Subscribe now to get notified about IU Jharkhand journal updates!

Indian Feed Industry - A Trend Analysis

Abstract :

This paper has tried to bring out the facts and figures along with insights and analysis about the Indian feed industry. The analysis may be useful for policy makers, dairy players and stakeholder to understand the gaps and issues related to feed industry thereby impact on dairy development in India.

Keywords :

Dairy, feed industryIntroduction :

Dairy development has assumed significant importance

in the rural economy of India due to its immense potential

for supplementing income and employment generation

for the rural people. (Babu & Verma, 2010).

India has one of the largest livestock population in the

world and one of its notable characteristics is that almost

its entire feed requirement is met from crop residues and

by products; grasses, weeds, and tree leaved gathered

from cultivated and uncultivated lands.(Dikshit & Birthal,

2010).

Supply of feed has always remained short of normative

requirement, restricting realization of the true production

potential of livestock (GoI 1976). Birthal and Jha (2005) has

found feed scarcity as the main limiting factor to

improving livestock productivity. Therefore, to increase

the productivity potential of milch animals the use of

commercial compound feed is inevitable as supply of

feed& fodder is shortening due to shrinking pasture land

in the country.

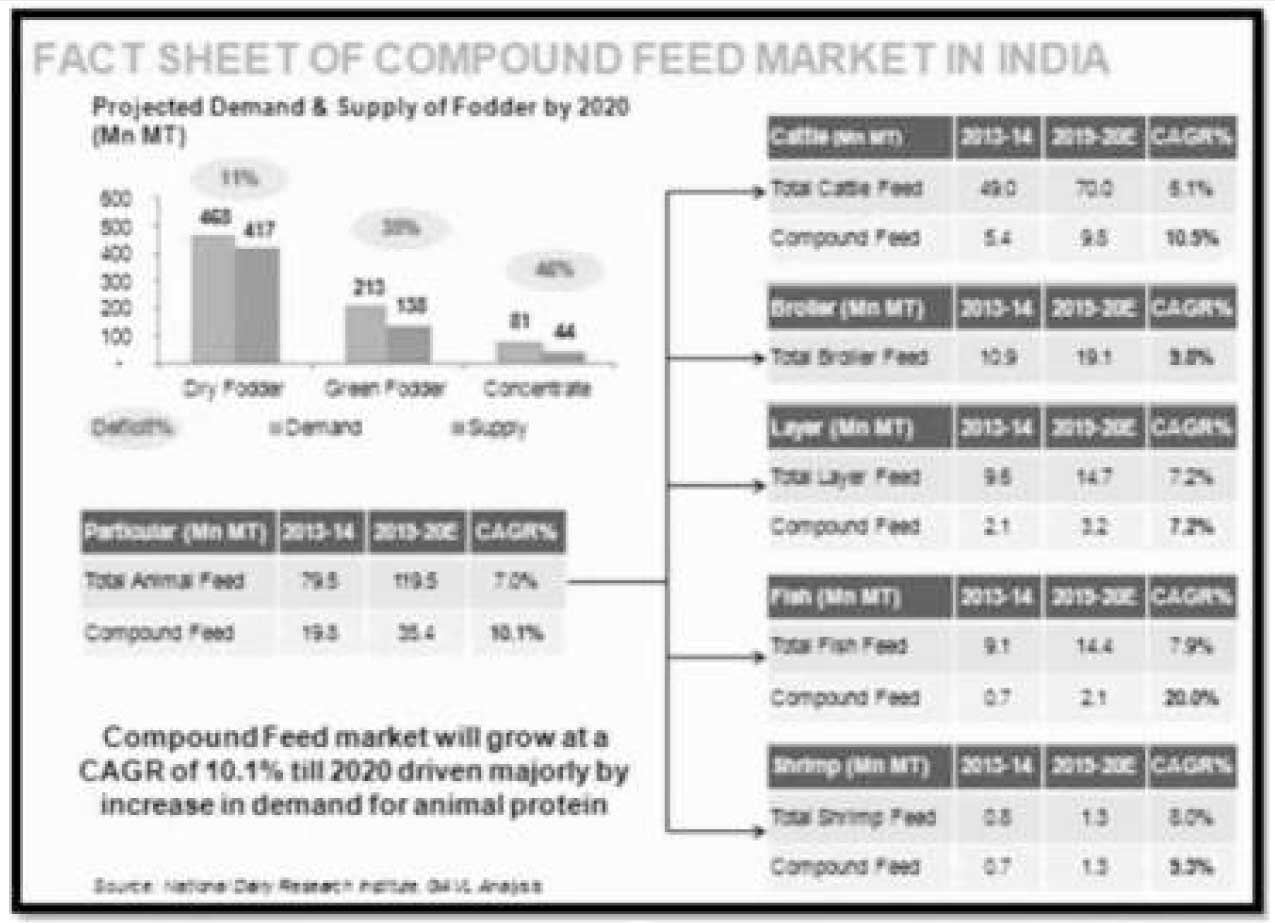

The Indian feed industry is about 35 years old. It is mainly

restricted to dairy and poultry feed manufacturing; the

beef and pork industry is almost non-existent. Which

represents only 5 percent of the total potential, and feed

exports are not very high. The Indian Animal feed market

was an estimated ~79.5 million tonnes in 2014 (all livestock

& aqua). However, the actual market is much smaller

because a large portion of this market is serviced by the

unorganized (grazing) sector.

The three key types of Compound cattle-feed producers

are :

- Home-mixers (Unorganized)- 33% (> 20000 feed manufactures)

- Dairy cooperatives -42%

- Private sector manufacturers of compound cattle feed- 25% (832 feed manufacturers)

The Organized Animal feed manufacturers are producing

around 30 Million tonnes of commercial feed. Out of total

production, Commercial production of cattle feed is about

8 million tonnes (organized manufacturers, as for eg

Godrej Agrovet is manufacturing 1 million tonne of

animal feed and is the largest compound feed

manufacturer in India). Godrej Agro vet has tie-up with

some of major diary companies like Creamline Dairy,

Heritage

Dairy, Hatsun Dairy for cattle feed distribution). India

exported 2000 tonnes of cattle feed (mainly maize basal) in

current year and imported 9000 tonnes of copra based cake

and feed supplement.

India is exporting 74% of cattle feed to Pakistan and 21%to

Belgium and importing 37% of cattle feed from Indonesia

and 17% from Srilanka. However, in value terms China is

the largest exporter to India. Mainly vet supplement like-

Folic acid based medicines, Vitamins are imported into

India from China.

