Subscribe now to get notified about IU Jharkhand journal updates!

Impact of Domestic Institutional Investments on Indian Equity Market

Abstract :

The Indian Equity market is one of the best performing and promising markets in emerging markets. The funds which play an

important role in the Indian Capital Market comprises of two major flows one is Domestic Institutional Inflows and other

Foreign Institutional Flows. There have been various studies pertaining to the flows of funds from foreign institutional

investors but none of the study has been done on Domestic Institutional Investors.

This paper identifies the causal relationship between Domestic Institutional Investors and the movement of Sensex. The tools

which have been used to analyze the causal relationship include Vector Auto Regression and Granger Causality Test. The

results analyzed by the above tools show that the inflows of Domestic Institutional Investors do not have any positive influence

on Sensex as these investments are not making any huge impact on the movement of Indices. But, the movement of Sensex is

having a huge impact on the trading pattern of DIIs. Actually, from the study, it has been found that DIIs are not influencing

the market but rather market return or market movements have a huge impact on the Investment pattern of DIIs.

Keywords :

Domestic Institutional Investors, Granger causality, Sensex, VAR.Introduction:-

After the Financial Liberalization of 1991, Indian market has seen huge inflows from Foreign Institutional Investors. The Indian Capital market was largely depending on the flows of Foreign Institutional Investors. If Foreign Institutional Investors were the net buyers then usually we use to see a rally in the market but if FIIs become the net sellers then we observe a big fall in the market.

But, slowly and slowly the Domestic players were getting matured. On the parallel side they were investing a lot in the market making the market a more stable place to invest. Our study manly focuses on the investment pattern of DIIs and it has been different from all other previous studies as other studies were mainly focusing on FIIs.

Domestic Institutional Investors means the investments made by (Mutual funds, Insurance Companies, Banks, Development Financial Institutions and the amount invested under New Pension Scheme.)

The investment and concept of Domestic Institutional Investors have been new to the market as it has been firstly introduced in the year 2007. Before that we don’t have the consolidated data of DIIs but rather we have the individual data.

After 2007, the Securities and Exchange Board of India has taken various reform measures and made the data available on a consolidated basis.

Institutional Investors hold huge fraction of financial assets in the form of stocks and bonds. Domestic Institutional Investors are having a very decisive role in giving support to the Indian Stock market especially when Foreign Institutional Investors are net sellers. From 2007, onwards their daily basis consolidated data is available on the website of SEBI, BSE and NSE.

Unlike other authors like Unlike Bose (2012) which considered the after crisis period only, we took a longer period of time starting from 2007 to 2016 and controlled the other factors with a dummy variable. Three parameters have been used for the study i.e DIIs (Purchase), DIIs (sales) and DIIs (Net Investment).

In this particular study the analysis has been done to see the impact of Domestic Institutional Investors have been seen on India Stock market. The motive of the study is to know that whether the flows of Domestic Institutional Investors in either direction have any impact of Indian Equity Market. It means if Domestic Institutional Investors are net buyers does it help Sensex to move upwards and when DIIs are net sellers will it make Sensex to move downwards.

Research Gap:

Various studies have been done on the relationship between foreign institutional players and Indian Equity Market but no study focuses on the role of Domestic Institutional Investors on the role of Indian Stock Market although they are the second largest investors in Indian Equity market.

Scope of the Study

The study is specific to India and the reason is that Indian economy is one of the fastest growing economies in the world and because of this reason Indian stock market has been receiving the maximum portfolio investment from both foreign and domestic players. The Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) are two leading stock exchanges of India. The domestic institutional investors are heavily investing in these markets. So, both of these markets have been taken into study to see the impact of Domestic Institutional Investors on these markets.

The Domestic Institutional Investors are the major investors in parallel to Foreign Institutional Investors and it is important to understand the overall strategies of Domestic players available in the market. The study includes all the major issues related to Domestic Institutional Investors like in which companies Domestic Institutional Investors invest in Indian Equity market, do their investments depend on the direction of Sensex and is there any impact of investments made by Domestic Institutional Investors on Volatility of Indian Stock Market.

Literature Review:

Sripriya and Shamugam(2014) in their paper “Foreign Institutional Investors Trading Activity and Volatility in Indian Stock Market” have used monthly data collected from 2003 to 2013 for their analysis. Various Econometric techniques like unit root test and GARCH (1, 1) model have been used to analyze the Data. It has been observed that Foreign Institutional Investors are the main factors behind the Volatility in the Indian Stock Market. The results also highlight that NIFTY and SENSEX are affected by past and recent affects whereas other sectors are affected only by past volatility. As the research was based on Time Series analysis the Stationarity of the data was tested using ADF test. GARCH (1, 1) model is used to capture time varying volatility of Stock Market. In conclusion, it has been found that the presence of FIIs in Indian Stock market has helped the Indian Stock markets to expand and at the same time it enhances the volatility.

