Subscribe now to get notified about IU Jharkhand journal updates!

Impact of Notifications on operational efficiencies of GST in India

Abstract :

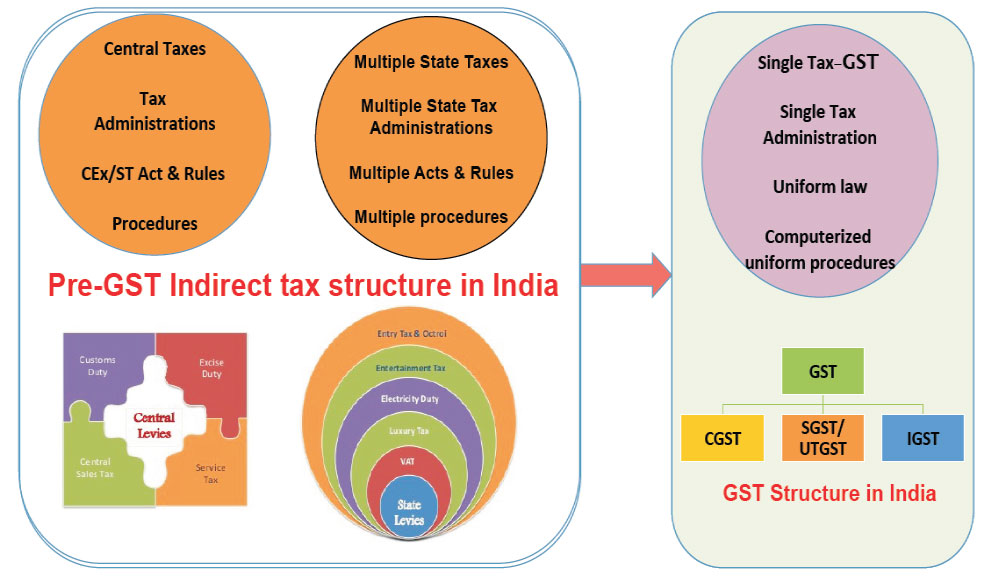

GST system has brought “one nation –one tax” concept to India. On 1st July 2017 Goods and services tax put significant impact reforms on indirect tax in India. GST brings amalgamating a large number of state tax and central tax into one tax system. In this paper an attempt has been made to assess the awareness operational efficiency and problems of GST through various notifications by the department of financial services, Ministry of Finance, Government of India. The present analysis is based on the period from 19th June to 2017 to 30th November 2018. It specifically focuses on a brief analysis of Central Goods and Service Tax (CGST) notification, CGST rate notification. Indirect taxation helps the systems towards the free flow of goods and services in an economy and also removing the cascading effect of tax. The collection of data's is made from secondary sources i.e. articles (both online & Print), journals, existing articles of ICMAI materials on the compilation of GST notifications and circulars, on various newspapers and websites. This article is acts as eye- opener for the students, professional sand end- users for creating awareness GST & its implementation. It brings conceptual understanding for the readers including students as well as discharging professional's duties. From the analysis, it was clearly understood that still, the concept is complicated as compared to other countries.

Keywords :

GST, CGST, IGST, Operational, cascading effect.Introduction:-

GST was introduced as latest reforms in the Indirect tax

structure. It was came into force in 1st month of July

2017. In many countries it was already introduce as a

replacement of sales tax systems. GST will be levied its

charges on sales, manufacturing and consumable

goods and services items in and around India. Since

1947 GST was considered as most powerful and biggest

tax reforms of India till date. Sales Tax, VAT, Excise

duty and other taxes was removed under this GST

systems .This GST systems will be very much useful for

the customer point of view because it will help to pay

separate tax in state level as well as central level. GST is

consider as “one nation one tax “The amendments

announced and declared through CGST notification.

Clarification have been communicated /provided by

GOI on various issues through circular. This paper is

based on the available materials on notification and

circulars for first one and half years of GST i.e 1st July

2017 to 30th November 2018.

Indian taxation system GST, is acting as harmonized

road to indirect tax system which flexibility to journey

of Indian economy.

Reviews of Existing Literatures

- Lourdunathan F and Xavier P (2017) this paper focuses on “challenges and prospects of implementation on GST” it concludes as One nation, one Tax structuret of GST will provide relief to producers, the consumers and burden from several tax .