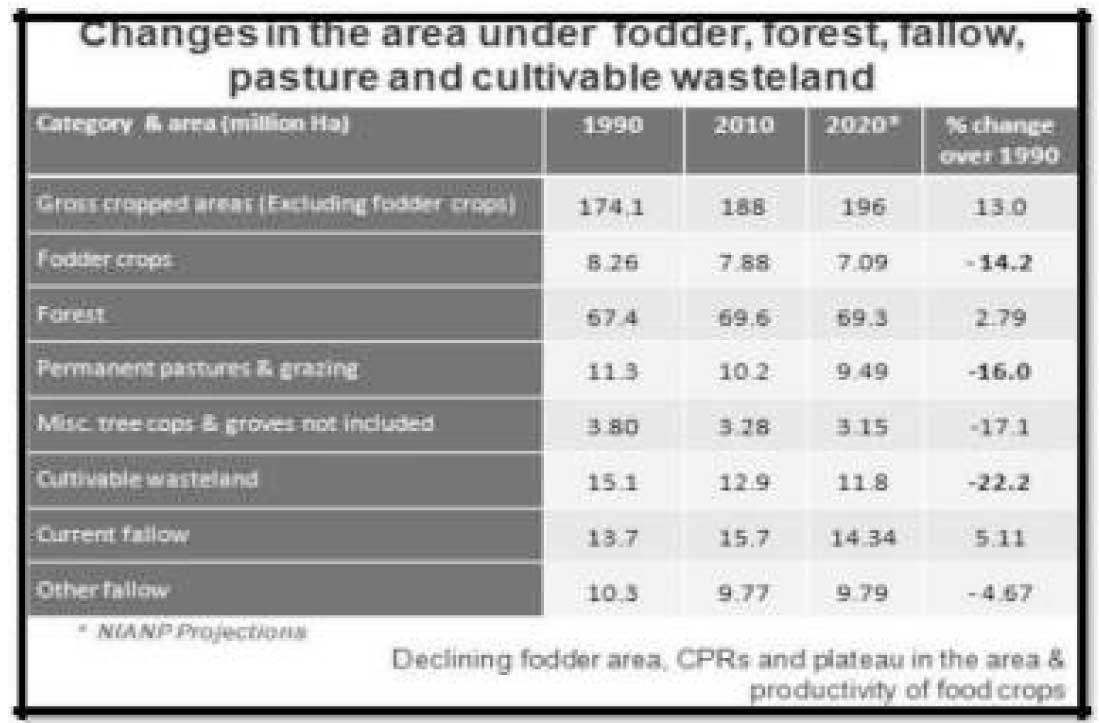

The land area under permanent pastures and grazing is

about 10.36 million hectares and constitutes about 38% of

total uncultivated land excluding fallow land in the

country. It is a major source of cattle feeding fodder.

Cooperatives, with 46% share of the compound cattle feed

industry, produce low-cost feed for their members. Homemixers

are farmers who prepare their own feed mixtures

and constitute 32%. Private compound cattle feed

manufacturers constitute about 22%. Dairy cooperatives

in India supply low cost compound feed to farmer

members while private feed manufacturers mainly cater

to the requirements of farmers with independent

operations and the buffalo meat industry.

Low quality forages form the bulk of basal diet of bovine in

India. In addition, farmers feed their animals one or two

locally available concentrate ingredients, depending upon

the level of milk production, unmindful of animals'

requirement. This type of diet is not always able to meet

protein, energy, minerals and vitamin requirements of

animals. As a result, animals either do not produce milk as

per their genetic potential or else, the cost of milk

production is high on account of imbalanced feeding.

Method of Study

Combination of Primary and secondary study was done to

collect information, data and insights for analysis of the

Indian feed industry. The paper made use of data from

various published and unpublished sources viz: NIANP,

Bangalore, CLFMA, Mumbai, Interviewing Industry

expert and stakeholders and websites.

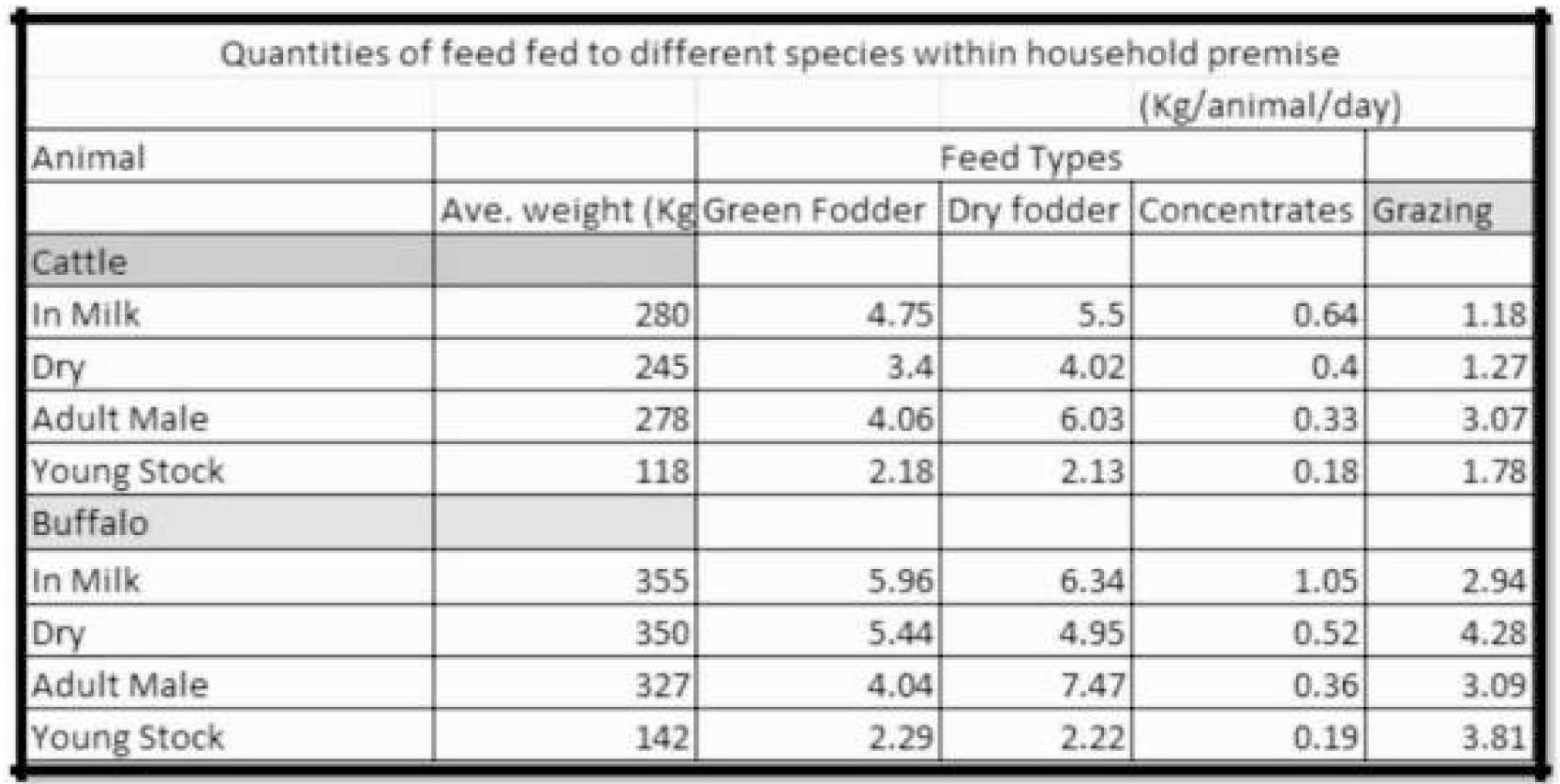

As per CLFMA (Compound Lives tock Feed

Manufacturers Association) study/source, it was

gathered that quantities of feed fed to different species

within household premise/farmer shown in below table.

