Subscribe now to get notified about IU Jharkhand journal updates!

Retail E-Commerce Sales Performance Of Asian-Pacific Countries

Abstract :

This paper focus to recognize the key performer of e-commerce sector in the Asian pacific countries. The researcher has chosen the Asian specific countries such as China, Japan, South Korea, Australia, India and other Asian countries. The retail e-commerce data has been taken for the period of 2014-2018 which was retrieve from the web source of www.emarker.com and the internet user data was taken from the www.internetworld.com. The researcher used percentage analysis for to find out the key performer of the e-commerce sector. In the result, china is play vital role in the e-commerce among Asian pacific countries.

Keywords :

E-commerce, internet, Asian pacific countries, Percentage analysis.Introduction

Marketing is a way of life for every kind of business in the world. Marketing is not only limited to selling goods for earning profit but also to satisfy the needs of the consumers. Modern marketing is the need of the day. It refers to the identification of the needs of the consumers and organizing the activities to meet their expectations. Mahatma Gandhi said the customer is an important visitor and he is giving the opportunity for the business firms to serve him. The present business has to focus on the concept of “consumer delight” setting back consumer satisfaction. Modern marketing activities involve the need identification of consumer with regard to products and services with obtaining goods from the suppliers through the transfer of ownership. It is the process of discovering what the consumers want, when they want, where they want, at what price they want ultimately aiming at consumer satisfaction. The five major aspects in marketing are production, product, sales, marketing and societal marketing.

E-Commerce

“The E-Commerce industry is a force that no investor

can afford to ignore”- Cushla Sherlock Electronic

Commerce or E-Commerce is the process by which

buyers and sellers conduct exchanges of information,

money and merchandise by electronic means

primarily on the internet (Peter & Olson 2007).

E-Commerce has made tremendous changes in the

transformation of traditional to technological

shopping and creating a huge necessity for updating

knowledge over the globe. This advent has been

made possible at a wider range which involves

computer networks which connect countries around

the world and synchronize them into a global

village, making purchases and sales of goods easier.

The first path of E-Commerce was made available by

the transmission of messages during the Berlin airlift

1948. The use of the World Wide Web (WWW) has

become very common like a telephone or any other

communication media. The WWW or the Web, is a

network of servers,” Talking across the Internet,”

that knows how to display text and graphics

information (Vikas & Sakshi, 2011).

Earlier days, the business started with the barter

system exchanging of things which were replaced

with a worth of the product in terms of money. The

Street Vendors came into the picture who sold the

products at the doorsteps of the consumers for

which they have to pay an additional value. The next

stage was the emergence of providing catalogue

through mail termed as Mail Order Cataloguing

came into the marketing field. It initiated the concept

of framing a new marketing strategy by introducing

marketing into media called teleshopping. The

growth of the internet provided a virtual platform

putting the buyers and sellers to make the sales

through their websites. This connected people with

different diversity, languages and reduced the

distance by sitting at their places and E-Commerce

emerged without any boundaries. With the concept

of E-Commerce, people can now conveniently and

securely buy what they want on the internet. ECommerce

provides an effective online activity and

the customer makes the payment easily (Kumar &

Singh 2014). All the physical transactions of trade

were made electronically with different modes of

payment which were newly termed as B2C ECommerce.

E-commerce trends in India

The Indian E-Commerce industry is growing day by day with a number of buyers and sellers in online trade. The growth of Online Shopping in India is represented below

- 2002 - Online Railway ticket reservation system was started by Indian Railway Catering and Tourism Corporation (IRCTC) which created an opportunity to make payment and book tickets in any part of India.

- 2004 - The largest online portal of India Baazee.com was acquired by eBay.

- 2007 - Sachin Bansal and Binny Bansal started Flipkart initially as an online book store. Myntra was established by Mukesh Bansal, Ashutosh Lawania and Vineet Saxena.

- 2010 - The Cash On delivery (COD) payment method was introduced by Flipkart which made a huge development in E-Commerce. Snapdeal initiated its first daily offers in its market place.

