Subscribe now to get notified about IU Jharkhand journal updates!

FPOs in India An Endeavour to Reconnaissance its Financial Succor Scenario

Abstract :

Collectivizing farming into Producer Organisations (POs) has been considered as one of the cogent approach to surmount the constraints witnessed by the small and marginal farmers. Under the 12th Five Year Plan (2012-2017) of the Government of India, promotion and strengthening of FPOs has been one of the crucial strategies to attain inclusive agricultural growth.

In the past recent years, the growth of the FPOs (Farmers Producer Organisations) has witnessed a big increase. In view of the fast growth of FPOs, the issue of access to credit, i.e., linking the FPOs to dependable and affordable sources of financing to meet their working capital, infrastructure development and other needs has gained center stage.

In view of the fact that in India nearly 85% of the farmers and small and marginal farmers. The agriculture sector is hindered by high transaction costs and low access to credit and agricultural produce markets. In view of this, the role of financial intermediaries like commercial banks, regional rural banks, NABARD etc. become vital in extending financial assistance to the FPOs.

This research paper makes an endeavor to reconnoiter the current scenario of FPOs, financial scenario of FPOs, financial assistance provided by various financial intermediaries, various government schemes aimed at strengthening the financial position of FPOs, growth potential of FPOs etc

Keywords :

Growth of FPOs; Financial Assistance to FPOs; Government Schemes for FPOs; Growth Potential of FPOs.JEL Classification Code: Q140 (Agricultural Finance)

Introduction

Indian agriculture has been playing a pivotal role in providing livelihood to more than 50 percent of the population besides making a significant contribution to India’s Gross Domestic Product. As per the provisional estimates of Annual National Income, released by the National Statistics Office, Ministry of Statistics and Programme Implementation the percentage share of Gross Value Added (GVA) of agriculture and allied sector to total economy stood at 20.2% in 2020-21.

More than 80 percent of the poor largely depends on farming for their livelihood and more than 85% of the farmers belong to small and marginal categories. The imperfect market scenario, inaccessibility to credit, suboptimal investment decisions, pool of unskilled human capital, insufficient access to extension services and poor technological know-how are some of the key constraints being witnessed by small and marginal farmers in this eon of cut-throat competition.

In this regard, Government of India has been consistently striving hard in terms of formulating optimum policies for ensuring better price to the farmers for their agricultural output. Now in the past also efforts have been undertaken to improve the earning scenario of the farmers as well as for mobilizing small and marginal farmers to fight for their interests in unison. These endeavours subsequently resulted in the emergence of collectives in various forms like societies and trusts, cooperatives, Mutually Aided Co-operative Societies (MACS) or self-reliant cooperative societies, private limited companies, public limited companies and producer companies.

Within the cooperatives, different forms such as Farmers Interested Groups (FIGs), Self-Help Groups (SHGs), Farmer Associations (FAs), Farmers’ Unions, Federations, Commodity Interest Groups (CIGs) etc. also functioned in terms of collective actions. However, the performance these cooperatives have been abysmal excepting few.

The previous experiences of cooperatives in India necessitated the requirement for more autonomy to cooperatives to function as business entities in competitive markets. Thus, a kind of cooperatives termed as ‘Producer Companies’ took birth with the amendment of Section 581 of the Companies Act, 1956, in 2003.

Under the Indian Companies Act, 1956, a producer company was registered under the provisions of part IX-A, chapter one of the mentioned Act. As per the Act, the objective of the mentioned company can be production, harvesting, procurement, grading, pooling, handling, marketing, selling, export of primary produce of the members or import of goods or services for their benefit.

According to Indian Companies Act, 2013, a producer company is basically a body corporate registered as Producer Company and shall carry on any of the following activities broadly categorized as under:

i) Production, investing, harvesting, processing, procurement, grading, pooling, handling, marketing, selling, export of primary produce of the members or import of goods or services for their advantage.

ii) Rendering technical services, consultancy services, training, education, research and development and all other activities for the promotion of the interests of its members.

iii) Generation, transmission and distribution of power, revival of land and water resources, their use, preservation and communications pertaining to agricultural produce.

iv) Fostering mutual assistance, welfare initiatives, financial services, insurance of producers or their primary produce.

Literature Review

Kumar Pramod, Kar Amit, PerumalAnubukkani and JhaGirish (2018) stated that the growth of FPOs across India and regions has been non-uniform with more than 50% of total mobilized farmers belonging to four states that is, Karnataka, Madhya Pradesh, Tamil Nadu and West Bengal. The highest number of promoting institutions have been observed in Karnataka, i.e., 89 constituting nearly 8.9 percent of the total promoting agencies working in the country.

Shah Samir and Singh Aparajita (2019) stated that on the demand side, raising a debt is a gargantuan issue for farmers producers organisations, as majority of financial institutions demand collaterals and minimum of three years of balance sheets for credit assessments.

Singh Gurpreet (2019) on farmers producers organisations (FPO) gaining significance stated that farmers who are primary producers can register as FPO. Initially, Small Farmers’ Agribusiness Consortium (SFAC) was the nodal agency to enable the constitution of FPOs under the Department of Agriculture and Cooperation. Further, National Bank for Agriculture and Rural Development (NABARD) has also played a pivotal role in promoting FPOs in various states of India.