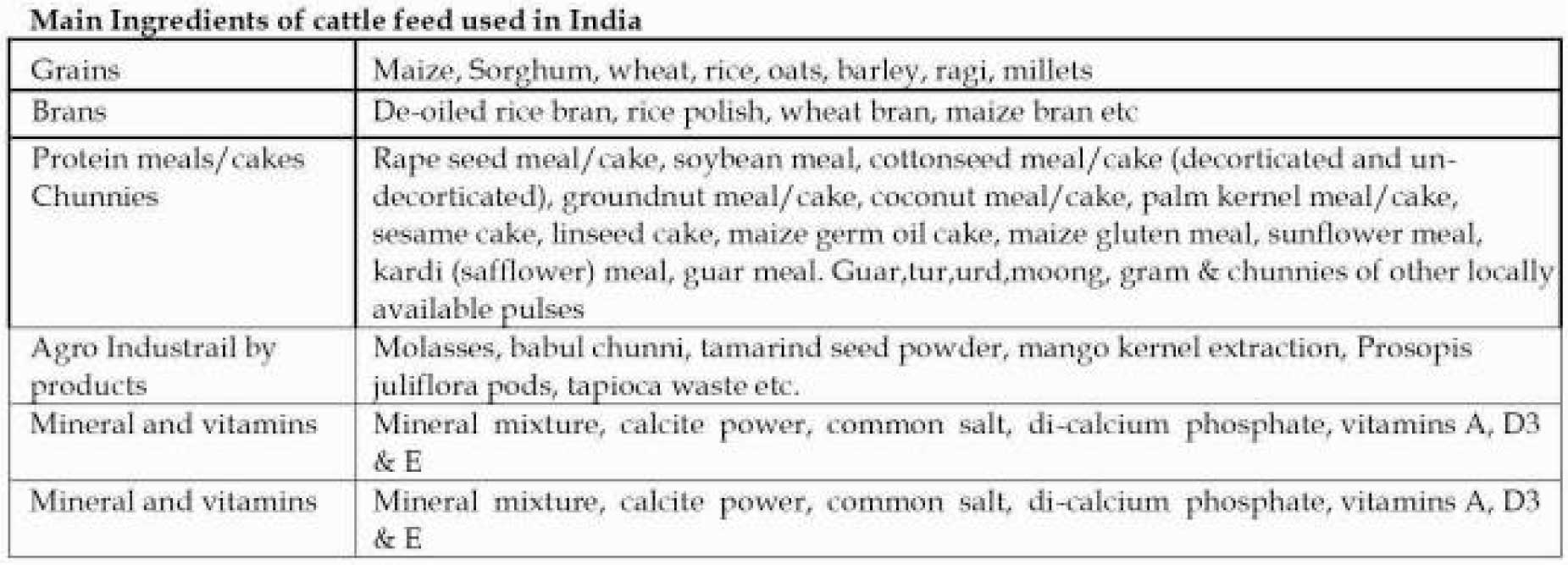

Different feed ingredients are rich in different nutrients. In

view of this, it was felt that if different grains, brans,

protein meals/cakes, chunnies, agro-industrial by

products, minerals and vitamins are mixed in suitable

proportion and this mixture is fed to animals along with

the basal diet, concentrate ingredients, which varies in

composition in accordance with the animal type, season,

region etc. Is called compound cattle feed. Compound

cattle feed could be in the form of mash, pellets, crumble,

cubes etc.

Quantities of feed fed to different species within household premise & Fact Sheet of Compound Feed Market in India

Different types of Compound Cattle feed

In India low, medium and producing animals in

different parts of the country, therefore, different types

of feeds are produced by feed milling plants. Variations

in feed formulations are also necessary due to

availability of different basal feeds in different seasons.

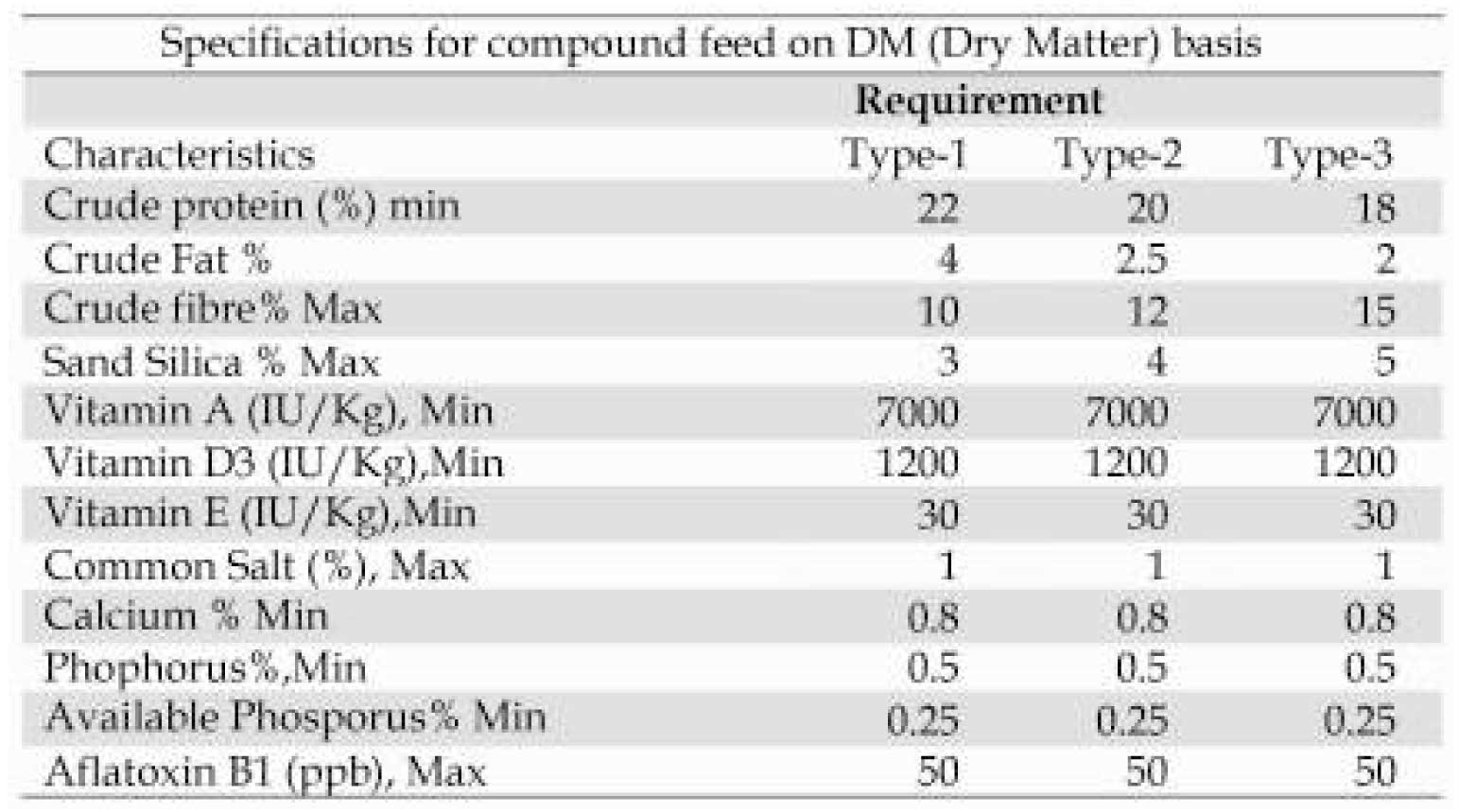

Specification for three different types of feeds

recommended by the Feed and fodder group,

constituted by the Department of Animal Husbandry

& Dairying, GOI are given below:

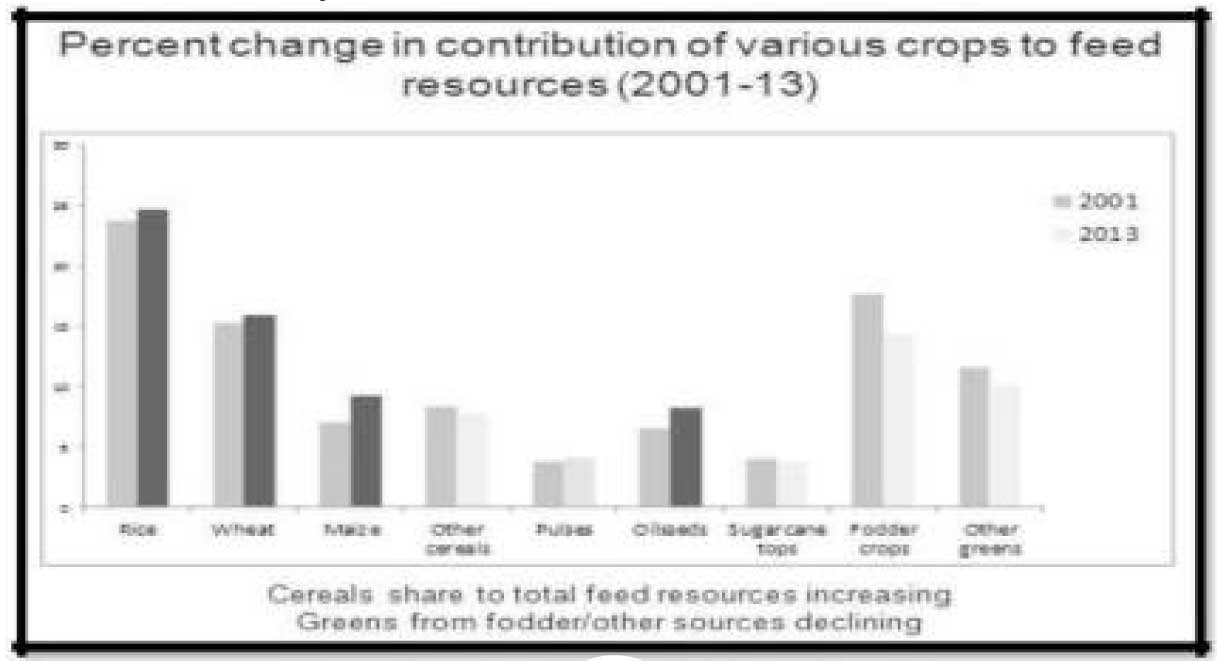

Contribution of different sources to Dry Matter

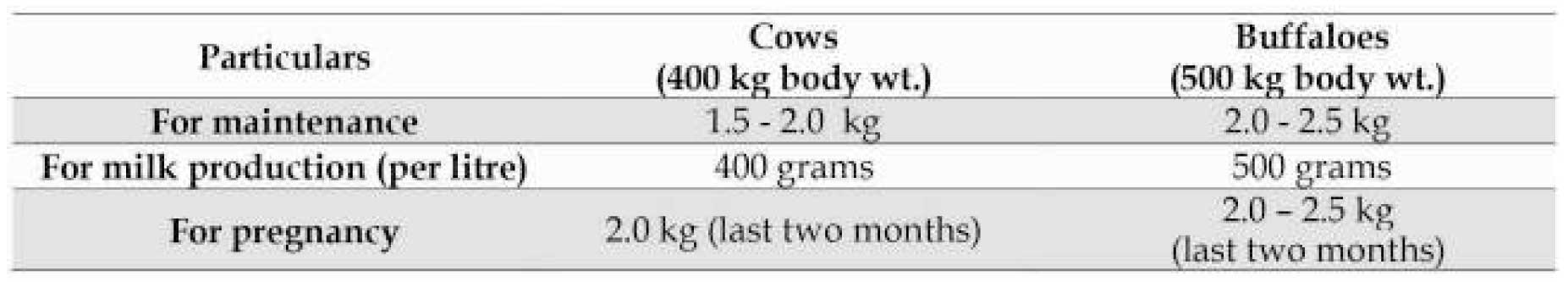

How much Compound feed Cattle to be fed

Cattle Feed can be fed directly or by mixing it with chaffed

dry/green fodder. Cattle feed need not to be cooked or

pre-soaked before feeding. If compound feed is uniformly

mixed with forages and fed, results are better. Animals

need to be fed compound feed as follows:

If 15-20 Kg good quality cultivated green fodder is

available for feeding the animals, then compound feed for

body maintenance need not be given.

Presently, in India only two types of compound cattle

feeds are manufactured for adult animals. Considering the

increase in milk yield, regional variation in feed

availability, preference of farmers it is required to produce

different varieties of compound cattle feed. As per NDDB

guidelines, NDDB also promotes use of different

compound feeds such as, calf starter, calf growth meal,

feed for high yielding animals, feed for low yielding

animals, buffalo feed, feed for dry or pregnant animals etc.

But in field observation only milking animals are fed with

compound feed. We have not seen Compound feed

feeding in Calf & dry animals. Further, farmers with one

two animals are hardly serious for use of compound feed

except during lactation period. It was found during

interaction with farmers in different regions of major milk

producing states that proper knowledge about benefits of

use of compound feed is missing and high price of

compound feed is another big concern among progressive

farmers. During my visit to Bihar & Bengal, farmers want

Compound feed in the rate home - made concentrate ( Rice

Bran+ Jaggery @Ra 15-20 Kg) or at the price at which

unorganized feed manufacturers are offering the product.

It was seen that local feed manufacturers

(unregistered/unlicensed) are selling feed in the range of

Rs 20-40/- per Kg.

During meeting with some of registered and big

Compound feed manufacturer, it was understood that

they also sell two types of Compound feed- High priced

and low priced, but they did not reveal the ingredients

and specifications. As per our broad estimates, Godrej

Agrovet is able to sell 50000 MT of Compound feed in

Maharastra, 50000 MT in Tamilnadu& Karnataka, 25000

MT in Bihar. No registered Compound manufacturers

were willing to talk about prescribed standards of low

price Compound feed quality.

Issues with feed & fodder in India

- As per XII five year plan of the Government of India, 5- 6% of growth rate in feed & fodder require to address the challenge of shortage of feed & fodder.

- Deficiency of feed and fodder accounts for half of the total loss in livestock production potential.

- Quality data and timeliness of data availability are serious issues.

- Only 5% of the farm household are able to access any information on animal husbandry against 40% of crop farming.

- Development of the cattle feed sector has not received enough attention in the past. (NDDB provide advisory services on commercial feed manufacturing only to the Cooperatives)

- Inadequate marketing ,financial and infrastructure support.

During meeting with Dr. RaghvendraBhatta, Director,

National Institute of Animal Nutrition and Physiology,

(NIANP), Bangalore it was understood that area under

Fodder crops, Permanent Pastures & Grazing and

Cultivable wastelands which are the major source of cattle

feed is shrinking drastically due to increase in demand for

real estate and infrastructure.

Further, large amount of useful paddy straw for livestock

is being burnt in the major Paddy producing states of

India. The Paddy straw is one of major source of dry

fodder for bovine in India, but handling and marketing

constraint at farmer level is the major reason behind

burning of the same in field.

Dr. Raghvendra also informed that the impact of climate

change is several regions are now visible and it is posing

challenge to livestock &live stock systems and need to

modify animal diets as increased temperature increase

lignifications of plant tissue and reduce the digestibility

and rates of degradation of plant species.

He suggested that small technological interventions in

feed & fodder management may bring big positive impact

and will solve fodder issue at maximum extent.

Crop residue Management :

- Bailing- dry fodder, transport and minimize losses

- Chaffing & Storage- reduce wastage and improve intake

- Urea Treatment- enrichment with nitrogen leading to better utilization

- Strategic supplementation- Improves the utilization of nutrients and improves productivity

Green fodder Management :

Strengthening of fodder

Seed chain

- Varietal and Management improvement

- Hay & silage making

Use of Alternate source of Feed :

Castor, Karanj, Neem, Mahua, Shea nut cake, Jatropa,

Tomato Pomace , Brewery Waste, Areach sheath, Azola

(algae), Pineapple fruit residue, Banana leaves, Cassava

tops, Corn cob, Cotton seed hull, Sunflower head, Coffee

pulp, Coffee bran/hull, Cocoa pods.

