Subscribe now to get notified about IU Jharkhand journal updates!

Study On the Factors Influencing Countries To Go Cashless Or Less Cash

Abstract :

In India the mobile payment transaction adoptability has increased extensively post the introduction of demonetization in November 2016. To discourage the usage of cash in the country’s journey towards making India a cashless economy, a tax deductible at source was introduced w.e.f September 1, 2019 on the cash withdrawals above a prescribed ceiling. To further encourage merchants to accept the digital transactions on par with cash, the Finance Minister announced on December 28, 2019, that the previously applicable Merchant Discount Rate (MDR) which was payable by the merchants on card transactions will not be applicable on digital transactions made through RuPay Cards and United Payment Interface (UPI) platforms. This decision of the Indian government discourages the practice of cash transaction and encourages digital payment options. As we know, India is presently one of the fastest growing economies in the world and various important steps are being taken to increase cashless monetary solutions. India is gearing up for its biggest revolutions in recent times as multiple digital payment gateways are available on different platforms to support cash less economy. This conceptual research paper broadly focuses on the practices and challenges faced by various countries to progress to a cashless economy. The catalyst that trigger an economy to transform to a cash less economy may come from diverse sources depending on their influence/ importance in a particular country/economy. It will be useful for adding values to the researchers at large to have a look at the some countries including India to understand the country specific factors that have spearheaded the cashless economy.

Keywords :

National Policy on Education; Principles; Disparity; Global setting; Sponsorship1. Introduction

