Subscribe now to get notified about IU Jharkhand journal updates!

Usage of Social Media Marketing On Insurance Business Performance K.Priya

Abstract :

The part of insurance as a profitable policy tools are that can be used to address the issue of climate changes. The magnitude of implicit loss, the adverse social and profitable consequences for millions of people and considerable financial strain assessed on government budgets by extreme rainfall events all indicate that governments can profit significantly from the use of an insurance instrument able not only of covering damage but also of furnishing an incitement for threat reduction behaviours. By examining the different insurance systems that live in European countries and grouping them into hazards insurance is examined in terms of private and public involvement. Businesses are decreasingly counting on digital advertising options similar as display and social media advertising. Still, the insurance assiduity continues to lag behind other diligence. A check through a structured questionnaire was used to probe consumer gets , views of social media advertising. And a relative analysis of four private insurers in India was done in this study.

Keywords :

Social Media, social media marketing, Business Performance, Insurance companyIntroduction

Social media marketing is getting decreasingly popular, it has shown as a successful strategy for carrying consumers' attention and their business. This success has been seen in numerous diligence, including insurance. still, there's a lack of conclusive exploration on the impact of social media marketing on small independent brokerages of property and casualty insurance. That's what this exploration aims to address. Social media marketing can produce analogous positive impacts on this specific assiduity as it does on others. To address this content, dyads a literature review of extant exploration of social media marketing with in- depth interviews of small business possessors in the insurance assiduity.

1.2 VALUE OF SMM IN INSURANCE

This exploration set out to understand how social media marketing creates value for small brokerages of property and casualty insurance. In general, most insurance policy guests hope to no way have to use their insurance policy. The ideal situation would be to no way use the policy since the operation of a policy means that kind of loss passed whether it be damage to a vehicle, injury to a person, or another loss. So how do social media marketing relay the value of that impalpable service to the consumer? One of the most successful insurance companies on social media didn't get successful by participating advertisements for insurance; they did it by creating value for their client (Penton, 2014). Participating papers and news reports are that are useful and add value to their customer life while incorporating insurance in the discussion. These posts generally don't mention the trade of a factual policy, nor do they include anything about prices or quotations. They're solely posted to educate the consumer on motifs including insurance or care for means that may be ensured like a vehicle. Insurance is one of the most complex diligences since it utilizes terms and expressions numerous everyday consumers aren't familiar with. When a company creates a social media runner to educate consumers on what those terms mean and what certain programs may cover it can produce immense value. It has been mentioned how a wrong purchase when it comes to insurance can eventually lead to being underinsured or having no insurance content on a policy you may have allowed would cover a loss ( Robson, 2015). Although it's eventually the agent or brokers duty to insure the client is duly covered for what they're demanding occasionally effects may get overlooked. The capability for the consumer to have a place to find education on insurance terms and types of programs can help in precluding them from copping incorrect content.

1.3 IMPORTANCE OF SMM ON INSURANCE COMPANY

Social media helps in adding the reach of a business and gives the company a chance to follow their client’s habits and taste for better targeting them with their products immolations. Advertisers have an option of customizing according to the target followership, which reduces the cost and increases the conversion rates at the same time. Time spent on social media has increased manifold in recent times and people are more habituated and apprehensive of brands whose announcements can be seen while operating their phones or desktops. Though these social media announcements are fancy and applaud able, there's a lot of energy and noise associated with them as well of which a marketer should be careful. It's a good place to increase brand mindfulness and encourage engagement among consumers.

2.1 REVIEW OF LITERATURE

P, I Made Indra (2022) assessed that social insurance as commodity less important and feel a loss if they share in social insurance. This is caused by the lack of knowledge carried out by the government. Thus, as a university in the field of insurance, it's necessary to carry out knowledge to the community through community service. Conditioning will be carried out in the form of performances by making animated vids about social insurance.

