Subscribe now to get notified about IU Jharkhand journal updates!

An Insight Into The Peer To Peer Lending Industry Of India

Abstract :

Peer to Peer lending has seen a large number of new entrants over the last year. Today, P2P lending companies like LenDen Club and Faircent estimate that the number of new members will be in lakh. Faircent, India's first NBFC-P2P company, has disbursed Rs. 1145 crore in loans in FY21 alone representing a nearly 24% increase in disbursals. The boom is due to the attractive returns of 14 to 16 percent per annum when compared to other asset classes. This article discusses the nature and the functions of peer to peer lending. It also tries to highlight the reasons, the investors find P2P platforms in India attractive amidst the global economic crisis.

Keywords :

peer to peer ,lending, P2P platforms, economic crisis.Introduction

Money flows from those who do not understand financial management to those who do. Many people were previously unaware of how to effectively manage their wealth. Changing technological dynamics and increasing internet penetration have resulted in a shift in financial transaction behavior. Several Indians who were previously unfamiliar with the concept of online wealth management platforms are now frequently investing in online wealth-tech platforms.

According to the CIC report, there are approximately 200 million credit-active individuals out of a total working population of 400 million in the country. The number of digital lenders has grown significantly in recent years and is expected to grow even more in order to fill this massive credit gap.

Some platforms host lending while others host investing, and then there are Peer-to-Peer lending platforms that cater to both borrowers and investors. Peer-to-peer lending, also known as crowd lending, is a type of debt financing in which borrowers request a loan from another person without the need for a financial institution to act as an intermediary. P2P lending has the potential to expand financial inclusion globally as a source of financing. When compared to other investment options, groups with low credit scores or income find P2P lending to be extremely accessible.

Furthermore, the under banked/unbanked population and small/micro businesses frequently face difficulties in obtaining organized credit. This makes peer-to-peer lending an appealing option for many people. Financial inclusion is a critical issue in India, where nearly 70% of the population lives in rural areas. However, widespread Smartphone adoption, combined with the implementation of infrastructures such as Aadhar, UPI, Digilocker, eKYC, eSign, BHIM, and India stack, has enabled many P2P lenders.

Although P2P loans are primarily personal loans, borrowers may apply for P2P loans for a variety of reasons, including:

- Education

- Purchasing real estate

- Debt consolidation

- Obtaining a secured business loan

- Finance for machinery

1. To understand the nature and the functions of peer to peer lending.

2. To investigate the reasons the investors, find P2P platforms in India attractive amidst the global economic crisis

3. To bring out te risks associated with P2P lending and suggest the best P2P platforms

.. III. RESEARCH METHODOLOGY

The research is based on secondary information. Secondary data is gathered from numerous journals, publications, and websites to investigate the risk associated with Peer to Peer lending, bringing out the best P2P platforms for investments in India.