- Aastha Sharma & Akansha khurana (2016) paper highlights on “GST in India- A positive reforms for indirect tax system” which gives relief to consumers, producers and providing wide range of service tax set-off, input credit set-off.

- Pradeep Chaurasia et.al (2016) this paper is based on “Role of goods and services Tax in the growth of Indian Economy” it reveals that GST will be acting as developmental wepon towards Indian economy and it helpful in improvement of countries GDP.

- Hamdani Rizwana (2016) is explaining in his paper “GST and Indian Economy” GST will increase the job opportunity and this lead to stability in the country, which needed for development of economy. lRaj Kumar (2016) discussed in his paper on the impact of GST on Indian economy. It gives a comparative analysis in between GST and Current taxation system.

- Milan deep kour, kajal Chaudhary, sujan singh (2016) studies on the impact of GST after its implementation and represented that the terms & condition of Indirect Tax and the GST, challenges and advantages for GST system.

- Monika Sehrawat, Upasana Dhanda (2015) defined goods and service tax and the key tax reform and explain the concept, feature, advantages and challenges of GST.

- Dr. N. Bagyalakshmi (2015) studied that impact of GST on different sectors and challenges for implementation of Goods and services tax and founded those benefits of introduction of GST and suggested various measures to overcome challenges of GST.

Objectives

The objectives of this paper will be-:

1. To make sequential analysis of the contents of the

notifications on Goods and Service Tax in India.

2. To analyze the impact of GST notifications on the

operational efficiency.

3. To identify the various problems which are associated

with implementation of GST in India.

Methodology

Present study is descriptive analysis of facts. It uses exploratory technique. The data are collected from the secondary sources i.e. articles (both online & Print), journals, existing article of ICMAI materials on compilation of GST notifications and circulars, on various newspapers and websites etc...

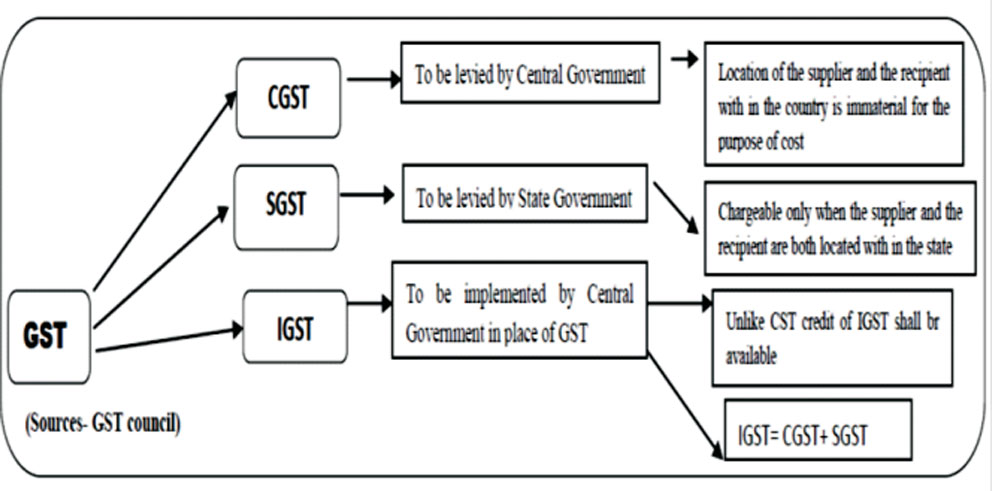

CGST Notification – Summary of all notification

CGST is based on tax levied on Intra State supplies of

goods and services imposed by Central Government

and the same will be governed by the CGST Act.