Kamenjarska T, Spremic M and Miloloža (2022) conveyed that insurance companies in the Republic of North Macedonia. The results attained from the structural equation modeling analysis, which seeks to determine the structural relationship between the measured variables and the idle constructions, reveal positive goods of invention performance on the profitability of insurance companies. The factors are that affect the degree of invention (invention sweats, competitive precedence’s and request strategy).

Venkatesh and Srinidhi (2019) examined that this study investigates the play of significant data analytics to recharge the insurance custom from its conventional ball game and abetment in exponentialpan-industry accretion. Data vacuity has expanded dramatically with the emergence of social media. This allows insurance firms to not only aggregate drew up data that are freely accessible to them, but also obtains turn to diverse kinds of unformed data that's visual on social media. Consequential data may be utilized efficiently for prophetic analytics and fraud analytics in this environment. Big data provides speedier data processing, allowing insurance businesses to recycle usages and claims more swiftly, influencing in upgraded situations of customer happiness. To sustainably evolve in the request, insurance firms must enforce a marketing plan, and important data is the return.

Delafrooz N, Zendehdel M and Fathipoor M (2017, ( a) assessed that changing Client communication channels and fragmentation of this communication from supplier to consumer has reduced more and more the guests' trust and belief. Social media provides the mates of insurance companies are (trade representatives) with an occasion for creating fast and effective communication with guests. Statistical population of the exploration consists of distribution channel of Iran and Asia insurance companies in three situations of central services (supplier), representatives of these companies and guests as consumers. Social media operation has a chain relation in the force channel of Iran and Asia insurance companies and creation of this chain relation will make guests pious to trade representatives of insurance companies and will ameliorate representatives' performance and brand trade of Iran and Asia insurance companies.

Kigen (2014) constructed that the insurance sector plays an important part in service grounded frugality of Pakistan. Profitability is one of the most important objects of fiscal operation because one thing of fiscal operation is to maximize the proprietor s wealth and profitability is veritably important determinants of performance. This study delved the effect of size on the profitability of insurance companies of Kenya. Specifically this study examined the goods of total means, influence and request share on profitability (ROA). A crucial index of insurance companies profitability is return on means (ROA), defined as the before duty profit peak by total means (TA). Profitability is dependent variable while total means, influence and request share are independent variables.

Porrini D, Schwarze R (2014) constructed that Social media provides the mates of insurance companies (trade representatives) with an occasion for creating fast and effective communication with guests. Statistical population of the exploration consists of distribution channel of Iran and Asia insurance companies in three situations of central services (supplier), representatives of these companies and guests as consumers. Social media operation has a chain relation in the force channel of Iran and Asia insurance companies and creation of this chain relation will make guests pious to trade representatives of insurance companies and will ameliorate representatives' performance and brand trade of Iran and Asia insurance companies.

3.1 IMPORTANCE OF THE STUDY

Social media marketing is an important tool for insurance companies to usage in instruction to involve with their customers, prospects, and communities. It has helped them build awareness and trust. Social media is an important tool for insurance companies. It look at some of the ways you may maximise the social media business to assist you achieve your insurance company objectives .Insurance firms benefit from social media advertisements because they may target a specific audience based on a variety of factors.

4.1 STATEMENT OF THE PROBLEM

This research is specially related to insurance businesses which surely not show all kind of product details in the online marketing. It is difficult to understand the consumer opinion of the product or policy. Illerate people difficult to understand the policy and online processes activity. Middle and low level consumer are not able to involve and not complete period of policy payment in the online insurance market.

5.1 OBJECTIVES OF THE STUDY

To study the overview of social media marketing and business performance in insurance business.

To analyses the relationship between social media and business performance of insurance product.

6.1 HYPOTHESIS

H1: There is a significant relationship between consumers’ perception towards social media marketing advertising.

H2: There is a significant relationship between in consumers’ perception of social media advertising because of gender.