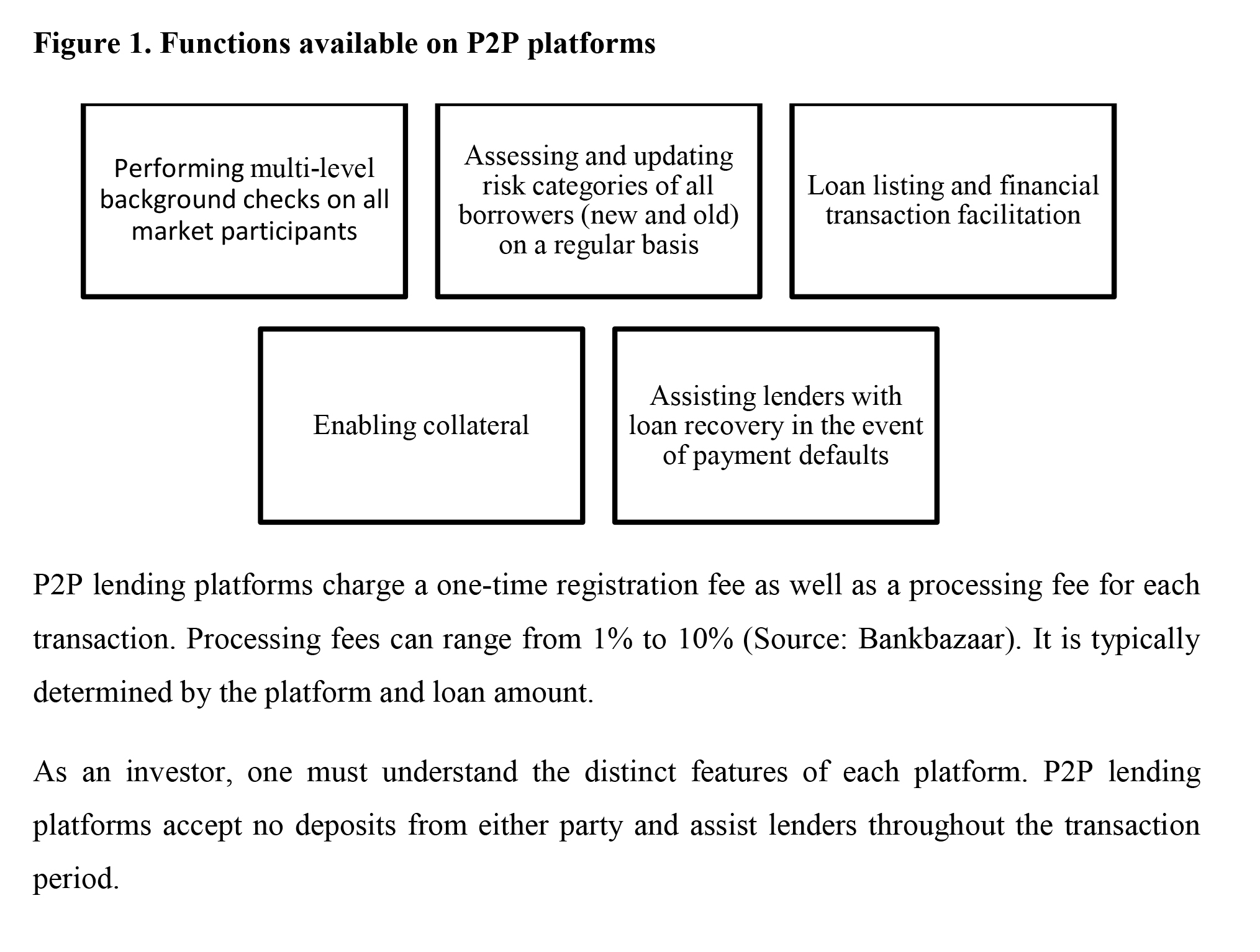

IV. PEER TO PEER LENDING PLATFORMS - FUNCTIONS

In the simplest terms, P2P platforms are a marketplace for borrowers and lenders to connect. The platforms use advanced lending CRMs such as Lead Squared during the on boarding process to accelerate the customer acquisition rates and reduce the turnaround times exponentially. Once a potential opportunity is on boarded, P2P platforms use their tech-based processes powered by analytics and data-driven algorithms to segment these opportunities.

These platforms can accurately classify all types of borrowers. It is an important component that assists P2P platforms in improving access for people with higher risk profiles.

