Subscribe now to get notified about IU Jharkhand journal updates!

Risk Management : A brief study on the strategies adopted in selected industries with specific focus on Indian IT services' organisations

Abstract :

Risks are inherent to every industry, although the nature of risks might differ between each industry segment. Risks can impact a

particular industry in the form of losses on financial, health, manpower, infrastructural, environment, quality, reputation, etc. More

and more business houses are expanding their foot-print globally which also means increased risk factors to deal with. Therefore, Risk

Management (RM) has become a key focus area within the organisations. Independent RM function is established in most of the

organisations to identify, monitor and control various risks to their business.

RM strategies adopted by an organisation are customized to handle & mitigate potential risks faced by them. Organisations are

gradually moving towards Enterprise Risk Management (ERM) which would holistically address the risks at a broader level rather

than dealing risks at individual element level. This article analyses the risk elements and risk management processes for a selected set

of industries along with a specific focus on Indian IT services organizations.

Keywords :

Risk Management, industry, potential risks, Enterprise Risk ManagementIntroduction :

Risk by definition is potential of gaining or losing

something of value. Something of value can be Financial,

Health, Property, Personal, Quality, etc. Risk is also an

uncertain condition or event that has an impact on at least

one objective of any project that is undertaken. Risks are

common across all industries and to name a few, IT,

Banking & Financial Services, Infrastructure, Logistics,

and Healthcare.

Managing risks aka Risk Management (RM) is therefore

an important objective or focus area within any

organization. Risk Management is the identification,

evaluation, and prioritization of risks. Making informed

decisions by consciously assessing what can go wrong, as

well as the likelihood and severity of the impact is at the

heart of RM. Independent RM function is established

within most of the organizations.

During the course of this article, the key elements of Risk

Management (RM) across a few industries are elaborated

and the strategies adopted for an effective RM is

explained. This article will then focus on RM strategies

adopted specifically in Indian Information Technology

(IT) services organizations and looks to draw comparisons

with the broad RM strategies implemented across

industries.

Defining Risk and Risk Management

Risk can be broadly classified under 3 categories namely,

Preventable Risks, Strategy Risks and External Risks.

Preventable risks are internal risks, arising from within the

organization that are controllable and ought to be

eliminated or avoided. Strategy risks are the ones that

companies voluntarily accepts in order to generate

superior returns from its strategy. External risks are

certain risks that arise from events outside the company

and are beyond its influence or control.

This process of risk management as depicted in the below

diagram defines six logical steps through which the team

manages current risks, plans and executes risk

management strategies. It is to be noted that below are

logical steps and they do not need to be followed in strict

chronological order for any given risk.

Risk Management adopted in selected industries

Risk Management strategies adopted in certain selected industries is detailed below.

Risk Management in Financial Services sector

Risk Management in a financial firm, be it Bank or

Financial Institution, is primarily concerned with financial

risks like bankruptcies, internal irregularities, frauds, etc.

This is in sharp contrast to RM for an industrial firm, which

generally focuses on physical risk. Since financial risk

occurs in the context of the interactions between

individuals with conflicting agendas, corporate risk

managers spend a good deal of time thinking about

organization behavior. The challenge of a modern

corporation is to ensure wealth maximization of their

stakeholders that is consistent with their risk preference.

On the other hand, risks have to be managed effectively

with a balance of providing adequate financial returns.

Key risk elements of the industry are as given below :

a) Market risk – defined as the potential of changes in

the market prices of an institution's holding which

may have an adverse impact on its financial

condition.

b) Credit risk – defined as a potential economic loss

from the failure of an obligor to perform according to

the terms and conditions of a contract or agreement

c) Operational risk – many other risks that are generally

grouped under this category like Legal risk,

Reputational risk, Accounting risk, Enterprise risk,

etc.

Management of Risks in financial firms consists of following measures :

a) Risk measurement or analysis : Measuring overall

risk of firm's position can be done in two principle

ways; a statistically based approach called Value at

Risk (VaR) or an approach based on economic insight

called stress testing or scenario analysis

b) Risk Control : Two fundamental and complementary

approaches are (i) place detailed limits on amount

and type of risk (ii) provide incentives to lower

management to optimize the trade-off between

return and risk

Risk Management in Insurance sector

Companies in the process of providing insurance and

other financial services, assume various kinds of actuarial

and financial risks. At the same time, they are major

providers of funds to the capital market. They use their

own balance sheet to facilitate the transactions and to

absorb risks associated with them. Therefore, risk

management and necessary procedures for risk control is a

crucial task for insurers.