PaliathShreehari (2020) stated in a newspaper article by referring the experts that India’s plan to collectivise and support millions of small and marginal farmers into profitable business groups may fail without crucial reforms in the existing funding and support ecology for farm collectives. Mentioning about financial issues of small and marginal farmers, opined that several farmers groups are struggling to survive or expand because small farmers find it difficult to pool in sufficient funds as shareholders and banks do not find them creditworthy enough to provide them loans.

ChaharRajkumar (2021) stated that agriculture and farming community should have overall benefit, it must be made entrepreneurial along with farming. Further, by getting organized through FPO, small and marginal farmers will not only benefitted in obtaining a market for their output, but also assists in procuring superior fertilizers, advanced seeds, certified machines, new technology agriculture machines etc.

Objective of the study

- To comprehend the financial assistance scenario for farmer producer organisations (FPOs) in India

- To have an understanding on the projected financial assistance for FPOs.

Research Methodology

- MANN Whitney U-Test: This non-parametric statistical tests will assist in determining whether on an average the contribution of two significant financial intermediaries, i.e., NABARD (National Bank for Agriculture and Rural Development and SFAC (Small Farmers’ Agri-Business Consortium).

- Parabolic trend equation: This statistical tool will assist in undertaking the prognosis of financial assistance by NABKISAN Finance Limited (a subsidiary of NABARD) to FPOs in India during the period 2023-2030.

Limitations of the study

- This research study is based on the secondary data.

- Due to various technical constrains all the vital facets of farmers producers organisations (FPOs) could not be studied, such as the analysis revolves around two major financial intermediaries, i.e., NABARD and SFAC, and could not cover scheduled commercial banks and other financial institutions engaged in providing financial assistance to FPOs in India

Financial assistance to FPOs

To foster the growth of FPOs in India, the Government of India has launched a Central Sector Scheme of "Formation and Promotion of 10,000 farmers producer organizations (FPOs)" for enhancing the income of farmers in the country including that in Jharkhand, under which professional handholding assistance is to be offered for a period of five years to the new FPOs formed under the scheme. Provision of financial aid to the extent of INR 18 lakhs to each FPOs under the scheme towards establishment cost for 3 years has been made.

It is to be noted that no state-wise target for financial assistance is provided under the scheme as the scheme is FPO centric. In addition to this, provision has been created for matching equity grant upto INR 2,000 per farmer member of FPO with a limit of INR 15 lakh per FPO and a credit guarantee facility upto INR 2 crore of project loan per FPO from eligible lending institutions to ensure institutional credit accessibility to FPOs.

NABARD’s set up Producers Organisations for Development Fund (PODF) in 2011, with an initial corpus of INR 50 Crore for grant and capacity building of FPOs, and providing loans for market linkage. A follow-on NABARD PRODUCE FUND was established in 2014, with an initial corpus of INR 200 Crores to create a network of more than 2,000 FPOs in the country.

Apart from the nature of financial assistance mentioned above, there are numerous policies of central and state governments that provide financial succor to the farmers producers organisations, which are under:

- Operation Green: A Centrally Sponsored Scheme (CSS) launched by the Government of India. Its total budgetary allocation is INR 500 Crores, and is implemented by the Ministry of Food Processing Industries (MoFPI). The scheme aims to build capacity of FPOs through professional development, reduction of post-harvest losses, creation of preservation & processing infrastructure, provision of agri-logistics for supply chain, price stabilization for consumers and producers and preventing distress sale.

- PMKSY Scheme: The MoFPI, under the Pradhan MantriKisanSampadaYojana (PMKSY), has sub-components, facilitating establishment of storage and processing infrastructure.

- Tax exemption: As of FY17-18, Farmer Producer Companies, registered under the Indian Companies Act, 2013, having an annual turnover upto INR 100 Crore received exemption from tax on profits earned from farm-related activities for a period of 5 years.

- Odisha Farmer Producer Organisations (FPOs) Policy,2018.

- Centre of Excellence for FPOs, 2017, by theGovernment of Karnataka.

- RythuKosam, Andhra Pradesh Farmer ProducerOrganisations Promotion Policy 2016.

- The Punjab FPO policy.

- Agriculture – Promotion of Collective Farming byorganising small/marginal farmers into Farmers InterestGroup (FIG)/Farmers Producer Group (FPG) of TamilNadu.

