Subscribe now to get notified about IU Jharkhand journal updates!

Financial Performance of ONGC Tripura Asset and ONGC India-A Comparative Study

Abstract :

Tripura is one of the main exertion centres of ONGC in the North-Eastern region. Tripura is the frontal forth belt of the Assam basin situated between the regions of commercial Oil & Gas reserves of upper Assam and the Gas bearing Sylhet region of Bangladesh. The study is based on the ONGC Tripura Asset which is in operation at Agartala. The study aims to analyse the performance and the financial stability of the ONGC Tripura asset, and also compares the performance growth level with the ONGC India. The study is based on three years of data for the financial year 2015-16 to 2017-18. The outcome of the study discusses the financial performance of the organisations resulting from ratio analysis.

Keywords :

Tripura, Financial Performance, ONGC, Comparative Ratio Analysis, organisations.Introduction:-

Organisational decision making necessitates

accurate analysis and interpretation of the financial

statements. Generally financial statements are

prepared for the purpose of periodical review or

assessment of progress made by management.

Measuring financial performance through financial

statements is crucial for taking actions. For every

financial expert employed in framing financial

statement, there are dozens of people interested in

analysing and using such statements, particularly

financial statements and income statements. These

people include creditors, bankers, investors,

executives and the general public. A carefully

prepared financial statement should be interpreted

in the same way for the valuable results. Along with

the rapid growth of accounting, there has been a

continuous improvement in the methods used in the

analysis of financial statements. These methods

usually establish meaningful relationships between

the assorted parts of a statement.

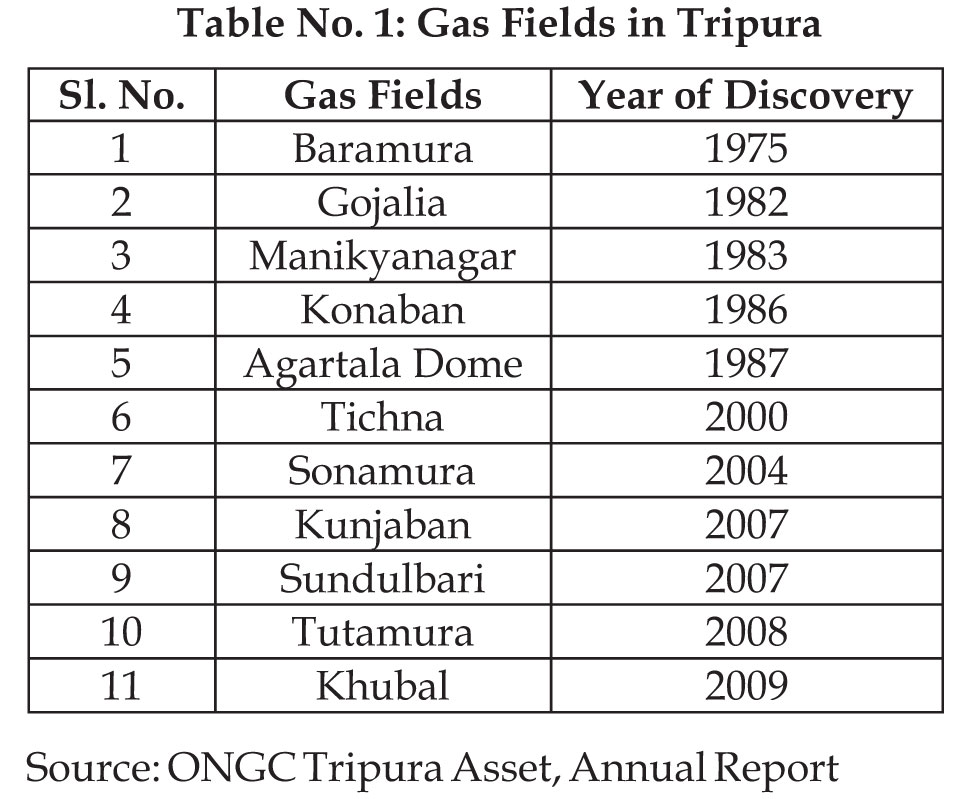

Presently ONGC is having 11 Gas fields in Tripura.

