Subscribe now to get notified about IU Jharkhand journal updates!

A Study on the Role of Banking Ombudsman Scheme in Customer Redressal in India

Abstract :

In the present banking system, excellence in customer service is the most important contrivance for sustained business growth. Customer complaints are part of the business living of any corporate entity. This is more so for banks since they are service organizations. Over a period of time, the number of complaints against banks with regard to deficiency of their services has been mounting in spite of several efforts taken by the banks on the advice of the Reserve Bank of India. Since the role of banks has changed from ‘Class Bank’ to ‘Mass Bank’, there is tremendous pressure on the part of banks to satisfy the various needs of the customers. The load of work is mounting day by day on banks taking into account The Banking Ombudsman (BO) Scheme was established by the Reserve Bank of India (RBI) in 1995 to provide speedy solutions to grievances faced by bank customers. Although the number of complaints received through this forum has augmented in recent times, the lack of awareness among the customers was a big concern. Through some proactive measures taken by the RBI and awareness campaigns conducted by the Ombudsman, the scenario looks much brighter today. In this backdrop, an attempt has been made to analyze the performance of Banking Ombudsman Scheme. Hence, the present study make & in-depth analysis about the trend & progress of Banking Ombudsman Scheme, especially for the Customers’ Redressal in India. The study is purely empirical in nature, depending on both primary and secondary data.

Keywords :

Bank Performance, Banking ombudsman, Customer Redressal, Consumer or Customer, Complaints, Grievances.1.0. Introduction

The institution of banking offers opportunity for investors and channelizes the resources available for the expansion and sustenance of trade,

commerce and industry, and, hence, an efficient banking system is indispensable forth growth of the national economy. It is necessary that in

such a system checks and balances be introduced to reduce inefficiency and administration. Furthermore, the quality of the service of the banks

depends upon the service provided to the customers and same determines the reputation and growth of the bank. Banking being public utility

services and in view of the declining services rendered to the public and also having regard to the fact that services so rendered by banks in

irresponsible manner, which are not only inefficient but deficient in character and in the said stress and strain, the public/customer is put

pillar to post without having any remedy, it was felt necessary to have a separate forum to receive and resolve such grievances. Of course, the

Consumer Protection Act, 1986 or courts, has taken care of it but as of now consumer forum is hard pressed with the alarming rise in number of

cases. In the banking sector, so far consumer or customer are concerned, their grievances are many and varied.

Reserve Bank of India (RBI) is flooded with complaints. They received complaint and forward the complaint to concerned bank and banks are required to submit comment and confirm that grievance of the customers stand redressed. Whether it is redressed or not, paper transactions take place. Banking sector is constantly under criticism by press, public and estimate committees. Various committees, commissions and working group were formed to go into the issue since 1972.

Banking Commission was headed by Sri R. G. Saraiya followed by Sri. R. K. Talwar which made as much as 172 recommendations and lastly report of the Goiporia Committee is a step further as to the sustained anxiety of RBI towards improvement of customer services in banks. Banks have implemented the recommendations to greater extent still there is no perceptible change in the quality of customer services and still the deficient areas are palpably visible and the customer remain dissatisfied.

The ‘Narasimham’ Committee on “Banking and Financial Sector Reforms” examined these critical areas and recommended introduction of the “Banking Ombudsman Scheme 1995” as a part of Financial Sector Policy and Systems Reforms 1991-92 to 1995-96. Recommendations are very much significant and certainly, it was a needed requirement. This is timely in the changing needs of the customers, in the context of growing liberalization in the banking and financial sectors along with the growing awareness amongst customers, of their rights. In this background RBI has accepted the recommendation and as a part of banking policy, Dr. C. Rangarajan; Governor, announced the “The Banking Ombudsman Scheme” on June 14, 1995. The scheme was issued under the provision of Banking Regulation Act, 1949, covers all Scheduled Commercial Banks and the Scheduled Primary Co-operative Banks having business in India. The Scheme has become operative from June 1995. Initially Ombudsman was appointed on full time basis in three centres i.e. Mumbai, New Delhi, and Bhopal but subsequently its base for operation has been expanded. The aim and objective mechanism of ombudsman is to deliver quick and inexpensive facility to resolve grievances of customers arising out of deficient services rendered by the banks. Hence, banking ombudsman is in place to cater to public complaints against deficiency in banking services concerning operation of deposit accounts and loans and advances.

2.0. The Banking Ombudsman Scheme

The Banking Ombudsman Scheme enables an expeditious and inexpensive forum to bank customers for resolution of complaints relating to certain services rendered by banks. The Banking Ombudsman Scheme is introduced under Section 35 A of the Banking Regulation Act, 1949 by RBI with effect from 1995. The Banking Ombudsman is a senior official appointed by the Reserve Bank of India to redress customer complaints against deficiency in certain banking services. As on date, fifteen Banking Ombudsmen have been appointed with their offices located mostly in state capitals. All Scheduled Commercial Banks, Regional Rural Banks and Scheduled Primary Co-operative Banks are covered under the Scheme.

3.0. Paradigm Shift of BOS 1995 to BOS of 2006

The attempt over years has been to extend the scope and jurisdiction of the Banking ombudsman to hitherto uncovered areas. This has been done in two ways:

1. Coverage of banks:under the 1995 Scheme, only commercial banks and Scheduled Primary Co-operative Banks, having a place of business in India, were covered. Then 2002 Scheme broadened the operation of the ombudsman by including within the definition of ‘bank’ such entities as Regional Rural Banks, State Bank of India, and ‘subsidiary bank’ as defined in Part I of the Banking Regulation Act, 1949. Even the Scheduled Commercial banks are covered under the latest scheme of 2006.

2. Entertainment of Complaints:the Ombudsman Scheme lays down the grounds on which complaints can be entertained by the Ombudsman. The trend over the year has been to extend the jurisdiction of ombudsman. The RBI has expanded the scope of the banking ombudsman to include customer complaints relating to credit cards, deficiencies on the part of sales agents of banks to provide promised services, levying service charges without prior notice to the customer and non-adherence to the fair practices code as adopted by individual banks. In order to make the scheme more effective, the RBI has decided to take the onus of recruitment and funding of the scheme. It has also allowed complainants to file their complaints online and appeal to it against the judgments given by the banking ombudsman. The Banking Ombudsman Scheme, 1995 was notified by RBI on June 14, 1995 in terms of the powers conferred on the Bank by Section 35A of the Banking Regulation Act, 1949 (10 of 1949) to provide for a system of redressal of grievances against banks. The Scheme sought to establish a system of expeditious and inexpensive resolution of customer complaints. The Scheme which is in operation since 1995 has been revised during the year 2002 and 2006. The Scheme is being executed and administered by Banking Ombudsmen appointed by RBI at 15 centres covering the entire country.

4.0. Review of the Available Literature

The number of studies has been conducted regarding the services of banking ombudsman to their customers. Some of them are listed below:

Goyal and Thakur (2008) concludes that public sector banks that have no monopoly licenses are to be given to new public sector banks and foreign banks. However, when the public sector banks realized that government was no longer there for them, they started devising various strategies for survival and growth.

Kamakodi (2007) examines how computerization has influenced the banking habits and preference of Indian customers, and which factors influence these preferences. Changing of residence, salary and non-availability of technology based services were given as the three main reasons for changing bank.

Jain and Jain (2006) show that the Indian banking industry has undergone radical changes due to liberalization and globalization measures undertaken since 1991. There has been a great surge in retail banking. The study based on responses received from 200 customers of Housing Development Financial Corporation (HDFC) bank, Industrial Credit and Investment Corporation of India (ICICI) bank and some other private and nationalized banks in Varanasi identified the various types of services offered by banks, the level of satisfaction about different types of services, expectations about these services and the level of segmentation among the services offered.

Shankar (2004) asserts that customer service in banks means satisfying the needs of customers at the right time and in the right manner with accuracy, reliability, high service speed, security and enquiry facility for an efficient customer service. The excellent and managing customer relationship is the future of any business or everybody’s business. As such, customer focus is not being viewed as just a business strategy, but should become a corporate mission.

According to S.Gousia, The Banking Ombudsman Scheme (BOS) attempts to ‘Treating the bank customers fairly’ with the awakening of consumers on the issues of investor/consumer protection. The present paper attempts to study and analyze the role and efforts of BOS as a part of Consumer Protection in banking services in India.

Malyadri, Pacha, Sirisha, S., opined that through some proactive measures taken by the RBI and awareness campaigns conducted by the Ombudsman, the scenario looks much brighter today. Even then, a lot needs to be done to make the Scheme function more effectively. Against this backdrop, an attempt has been made to analyze the performance of Banking Ombudsman Scheme.

P. Nikiforos Diamandouros, describes in his study that The mandate of the European Ombudsman (EO) to tackle maladministration is limited to the European Union institutions and bodies. However, the EO also promotes the correct application of EU law by the Member States, in two main ways. First, the EO deals with complaints against the European Commission in its role as ‘guardian of the Treaty’ and against the European Investment Bank, as regards its role in checking compliance with EU law in relation to the projects it funds. Second, the EO co-operates closely with national and regional ombudsmen and similar bodies, who have power to tackle problems of incorrect implementation of EU law by public authorities in the Member States. Some recent developments are creating links between these two aspects of the EO’s work.

P. Suganya, R. Eswaran, raise, through their study, some basic questions, Can we complain to Banking Ombudsman in case any complaints against the bank in India? Yes. Banking Ombudsman is a body created by RBI to look after banking related complaints. Imagine the scenario’s – while ATM card is inserted to withdraw Rs. 500, if transaction fails, but account is debited by Rs. 500. It leads frustration, irritation; even it is complained to the bank about the money being debited after the failed transaction. The bank tells that your money will soon be credited to account, but nothing happens for weeks… Six months pass by, with all of this up-down in-out stuff, all done, but nobody is listening! Can we imagine getting a compensation of Rs. 16,200 because of the bank’s inability to honour the rules set by RBI? Can a person imagine that for not getting Rs. 500 within a few days, he will get Rs. 100 penalty for each waited 162 days? Yes it can happen! And it has happened! In this article, the power of the Banking Ombudsman and Ombudsman officers, profile of complaints were discussed.

5.0. Objectives of the Present Study

In the light of the above literature review, the main objectives of the study are:

- To analyze the performance of the Banking Ombudsman Scheme.

- To investigate the customer awareness & perception about this scheme through an empirical study.

The main objectives of the research are to find out how the consumers react to the Banking Ombudsman Scheme and their response towards the Grievance Settlement System by the BOS. I undertook my research through on-field research because I thought that my research would be ideal if I could use Primary Data and interpret the data in a lucid form through some convenient statistical tools of research.

5.1. Type of Data Used

5.1.1. Primary Data

Data that has been collected from first-hand experience is called primary data. Primary data has not been published therefore it is more reliable authentic and objective. Primary data has not been altered or changed thus it has greater validity than secondary data. For the collection of Primary Data, I prepared a structured questionnaire in order to conduct my on-field research.

5.1.2. Secondary Data

Secondary data on the BOS and its customer redressal has been taken from the various annual reports on Banking Ombudsman Scheme published by The Reserve Bank of India. Besides, secondary data has also been collected from different official and non-official sources like Books and Journals, Websites, etc.