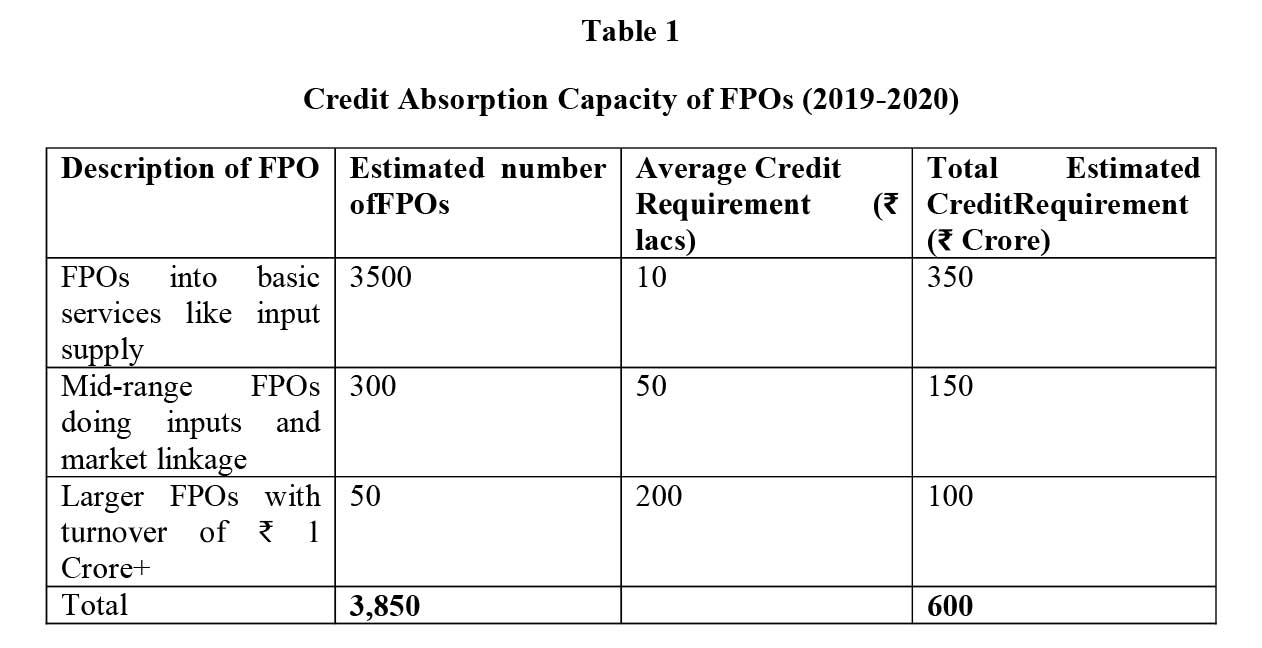

The credit absorption capacity of FPOs based on interaction with key market players providing financial assistance to FPOs, i.e., the Non-Banking Financial Companies that provide mammoth financial assistance to FPOs, that is, NABKISAN (A subsidiary of NABARD), Samunnati and Ananya, NABARD Financial Services Limited (NABFINS), Maanaveeya and Caspian is provided in the table 1 below

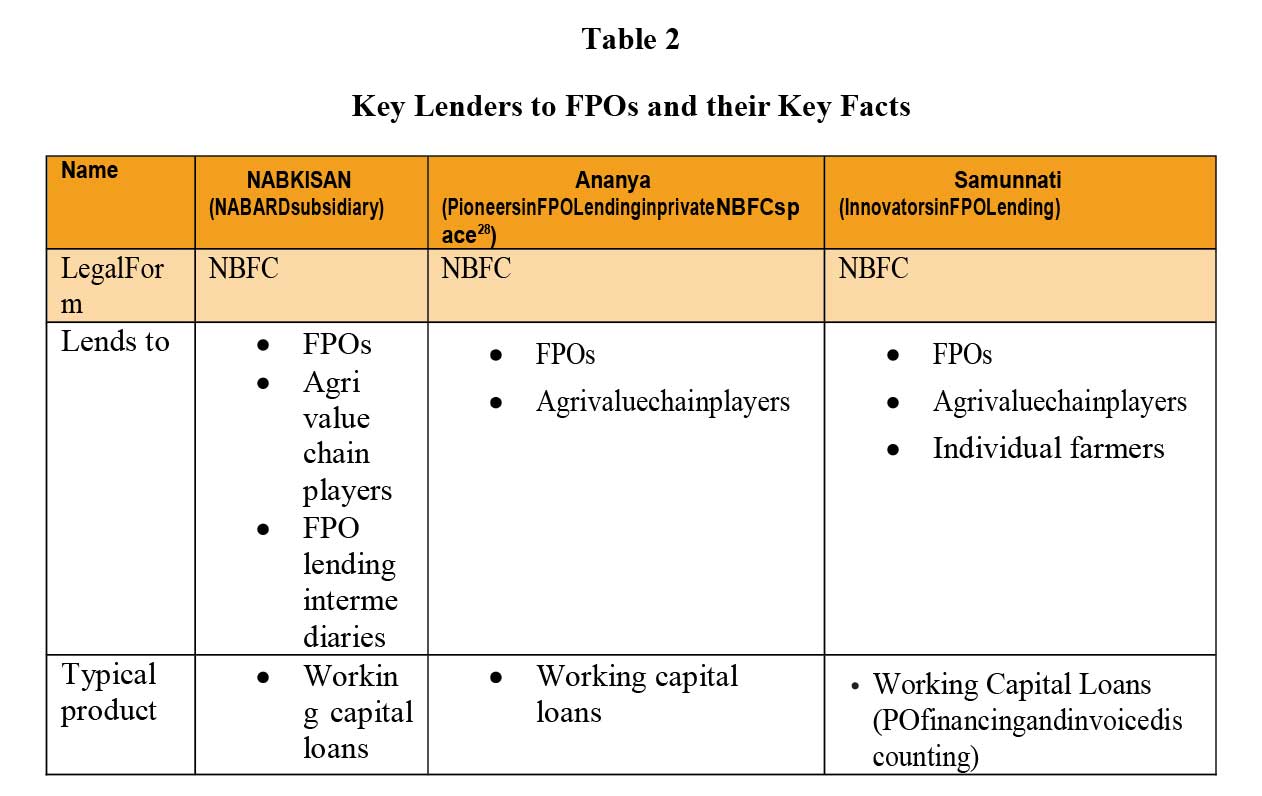

From Table 1 it may be observed that FPOs are quite good in number and their scale of operations are rising in view of the average credit requirements. The three major lenders to FPOs, i.e., NABKISAN, Ananya and Samunnati are playing a noteworthy role in extending assistance to FPOs, as evident from the following facts provided in table 2.