The ratio of exploration of Gas in Tripura is 2:1

(drilled 164 wells in Tripura and out of which 76

wells are yielding Gas). The Average success ratio of

ONGC Tripura is around 7:1. Gas reserves are

approximately 32 billion cubic metres. The

consumers of Tripura ONGC Assets are: ONGC

T r i p u r a P owe r C omp a n y , NE E P C O ,

MONARCHAK, RAMCHANDRANAGAR,

BARAMURA, TNGCL, ROKHIA, CITY GAS, and

TNGCL IGC.

Literature Review:

Literature review founds that, the author makes

both intra firm as well as inter firm comparative

analyses by taking five years data of HPCL

(Hindustan Petroleum Corporation limited) from

2012 to 2017 and on the financial performance of

HPCL with BPCL (Bharat Petroleum Corporation

ltd), ESSAR (Essar oil ltd), GAIL (Gas Authority of India ltd) and IOC (Indian Oil Corporation).

Applying ratio analysis technique the study verifies

that HPCL is performing better compare to many

other highly performing firms of the same industry.

HPCL is incessantly generating its resources both

financially as well as in terms of fixed assets etc. It is

continuously expanding and taking up several

projects which indicating towards the better

performance of the entity (Pudi, 2018).

Present study aims to make a comparative analysis

on financial performance of Islamic and

conventional banks of Pakistan. It is based on

convenient sampling technique. Islamic banks

(Mezan Bank Ltd, Bank Islamic and Albaraka) and

conventional banks (Faysal Bank, KASB and Bank of

Khyber) have been selected for the period 2007 to

2009. Using paired sample t-test and ratio analysis

the study found that Islamic banks are performing

better with high growth and profitability compared

to conventional banks. The study also shows that

Islamic banks are more liquid over conventional

banks and optimally utilising its resources to derive

more benefits (Usman & Khan, 2012).

Here the author attempts to analyse merge effect on

financial performance of banking and financial

institutions in Nepal. As a sample six banks and

financial institutions has been considered along with

120 respondents for primary and secondary data

respectively. Ratio analysis and t-test has been used

to analyse the data. This study found that merger

impacts performance certainly when larger and

stable parties such as commercial banks act as

bidders as opposed to the merger between smaller

banking and financial institutions, mainly other than

commercial banks as bidder. The loan quality

extensively deteriorates after merger in most of the

cases and profitability measured in terms of ROA

and ROE is adversely affected. Therefore, the study

concluded that merger should not be considered as

the definite way out to overcome the market

challenges (Shrestha, Thapa & Phuyal, 2017).

The author here examined financial statement

analysis in Tamil Nadu Newsprint and Papers ltd to

comprehend the liquidity position, for that financial

statements of last five years from 2012-2017 has been

considered. Using ratio analysis as a tool, common

size balance sheet and comparative balance sheet the

study found that the performance of the company is

positively increasing every year. Sales turnover is

also showing rising trend along with good reserve

and reputation. The study is giving positive

indications about the mentioned concern but at the

same time emphasis given on efficient and effective

management to reach the new height (Sassikala,

2018). Similar type of study has been done by the

author on financial performance of sugar industry at

Ammundi, Vellore. Period undertaken for the study

is 2013-2017. Using ratio analysis as technique the

study shows that company's financial performance

over the year is positive. It also indicates towards

profitability and good liquidity position of the

concern, which is very important for decision

making for future growth (Srinivasan, 2018).

Objective of the Study

- lTo make a comparative analysis of ONGC Tripura Asset with ONGC India based on financial performances.