5.1.3. Questionnaire

In order to know how the Bank Customers are influenced by the Bank Ombudsman Scheme and to what extent, I have prepared a structured questionnaire (Shown in the Annexure).

5.1.4. Respondents

The respondents to this questionnaire include Bank Customers belonging to all the age groups, categories, all the income groups and all clusters

of the society.

(i) No. of respondents : 75

5.1.5. Response Rate

Out of the 80 persons questioned there are 75 responses so the response rate is also high

5.1.6. Response Error

There are no un-answered questions or answered wrong questions. When they had doubts regarding some questions I was there to answer.

5.1.7. Data Analysis and Representation

For the Secondary data analysis, the Spreadsheet software MICROSOFT EXCEL 2010 has been used. The data has been represented in the most lucid and attractive way possible with the use of Bar Graphs and Pie Charts so that the viewer can have a clear idea about the results of the research

5.1.8. Use Of Statistical Tools

For the most specific primary data analysis, factor analysis has been done using the statistical package SPSS 21.

6.0. Data Analysis and Presentation

6.1. Secondary Data Analysis

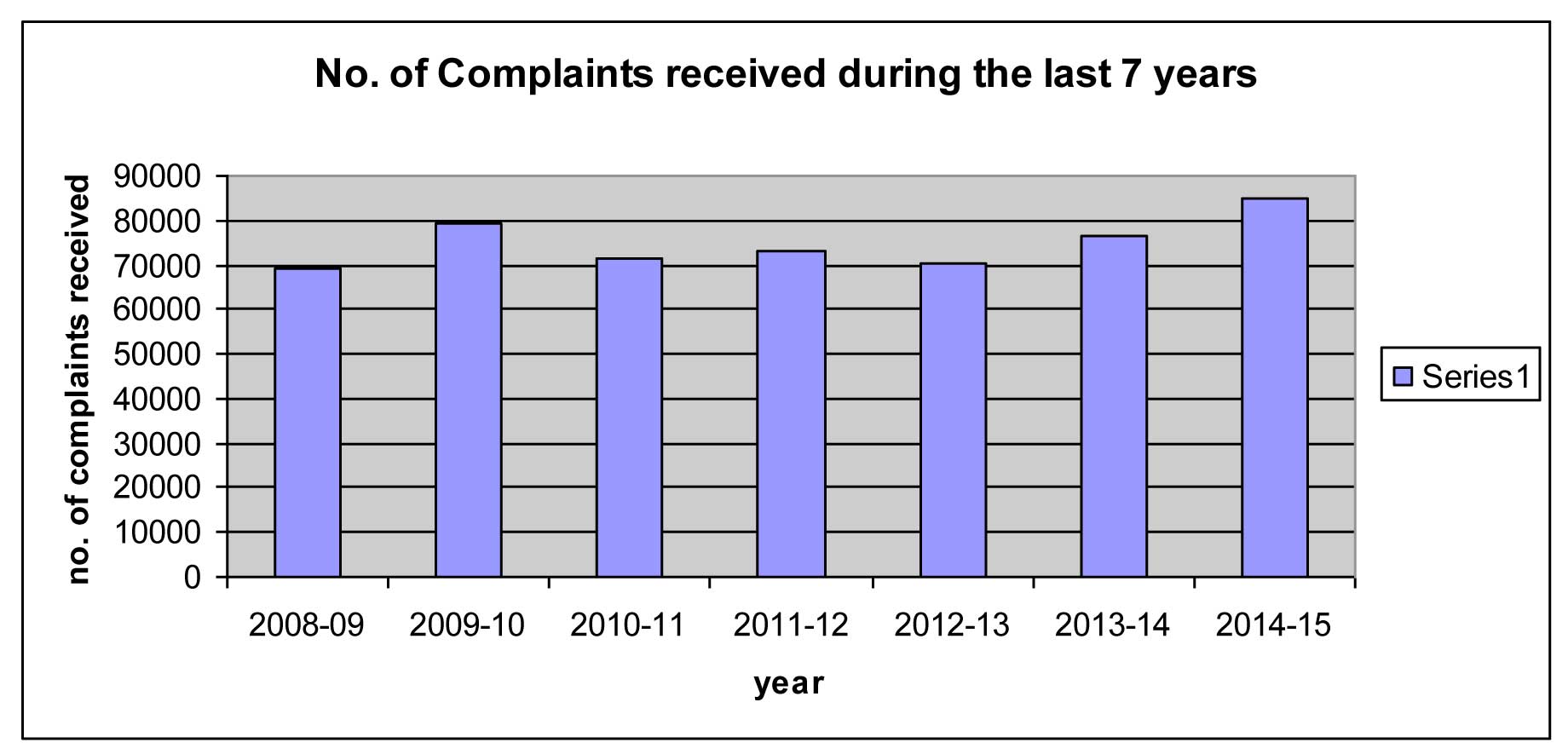

6.1.1. Number of Complaints received by the OBO during the last 7 Financial Years

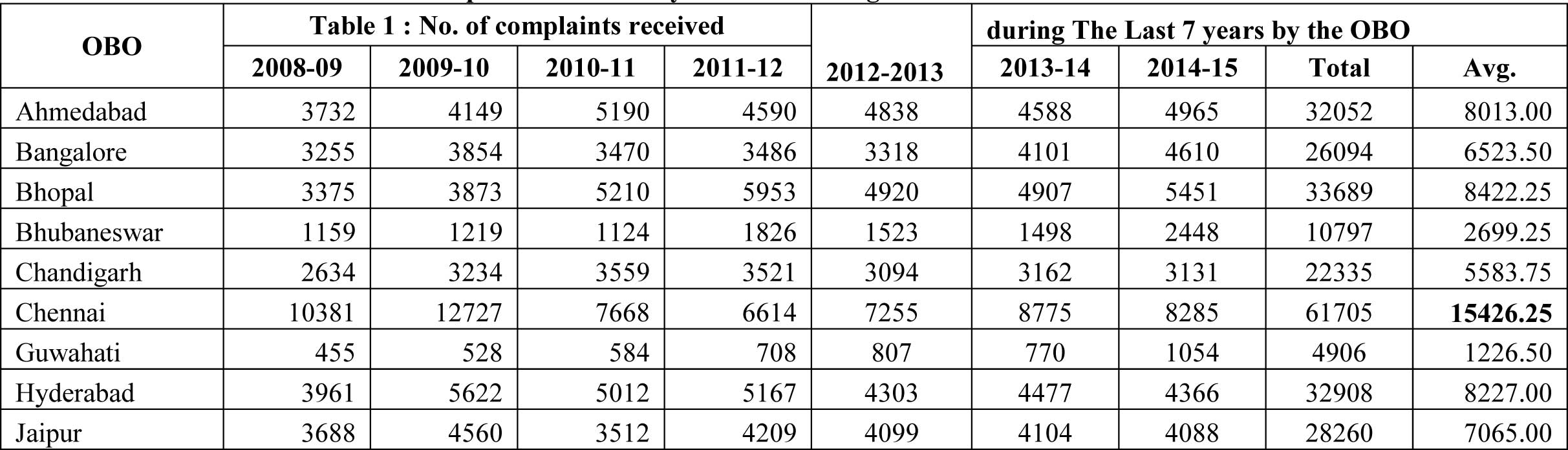

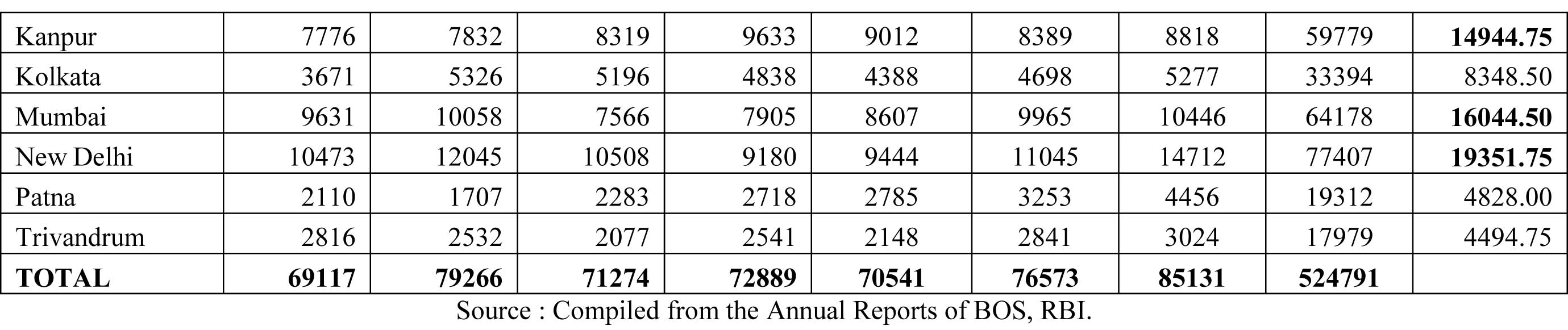

The above table shows that metro cities like Delhi, Mumbai, Chennai and Kanpur are having highest number of customers’ complaints towards banks, whereas in case of Kolkata, it is at a moderate level, although not very low. This is also evident from the following Chart:

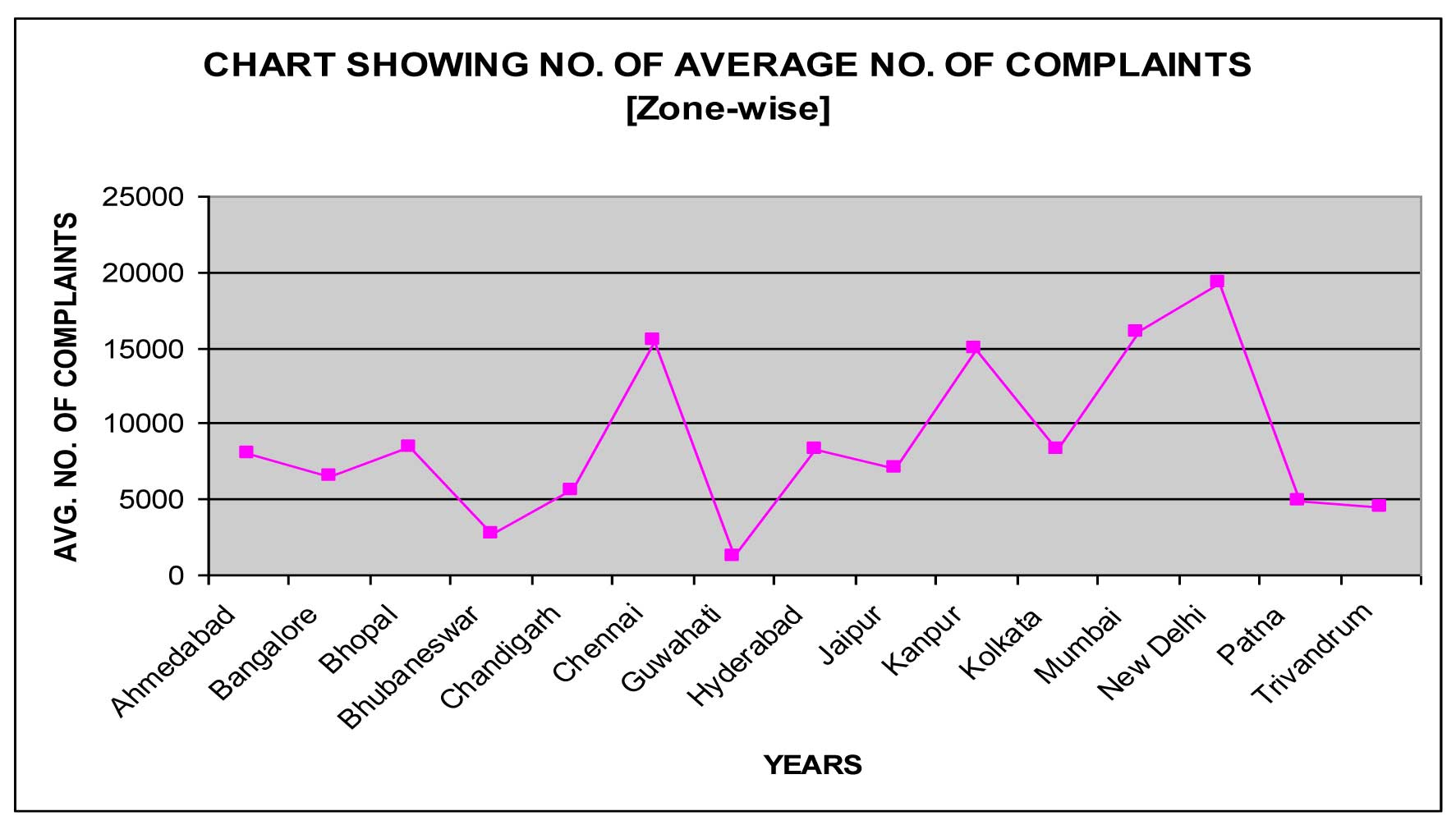

The above table depicts that the total number of consumers’ complaints have increased from 69117 to 85131 during the last 7 financial years, which clearly indicates that with the increase in the retail banking business over the past few years, customers’ grievances have also increased. This is further supported by the following chart.

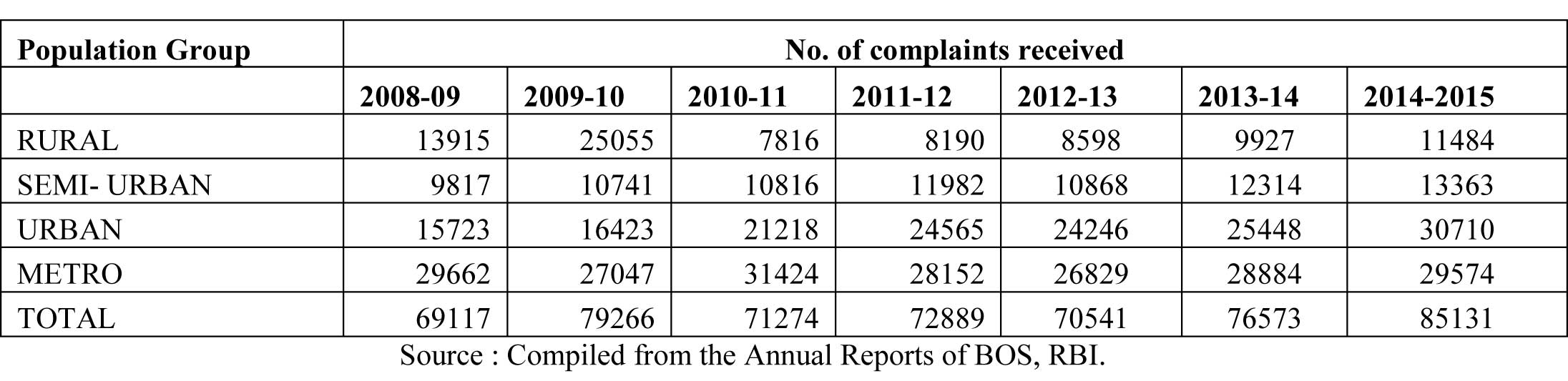

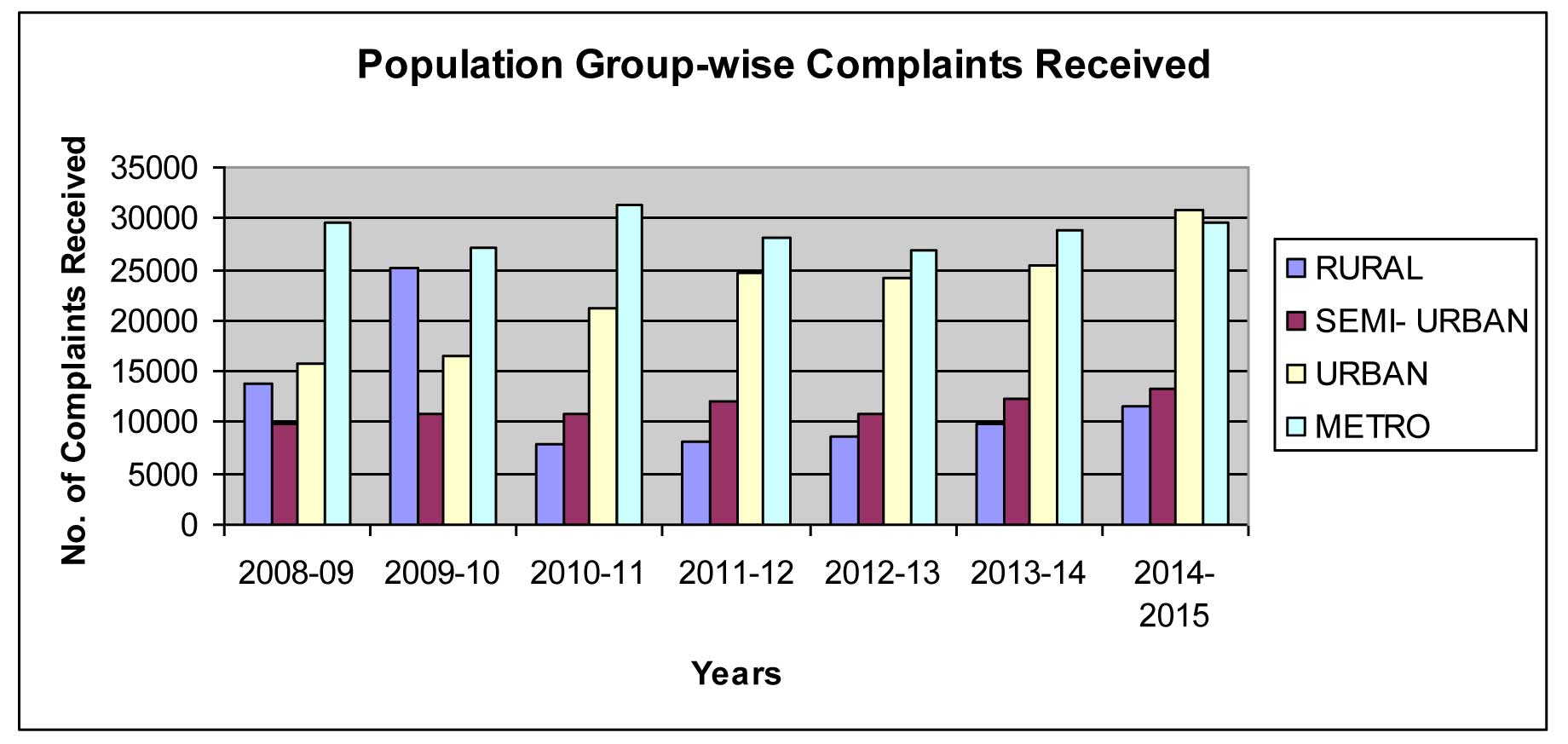

6.1.3. Total Number of Complaints received (Population Group-wise) by the OBO during the last7 Financial Years

Table 3 : Population Group-wise No. of Complaints Received during the last 7 Financial Years

The above table depicts that the number of complaints received from the urban consumers is maximum during the last 7 financial years, followed by the consumers from the Metro Cities. This is also evident from the following chart.

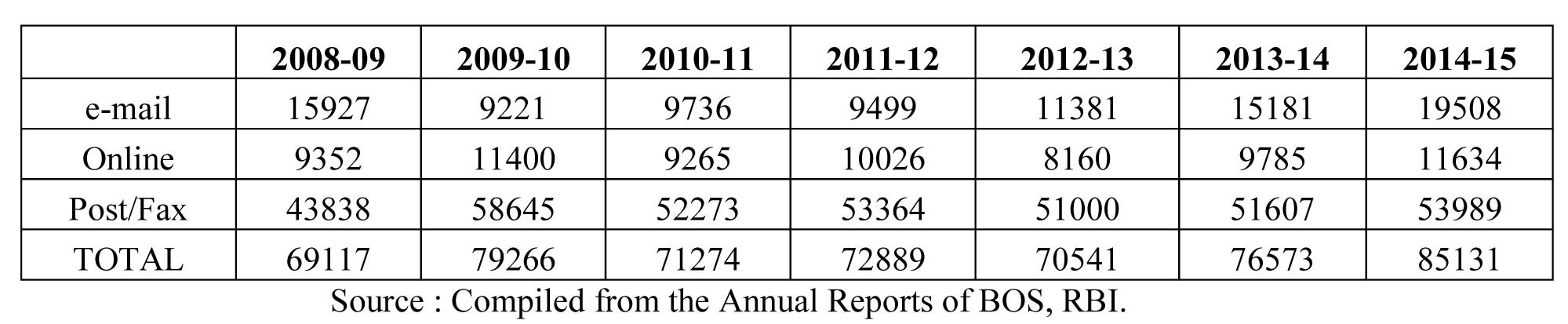

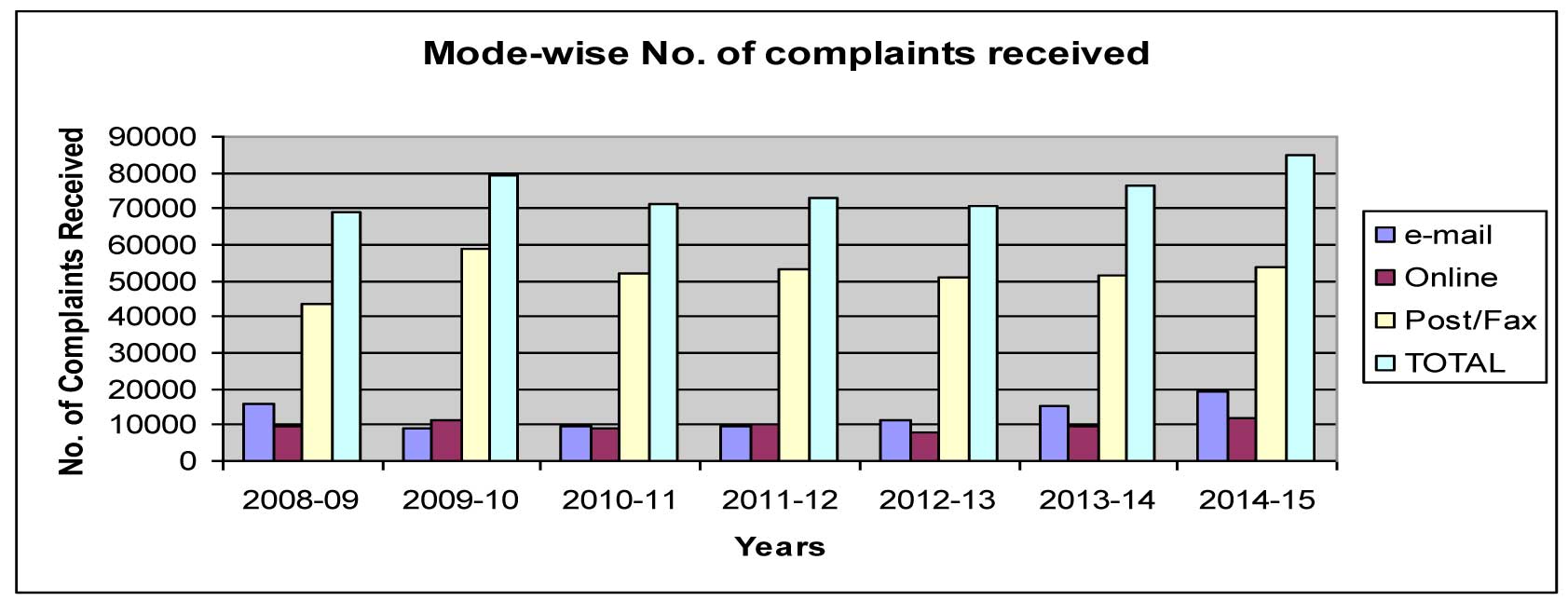

6.1.4. Mode-wise Number of Complaints received by the OBO during the last 7 Financial Years

Table 4 : Mode-wise No. of Complaints Received during the last 7 Financial Years

The above table depicts that the number of complaints received through Post-Fax is maximum, followed by e-mails and online complaints during the last 7 financial years. This is also evident from the following chart.