NABARD and SFAC’s Role in supporting FPOs

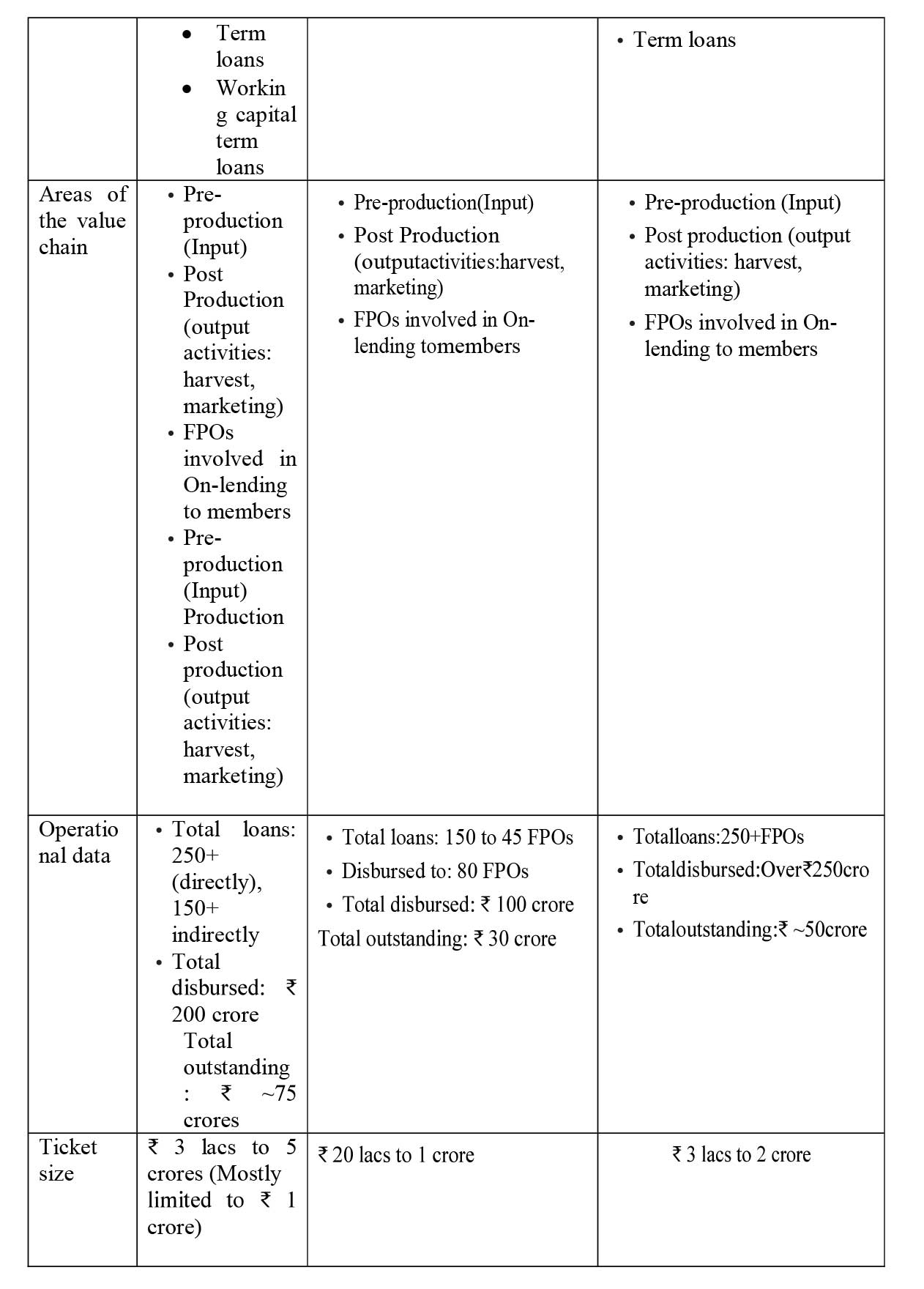

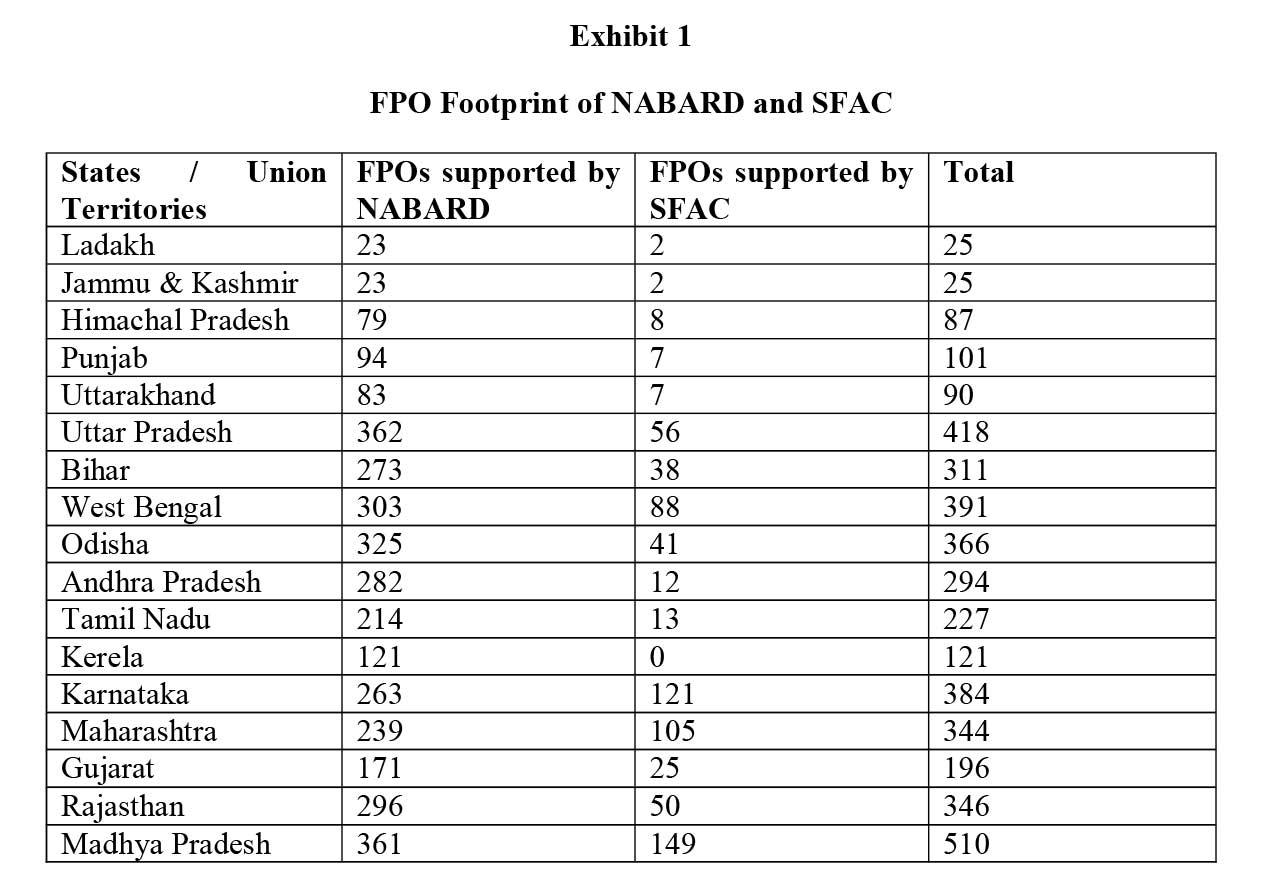

To comprehend the financial assistance scenario of FPOs in India, it would be of substantial academic and research interests to have a look at the data pertaining to the FPOs that have been supported by two major organizations, i.e., National Bank for Agriculture and Rural Development (NABARD) and Small Farmers’ Agri Business Consortium (SFAC). The data of Small Farmers’Agri Business Consortium is as on October 31, 2020 and that of NABARD is as on August 15, 2019. Please refer exhibit 1.

In view of the pivotal role being played by both NABARD and SFAC in fostering growth of FPOs, in this regard, a research endeavour has been made to ascertain the contribution of NABARD and SFAC in supporting FPOs, MANN Whitney U-Test have been used.