- 2011 - Mime360 and Chakpak.com were acquired by Flipkart.

- 2012 - Indian post played an important role in Indian E-Commerce and an accomplished number of pin codes at India. Jabong began its operations and Junglee website was started by Amazon India.

- 2013 - Fitiquete was acquired by Myntra. A pilot test was made to provide one-hour delivery system in Bangalore and Delhi for the address locations situated within 5 kilometres. Cash on Delivery in India was provided by Amazon to capture the market in India. Pay Zippy was introduced by Flipkart in its own payment gateway.

- 2014 - Myntra was acquired by Flipkart. Ekart logistics was formed. Myntra initiated mass advertising campaigns for the sale of its branded products. Doozton was attained by Snapdeal. Amazon made a tie-up with BPCL (Bharat Petroleum Corporation Limited) and started grocery stores at Delhi and Mumbai. The company also merged with a private firm of Narayanamurthy to cover the consumer base in India. A lot of new categories of products were introduced by Flipkart to face the market.

Mode of Payment in Online Shopping

Payment mode for online shopping system can be made either online or offline. The level of familiarity and the trust that a consumer holds towards the online website determines the mode of payment to be made. The E-Commerce transactions are paperless financial transactions which require less time for the business concern to widen their market. The following are common online payment types that can be made while purchasing the product.

Credit card

A credit card is a plastic card issued with a unique number to an account. The user purchases the product at the Point of Sale (POS) with this card. The bank which issues the card makes the payment on behalf of the customer and certain time period is given for paying the credit card, bill normally a month period. In case the bills not paid on a stipulated time interest is charged to the balance at compound interest till the balance is paid completely. Credit card is preferred for the reasons like confidence, global reach and pays at anytime options. To motivate the users of cards the card companies put forth the concept of reward points. On making every purchase for a specified amount, a particular point to the customer by the company is offered which is not the same in all the companies. After the completion of one year, the consumer will accumulate reward points for their overall purchases from the card issuing company. If the consumer wants, the reward points can be extended as discounts, products, gifts, paying annual fees or cash backs.

Debit card

The debit card is a plastic card with a unique number attached to an account. The debit card needs a bank account as the primary requirement. Only the account holders will be provided with a debit card. For every purchase made the amount will be debited from the customer‟s account balance immediately. In order to make purchases online, sufficient balance is required to be maintained in the account and if not, the transaction will not be processed.

Cash on Delivery (COD)

This is the most preferred mode of payment by the consumers. The consumer pays the amount of receiving goods. If cash is not paid, the goods will be returned to the seller

Net Banking

It is also termed as internet banking, online banking or virtual banking. Under this method, payment is made electronically and all kinds of traditional transactions can be done in this mode. It enables the consumer to perform the financial transactions by logging into the website of financial institution. A Personal Identification Number (PIN) and password are provided for the purpose of secured transactions. Money transfer, credit card payments, shopping, bill payments etc can be availed in this method.

Mobile Wallets

The mobile wallet is similar to the real wallet for all the purposes. It replaces plastic cards such as debit cards, credit cards and smartcards. It is a mobile technology where the customers can purchase the product through their mobiles. The wallet helps to hold personal information, debit and credit cards, medical records etc. It is of three types closed, semi-closed or open. The closed wallet is issued by the company to the consumer to buy the products and services of that particular company. In the semi-closed wallet, the customers buy goods, services and financial services from identified sellers or locations that have an agreement with the issuer company to make payment. It does not allow cash withdrawal or redemption. The open wallet is issued by banks and is used for the purchase of goods, services including monetary services with fund transfer at business places or Point of Sale (POS) terminals accepting cards and withdrawals can be made at Automated Teller Machine (ATM).

Prepaid Cards

The prepaid cards are issued by the banks which are not linked to the account of the consumer. The amount to be spent is loaded on to the card in advance. Instead of paying after purchasing through a card, it helps buy within a prescribed limit with already loaded funds.

