Subscribe now to get notified about IU Jharkhand journal updates!

Sustainability Meets Finance A Bibliometric Review of ESG Performance and Capital Structure Research

Abstract :

This study presents a bibliometric analysis of research on the nexus of capital structure and Environmental, Social, and Governance (ESG) performance. This area is becoming increasingly significant in sustainability and finance scholarship. The analysis uses descriptive indicators, co-authorship mapping, co-citation analysis, keyword co-occurrence, and bibliographic coupling to track the field's intellectual, collaborative, and thematic evolution. This study draws on 323 peer-reviewed articles indexed in the Web of Science Core Collection (2010–2025).The findings show a rapidly growing body of work, especially after 2018, with contributions scattered across journals related to sustainability, business ethics and finance. Traditional capital structure and firm performance, ESG disclosure and governance quality, corporate social responsibility and stakeholder governance, and green finance instruments and climate risk are the four main thematic clusters identified. Co-citation analysis shows that traditional finance theories are still relevant, but it also shows how stakeholder and sustainability viewpoints are becoming more integrated. This study unifies a dispersed body of literature and offers a scientometric basis for upcoming multidisciplinary research on ESG and financial structuring by mapping significant authors, journals, institutions and knowledge clusters.

Keywords :

Bibliometric analysis; Environmental, Social, and Governance (ESG); Capital structure; Sustainable finance; Green bondsIntroduction

A crucial topic in research on corporate governance, sustainability, and finance is the relationship between capital structure and Environmental, Social, and Governance (ESG) performance. In an era of increasing climate risks, changing stakeholder expectations, and more stringent regulations, companies are judged on their capacity to exhibit sustainable and ethical practices in addition to their financial performance. Therefore, it is crucial and timely to comprehend how ESG factors affect capital structure choices. Debt-equity trade-offs, tax shields, and information asymmetries are the main topics of traditional capital structure theories, which have long influenced scholarly discussions. These theories include the Modigliani–Miller theorem, Trade-Off Theory, and the Pecking Order Theory. However, these frameworks assume that markets are rational and ignore non-financial factors such as stakeholder legitimacy, climate-related risks, and reputational capital. These paradigms are being challenged by the increasing significance of ESG factors, which also pushes the limits of capital structure theory (Friede et al., 2015; Flammer, 2021; Li et al., 2023; Zhang & Luo, 2024).

According to mounting empirical evidence, stronger ESG profiles are associated with reduced financing costs, easier access to outside funding, and increased investor confidence, all of which influence leverage and equity preferences (Atan et al., 2018; Goss & Roberts, 2011). Additionally, ESG-compliant companies are more likely to issue sustainability-related securities and green bonds, thereby strengthening their position in the capital market. However, regulatoryasymmetries, greenwashing risks, and inconsistent ESG ratings make the analysis more difficult to understand and raise questions about its generalisability across markets (Bui & de Villiers, 2023; Khan et al., 2022).

Despite its importance, the literature on capital structure and ESG remains dispersed. While some studies use legitimacy and stakeholder theories to explain ESG-driven financing, others adhere to traditional cost-benefit analysis. Furthermore, most of the evidence comes from developed markets, with little information coming from emerging economies, where financial institutions and ESG practices are rapidly changing but not uniformly institutionalised (Singh & Aggarwal, 2022).

This study uses a bibliometric analysis of the ESG–capital structure literature to address these gaps. In contrast to narrative reviews, bibliometric techniques offer quantitative and systematic mapping of thematic clusters, journals, influential authors, and research trends (Zupic&Čater, 2015; Donthu et al., 2021). This method works best in rapidly expanding interdisciplinary fields, where conceptual boundaries are still pliable.

Consequently, the following research questions are addressed in this study: (a) How has research on ESG and capital structure changed over time? (b) Which contributors have the greatest influence? (c) Which theoretical clusters and prevailing themes are present? (d) How do authors, institutions, and nations organise their collaboration patterns? (e) What are the remaining research gaps?

The study's responses to these queries help bring together a disparate body of knowledge and offer a future-focused agenda for academics, industry professionals, and legislators interested in incorporating ESG requirements into corporate financing plans.