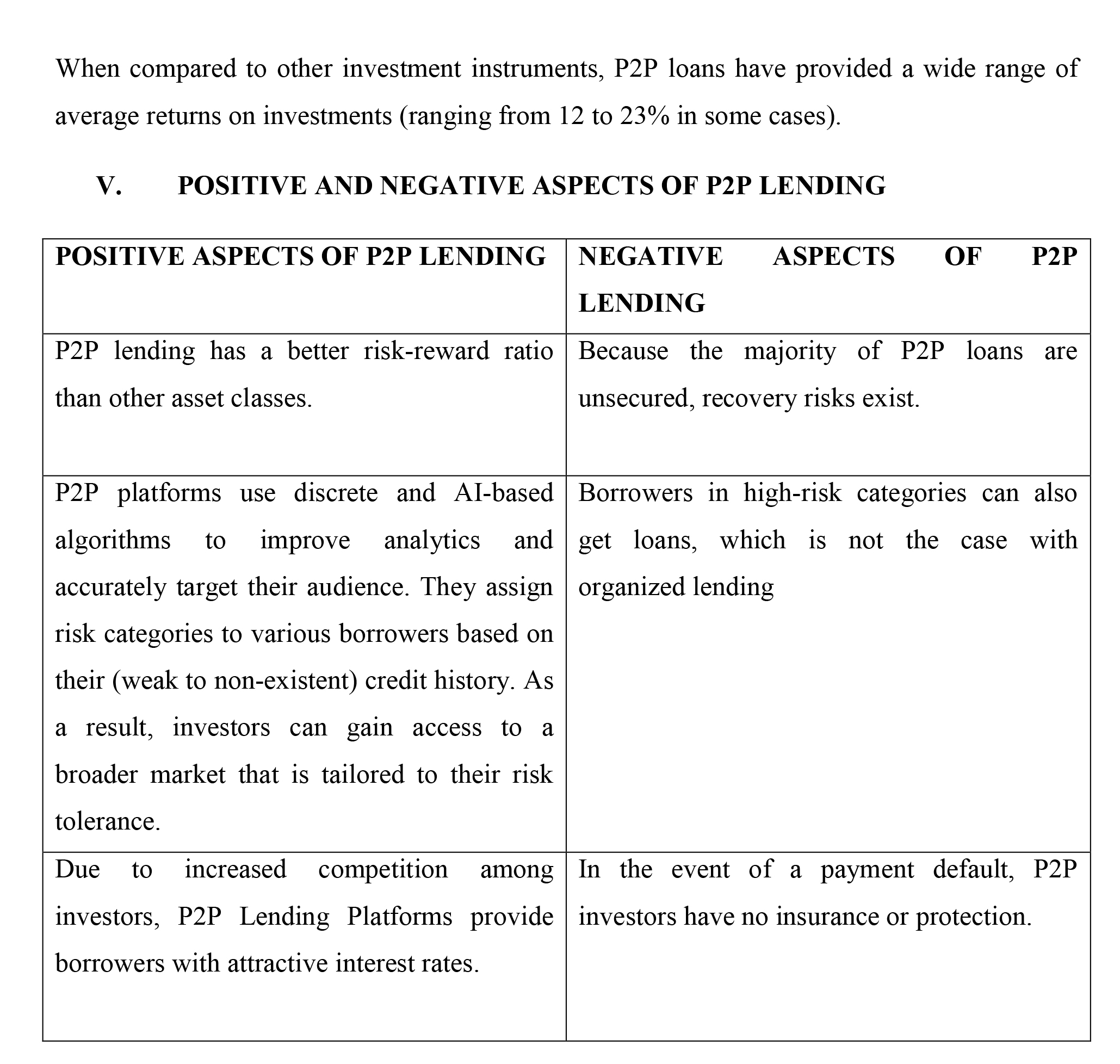

VI. RISK INVOLVED WITH P2P LENDING

A P2P platform may offer a higher rate of return to an investor than a fixed deposit with a bank, though this is not guaranteed. The platform also finds and verifies the borrower. For the borrower, the platform offers an alternative source of funds with potentially fewer hassles than the lengthy process of obtaining funds from a bank. At least 3-3.5 million investors have opened investment accounts on P2P lending platforms to date. While this may appear insignificant in comparison to mutual funds, it is significant. In India, P2P lending platforms have invested approximately Rs 20,000 crore in loans, with a total outstanding AUM (assets under management) of approximately Rs 4,000 crore. P2P lending is risky, just like any other asset class. The two major risks before investing in P2P, investors should be aware of are:

- Payment defaults pose risk and collections can be difficult. Many P2P platforms assist the investors in recovering their invested amount from the borrower in accordance with the RBI guidelines for NBFC-P2P. However, in some cases, recovering the amount may necessitate a lot more effort.

- The risk of lower returns If the borrower repays the loans ahead of schedule, one may end up with less profit than expected.

- LenDenClub LenDenClub, founded in 2014 by Bhavin Patel, is one of India's fastest-growing peer-to-peer lending platforms. It serves over a million customers across 19,000 zip codes. The platform's digital lending application, InstaMoney, aims to expand its reach across India and increase financial inclusion.

- Faircent Faircent was India's first P2P lending platform to receive an NBFC-P2P license from the RBI, with over 2 lakh lenders at the end of FY-21. Faircent was founded in 2013 by Rajat Gandhi, Vinay Mathews, and Nitin Gupta. Faircent's innovative loan portfolio, which includes anti-lockdown loans, aims to alleviate liquidity-related stress on borrowers affected by the pandemic.

- Lendbox Lendbox, another popular P2P lending platform, has over 50000 investors and 5.4 lakh registered borrowers. Lendbox was founded in 2015 by Ekmmeet Singh, Bhuvan Rustagi, and Jatin Malwal. Lendbox investors have earned up to 16% annual returns by lending to a variety of borrowers. Through technology, it aims to reduce lending middlemen and increase financial inclusion for many borrowers.

- Lendingkart Ex-banker Harshvardhan Lunia founded Lendingkart in 2014 to support India's SME sector. It has assisted over 90,000 small businesses in 1300 cities since its inception. The company categorizes its borrowers using cutting-edge credit assessment algorithms, allowing you to meet the best candidates.