Gift Cards

Gift cards are similar to prepaid cards wherein a particular amount to spend is loaded in the card where the consumer can use the card only up to that limit. Some cards can be reloaded and they range between a minimum and maximum loadable limits. The minimum amount loaded is Rs 100 and the maximum is Rs 49,999. The cards can be used both in person and through online modes.

Smart Cards

The smart card is a plastic card which has a small chip fixed in it. It can store personal and official information of a customer. The money is stored in the card which can be availed while making purchases. The card is protected with a PIN number and all data are secured as they are in the encrypted format. The smart card can hold ample information as it has a microprocessor in it.

The primarily preferred mode of payment by the India consumer is Cash on Delivery (COD) being fear of security issue. Because of the concept of digital India and various schemes like Jan Dhan Yojana have created more debit cards for easy accessibility electronically. The Unified Payment Interface (UPI) by the Reserve Bank of India for mobile banking which would support the troubles of tough cash transaction enabling collection of money electronically by the people delivering the product.

SCOPE FOR THE STUDY

- Identify, document, evaluate, and provide an authoritative and up-to-date account of B2C e-commerce in the region.

- Develop a conceptual framework to study B2C e-commerce across the region.

- Identify and assess barriers organizations and consumers face when adopting e-commerce.

- Examine the macro-level impact of B2C e-commerce.

- Evaluate how technological advances can help develop the e-commerce industry and market.

