Subscribe now to get notified about IU Jharkhand journal updates!

Study of Developmental Issues Impacting Micro, Small and Medium Enterprises

Abstract :

Micro, Small and Medium sector constitute sizeable proportion in total entities in India. MSME sector houses the largest workforce after agriculture. Owing to its significant contribution to economic and social development of the country, this sector has been identified as one of the priority sectors. In Bihar, due to the absence of large industries, micro, small and medium enterprises have been the mainstay of private investments. MSMEs have also been the pillar stone to social inclusion as there has been incorporation of entrepreneurial skills through traditional business. Through this study, an attempt is made to present the analysis and interpretation related to the contribution of the MSME sector in social inclusion and its future prospect in tapping the opportunities arising out in light of recent initiatives. The study further presents a comparative analysis of differences in the views of micro, small and medium enterprises towards the obstacles faced by them in operations of their establishment.

Keywords :

Social Inclusion, Role of Economics, Inequality, MSME, MSMED Act, MSME-DI, DIC1. Introduction

1.1. Growth and development scenario of MSMEs in India

In India, there has been significant change in policy for MSMEs since independence. Initially the MSME sector (also known as small scale industries- SSIs) enjoyed significant protection from competition through reservation of product categories under dedicated production from this sector. However this policy witnessed some change with subsequent adoption of industrial policy later on. Liberalization has been one such dynamic macro-economic factor which transformed the ecosystem for MSMEs. The enactment and implementation of provisions of Micro, Small and Medium Enterprises Development Act, 2006 laid the criteria for classifying entities into Micro, Small and Medium Units depending upon their investments– in plant and machinery for manufacturing units and– in equipment’s for service oriented units.

The new policy and provisions was laid down in annual budget of 1991-92 for Small and Micro enterprises. The main thrust areas identified was to enhance and accelerate the employment and exports of the country. Through the onset of process for deregulation, de-bureaucratization and simplification of statutes, regulation and procedures as part of the New Industrial Policy 1991, macro and micro environment for small and tiny sector as well as khadi and village industries changed significantly.

In context of Bihar which forms the focal point of this study, for a sustained period of time, investments in large sector have been confined through public investments which makes implicit that MSME sector remains the integral and driving force for socio-economic development of Bihar through private sector investments.

Small sector units have shown significant growth in financial year 2017-18 in Bihar. The percentage of medium enterprises in the state however, is abysmally low. Micro entities comprise the significant proportion of total units. Consequently, the cumulative annual growth rate (CAGR) is negative for Micro units whereas it is 20.5 percent for small units. The cumulative annual growth rate for overall growth of MSME units is -12.5 percent.

Patna division housed maximum percentage of MSMEs in the state, registered in financial year 2017-18. Despite the government thrust towards increasing infrastructural facilities in other parts of the state apart from the state capital, third preference among owners of MSMEs continues to be a focal point of discussion. Out of the total number of units registered in various divisions of Bihar– along with units set up in area developed by BIADA (Bihar Industrial Area Development Authority) – for the financial year 2017-18, it was observed that most of the MSMEs prefer to be registered in Patna division. The total number of units set up in Bihar during financial year 2013-14 was 3133 out of which 827 units (26%) were registered in Patna Division. In Tirhut division 17% units was registered.

1.2 MSME in Bihar

Bihar is one of the major home of MSME sector in India, with nearly 95% of its industries falling under the particular category, notwithstanding, only 5% of these industries are exposed to banks (SME Venture, 2017). Despite the Government of India (GoI) releasing press reports reviewing the year end success story of MSMEs and their employment generation in 2018, of which Bihar shows to have 915 projects involving assistance to women empowerment (Press Information Bureau, 2018), majority of these MSMEs in the state faces from difficulty in obtaining capital, inadequate and unreliable power supply, zero access to modern technology, dearth of latest information and lack of market and infrastructure. All these challenges contribute in the dismal growth of the sector, despite being the backbone of the state’s employment and economy. Report published by the (MSME-Development Institute, 2019) shows a positive development in the state’s MSME through adequate funding by the state government in various units and promotional activities like Common Facility Centre, Silao Khaja Cluster, Lakhisarai Rice Mill, Ship Button Cluster, Bathna, development of newer skills, transfer of technology, research and development, to name a few. Nonetheless, the reports admits decline achieving of targets of Prime Minister’s Employment Generation Programme (PMEGP) in 2017-18 from the previous year. In 2017-18, the total number of beneficiaries 48 in 2017-18 was 2255 artisan units which together received a margin money amounting to Rs. 6407.64 lakh. However, sector wise scenario showed that except the mining and quarry industry, the sugar industry, dairy industry (in terms of retail outlets and cooperative societies), handloom, sericulture, Khadi and village industries to perform better in 2017-18 than its preceding year. The lacunae observed in the report are that there is no clarity of the total achievement in boosting the functioning of the existing as well as new units/industries against the targets set. Unless a comparative picture is established between the total numbers of MSMEs, their functional and developmental challenges, and resolution meted out to these challenges– and also a clear picture of the amount of people gained employment and empowerment against the target set by the Government of India, it is difficult to present the actual scenario Bihar is experiencing. Most of the academic studies and reports project the developmental issues of India as a whole and there are only few government report projecting the state’s MSME sector. Further, the academic studies are substantially based on review of existing literature or secondary data derived from annual reports of the MSME sector and seldom talk about the social inclusion scenario of the sector and how they are marred by the developmental issues the MSMEs are facing. To address this lacuna this study has been developed, where through empirical investigation on the MSME sector, the actual challenges faced by the local entrepreneurs and the extent to which these issues have been resolved (or attempted to resolve) in terms of social inclusion, has been put forth.