7.1 METHODOLOGY

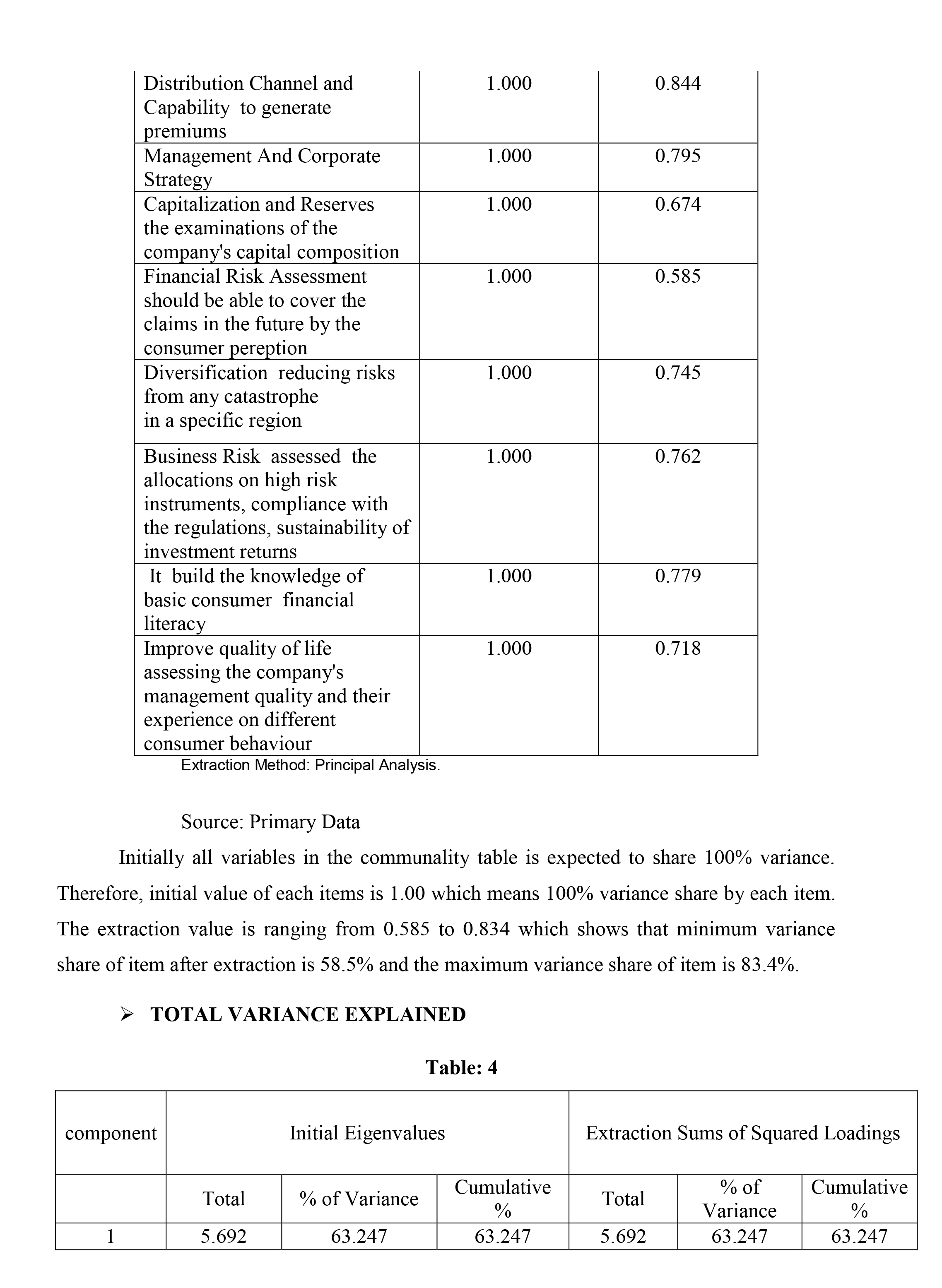

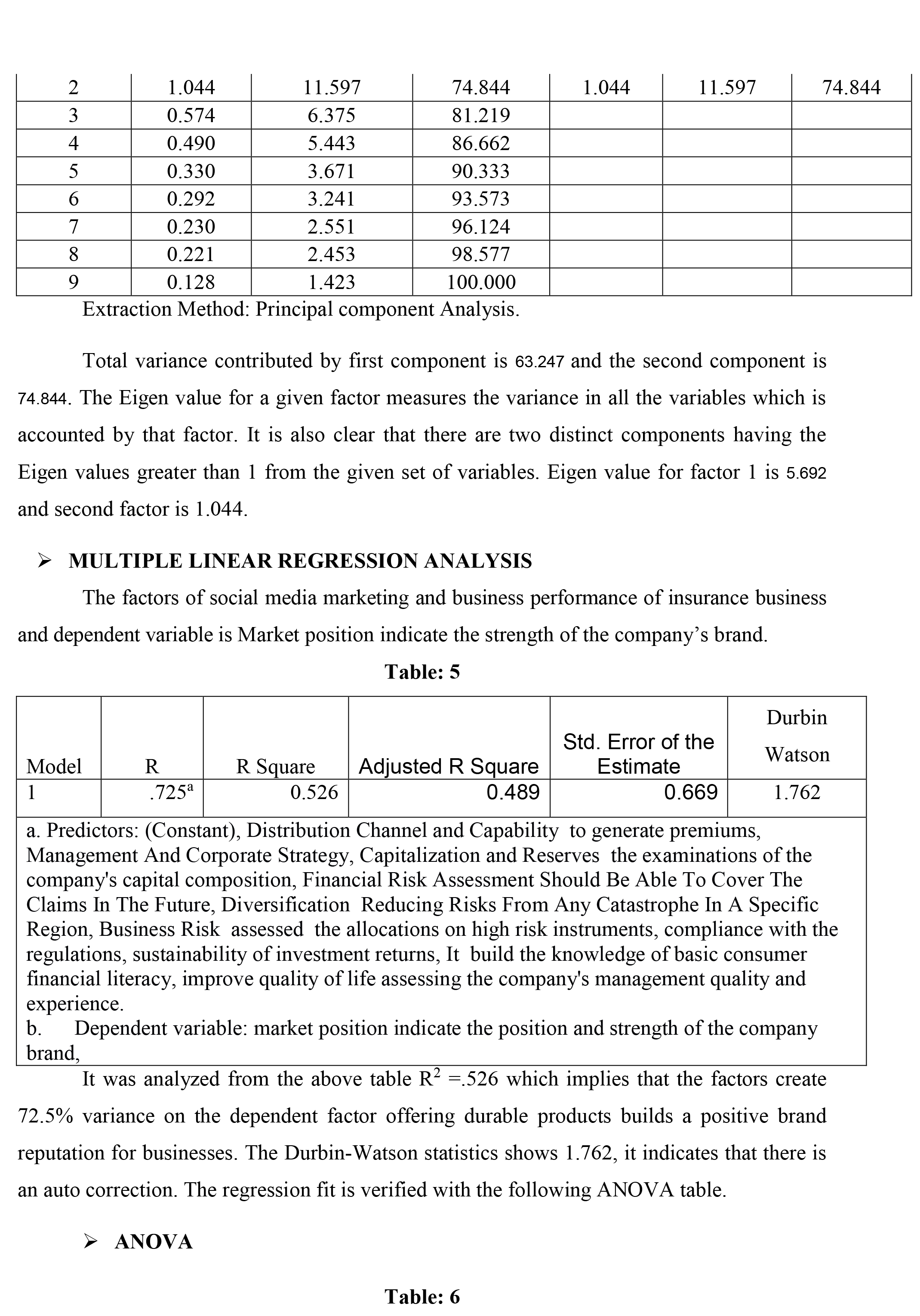

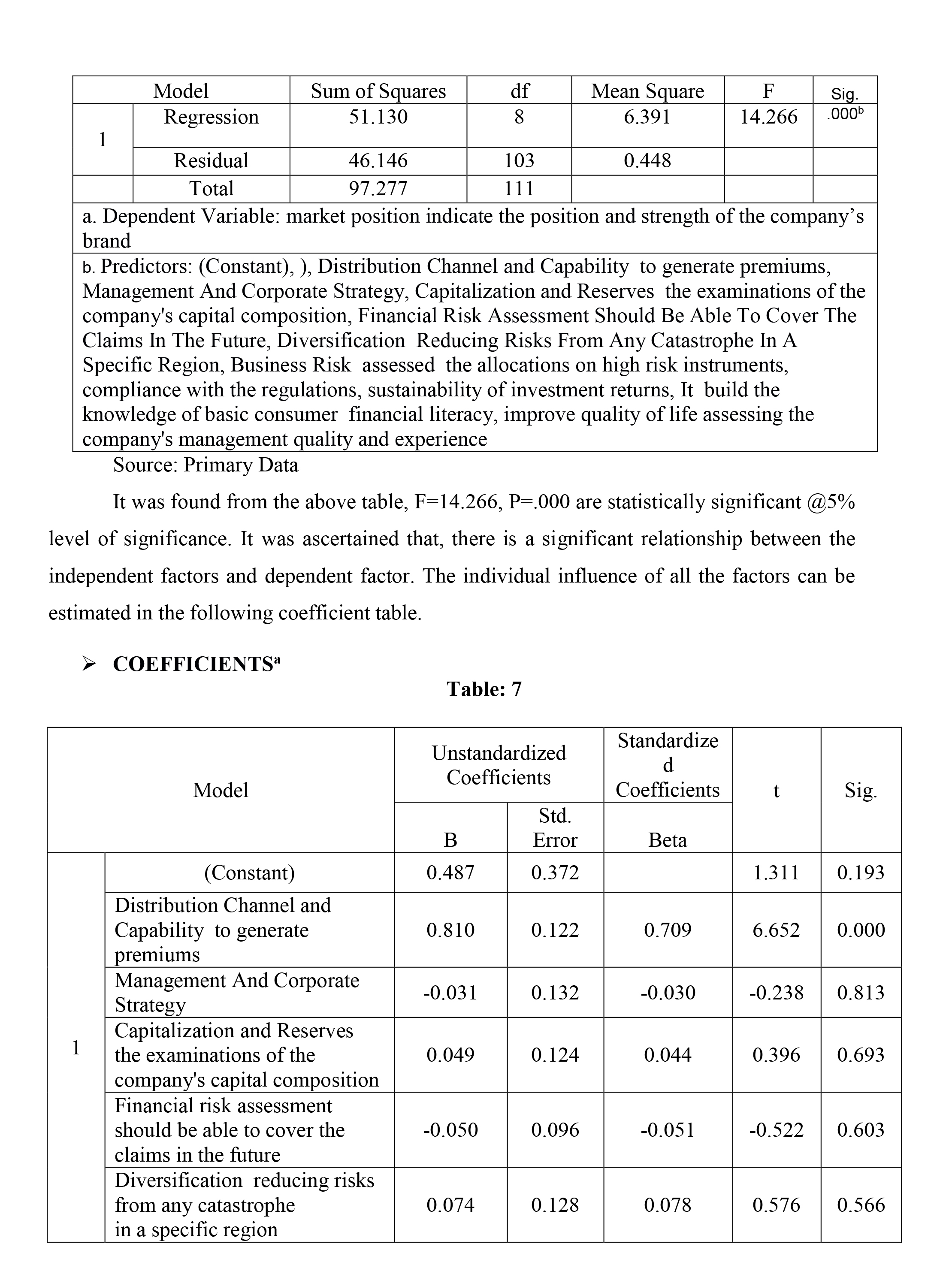

The researcher used 115 questionnaires to collect data from the respondents. The usable questionnaires were 115. The 113 respondents are responding the questionnaire. Therefore the sample size of this study is 113. Crobach’s Alpha test, KMO and Bartlett & test, communalities, one sample test, multiple linear regression analysis and CFA model adapted to analyze the effectiveness of social media marketing on insurance business performance .