2. Literature Review

2.1 Evolving Perspectives on Capital Structure

Neoclassical finance theories, which emphasise the trade-offs between debt and equity to maximise a firm's cost of capital and resolve agency conflicts, have traditionally dominated capital structure studies. The theoretical underpinnings for comprehending financing decisions in terms of tax shields, bankruptcy costs, information asymmetries, and managerial incentives were established by seminal works by Modigliani and Miller (1958), Jensen and Meckling (1976), and Myers (1984).

Despite their continued influence, these frameworks cannot adequately represent the growing complexity of the contemporary business environment. Businesses no longer base their capital structure decisions solely on financial optimisation, as evidenced by the rise of non-financial factors such as sustainability, ethical governance, and stakeholder legitimacy. To explain capital structure in socially and environmentally conscious contexts, scholars have integratedinsights from institutional, stakeholder, and resource-based theories (Hillman & Keim, 2001; Singh & Aggarwal, 2022).

2.2 ESG Performance and Corporate Financial Strategy

ESG performance has emerged as a factor that influences financing outcomes, investor trust, and firm valuation, in tandem with growing calls for corporate accountability. Strong ESG practices are said to improve relationships with creditors and investors, increase reputation capital, and reduce perceived risk

(Dhaliwal et al., 2011; Cheng et al., 2014). These advantages can directly impact capital structure decisions by lowering the cost of debt and increasing access to equity financing.

Nevertheless, conflicting empirical results regarding the relationship between ESG and capital structure persist. According to some research, companies with strong ESG profiles favour internal financing or equity to reduce the reputational risks associated with leverage (Auer & Schuhmacher, 2016). According to some studies, ESG increases creditworthiness, which in turn increases debt capacity (Bae et al., 2011). According to more recent research, the results differ depending on industry-level dynamics, institutional contexts, and ESG measurement standards (Li et al., 2023; Zhang & Luo, 2024).

2.3 Corporate Social Responsibility, Governance, and Stakeholder Influence

The ethical and reputational aspects of corporate behaviour have long been studied in the corporate social responsibility (CSR) literature. Governance practices such as board independence, moral leadership, and transparency are now seen as essential to financial structuring and corporate sustainability as ESG frameworks and CSR become increasingly similar.

By asserting that companies have obligations to employees, regulators, customers, and larger communities in addition to shareholders, stakeholder theory (Freeman, 1984) broadens the scope of analysis. According to this viewpoint, decisions about capital structure are not just technical financial decisions; they also represent legitimacy, social impact, and long-term alignment with stakeholder priorities (Hillman & Keim, 2001; Orlitzky et al., 2003). According to recent data, the relationship between ESG and finance is increasingly moderated by these governance-stakeholder dynamics (Bui & de Villiers, 2023).

2.4 Green Finance, ESG Instruments, and Regulatory Shifts

A noticeable trend in capital markets towards financing instruments that are in line with environmental principles is reflected in the growth of green bonds, sustainability-linked loans, and ESG-indexed funds. These developments enable businesses to incorporate investor mandates, regulatory requirements, and climate goals into their financing arrangementsto achieve sustainable development. ESG disclosure is being institutionalised and incorporated into capital market access by policymakers and regulatory agencies, such as the European Union with its Green Taxonomy and the IFRS with sustainability disclosure standards. Consequently, ESG ratings, the quality of disclosure, and the availability of sustainable finance instruments increasingly influence businesses' financing strategies. For academics studying how capital structure adjusts to climate risks, regulatory pressures, and changing investor expectations, these changes present both opportunities and challenges (Qian, 2024; Yang et al., 2024).

2.5 Bibliometric Gaps and Rationale for the Study

Although the relationship between ESG and capital structure has been the subject of numerous studies, the field remainsfragmented and methodologically diverse. There is a lack of a cohesive viewpoint in current scholarship regarding the evolution of the field, dominant theoretical underpinnings and thematic clusters, and top contributors across institutions and geographical areas. Scholars and practitioners alike lack a comprehensive grasp of the collaborative patterns and intellectual framework influencing the field because of the lack of such a systematic overview.