Methodology

The study is descriptive in nature mainly based on secondary data, related to financial aspects of ONGC Tripura Asset and ONGC India. The data has been collected from published and unpublished sources on the subject from the office of ONGC Tripura Asset, journals, articles, related books, and financial report of the company. Period undertaken for the study is 2015-16 to 2017-18. For the purpose of analysis of collected data and to reach meaningful inferences in line with the stated objective, ratio analysis (mathematical) technique has been used. Different visual presentation techniques such as bar chart, line chart, and column chart have also been used in order to accompany the interpretation of the study.

Data Analysis & Interpretation

The study has been analysed based on the financial

performance of ONGC Tripura Asset and ONGC

India. Different ratios such as efficiency, liquidity,

profitability and solvency have been used to

evaluate various aspects of company's operational

and financial performances to draw correct

interpretation.

Source: Calculated (based on data from ONGC

Tripura Asset

& www.moneycontrol.com)

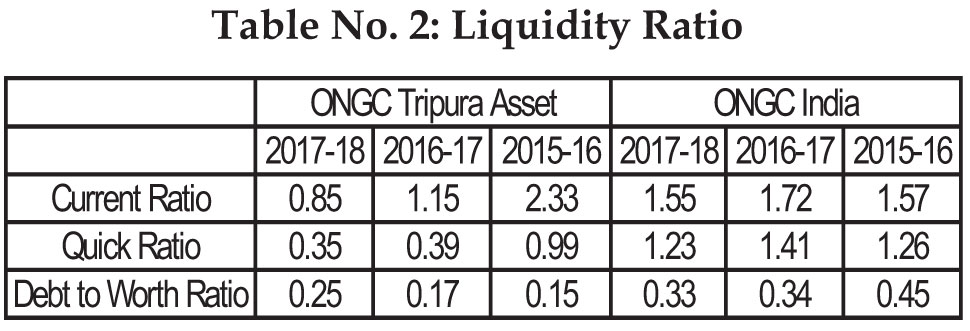

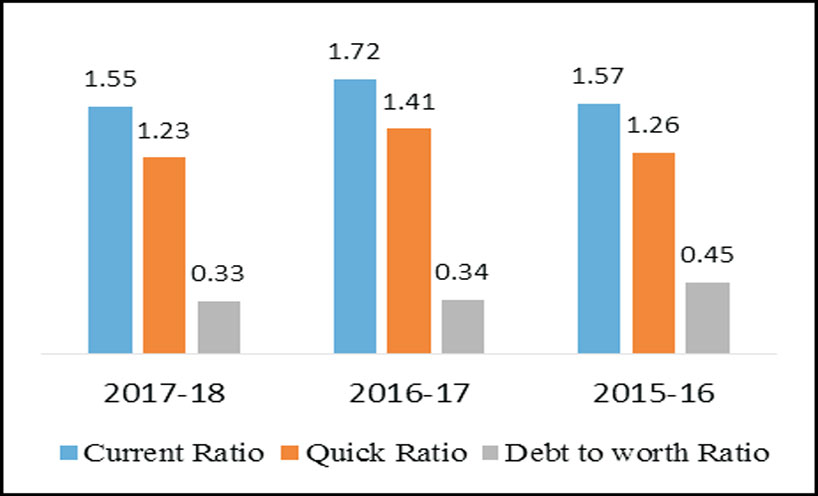

Graph 1: Liquidity Ratio of ONGC Tripura Assets