Srinivasan and Kalaivani (2013) also studied various Determinants of Foreign Institutional Investors Investment in India through empirical study. Using quarterly time series data the empirical analysis was carried out for the period from January 2001 to December 2010. Negative impact of Exchange rate on FII inflows has been clearly seen both in the short run as well as in the long run. It means that if the local currency in which FIIs are investing is depreciating than it is making a Negative impact on the economy as well as on the Investment patterns of Foreign Institutional Investors and also on their sentiments.

It creates a kind of nervousness in the Economy and it will become costlier for the FIIs to buy in the Indian Equity Market. Another research area on which they have focused on was US Stock Market and through their analysis it was found that US Equity Market returns has positive and significant influence on FII flows in the long run but positive and insignificant influence in the short run. And this is the reason behind the motivation of FIIs to invest in Indian Equity Market.

There was another important factor which was highlighted in the research and that was Inflation. Inflation has both positive significant impact in long run and negative influence in the short run. Finally, it has been concluded that FII inflows to Indian Stock Market has various deciding determinants or factors which include Inflation, Exchange rate , Domestic Equity returns, Risk and Return associated with US Equity Market.

Mohanamani and Sivagnanasithi (2012) in their research article “Impact of Foreign institutional investors on Indian Capital Market” focus on the nature and extent of foreign institutional investment in Indian Capital Market. It has been found that Foreign Institutional Investment tends to buy and sell stocks in bulk and tend to create a major withdrawal effect when they leave. It is the reason that the term used for Foreign Institutional Investors is “Hot Money”. Heavy inflow of money by Foreign Institutional Investors has been seen between the periods from 2000 to 2010 except in 2008 where there has been huge withdrawal of money made by Foreign Institutional Investors and which makes a negative impact on Indian Stock Market.

A very close relationship has been seen between Foreign Institutional Investors investment and the movement of SENSEX and NIFTY. It means that the movement of Foreign Institutional Investors has significant influence on the movement of Stock Market indices especially when there is an upward trend in the market due to heavy buying made by Foreign Institutional Investors (FIIs). Another factor which is prevailing in the market is Volatility. It has been seen that Volatility and Foreign Institutional Investors investment behavior shows some kind of positive correlation.

It means that when FIIs tends to buy or sell in bulk then normally the Volatility factor tends to increase. Although, Indian Stock market is quite promising but one has to be a little cautious since it is very difficult to predict the nature of Foreign Institutional Investors

Objective of the Paper:

- To find out the causal relationship between Domestic Institutional Investors and Sensex.

- To explore the impact of Domestic Institutional Investors on Indian Stock Market.

