Subscribe now to get notified about IU Jharkhand journal updates!

Need Gap Analysis of Online Taxi Aggregation Business

Abstract :

Since the time the online taxi aggregator companies like Ola and Uber have started their operations in the Indian market, they have brought about a disruption in the market with the help of technology and mobile phone. There is no denying that the commuter has greatly benefited from the services of these taxis but there is still scope for the online taxis to further improve their services. This study was carried out to find the gaps that exist within the online taxi aggregation business through analysing the satisfaction level of the drivers as well as the users by doing primary research. The scope of the study was to reach individuals who use online taxi service to travel as well the drivers who are connected with Ola, Uber & Jugnoo. The area which was targeted for the study was the city of Indore as it has a good market for taxi aggregation business. This study involved primary and secondary research. As a part of primary research, a survey was conducted to get the data of drivers as well as users. The important information related to the taxi industry was also gathered through secondary research, which was carried out through various journals, articles, and reports. The results of the study suggest that companies should focus on quick settlement of wallet money to the drivers. Customers were not satisfied with high cancellation charges and expected better upkeep of cabs along with the safety and availability of women drivers. These gaps are opportunities for any new cab aggregator to plug in the service quality gap for both drivers and commuters and increase their customer base.

Keywords :

online taxi, commuter, industry, women drivers, customer base.Introduction

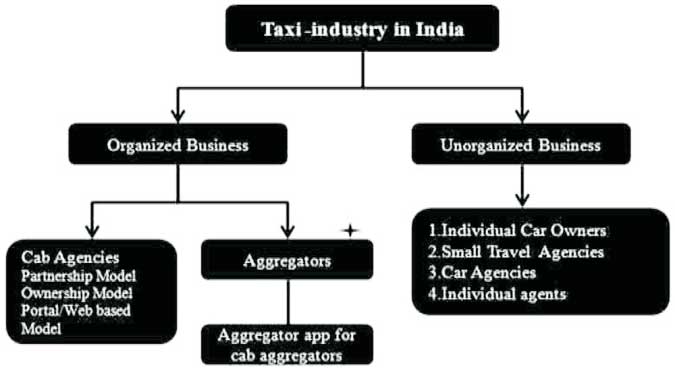

India is a developing nation and with this ongoing development of the country is the rising needs and wants of the customer. Since not all belonging to the middle class family can buy a personal vehicle for use, they have to use public transport for travelling. One of the most important source of transport for the public is auto taxis and cabs for daily commuting to work, airport, railway station etc. Taxi Industry is having two types of markets: organised and unorganised. Unorganised market consist of individual car owners, small travel agencies, car agencies and individual agents. The organised market consist Cab Agencies, Partnership model, Web Based model and the very important Aggregators which is also a web based business. The unorganised market of taxi industry are slowly adopting the organised way of doing business because they are getting automatic business from it and there is no need of negotiation with the customers. Technological changes brought a big change in the taxi industry as well. Finding and getting a cab or taxi for short distance within a kilometre was a very difficult task few years back and it was inconvenient for the users as well. The organised market established in 2001 with Mega cab which was started in Mumbai where taxis could be booked by call. It was started with the objective to provide safety, comfort and reliability to the customers by charging less price. Since the time the online taxi aggregator companies came into the market, they have brought about a disruption in the market with the help technology and mobile phone. The aggregators don't own any cabs or drivers. All they do, is to facilitate to connect the customer with the cab drivers through the technology and mobile phone. The aggregation has grown with very good speed and the number of aggregators of autos and cabs are increasing. It has emerged as the most popular business model which is operated by many big players like Ola, Uber, Jugnoo, Taxi for Sure etc.

Figure-: Taxi Industry in India

(Source: Redseer Consulting presentation,

published in Automotive dated April, 2015,

www.in.com/automotive)

Despite the presence of these aggregators for some

years now, there are still issues like availability,

price, on time arrivals etc. faced by users and there

are some business related concerns of the drivers.

This research is aimed to identify the problems faced

by drivers who are connected with aggregators as

well as problem faced by the users while using this

services from taxi aggregators.