8.1 DATA ANALYSIS AND INTERPRETATION

RELIABILITY STATISTICS

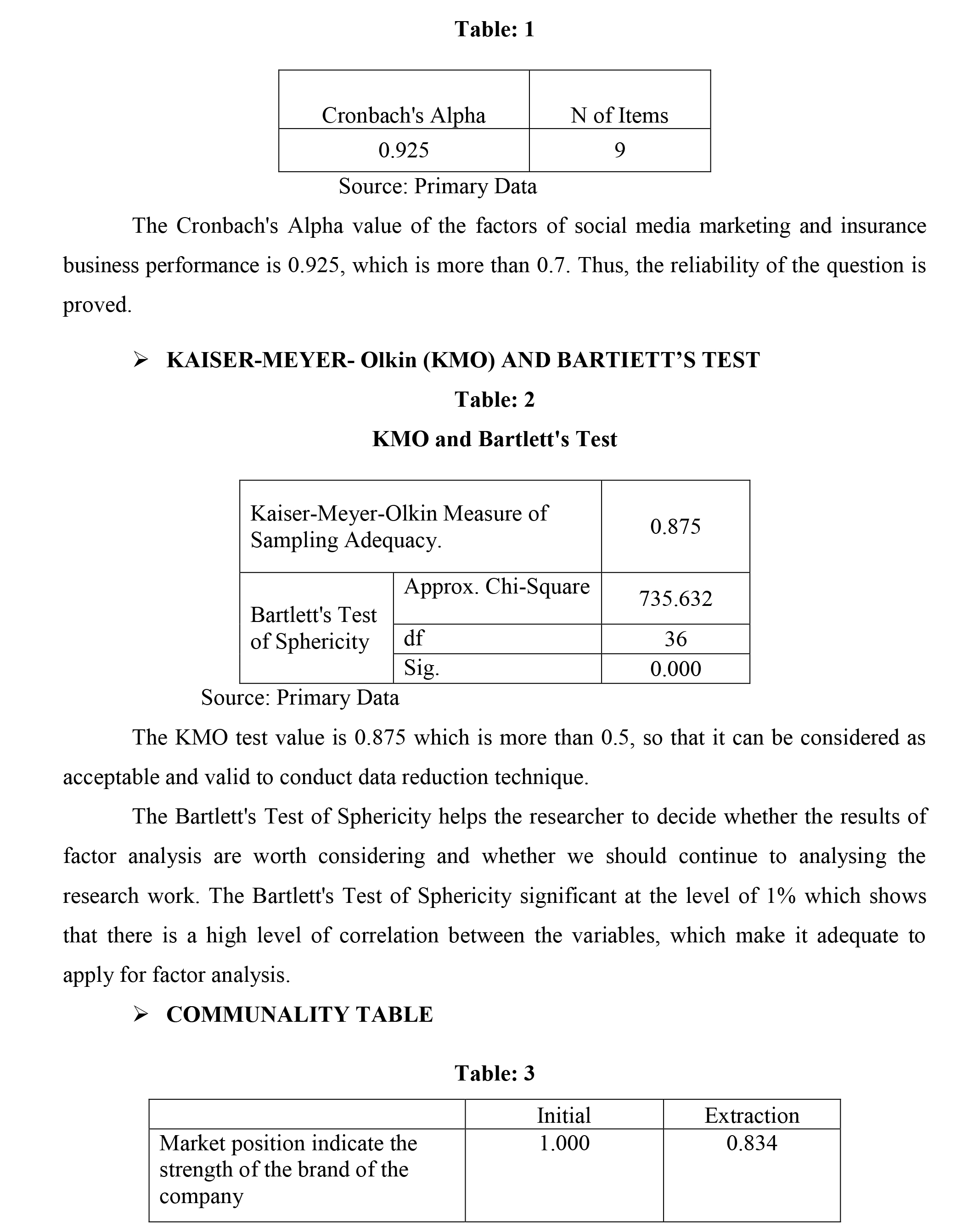

Table: 1

Cronbach's Alpha N of Items

0.925 9

Source: Primary Data

The Cronbach's Alpha value of the factors of social media marketing and insurance business performance is 0.925, which is more than 0.7. Thus, the reliability of the question is proved.