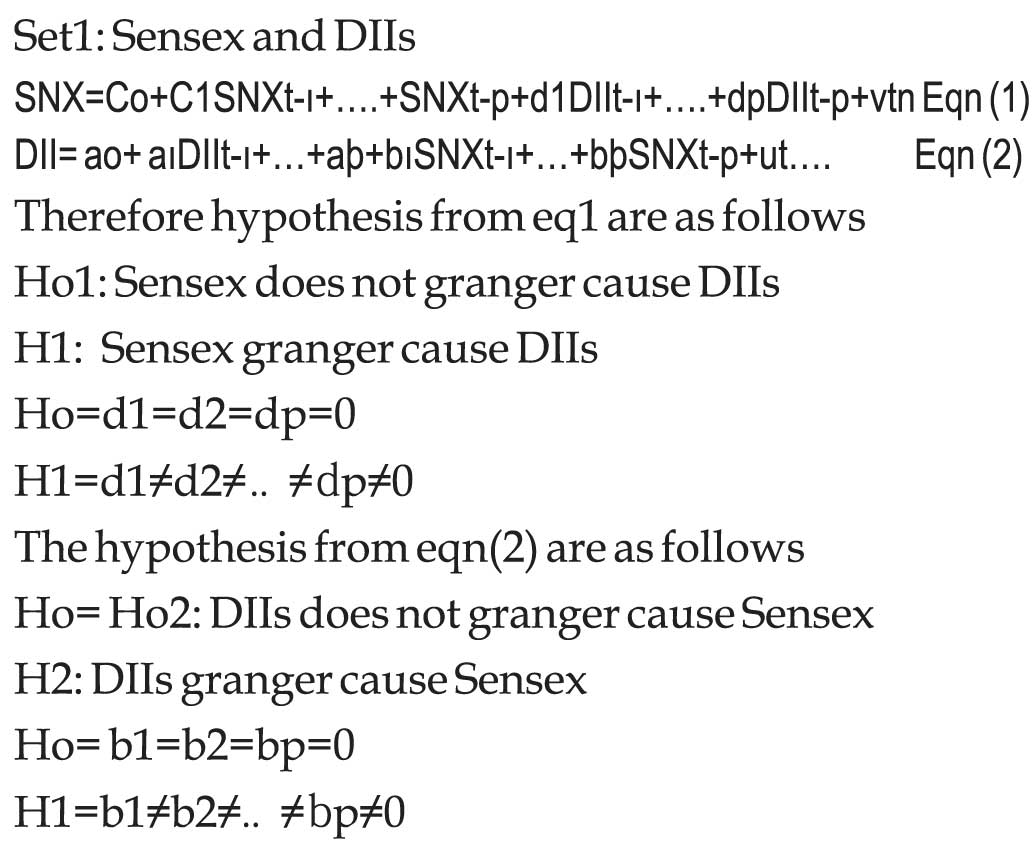

Hypothesis of Study:

Ho1: Sensex does not granger cause DIIs

H1: Sensex granger cause DIIs

Ho2: DIIs does not granger cause Sensex

H2: DIIs granger cause Sensex

Research Methodology:

The data has been based on Secondary Sources. In this paper basically, closing value on daily basis have been collected for both Sensex and DIIs net flows from April 2007 to March 2016.

For Domestic Institutional Investors (Purchase, sales and net Investment were available but to make it precise we have taken net flows of Domestic Institutional Funds.

Since our data was time series that then it is important to make that data a stationary one. For that unit root test have been applied. The data has been taken from the websites of Bombay Stock exchange, National Stock Exchange and Securities Exchange Board of India (SEBI) website.