- Finzy In 2016, Amit More,Abhinandan Sangam ,Dixit and Apoorv Gawde set out to build a platform that would allow for risk-adjusted investing. They began Finzy with this mission. It provides various opportunities for investors to earn returns ranging from 7.99% to 27.99% depending on their risk tolerance. To reduce risk while maximizing returns, investors use advanced investment solutions such as finzyPRO+, finzyBolt, and Reinvest-Pro available on the platform.

VII. TOP FIVE BEST PEER-TO-PEER LENDING PLATFORMS IN INDIA

Currently, around 26 companies, including LenDenClub, Faircent, and LiquiLoans India, P2P, are registered with the RBI as NBFC-P2Ps. Then there are fintechs, such as BharatPe's 12% Club and MobiKwik Xtra, which have partnered with NBFC-P2Ps to provide lending services to their customers. Fintech companies such as BharatPe provide both borrowing and lending services with interest rates of up to 12%. It also allows investors to lend to the company's merchants, whose creditworthiness can be determined using business cash flows, and to facilitate repayment by deducting a small portion of their daily payouts. The funds borrowed through the "12% Club" initiative are facilitated by a traditional NBFC, such as Hindon Mercantile, which makes consumer loans.

VIII. CONCLUSION

By entering the sector, many well-known fintech companies hope to gain a slice of the growing P2P market share. As India strives to become a $5 trillion economy, credit options such as peer-to-peer lending help to provide credit to the country's credit-deprived population. P2P lending platforms can meet the high demands of consumers by deploying technological advancements in activities such as onboarding, underwriting, and disbursement. Following recognition, the sector has evolved tremendously, and with more innovations and new players entering the market, the industry is poised to reach new heights in the coming years. According to a market research firm, Industry ARC, the Indian P2P lending market is expected to reach $10.5 billion by 2026, growing at a rate of 21.6 percent between 2021 and 2026.. The increase can be attributed to factors such as increased internet penetration, an increase in digital payments, and increased credit demand among first-time borrowers and businesses. The RBI regulatory framework has aided in the development of the industry by increasing investor trust. There are currently about 26 companies registered with the RBI as NBFC - P2P. Faircent, LenDen Club, Liquiloans, Finzy, and i2ifunding are some of the leading platform

REFERENCES

- https://www.faircent.in/

- https://www.leadsquared.com/industries/lending/p2p-lending/

- https://www.lawstreetindia.com/experts/column?sid=722#:~:text=Peer%2Dto%2DPeer%20Lending%20(,to%20act%20as%20an%20intermediary.

- https://www.businesstoday.in/magazine/money-today/story/rise-of-p2p-lending-platforms-why-users-need-to-exercise-caution-before-diving-into-it-389409-2023-07-12

- Anil, K., & Misra, A. (2022). Artificial intelligence in Peer-to-peer lending in India: a cross-case analysis. International Journal of Emerging Markets, 17(4), 1085-1106.

- Rao, S. P., & Anand, M. R. (2019). Peer to peer lending platforms in India: Regulations and response. Prajnan, 48(2), 107-122.

- Khatri, P. (2019). An overview of the peer-to-peer lending industry of India. International Journal of Business and Management Invention, 8(3), 1-11.

- Kaveri, V. S., & Narang, D. (2020). Peer to Peer Lending in India under COVID-19 Scenario. Vinimaya, 41(1).

- Manda, V. K., & Yamijala, S. (2019). Peer-to-peer lending using blockchain. International Journal Of Advance Research And Innovative Ideas In Education, 6, 61-66.

- Ravishankar, M. N. (2021). Social innovations and the fight against poverty: An analysis of India's first prosocial P2P lending platform. Information Systems Journal, 31(5), 745-766.

- Liu, Z., Shang, J., Wu, S. Y., & Chen, P. Y. (2020). Social collateral, soft information and online peer-to-peer lending: A theoretical model. European Journal of Operational Research, 281(2), 428-438.

- Ichwan, I., & Kasri, R. A. (2019). Why are youth intent on investing through peer to peer lending? Evidence from Indonesia. Journal of Islamic Monetary Economics and Finance, 5(4), 741-762.

- Oh, E. Y., & Rosenkranz, P. (2022). Determinants of peer-to-peer lending expansion: The roles of financial development and financial literacy. The Journal of FinTech, 2250001.

- Sachdev, N., & Singh, K. N. (2021). Fintech Environment and funding activity in India. Vidyabharati International Interdisciplinary Research Journal, 13(1), 11-20.