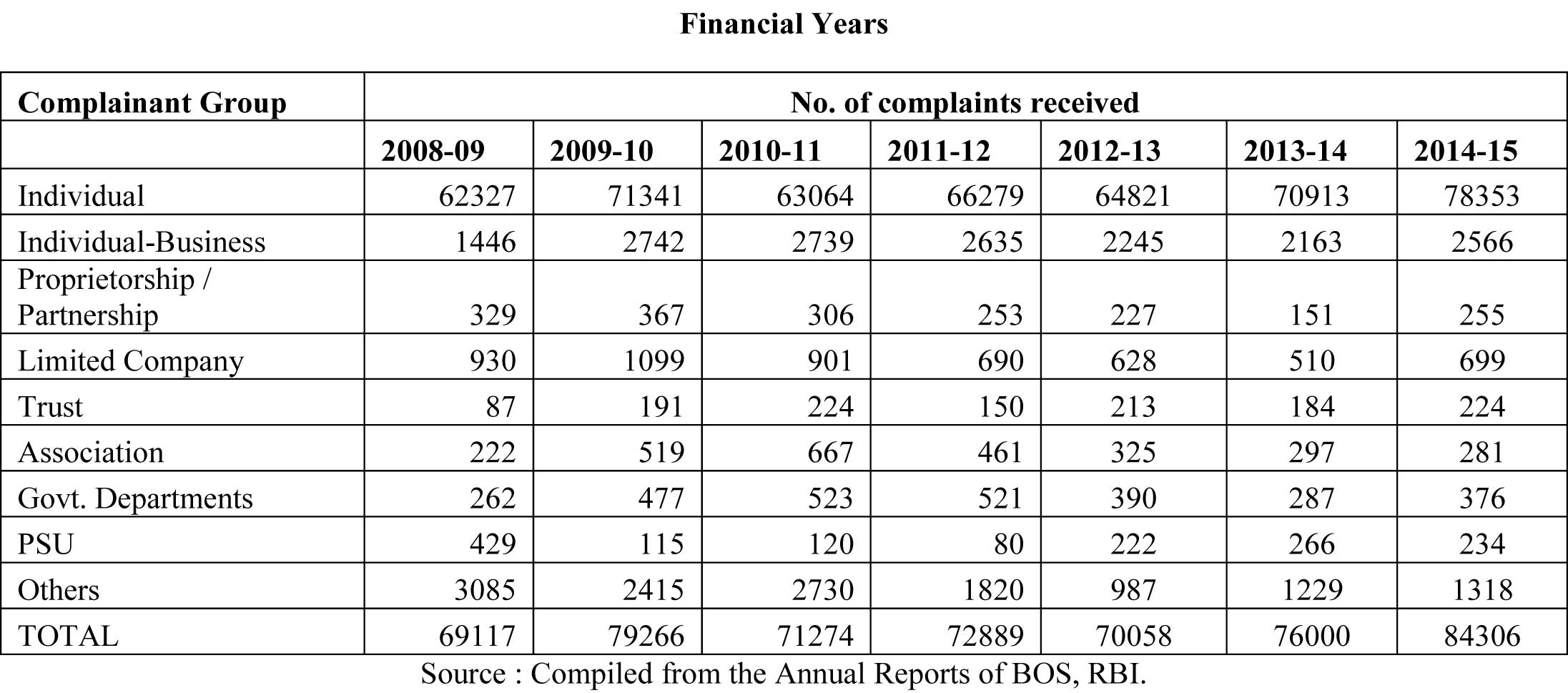

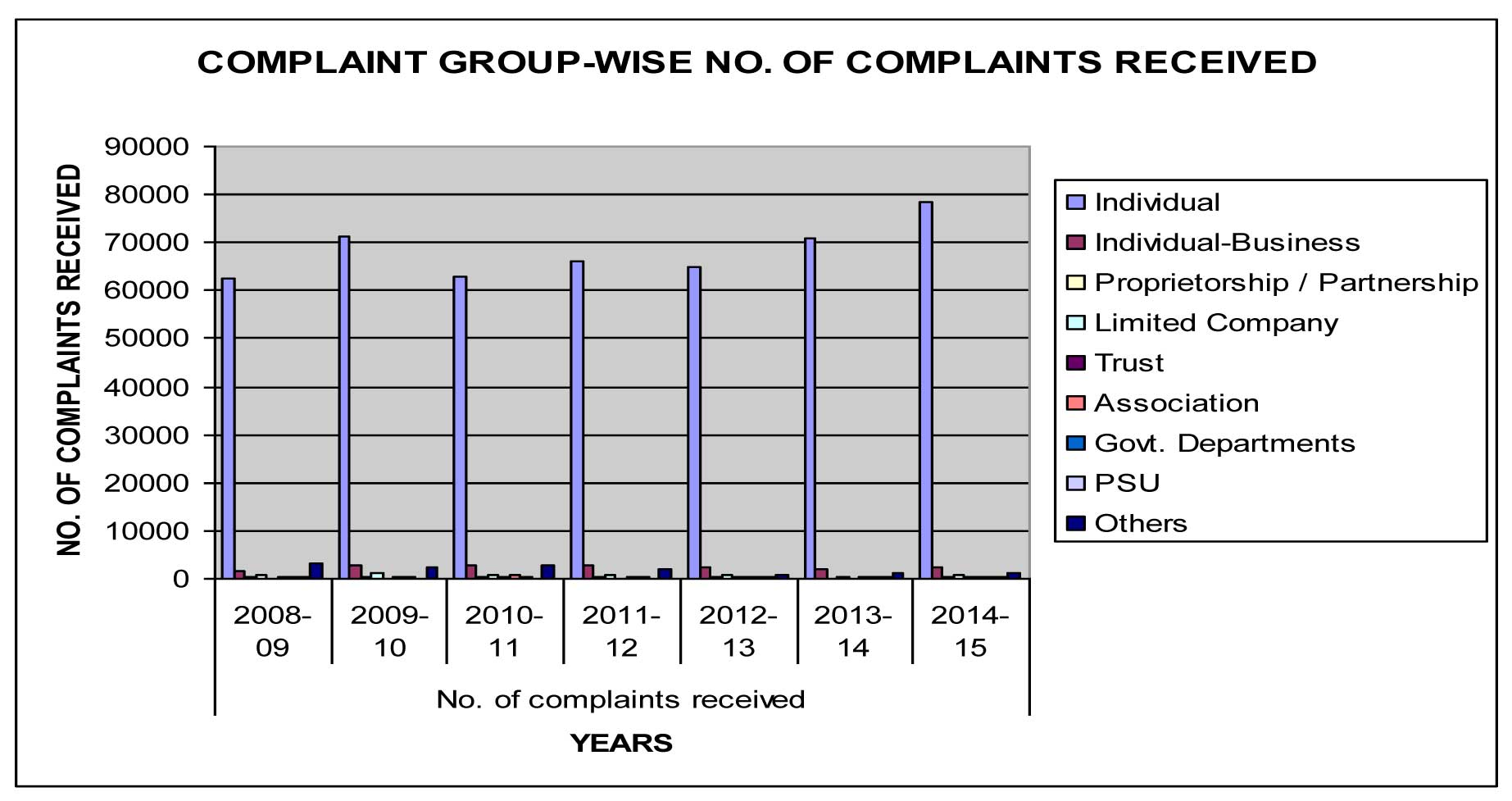

6.1.5. Complaint Group-wise Number of Complaints received by the OBO during the last 7 Financial Years

Table 5 : Complaint Group-wise No. of Complaints Received during the last 7

The above table depicts that the number of complaints received from the individual customers is maximum, followed by individual-business customers and other’ proportion of complaints is very minimal during the last 7 financial years. This clearly indicates either the ignorance or awareness on the part of individual customers or the mis-behaviour or negligence on the part of banks with the increase in the retail banking business. This is also evident from the following chart.