Literature Review:

There is a revolutionary change India is witnessing in the taxi industry. The cab industry in India have both organised as well as unorganised sector. The usage of mobile application is the result of technology progress which has resulted in simplifying the way commuters can hire and use transportation services. It is this technology which is playing a major role to run the organised taxi industry. Ola, Uber and Jugnooare most popular in India and the companies try to connect the drivers to get more and more commission out of it. (Sarvepalli & Prakash , 2016). The cab industry has seen a very significant growth in recent times and there exists three different models of operating taxi services in India viz. (a) Marketplace/Aggregator model where the drivers register themselves with fleet operators like Uber, Ola Meru etc. Smartphone is essential as a communication device and the customers can reach out the aggregator through their application; (b) Cab- Sharing model – This was introduced in January 2015 in India by BlaBla and it facilitates people having private vehicles to know about each other's travel plans and share the cab wherein there is a ceiling cost set by the company based on the route travelled and (c) Self-Drive model – This was popularized by zoom cars in India where the company provides cars on rental basis to commuters and charges them on an hourly or daily basis wherein the payment is made in advance(Pandya, Rungta, & Iyer, 2017). The driver's professionalism and convenience of booking impacts the overall satisfaction of the customer (Khan, Jangid, Bansal, & Tyagi, 2016). Instances where companies fail to provide value to the customers have served as opportunities for the competitors to snatch away the customers and cause loss through customer defection to competition. Cab aggregators therefore need to focus on building long term relationships with the customers, offering higher level of satisfaction, thereby resulting in an increase in customer loyalty and retention. Gaps in service quality also needs to be identified and certain service recovery strategies should be in place to provide instant solution to customers in case there are failures in delivery of service (Malik & Bansal, 2017). Some studies measured the performance of taxi aggregators service to satisfy their customers and quality of service. Some performance metrics such as responsiveness, flexibility, reliability, profitability and resource utilisation have been found to be the important parameters valued by customers while booking cab services (Venkatesh & Easaw, 2015).

Objectives:

In the recent years with a rapid growth in aggregation business, the usage of this service has witnessed a marked increased. Despite the presence of these aggregators for some years now, there are still issues like availability, price, on time arrivals etc. faced by users and there are some business related concerns of the drivers. This research is aimed to identify the problems faced by drivers who are connected with aggregators as well as problem faced by the users while using this services from taxi aggregators.

Research Methodology:

For the purpose of the study, primary research was

used to study the market and to fetch some other

necessary detail. For the purpose of finding need gap

analysis of online taxi aggregation business in

Indore, separate questionnaires were prepared for

both drivers as well users. The scope of the study

was limited to surveying the drivers as well users of

Ola, Uber and Jugnoo.

Convenience sampling method was used to reach

out to drivers and consumers and get the survey

form filled. 57 drivers and 205 customers we

resurveyed in order to identify their issues and

concerns related to Uber, Ola and Jugnoo services.

Secondary research of published literature was

carried out to fetch the details related to taxi industry.

Data analysis was carried out using excel and spss.

Hypothesis:

Since both Uber and Ola are available in every city, it

can be assumed that both are equally preferred by the

customers. Further it is assumed that there should be

no gender based significant difference in the

preference of the cab service. Based on these

assumptions the null hypothesis framed are as

follows:

H10: There is no significant difference in customer 0

preference for Ola versus Uber versus Jugnoo

H20: There is no gender based significant difference 0

in the customer preference for Ola versus Uber versus Jugnoo

Data Analysis and Interpretation:

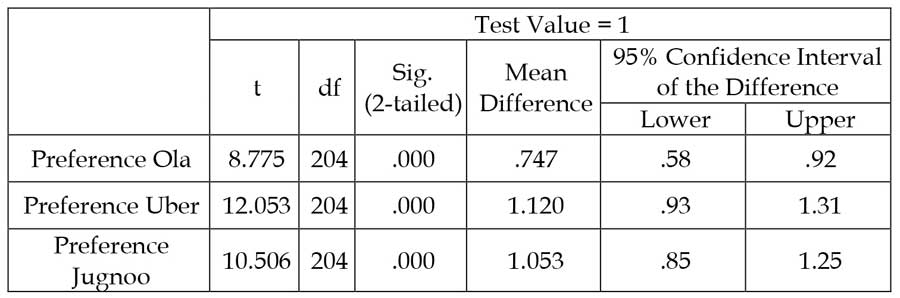

One sample t-test was conducted to identify if there was any difference in preference of customers for Ola, Uber and Jugnoo.

Table 1: One-Sample Test

From table 1 it can be inferred that since the

significance level is below 0.05 there exists a

significant difference in the preference of the

customers for the different taxi aggregators.

Therefore the null hypothesis H1 is not accepted and 0

it is inferred that customers do not exhibit similar

level of preference for the different taxi aggregators

operating in their city.