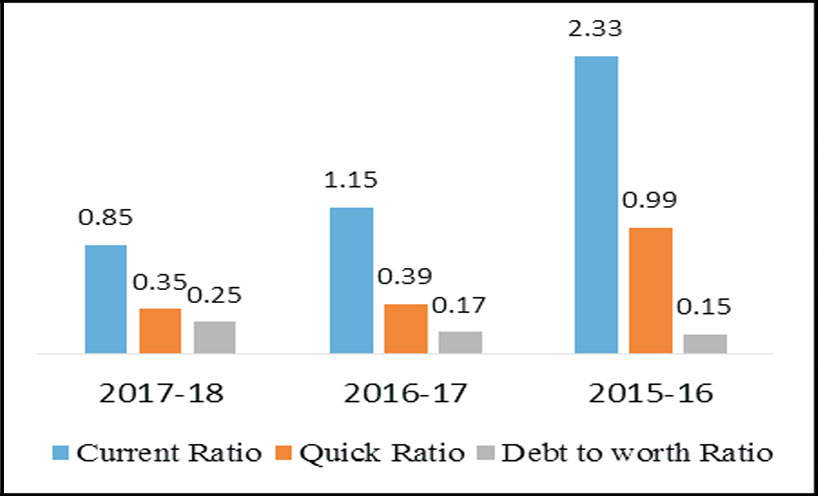

Graph 2: Liquidity Ratio of ONGC India

Generally, a higher liquidity index indicates that a company is more liquid and has better coverage of

outstanding debts. On the other hand higher current ratio leads to greater volume of current assets more than

the specified norm denotes that the firm possess excessive current assets than the required, depicts idle funds

invested in the current assets.Comparing ONGC Tripura asset and ONGC India the flow of current ratio of

Tripura asset shows decreasing trend, which is not at all good sign for the company. Similarly quick ratio also

shows negative trend. It may also considered that the liquid assets of the company in Tripura cannot be easily

translated into cash to meet out the urgent financial commitments, whereas the debt worth ratio indicates that

the debt amount of Tripura asset was increased but in very less volume. So the study indicates that ONGC

India is in a good position compare to ONGC Tripura Asset also there is stable deviation in the liquid ratios of

ONGC India compare to ONGC Tripura Asset.

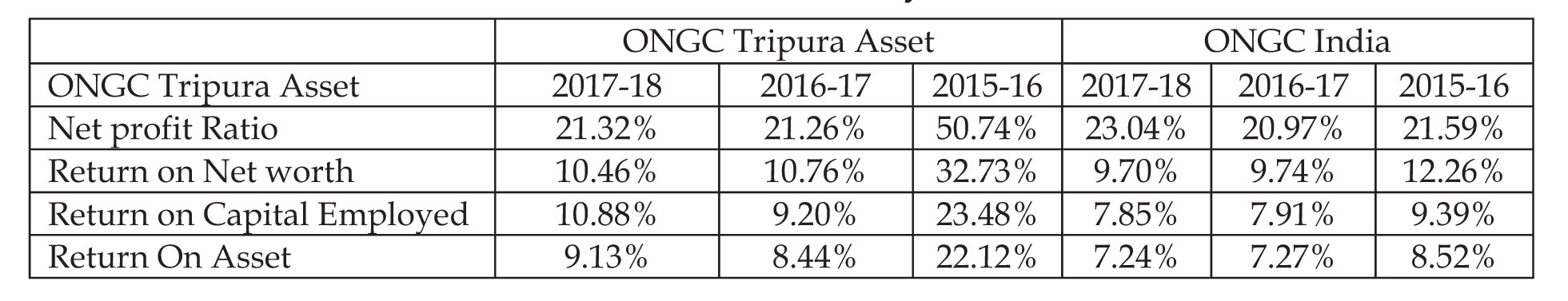

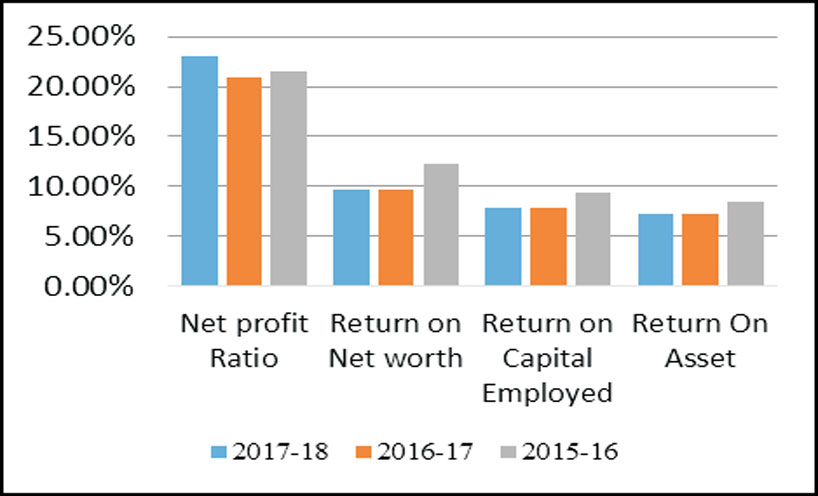

Table No. 3 Profitability Ratio

Source: Calculated (based on data from ONGC Tripura Asset & www.moneycontrol.com)

