Subscribe now to get notified about IU Jharkhand journal updates!

Contemporary Issues Faced By Customers Of Tirunelveli City In Online Retailing

Abstract :

In today's world of increasing awareness regarding sustainable development, green banking becomes a supreme issue. The

main economic agent influencing industrial activity and economic growth is the financial institutions i.e., banking sector.

This study is designed to analyze the customer's awareness of green banking initiatives in the Indian market. Some of the

relevant factors which are undertaken are Environmental Protection, E- Banking, Paperless banking, Use of renewable

resources, Sustainable banking, Corporate Social Responsibility, etc. to evaluate the level of customer's awareness on green

banking initiatives. After collection of data through a survey, this study has been analyzed using a pilot study, frequency table,

cross-tabulation, chi-square test, factor analysis, and rank analysis technique to find out the significance of individual factors

as stated above.

The finding reveals that 24.5% of the respondents agree that Green Banking promotes environmental protection. 9% of the

respondents feel that Green Banking is similar to E-Banking, 22.8% of the respondents' feet it is paperless banking. 6.8% of

them feel that it is related to the use of renewable resources. The data also reveals that the majority of the customers prefer to

adopt paperless banking in the Kolkata area. The overall findings of this study provide implications for bank managers and

bankers of different banks of Kolkata.

Keywords :

Customer's awareness, environmental protection, e-banking, paperless banking, renewable resources, sustainable banking, corporate social responsibility.Introduction

Finance is the lifeblood of business. Every business

firms directly or indirectly depend on the financial

institution for their fund. The banking sector is the

major lending agent that affects entire industrial

activity as well as the economic development of our

whole nation. Nowadays, banks have taken initiative in

envi ronmental protec t ion by inves t ing in

environmentally and socially responsible projects that

save costs and minimize risk. These initiatives help

banks to serve both commercial objectives and also their

social responsibility.

India is one of the fastest-growing countries in terms of

the emission of greenhouse gases. Among the major

cities in India, i.e., Delhi, Mumbai, and Chennai are

there in the top ten most polluted cities in the world. So

in order to highlight the role of banks in corporate social

responsibility RBI circulated a notice on 20th December

2007 for all scheduled commercial banks with the title

“CSR - sustainable development and non-financial

reporting”.

Apart from reducing risks, green banking also opens

new ways for marketing different products and

services. By this process, banks will be able to satisfy

both the commercial objective of the bank and also its

social responsibilities. Indian commercial banks are

implementing green banking technology for the

purpose of rending timely and valuable services to the

banking beneficiaries. It also rends valuable innovative

services to the banking beneficiaries. The innovative

services rending are core banking, re-engineering and

revise engineering scheme which increases the

efficiency of the bank.

The main reason for green banking is that it reduces

electricity consumption and electricity prices of the

firm. Increase in the demand for eco- friendly products.

It protects the environment from the side effects of

pollution.

Literature review

Indian Banks Association (IBA, 2014) defines green

banking as “like a normal bank, which considers all the

social and environmental/ecological factors with an

aim to protect the environment and conserve natural

resources”. Through this, the bank will act like a normal

bank controlled by the same authority, but its

operational activities are somewhat different

attributing an additional agenda of sustaining

environment. Therefore, it is associated to the notion of

sustainable banking and sustainable banking

management.

Environmental impact might affect the element of

assets and also the rate of return from banks in the longrun.

Thus, the banks should go green and play a proactive

role by taking environmental and ecological

aspects as part of their lending principles; which would

force industries to go for mandated investment for

environmental management, use of appropriate

technologies and management systems (Sekaran, 2010).

Green banking dodges as much paperwork as possible

and relies on electronic transactions for processing so

that we get green credit cards and green mortgages.

Less paperwork means less cutting of trees (Singh &

Singh, 2012). Green banking is also called ethical

banking or a sustainable banking which are controlled

by the same authorities but with an additional agenda

of taking care the earth's environment (Jha&Bhome,

2013; Karunakaran, 2014; Nath et al., 2014; Singh &

Singh, 2012).