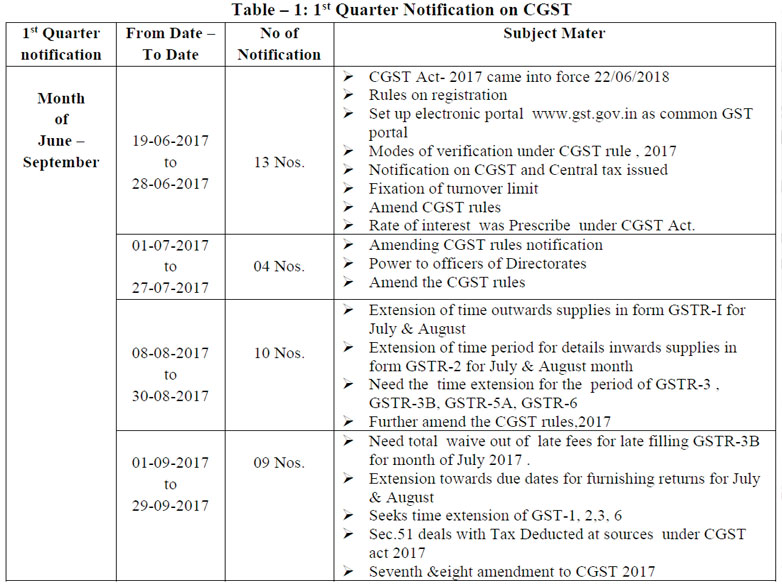

Analysis of 1st Quarter

In the inception stage of GST, Notification is act as

conceptual weapon against existing taxes like vat, sales tax.