Most earlier reviews in the fields of finance and ESG have been narrative or meta-analytic in nature, offering helpful insights but having little ability to fully convey the depth and complexity of a fast-growing multidisciplinary field. In contrast, bibliometric analysis provides a methodical and quantitative way to map research landscapes, find significant authors and sources, and track how thematic clusters change over time (Zupic&Čater, 2015; Donthu et al., 2021).

This study conducts an extensive bibliometric review of research on ESG and capital structures. It attempts to compile the body of knowledge, identify recurring themes and networks of collaboration, and offer a data-driven roadmap for furthering future research by methodically examining 337 peer-reviewed articles published between 2000 and 2025. This lays the groundwork for the methodological framework that is discussed in the next section.

3. Methodology

3.1 Research Design and Approach

The intellectual, collaborative, and thematic underpinnings of research relating Environmental, Social, and Governance (ESG) performance to capital structure are mapped in this study using a bibliometric approach. Because bibliometric methods quantitatively analyse research networks and citation patterns, they are especially well suited for this purpose. This allows for the identification of important authors, journals, institutions, and emerging themes (Zupic&Čater, 2015; Donthu et al., 2021).

The structure and dynamics of an entire research field are captured by bibliometric analysis, as opposed to narrative reviews, which frequently offer descriptive overviews, or meta-analyses, which concentrate on effect sizes. The interdisciplinary and fragmented nature of ESG finance studies, with their shifting theoretical and empirical boundaries, makes this approach particularly beneficial (Aria & Cuccurullo, 2017; Wang et al., 2023). Bibliometric techniques facilitate the systematic consolidation of knowledge and identification of unexplored research directions by improving objectivity and replicability.