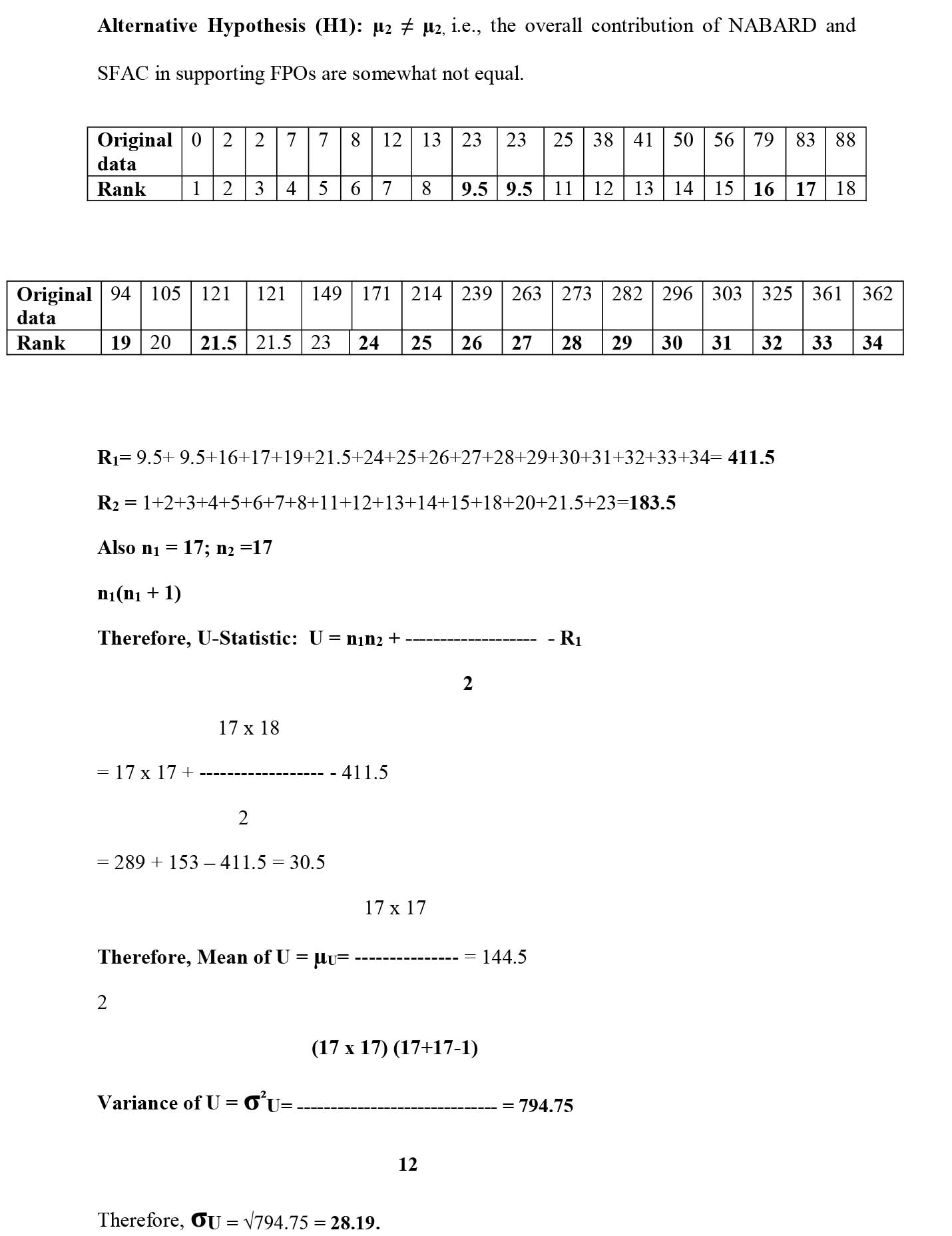

Null Hypothesis (H0) :µ1 =µ2, i.e., the overall contribution of NABARD and SFAC in supporting FPOs are equal.

Alternative Hypothesis (H1): µ2 ≠ µ2, i.e., the overall contribution of NABARD and SFAC in supporting FPOs are somewhat not equal.