It brings single tax concept to India. Specified website was

opened as a common GST portal. CGST rules 2017 was

enacted with the motives to fix of turnover limit for

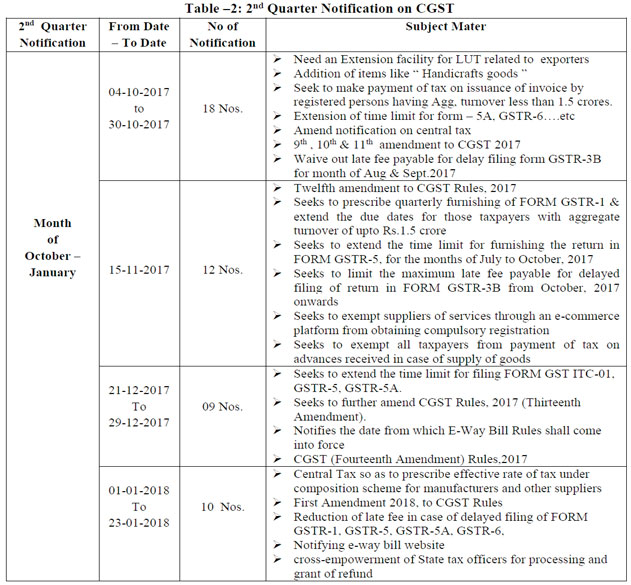

Analysis of 2nd Quarter

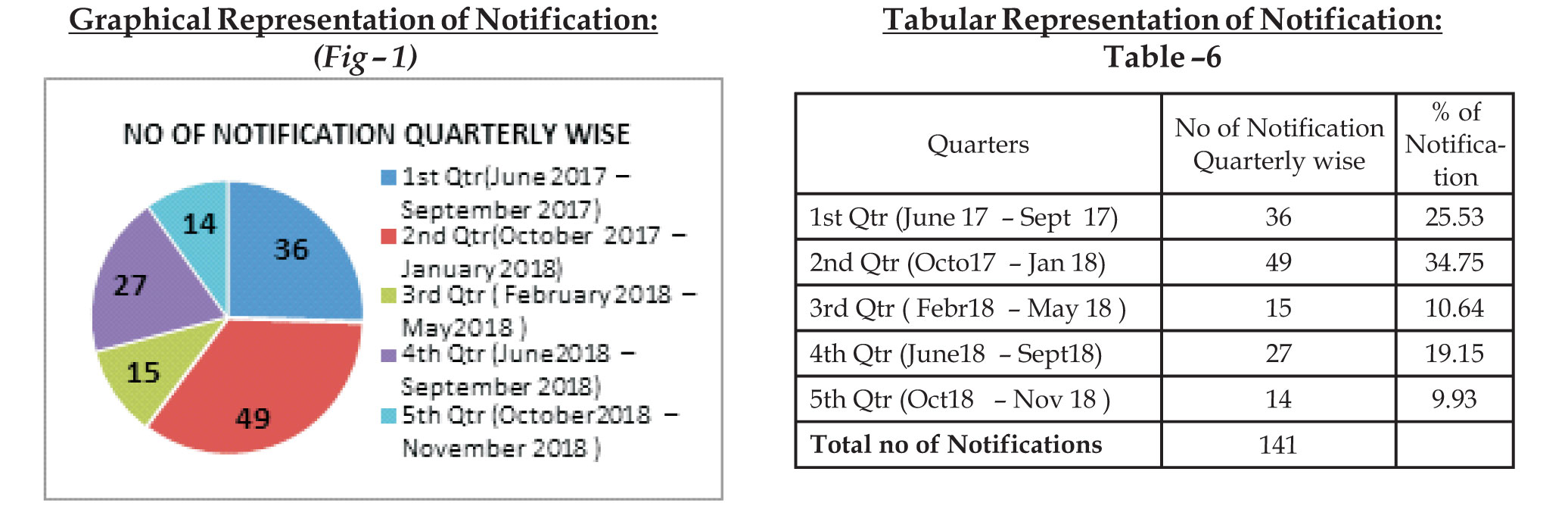

It is the quarter which bring highest no of notification .i.e.49

which is 35% total notification under period of our study.

Later of undertaking (LTU) was extended for exporter of

goods. Handicraft items are included under CGST.

Relaxation of Compulsory registration for suppliers of

services made on e-commerce basic platform. E-Way bill

rules come into force in 2nd quarter. In 1st amendment of

2018 in rules of CGST introduce 14 valid points starting

from filing GST ITC-03 to First Amendment 2018, to

notification of EWB guidelines. www.ewaybillgst.gov.in

will be electronic payment of way bill. On the last part of 2nd

quarter they took important decision on refund process of

exported good I.e. sanction authority will decide rate of tax.

different transaction. Power given to different directors. 1st

quarter is based on eight amendments to GST. It deals with

goods service tax rates GSTR-3, GSTR-3B, GSTR-5A,

GSTR-6. Due to early stage of adoption it needs lot of

time extension for inwards/outwards supplies and fees

waive out option related to late payment of GSTR.

Analysis of 2nd Quarter

It is the quarter which bring highest no of notification .i.e.49

which is 35% total notification under period of our study.

Later of undertaking (LTU) was extended for exporter of

goods. Handicraft items are included under CGST.

Relaxation of Compulsory registration for suppliers of

services made on e-commerce basic platform. E-Way bill

rules come into force in 2nd quarter. In 1st amendment of

2018 in rules of CGST introduce 14 valid points starting

from filing GST ITC-03 to First Amendment 2018, to

notification of EWB guidelines. www.ewaybillgst.gov.in

will be electronic payment of way bill. On the last part of 2nd

quarter they took important decision on refund process of

exported good I.e. sanction authority will decide rate of tax.

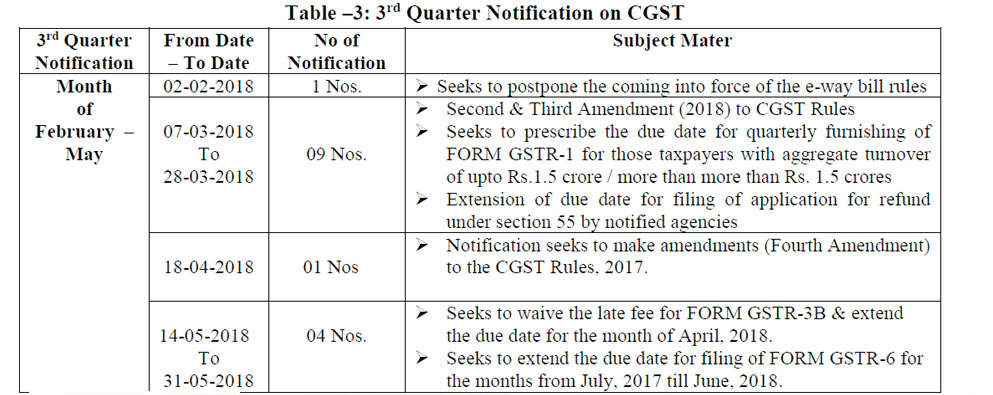

Analysis of 3rd Quarter

It is the second lowest of Notification of 15 nos which is 11% of total notification. Application for refund of tax paid on

inward supplies should be paid before the expiry of 18 months from the last date of the quarter.