2.0 Research Aim

This research aims to highlight the developmental issues faced by the MSME sector, especially with respect to the Bihar state of India.

2.0 Literature Review

India is the fourth largest economy in the world (in terms of PPP mode, and the second largest in developing Asia) which accounts for 22% of GDP, 33.8% population and 32.5% of the potential workforce in developing Asia. The frequency of growth is evident from the increased investment in infrastructure, job opportunities, emergence of a private sector. The MSME sector has the potentialities to surface as the vertebrae of Indian economy and to continue as an engine of growth.

According to Das (2017) MSMEs in India and abroad have demonstrated substantial strength and resilience in maintaining a consistent rate of growth and generation of employment during the economic slowdown. MSME sector must address the deficiencies to meet the emerging challenges for its growth and survival in a globally competitive order. Stand-Up India scheme, (2016) facilitate bank loans between 10 lakh to 1 Crore to at least one Scheduled Caste (SC) or Scheduled Tribe (ST) borrower. At least 51% of the shareholding and controlling stake should be held by either an SC/ST or Woman entrepreneur in case of non-individual enterprises.

3.0 Literature Review

3.1 MSME as a platform of socio-financial inclusion

Several studies and reports over the years have termed MSME as the backbone of the Indian economy, acting as a platform for socio-economic development of the country through generating employment opportunities across social hierarchies. Being majorly present in the suburban and rural areas, these MSMEs have contributed in providing jobs to population residing in these Tier II, III cities and villages, enabling them to become financially independent and self-sufficient.

India for a substantial period of time is experiencing immense problems in turning into a socially and financially inclusive society despite the focus of the government and policymakers and progress made by several private sector and financial institutions. In such a scenario, MSMEs along with unorganised segments through provision of employment is improving these ‘excluded’ individuals’ bankability and thereby, their competitiveness through employing 60 million people and creating 1.3 million jobs every year and in turn ensuring balanced regional and socially-inclusive growth.

(Kapoor, 2011) opined MSMEs to be the greater driving force in this work of social inclusion than what can be achieved through the implementation of the UID and large-scale utilisation of mobile banking and other technologies, which might take nearly 2-3 decades to reaching the outcome. Study conducted by (Sajuyigbe, 2017) in Nigeria show MSMEs contributing substantially in self-employment and entrepreneurial opportunities, especially to women which forms more than 97% of all enterprises, 60% of the nation’s Gross Domestic Product (GDP) and 94% of the total share of the employment. Although this opportunity still lags behind in empowering socially excluded groups like women when compared to their male counterparts, yet this sector has enabled the delivery of banking services at an affordable cost to the large sections of disadvantaged and low-income groups, thereby ensuring financial exclusion as well.

Despite these contributions of the MSMEs in terms of socio-financial inclusion, there exists several developmental issues as well which is in turn hindering in achieving complete empowerment of the excluded groups

3.2 Developmental issues faced by the MSMEs: Empirical Review

Review study conducted by (Ali & Husain, 2014) on the unequal distribution of the MSMEs across India showed the lack in entrepreneurial skills development, unavailability of raw material, and absence of financial and technical assistance from the local, state or central government to be the primary reasons to the cause. The study reviewed the annual reports of MSMEs from 2006 to 2012 taking into consideration of variables like market value of fixed assets, their gross outputs, and total outstanding bank credit to micro and small industries. The findings showed lack of credit from banks, competition from multinational companies, poor infrastructure, lack of advanced technology, lack of distribution of marketing channels, lack of skill development, and complex labour laws and red tape to be the contributing factors behind unequal distribution of MSMEs.

(Yoshino & Taghizadeh-Hesary, 2016) considers MSMEs to the backbone of the Asian economy and studied the challenges this sector faces taking the case of entire Asia. Through their study, they portrayed severe challenges like lack of databases, access to finance, undeveloped sales channels, low levels of financial inclusion and low R&D expenditures contributing in the slow growth of the concerned sector.