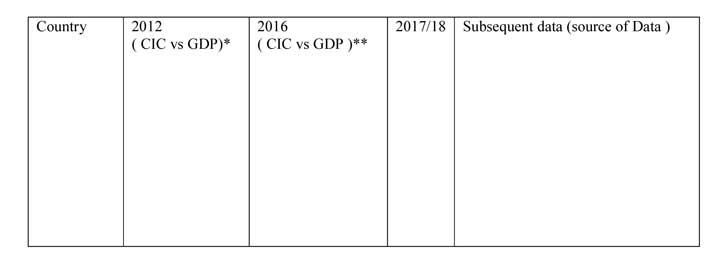

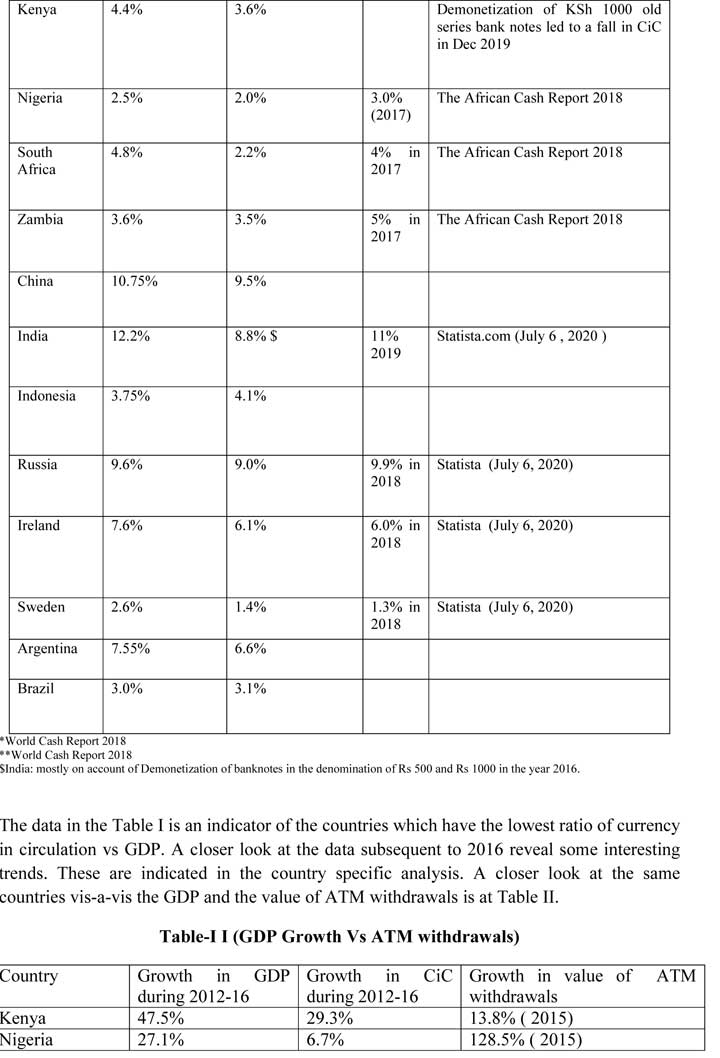

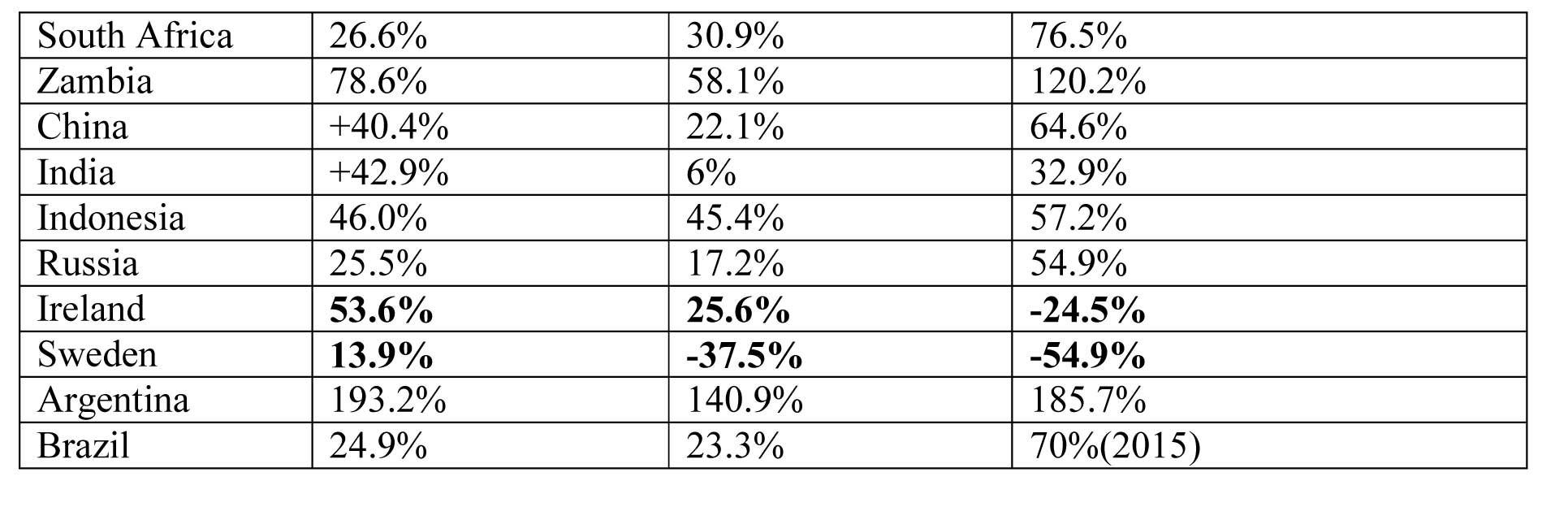

The purpose of this paper is to understand the progress of certain countries in moving towards a cashless or a less-cash economy and to examine the possible factors and commonalities (if any) that have led to this transitioning. Cash by its very nature does not allow tracking its use and any measurement of its velocity, therefore the dependence on cash of a particular country/economy is identified by certain indirect metrics used for research. They are (i) Currency in Circulation (CIC) as a percentage of Gross Domestic Product (GDP) (ii) value of ATM withdrawals and (iii) the number of card transactions per capita in a year. These metrics are made available by the Central Banks/Governments of particular jurisdictions or by recognized Reports like the World Cash Report 2018 ( published by G4S Global Cash Solutions ), World Payments Report 2019 ( Cap Gemini Research Institute ) etc.