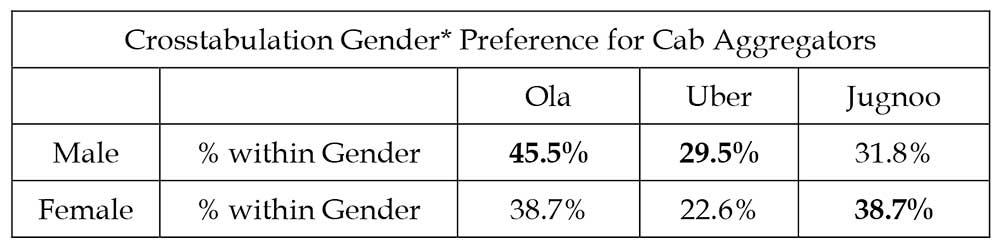

Crosstabulation analysis was carried out to analyse if

there existed gender wise difference in preference for

cab aggregator (Ola, uber and Jugnoo)

Objective of paperTable 2: Crosstabulation Gender*Preference for Cab Aggregators

The cross tabulation analysis in table 2 depicts there exists a gender based difference in the preference for the different cab aggregators. Males generally preferred Ola or Uber cab whereas the females expressed higher preference for Jugnooautorickshaws. This preference percentage was same as their preference for Ola cabs (38.7%). Therefore the null hypothesis H2 cannot be accepted and it can be 0 inferred that there is a gender wise difference in the preference for cab aggregator.

Responses from Drivers:

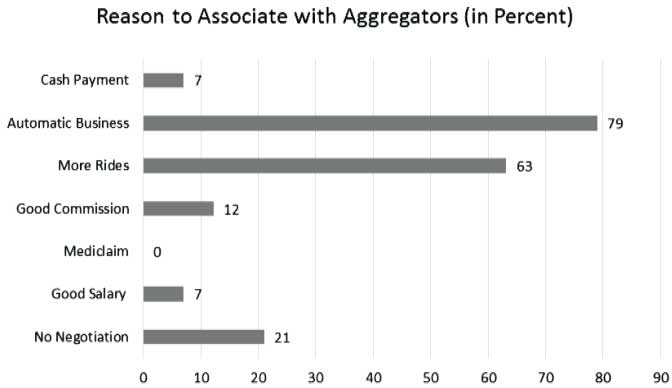

From the sample of drivers' responses, it was observed that majority of drivers belonged to the age bracket of 21 to 40 years (82%) while 10% were in the age bracket of 41 to 60 years. 82% of the drivers had their auto-rickshaws connected with Jugnoo. Further 60% out of these 82% drivers had their taxis tied up with Ola cab aggregator. Only 12% of the cab drivers surveyed had their cabs connected with Uber cab aggregators. The survey also revealed that 90% of the drivers were owning the auto/cabs and only 10% of drivers were driving rented vehicles provided by the company. 56% of the drivers preferred cash payment over online payment. Remaining 44% were satisfied with both cash and wallet payment. The reason cited for preferring cash over wallet payment was because the drivers who received wallet money from passenger did not receive the amount from the company on the same day. Cash was needed by drivers to fulfil their day to day needs of fuel, gas and maintenance of their vehicle which was not fulfilled by wallet payment like Ola money, as the remittance of this wallet money took as long as a week or even 10 days. As per the sample responses, around 79% of the drivers responded that they were connected with the service provider because it provided them automatic business. 63% of the drivers responded that they benefitted in terms of more rides in comparison of unorganised market.

Figure- 2: Reasons to Associate with Cab Aggregators (in Percent)

Further 21% of the drivers responded that there was

no hassle of price negotiation with the customers

since the time they have got associated with the cab

aggregator.

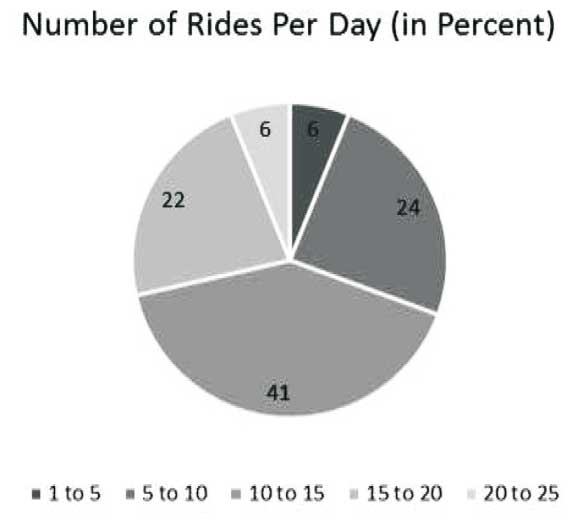

As per the survey, 41% of the drivers were able to

complete 10 – 15 rides in a day, 24% of the driver are

able to complete 5 – 10 rides in a day and 22% of the

drivers could complete 15-20 rides per day.