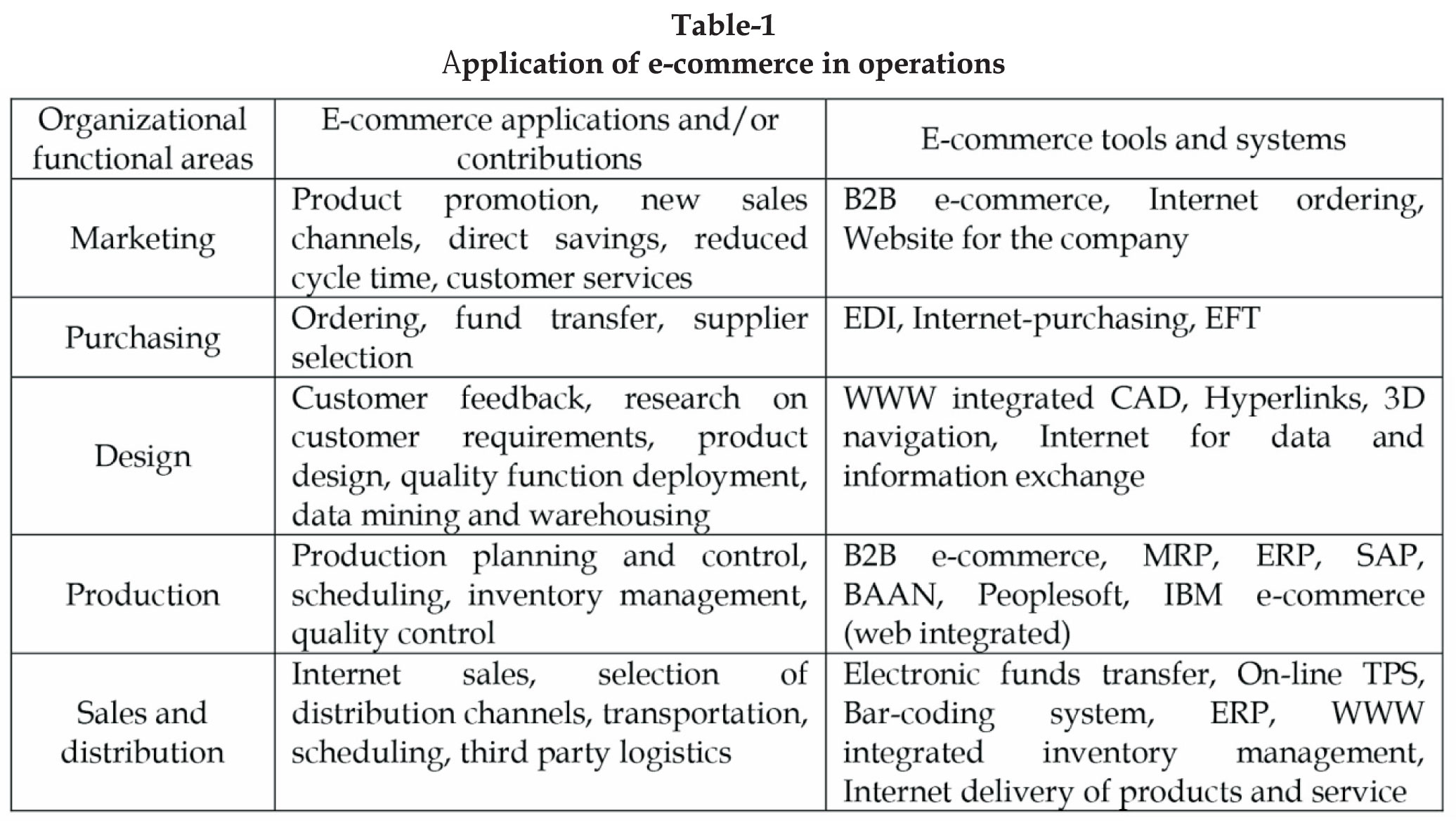

A FRAMEWORK FOR IMPROVING THE OPERATIONS IN AN E-COMMERCE ENVIRONMENT

As the ever-growing WWW becomes more popular, EC promises to become a mainstay of modern business. Enterprises are generating demand for Internet connectivity through the development of new service offerings that provide value to customers. Many people think EC is just having a web site, but EC is much more than that. There are dozens of applications of EC such as home banking, shopping in online stores and malls, buying stocks, finding a job, conducting an auction and collaborating electronically on research and development projects. To execute these applications, it is necessary to have supporting information, and organizational infrastructure and systems. Companies now find that the development of a WWW presence is a competitive necessity, particularly for retailers who need to establish online storefronts. Even so, there are few useful frameworks in the EC literature to help managers understand the potential of EC.The framework proposed herein relates E-commerce application areas and EC tools and systems to the various functional areas of an organization to suggest how EC might support functional activities (see Table 1). For example, marketing can use e-commerce tools and systems such as B2B systems, Internet ordering, and Web sites to