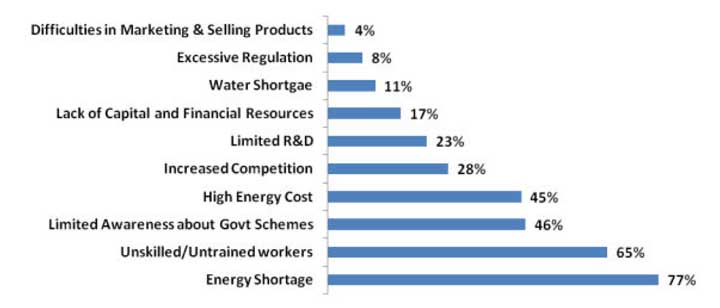

Descriptive study conducted by retrieving secondary data from MSME Annual Reports, Fourth All India Census Report, CII report, newspapers and such others by (Pathak & Agrawal, 2016) highlighted the impediments of the growth and performance of MSMEs of Uttarakhand. Primary impediments include poor connectivity and lack of infrastructure in the hills. The study further projected shortage of energy, unskilled workers, limited awareness about government schemes as the top three reasons out of ten they summed up from their review.

(Bhoganadam, Rao, & Rao, 2017) examined the role of MSMEs through review of literature and developing a matrix model based on the findings projecting the issues and challenges faced by the concerned sector, based in India. They have clubbed the challenges under eight categories namely, external challenges, infrastructure challenges, HRD challenges, financial challenges, marketing challenges, production challenges, socio-cultural environment and environmental challenges. While HRD challenges involve lack of training, lack of motivation among employees, lack of skilled employees, lack of technical and managerial training, and improper way of recruiting; infrastructural challenges include lack of storage facilities, water crisis, and drainage facilities. However, among all the above issues external and environmental challenges are difficult to handle, they being not in organisation control

(Pathak & Agrawal, 2016) while analysing the case of Indian Coir Industry, highlights how the MSMEs are lagging behind the rival firms– originating from the neighbouring countries– in terms of competitiveness of export. Theoretical insights on the importance of technology in boosting the country’s exports in coir industry shows how use of social media mobility, analytics and cloud computing will help the MSMEs in knowing the specific taste and preferences of international consumers and in turn help them access to the international market. However, present scenario shows Indian MSMEs to be producing a substandard product of inferior quality using obsolete technology. Besides, there is lack of appropriate marketing and advertising of their products and hence lesser awareness among customers which overall leads to their lagging behind their rivals in the international platform.

4.0 Hypothesis and Conceptual Framework

5.0 Methodology

Research Objective:

Some of the objectives which are aimed to be accomplished through this paper can be listed as follows.

1. To evaluate the resource skill of entrepreneurs availing facilities /initiative of Government

2. To ascertain the effectiveness of schemes in alleviating the developmental issues of MSMES.

Methodology in brief: Research methodology aims to determine the development issues that impacts Micro, Small and Medium Enterprises in development of state economy of Bihar. These charecterstics hasve been generalised on the basis of sample study. For the purpose, descriptive study was undertaken.

Data Collection: The study aimed to collect primary as well as secondary data pertinent for the purpose. Primary data has been collected by conducting survey with a structured questionnaire. The first section of questionnaire was related to demographic variables of the respondents that might influence the overall performance of MSMES. The second and third section of the questionnaire was specifically designed for this study utilizing Five-Point Numerical and Likert Scale. All items were rated on a five-point Likert scale (eg, 5= Strongly Disagree; 4=Disagree; 3= Neither Agree nor Disagree; 2= Agree; to 1= Strongly Agree) to study the perception of the respondents on the given variables. Information’s where responses was drawn on Numerical scale the movement of affinity of variables was as follows: Very Severe Obstacle=5, Major Obstacle=4, Moderate obstacle=3, Minor obstacle=2, No obstacle=1. Assessment of reliability of questionnaire was ascertained with help of Cronbach’s alpha. A sample size of 150 units determined on the basis of Judgment has been surveyed.

Data Analysis: Response from respondents has been summarized with the help of Table. To determine the relationship between variables statistics test was conducted (i.e., Chi –square test) and subsequently Hypothesis tested with suitable statistical tools.