Key risk elements of the industry are as given below :

a) Actuarial / Insurance risk – arising from assumptions

that actuaries implement into a model to price a

specific insurance policy may turnout wrong or

somewhat inaccurate

b) Systemic risk –disruption to the flow of financial

services that is (i) caused by an impairment of all or

parts of the financial system; and (ii) has the potential

to have serious negative consequences for the real

economy [Financial Stability Board]

c) Credit Risk – defined as the risk of loss due to the

inability or limited willingness of a borrower

(obligor), issuer or counterparty to meet its financial

obligations. For insurers, the source of credit risk may

include (i) Investment portfolio risk (ii) Counterparty

risk (iii) Reinsurance counterparty risk (iv)

Country/Transfer risk

Management of Risks in the sector consists of following

measures :

Journey of corporate risk management in insurance

industry has witnessed significant improvements in last

few decades, moving away from element-wise risk

management towards Enterprise Risk Management

(ERM). ERM is a step towards more defined and

formalized RM. ERM typically comprises of 8 interrelated

components as defined below:

a) Internal environment

b) Objective setting

c) Event identification

d) Risk assessment

e) Risk response

f ) Control activities

g) Information & Communication

h) Monitoring

a) Supply risk – like supplier opportunism, inbound

product quality, transit time variability, supplier

insolvency, etc.

b) Demand risk –like demand variability, forecast

errors, competitor moves, etc.

c) Operational risk – Inventory ownership, asset and

tools ownership, Product quality and safety issues,

Currency issues, etc.

Management of Risks in the sector consists of following

measures :

Risk management is a continual process that involves

long-term dedication of supply chain members. Below are

the typical strategies adopted for handling and mitigation

of several risks :

a) Risk Identification – Using multiple sources and

classifying risks into supply, operations, demand and

security risks

b) Risk assessment and evaluation – Decision analysis,

case studies and perception based

c) Selection of appropriate risk strategy – avoidance,

postponement, speculation, hedging, etc.

d) Implementation of supply chain risk management strategy – complexity management, organizational

learning, information technology and performance

metrics

e) Mitigation of supply chain risks – Preparing for

unforeseen risk events

Risk Management in Indian IT Services' sector

Software projects generate variable performance

outcomes and are high risk activities. Industry surveys

suggest that only about 35-40% [12] [13] of software

projects succeed within the agreed Cost, Time, Quality

and Scope. Billions of dollars are lost annually through

project failures or projects that do not deliver promised

benefits. The need to manage risks increases with the

system complexity, both technical and non-technical.

Risk elements as argued by Boehm and Ross (1989) [10] fall

into two categories as defined below:

a) Generic risks – which are common to all projects like

Manpower attrition, Scope creep, Network issues,

Location outages, etc.

b) Project-specific risks – which are specific to a

particular project like Technology complexity,

Requirement gaps, Schedule variance, etc.

Risk Management in IT services is more than a process or

methodology. It is a real-time threat management

capability that is developed within an organization,

through learning, practice and other mechanisms, over a

period of time. Risk Management process as defined in the

pictorial (Fig. 1) of this article is a general guideline

followed in many of the IT organizations.

Risk Management typically involves two broad steps

namely:

a) Risk Assessment

- Risk identification

- Risk analysis

- Risk prioritization

- Risk management planning

- Risk management execution

- Risk monitoring and control

Since Indian IT services organizations manage projects

that are outsourced from their customers located in

various global geographies, the expectation from the

customers are very high in delivering projects with right

quality and within agreed timelines. Also, competition

within the Indian IT industry is very high and hence they

are always at the risk of losing a customer to the

competition if the project deliveries at not up-to the mark.

Hence, IT organizations adopt a clearly defined Project

Management (PM) practice based on models defined by

reputed institutes like PMI, CMMI, etc. Risk Management

is an integral part of the PM practices. Risk Management

(RM) guidelines are well defined and documented within

the organizations. Periodic internal and external audits are

conducted to ensure the effectiveness and compliance to

the RM policies. Being proactive in risk prevention and

control is at the heart of good risk management.

