effect of gender, age and income differences on investors' risk perception in investment decision in the Indian context. Delhi-NCR region is the primary location of the study for data collection with the help of a questionnaire method. The finding of the study says that there is no significant difference in investors' risk perception among the different independent groups.

Keywords :

Risk, Risk perception, investors, Investment decision.Introduction :

The advancement in finance proliferated the introduction

of behavioural finance as a new discipline, which mainly

deals with investors' biases and psychological factors. The

factors caused investment decision making nasty

sometimes. The principal cause of this nasty behaviour is

that “the investors' act irrational” (Shiller, 2000), by its sex,

age and income. Apart from these, the foremost cause is

the individual investors' himself and his level of risk

perception which intervene the investment decision

making. In other words, the investors' risk perceptions are

influenced by its social emotion which affects the

investment decision making. In behavioural finance

(Slovic, 1987), risk perception is defined as the subjective

judgments which relates to how much people know about

and understand risks. Similarly, Bairagi et al., (2018) say

about the concept "Risk perception" which defines the

way retail investors' view the financial risk basaed on

expert knowledge and experiences that acquired from a

different class of people.

In this study, we investigate systematic differences of risk

perception between groups. In particular, we study the

interaction of risk perception of an individual with the

gender, age and income of the decision maker. The

common stereotype is that women are more risk-averse

than men, people of young age are more proactive in

investment. Therefore, the financial risk or the perception

acquired from a different class of people is characterised

by sex differences, age differences and individual income

Palash Bairagi1 Dr. Anindita Chakraborty2

differences which we called the socio-economic factor.

These factors are influences the investment decisions due

to their perception of risk toward investment. In other

words, we can say that investors' risk perception involved

with the differences male-female character, age variation

and the income figures. Take some previous context who

says that “is men more willing to perceive or take the

financial risk than women?” (Charness et al., 2007)

answered this question by concluding that women make a

smaller investment than the men do and they appear to be

more financial risk averse.

Furthermore, the novelty of the study gearing to improve

the clarity of the study by deep investigating the

significantly difference of the individual perception in

investment decision among the groups. While doing so,

most of the data were collected not for gender, age or

income valuation but for satisfying the research

hypothesis in below. Therefore, the study fulfilling the

criteria of gender, age and income of individual investors'

perception towards investment risk and their relation.

With this, the present study extended with some extensive

literature review, objective and hypothesis framework,

methodology and analysis and discussions in below.

2. LITERATURE REVIEW

The existing literature in the area of effect of gender, age

and Income on risk perception and it relates to the

investment decision making. The discussion supports

some of the critical summaries of the literature reviewed

which paves the way for the study which includes with the

concept of risk in investment decision making. Lopes

(1987) defined risk is a situation where decisions are made

from consequences whose, future events having known

probability. It involves a factor of uncertainty and a

potential loss (Kaplan and Garrick, 1981). Further,

Wildavsky and Dake (1990) defined psychology of risk is

the ability to predict and explain what kind of people will

perceive potential hazards to be how dangerous. In

another word, it is a psychological aspect of risk

perception that studies behavioural finance and the biases

(Ricciardi, 2008).

Weber and Milliman (1997) experimented that risk

perception of investors and the choices are related to each

other which gives same preferences for perceived risk in

both the series of decision making. The authors also tried

to find out the factor that changes and affects choices

which in turn also affects risk perception.

Madhumarthi (1998) suggested that the preferences of the

investors and their perception about the risk in the Indian

markets. Three classes of investors had been identified

based on their risk perception namely, risk seekers, risk

bearers and risk avoiders. The result showed the operating

performance of the companies influenced the investors.

The risk perception changed the investment decisions of

the investors and the profit earned by them.