Although banking is never considered a polluting

industry, the present scale of banking operations have

considerably increased the carbon footprint of banks

due to their massive use of energy (e.g., lightning, air

conditioning, electronic/electrical equipments, IT, etc),

high paper wastage, lack of green buildings etc.

Therefore, banks are suggested to adopt technology,

process and products in which would result in

substantial reduction of their carbon footprints as well

as develop a sustainable business (Bhardwaj and

Malhotra, 2013).

A study on socially responsible banking in India

elucidated that green banking starts with the aim of

protecting the environment; whereby before granting a

loan, the banks consider whether the project is

environment friendly and has any implication for the

future. A company will be given a loan only when all

the environmental safety standards are adhered to

(Bihari, 2011).

Khondokar Morshed Millat, Rubayat Chowdhury and

Edward Apurba Singha (2012) focused on the definition

of green bank as an ethical, sustainable as well as

socially responsible bank that depends on a unit or a

group of a team that defines not only more than a

banker, but also an environmentalist like all-rounder in

a game. He also appreciated the budget at the inception

of Green Banking of banks for the year 2012 and green

finance through Environmental Risk Rating (EnvRR).

Ahmed, Zayed and Harun (2013) explained the green

banking as a multi-stockholders' endeavor and

elucidated that the green banking is the outcome of

RIO+20 summits where the different nation raised

their voice over environmental safety. And from factor

analysis, they identified the six influencers affecting

green banking that are economy, policy, demand,

pressure, environment and legal factors that have a

combined variance about 65.25% of green banking

decisions.

Research gap

Previous research has established some concepts regarding green banking issues but not enough is known regarding the customer's awareness of green banking initiatives in Indian context. However, through this study, we like to establish whether abovestated factors do have an effect on the awareness level of customers regarding green banking initiatives in Kolkata.

Objectives of the study

The objective of this research paper is to know the awareness level of the customers with respect to Green Banking initiatives undertaken by the different branches of State Bank of India in Kolkata chapter.

Research methodology

In this study, descriptive research design has been implemented. This type of research design is undertaken to describe the characteristics of the variables.

Pilot study:

Before executing the project a pilot study has been done with the help of a pre-designed questionnaire. By this process, we have tried to judge the feasibility and scope of the project.

Data Collection:

To conduct this study, primary data were collected throughpre-tested structured questionnaires which were given to the customers of different branches of State Bank of India and their responses are recorded for further analysis. Secondary data was also used and collected from various published reports of Reserve Bank of India, other public and private sector banks, reputed journals, etc.

Sampling:

175 customers of different branches of State Bank of India in Kolkata are interviewed for the collection of data. Convenience sampling technique has been used for data collection purpose. Data was collected from 17th May, 2019 to 31st July, 2019.

Statistical package:

SPSS software has been used for the analysis of the data. Frequency table, crosstabulation, chi-square test, factor analysis, and rank analysis technique has also been used for data analysis purpose.

Data analysis

Frequency Distribution:

Demographic profile of the customers has been judged on the basis of age, gender, educational qualification, occupation, annual income and period of relationship with the bank.