Figure-3: Number of Rides Completed Daily

Further most of the drivers (68%) got the ride

distance of 3-5KM for a single trip. 55% of drivers

reported to be working for more than 10 hours a day

which fetched them good earning. Data analysis also

revealed that around 66% of the drivers earned

between 10 – 20 thousand per month. Those cab

drivers who operated for more than 10 hours daily

could earn more than 30 thousand rupees per month.

With regards to the commission charged by the

aggregators, Jugnoo charged 10% from the drivers

while Ola charged 20% from the drivers.

The survey also revealed some problems as well

expectations of the drivers from the aggregator

companies. Drivers expected to be charged less

commission by the aggregator companies and also

desired to remittance of wallet payment the same

day or maximum within 24 hours. The drivers also

desired that they should be paid some sort of pickup

charges from the company as they usually have

to travel 2 to 3KM for pick-up and for the same, they

get nothing.

Responses from Consumers:

The consumer data collected during the survey

revealed that the maximum users (44%) were in the

age bracket of 21 to 30 years of age followed by 24%

in the age group of 31-40 years and 16% were above

40 years of age. Further 52% of users were males and

48% of users were females. 42% of users used the

aggregator cab services for personal trips whereas

32% of users used it for travelling to airport and

railway stations. Further 20% respondents stated

that they used it for daily travelling to their work

place. The survey results indicated that 54% of the

customers undertook up to 5 per month while 16%

of users undertook 5 to 10 rides monthly. Another

16% of the respondents claimed that they took

somewhere between 10 to 15 rides monthly using

the app of the cab/auto aggregator. 54% users

usually travelled 5 to 10 Km for a particular ride

where as 24% of users travelled up to 5 Km in a

single trip.

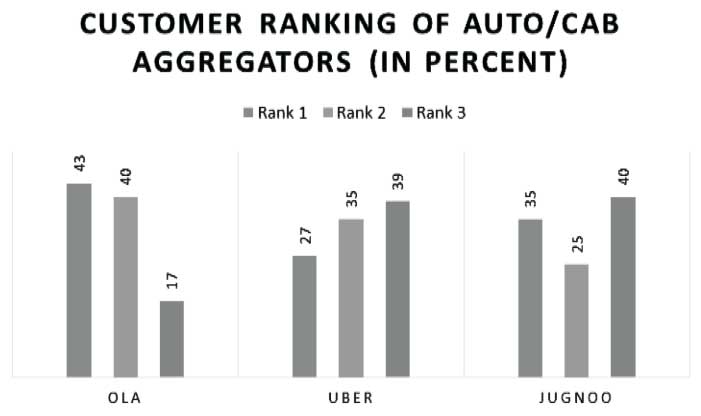

As per the customer responses of market survey,

43% of the respondents gave highest rank to Ola

cabs while for Uber only 27% of the respondents

gave the highest ranking.