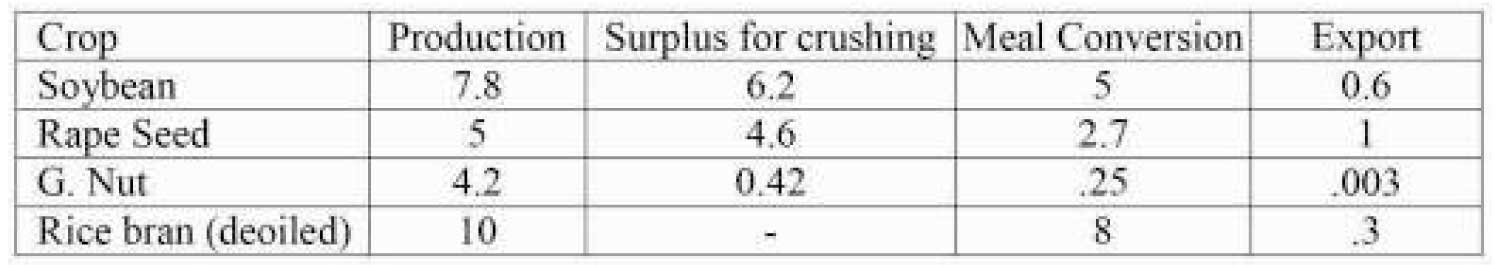

As per our estimate, the export of oil seed cake/meal has

drastically came down in India from 5 Million tonne to 2

million tonnes from 2011,due to low production of oil

seeds. Currently India is exporting around 2 Million

tonnes of protein meal to South Korea and Middle east

countries and other side import of oil seed cake/meal is

limited to save guard the domestic producers. Hence, such

scenario will impact the compound feed manufacturers

who are using oil seed meal as base material for

commercial feed.

Primary study on De-oiled rice bran use and its availability

in major states revealed that Deoiled rice bran (present

rate- Rs 10/- 11/- per Kg) is used as major source of protein

for animal feed in western part of country. AMUL (Anand

Milk Union Limited) and other major dairy cooperatives

are buying large quantity of Rice bran as a basal for low

cost compound feed production.

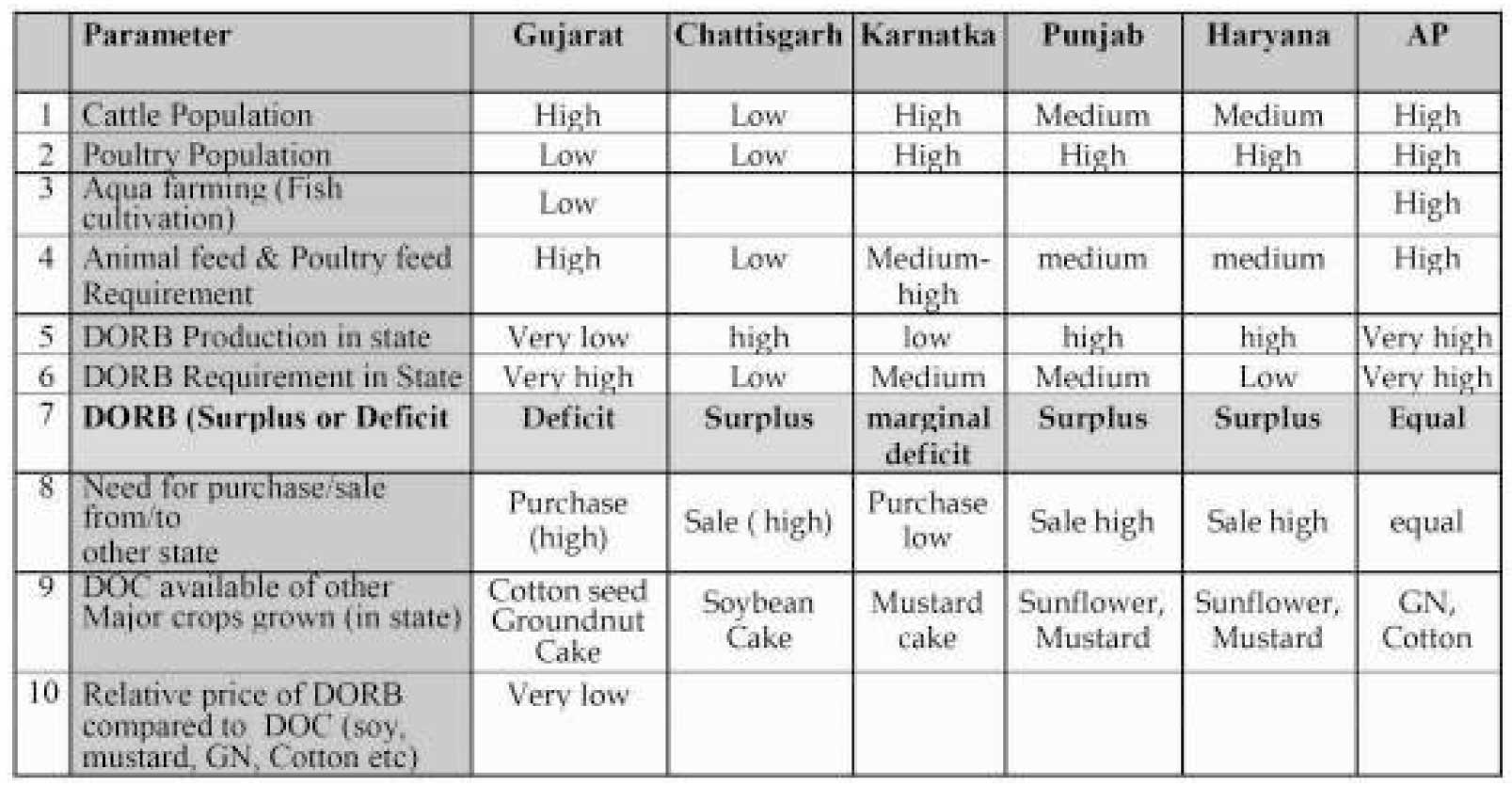

In above table, multiple parameters have been taken into

consideration for assessment of exiting dairy/poultry feed

demand dynamics along with availability of DORB in

respective state. This also indicates Surplus/deficit state in

terms of DORB Production.

As visible in above table, Punjab, Haryana & Chhattisgarh

is surplus states where as Gujarat, Rajasthan (not in table)

is most deficit state as far as DORB is concerned. Hence

demand from deficit state dictates price of DORB

prevailing in Punjab and Haryana. (Note: relative price of

other DOC in market is also taken into consideration)

Further major consumption of animal/poultry feed is

reported in Punjab, Gujarat, UP, Rajasthan, Maharashtra,

AP, Karnataka and Tamil Nadu (Mostly western &

southern states). Movement of DORB is reported from

surplus states to deficit states and requirement in deficit

states dictates its price. Normally DORB from Punjab &

Haryana is transported to Gujarat & Rajasthan and

purchase price in Gujarat becomes the benchmark price

for DORB in these states.

To bring to notice, West Bengal (Eastern India) is one of the

leading producers of de-oiled rice bran. The high railway

freight from West Bengal to western or southern India

makes transport unviable for the producers in Eastern

India, thereby compelling them to export de-oiled rice

bran to the neighboring countries.