6.0 Data Analysis and Interpretation

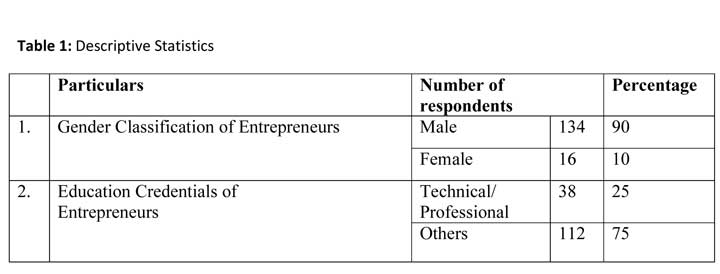

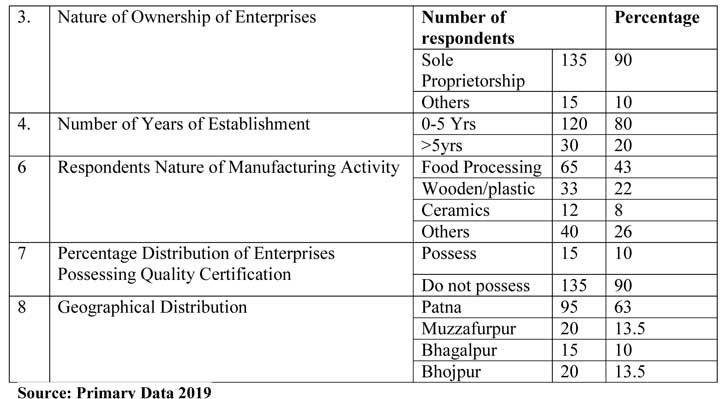

Table 1 show that 90% of the units were proprietary units while 5% were run on partnership basis. No Units were stock holding companies with shares traded either in the market or privately. 80% of the units were relatively young with less than 5 years of existence. Only 5 units, i.e. 3% of all units, were over 10 years old.

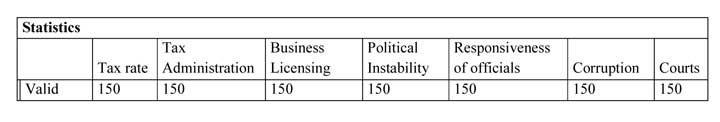

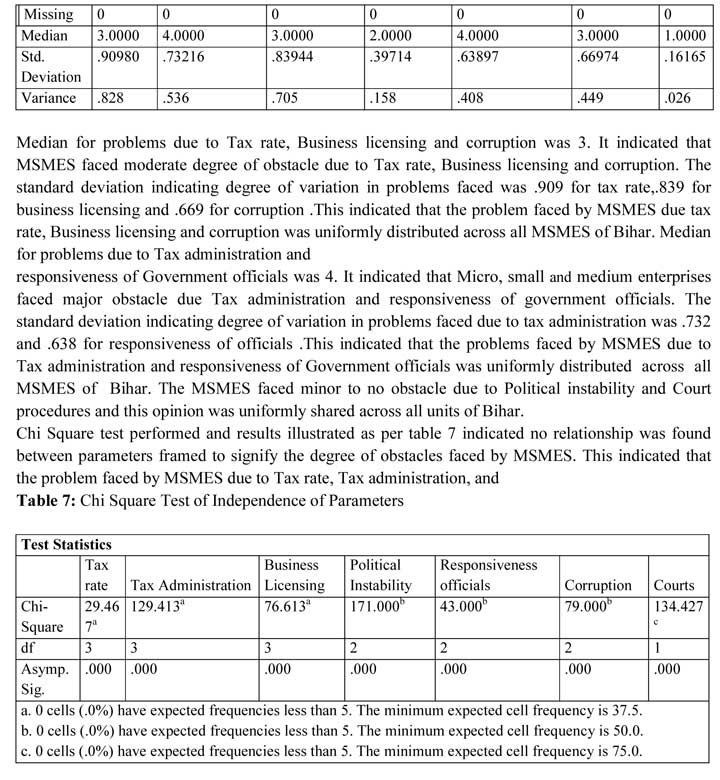

Business-Government relations: By using numerical scale option, response from MSMES was drawn to gain insight on the problems faced by Units due to Tax rate, Tax administration, Business licensing, Political instability, Responsiveness of Government officials and Corruption. The output has been demonstrated in table 6.

40% of the MSMES faced Major to severe obstacles due to Tax rate structure of the government. The percentage of Units facing moderate obstacle due to tax rate was found to be 40%. Around 65% of the MSMES faced Major obstacles due to Tax administration procedures of the government. The percentage of Units facing Minor obstacle due to tax administration was found to be 8%. More than 50% of the MSMES faced moderate obstacles due to business licensing procedures of government agencies. The percentage of Units facing severe obstacle due to business licensing was found to be 12%. More than 80% of the MSMES faced minor obstacles due to political instability in Bihar. More than 50% of the MSMES faced major obstacles due to responsiveness of government officials to resolve the Tax related issues of MSME. The percentage of Units facing severe obstacle due to responsiveness of government officials was 30%. 90% of the MSMES faced moderate to major obstacles due to corruption among government officials to resolve the Tax related issues of MSME. The percentage of Units facing severe obstacle due to corruption was 10%. 90% of the MSMES faced no obstacles due to judicial procedures to resolve the Tax related

issues of MSME.

Table 6: Central Tendency and Dispersion

Business licensing, Political instability, responsiveness of officials, corruption and courts was significantly different across responding Units.

Business licensing, Political instability, responsiveness of officials, corruption and courts was significantly different across responding Units.