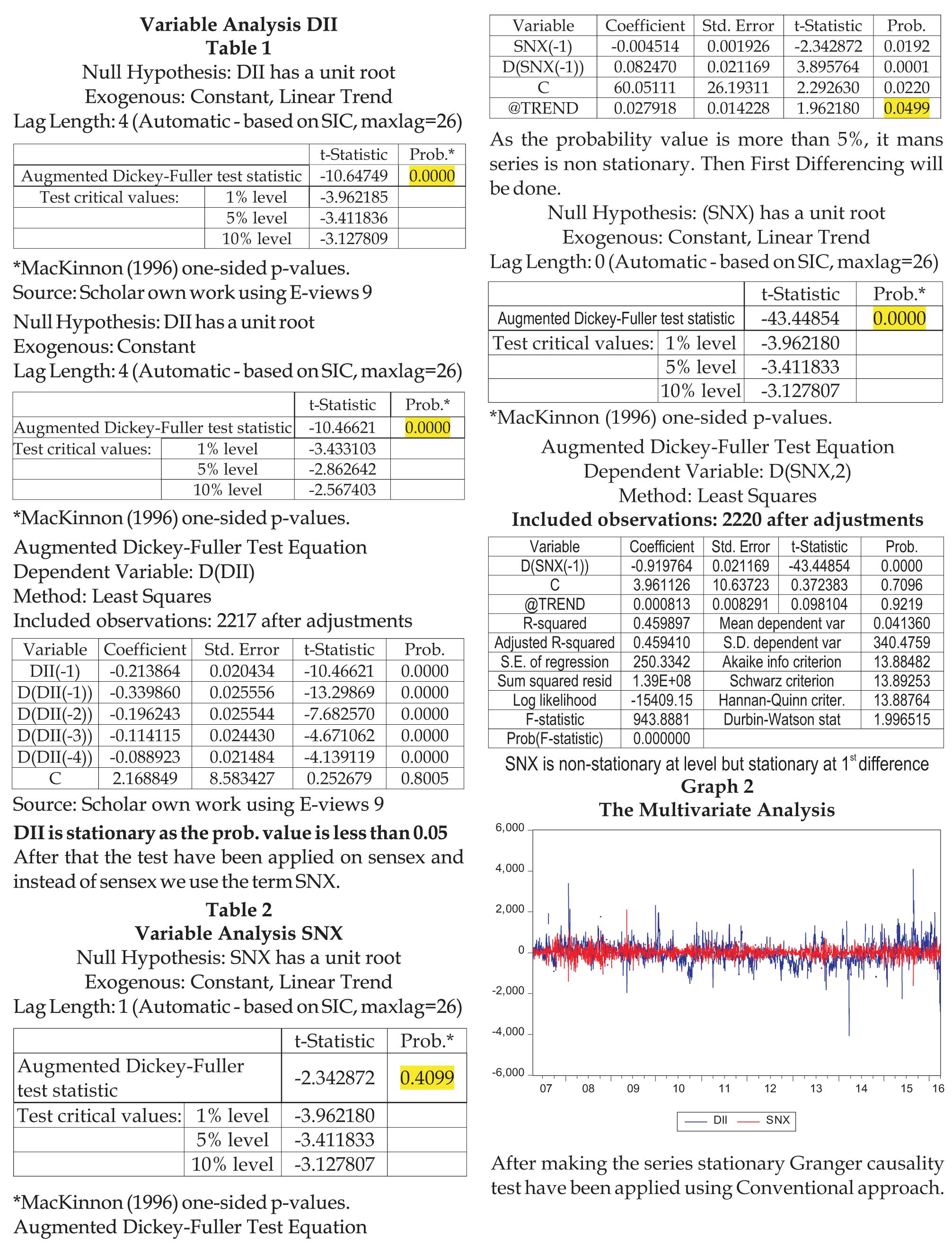

Firstly, it has been checked that whether the DIIs data is stationary or not by Augmented –Dickey Fuller test but the data was found stationary as the probability value was .000 which was less than .05 and therefore no further test has been applied. After this Sensex index has been checked on stationary aspect and it has been seen that the sensex series was non stationary.

To make it stationary test the first difference log have been used or the data have been made stationary at first difference. After making both series stationary the granger causality test have been applied. But, before applying granger causality test VAR framework have been formed and various necessary conditions of granger causality have been tested before applying the final test.

Before applying the Granger Causality test various conditions have to be fulfilled which includes checking the problem of Auto correlation also called as serial correlation.

Econometric Models and Estimations:

With respect to the study, the combination to be studied is DII (Net Investment) and Sensex (Closing). The absence or presence of granger causality will be tested using the following eqn.

Since the data was time series one it is important to check whether the data is stationary or not and if not the data has to be made stationary. We have two time series one is the net investment of Domestic Institutional Investors and other closing of sensex.

Audmented-Dickey Fuller Test has been applied to check the stationary of both the series. Firstly, the test has been applied on DIIs (Domestic Institutional Investors) and it has been found that the series is already stationary (Table 1).

The following are the steps

Step 1.

Firstly Vector Auto Regression model will be set up with VAR (1, 1).The basic objective of creating this VAR model is to analyze that whether the Impact on Sensex movement or Sensex Index is due to the Investment pattern of Domestic Institutional investors or it is due to the previous lags means previous days investment pattern of sensex itself. It has to be seen that how the previous lags if DII are having an effect on itself and Sensex. Because the VAR model will treat both Dii and Sensex as dependent variable and will how its previous lags are having an effect on its values. It has been observed that it has been rejected as the lag length criterion says 7 when we estimate with 10 lags as hit and trial. Thus, we again estimate VAR (1, 1) and the output is as follows

Granger Causality by conventional approach

We have two series; series DII is stationary while SNX is stationary at level one. We make the data stationary for SNX variable. (Table 2)

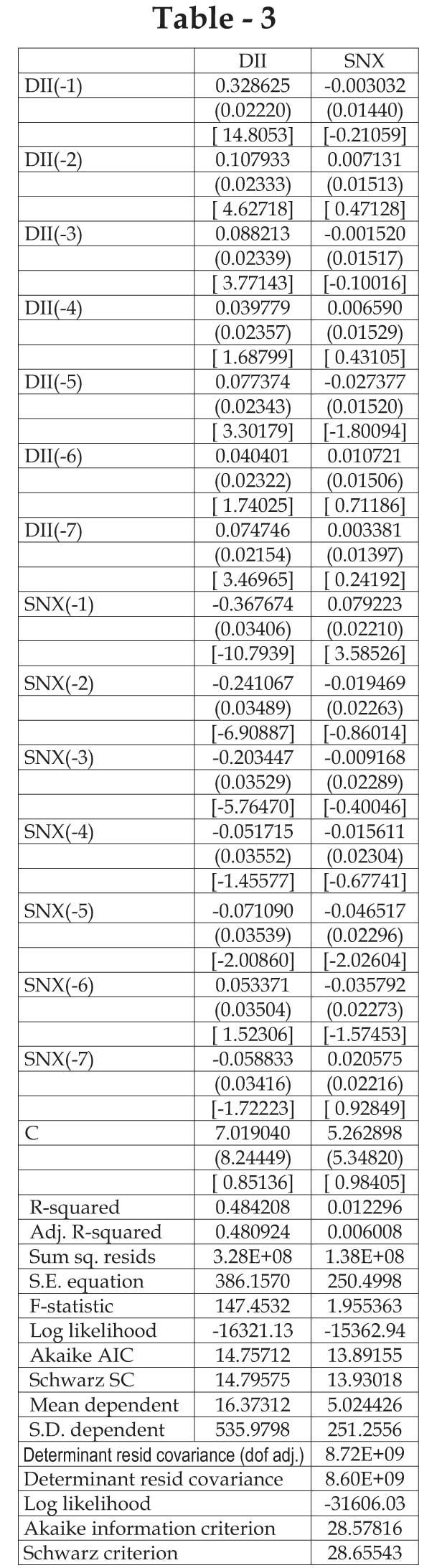

Step 1: Setup VAR (1, 1). It is rejected as the Lag Length Criteria says 7 when we estimate with 10 lags as hit and trial. Thus, we again estimate VAR with (1, 7) and the output is as follows: (Table 3)

Table - 3

Vector Auto regression Estimates

Included observations: 2214 after adjustments

Standard errors in ( ) & t-statistics in [ ]

Table-3 is a VAR(1,7) model of DIIs (Net Investment) and Sensex return and it

has been found that that DIIs previous values up to 7 lags are having an

impact on it and similarly sensex previous lags are also having an impact on

Domestic Institutional Investors. But, Domestic Institutions does not making

any impact of Sensex return.