The metrics used for evaluating the usage of cash in an economy for this Literature Review are based on the two metrics i.e. (i) percentage of Currency in Circulation vs GDP and also (ii) value of ATM withdrawals. The card transactions have not been considered for this literature review to have a more inclusive look at various economies that are not having a card-based infrastructure but have still progressed in reducing cash in their economies. This is because the card usage and infrastructure is centered on Europe and North America. The usage of cards is based on card issuance plus the establishment of an acceptable infrastructure i.e. onboarding merchants with Point of Sale (PoS) with well-established broadband connectivity involving multiple players (merchants, banks, card issuing agencies, and internet service providers). There is a considerable investment required in the development of this infrastructure and this is very well established in the economically and technologically advanced countries in Europe and North America who have had the advantage of early adoption to technology. The drivers for an economy going the cashless way have been collated based on Literature Review on the subject. The World Cash Report examines the data of various countries across the world for a period of 5 years from 2011-2016 giving us an indicator of countries that have successfully reduced the currency in circulation over a period of time.

Cash as a payment instrument has been around for more than 300 years now. It satisfies the criteria as a medium of exchange, store of value and payment finality, easy availability, reliability and wide acceptance. Thus it is by far the most popular payment instrument in most of the countries. Over the past few centuries, with industrialization, setting of banking institutions, central banks and more recently with opening up of economies, technology adoption, the advent of mobile banking, especially smartphones and cheap availability of data service, there have been inroads into the payment ecosystem which involves changes in instruments and processes.

While countries in Europe and North America adopted mechanization early in their evolution and have over the years developed a well-established card-based transactional system, and have moved to the next stage of mobile banking infrastructure; many countries in Asia and Africa who have typically been late starters in adoption of technology in payment systems and economies as a whole, have insufficient card enabled infrastructure and have still jumped into the mobile payment landscape powered by the presence of Fintech companies, E-Commerce Giants, Government-led initiatives, Central Bank initiatives or simply the organic evolvement of an economy to a cashless one based on conscious choices by its citizens.

Moreover, Sweden, actually showed a CIC decrease in absolute value terms even though there was robust growth in the GDP. In terms of the World Cash Report 2018, the countries with the lowest Currency in Circulation vs GDP on a Y-o-Y basis are Nigeria (2.0% in 2015) and Zambia (3.0% in 2016) are among the lowest ratios in the world (comparable to Sweden and New Zealand with scores of 1.4% and 2.1% respectively).

III. Outcomes of the study

The reasons for making this transition possible for these countries towards a “less-cash’’ regime, therefore, has been attempted to be examined. The other metric i.e. the value of ATM withdrawals; though it is increasing at a global level, a few countries are also showing negative growth here, indicating the decreasing relevance of cash (Ireland and Sweden).

In this article, we shall have a look at the experience of a few countries that have reduced the currency in circulation in their economy.

Nigeria: The Central Bank of Nigeria is perhaps one of the earliest Central Banks to come up with an explicitly stated policy of Cash-Less Nigeria in 2011 aimed at reducing the volume of notes in circulation and encouraging more electronic-based transactions. This was introduced to (i) drive development and modernization of the payment system in line with Nigeria’s Vision 2020 goal of being amongst the top 20 economies by the year 2020. It also sought to reduce the cost of banking services (including the cost of credit) and drive financial inclusion by providing more efficient transaction options and greater reach. To achieve its goal, Nigeria introduced charges for cash withdrawals beyond a threshold and also tried to reduce the supply of cash at cities in a targeted manner. A study of the factors affecting the prospect and implementation of a cashless banking system with special reference to selected commercial banks in Nigeria (Ph.D. Thesis by Mr. Mohammed Isa Kida); concluded that the mechanism and supporting systems of Cashless Banking by banks (and the role played by them) in Nigeria guarantee the prospect of implementing the cashless Policy the policy in Nigeria; the awareness of the Cashless Banking by customers enables a positive perception that guarantees the prospect. The study recommended that more sensitization should be provided to customers. It may be observed from the data that the Currency in Circulation for Nigeria has remained low because of conscious efforts by its Central Bank in reducing the supply of cash and putting in places deterrents (transactional fees for cash withdrawals and deposits) as per its Cashless Policy, this is despite robust growth in GDP vis-à-vis growth in CIC. Despite a fall in the CIC, the preference for cash is evidenced by its growth in value of ATM withdrawals despite sustained efforts by the Central Bank of Nigeria to reduce the percentage of currency in circulation. However, in terms of the World Cash Report 2018, the card infrastructure has risen by 475% during the same period, indicating the establishment of a robust alternate payment mechanism in the move to achieve a less-cash economy. While examining the effectiveness of the Cashless Policy in Nigeria a study on “Effect of Cashless Policy on Customer Satisfaction in the Nigerian Banking Industry” by Asenge, Emmanuel Lubem, Agwa, Terwase Richard and Tyonande, Iorwuese published in the International Journal of Current Aspects on Innovations and Research, Volume 3, Issue I in January 2019, have found that much awareness has been done on cashless policy and its impact in the banking sector. This study established that one of the most significant contributions of the cashless policy is its expected reduction in risk associated with carrying cash. The study concludes that internet banking has positively affected customers of banks in Nigeria. The study also concludes that with mobile banking, customers can now carry out transactions at home without going to their banks.