Olsen and Cox (2001) studied the influence of gender

perception and their responses on investment risk where

social and technological hazards is an extensive evidence

which includes the factors as age, education, wealth and

experience for determining the answers to investment risk

for both genders are different from each other or not and

their perception level. The evidence on the existing

literature of gender differences in financial decision

making stems from the behavioural studies. The

consensus on the size of the gender differences and the

methodical consistency of the study (Powell and Ansic,

1997).However, in the case of behavioural finance study of

general investors, Gender is the most important

explanatory factor that affects the confidence in the

investment decision. If we look back to some traditional

literature like Lewellen et al. (1977) who said that gender

differences had been associated with the types of financial

information possessed and the use of such information

directly or indirectly influences the investors' decision

making. More likely, Estes &Hosseini (1988) also said that

women have significantly lower confidence in an

investment task than men, Similarly after controlling for

all other relevant variables and characteristics including

the amount of the investment decision.

Garbarino and Strahilevitz (2004) examined that men and

women differ in their perception of the risks which

associated with the shopping online and its effects.

Similarly, they also discussed the gender differences in the

effect of receiving a recommendation from relatives,

friends on perceptions of online purchased risk. They

further compared the men women willingness towards

the investment in online. The result revealed that women

perceived a higher level of risk in online purchasing than

the men.

Similarly, Age exhibits the investors' risk perception and

the financial decision over the life cycle and implications

for regulation by Agrawal et al. (2009), who said that the

average person peak financial decision making age is

around 53 years of old. In contrary to this Goetting and

Schmall (1993) noted that the ability of investors to make

sound financial decisions which associated with the

gaining financial knowledge. To make sound financial

decisions increases sharply in the age of 20 years to 30

years of old, the levels off and peak in the 50 years of old,

then it begins to fall sharply on 70 to 80 years of old.

Onsomu (2015) identified the effect of age on investors'

decision at the Nairobi Securities exchange where the

respondent in the age bracket of 18-30 years, 31-40 years

and 41-50 years respectively were affected investors

decision to overconfident bias. The finding depicted that

age differences have a significant effect on the level of

overconfident bias among the participants. Further, the

author concluded that the most affected investors are in

the age bracket between 31-40 years of old.

In case of Income, which we can be called it socio-economic

factor, Lutfi (2011) explained the relationship between the

demographic factors like such as gender, age, marital

status, education, income, and family members, and

investor's risk tolerance as well as investment preference.

The author resulted that the respondent with income of at

list 10 million, puts most of their money in capital market

instruments than the that of the respondent with an

income of less than 10 million tents to put their money in

bank account. Therefore, they concluded that low-income

investors tend to save their money in a bank account which

indicates that the income affects the investors' risk

behaviour.

Ansri and Moid (2013) explained the crucial factors that

affect investment behaviour of young investors' on which

the study inferred that majority of investors invest for

growth and additional income and the primary factor that

guides their investment decision is a risk factor which

means that investors mostly are risk-averse.

Similarly, Prakash et al. (2014) studied the different socioeconomic

classes which influence the risk decision

behaviour in Karachi. The authors also said that investors

in Karachi are particular about their future market

condition and hence they are reluctant to take risk decision

and invest in less risky assets. Similarly, regarding socioeconomic

factors, the investors with high income prefer

more risk than the investors' with less income.

Furthermore, they also exhibited that the people with

higher level of education prefer higher risk than the

investors have a low level of education.

3. THE OBJECTIVE OF THE STUDY

The objective of the present study is to investigate the

effect of gender, age and income on investors' risk

perception in the investment decision.

Hypothesis framework :

For Gender

Ha = There isa significant relationship between the effect of a

gender on investors risk perception in the investment

decision.

For Age

Ha =There is a significant relationship between the effect of a

ageon investors risk perception in the investment

decision.

For Income

Ha = There is a significant relationship between the effect of a

income on investors risk perception in the investment

decision.

3. METHODS AND PARTICIPANTS

The present study is exploratory cum descriptive in

nature. Both secondary and primary sources of data were

used for the research. The secondary data were collected

for the support of various questions such as what supports

the determinant of risk perception. The primary data were

obtained from conducting the retail investors' survey with

437 filled responses, through self-designed questionnaire

method, the survey was also conducted from the

geographical area of Delhi NCR region. The Questionnaire

was divided into two parts. In the first part, the questions

were directly related to demographics like the gender, age,

income. In the second part of the questionnaire,

respondents were asked to give their responses on fivepoint

Likert scales of ten statements of risk perception. In

the given scales 1 indicates "Strongly disagree" 2 is

"disagree" 3 is "undecided" 4 is "Agree" and 5 indicates

“Strongly Agree". Of The reliability of the investors'