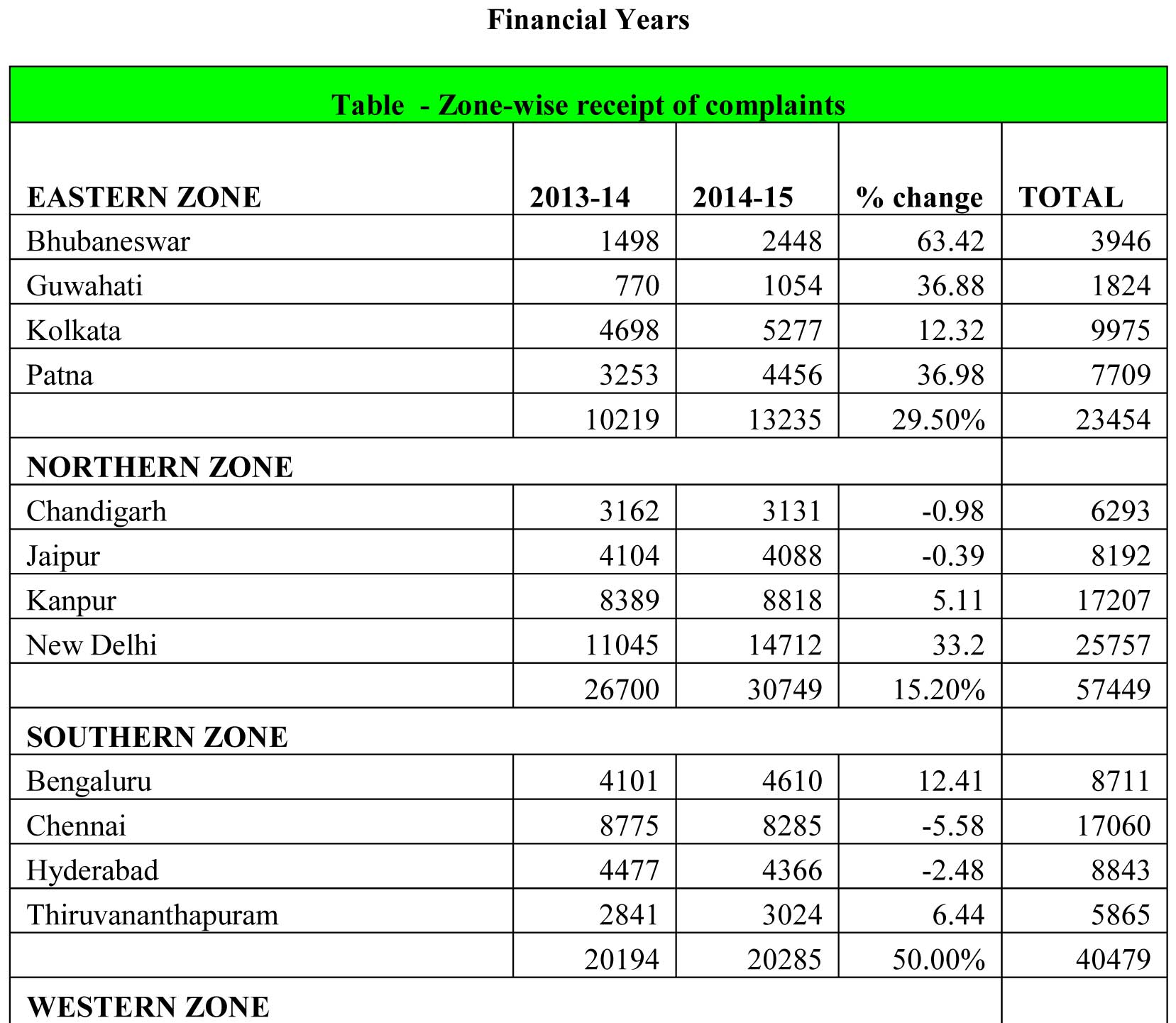

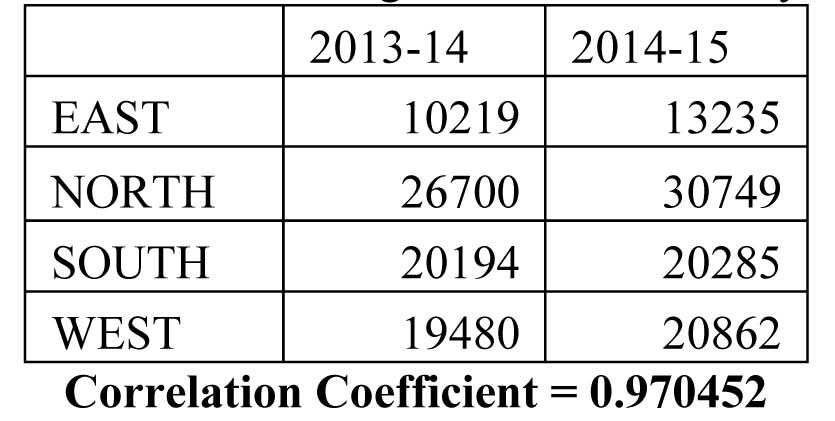

6.1.6. Geographical Zone-wise Number of Complaints received by the OBO during the last 7 Financial Years

Table 6 : Geographical Zone-wise No. of Complaints Received during the last 7

The above table depicts that the number of complaints received from the Northern Zone is maximum, followed by southern and western zone, whereas the number of complaints received from the bank customers of Eastern Zone is minimal during the last 7 financial years. Further, there is a very high correlation between the complaints received during the last 2 financial years (shown below).