The Nigerian Model is a typical example of a Central Bank led model for progressing to a cashless economy.

Sweden: Sweden is one of the first countries in the world that pursued a policy to reduce its currency in circulation. This started after currency in circulation peaking in 2007; the country saw a spate of robberies during the period which engaged the citizens and unions, merchants, and banks in an intense debate on securing themselves through less use of cash and adoption of digital transactions, mainly cards. As enumerated by Arvidsson, Niklas (2019) in his book “Building a Cashless society: The Swedish Route to the future of cash payments”. The factors for cash losing its relevance are Cash is no longer legal tender,

1. A merchant can say no to cash in Sweden. It means that the legal system supports digital payments.

2. Further, since, the system for cash handling services in Sweden has also been subjugated to outsourcing and privatization. This has led to a supply and demand-driven development of the use of cash in Sweden. Therefore the lessening of demand by the public is a factor.

3. Yet another factor relates to the tightening of the tax system. From 2004 and onward, the state introduced several different tax incentives aiming at, first, stimulating the economy via incentives for consumers and, second, turning sectors like construction and household services into transparent and taxpaying industries. Therefore,

a. In 2008, the regulation stimulating tax payments for household services also started to include other services like cleaning and gardening. This meant that private persons could get tax reductions if they paid construction and/or household services for private houses. These incentives stimulated transparency in these sectors which in turn meant the cash payments were replaced by payments primarily via invoicing and therefore negatively affected the use of cash.

b. The tax authorities wanted to reduce the avoidance of paying taxes in restaurants, temporary merchants, and other merchant activities that traditionally were cash-intensive. The new laws stipulated that all cash registers must be impossible to manipulate and must provide possibilities for tax authorities to get information on sales, which in turn enabled tax authorities to control if they paid correct taxes or not. This made merchants gradually reduce the acceptance of cash and instead start to prefer card payments since these tend to be efficient, not too costly, and often liked by consumers.

New entrants that are strong in the area of mobile payments and Internet payments—like Apple, Google, Paypal, Klarna, Seamless, iZettle have influenced people active on the Internet to adopt online purchasing behaviours. This has also stimulated a shift away from physical stores and cash to e-commerce and electronic payments.

Another factor influencing the view of cash is the economic reports made by the Riksbank as well as the European Central Bank. The socioeconomic reports show that the costs of cash are higher than the costs of card payments. This also stems from the fact that Sweden is very sparsely populated, making the movement of cash not only expensive but also risk-prone. The social costs of a debit card payment were estimated to be 5.5 SEK, while the social costs of a cash payment were estimated to be 8.3 SEK (Segendorf & Jansson, 2012). The socioeconomic cost of cash payments was shown to be higher than those of debit card payments, which implies that a society may gain from reducing the use of cash. From a macroeconomic perspective, there are strong indications that a society would gain from replacing cash payments with debit card payments.

Thus it is seen that the Sweden experience of going cashless started as a citizens movement, supported by the Government by tightening and incentivizing the cash transactions by making them accountable. This plugged the revenue loopholes and also helped in working out the applicable social benefits and rebates by encouraging the recording of all cash transactions.

In another take, a study on “The Cashless Society in Practice” by Malin Kall and Johanna Lagerkvist conclude that by framing the (commercial) bank’s incentives into the intersegment devices of cost, study, and environment, banks were able to declare their intention to become cashless. The bank has succeeded and the network has developed into something powerful where each entity influences/empowers the other. Without each actor being enrolled and supporting the change the movement would not have been successful. Thus the active cooperation of Fintechs, banks, merchants, customers, and the Government have been enrolled by taking into account the benefits of cost, environment, security, and other issues to make the movement a powerful one.