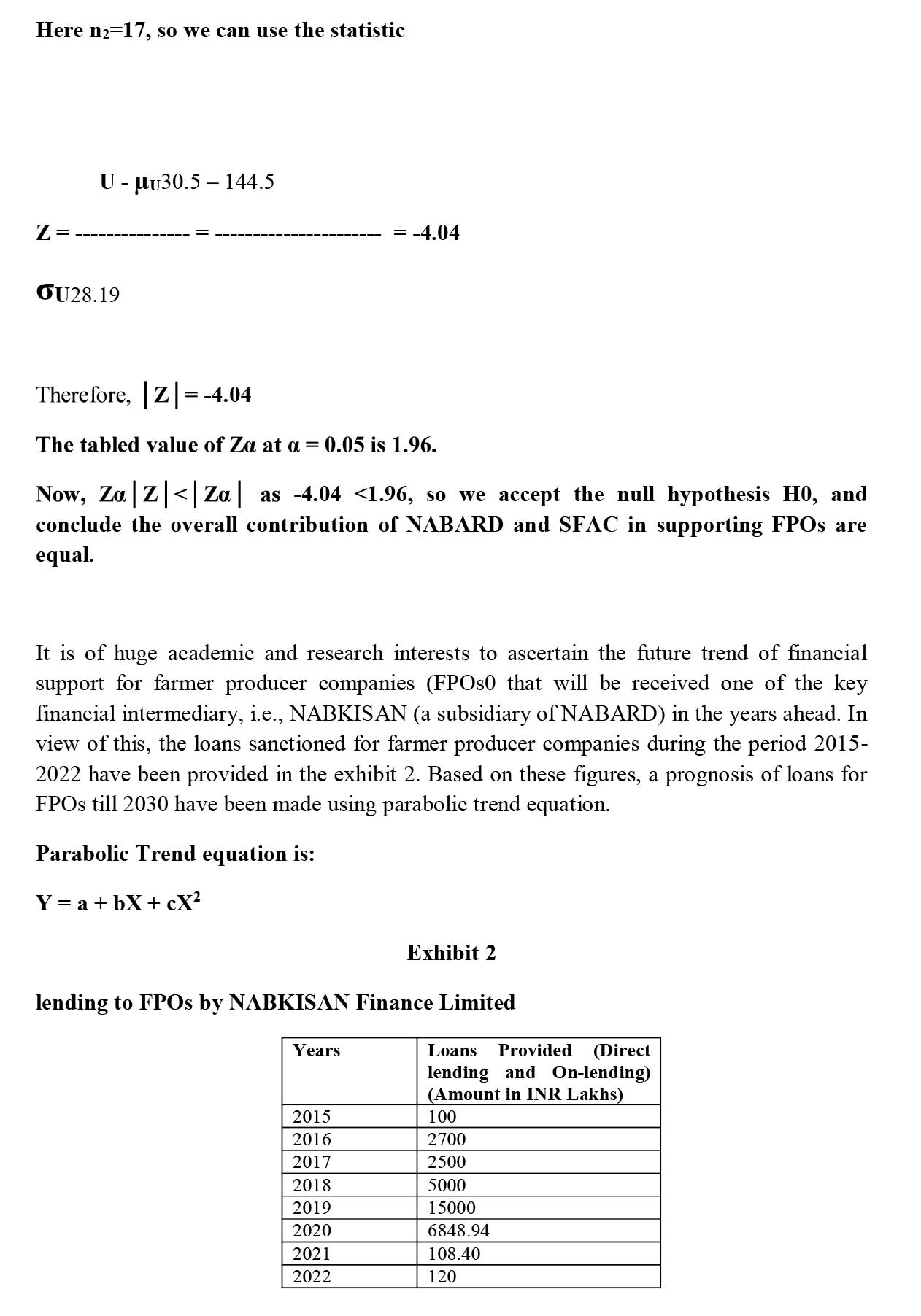

It is of huge academic and research interests to ascertain the future trend of financial

support for farmer producer companies (FPOs0 that will be received one of the key

financial intermediary, i.e., NABKISAN (a subsidiary of NABARD) in the years ahead. In

view of this, the loans sanctioned for farmer producer companies during the period 2015-

2022 have been provided in the exhibit 2. Based on these figures, a prognosis of loans for

FPOs till 2030 have been made using parabolic trend equation.

Parabolic Trend equation is:

Y = a + bX + cX2

Based on the data provided in the exhibit 2, the forecasted quantum of loans for the FPOs

is provided in the exhibit 3.

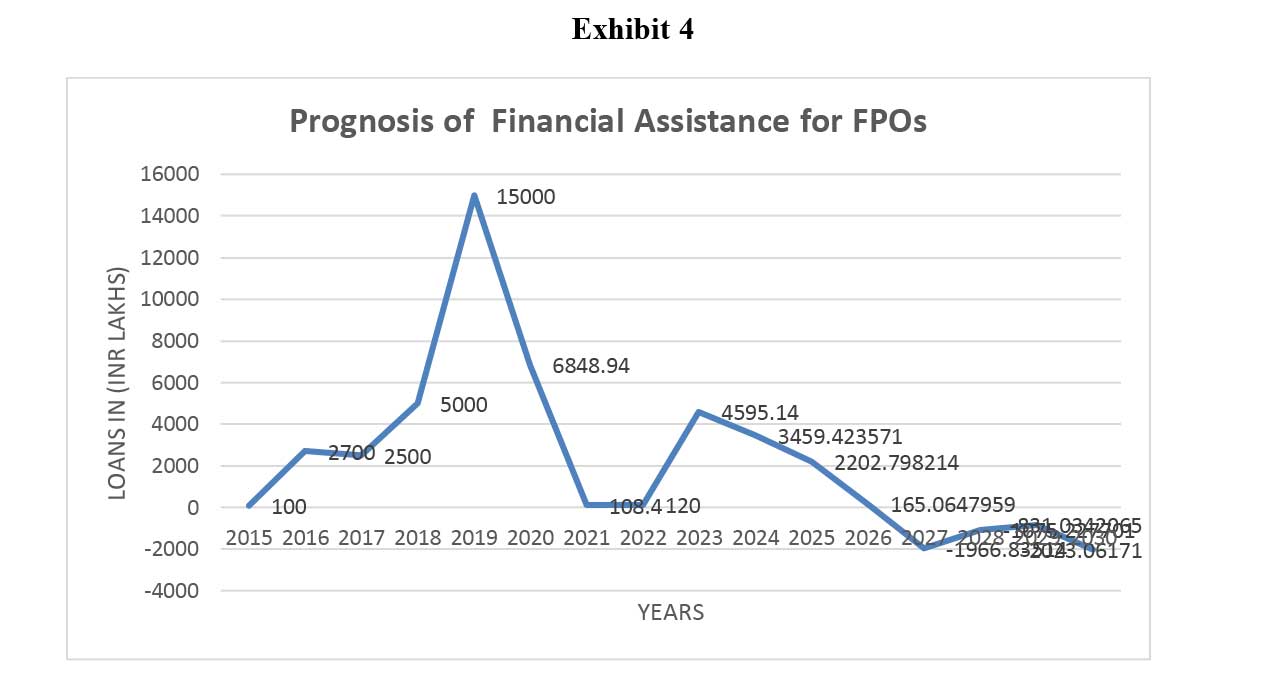

The parabolic trend of the forecasted loan amount for FPOs is provided in exhibit 4. On observing the parabolic trend it is being observed that initially there is an increase in financial assistance but later on it moves southwards. However, it is to be noted that this forecast is based only on the data of one financial intermediary and there are other financial institutions / intermediaries also like commercial banks, Samunnati, Ananya, SFAC etc. that are playing a pivotal role in providing financial support to various farmer producer organisations in India.