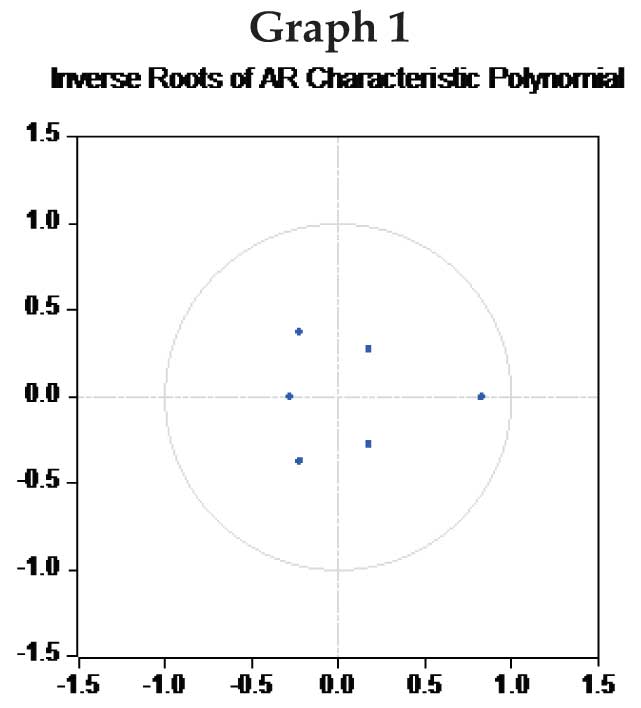

Step 1.

We now check the VAR model for stability condition and the necessary

condition will be check to reach towards the granger causality test.

Stability Condition: Graph 1

AR Roots Graph

Since we have seven lags than the formula is 7x2=14 points should live within

the circle if they are coming within the circle than the stability condition is

fulfilled otherwise not

Rule: All the points should remain within the unit root circle. If they are not

then the model is unfit for Granger causality testing

As all the points are within the unit circle, therefore, the VAR

model is stable.

Since all the points are within the unit circle, therefore the

VAR model is stable. After this the necessary conditions have

to be fulfilled.

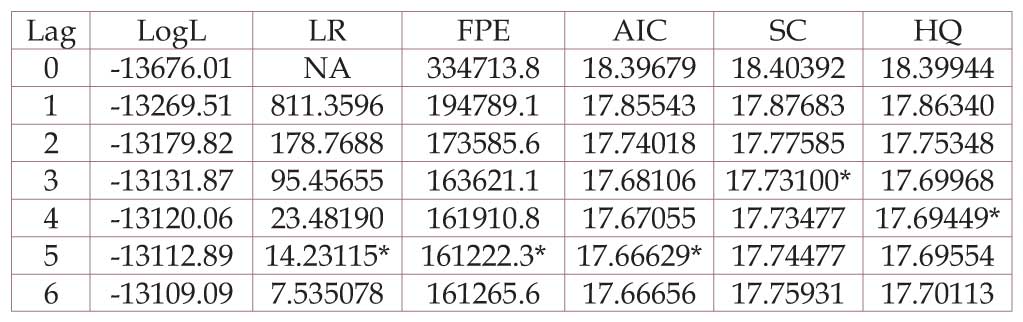

First necessary Condition: Lag Length Criteria (Table 4)

According to lag length criteria maximum stars should come

at 7 to fulfill the condition.

The lag length criteria should come at 7 for using this model.

And for this we run the lag length criteria test with an

additional lag that is 7+1 =8 and the output is as follows

(Table - 4)

VAR Lag Order Selection Criteria

Endogenous variables: NET RETURN

Exogenous variables: C

Date: 09/23/16 Time: 22:09

Sample: 4/01/2010 3/31/2016

Included observations: 1487

* indicates lag order selected by the criterion

LR: sequential modified LR test statistic (each test at

5% level)

FPE: Final prediction error

AIC: Akaike information criterion

SC: Schwarz information criterion

HQ: Hannan-Quinn information criterion

All the criteria except one suggest 7 to be the

appropriate lag length criteria. Thus, the model has

fulfilled the first necessary condition.