perception in investment decision making are measured

by calculating Alpha Coefficient of 0.72, often items,

which satisfy the criteria of further study. The criteria for

the selecting the responses are judgmentally basis, where

the presumptions are made from retail investors'

perception and experience towards their investment

decision making. Based on the above criteria we calculated

the median value from all sum of respondents for

categorising the investors' risk perception in investment

decision (i.e. Low risk perception (LRP)< Median Value

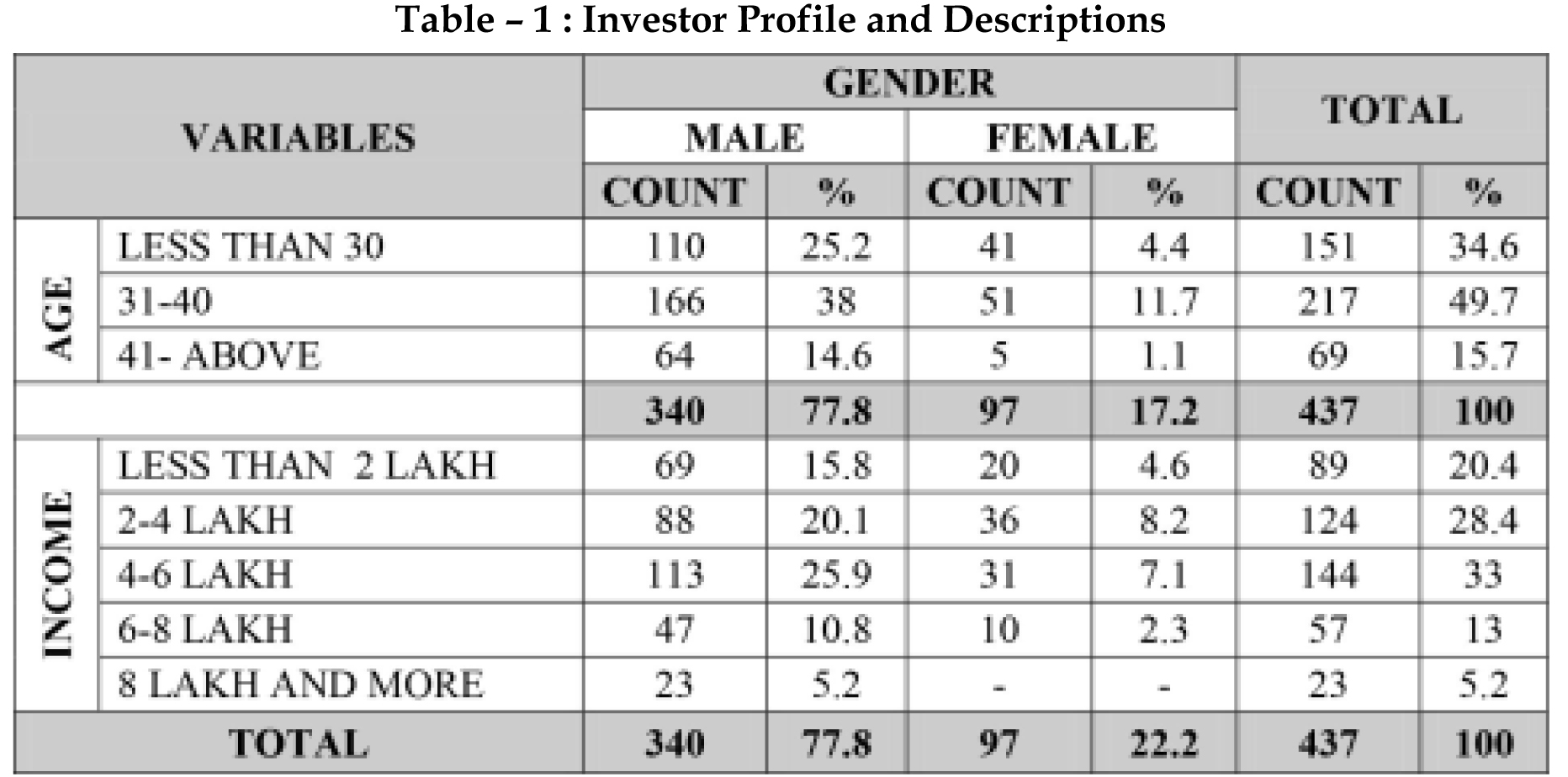

Table.1 describes the investors' profile and the personality

of the investors' which includes gender, age groups and

inc ome g r oups . Re g a rding Gende r a g e and

incomedifferences,the study forgo with the 437

participants responded the full questionnaire in the retail

investor survey, out of which 77.8 per cent (i.e. 340) of

respondents were male and remained 22.2 per cent (i.e. 97)

of the sample respondents were female. Thus, the result

indicates that female participant in the investment front is

still away from the male opponent.