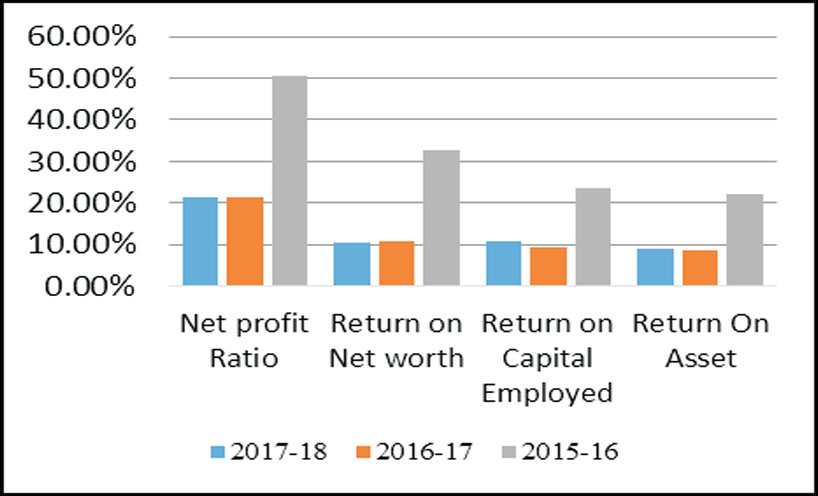

Graph 3: Profitability Ratio of ONGC Tripura Asset

The analysis of profitability index is to measure the company's performance. The profitability of the company

is very important for stakeholders. Table 2 portrait that net profit margin of the companies declines from 2015-

16 to 2017-18 in a huge percentage, which indicate that the company overall performance was not up to the

mark. The return on net worth ratio also decreases which implies the inappropriate utilization of the

shareholder fund for earning profit. Similarly the return on capital employed and return on asset of the

Tripura asset was also decreases, which directly affects the net profit of the company. But at the same time the

study may draw one significant observation from the above analysis of

Based on the analysis of mentioned profitability ratios (i.e.Net profit ratio, Return on net worth, return on

capital employed and return on asset), the study indicates that in both the cases of ONGC India & ONGC

Tripura asset the overall profitability ratio's decline during 2015-16 to 2017-18 in large volume. But the

performance of ONGC Tripura Asset is comparatively better to ONGC India, which is a good indicator.