In a study “Cash Less Society: Is there a relationship between innovation and Cash Circulation in the Economy” by Emma Glennow and Alexandra Granström published in Kth Royal Institute Of Technology School Of Industrial Engineering And Management in 2019, observed that innovation within payments systems as well as the willingness of private persons and businesses to find efficient ways of payments triggers innovation. This in this turn leads to more efficient ways to operate businesses and day-to-day transactions saving time and money for businesses to be able to invest more in innovation and research and development to gain a competitive edge i.e. to say that less cash usage can unlock more innovation in a country or a country with higher innovation in payment systems could have less cash circulating in the economy.

A look at the currency in circulation vs GDP for Sweden in 2018 reveals that it has further dropped to 1.3% as recorded in the website Statista.com.

In an interesting turn of events, the Swedish Government has set up a Commission to look into the (lack of) preparedness of the state in case of defence exigencies against the backdrop of going cashless. In the Summary of the recommendations at https://www.government.se/4ade68/contentassets/57e0337f21a1480b8a5665cf8a51486c/the-riksbank-committees-proposal-for-a-new-riksbank-act-summary.pdf the Committee proposes that the Riksbank be given an objective for all of its cash activities: to contribute to the availability of cash to a satisfactory extent throughout Sweden.

China

The cashless movement has been triggered by its booming e-commerce sector especially Alibaba. As per the article “Decoding Alipay: mobile payments, a cashless society and regulatory challenges” by Dr. Lerong Lu published in the Butterworths Journal of International Banking and Financial Law in January 2018; Alipay is backed by the e-commerce giant Alibaba, Alipay has become the world’s largest mobile payment system. Together with WeChat Pay, they dominate China’s $5.7trn mobile payment sector. Alipay has a presence in over 70 countries including the UK, US, Japan, South Korea, and Australia. These service providers require regulatory approvals from the Central Bank. In the article “The Role of Alipay in China”

By Rongbing Liu published in October 2015 observed that with the increase in the penetration of network availability in China and so more and more internet users preferring online shopping online, there are a lot of excellent online payments applied for all kinds of individuals and merchants, Alipay being the most prominent of them all. Alipay acts as a popular payment channel in China as a leading online e-commerce platform that provides an easy-to-use, secure, swift way to make/receive a payment between buyer and seller during the transaction.

Incidentally, the volume of business on the mobile payments channel forced the Peoples Bank of China to set up a unified clearing house for all mobile payment service providers for better industry supervision.

Kenya

Innovative Payment Solutions has skyrocketed the mobile payment space as concluded in the article Mobile Banking: The Impact of M- Pesa in Kenya by Isaac Mbiti and David N. Weil published in the book African Successes, Volume III: Modernization and Development by National Bureau of Economic Research. M- Pesa is a money transfer system operated by Safaricom, Kenya’s largest cellular phone provider. M- Pesa allows users to exchange cash for “e- float” on their phones, to send e-float to other cellular phone users, and to exchange e-float back into cash. This service was floated in 2007 to offer remittance facilities to migrant labour on account of the poor reach of the banking system into the rural areas. M- Pesa agents (or service locations), which grew to over 18,000 locations by April 2010, from a base of approximately 450 in mid- 2007 (Safaricom 2009; Vaughan 2007). By contrast, Kenya has only 491 bank branches, 500 post bank branches, and 352 ATMs. The study concluded that M-Pesa does not entirely serve as a substitute for the formal banking system, but, rather, is viewed (or used) as a complementary tool by individuals. As stated in the article, after initial efforts by commercial banks to force the Central Bank to regulate M-Pesa under the existing commercial banking laws failed; the commercial banks in Kenya partnered with M- Pesa to offer better services to customers, and in some cases became M- Pesa agents. There is also suggestive evidence that M- Pesa has increased the efficiency of the banking system. According to a 2009 newspaper article, the advent of M- Pesa has brought in efficiency in the clearing processes as it forced commercial banks to work toward speeding up the cheque clearing process, which took a minimum of three days.