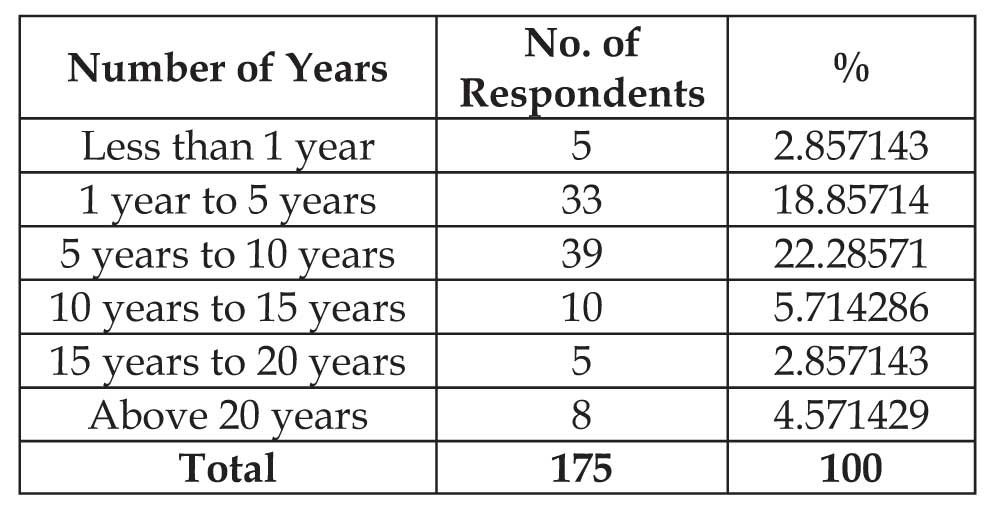

(a) Period of relationship with State Bank of India:

It is clear that 39% of the customers are maintaining the relationship with SBI for 5 to 10 years. Next, 33% of the customers have a relation with SBI for 1 year to 5 years.

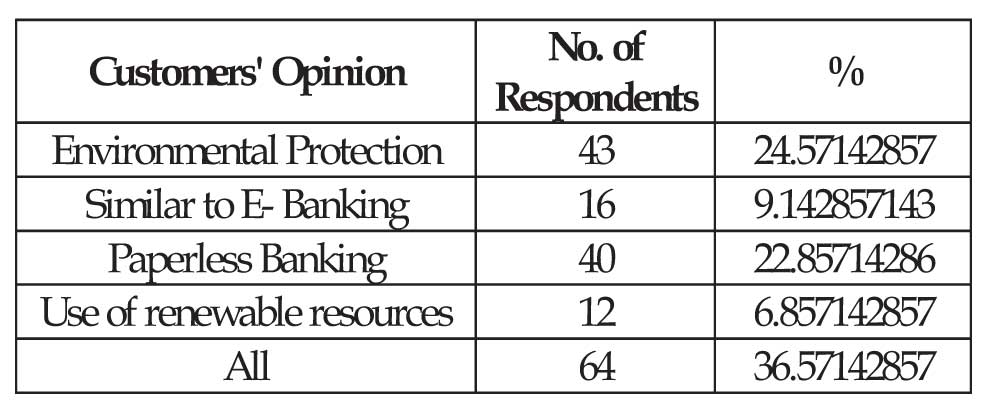

(b) Opinion about E-Banking:

From the chart, it is clear that 24.5% of the respondents say that Green Banking promotes environmental protection, 9% feel that Green Banking is similar to EBanking, 22.8% feet that it is paperless banking, 6.8% of them feel that it is related to the use of renewable resources and remaining 36.5% feel that it covers all the above options.