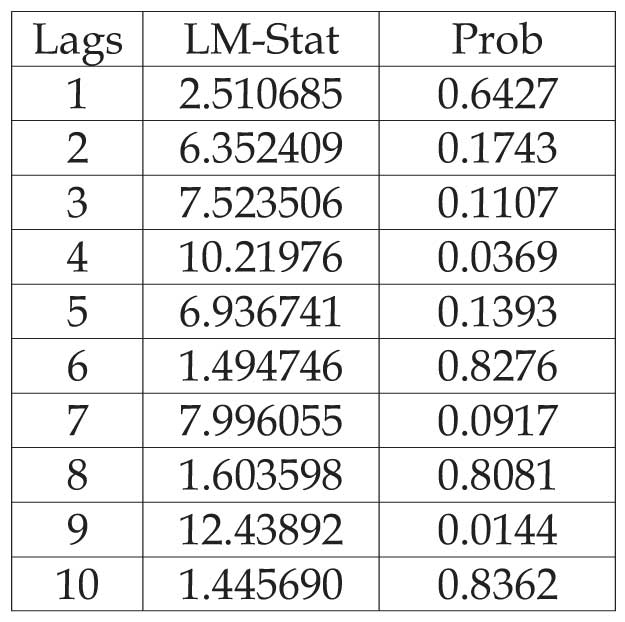

Second Necessary Condition:

Auto Correlation:

The VAR model should be free from the problem of

Auto Correlation (Serial correlation). We run the LM

Auto correlation test for 10 lags that is few lags then

the more than the lags suggested by Lag length

criteria. (Table - 5)

The rule is that majority of the lags should accept the

null hypothesis of “No correlation”. The output is as

follows.

Table - 5

VAR Residual Serial Correlation LM Tests

Null Hypothesis: no serial correlation at lag order h

Probs from chi-square with 4 df.

As it is clear that for majority of lags the prob. value is

more than 0.05 thus accepting the null of no serial

correlation. Thus the model is free from

Autocorrelation.

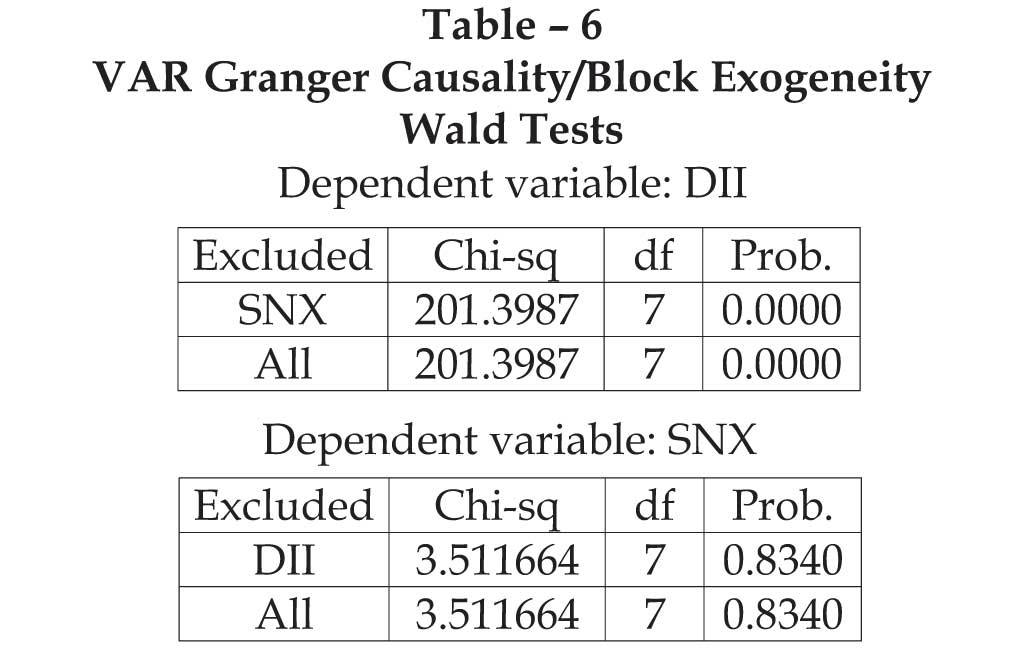

Finally, we move to measure the Granger Causality.

We run the Granger Causality Block Exogeneity Test

on both the series and the output is also follows

Since 7 values are more than 0.05 than the null

hypothesis is accepted i.e. no serial correlation and

hence accepted the null hypothesis of serial

correlation. Thus the model is free from Auto

correlation.

Finally, we move towards granger causality test. We

run the Granger Causality Block Exogeneity Test on

both the series and the output is as follows. (Table 6)

H01: SNX does not Grange cause DII. Rejected, as the

prob. value is less than 0.05

H02: DII does not Granger cause SNX. Accepted, as

the probability value is more than 0.05.