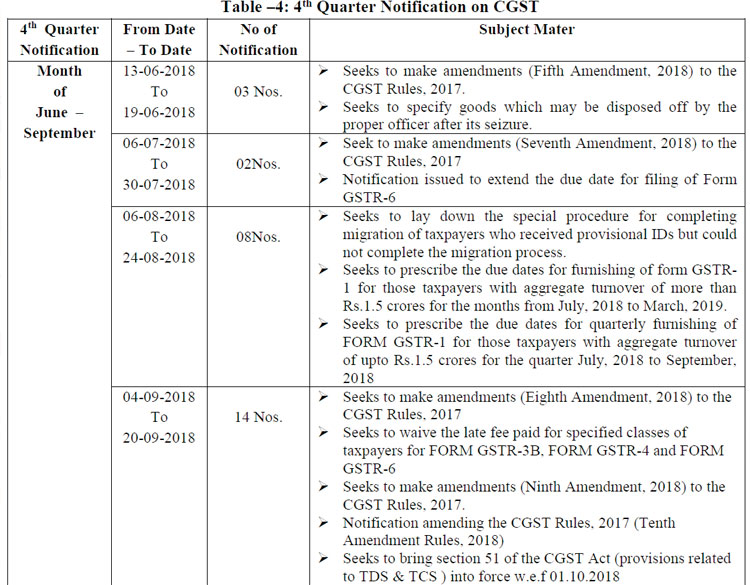

Analysis of 4th Quarter

For being enroll as GST tax practitioner a person must be a sales tax practitioner/tax return preparer as per existing law for

a time period of not less than 5 years and answer the prescribed exam within 18 months. The time period was 12 months

before this notification. A transporter can apply for an UCRN (unique common enrolment number) by submitting the

details in FORM GST ENR-02 by using any one number of GSTINs. Time limit for file Form GST ITC-04 was from July 2017

to June 2018 and further extended to till 30th Sept 2018. GSTR-9C i.e is dealing with reconciliation statement to be

furnished along with annual returns. As per thus act TCS provisions will be effective from 1st Oct 2018 under GST. Rate of

o.5% rate will be collected by TCS under CGST Act on the value of net taxable supplies.

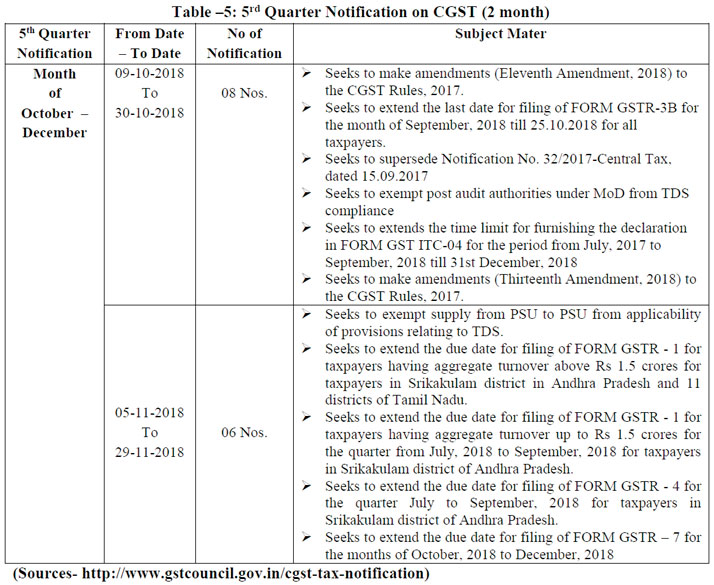

Findings of 5th Quarter

Though we took 5th quarter but as per our analysis it is from July 2017 to November 2018 so in the last quarter we only have

two months which is taken for consideration. CGST rules 2017 restore rule 96(10) which is meant for refund of IGST paid

on exports. Ministry of Defence exempted from TDS compliance from Post audit authorities. TDS provisions exempt from

Supply of goods and/or services from a PSU to another PSU. Extnsion of return filling for cyclone (Titli) affected region of

Srikakulam, Andhra Pradesh.

From 1st October 2018, TDS provisions were applicable. The first return in GSTR-7 was revised for month of Oct. 2018 will

be on 10th Nov. 2018. The extension for filing GSTR-7 will be extended for dedicator from Oct. 2018 to Dec. 2018 up to 31st

Jan. 2019.