Drought or excessive rain in few provinces, El Nino

impact, paddy/ edible oil crop failure in one or multiple

state drives relative DORB demand in the market. The net

realization from sale of DORB, influences solvent

extraction margin and indirectly affects pricing of CRBO

as well. Hence parity in DORB sales realization is one of

the indicators of rising/declining pace for production of

CRBO.

Though Rice bran must be processed immediately after

milling within 1-5 days (if possible), a solvent extractor

has no choice but to do extraction irrespective of DORB

price ruling high or lower (if bran already purchased).

However, if parity is not met he will stock DORB&sales at

appropriate time. As demand for CRBO for last 3-4 yr has

been very encouraging with expectation of rising demand

and prospective future, a higher extraction of more

RiceBranmay be visible in next 3-5 yr.

The Recent ban on beef product in India is indirectly

helping more feed/fodder requirement for dry animal. As

dry animal could not be culled and have to fed with

additional feed/fodder to keep it alive. This indirectly,

may push marginal additional demand for all feed

products including DORB.

At Poultry feed industry front, seasonal demand from this

industry also influences pricing of DORB. During winter

month, demand of feed material rises, whereas in summer

it reduces by 20-25%.

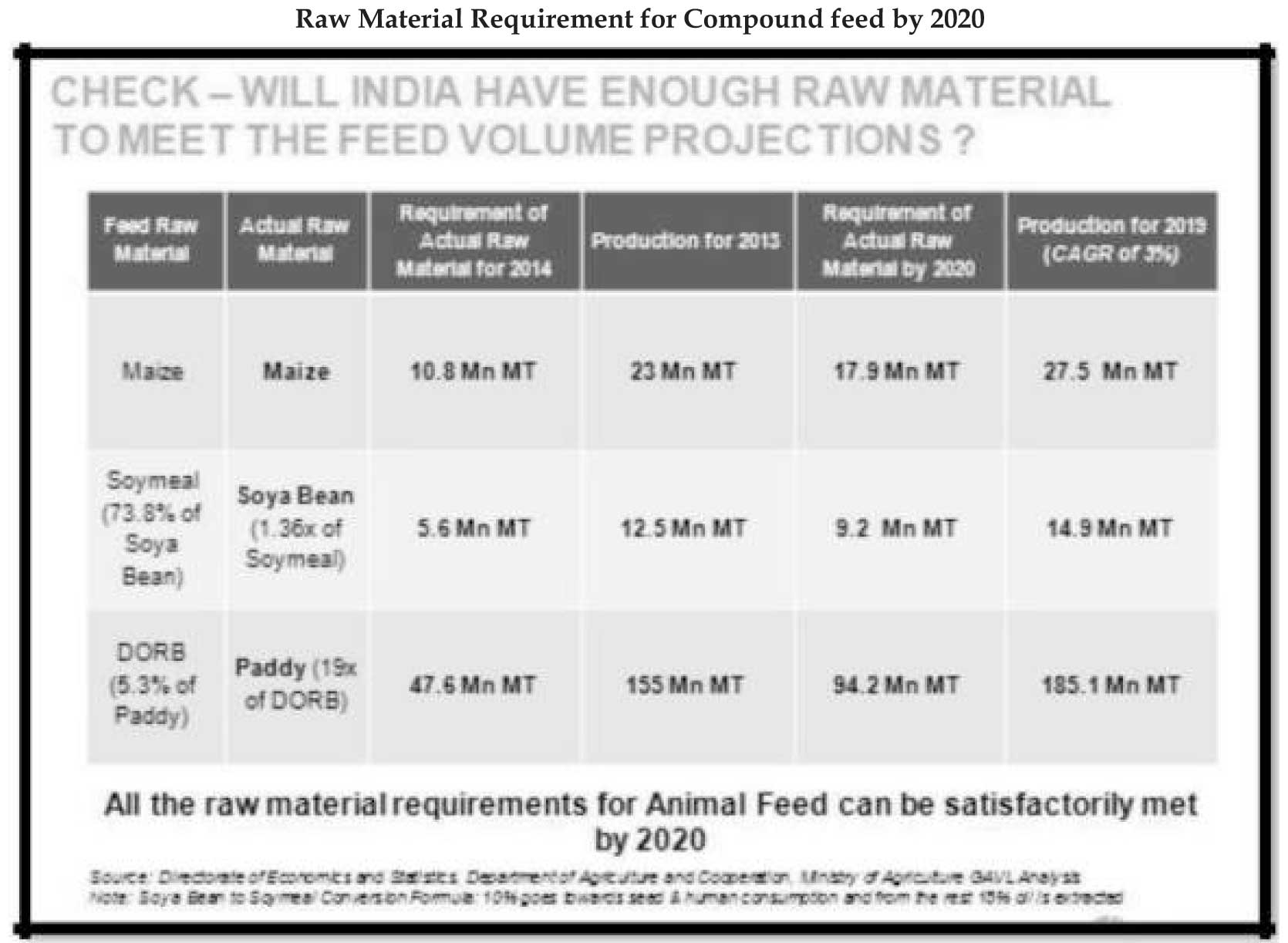

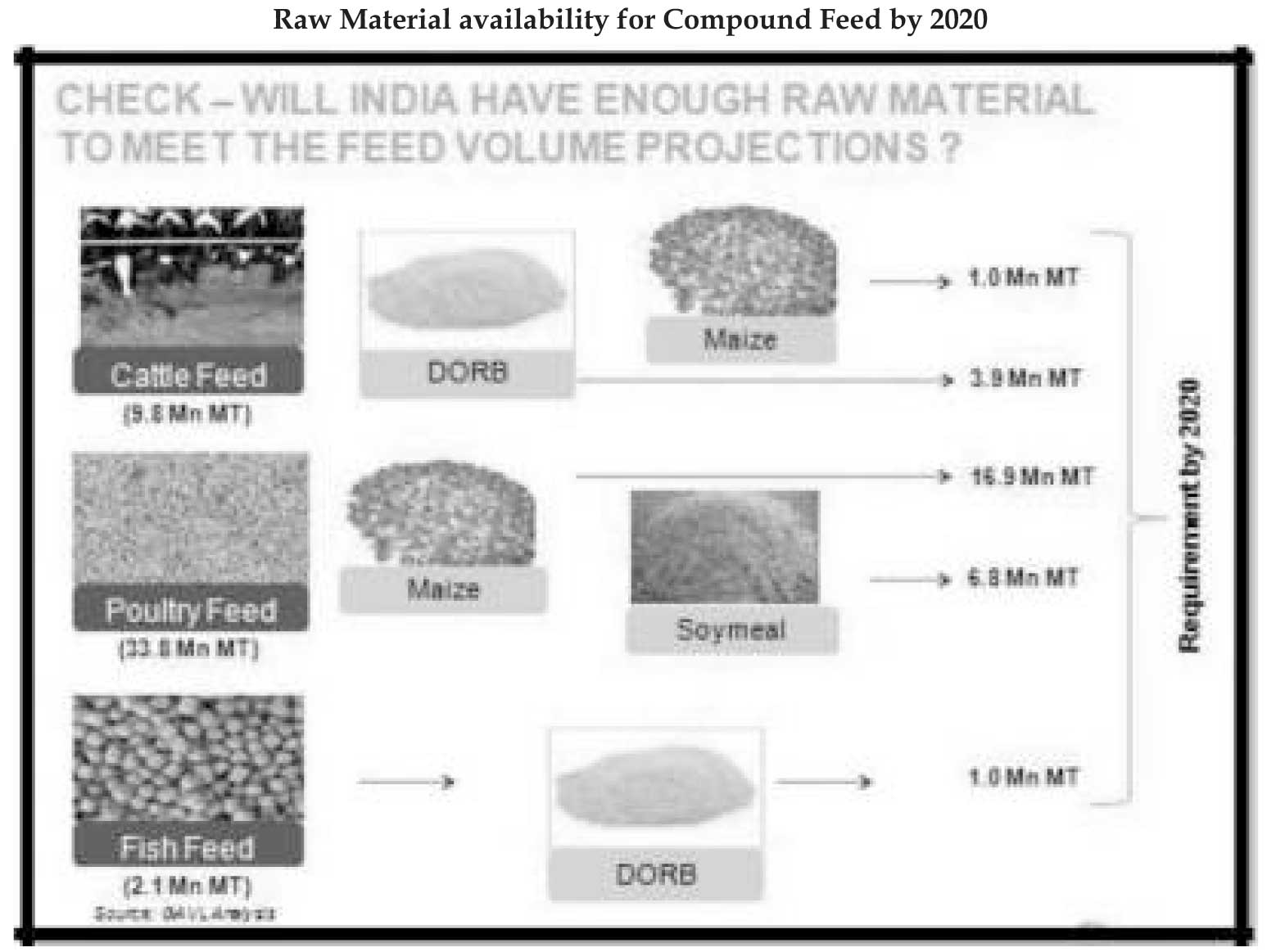

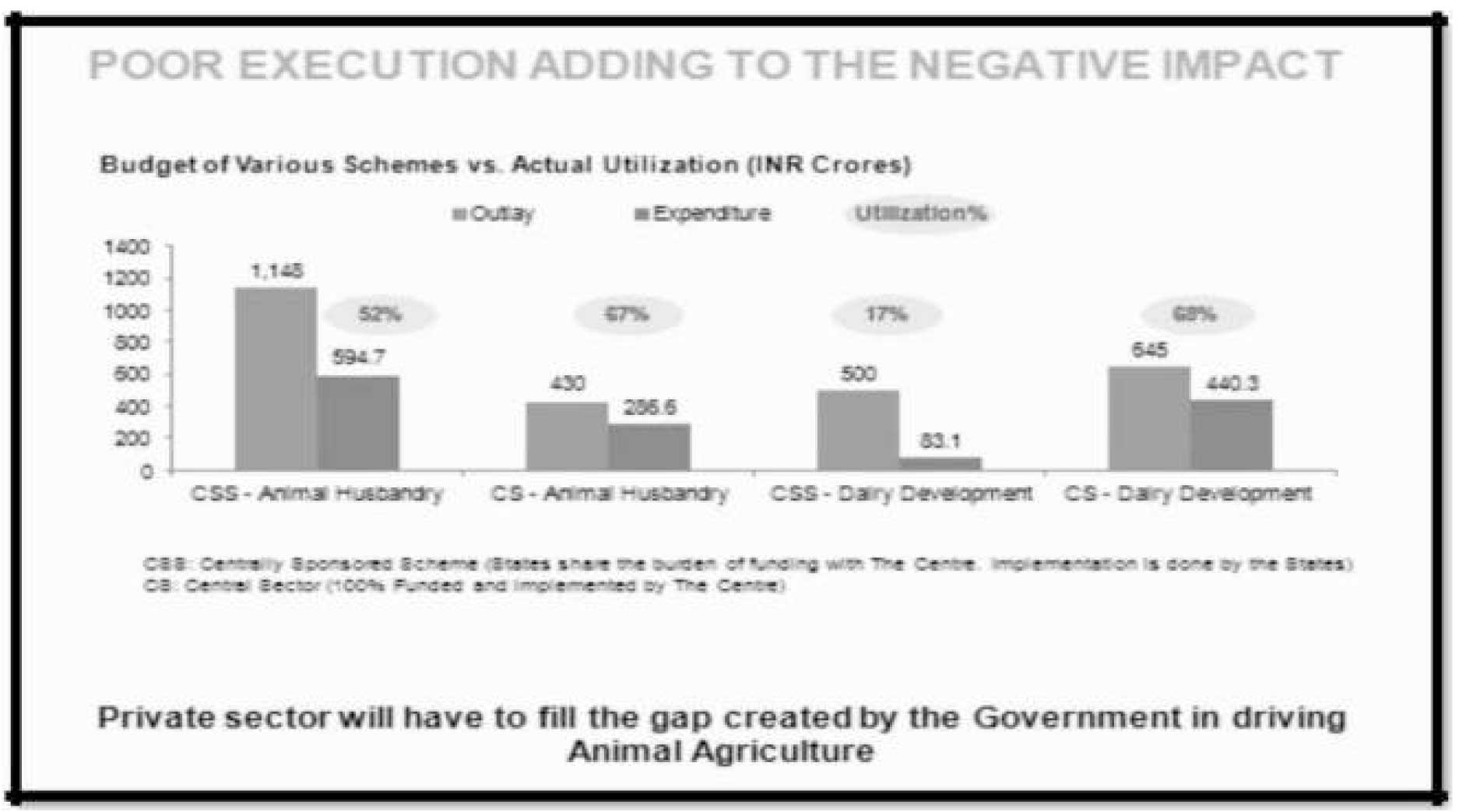

While raw material is not a problem then Govt plan seems

like a case of misplaced priority. The below slide is

showing poor allocation of funds is Animal Husbandry &

Livestock which contributes 23% to the total output from

Agriculture.

Further, poor execution adding budget verses actual

utilization of funds to the negative impact. Private sector

will have to fill the gap created by the Government in

driving agriculture. The Gaps to filled mainly in

Education of farmers about live stock management.

Issues before Compound feed manufacturers in India :