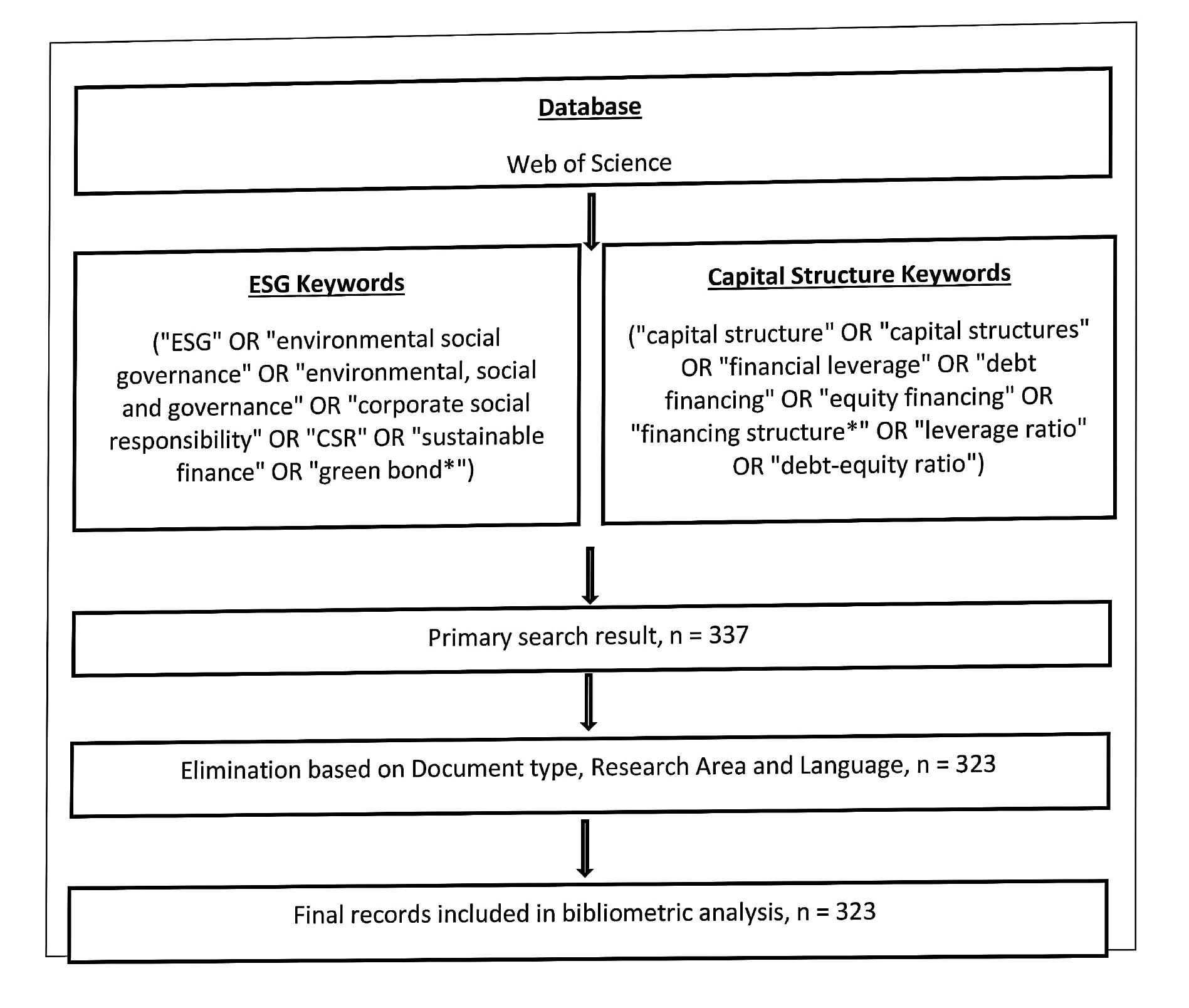

3.2 Data Source and Search Strategy Database Selection

The Web of Science (WoS) Core Collection, which is well-known for its extensive coverage of peer-reviewed journals and appropriateness for citation-based analyses, provided the bibliometric dataset (Donthu et al., 2021). One of the most trustworthy resources for bibliometric mapping is the WoS, which offers excellent metadata on citations, authorship, and affiliations. Despite the recent rise in the popularity of alternative databases such as Scopus and Dimensions, WoS continues to be the recommended option for guaranteeing data accuracy and comparability across scientometric studies(Wang et al. 2023).

Search String and Inclusion Criteria

To capture research at the intersection of ESG performance and capital structure, a carefully constructed Boolean search string was employed:

TS = (("ESG" OR "environmental social governance" OR "environmental, social and governance" OR "corporate social responsibility" OR "CSR" OR "sustainable finance" OR "green bond") AND ("capital structure" OR "capital structures" OR "financial leverage" OR "debt financing" OR "equity financing" OR "financing structure" OR "leverage ratio" OR "debt-equity ratio"))

The query was executed in July 2025 and refined using the following criteria:

- Document type: Peer-reviewed journal articles and reviews

- Language: English

- Timespan: 2010–2025

- Indexes: WoS Core Collection (SCI-E, SSCI, ESCI)

After duplicate removal and manual screening for thematic relevance, the final dataset comprised 323 documents. This refined corpus provides sufficient breadth for mapping intellectual and thematic patterns while maintaining analytical manageability for robust bibliometric analysis.

3.3 Justification of Sample Size

The 323 publications in the final dataset were in good agreement with the accepted bibliometric research procedures. According to Donthu et al. (2021) and Zupic and Čater (2015), a bibliometric study's strength is not the sheer number of documents but rather the dataset's analytical clarity and thematic coherence. Excessively restrictive samples run the risk of missing important contributions, whereas oversized or loosely defined samples may inflate the data without yielding insightful information.

To balance breadth and depth, bibliometric studies in sustainability-finance research usually use datasets with 200–500 records (Aria & Cuccurullo, 2015; Aria & Cuccurullo, 2017). Because it falls within this range, the current dataset is both analytically manageable and provides adequate coverage of the field’s intellectual and thematic diversity. Given the multidisciplinary and dynamic nature of ESG–capital structure research, where precision in charting connections and patterns is more important than sheer volume, this size is especially suitable (Kumar et al., 2022).

3.4 Data Analysis Tools and Techniques

3.4.1 Descriptive Bibliometric Indicators

This study first used a set of common descriptive bibliometric indicators, such as the h-index, total publications (TP), total citations (TC), and citations per publication (CPP), to assess research performance. To further capture the distribution of contributions across scholars and outlets, authorship trends and journal productivity metrics were evaluated in this study. According to Donthu et al. (2021), these indicators offer a baseline understanding of the field's growth trajectory, influence, and visibility.