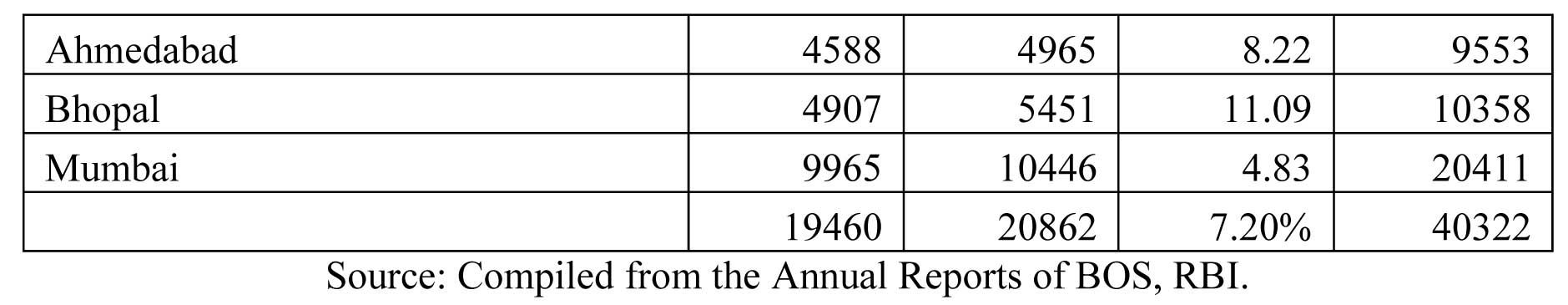

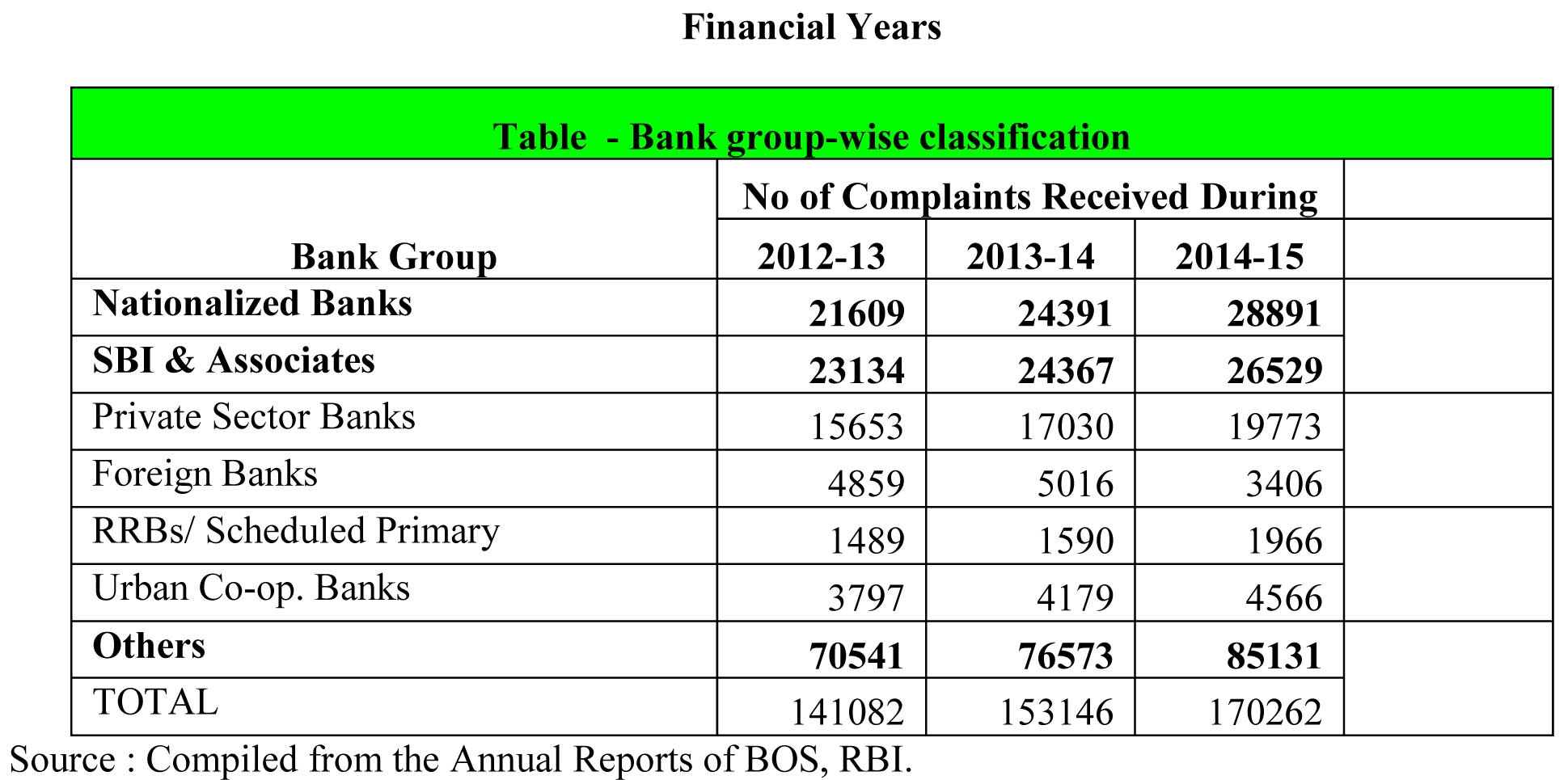

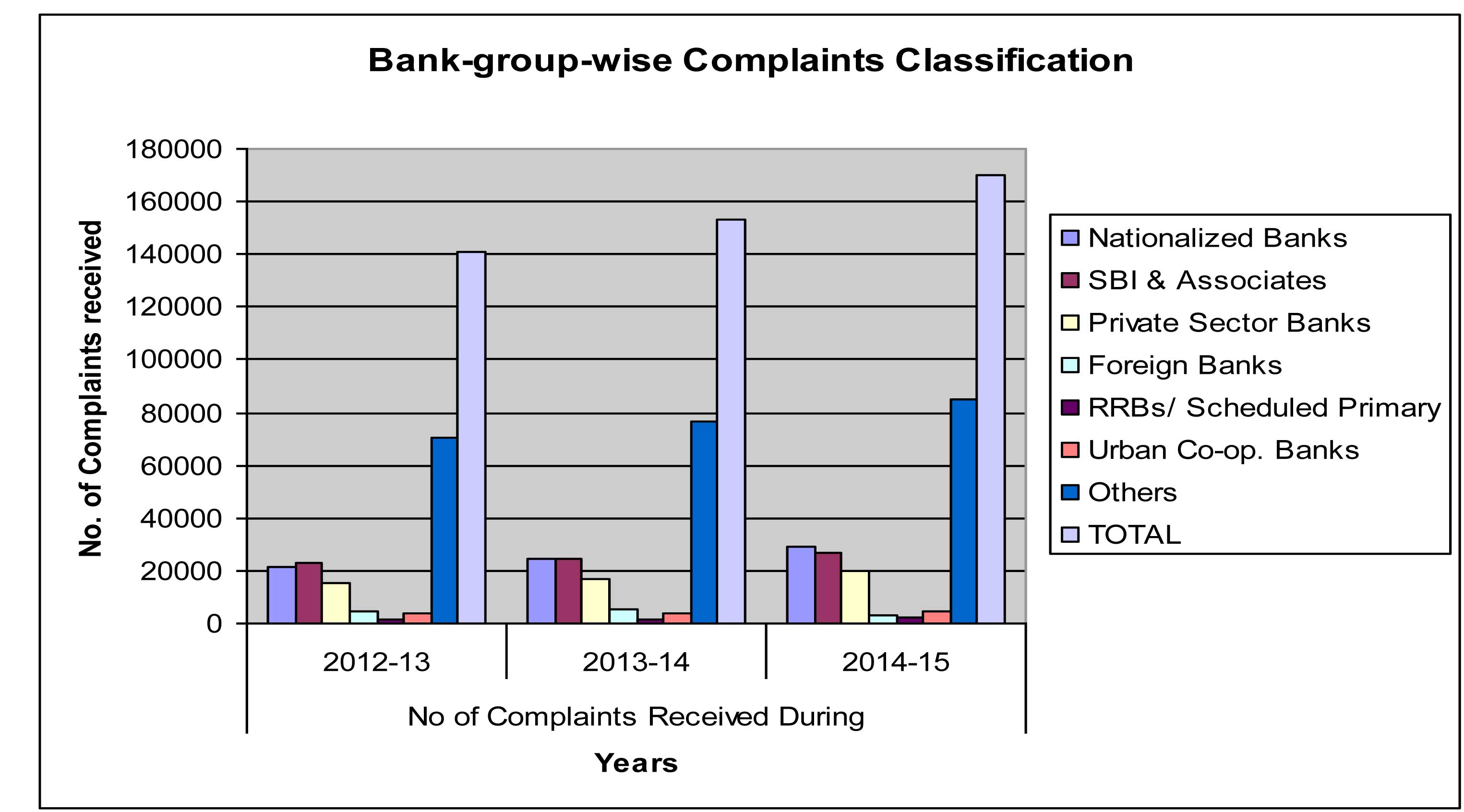

6.1.6. Bank Group-wise Number of Complaints received by the OBO during the last 7 Financial Years

Table 6 : Bank Group-wise No. of Complaints Received during the last 7

The above table depicts that the number of complaints received from the Nationalized Banks is maximum, followed by SBI & Associates and Others, whereas the number of complaints received from the Private Sector Banks, Foreign Banks and RRBs and Urban Cooperative Banks is minimal during the last 7 financial years. The main reason may be that the nationalized banks and SBI group of banks are having the highest customer-base and the same is increasing day-by-day. This is also shown through the following chart:

6.1.7. Customer Complaints Handled by the OBOs during the last 7 Financial Years

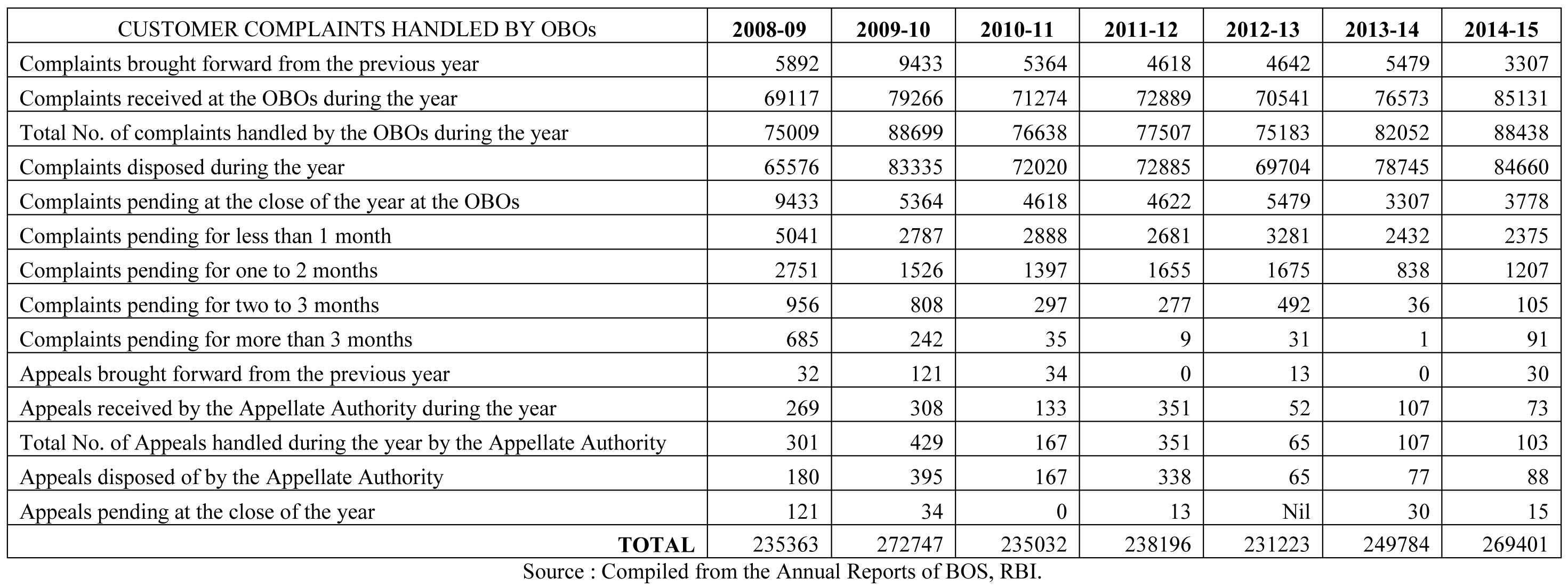

Table 7 : Customer Complaints Handled by OBOs during the last 7 Financial Years

It is quite clear from the above table that although number of complaints received at the OBOs have increased during the last 7 financial years, but the total number of complaints handled by the OBOs is obviously more than that which shows the efficiency of the Bank Ombudsman Office and also the speed with which these complaints are handled and settled.

6.2. Primary Data Analysis

6.2.1. Reliability Test

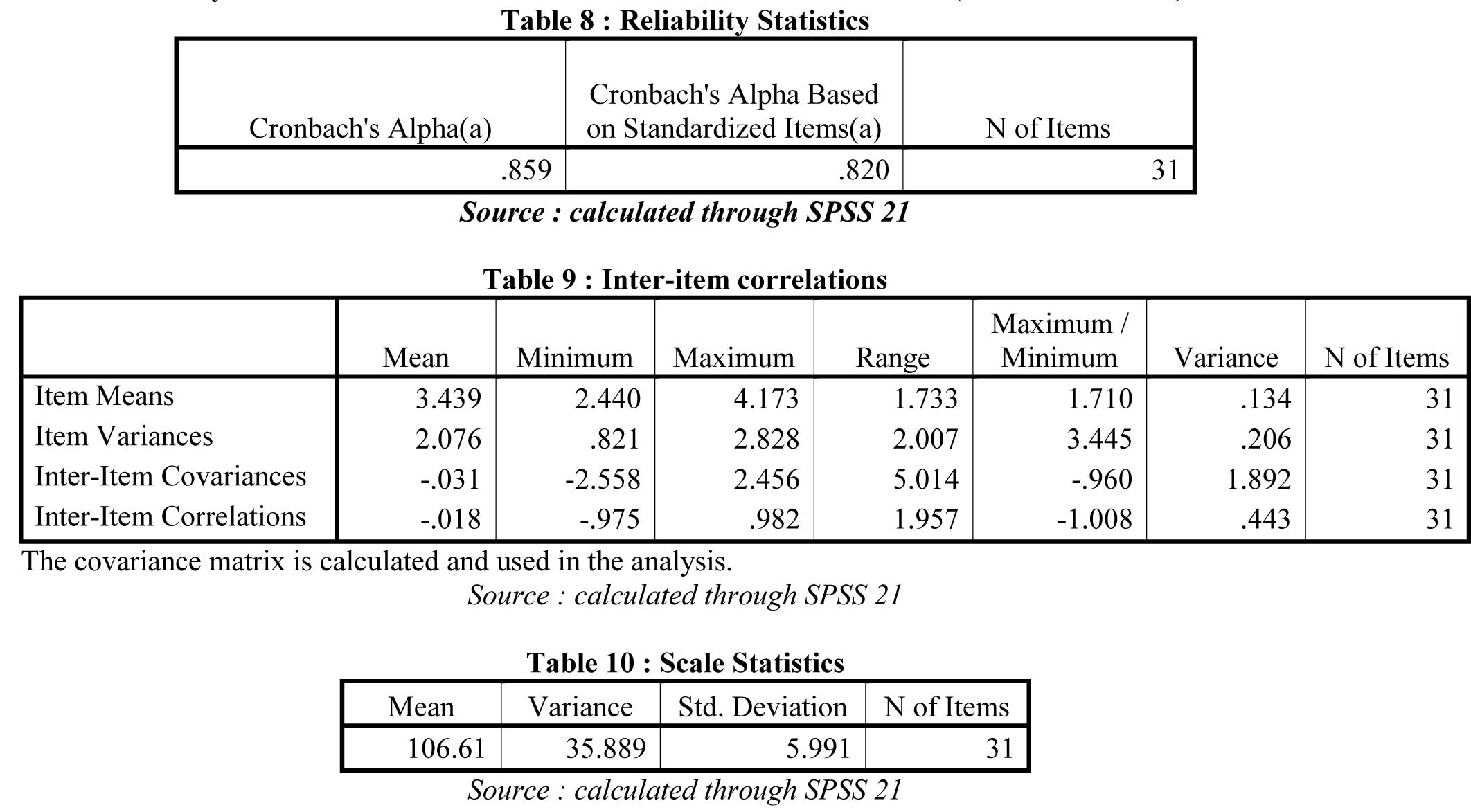

Any study, depending on primary data, must be backed up by a proper test of reliability and validity. The evaluation of questionnaire reliability- internal consistency is possible by Cronbach’s α (Cronbach, 1984), which is considered to be the most important reliability index and is based on the number of the variables/items of the questionnaire, as well as on the correlations between the variables (Nunnally, 1978). The reliability of the instrument means that its results are characterized by receptiveness’ (Psarou and Zafiropoulos, 2004) and these results are not connected with measurement errors (Zafiropoulos, 2005), was evaluated by Cronbach alpha coefficient. The index alpha (a) is the most important index of internal consistency and is attributed as the mean of correlations of all the variables, and it does not depend on their arrangement (Anastasiadou, 2006). So, we have conducted reliability test on standardised item and the Cronbach’s alpha based on standardised item found at .820 (shown in Table 8) which proved the reliability of the questionnaire and data. Similarly there was a very little variance of .018 between the inter-item correlations (shown in Table 9).