Kenya decided to demonetize its higher denomination note of KSh 1000 which was announced on June 6, 2019 through a press release wherein it was decided to withdraw the banknote (KSh 1000) in September 2019 with the purpose of curtailing illegal cash transactions and addressing the issue of counterfeit bank notes. It is also reported in the press that the currency in circulation was at its lowest in the last 6/7 years subsequent to the demonetization exercise. However the official data from the Central Bank of Kenya is awaited. An interesting observation as announced by the Central Bank of Kenya is that they have closely followed the Indian experience in Demonetization in 2016 wherein they have observed that the communication could have been better to avoid long queues. Kenya had the new design banknotes introduced in June 2019 (prior to the demonetization) with planned public awareness and had the supplies in place before the actual withdrawal of KSh 1000. Further the public had a four month window to exchange their old bank notes. CBK has also stated that they are satisfied with the outcome of the exercise and it is expected as concluded in an article A Critical Review of the Impact of Demonetization on Kenyan Economy”” by Sahil Abrol, Ratemo Nyaribo Zacharia published in Texila International Journal of Management Special Edition Dec 2019 that going ahead, this will facilitate lowering the volumes of cash in circulation

Ireland

In terms of the article From apps to taps: Where Ireland sits in the march toward a cashless society “dated Jan 18, 2020, https://fora.ie/ireland-cashless-4965404-Jan2020/ , Ireland ranked eighth overall in research (for E-commerce transactions conducted by Global Data), but Global Data said it comes top for the frequency of use of payment cards. Increasing card use and the advent of mobile payments and Fintech apps have facilitated much of this rise. The overall move away from cash has been made up of a mix of mobile and card payments in traditional brick-and-mortar stores and online payments.

As elucidated in the article Ireland Fintech Landscape by Varun Mittal, Duke University published at www.researchgate.net/publication/330700101, as of March 2018, there were as many as 150 Fintech Companies in diverse areas concentrating on Fintech and Regtech.

Banks in Ireland have leveraged FinTechs’ expertise through investment and cooperation initiatives. The Bank of Ireland also took the initiative to launch the StartLab in Galway in 2015, an incubator program to support the tech startup community in Galway City and the surrounding region.

In April 2018, the Central Bank of Ireland, which announced the launch of an Innovation Hub to engage directly with firms interested in FinTech and its implications for regulation. The Central Bank would also start an Industry Engagement Programme that will see regular FinTech Roundtables being hosted by the Central Bank for interested parties, starting later in 2018. The new resources will give firms a way to engage with the Central Bank outside of more formal regulatory interactions. This coupled with Dublin’s “Silicon Docks” home to leading tech firms such as Facebook, Google, Airbnb and more sets the tone for a vibrant technological innovation space powered by the citizens and e-commerce platform and massive collaboration efforts by the Regulator, has transformed the digital payments space making it to the cashless way.

South Africa

In an article on “Digitising Financial Services: A Tool for Financial Inclusion in South Africa?’ published by Palesa Shipalana in the Occasional Papers in Sept 2019 by the South African Institute of International Affairs, the author observes that the use of mobile devices for bank transactions has increased significantly in the past few years. The role of branches is changing as customers move over to digital channels that offer fast and convenient banking, which has become the new industry standard. Branches and ATMs are expected to significantly decrease as primary banking channels in the medium term, with their role in user services changing.

The Government of South Africa has harnessed the technology available for the disbursement of benefits on account of its well-established social welfare system. This was initiated in 2012 and was curbing fraud in the grants system, improving on the delivery of grants, and reduce the costs involved in making payouts. As such, efforts are underway to modernize the country’s payment system legislation, the National Payment System (NPS) of 1998. The policy paper on the review of the NPS calls for enabling non-banks to provide payment services that involve pooling funds, such as e-money, remittances, and transactional accounts, independently – thus, without the need to partner with banks, as currently required by legislation. Financial inclusion requires a well-functioning retail payments ecosystem that encourages innovation without compromising the safety and soundness of the national payments system.

In South Africa, it may be seen that the cashless agenda has been spearheaded by the financial inclusion agenda which is similar to India by the active involvement of the Government and the Central Bank.