Chi Square test performed indicated that there was significant difference in problems among MSMES due to tax rate of the government, χ 2 (3, N = 150) = 29.467, p < .05. The median for problems due to procurement of raw material was 3. It suggested that MSMES faced moderate obstacle due to tax rate. The standard deviation indicating degree of variation in problems due to tax rate was .909. This indicated that problem faced due to tax rate was uniformly distributed across MSMES of Bihar. Chi Square test performed indicated that there was significant difference in problems among MSMES due to tax administration of the government, χ 2 (3, N = 150) = 129.413, p < .05. The median for problems due to procurement of raw material was 4. It suggested that MSMES faced major obstacle due to tax administration. The standard deviation indicating degree of variation in problems faced by MSMES due to tax administration was .732.This indicated that problem faced due to tax administration is uniformly distributed across MSMES. Chi Square test performed indicated that there was significant difference in problems among MSMES due to business licensing procedures adopted by agencies, χ 2 (2, N = 150) = 76.613, p < .05. The median for problems due to business licensing procedures was 3. It suggested that MSMES faced moderate degree of obstacles due to business licensing procedures. The standard deviation indicating degree of variation in problems faced due to business licensing procedures was .839. This indicated that problems faced by MSMES due to business licensing procedures were uniformly distributed across MSMES of Bihar. Chi Square test performed indicated that there was significant difference in problems among MSMES due to political instability, χ 2 (2, N = 150) = 171.000, p < .05. The median for problems due to political instability was 2. It suggested that MSMES faced minor obstacle due to political instability. The standard deviation indicating degree of variation in problems due to political instability was .390. This indicated that problem faced due to political instability was uniformly distributed across MSMES of Bihar. Chi Square test performed indicated that there was significant difference in problems among MSMES due to responsiveness of officials, χ 2 (2, N = 150) = 43.000, p < .05. The median for problems due to responsiveness of officials was 4. It suggested that MSMES faced major obstacle due to responsiveness of officials. The standard deviation indicating degree of variation in problems due to responsiveness of officials was .638. This indicated that problem faced due to responsiveness of officials was uniformly distributed across MSMES of Bihar. Chi Square test performed indicated that there was significant difference in problems among MSMES due to corruption, χ 2 (2, N = 150) = 79.000, p < .05. The median for problems due to corruption was 3. It suggested that MSMES faced major obstacle due to corruption. The standard deviation indicating degree of variation in problems due to corruption was .669. This indicated that problem faced due to corruption was uniformly distributed across MSMES of Bihar. Chi Square test performed indicated that there was significant difference in problems among MSMES due to courts, χ 2 (1, N = 150) = 134.427, p < .05. The median for problems due to courts was 1. It suggested that MSMES faced no obstacle due to courts. The standard deviation indicating degree of variation in problems due to courts was .161. This indicated that problem faced due to courts was uniformly distributed across MSMES of Bihar.

Government Policy

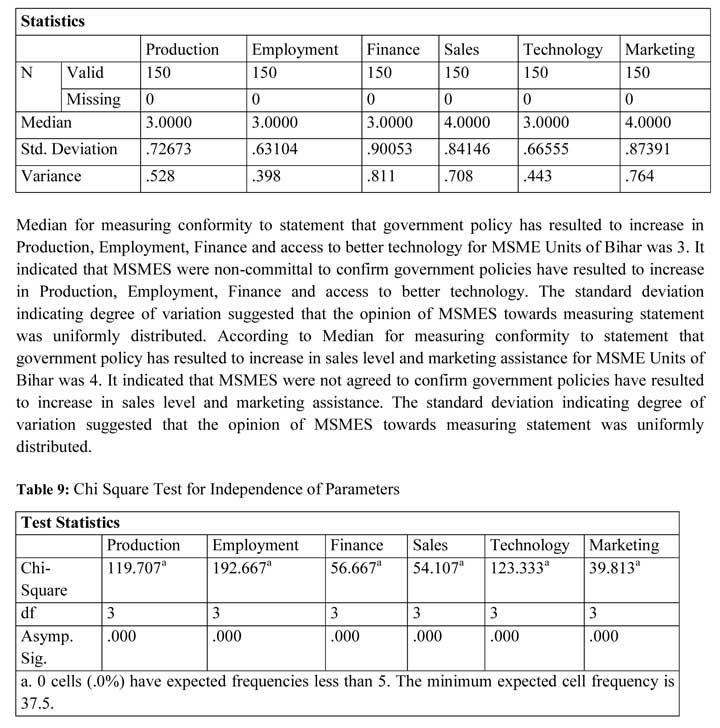

By using numerical scale option, response from MSMES was drawn to gain insight on MSMES opinion towards Government policies in easing issues of Production, Finance, Sales, Technology, and Marketing facilities for entities.

Only 5% of responding MSMES of Bihar agreed towards the statement that due to government policy the production level of their units have increased. Majority of the MSMES units were neutral or non-committal in confirming that due to government policy the production level of their units had increased. Around 25% of the units were not agreed to the statement. Only 5% of the responding MSMES of Bihar agreed towards the statement that due to government policy the employment level of their units have increased. 73% of the MSMES remained non-committal in confirming that due to government policy the employment level of their units had increased.