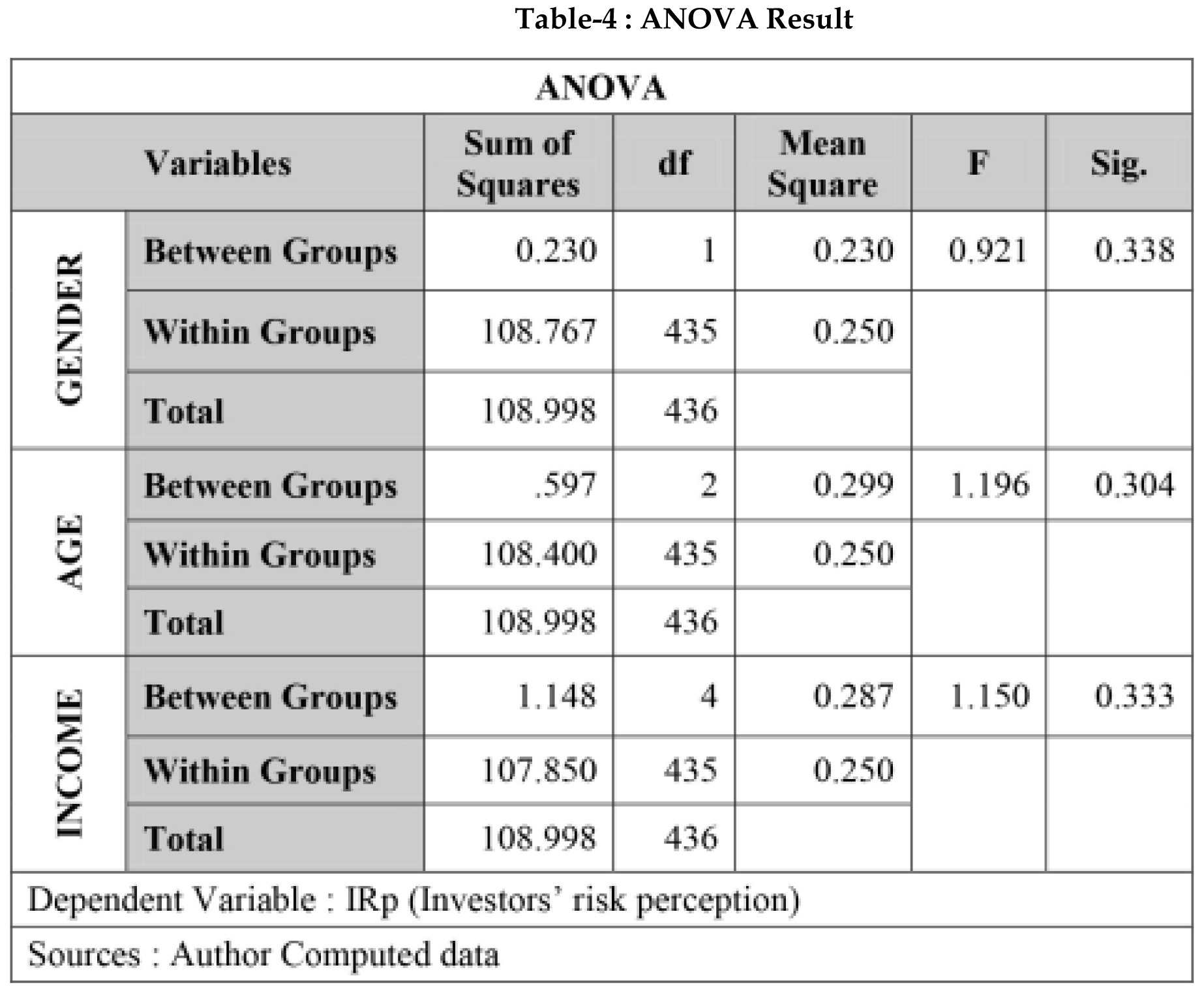

Based on the research objective the effect of gender, age and

income on investors' risk perception in the investment

decision and the hypothesis. The study found that male

respondents (77.8 %) are more than the female (22.2%)

shown in investors profile table no.1. For the hypothesis as

concern ANOVA result shows in terms of gender that there

is no significant difference in risk perception of male and

female in investment decision. Similarly, for age groups,

there is no significant difference among different age group

in risk perception of investors 'in decision making. For

Income group, it is found that there no significant

difference in investors' risk perception in different income

groups in investment decision. This is because the

significant score in ANOVA results (Table no.4) for the

entire three independent group variable i.e.0.338, 0.304 and

0.333 for gender, age and income are more than that of the

.05 % of significant. Therefore, the result of all three

variables like gender, age and income shows a similarity in

the mean scores on the dependent variable. Hence, all the

three independent variable gender, age and income are

failed to accept the null hypothesis for dependent variable.

By looking into the objective of the study, the present study

concluded that the effect of gender, age and income are

adversely affected investors' perception, which is shown in

the literature review. However, in this study, the mean

score for equality of variance are same for age groups and

between income groups as compared to gender, which

shows the inequality of mean score between male and

female Hence, it can be said that the independent

grouping variable like gender, age and income does not

affect so much to investors' perception towards risk as the

study is statistically significant among the dependent

group variable. While looking into the investor profile, we

can also make differentiate among male participants are

more advanced than the female participants in investment

matters. In terms age differences the level of risk remains

the same for investors' perception in investment decision

for age groups.

5. ANALYSIS AND DISCUSSIONS

5.1. Description of Investor profile.

In case of age of respondents, 49.70 per cent of majority

investors were in the age group between 31-40 years of old,

as compared to others like 34.6 per cent in between 30 years

(less than 30) and 15.8 % were more than 40 years of early

investors'. The cross-tab analysis results between age and

gender reveals that 38 per cent of the male respondents

were under the age group of 30-4 years of old followed by

25 per cent (less than 30) and 14.6 per cent (40-above) as

compared to female respondent of 11.7 per cent (31-40), 4.4

per cent (less than 30) and 1.1 per cent (40-above).This

indicates that the age group between 31- 40 years of old is

more prone towards investing into stock.