Zambia

While there is not enough literature regarding the position in Zambia, the Annual Report 2019 of the Bank of Zambia (Central Bank of Zambia) states that the volume of transactions processed on mobile money platforms increased by 81.0% in 2019 (y-o-y) and the value of transactions also grew by 119.0%. The substantial increase in mobile money transactions was mainly as a result of the new products introduced by mobile money service providers. The number of active mobile money wallets increased by 41.0% and the number of active agent outlets increased by 104.0%. Therefore the agent of change in Zambia appears to be the Payment apps. It may be noted that because of huge levels of inflation the revaluation in the currency by which banknotes of higher denomination were replaced with banknotes of lower denomination and the such banknotes were accepted by the people of Zambia as elucidated in the article “Cash lite or Cashless? It Depends on the Financial Ecosystem” by Vivian DoCoMo & Miya Miasmic published on July 5, 2016, in the journal of the Institute of Money, Technology and Financial Inclusion. This could be a possible reason for the lower value of Currency in Circulation vs GDP.

IV. Trends in India

While the world average currency in circulation is 9.6% of GDP (World Cash Report, 2018); the CGPR of currency in circulation as a percentage of GDP has been 10.2 % during the FY 2014-15 to 2018-19 (Assessment of the progress from Cash to Electronic, 2020) which is indicative of a strong preference for Cash. In India, there has been a fall in the percentage from the pre-demonetizations levels of approximately 12%. The Currency in Circulation vs GDP as on 2019 was of 11.0% (www.Statista.com) which is high but lower than the pre demonetization levels of appx 12.0%. While the average in India is significantly more than the world average, there is a small yet distinct shift away from cash usage. The growth in value of ATM withdrawals has been 9% in volume and 10% in value which is much lower than the growth in Digital payments which grew at a CAGR of 61% in volume and 19% in value. A metric used to measure the usage of cash is the use of digital payments used for personal consumption. Though more than 81% of the country’s population is having access to banking facilities, only 5% of digital payments are used for personal consumption. This shows a high preference for cash in payment preference. The empirical evidence suggests a dense picture, yet the aggregates of CIC indicate a subtle shift in payment patterns in the country.

In India, the move for Cashless India under the banner of Digital India came into focus with the coming to power of the present Government in 2014. This was initially envisaged to deliver Aadhar scheme, Mobile number seeding, Prime Ministers Jan Dhan Yojana popularly called as the JAM Trinity. This was designed to prevent leakage of benefits to the beneficiaries and was sharply carried forward by the Demonetization of higher denomination banknotes (of Rs 500 and Rs 1000) announced in November 2016. The scheme was supported by the Reserve Bank of India and the National Payments Corporation of India (NPCI) through the launch of their UPI interface and BHIM App. The availability of the Paytm payment app also saw a surge in its use post demonetization. Since then several Apps have emerged to occupy the payment space in India. An article Measuring demonetization: a path towards cashless India published by Kritika Nagdev and Parul Kumar in the International Journal on Public Sector Performance Management, Vol. 4, No. 1, 2018 concludes that demonetization has moved the Indian economy towards cashless economy; and economic concerns mediate the effect of demonetizations on cashless economy. This is also corroborated in the article Impact of Mobile Wallets on Cashless Transaction by P.Sarika, S.Vasantha published in April 2019 https://www.researchgate.net/publication/339253038 which concludes that Demonetization has triggered more usage of e-payment among the public which increases the usage of cashless transactions. Also, transferring money through cashless modes would demand the usage of plastic money i.e. credit/debit cards, mobile wallets, net banking, and more, indicating a shift towards a cashless economy.

In the article Cashless Economy/Transaction by Dr. P.R.Kaushalya and R.Guru Shankar published in February 2018 in Indian Journal of Applied Research to understand the achievement in cashless economy and achievement in the rural economy; it is observed that the benefits of this move have now started trickling in with more and more people switching to digital modes of receiving and making payment. India is gradually transitioning from a cash-centric to a cashless economy. The study also proposes that the government boosts the efforts for a cashless economy by making certain payments mandatory in digital mode will go a long way, if certain payments for certain cervices above a prescribed threshold are mandated to be in a digital mode. Further, the author proposes a tax rebate (of say 1% to 2%) on payments made by households as salary to the unorganized sector (domestic servants, sweepers, etc) to boost cashless payments. This is in line with the efforts made by the Swedish Government to include the cash transactions for accounting purposes. The merits and demerits of the cashless transactions in India have been examined in Cashless Transaction in India: A Study” by Rudresha C.E published in February 2019 in International Journal of Scientific Development and Research.