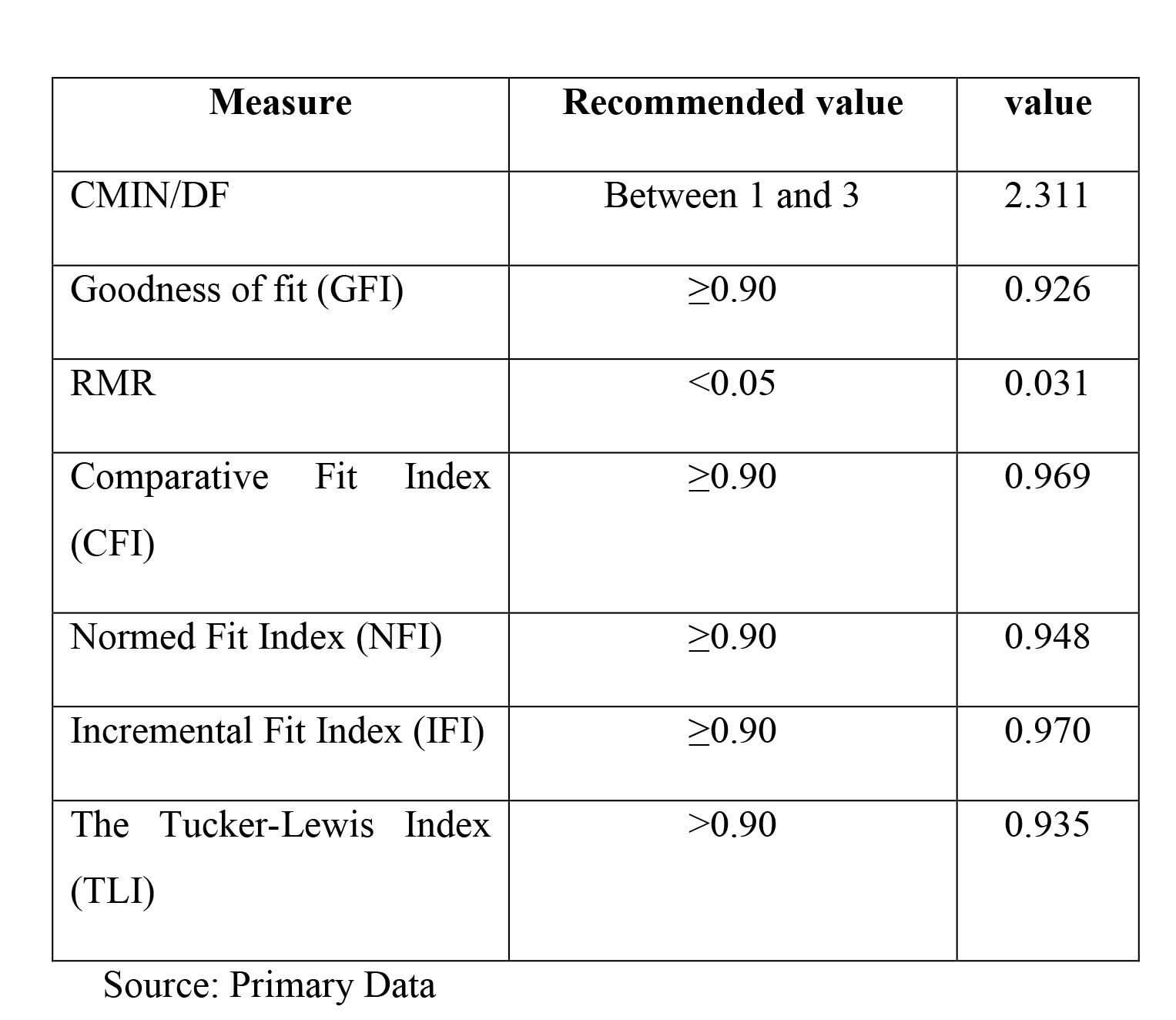

It was clear from the above table the model fitness like CMIN/DF= 2.311, Goodness of fit =.926, RMR= 0.031, Comparative Fit Index =0.969, Normed Fit Index = 0.948, Incremental Fit Index = 0.970 and The Tucker-Lewis Index = 0.935. It indicates that the model fit is good.