5.2. Descriptive Statistics.

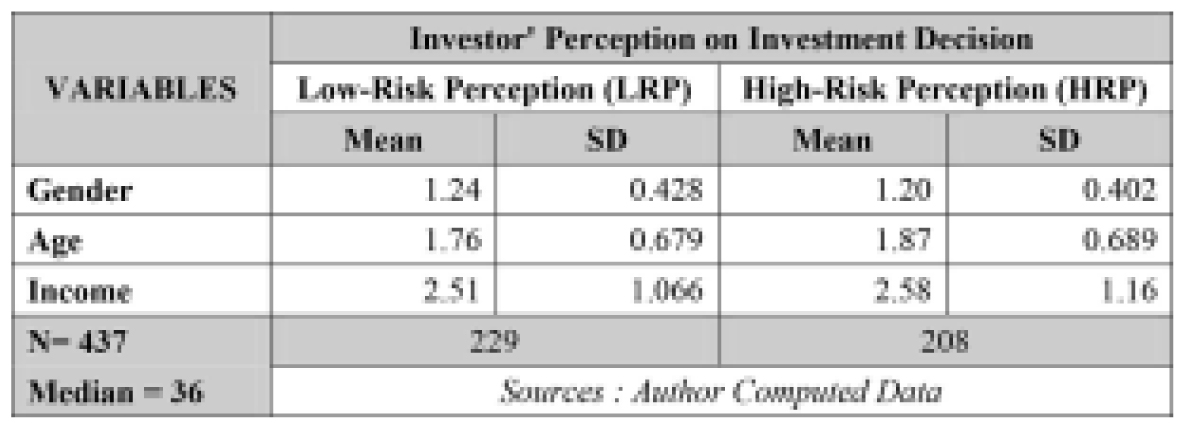

Table.2. Descriptive statistics of Investor' risk perception

on investment decision.

Table.2. Describes the descriptive statistics of investors risk

perception on investment decision which is categories as

low-risk perception, which can define as the

investors'who's'average score below the median valueare

called low-risk perception and the investors' whose

average score are above the median value is called highrisk

perception, among the different independent

variables. The table also says out of the total sample of 437

respondent. Out of which 229 respondents have a low-risk

perception in investment decision making with the overall

mean value of the different independent categorical

variable with gender 1.24 (SD of 0.428), age 1.76 (SD of

0.679) and income 2.51 (SD of 1.066). As compared to that of

the mean score of all the respondents who perceive high

risk on investment decision in different groups like gender

1.20 (SD of 0.402), age 1.87 (SD of 0.689) and income 2.58

(SD of 1.16).

5.3. Homogeneity of variance among the independent

variable

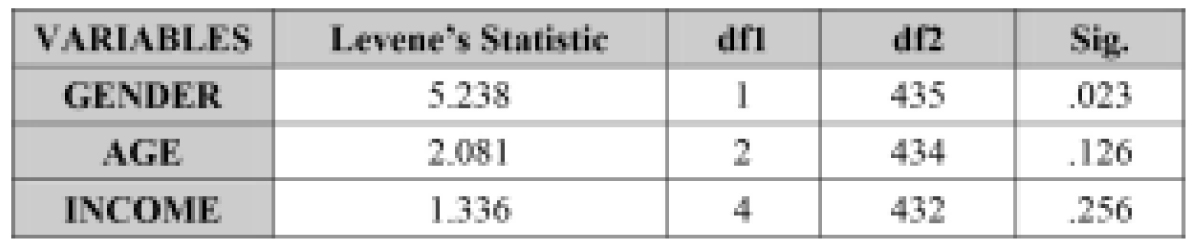

Table-3 : Levene's test of equality of variances

Dependent Variable : IRp

Sources : Author computed data.

Table.3. Depicted thehomogeneity of variance among the

independent variable like gender, age and Income with the

dependent variable of investors' risk perception (IRp). The

assumption of Levene's test of equality says that the

significant values for two independent groups' variable are

more than .05, which is.380 and .108. This indicates that the

equality of variance exists among the age and income and

the mean score of all categorical of the independent

variable is same. Therefore, we can say that there is no

significant difference between the age and income

categories on the dependent variable, i.e. the investor risk

perception. In the case of gender, the significant value is

less than .05 which is .023. This indicates that the theory of

euqality in gender difference are not same with the mean in

risk perception which means male and female in the

investment decision have different risk perception.

5.4. The result of Analysis of Variances (ANOVA)

Table-4 : Describes the ANOVA result of between group

and the within groups of the different independent

variable like gender age and income. The result shows that

the significant value is greater than 0.05 % level of

significance among different independent variables like

0.338, 0.304 and 0.333 for gender, age and income which

means we fail to accept the null hypothesis.6. FINDINGS.

7. CONCLUSION.

Regarding Income, sometimes individual income does not

affect the perception of the investor. Because it is not

necessary that one has the high income, he or she should

look high risk or vice-versa. At the end, the study also

concluded that for the fulfilment of the objective that the

effect of gender, age and income on investors risk

perception in the investment decision. However, in general

terms of individual investors' perception are almost similar

in conceptually, but in practice, the situation is something.

else, personal risk differs with the uncertainty of time

frame and domain knowledge that may be by different

race and class of individual.8. REFERENCES