IV. Conclusions

A study of the Cashless journey of the countries reveal that the catalyst for transforming an economy to a cashless / less cash economy has been the Central Banks, the local governments, the online marketing giants , the Fntech companies or the local citizens who have made conscious decisions in this regard. It could be one of them or a combination of availability of local catalysts. As always, developments in payment systems infrastructure in the cashless move involves people’s money and their safety on account of which the Central Banks of all the countries become part of the cashless/less cash journey. The lack of avilability of acceptance infrastructure in emerging economies has created scope for Fintech companies and has altered the course of the cashless journey in the emerging markets. Like other emerging economies, India has had suboptimal availability of acceptance infrastructure creating a rich landscape for Fintech companies to provide mobile payment apps. With the Government of India and the Reserve Bank of India supporting the change, it remains to be seen how actively the citizens adapt to make an effective transformation to a cashless or a less cash economy.

References

- World Cash Report 2018 ( published by 4S Solutions )

- World Payments Report 2019 ( Cap Gemini Research Institute )

- A study of the factors affecting the prospect and implementation of a cashless banking system with special reference to selected commercial banks in Nigeria by Mr. Mohammed Isa Kida

- Building a Cashless society: The Swedish Route to the future of cash payments” by Arvidsson, Niklas (2019)

- Decoding Alipay: mobile payments, a cashless society and regulatory challenges” by Dr. Lerong Lu published in the Butterworths Journal of International Banking and Financial Law in January 2018

- Measuring demonetization: A path towards cashless India published by Kritika Nagdev and Parul Kumar in the International Journal on Public Sector Performance Management, Vol. 4, No. 1, 2018

- RBI Pulication: Assessment of the progress from Cash to Electronic, 2020

- The Impact of M- Pesa in Kenya by Isaac Mbiti and David N. Weil published in the book African Successes, Volume III: Modernization and Development by National Bureau of Economic Research

- From apps to taps: Where Ireland sits in the march toward a cashless society “ dated Jan 18, 2020, by Jonathon Keane https://fora.ie/ireland-cashless-4965404-Jan2020/ published in January 2020

- Fintech Landscape by Varun Mittal, Duke University published in www.researchgate.net/publication/330700101 March 2018Digitising Financial Services: A Tool for Financial Inclusion in South Africa?’ published by Palesa Shipalana in the Occasional Papers in Sept 2019 by the South African Institute of International Affairs

- Annual Report 2019 of the Bank of Zambia

- “Cash lite or Cashless? It Depends on the Financial Ecosystem” by Vivian DoCoMo & Miya Miasmic published on July 5, 2016, in the journal of the Institute of Money, Technology and Financial Inclusion.

- Cashless Economy/Transaction by Dr. P.R.Kaushalya and R.Guru Shankar published in February 2018 in Indian Journal of Applied Research

- Cashless Transaction in India: A Study by Rudresha C.E published in February 2019 in International Journal of Scientific Development and Research

- Impact of Mobile Wallets on Cashless Transaction by P.Sarika, S.Vasantha published in April 2019 https://www.researchgate.net/publication/339253038

- The Cashless Society in Practice” by Malin Kall and Johanna Lagerkvist

- Cashless Policy in Nigeria "a study on Effect of Cashless Policy on Customer Satisfaction in the Nigerian Banking Industry” by Asenge, Emmanuel Lubem , Agwa, Terwase Richard and Tonnage, Iorwuese published in the International Journal of Current Aspects on Innovations and Research, Volume 3, Issue I in January 2019

- “The Role of Alipay in China” by Rongbing Liu published in October 2015

- “Cash Less Society: Is there a relationship between innovation and Cash Circulation in the Economy” by Emma Glennow Alexandra Granström published in Kth Royal Institute Of Technology School Of Industrial Engineering And Management in 2019

- A Critical Review of the Impact of Demonetization on Kenyan Economy by Sahil Abrol, Ratemo Nyaribo Zacharia published in Texila International Journal of Management Special Edition Dec 2019

- https://www.government.se/4ade68/contentassets/57e0337f21a1480b8a5665cf8a51486c/the-riksbank-committees-proposal-for-a-new-riksbank-act-summary.pdf