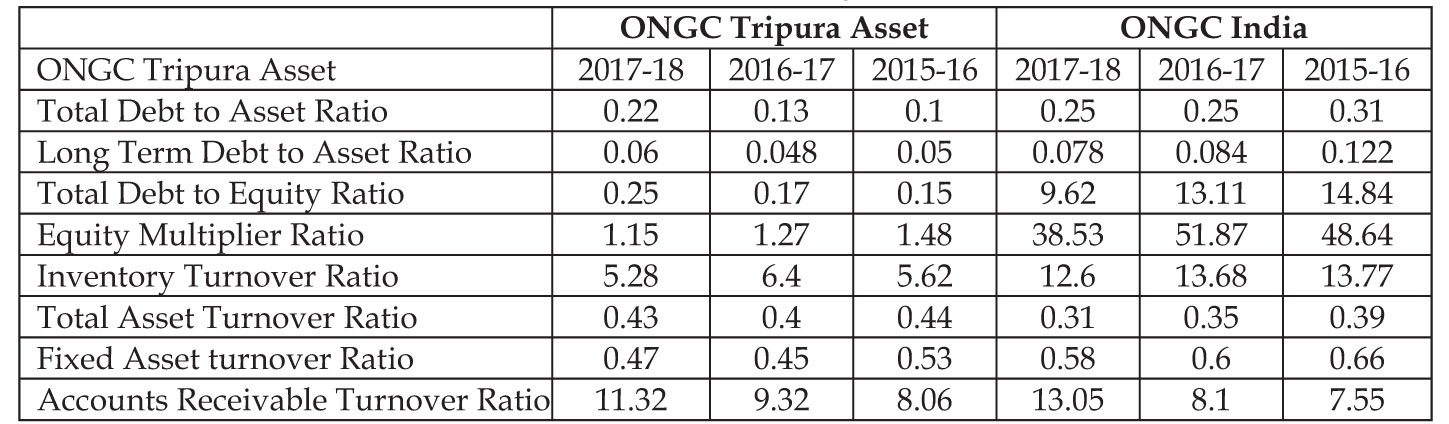

Table No.4: Solvency Ratio

Return on capital employed is that in

Tripura it is quite more than all India's performance of the company, which depicts that in the state of Tripura

either less capital is invested which yields high return or company efficiently using its capital. In other words,

the ratio measures how well a company is generating profits from its capital.

,br>

Based on the analysis of mentioned profitability ratios (i.e.Net profit ratio, Return on net worth, return on

capital employed and return on asset), the study indicates that in both the cases of ONGC India & ONGC

Tripura asset the overall profitability ratio's decline during 2015-16 to 2017-18 in large volume. But the

performance of ONGC Tripura Asset is comparatively better to ONGC India, which is a good indicator.

Table No.4: Solvency Ratio

Source: Calculated (based on data from ONGC Tripura Asset & www.moneycontrol.com)