Only 43% of responding MSMES of Bihar agreed towards the statement that due to government policy availability of finance of has increased. 20% of the MSMES units were not in favour to confirming that due to government policy availability of finance for their units have increased. Only 5% of responding MSMES of Bihar agreed towards the statement that due to government policy sales level of their units increased. 44% of the units were neutral on the statement.50% of the MSMES units were not in favour to confirming that due to government policy availability sales level of their units have increased. Only 3% of responding MSMES of Bihar agreed towards the statement that due to government policy access to better technology for their units has increased. 60% of the units were neutral on the statement. 37% of the MSMES units were not in favour to confirming that due to government policy availability of better technology for their units have increased. Only 8% of responding MSMES of Bihar agreed towards the statement that due to government policy they are able to get marketing assistance for the products of their units.41% of the units were neutral on the statement. 51% of the MSMES units were not in favour to confirm that due to government policy marketing assistance for the products of their units has increased.

Table 8: Central Tendency and Dispersion

Chi Square test output as per table 9 was performed and no relationship was found between parameters framed to signify the MSMES degree of conformity towards government policy resulting to increase in production, employment generation, and access to finance, sales, technology and marketing assistance. Chi Square test performed indicated that there was significant difference in degree of conformity among MSMES of Bihar regarding government policy resulting to increase in production, χ 2 (3, N = 150) = 119.707, p < .05. The median demonstrating degree of conformity towards statement that government policy resulted to increase in production of their units was 3. It suggested that MSMES were non-committal to confirm that due to government policy production of units increased. The standard deviation indicating degree of variation in response of MSMES towards statement that government policy resulted to increase in production of their units was .726. This indicated that response of MSMES towards statement that government policy resulted to increase in production was uniformly distributed across MSMES of Bihar. Chi Square test performed indicated that there was significant difference in degree of conformity among MSMES of Bihar regarding government policy resulting to increase in employment generated, χ 2 (3, N = 150) = 192.667, p < .05. The median demonstrating degree of conformity towards statement that government policy resulted to increase in employment provided by units was 3. It suggested that MSMES were non-committal to confirm that due to government policy they were able to employ more workforces. The standard deviation indicating degree of variation in response of MSMES towards statement that government policy resulted to increase in employment generation by their units was .631. This indicated that response of MSMES towards statement that government policy resulted to increase in employment was uniformly distributed across MSMES of Bihar.

Chi Square test output as per table 9 was performed and no relationship was found between parameters framed to signify the MSMES degree of conformity towards government policy resulting to increase in production, employment generation, and access to finance, sales, technology and marketing assistance. Chi Square test performed indicated that there was significant difference in degree of conformity among MSMES of Bihar regarding government policy resulting to increase in production, χ 2 (3, N = 150) = 119.707, p < .05. The median demonstrating degree of conformity towards statement that government policy resulted to increase in production of their units was 3. It suggested that MSMES were non-committal to confirm that due to government policy production of units increased. The standard deviation indicating degree of variation in response of MSMES towards statement that government policy resulted to increase in production of their units was .726. This indicated that response of MSMES towards statement that government policy resulted to increase in production was uniformly distributed across MSMES of Bihar. Chi Square test performed indicated that there was significant difference in degree of conformity among MSMES of Bihar regarding government policy resulting to increase in employment generated, χ 2 (3, N = 150) = 192.667, p < .05. The median demonstrating degree of conformity towards statement that government policy resulted to increase in employment provided by units was 3. It suggested that MSMES were non-committal to confirm that due to government policy they were able to employ more workforces. The standard deviation indicating degree of variation in response of MSMES towards statement that government policy resulted to increase in employment generation by their units was .631. This indicated that response of MSMES towards statement that government policy resulted to increase in employment was uniformly distributed across MSMES of Bihar.