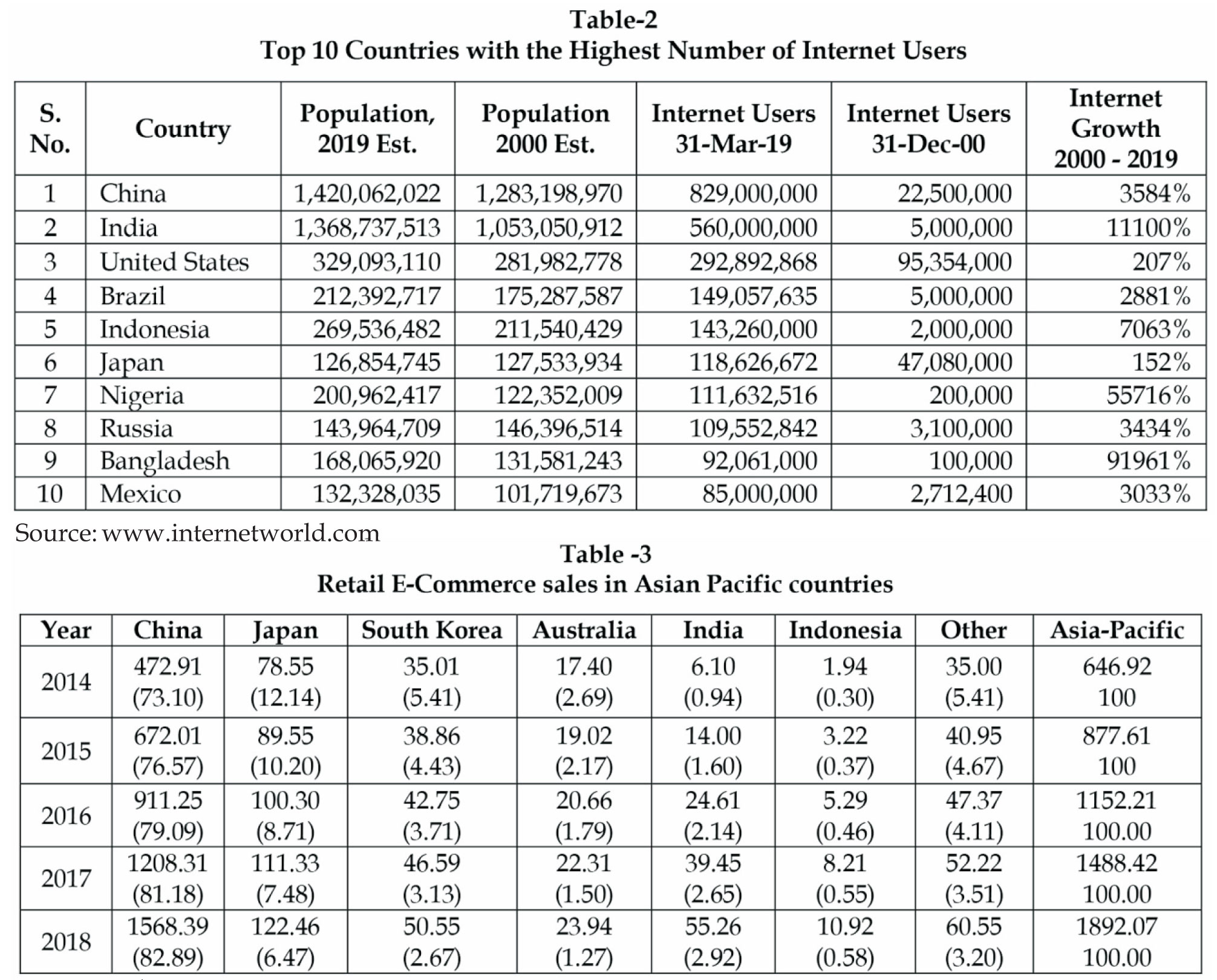

Table 1 represents the internet user of top 10 countries in the world. Bangladesh is the highest internet user growth over the period of 2000-2019, the growth rate is 91961 per cent and followed by Nigeria and India have the high internet user growth. Overall china and india have the high internet user in the world. Mexico is least in highest number of internet user. The Main reason why India is second in the list mainly due to introduction reliance jio in the year 2016 with lots of scheme and offer.thats the reason number users started increasing.

Source: www.internetworld.com

Indicate the values in percentage

Table 2 demonstrates the retail e-commerce sales in the Asian pacific countries. The countries are such as China, Japan, South Korea, Australia, India and other Asian countries. From the percentage analysis the China has recorded high e-commerce sales during the study period, respectively 73.10 %, 76.77%, 79.09%, 81.18% and 82.89. In the remaining countries India and Indonesia are performed in e-commerce sales during the period of 2014-18, below 10 per cent.

Conclusion

This study evaluates the performance of the retail ecommerce sales in Asian pacific countries. In the world China and India have high population and the both countries have high internet users also. But in ecommerce sector China alone performed vital role in the Asian continent. India has the second largest population and internet users in the world but it cant support for the business. Indian are lack in use of e-commerce and online shopping. Recent Indian government also introduce the various schemes are digital payment and cashless economy. In future, it will helps to increase the growth of e-commerce in India.

References:

- Joseph, P.T. (2009). E – Commerce: An Indian Perspective. (3rd ed.). New Delhi: PHI Learning Private Limited

- A.T. Kearney. (2011). China’s E-commerce Market: The Logistics Challenges. https://www.atkearney.com/documents/10192/253176/Chinas_E-Commerce_ Market.pdf

- Goyal, A. (2014). The mouse charmers: digital pioneers of India. Noida, UP: Random House India.

- Kumar, A., & Singh, K. (2014).Consumer Behaviour and Marketing Communication An Indian Perspective. (1st ed.).New Delhi: Bizantra

- Abudheen, S. (2017). Farm Taaza Raises $8 Million to Source Fresh Produce Directly from Farmers for Retailers in India. e27. 6 October.