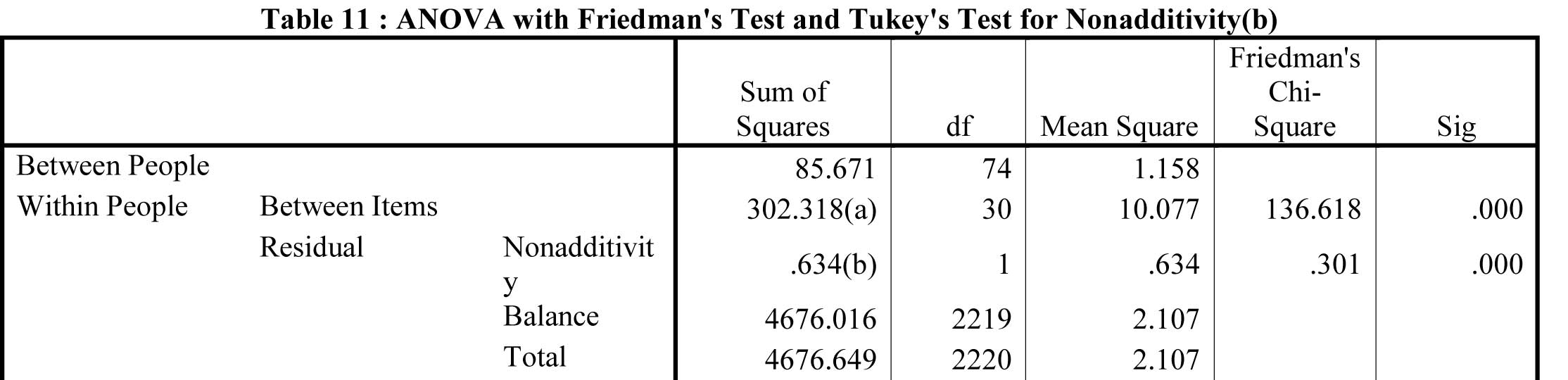

Further, for validity test, we have conducted Friedman test and Tukey test. In statistics, Tukey's test of additivity, named for John Tukey, is an approach used in two-way ANOVA (regression analysis involving two qualitative factors) to assess whether the factor variables are additively related to the expected value of the response variable. It can be applied when there are no replicated values in the data set, a situation in which it is impossible to directly estimate a fully general non-additive regression structure and still have information left to estimate the error variance. The test statistic proposed by Tukey has one degree of freedom under the null hypothesis, hence this is often called "Tukey's one-degree-of-freedom test." Tukey's test for nonadditivity was also found to be significant (shown in Table 11), signifying that there are no replicated values in the data set.

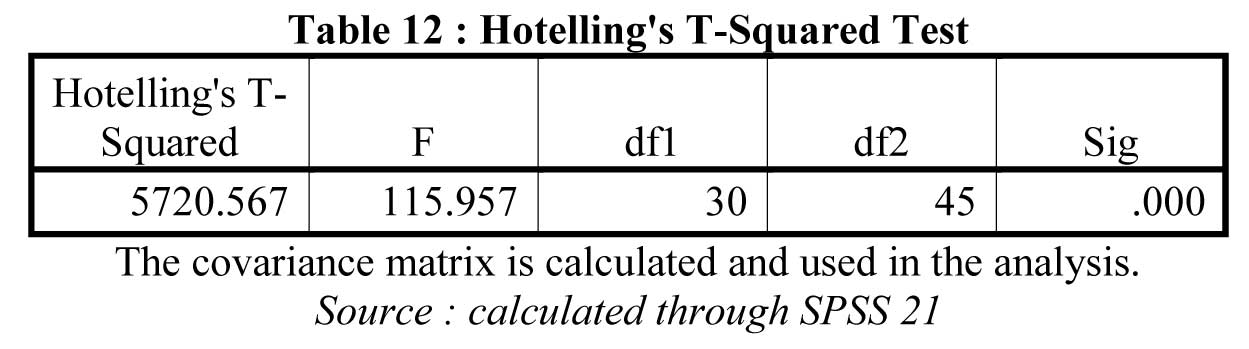

Then we have conducted Hotelling’s T-squared test for inter-class correlation coefficient which was also found to be significant. (shown in Table 12)

6.2.3. Test for Normality: One-Sample Kolmogorov-Smirnov Test

The Kolmogorov–Smirnov test can be modified to serve as a goodness of fit test. In the special case of testing for normality of the distribution, samples are standardized and compared with a standard normal distribution. This is equivalent to setting the mean and variance of the reference distribution equal to the sample estimates, and it is known that using these to define the specific reference distribution changes the null distribution of the test statistic: see below. Various studies have found that, even in this corrected form, the test is less powerful for testing normality than the Shapiro–Wilk test or Anderson–Darling test. The result of one-sample K-S Test was found to be .000, i.e., significant, implying that although convenience sampling was adopted as a method of sampling, but the dataset followed normal distribution.

6.2.4. Results of Factor Analysis

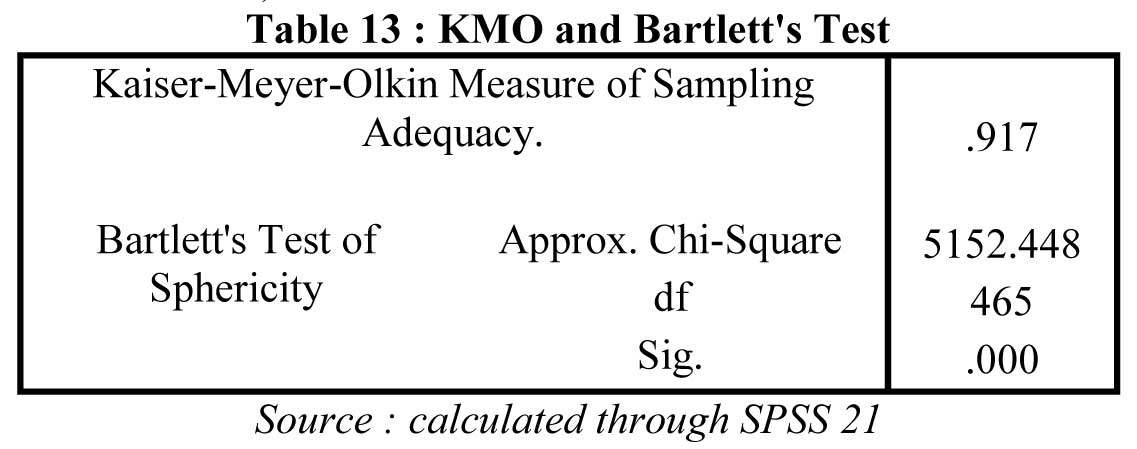

Then the supposition test of sphericity was conducted by the Bartlett test (Ηο: All correlation coefficients are not quite far from zero) is rejected on a level of statistical significance p<0.0005 for Approx. Chi-Square=5152.448. (shown in Table 13)

We have also conducted the Kaiser-Meyer-Olkin (KMO) measure of sampling adequacy and Bartlett’s test of sphericity. To define if the subscales were

suitable for factor analysis, two statistical tests were used. The first is the Bartlet Test of Sphericity, in which it is examined if the subscales

of the scale are inter-independent, and the latter is the criterion KMO (Kaiser-Meyer Olkin Measure of Sampling Adequacy, KMO) (Kaiser, 1974), which

examines sample sufficiency. The KMO measure of sampling adequacy results in .809 i.e. greater than .05 which was supported by the Bartlett’s test of

sphericity with 5671 degrees of freedom. The adequacy indicator of the sample ΚΜΟ=0.917>0.70 (shown in Table 13) indicated that the sample data are

suitable for the undergoing of factor analysis. The control of sphericity (Βartlett’s sign<0.001) proved that the principal component analysis has a

sense. Through this analysis, data grouping was based on the inter-correlation with the aim of imprinting those factors which describe completely and

with clarity the participants’ attitudes towards the research subject. Consequently, the coefficients are not all zero, so that the second acceptance

of factor analysis is satisfied. As a result, both acceptances for the conduct of factor analysis are satisfied and we can proceed to it.

Then a Principal components analysis with Varimax Rotation produces the dimension of differentiation was used in order to confirm or not the scale

constructs validity. The main method of extracting factors is the analysis on main components with right-angled rotation of varimax type

(Right-angled Rotation of Maximum Fluctuation), so that the variance between variable loads be maximized, on a specific factor, having as a final

result little loads become less and big loads become bigger, and finally, those with in between values are minimized (Hair et al., 2005).

The following factors were found from the factor analysis.

For factor analysis we have used Principal Component Analysis with 4 components consisting of 31 variables and also Varimax Rotation Method and

finally they were extracted into 4 factors which explain near about 90% of the total variance. (Shown in Table 14 and 15)

From table 14, it is seen that 90% of the variance is explained by the factors. Further from table 15, we see that 31 variables relating to the

consumers as an important component of Governance are conjoined into 4 factors:

- The first factor include the variables like Banking Ombudsman Scheme (BOS) settled the complaints relating to disputes arising from non-payment or inordinate delay in the payment or collection of cheques, drafts, bills etc.; Banking Ombudsman Scheme (BOS) settled the complaints relating to disputes arising from non-acceptance, without sufficient cause, of small denomination notes tendered for any purpose, and for charging of commission in respect thereof; Banking Ombudsman Scheme (BOS) settled the complaints relating to disputes arising from delays, non-credit of proceeds to parties accounts, non-payment of deposit or non-observance of the Reserve Bank directives, if any, applicable to rate of interest; Banking Ombudsman Scheme (BOS) settled the complaints relating to disputes arising from refusal to open deposit accounts without any valid reason for refusal; Banking Ombudsman Scheme (BOS) settled the complaints relating to disputes arising from non-payment or delay in payment of inward remittances; etc. So, this may be termed as ‘Banking Facilities and NRI Remittance related issues’.

- The second factor may be termed as ‘Payments and Settlement Related Disputes’.

- The third factor may be termed as ‘Non-adherence to Working Hours and Non-Disbursement of Pensions’.

- The fourth factor may be termed as ‘Dispute Settlements relating to failure to issue Cheques and Drafts’.

7.0. Findings from the Study

- Metro cities like Delhi, Mumbai, Chennai and Kanpur are having highest number of customers’ complaints towards banks, whereas in case of Kolkata, it is at a moderate level, although not very low.

- The total numbers of consumers’ complaints have increased from 69117 to 85131 during the last 7 financial years, which clearly indicates that with the increase in the retail banking business over the past few years, customers’ grievances have also increased.

- The number of complaints received from the urban consumers is maximum during the last 7 financial years, followed by the consumers from the Metro Cities.

- The number of complaints received through Post-Fax is maximum, followed by e-mails and online complaints during the last 7 financial years.

- The number of complaints received from the individual customers is maximum, followed by individual-business customers and other’ proportion of complaints is very minimal during the last 7 financial years. This clearly indicates either the ignorance or awareness on the part of individual customers or the mis-behaviour or negligence on the part of banks with the increase in the retail banking business.

- The number of complaints received from the Northern Zone is maximum, followed by southern and western zone, whereas the number of complaints received from the bank customers of Eastern Zone is minimal during the last 7 financial years. Further, there is a very high correlation between the complaints received during the last 2 financial years.

- The number of complaints received from the Nationalised Banks is maximum, followed by SBI & Associates and Others, whereas the number of complaints received from the Private Sector Banks, Foreign Banks and RRBs and Urban Cooperative Banks is minimal during the last 7 financial years. The main reason may be that the nationalised banks and SBI group of banks are having the highest customer-base and the same is increasing day-by-day.

- It is quite clear from the above table that although number of complaints received at the OBOs have increased during the last 7 financial years, but the total number of complaints handled by the OBOs is obviously more than that which shows the efficiency of the Bank Ombudsman Office and also the speed with which these complaints are handled and settled.

- Reliability Test : Cronbach’s alpha based on standardised item found at .820 which proved the reliability of the questionnaire and data. Similarly there was a very little variance of .018 between the inter-item correlations.

- Validity Test : Tukey's test for nonadditivity was also found to be significant, signifying that there are no replicated.

- Then we have conducted Hotelling’s T-squared test for inter-class correlation coefficient which was also found to be significant.