Chi Square test performed indicated that there was significant difference in degree of conformity among MSMES of Bihar regarding government policy resulting to increase in access to finance, χ 2 (3, N = 150) = 56.667, p < .05. The median demonstrating degree of conformity towards statement that government policy resulted to increase in access to finance for their units was 4. It suggested that MSMES were non-committal to confirm that due to government policy access to finance increased. The standard deviation indicating degree of variation in response of MSMES towards statement that government policy resulted to increase access to finance for their units was .900. This indicated that response of MSMES towards statement that government policy resulted to increase in access to finance was uniformly distributed across MSMES of Bihar. Chi Square test performed indicated that there was significant difference in degree of conformity among MSMES of Bihar regarding government policy resulted to increase in sales order, χ 2 (3, N = 150) = 54.107, p < .05. The median demonstrating degree of conformity towards statement that government policy resulted to increase in sales order received by units was 4. It suggested that MSMES were not agreed to statement that government policy resulted to increase in sales order. The standard deviation indicating degree of variation in response of MSMES towards statement that government policy resulted to increase in receiving sales order by their units was .841. This indicated that response of MSMES towards statement that government policy resulted to increase in sales order was uniformly distributed across MSMES of Bihar. Chi Square test performed indicated that there was significant difference in degree of conformity among MSMES of Bihar regarding government policy resulting to increase in access to better technology, χ 2 (3, N = 150) = 123.33, p < .05. The median demonstrating degree of conformity towards statement that government policy resulted to increase in access to better technology was 3. It suggested that MSMES were non-committal to confirm that due to government policy access to better technology increased. The standard deviation indicating degree of variation in response of MSMES towards statement that government policy resulted to increase access to better technology for their units was .666. This indicated that response of MSMES towards statement that government policy resulted to increase in access to better technology was uniformly distributed across MSMES of Bihar. Chi Square test performed indicated that there was significant difference in degree of conformity among MSMES of Bihar regarding government policy resulted to increase in Marketing assistance for their product, χ 2 (3, N = 150) = 39.813, p < .05. The median demonstrating degree of conformity towards statement that government policy resulted to increase in Marketing assistance received by units was 4. It suggested that MSMES were not agreed to statement that government policy resulted to increase in marketing assistance. The standard deviation indicating degree of variation in response of MSMES towards statement that government policy resulted to increase in Marketing assistance provided for their product was .873. This indicated that response of MSMES towards statement that government policy resulted to better Marketing assistance was uniformly distributed across MSMES of Bihar.

Conclusion

There is no denying of the fact that the MSMEs can be aptly identified as the facilitator of sustainable growth. They can provide employment opportunities to large population thereby eradicating unemployment and thus mitigating poverty. The central and state government has from time to time initiated policies and number of programmes to help and assist entrepreneurs and small businesses. But there seems to be lack of real time region specific availability of data to ascertain how these programs and interventions has been utilized at ground level particularly by enterprises of remote and under privileged areas. . Bihar need to do a lot of ground work for the promotion & development of the MSMEs. There is also a pertinent need to evaluate whether these programmes and schemes have been able fulfil their desired goal.

In short, the MSMEs can be nurtured to cause positive transformations in the socio-economic surroundings of a society. Therefore, the need of the hour is to devise a national policy for nurturing and strengthening the MSME ecosystem in the country.

Small and medium-sized enterprises (SMEs) are powerhouse of growth, jobs and backbone to the nursery of entrepreneurship globally. These are universally acknowledged as major contributors to GDP and even larger contributors to exports and employment and play a crucial role in the Socio-economic profile of nations.

Among key problem identified are lack of adequate and timely banking finance, limited capital, access to international market and knowledge management. SME's play a significant role in the economic and social development of emerging markets and their role needs to be strengthened further in view of their contribution towards fostering equitable growth and employment generation.

It is vital to enhance SME's competitiveness, which requires the formation of enabling legal, regulatory and administrative environment, access to finance and capable institutional structures and most importantly, human capital. The most important change needed is in the attitude of the stake holders and the mindset of the institutions which are engaged in the task of small enterprise development. Efforts should be made to take full advantage of opportunities made available by globalization.

References

- Das, K. (2017), ‘SMEs in India: Issues and Possibilities in Times of Globalisation’, in Lim, H. (ed.), SME in Asia and Globalization, ERIA Research Project Report 2007-5, pp.69-97.

- Great Lakes Herald March 2017, Volume 11 Issue No 1 Page 88

- Kadivar, A.A. (2016). Growth and performance of SMEs in India-An overview. International Journal for Scientific Research, 5(3).

- Pachouri, A. & Sankalp, S. (2016). Barriers to innovation in Indian small and medium-sized enterprises. Asian Development Bank Institute, Working Paper Series, No. 588;

- Kadivar, A.A. (2016). Growth and performance of SMEs in India-An overview. International Journal for Scientific Research, 5(3).

- Sahoo, P. & Bhunia, A. (2014). China’s manufacturing success: Lessons for India. Institute of Economic Growth, India, Working Paper Series, No. 344.

- Sahoo, P. & Bhunia, A. (2014). China’s manufacturing success: Lessons for India. Institute of Economic Growth, India, Working Paper Series, No. 344.

- Saini, P. (2014). Study of micro, small and medium enterprises. Centre for Civil Society, Working Paper 319;

- Saini, P. (2014). Study of micro, small and medium enterprises. Centre for Civil Society, Working Paper 319;

- Chandra, A. & Pareek, V. (2014). Regulatory barriers to micro, small and medium enterprises. Centre for Civil Society.

- Ud-din Ahmed, J. & Rashid A.Md. (2014). Micro, small & medium enterprises (MSMEs) in India. Institutional Framework, Problems and Policies. New Delhi: New Century Publications;

- Lohana, S. (2014). Micro, small & medium enterprises for inclusive growth. New Delhi: New Century Publications.