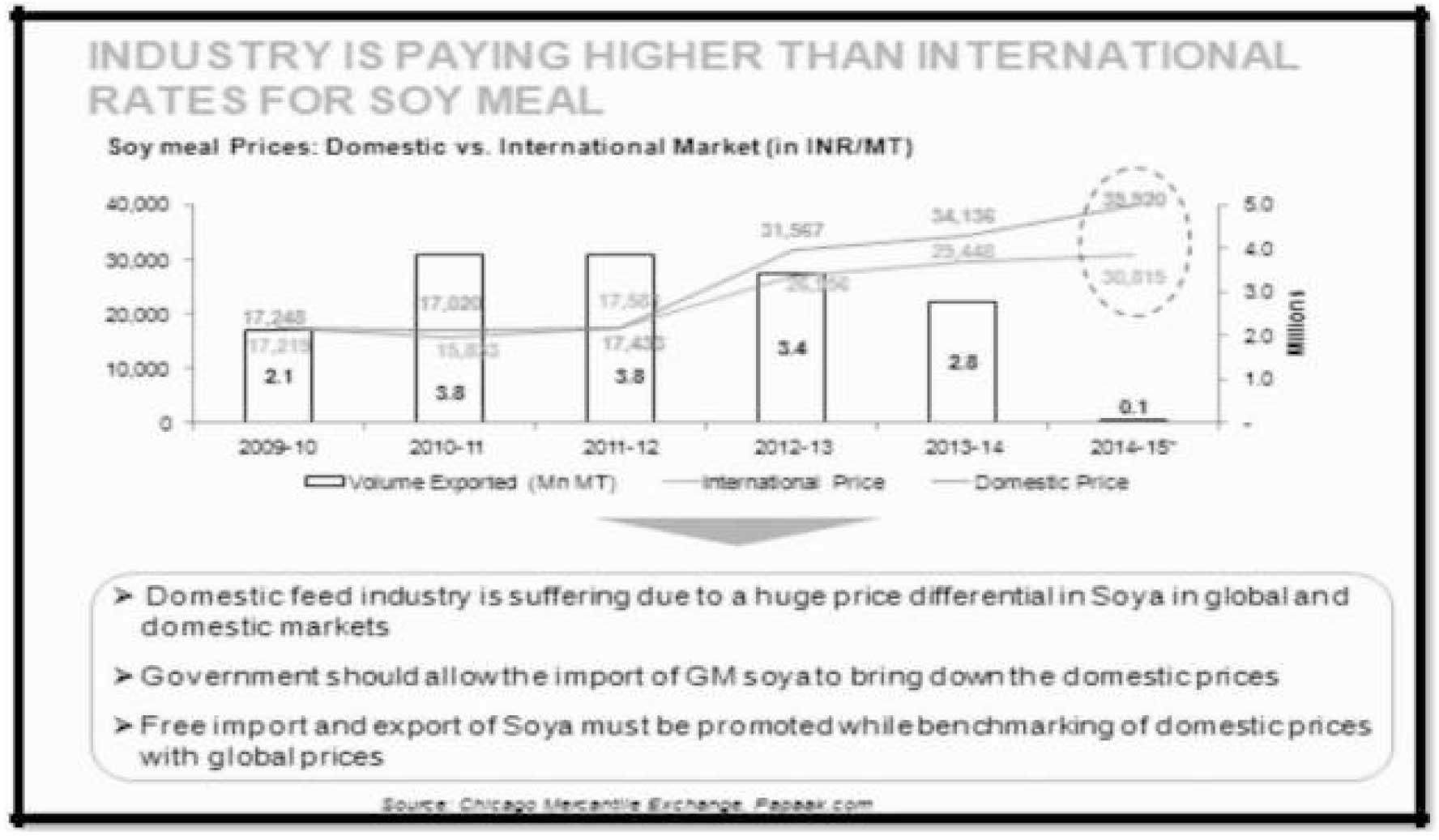

Indian Feed manufacturing Industry is paying higher prices for main protein meal i.e Soy mean than in International

price due to high duty paid import & export.

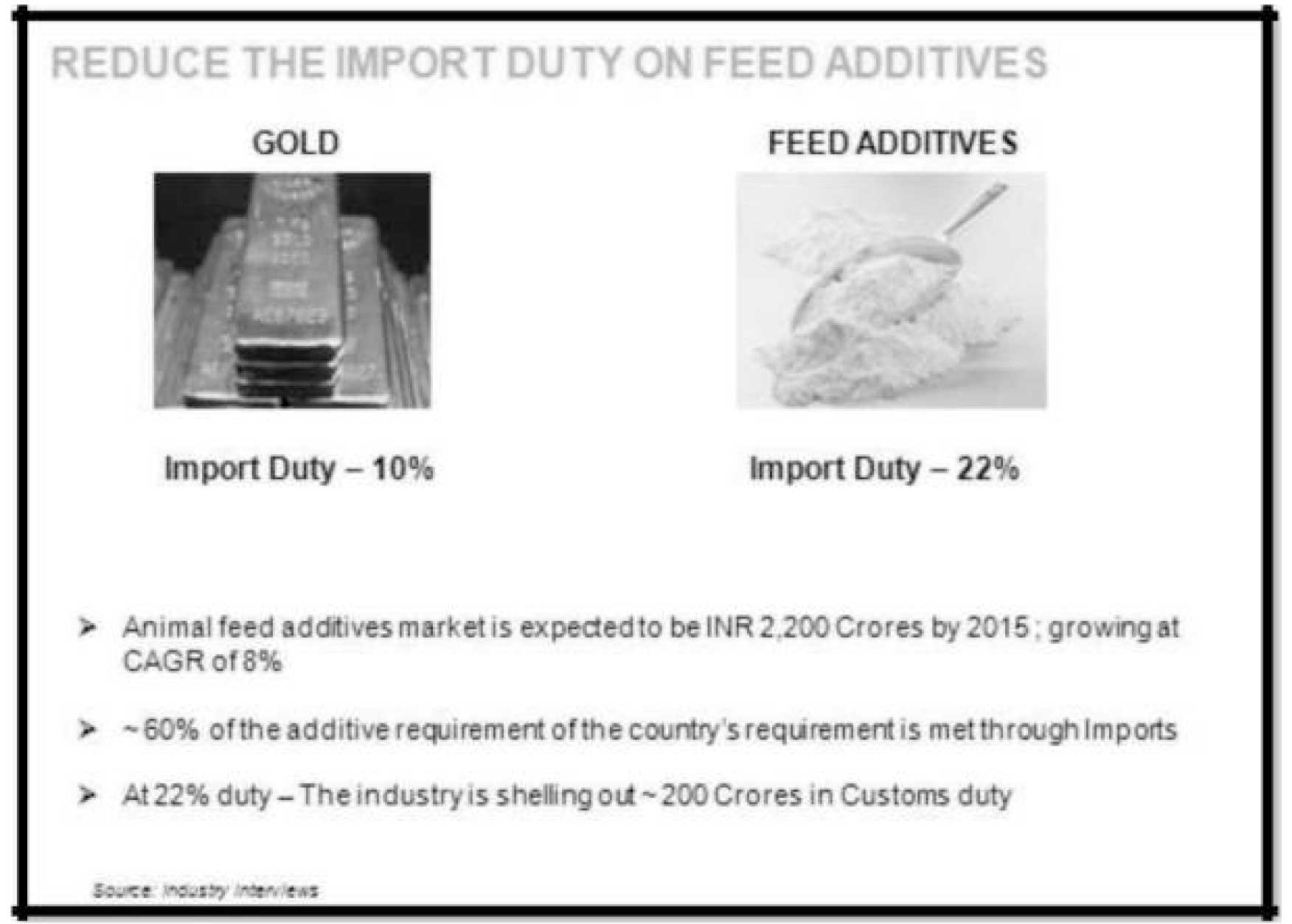

Finally, major issue is Import duty on feed additive which

India is majorly importing from China. The high price feed

additive for cattle feed is stopping farmers to choose extra

supplement for milk enhancement and adding high cost to

quality feed.

Eventually, we can say that the commercial/compound

feed exploitation is must for better milk production and

animal health.

References :

- A.K.Dikshit & P.S. Birthal, 2010. India's Livestock Feed Demand : Estimates and Projection, published in Agricultural Economics Research review Vol.23, January- June 2010 pp 15-28.

- Retrieved from URL ht tp://www. fao.org /docrep/article/agrippa/ x9500e01.html.

- http://www.nddb.org/services/animalnutrition/ cattlefeed.

- ht tp://www. abhaycot e x . com /Inve s tor _ cattlefeed.html#sthash.26ssUCy7.dpuf

- http://www.animal-feed- india.com/ history.htm

- http://www.slideshare.net/DrSandeepJuneja/ india-livestock-feedopportunity.

- Interview with Dr. RaghvendraBhatta, Director, NIANP, Bangalore.

- Interview Mr. Amit Sarogi, President, CLFMA, Mumbai.

- Industry Interviews, field visits.

- Data base obtained from Transgraph Consulting Pvt. Ltd.

- Jhon MP Paper published in International Global Research Analysis Journal on Cattle feed Market in Kerala: A Study of purchasing behaviour pattern and Buyer behaviour, Jhon MP, Ph.D Scholar, Karpagam University, Coimbatore, Tamilnadu, India Dr. Manoj Research Guide, Assistant Professor, Deaprtment of Applied Economics, Cochin University of Science & Technology, Kochi, Kerala, India.

- D. Babu and N.K.Verma, 2010, Value chains of Milk and Milk Products in Organized sector of Tamilnadu- A Comparative Analysis published in Agricultural Economics Research review Vol.23. January-June 2010 pp 479-486.