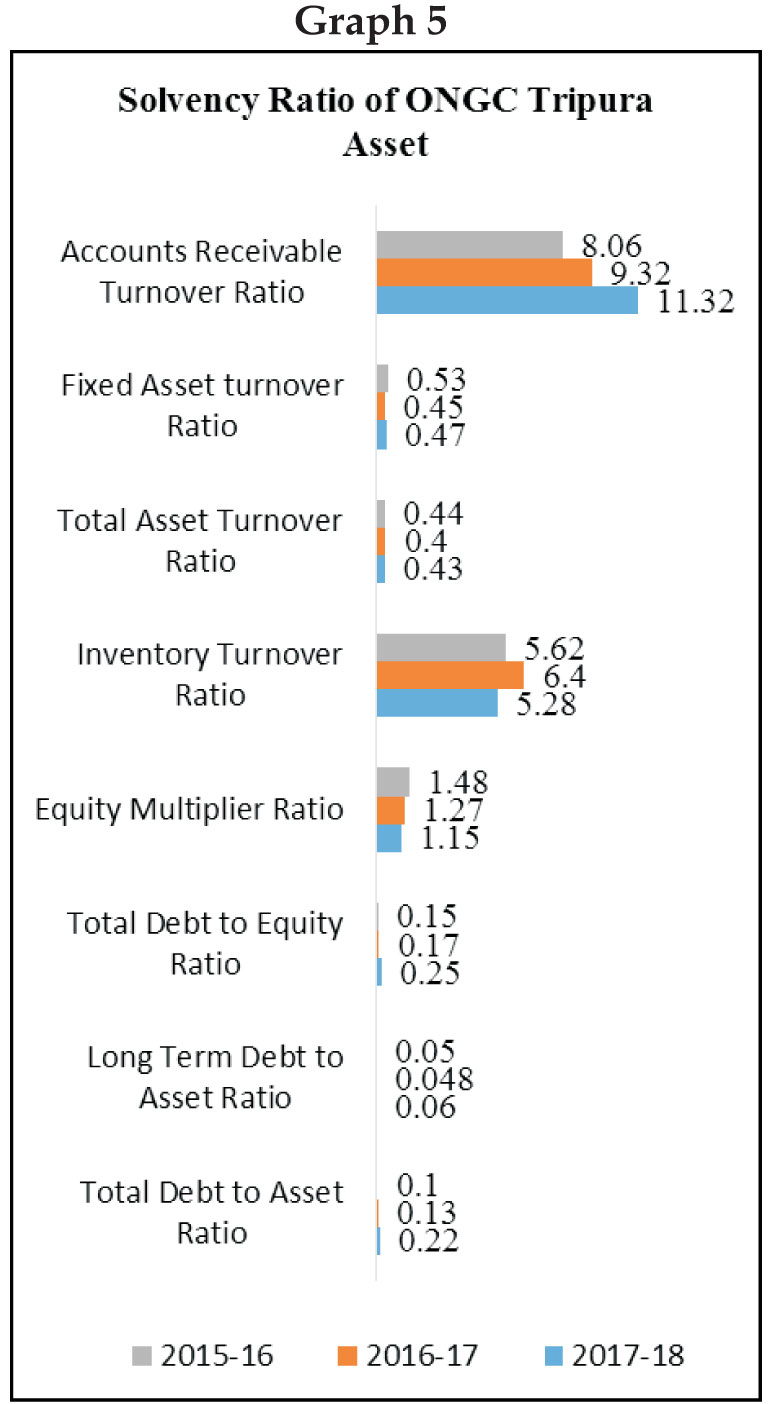

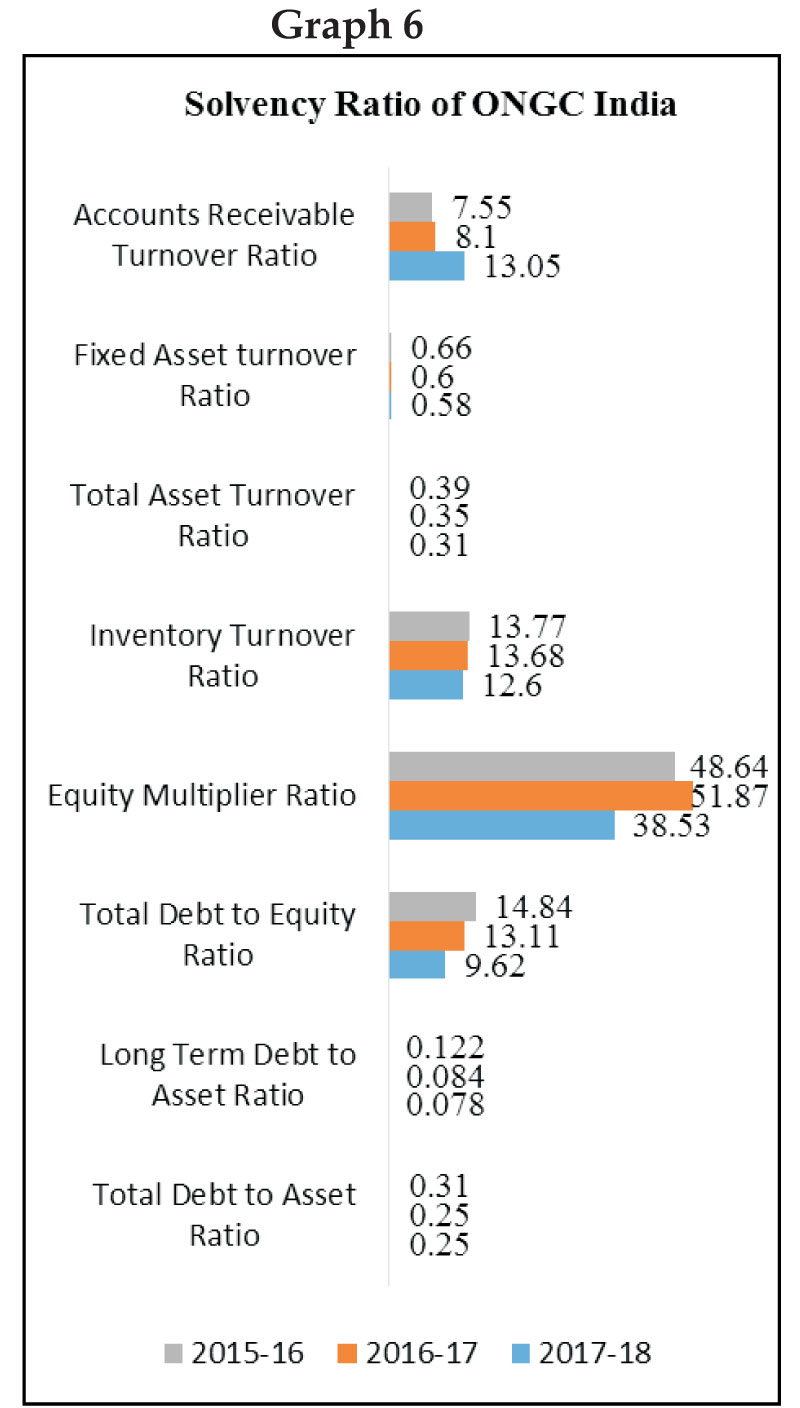

The solvency ratio is a key measure used to measure

a company's ability to meet its debt and other

obligations. The analysis of the different solvency

ratio like debt to asset ratio, long term debt to asset

ratio, and the total debt to equity ratio indicates that

the company increases every year their debt amount

but in less volume in case of ONGC Tripura Asset,

which ultimately increases the operational risk of the

company, also may effects the profit level. But on the

other hand after analyzing the equity multiplier

ratio, it shows that the company (Tripura asset) has

less dependence on debt financing for creation of

assets. Relating to inventory turnover ratio it is found

that changes are minor and close to each other, which

indicates that management system for the inventory

of the company is good that's why the inventory

turnover took place very frequently. Finally, debtors

turnover ratio, shows that in every financial year the

collection of money from debtors is prompt (2017-

18= 11.32 times, in 2016-17=9.32 times 2015-16=8.06

times) similarly in case of ONGC India too indicates

that the solvency position of the company is good.

Conclusion

The Oil and Natural Gas Corporation (ONGC) limited is well known and highly profitable PSU based company in the country. It is known for its hard work and unique ideas. ONGC has efficient man power and provides good facilities to its stakeholders. Although the overall performance of ONGC Tripura asset can be considered as satisfactory, but during the study it is found that ONGC Tripura asset slow down its performance in current years. So it is needed to upgrade level of performance, competence to reach the new height.