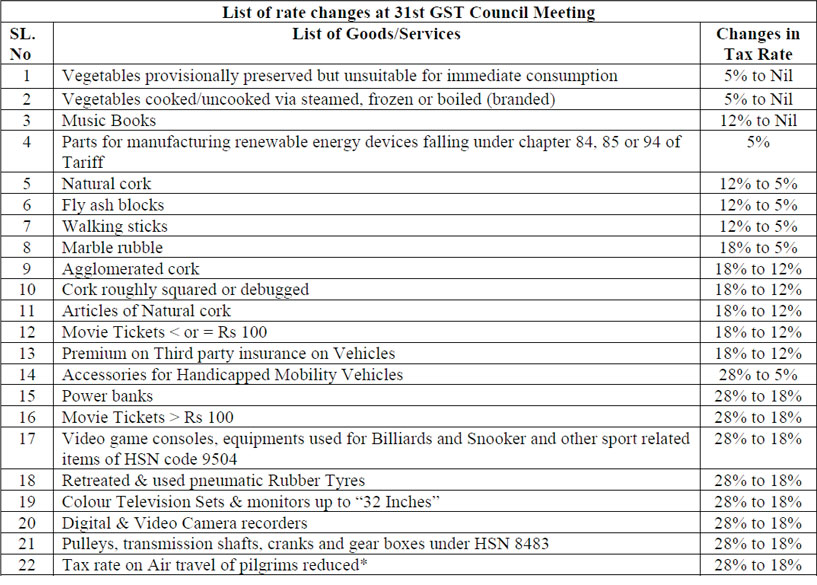

Operational Efficiency of GST Notification

Operational efficiency of GST should be possible only after

the successful implementation GST Regime. Transaction

with Cut-off dates post or near to its implementation need

its re assessment to avoid any negative impact caused by

changing tax rates. Changing Rate as per need of the hour

by looking at growth and development of Tax system

should bring operational synergies/efficiency to the

systems.

For travel by non-scheduled and chartered operations

for religious pilgrimage , facilitated by Govt of India

under bi-lateral agreements.

Others:

—5% GST rate on the composite supply of goods where it

also include supply of construction services and other

goods for solar power plant, is now levied as follows:

5% GST will be for 70% of value of supply of goods

Remaining 30% of the EPC contract value is supply of

service

—Rate of 5%/18% on footwear.

—12% Uniform GST rate on Flexible Intermediate Bulk

Container (FIBC)

Goods recommended to be exempted

—Supply of gold by Nominated Agencies to exporters of

gold Jewellery.

—Gifts received by President, Prime Minister, Governor or

Chief Minister proceeds of which is used for public or

charitable cause may be used for auction.

—IGST and Compensation cess can be exempted for

Vehicles imported for temporary purposes under the

Customs Convention on the Temporary importation of

Private Road Vehicles.

Services recommended to be exemption

—Banks Services supplied to Basic Saving Bank Deposit

account holders under Pradhan Mantri Jan Dhan Yojana.

—Rehabilitation Council of India Act, 1992 includes

Services supplied by rehabilitation professionals at

hospitals, schools or rehabilitation centres established by

Government or charitable institute registered under

Section 12AA of IT Act, 1961.

—Loan guarantee services provided by Government to its

undertakings and PSUs for bank loans.

(Sources- https://cleartax.in/s/gst-rates)

Problems in Implementing GST

“Although, the introduction of GST a year-ago led to

consolidation of multiple taxes, thereby simplifying

processes, its implementation is taking time for customers

and logistics companies as they are getting accustomed to

the changed systems and the benefits it can offer. While the

transactional part is getting stabilized with unbilled

revenues reducing, we are witnessing delays in finalizing

the new orders from customers. Customers are still

grappling with their post-GST strategy and this has

impacted the new business acquisition” by Pirojshaw

Sarkari.

— Compliance Journey has miles to go : Due to damper

in compliance process of GST, as a result of which

technology took more time as compared to

anticipated time to resolve the issue. Initial steps

adopted was suddenly taken out by committee

looking at struggle facing by business houses to meet

the requirement of compliance. From the analysis of

notification we founds a lots of correction has been

made in the second quarter of implementation.

— Involvement of High software installation cost: by

looking at present trend every business has to update

their manual systems to automated machine system

with installing ERP software for GST complaint.