- Test for Normality: One-Sample Kolmogorov-Smirnov Test : The Kolmogorov–Smirnov test was found to be .000, i.e., significant, implying that although convenience sampling was adopted as a method of sampling, but the dataset followed normal distribution.

- Results of Factor Analysis : Then the supposition test of sphericity was conducted by the Bartlett test (Ηο: All correlation coefficients are not quite far from zero) is rejected on a level of statistical significance p<0.0005 for Approx. Chi-Square=5152.448. We have also conducted the Kaiser-Meyer-Olkin (KMO) measure of sampling adequacy and Bartlett’s test of sphericity. The adequacy indicator of the sample ΚΜΟ=0.917>0.70 indicated that the sample data are suitable for the undergoing of factor analysis. The control of sphericity (Βartlett’s sign<0.001) proved that the principal component analysis has a sense. Through this analysis, data grouping was based on the inter-correlation with the aim of imprinting those factors which describe completely and with clarity the participants’ attitudes towards the research subject. Consequently, the coefficients are not all zero, so that the second acceptance of factor analysis is satisfied. As a result, both acceptances for the conduct of factor analysis are satisfied and we can proceed to it.

- For factor analysis we have used Principal Component Analysis with 4 components consisting of 31 variables and also Varimax Rotation Method and finally they were extracted into 4 factors which explain near about 90% of the total variance. it is seen that 90% of the variance is explained by the factors. Further from table 15, we see that 31 variables relating to the consumers as an important component of Governance are conjoined into 4 factors:

- The first factor may be termed as ‘Banking Facilities and NRI Remittance related issues’; The second factor may be termed as ‘Payments and Settlement Related Disputes’; The third factor may be termed as ‘Non-adherence to Working Hours and Non-Disbursement of Pensions’; The fourth factor may be termed as ‘Dispute Settlements relating to failure to issue Cheques and Drafts’

8.0. Conclusion

Retail banking in India is not a new phenomenon. It has always been prevalent in India in various forms. For the last few years it has become synonymous with mainstream banking

for many banks. The typical products offered in the Indian retail banking segment are housing loans, consumption loans for purchase of durables, auto loans, credit cards and

educational loans. The loans are marketed under attractive brand names to differentiate the products offered by different banks. As the Report on Trend and Progress of India,

2003-04 has shown that the loan values of these retail lending typically range between Rs.20, 000 to Rs.100 lack. The loans are generally for duration of five to seven years

with housing loans granted for a longer duration of 15 years. Credit card is another rapidly growing sub-segment of this product group. In recent past retail lending has turned

out to be a key profit driver for banks with retail portfolio constituting 21.5 per cent of total outstanding advances as on March 2004. The overall impairment of the retail

loan portfolio worked out much less then the Gross NPA ratio for the entire loan portfolio. Within the retail segment, the housing loans had the least gross asset impairment.

In fact, retailing make ample business sense in the banking sector. While new generation private sector banks have been able to create a niche in this regard, the public sector

banks have not lagged behind. Leveraging their vast branch network and outreach, public sector banks have aggressively forayed to garner a larger slice of the retail pie. By

international standards, however, there is still much scope for retail banking in India. After all, retail loans constitute less than seven per cent of GDP in India vis-à-vis

about 35 per cent for other Asian economies — South Korea (55 per cent), Taiwan (52 per cent), Malaysia (33 per cent) and Thailand (18 per cent).

But the real Challenges of Retail Banking in India are the Retention of customers. According to a research by Reichheld and Sasser in the Harvard Business Review, 5 per cent

increase in customer retention can increase profitability by 35 per cent in banking business, 50 per cent in insurance and brokerage, and 125 per cent in the consumer credit

card market. Thus, banks need to emphasize retaining customers and increasing market share.

In this respect, The Ombudsman scheme is a godsend and a very important channel for redressal of grievances by the general public against banks and banking services. It is

framed in such comportment that it does not oust the jurisdiction of other courts, and hence, distressed people do not hesitate in using the banking ombudsman as a primary

forum for decree of disputes regarding banks. The trademark of the banking ombudsman probably is that it is in position to do justice in an individual case, in the sense it

is not bound by the precedents and in certain circumstances, can ignore technicalities and legal rules of evidence while resolving disputes between aggrieved customer and the

bank. Apart from above BO‟s offices have also started outreach activities for creating awareness among customers like interface with banks, organizing awareness camps,

participation in exhibitions, responding to readers‟ queries in newspapers, broadcasting advertisements through AIR and Doordarshan and many others.

A lot can be achieved by thought better corporate governance in banking sector and education of the customer. It is the money of customer which banking sector should be acting

as a trustee. If customer is aware of his/her rights then it can be better protected by being vigilant for its interests of safeguarding its money and better services. Strict

actions taken on banks who default cab help in protecting consumer interest in better way. Education that can improve awareness of banking sector customer which should be like

a movement will help safeguarding the interest of the biggest stakeholder i.e. customer of the bank.

9.0. Recommendations

The response of individual ombudsman schemes may include:

- increasing consumer awareness and accessibility, with schemes promoting themselves more, conducting research into low awareness and working with service providers to ensure consumers reach ombudsman schemes;

- improved customer service, with schemes using more flexible, informal and speedy procedures (where appropriate), enabled through judicious use of technology while also developing interpersonal customer service;

- greater sharing of learning, with ombudsman schemes becoming more proactive in using casework intelligence to help service providers to improve and taking – along with regulators – a more strategic approach to dealing with disputes; and

- Continued operational efficiency, with ombudsman schemes needing to maintain complaint handling efficiency, maintain reputation and trust and avoid backlogs.

The response of the ombudsman community may include:

- Increasing strategic influence, creating a stronger Ombudsman Association that is able to influence policy, help drive change and play a part in filling the vacuum that exists in government around ombudsman policy; and

- Increasing sharing, integration and merging, with ombudsman schemes sharing duplicated functions where appropriate, and working towards reducing consumer confusion either by pushing for mergers or developing a single doorway for ombudsman schemes.

Deregulation and information technology initiatives in banking sector have given competitive advantage to banks in India. Present thinking is that competition would take care of consumer welfare more than any other legislative measure. This apart, the ombudsman should demonstrate its impartiality for consumer protection to win the confidence of small consumers. Retired executives of banks and financial Institutions with some legal and practical background would be most eligible for the post of ombudsman. There is a need to give some sort of legal backing to the ombudsman scheme in India. If the scheme is codified and the ombudsman given the powers of an ordinary court of law, viz., the power to summon witnesses, to call for disclosure of any document or information, to conduct an inquiry etc. Will greatly facilitate is working. Most importantly, the Ombudsman must be given powers of contempt because without this, all concerned ca flout the directives of the ombudsman. To instill consumer confidence in the scheme, the RBI has to ensure that the awards of the ombudsman are implemented by the banks.

References :

- S.Gousia, (2013), “ Banking Ombudsman: Protection to Consumer”, SIT Journal of Management, Vol. 3. No. 2, pp.110-120.

- Malyadri, Pacha1, Sirisha, S., Success of banking ombudsmen scheme: Myth or reality Institute of Technology and Management, Warangal, Andhra Pradesh, India (sirisha@itm.edu), Received: 1 September 2011 Revised: 3 September 2011 Accepted: 5 September 2011, Available Online: 6 September 2011 DOI: 10.5861/ijrsm.2012.v1i1.21, ISSN: 2243-7770

- The European Ombudsman and the Application of EU Law by the Member States, European Ombudsman, Professor of comparative politics at the Department of Political Science and Public Administration of the University of Athens, Review of European administrative law, Vol. 1, No. 2, pp. 5-37.

- P. Suganya, R. Eswaran(2015), “ Banking and bank-ombudsman; requirement, changes complaint analysis and the way forward”, International Journal of Multidisciplinary Research and Development, Vol.2, No.1, pp.528-533.

- Cronbach, L (1984), “Essentials of psychological testing”, New York: Harper & Row.

- Nunnally, J (1978), “Psychometric methods”, New York: McGraw-Hill.

- Psarou, M. K., & Zafiropoulos, C (2004),“Scientific Research: Theory and Applications in Social Sciences”, Athens, Tipothito, Dardanos.

- Zafiropoulos, K ( 2005), “How a scientific essay is done? Scientific research and essay writing”. Athenhs, Greece, Ed, Kritiki.

- Anastasiadou, S (2006), “Factorial validity evaluation of a measurement through principal components analysis and implicative statistical analysis”, In 5th Hellenic Conference of Pedagogy Company, Thessaloniki, pp. 341-348.

- Kaiser, H. F (1974), “An index of factorial simplicity. Psychometrika”,Vol.39, No.1, pp. 31-36.

- Hair, F. J., Black C. W., Badin, N. J., Anderson, E. R., Tatham, R. L(2005), “Multivariate Data Analysis”, New Joursey, Pearson Education Inc.

- Bhaskar, P. V (2004), “Customer service in banks”, IBA Bulletin, Vol.36, No.8, pp. 9- 13.

- Ganesh, C., & Varghese, M. E (2003), “Customer service in banks: An empirical study”, Vinimaya, Vol.36(2), pp.14-26.

- Goyal, S., & Thakur, K. S. (2008), “A study of customer satisfaction public and private sector banks of India”, Journal of Business Studies, Vol.3, No.2, pp.121-127.

- Hasanbanu, S(2004), “Customer service in rural banks: An analytical study of attitude of different types of customers towards banking services”, IBA Bulletin, Vol. 36, No.8 , pp.21-25.

- Jain, A. K., & Jain, P (2006), “Customer satisfaction in retail banking services”, Journal of Business Studies, Vol.1, No.2, pp.95-102.

- Kamakodi, N (2007), “Customer preferences on e-banking services: Understanding through a sample survey of customers of present day banks in India contributors”, Banknet Publications,Vol. 4, pp.30-43.

- Mahesh BP( 2011),“Ombudsman in banking among the members of urban co-operative banks in thane city”, Maharashtra state International Referred Research Journal, Vol.ii, No.20.

- Malyadri P, Sirisha S (2012), “Success of banking ombudsmen scheme: Myth or reality”, International journal of research studies in management, Vol.1, No.1, pp.17-24.

- Mishra, J. K., & Jain, M. (2007), “Constituent dimensions of customer satisfaction: A study of nationalized and private banks” , Prajnan, Vol. 35, No.4 , pp.390-398.

- Patil MB(2015), “A study of awareness of ombudsman in banking among the members of urban co-operative banks in thane city Maharashtra state”, International referred research journal, Vol. X; pp.4-5.

- Shankar, A. G (2004), “Customer service in banks”, IBA Bulletin,Vol. 36, No.8, pp.5-7.

- Singh, S (2004), “An appraisal of customer service of public sector banks”, IBA Bulletin,Vol. 36, No.8, pp.30-33.

- Singh, S. B (2006), “Customer management in banks”, Vinimaya, Vol.37, No.3, pp.31- 35.

- Dr. Tejinderpal S(2011), “Redressal of customers’ grievances in banks: A study of bank ombudsman’s performance in India”, Vol. 2, No.6, pp.84-90.

- Uppal, R. K. (2010), “Customer complaints in banks: Nature, extent and strategies to mitigation”, Journal of Economics and International Finance,Vol. 10, pp.212-220.

- Annual Report on Banking Ombudsman Scheme, source Reserve Bank of India, 2012-13.