Microsoft Excel was used to create the descriptive statistics, allowing bibliographic data to be aggregated at several levels of analysis, including authors, institutions, countries, and journals. These metrics are useful for assessing productivity and impact, but they have drawbacks because citation counts can be affected by self-citation patterns, journal indexing procedures, or disciplinary norms (Wang et al., 2023). Consequently, relational and network-based analyses that offer a more complex view of the field's intellectual and collaborative structure are used in conjunction with the descriptive indicators in this study, which are interpreted as an initial diagnostic step for future studies.

3.4.2 Network Analysis

This study used a set of network-based bibliometric techniques with VOSviewer to supplement the descriptive indicators. These techniques make it possible to identify thematic clusters, intellectual underpinnings, and patterns of collaboration in the literature on ESG and capital structure (Aria & Cuccurullo, 2017; Van Eck & Waltman, 2010). Four distinct analyses were performed (Table 1).

Table 1. Overview of Bibliometric Network Analyses Conducted and Their Purpose

| Analysis Type | Network Nodes | Purpose |

|---|---|---|

| Analysis Type Co-authorship | Authors, Institutions, Countries | Examine collaboration patterns across different levels of research |

| Co-citation | Authors, Sources, Documents | Identify influential references and intellectual foundations |

| Keyword co-occurrence | Author Keywords | Detect thematic clusters and emerging topical trends |

| Bibliographic coupling | Documents, Sources | Explore intellectual linkages among recent works |

The node size indicates the frequency of publications or citations in all network visualisations, whereas the link strength indicates how closely nodes are related to one another. While co-citation networks reveal the most significant works influencing the body of knowledge, co-authorship analysis emphasises the collaborative nature of the field. Bibliographic coupling offers information about the intellectual proximity of recent publications, whereas keyword co-occurrence identifies dominant and emerging research themes. When combined, these techniques enable a thorough mapping of the conceptual, intellectual, and social structures of a field (Donthu et al., 2021; Wang et al., 2023).

3.4.3 Clustering and Normalisation

Minimum threshold values were used to ensure analytical robustness and to refine the network analyses. For instance, only terms that appeared at least eight times were included in the keyword co-occurrence analysis. This threshold reduces noise from uncommon terms while maintaining adequate thematic breadth, thus striking a balance between inclusivity and interpretability. In accordance with accepted bibliometric practices, the association strength method was used as the normalisation technique for network construction (Van Eck & Waltman, 2010). This approach is especially suitable because it accounts for variations in the frequency of publications and citations, enabling insightful comparisons between nodes in visualisation maps.

3.5 Ethical Considerations

The sole source of secondary bibliographic information for this study was the Web of Science database, an academic resource that is openly available to the public. There were no human participants, and no private or sensitive information was collected. Therefore, there are no direct ethical risks associated with this study. However, in accordance with sound scientometric practices, care was taken to ensure transparency and replicability in the design, search strategy, and analytical procedures (Donthu et al., 2021).

4.1 Descriptive Analysis

The 323 research articles pulled from the Web of Science Core Collection are described in this section, which also highlights the field's impact and productivity in several ways. The intellectual and collaborative landscape of ESG–capital structure research is interpreted using descriptive indicators, such as country-level contributions, leading journals, prominent authors, influential institutions, and the temporal evolution of publications.

Analysing these patterns is crucial for determining the field's maturity and growth trajectory, as well as for locating areas of research activity concentration and possible disparities in institutional or geographic contributions. These baseline insights are essential because they contextualise the findings of later network-based analyses (such as co-authorship, co-citation, and keyword co-occurrence) and allow for a more nuanced understanding of how scholarly attention and collaboration have shaped this new interdisciplinary field.

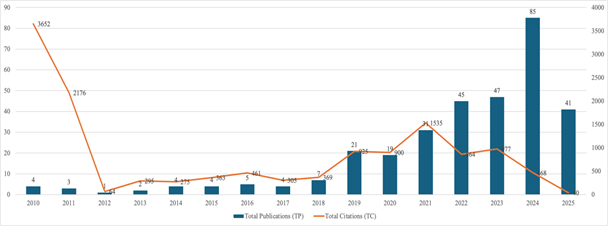

4.1.1 Annual Publication and Citation Trends

The yearly trends of publications and citations on capital structure and ESG performance from 2010 to 2025 are shown in Figure 2 and Table 2. The findings point to a field that has progressed from the exploratory phase to one of increasing scholarly activity. Publication output averaged less than five articles annually from 2010 to 2014. Although few in number, these early works had a comparatively high citations per publication (CPP), indicating their significance as foundational works that have influenced later research agendas. The increase in citations in 2011 and 2013 highlights the lasting impact of early research.