9.1 FINDINGS AND SUGGESTIONS

- For me social media isn't attracted me to buy insurance. It prefers expert for any fiscal thing.

- Just seeing an announcement won't guide me to decide between buying insurance.

- Social media marketing announcements have told me in buying insurance policy.

- It can be an effective way for the client's magnet towards the insurance policy. The insurance company needs to describe all the stylish/ unique programs offers they're furnishing which make them different from the other insurance companies.

- Social media is the new normal for announcement and surely it'll work in near future insurance policy.

- In terms of insurance policy good to know the benefits of policy through advertisements.

- Insurance is still a veritably particular matter, so it needs to be face- to- face selling of insurance.

All these responses collected are disposed towards still, there's still tableware filling that people have started accepting social media for the insurance assiduity as well. The negative commentary can help the company to work upon on these issues and increase consumers’ acceptance of social media announcements. Once consumers ’ trust and confidence builds- up, adding brand mindfulness which would goad brand fidelity in the future will be a cakewalk for the company.

10.1 CONCLUSION

The lack of brand mindfulness among people was a big stumbling block in targeting people through social media advertising. Through vigorous advertising, way should be taken to ameliorate brand mindfulness among the general public. People have a favorable view toward believable and applicable commercials, according to the check results. As a result, businesses should make a trouble to incorporate these rates into their marketing. The Insurance sector continues to spend a significant quantum of plutocrat on traditional advertising styles. According to the findings of the bean, the sector will need to pivot to social media in the unborn times and effectively influence this digital tool to make brand mindfulness, enhance engagement, and conversion rates. To reach out to the followership on social media, acceptable targeting should be done grounded on their age and profession. Individual advertising to responses are and the conversion rates. Businesses should make a trouble to boost exertion on their social media accounts. The number of bulletins needs to be increased on precedence’s for the intended impact. The post types are trend shows a preference toward carousel posts, which have advanced engagement than regular print posts. Adding the reach of posts on social media by using applicable and trendy hashtags should be an ongoing exertion which as a consequence leads to advanced brand recall.

REFERENCES

- Delafrooz, N., Zendehdel, M., & Fathipoor, M. (2017a). International Journal of Economics and Financial Issues The Effect of Social Media on Customer Loyalty and Company Performance of Insurance Industry. International Journal of Economics and Financial Issues, 7(3), Page no: 252–264.

- Delafrooz, N., Zendehdel, M., & Fathipoor, M. (2017b). The Effect of Social Media on Customer Loyalty and Company Performance of Insurance Industry. International Journal of Economics and Financial Issues, 7(3), Page no: 254–264.

- Kamenjarska, T., Spremic, M., & Miloloža, I. (2022). The Impact of Innovative Capabilities and Innovation Types on the Financial Performances of Insurance Companies. International Journal of E-Services and Mobile Applications, 14(1). Page no: 1-10

- Kigen, W. K. (2014). The effect of firm size on profitability of insurance companies in Kenya. School of Business University of Nairobi, November, Page no: 1–48.

- P, I. M. I. (2022). Social insurance literacy through animated media in insurance performances. Indonesian Journal of Engagement, Community Services, Empowerment and Development, 2(3), Page no: 348–353.

- Porrini, D., & Schwarze, R. (2014). Insurance models and European climate change policies: An assessment. European Journal of Law and Economics, 38(1), Page no: 7–28.

- Venkatesh, S. (2019). Big Data - Can it make a big impact in the Insurance sector? Journal of the Insurance Institute of India, 6(4), Page no: 1–19.