Software's are costly in nature. All this new adoption

process leads to increasing cost of organization.

Cleartax is the 1st company in India to launched

readymade GST software.

— It deals with Dual Control: Business was controlled by

indirectly by both the center and state related to tax

calculation. Many cases state will lose its autonomy on

rate of change the tax rate as regulated by GST council.

It is act as a compulsion for the state to implement the

tax.

— Problems related to cumbersome registration system:

Due to multiple registration requirement of brings lot

of complicacy for industry and business. companies

have not interested towards approaches of GST due to

the multiple audit and assessment due to multiple

registration.

— Complexity due to crop up of new Cesses: GST have

scrapped a multiplicity of taxes and cesses in every

quarter for all types of goods. It includes automobiles,

sugars etc needs to be examined thoroughly to

understand its complicity.

— Problems related to the refund process for export: The

mechanism associated with exporters, which accounts

for data matching law have create difficult situation

for refund process. It is a burden for SME which affect

their day to day operating.

Conclusion

The implementation of GST is really remarkable achievement of India government but still it is in its early stage of its adoption. The concept behind GST is very positive for its entire stakeholder. After 1 year of implementation now time comes for Indian Govt. to stabilize the whole system by removing the uncertainty, facilitate compliance by easing processes and expanding tax base of GST to provide successive progress to both India as well as Its Govt. we have taken total 141 no of GST notifications from 19th June to 2017 to 30th November 2018 systematically and find out that it had came across lots of ups and down for meetings the requirement. Public acceptance to these GST systems is comparatively less to earlier tax systems. The impact of GST notifications on the operational efficiency is quite satisfactory because it could able to bring changes on rate of taxes as per demand of Public, business houses and Industrial Units. According to American Actor Jimmy Dean, “I can't change the direction of the wind, but I can adjust my sails to always reach my destination.” Similarly, the reality is GST already implemented and hence all have to accept the reality with individual adjustment. Problems are reduces in 5th quarter as compared to 1st quarter but still it needs to special attention for making GST systems Error frees Tax systems. In short term GST may be looks confused, critical and uncertain but if you look on the medium or long term prospective it will help full to India in the context of cost reduction, efficiency enhancement and increasing overall efficiency in global market.

References

- lLourdunathan F, Xavier P. A stuy on implementation of goods and services tax (GST) in India: prospects and challenges. International Journal of Applied Research. 2017; 3(1):626-629.

- Akansha Khurana, Aastha Sharma. Goods and Services Tax in India- A positive reform for indirect tax system. International Journal of Advanced research. 2016; 4(3):500-505.

- Chaurasia Sing, Sen. Role of Goods and Services Tax in the growth of Indian Economy. International Journal of Science Technology and Management. 2016;5(02):152- 157.

- Hamdani Rizwana. GST and Indian Economy. International academic Institute for Science and technology. 2016; 3(9):1-6.

- Raj Kumar. Comparison between Goods and Services Tax and current taxation system-a brief study. International Journal of Allied practice, Research and Review. 2016; 3(4):09-16.

- Monika Sehrawat, Upasana Dhanda (December 2015) “GST In India: A Key Tax Reform” International journal of research granthaalayah, [Sehrawat et.al., vol.3 (Iss.12): December, 2015.ISSN-2350-0530(O) ISSN-2349-3629(P) lDr. N. Bagyalakshmi “Impact of GSTon various sectors and challenges for GST Implementation” (2015) ISBN: 978-81-924180-4-9.

- Milandeep Kour, Kajal Chaudhary, Surjan Singh, BalijinderKaur “A study of impact of GST after its implementation” (Nov.2016) International journal of innovative studies in sociology and humanities, volume: 1 issue: 2| November 2016.

- http://www.gstseva.com/gst-rate-worldwide/

- http://www.gstcouncil.gov.in

- https://cleartax.in/s/gst-rates

- Sources-https://www.pwc.in/assets/pdfs/indiaservices/ indirect-tax/365-days-of-the-gst-a-historicjourney/ a-historic-journey.pdf

- http://www.businessworld.in/article/GST-Enhances- Efficiency-Reduces-Operational-Costs/22-09-2018- 160165

- https://www.sgco.co.in/gst-journey-so-far.php