As H01 is rejected, it means that SNX causes DII.

Therefore, we attempt to measure the specific impact

of SNX on DII.

We have two null hypotheses

H01: SNX (sensex) does not granger cause DIIs

H02: DIIs does not granger cause SNX (sensex)

After applying the test following are the results

H01: SNX does not granger cause DIIs –Rejected as

the probability value is less than 0.05.

H02: DIIs does not granger cause SNX have been

accepted as the Probability value is more than 0.05.

As H01 is rejected, it means the Sensex is causing

Domestic Institutional Investors. Means, Sensex

movement in either ways is going to impact the

investment strategies made by Domestic

Institutional Investors and mutual funds in

particular. But, on contrary the investments made by

DIIs are not making any impact on the movement of

Sensex. Although, there are various other factors

which helps the Sensex to move in either way.

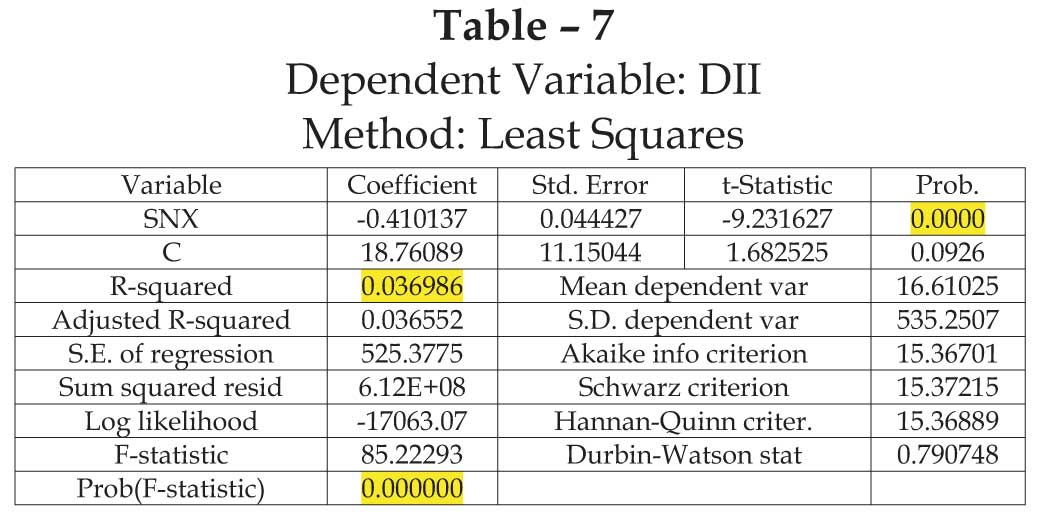

Since, Sensex is having an impact on Domestic

Institutional Investors; therefore, we attempt to

measure the specific impact through regression.

Since the value of Mean is negative it means SNX

movement and DIIs investments are moving in

opposite direction.

And it has been normally seen that when Sensex is in

negative direction or having a downward trend

either because of local factors or international factors

or due to heavy selling from Foreign Institutional

investors, the strategies of DIIs is totally different

and they try to buy stock when sensex is at lower

level and when fundamentally good stocks are

available at cheap prices.

It means there is huge buying made by DIIs when

Sensex is in downwards trend and on the opposite

side Foreign Institutional Investors used to sell at this

moment. But, when sensex changes its direction and

start moving upwards, DIIs became net sellers or

they start booking their profits on the investments

which they have made at lower level.

Conclusion:

It has been concluded that the DIIs used to influence

the stock market but not in a huge manner because

there are other players also mainly Foreign

Institutional players or investors which play an

important role in volatility of Indian Stock Market..

DIIs play an important and crucial role in

channelizing the savings of individual Indian

investors and then invest in Indian stock market.

DIIs buying or selling is not making huge impact on

the movement of Sensex or on returns of sensex.

But, on the contrary side Sensex is causing the DII

and Sensex movement and returns are affecting the

investments made by DIIs. So DIIs always look

towards the movement of sensex for their

investments and also some other factors like

company fundamentals to invest in Indian Stock

market.

References:

- Alexakis, C., Niarchos, N., Patra, T., & Poshakwale, S. (2005). The dynamics between stock returns and mutual fund flows: Empirical evidence from the Greek market. International Review of Financial Analysis, 14 (5), 559-569.

- Ananthanarayan, S., Krishnamurti C. & Sen, N, (2005). Foreign Institutional Investors and Security Returns: Evidence from Indian Stock Exchanges, paper presented at Summer Conference, Centre of Analytical Finance. Indian School of Business, Hyderabad.

- Anshuman, V. R. (2010.). Trading Activity of Foreign Institutional Investors and Volatility, 1–28.