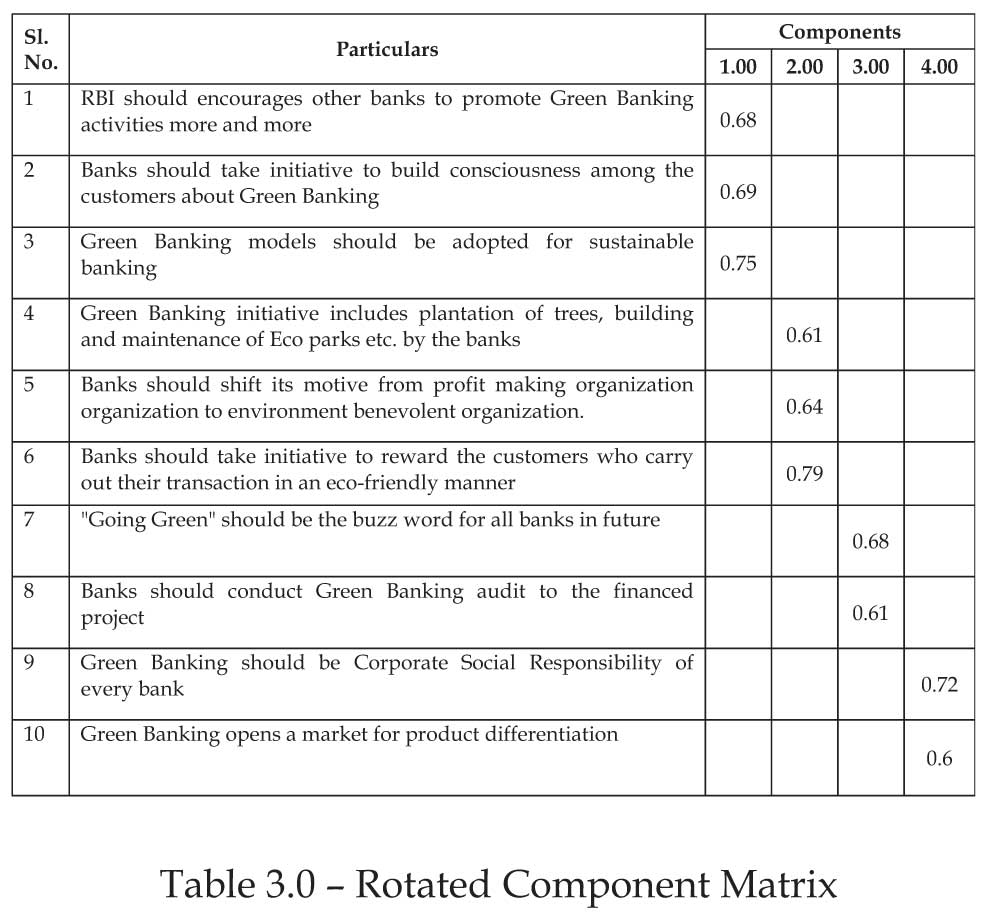

Factor Analysis:

Rotated Component Matrix shows the correlation of each variable with other factors from the contribution of variables. The correlations possible values range from +1 to -1.

In Table 3.0 all the items that are loaded are reduced

into 4 significant factors. These factors can be explained

by arranging the variables from the questionnaire, into

4 groups based on the highest Component Matrix

loadings per statement. Factors are as follows:

Factor 1:Variables 1 to 3 of Table 3.0 suggests that Green

banking cell must be framed by every bank and it must

take measures to formulate policies for Green banking

and implement the green strategic plan.

Factor 2:Banks should promote Green Banking

activities seriously in order to implement environmentfriendly

practices and reduce the carbon footprint from

banking activities. Factor 3:Green Banking should be

included in the curriculum of most of the banks. Banks

should conduct Green Banking audit to the financed

project and award loans to its customers only when

environmental safety standards are followed. Reserve

Bank of Indiashould make it mandatory for every bank

to disclose its Green Banking activities in an annual

report.

Factor 4:Corporate Social Responsibility (CSR) is a

process where generally banks contribute ethically to

economic development. Among various CSR banking

activities, Green Banking is a newly emerging one.

Identification of the factor as CSR strategy is carried out

from variables mentioned in Table 3.0 particulars 9 to

10.

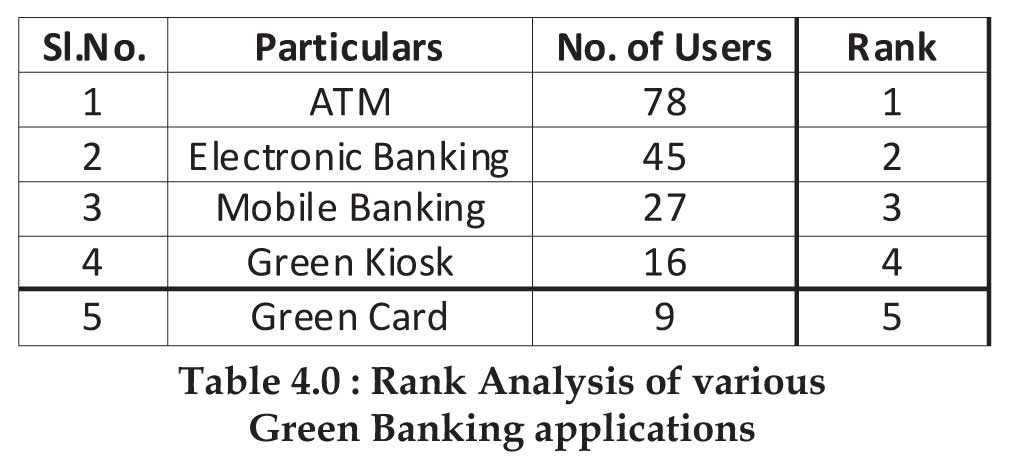

Rank Analysis:

Rank is allotted to different variables by calculating frequency and means scores of the responses collected. Rank 1 is given to highest score and proceeded accordingly. In order to know the satisfaction level of Green Banking applicants and to understand the most preferred way of implementing Green banking rank analysis has been carried out.

From above Table, it can be concluded that majority of customers use ATM card and E-Banking and mobile banking rank 2nd and 3rd position respectively. Green banking products possess a lower rank on the list.

From Table 5.0 it is clearly understood that the majority of the customers prefer to adopt paperless banking. Use of solar panel is one of the energy consumption methods and it gets the second rank. Introducing Green Banking financial products such as green loan gets third preference. As many numbers of office staff can use common transport at a time to save fuel consumption get second preference. Finally, the last preference is given to the green building.

Findings and implications

- There is a lack of awareness among banking users about green banking. It is the duty of the bank to create awareness among the customers about the benefits of green banking;

- Strategies should be framed and followed to popularize Electronic Banking and mobile banking among users. The training program should be organized by banks to educate and guide customers on how to carry out transactions in an eco-friendly manner;

- For further development customers feedback is valuable. Banks should give focus on this area;

- Last but not the least green banking has to be included in the curriculum or an activity in school or college level study;

Conclusion

The result of this study shows that promoting environment friendly practices and reducing carbon footprint from banking activities is an important area to uphold in recent area. It involves use of E-Banking, mobile banking, green kiosk, E-statement, online transaction, green loans, ATM etc. But introduction of various green banking products are useless without proper utilization in a proper way. Green banking has become Corporate Social Responsibility (CSR) of every bank. Indian banks have already taken several initiatives to popularize green banking but when compared globally, they are lagging behind. Banks should continuously work on improving and introducing several green banking products. In order to enhance green banking activities banks should acquire support of government, NGOs, business organization and the customers.

References:

- Ahmad, F., Zayed, N. M., &Harun, M. A. (2013). Factors behind the Adoption of Green Banking by Bangladeshi Commercial Banks. ASA University Review, 7.2, 241-255.

- Bhardwaj BR, Malhotra A (2013) Green Banking Strategies: Sustainability through CorporateEntrepreneurship. Greener Journal of Business and Management Studies 3 (4), 180-193, ISSN: 2276-7827.

- Bihari SC (2011) Green Banking – Socially Responsible Banking in India. The India Banker VI (1).

- Indian Banks Association (2014) Green Banking Innovations; Indian Bank 'Association. [Cited 10/2/2015]. Available from: http://www.theindian banker.co.in/html/sto_5.htm.

- Jha N, Bhome S (2013) A Study of Green Banking Trends in India. Abhinav132 (2), 127-132. ISSN –2320- 0073.

- Karunakaran R (2014) Green Banking – An Avenue to Safe Environment. Galaxy international Inter disciplinary Research Journal 2 (2). ISSN 2347-6915.

- Millat, K. M., Chowdhury, R. &Singha, E. A. (2012). Green Banking In Bangladesh: Fostering Environmentally Sustainable Inclusive Growth Process. Dhaka, DHK: Bangladesh Bank.

- Nath V, Nayak N, GoelA (2014) Green Banking Practices – A Review. IMPACT: International Journal of Research in Business Management 2 (4), 45-62. ISSN (E): 2321-886X; ISSN (P): 2347-4572.

- Sekaran S.C. (2010) The role of Green banking in Environmental Management, Articlesbase.

- Singh H, Singh BP (2012) An Effective and Resourceful Contribution of Green Banking towards Sustainability. International Journal of Advances in Engineering Science and Technology 1(2).