References:

- Khan, A. U. (2012). Evaluating the Financial Performance of Islamic and Conventional Banks of Pakistan: A Comparative Analysis. International Journal of Business and Social Science ,3 (7).

- Magina Shrestha, R. K. (2017). A Comparative Study of Merger Effect on Financial Performance of Banking and Financial Institutions in Nepal. Journal of Business and Social Science Research, 2(1),pp 47-68.

- Poongavanam, S. (2017). A Study on Comparative Financial Statement Analysis wth Reference to Das Limited. IOSR Journal Of Humanities and Social Science (IOSR-JHSS),22 (10),pp 9-14.

- Pudi, P. (2018). A Study on financial analysis through comparative statements with special reference to HPCL. International Journal Of Commerce and Management Research,4(2), pp 49-55.

- Sassikala, A. (2018). A Study on Financial Statement Analysis in Tamil Nadu Newsprint and Paper Limited, Kagithapuram, Karur. Journal of Business & Financial Affairs ,7(2): 337.

- Sharma, K. C. (2011). Performane Of Indian Public Sector Banks and Private Sector Banks: A Comparative Study. International Journal Of Innovation, Management and Technology, 2(3).

- Srinivasan. (2018). A Study on Financial Ratio Analysis of Vellore Cooperative Sugar Mills at Ammundi Vellore. International Journal of Advanced Engineering and management ,3(2), pp- 51-58.