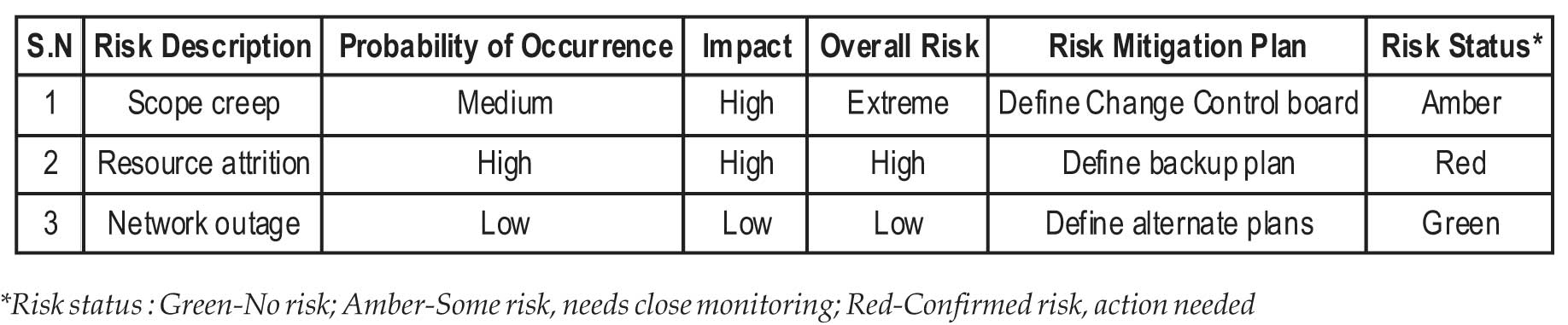

Potential Risks are identified at various stages of the

Project lifecycle like a) Proposal stage b) Contractual stage

c) Project initiation stage and d) Project execution stage.

Risk monitoring and control is a continuous activity

throughout the project lifecycle. Below is a sample risk

register followed within the project which helps in

monitoring and controlling the project risks at several

stages.

Conclusion

It is clear from this article that every industry faces several

risks as part of their operations, be it internal or external

risks. However, risk elements could vary by the type and

nature of the industry. Higher the complexity of the

industry operations, higher will be the risks. Therefore,

Risk Management is an important function with the

organisations. Element-wise RM is giving way to more

formalized ERM.

Indian IT service organisations face typical risks by way of

servicing their predominantly international clientele.

Industry surveys depict just 35-40% of successful software

projects. Therefore, RM gets a focused attention within the

IT organisations. Based on the analyses done in this article,

it can be concluded that the Risk Management Process (like

risk identification, analysis, control, etc.) followed within

the IT organisations broadly matches that of the other non-

IT industries.

References :

- Kaplan Robert S., Mikes Anette (June 2012). Managing Risks: A New Framework Harvard Business Review.

- Steven Allen. Financial Risk Management – A practitioner's guide to managing market and credit risks. Wiley Finance.

- Financial Risk Management. Dun & Bradstreet – Tata McGraw-Hill Professional.

- P.K.Gupta. Insurance and Risk Management. Himalaya Publishing House, Second Edition.

- Systemic Risk in Insurance – An analysis of insurance and financial stability. The Geneva Association Systemic Risk Working Group, March 2010.

- Credit Risk Management. EY Article.

- Ila Manuj, John T. Mentzer (January 2008).Global supply chain risk management strategies. IJPDLM, Journal of Business Logistic, 29(1).

- Supply Chain Risk Management: A compilation of best practices. Supply Chain Risk Leadership Council (SCRLC), August 2011.

- Bennet P. Lientz, Lee Larssen, Risk Management for IT Projects. BUTTERWORTH-HEINEMANN An imprint of Elsevier (2006).

- Barry W. Boehm, Rony Ross (July 1989). Theory-W Software Project Management: Principles and Examples. IEEE Transact ions on Sof tware Engineering.

- Ronald P. Higuera, Yacov Y. Haimes. (June 1996). Software Risk Management. Carnegie Mellon University: Software Engineering Institute.

- CHAOS Manifesto .(2013)The Standish Group.

- Driving Business Performance – Project Management Survey 2017. KPMG report.