Further, the government aims to form and promote 10,000 FPOs will definitely trigger a financial solace from more financial intermediaries in the near future, thereby leading to growth and prosperity of FPOs in India

Conclusion

A conducive milieu is a must for growth of farmer producers organisations because they have to witness the most vulnerable part of agri-value chain, which commences from the farm and goes on till processing and the far away markets. The vital ecosystem services covers emergency credit, consumption credit, production credit, retail services of inputs for agriculture and other agricultural production services needed by small and marginal farmers. Unless these services are provided by a farmer producers organisations, it may be difficult in diverting the excess produce from the local trader to the producer organisation.

Further, a farmer producersorganisation can take up other services pertaining to facilitating linkage with the banks and line departments for ensuring access to the required infrastructure for the business. It is to be noted that to enhance the financial support for FPOs through various financial institutions, a lot to be done in building an amicable environment for FPOs in India. In this regard, the following needs to be emphasised-

i) Policy environment- production, market and price risk mitigation, licencing, agri-logistics, adequate infrastructure, contract farming, compliances etc.

ii) Technology support- Extension and advisory services, value addition, processing & marketing etc.

iii) Consumption / production / post production credit support- Banks / financial institutions, NBFCs, Government institutions, Developmental agencies, Corporates etc.

iv) Retail services / Markets- Quality inputs, retail marketing, spot markets (eNAM, APMC), future’s trading, linkages with agri-corporates, exporters, direct marketing etc.

Further, the Equity Grant Fund Scheme and Credit Guarantee Fund Scheme may be strengthened. As NABARD have been and is playing a pivotal role in providing financial succour to the FPOs, in view of this, it may embrace the following significant recommendations of the Internal Working Group of Reserve Bank of India:

a. NABARD must design a financing model for credit needs of FPOs / FPCs across the complete supply and value chain. Further, NABARD should encourage women-oriented FPOs by identifying successful women SHGs (Self-Help Groups).

b. Bank loans to FPOs / FPCs undertaking farming with assured marketing of their output at a pre-determined price, having at least 75 percent SMF, should be eligible for PSL with a credit cap of INR 50 million.

c. To broaden the scope and reach of the guarantee fund presently available to FPCs through SFAC, Government of India should increase its corpus and extend the facility to FPOs so that banks can lend without laying stress on collateral.

-

References

- "Policy Paper- Financing for Farmer Producer Organisations", UNDP, Accessed from https://www.livelihoods-india.org/uploads-livelihoodsasia/subsection_data/financing-for-farmer-producer-organisations.pdf.

- National Paper (2019-20). "Farmer Producers’ Organizations (FPOs): Status, Issues & Suggested Policy Reforms", Accessed from https://www.nabard.org/auth/writereaddata/CareerNotices/2708183505Paper%20on%20FPOs%20-%20Status%20&%20%20Issues.pdf

- GoyalDivesh (2020). "Producer Companies under Companies Act, 2013", Tax Guru, Accessed from https://taxguru.in/company-law/producer-company-under-companies-act-2013.html

- Kumar Pramod, PerumalAnbukkani, Kar Amit and JhaGirish (2018). "Progress and Performance of States in Promotion of Farmer Producer Organisations in India", Retrieved Accessed from https://www.researchgate.net/publication/329642200_Progress_and_Performance_of_States_in_Promotion_of_Farmer_Producer_Organisations_in_India

- Neti Annapurna, GovilRicha and Rao Madhushree R (2019). "Farmer Producer Companies in India: Demystifying the Numbers", Accessed from http://ras.org.in/farmer_producer_companies_in_india

- Rangarajan C and Dev Mahndra S (2021). "How FPOs can help small and marginal farmers", Accessed from https://indianexpress.com/article/opinion/columns/nabard-agrarian-distress-farmers-protest-farm-laws-7222830/

- Shah Samir and Singh Aparajita (2019). "The Road Ahead for Farmer Producer Organisations in India", https://www.dvara.com/research/blog/2019/06/20/the-road-ahead-for-farmer-producer-organisations-in-india/

- PaliathShreehari (2020). "India’s 10,000 farmers- collective plan may fail without funding reforms", Accessed from https://www.business-standard.com/article/current-affairs/india-s-10-000-farmers-collective-plan-may-fail-without-funding-reforms-120111800155_1.html

- Singh Gurpreet (2019). "Promotion of Farmer Producers’ Organisations: Rhetoric versus Policy Action", Accessed from https://www.cbgaindia.org/blog/promotion-farmer-producers-organisations-rhetoric-versus-policy-action/

- Ministry of Agriculture & Farmers Welfare (2021). "Promotion of FPOs", Accessed from https://www.pib.gov.in/PressReleasePage.aspx?PRID=1705512#:~:text=Provision%20of%20financial%20assistance%20to,3%20years%20has%20been%20made.&text=Already%20a%20target%202200%20FPOs,released%20under%20the%20new%20scheme.

- "Farm Sector Development Department", Accessed from https://www.nabard.org/about-departments.aspx?id=5&cid=470

- Nathan Senthil T.S. and PalanichamyVenkatesa N. (2021). "Farmer Producer Companies in India: An Overview", Accessed from file:///C:/Users/USER/Downloads/31528-Article%20Text-58632-2-10-20211015.pdf

- "Guidebook on Lending to Farmer Producer Organisations", Accessed from https://birdlucknow.nabard.org/wp-content/uploads/2021/02/Guidebook-on-lending-to-FPOs.pdf

- "Annual Reports of NABKISHAN Finance Limited", Accessed from https://www.nabkisan.org/annual-reports