- Nishanth, P. & Zakkariya, K.A. (2014). Barriers faced by micro, small and medium enterprises in raising finance. Abhinav National Monthly Referred Journal of Research in Commerce & Management, 3(5).

- Lohana, S. (2014). Micro, small & medium enterprises for inclusive growth. New Delhi: New Century Publications.

- Sahoo, P. & Bhunia, A. (2014). China’s manufacturing success: Lessons for India. Institute of Economic Growth, India, Working Paper Series, No. 344.

- Nishanth, P. & Zakkariya, K.A. (2014). Barriers faced by micro, small and medium enterprises in raising finance. Abhinav National Monthly Referred Journal of Research in Commerce & Management, 3(5).

- Rakesh, C. (2014). PEST analysis for micro, small & medium enterprises sustainability. MSRUAS-JMC, 1(1).

- Lohana, S. (2014). Micro, small & medium enterprises for inclusive growth. New Delhi: New Century Publications.

- Srinivas K T (2013): International Journal of Engineering and Management Research.3 (4) August 2013 ISSN No.: 2250-0758. International Finance Corporation (IFC) World Bank Group. Micro, Small and Medium Enterprise Finance in India.

- K. Vasanth Majumdar M.K. Krishna (2012) Innovative Marketing Strategies for Micro, Small & Medium Enterprises Inter disciplinary Journal of Contemporary Research in Business.

- Export - Import Bank of India 2012; Strategic Development of MSMEs: Comparison of Policy Framework and Institutional Support Systems in India and Select Countries.

- . K. Vasanth Majumdar M.K. Krishna (2012) Innovative Marketing Strategies for Micro, Small & Medium Enterprises Inter disciplinary Journal of Contemporary Research in Business.

- K. Vasanth Majumdar M.K. Krishna (2012) Innovative Marketing Strategies for Micro, Small & Medium Enterprises Inter disciplinary Journal of Contemporary Research in Business. Export - Import Bank of India 2012; Strategic Development of MSMEs: Comparison of Policy Framework and Institutional Support Systems in India and Select Countries.

- Export - Import Bank of India 2012; Strategic Development of MSMEs: Comparison of Policy Framework and Institutional Support Systems in India and Select Countries

- Sahapathi, A. & Parul, K. (2011). An appraisal of small and medium enterprises (SMES) in Haryana state of India. International Journal of Multidisciplinary Research, 1(6).

- Sahapathi, A. & Parul, K. (2011). An appraisal of small and medium enterprises (SMES) in Haryana state of India. International Journal of Multidisciplinary Research, 1(6).

- De Sankar (2009):ISB INSIGHT 11 Winter 09-10.

- Christopher J. Green Colin H. Kirkpatrick, and Victor Murinde, (2006) Finance for Small Enterprise Growth and Poverty Reduction in Developing Countries Journal of International Development J. Int. Dev. 181017–1030 (2006) Published online in Wiley Inter Science. (www.interscience.wiley.com)

- Bala Subrahmanya, M.H.(2004). Small industry and globalization: Implications, performance and prospects. Economic and Political Weekly, 39(18).

- Moli. P. Koshy and Dr. Mary Joseph Women Entrepreneurship in the Small-scale Industrial Units: A Study of Kerala Southern Economist, Bangalore, March 2000, P.19

- Ashok K. Arora, Financing of Small-scale Industries, Deep and deep Publications, New Delhi, 1992.

- J.C Sandesara, Institutional Frame Work for Promoting Small-scale Industries in India, Asian Development Review, 1988, No: 2 p. 10-40.

- Ram K. Vepa, “Small Industry Development Programme “Indian Institute of Public Administration, New Delhi, 1983.

- Roy Roth well, Walter Zegveld, Innovation and Small and Medium Sized Finn. Their Role in Employment And in Economic Change, Frances Printer (publishes) London 1982.

- Inderjith Singh and N.S Gupta, Financing of Small Industries, S Chand and Co. New Delhi 1977.

- Role of SMEs in economic development of India. Asia Pacific Journal of Marketing & Management Review, 2(6).

- MSME Annual Report 2014-15 (and various issues) Government of India.

- Prime Minister’s Task Force on MSME (Jan. 2010) Government of India.

- MSME Annual Report 2015-16 Government of India.

- 4th All India Census of MSME Sector Government of India (http://msme.gov.in) Report on ‘The State of MSME Sector in Bihar: Issues Challenges and Way Forward’

- Report of the Working Group on MSME Growth for 12th Five Year Plan (2012- 17) Ministry of MSME Government of India.

- Grant Thornton Vision 2020-Implications of MSMEs.

- Report of the Committee set up by Ministry of Finance Govt. of India to examine the financial architecture of the MSME sector February 2015.

- https://www.abacademies.org/articles/Performance-of-the-Micro-Small-&-Medium-Enterprises-(Msmes)-1528-2686-24-1-122.pdf