- Apte, P. G., & Badrinath, H.R. (2003). Impact of FII Investments Flow on Stock Prices, Seventh Annual Capital Markets Conference, UTI, Institute of Capital Markets, Mumbai, December18-19, 2003.

- Boyer, B. H., & Zheng, L. (2009). Investor flows and stock market returns. Journal of Empirical Finance, 16 (1), 87-100.

- Bhattacharya, B. B. (1987). The Effectiveness of Monetary Policy in Controlling Inflation: The Indian Experience, 1951-85. Prajnan, 16, (4).

- Bhanumurthy, N. R., & Irwin, I. (2004). Determinants of foreign institutional invest- ment in India: the role of return, risk, and inflation, 4(December), 479–493.

- Bhattacharya, B. B. (1984). Public Expenditure Inflation and Growth: A Macro Econometric Analysis for India. Delhi: Oxford University Press.

- Blonigen, B., & Wang, M. (2005). Inappropriate pooling of wealthy and poor countries in empirical FDI studies, in Does Foreign Direct Investment Promote Development? (Eds) T. Moran, E. Graham and M. Blomstrom, 221- 244. Washington, DC: Institute for International Economics.

- Bollerslev T., (1986), Generalized Autoregressive Conditional Heteroskedasticity, Journal of Econometrics, 31: 307-327.

- Bose, S. (2012). Mutual Fund Investments, FII Investments and Stock Market Returns in India, 89–110.

- Braun, P. A., & Mittnik, S. (1993). Misspecifications in vector auto regression and their effect on impulse response and variance decomposition. Journal of Econometrica, 59, 319-341.

- Buckley, P. J. (1981). The Entry Strategy of Recent European Direct Investors in the USA. Journal of Comparative Corporate Law and Securities Regulations, 3, 169-191.

- Retrieved from hhttp://scholarship.law. upenn.edu/cgi/viewcontent.cgi?article=1316 & context = jil.

- Cha, H. and Lee, B. (2001), “The market demand curve for common stocks: Evidence from equity mutual fund flows”, Journal of Financial and Quantitative Analysis, Vol. 36, pp. 195-220.

- Calvo, G. A., Leiderman, L., & Reinhart, C. M. (1996). Inflows of Capital to Developing Countries in the 1990s. Journal of Economic Perspectives, 10(2), 123-139. Retrieved from http://www.jstor.org/ stable/2138485

- Chakrabarti, R. (2002). FII flows to India: Nature and Causes. Money and Finance, 2 (7), 61-81.

- Chander, S. & Philip, M. (2003) .Behavior of Stock market Prices at BSE & NSE: An Application of the Runs Test, Journal of Accounting and Finance, 17:2, 41-60.

- Chen, J., Hong & H., Stein, J. (2001). Forecasting crashes: trading volume, past returns, and conditional skewness in stock prices. Journal of Financial Economics, 61, 345–381.

- Dolado, J. J., Ganzalo, J., & Mormal, F. (2003). Cointegration. In H. Baltagi. (Eds.). A Companion to Theoretical Econometrics. USA & UK: Blackwell Publishing.

- Drachter, K., Kempf, A. & Wagner, M. (2007). Decision processes in German Mutual Fund Companies: Evidence from a telephone survey. International Journal of Managerial Finance. (3). pp 49-69.

- Durham, J. B. (2002). The effects of stock market development on growth and private investment in lower-income, 3, 211–232.

- Edelen, R., Warner, J. (2001). Aggregate price effects of institutional trading: a study of mutual fund flow and market returns, Journal of Financial Economics, 59, 195–220.

- Grinblatt, M., Titman, S. and R. Wermers. (1995), “Momentum Investment Strategies, Portfolio Performance, and Herding: A Study of Mutual Fund Behavior.” American Economic Review, Vol. 85, No. 5, pp. 1088-1105.

- Ila and Shah (2008) “Investment choices of Foreign and Domestic Institutional Investors” in NIPFP_DEA Research Program on Capital flows and their consequences.

- Mukherjee, P. and Roy, M. (2011), “The nature and determinants of investments by institutional investors in the Indian stock market”, Journal of Emerging Market Finance, Vol. 10, No. 3, pp. 253- 283.

- Sehgal, S. and Tripathi, N. (2009), “An Examination of Home Advantage (Bias) Argument in the Indian Financial Markets: Domestic Financial Institutional Investors (DFIIs) Visa-Vis Foreign Institutional Investors (FIIs)”, Asian Journal of Finance & Accounting, Vol. 1, No. 2, pp. 163-174.

- S S Kumar “Role of Institutional Investors in Indian Stock Market” by, International Journal of Management Practice & Contemporary Thoughts.

- Themozhi and Kumar (2008) “Dynamic interaction among Mutual fund flows, Stock Market returns and Volatiltiy” in NSE India, Research Paper series.