Figure- 4: Customer Ranking of Auto/Cab Aggregators

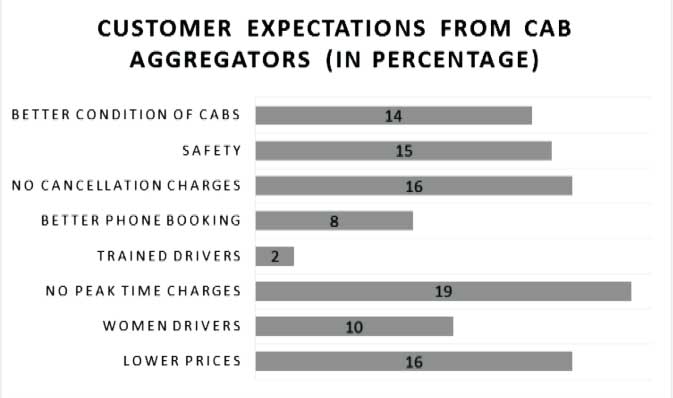

78% of the respondents preferred cash mode of payment instead of any other online payment. 60% of the respondents preferred taking auto rickshaw (Jugnoo) while travelling alone, 10% of the respondents preferred taking shared cab services and 26% of the respondents preferred booking the cab services exclusively for their use. As per the sample data, pre- disclosed price got the 1st rank in preference over others. Safety & security and 24- hour availability got the 2nd and 3rd rank respectively. With regards to the problems faced by commuters while using these services, the fluctuating fares received the highest ranking (48%) followed by delay in arrivals of the cabs (27%). High cancellation charges was ranked third (13%) and finally the cacellation of cab by the driver (8%) and preference of the driver for cash only as the mode of payment (4%) were ranked fourth and fifth by the respondents. 19% of the passengers expected 'no peak time charges' in the cab services. Some other services like lower prices, trained drivers, no cancellation charges, etc. are also expected by the passengers.

Figure-5: Customer Expectations from Cab Aggregators

Conclusion:

The motivational part for the driver to be connected with service provider is automatic business and more rides as compared to unorganised market. For customers too, the convenience of booking a cab from their location and getting assured of the availability of cab has been a welcome change in the way taxi rides are taken in present times. Besides the plus points there are certain areas which need improvement in this taxi service. Through this research some gaps have been identified which if fixed can result in better service to the customers and increased business to drivers and ultimately the cab aggregator. Firstly the drivers need cash in hand for the fuel and upkeep of their vehicle. In absence of timely remittance of the wallet money to the drivers (sometimes the money is transferred to their account after 10 days), there is demand from the drivers to the customers for payment through cash. Many a times this does not go well with the customers and they are in a fix when the driver cancels the ride on the condition of being paid by cash. Secondly the drivers expect some medical and insurance policies for them and also are dissatisfied by the high commission being charged from them by the cab aggregator. The customers especially look for safety while travelling in the cab. However, with frequent instances of theft or molestation of female passengers by divers of cab aggregators has put down the image of the company. Ladies feel safer travelling in Jugnoo auto-rickshaws as compared to cabs. The cab aggregators need to take this service gap very seriously and ensure safe ride for the passengers. Last minute cancellation of ride by the customers is a problem faced by the drivers since many a times they are on their way to pick up the passenger from the location mentioned and in instance of cancellation of cab by the customer, there is a loss of money for the distance travelled for pick. The drivers also said that many a times they have to travel 3-4Kms to pick up a passenger for which they are not paid by the cab aggregator and this is one very important dimension which drivers expected the cab aggregators to address. On the other hand the customers also are troubled when last minute ride is cancelled by the driver as they feel stranded and helpless when there is shortage of these cabs at peak times. The high cancellation charges is another area of dissatisfaction cited by the customers. Some of the cabs are not well maintained and the customer at times feels cheated because of the premium price which he/she is paying for the service does not justify the quality of the vehicle and the service provided.

Managerial Implications:

With the growth in the online taxi aggregation business, there are higher chances of more companies entering this business and this will increase the competition. Further with the option of going for self- drive car rentals like Zoomcars, Mychoize, Car on Call, Mdrive etc. there might be a dent on the car aggregation business when it comes to outstation booking. It is therefore essential that there is an increased focus on service quality and also the relationship of the cab aggregators needs to be stronger both with the drivers and customers. Only then they would be ready to face the ever increasing competition and increase the bottom line of the company. Further the gaps identified through this research can be useful in providing insight to cab aggregators who wish to make an entry into this business space.

References

- Khan, A. W., Jangid, A., Bansal, A., & Tyagi, V. (2016). Factors Affecting Customer Satisfaction in the Taxi Service Market in India. Journal of Entrepreneurship & Management, 5(3).

- Malik, G., & Bansal, S. (2017). Analyzing the Criticality of Service Level in Cab Aggregating Indus t ry on Cus tomer Expec tat ions , Satisfaction, and Retention. Indian journal of Computer Science, 2(1), 30-38.

- Pandya, U., Rungta, R., & Iyer, G. (2017). Impact of Use of Mobile Apps of Ola Cabs and Taxi for Sure on Yellow and Black Cabs. Pacific Business Review International, 9(9), 91-105.

- Sarvepalli, M. K., & Prakash , N. M. (2016, April). CAB AGGREGATION INDUSTRY IN INDIA. Department of Marketing, 1(4).

- Venkatesh, G., & Easaw, G. (2015). Measuring the Performance of Taxi Aggregator Service Supply Chain. Service supply chain, 26-36.