After 2018, there was a sea change, with output growing gradually before accelerating in 2019. A record-breaking spike in interest in sustainable finance, ESG disclosure standards, and their effects on capital structure was indicated by the peak year of 2024, when 85 publications (26.3% of the dataset) were published. Given that recent works have had less time to accrue citations, the 2024 CPP decline (5.51) aligns with bibliometric expectations.

Interestingly, a small group of highly cited papers in 2010 produced the highest CPP (913). This pattern exemplifies a typical phenomenon in developing fields: even as more recent research broadens the domain's thematic and methodological scope, a few early, agenda-setting contributions remain at the centre of the conversation. Overall, the pattern indicates that research on ESG and capital structure is expanding rapidly, with opportunities for theoretical unification and growing international interest.

Table 2: Annual Publication trends

| Years | TP | TC | CPP | Authors | Journals | Countries | H-Index | % of 323 |

|---|---|---|---|---|---|---|---|---|

| 2010 | 4 | 3652 | 913 | 11 | 3 | 4 | 4 | 1.238 |

| 2011 | 3 | 2176 | 725.33 | 10 | 3 | 5 | 3 | 0.929 |

| 2012 | 1 | 64 | 64 | 3 | 1 | 1 | 1 | 0.31 |

| 2013 | 2 | 295 | 147.5 | 5 | 2 | 4 | 2 | 0.619 |

| 2014 | 4 | 275 | 68.75 | 13 | 4 | 7 | 4 | 1.238 |

| 2015 | 4 | 363 | 90.75 | 14 | 4 | 5 | 4 | 1.238 |

| 2016 | 5 | 461 | 92.2 | 13 | 5 | 7 | 5 | 1.548 |

| 2017 | 4 | 305 | 76.25 | 9 | 3 | 3 | 4 | 1.238 |

| 2018 | 7 | 369 | 52.71 | 22 | 7 | 6 | 7 | 2.167 |

| 2019 | 21 | 925 | 44.05 | 58 | 16 | 17 | 14 | 6.502 |

| 2020 | 19 | 900 | 47.37 | 62 | 13 | 17 | 14 | 5.882 |

| 2021 | 31 | 1535 | 49.52 | 96 | 22 | 24 | 20 | 9.598 |

| 2022 | 45 | 864 | 19.2 | 142 | 25 | 25 | 18 | 13.932 |

| 2023 | 47 | 977 | 20.79 | 146 | 36 | 31 | 18 | 14.551 |

| 2024 | 85 | 468 | 5.51 | 254 | 45 | 36 | 12 | 26.316 |

| 2025 | 41 | 40 | 0.98 | 129 | 27 | 18 | 3 | 12.693 |

Note: TP – Total Publications; TC – Total Citations; CPP – Citations per Publication

Source: Authors’ compilation from Web of Science

Figure 2: Evolution of published articles and citations from 2010–2025

4.1.2 Leading Journals in the Field

The ten most active journals that publish research on capital structure and ESG are listed in Table 3, which also shows the disciplinary anchors and cross-field diffusion of scholarship. Sustainability, with 36 publications (more than 11% of the dataset), comes in first, followed by Research in International Business and Finance (15) and Finance Research Letters (17). These sources demonstrate the prevalence of ESG–capital structure research in journals focusing on sustainability and finance.

However, intellectual influence is not always synonymous with leadership. With 11 articles, the Journal of Business Ethics has produced 2,264 citations and an impressive CPP of 205.82, significantly outperforming other journals in terms of citation impact. This implies that when presented with solid theoretical foundations, research at the nexus of ethics, governance, and finance resonates more strongly with the academic community.The multidisciplinary nature of this field is further highlighted by the important contributions of the Journal of Cleaner Production, Environmental Science and Pollution Research, and Corporate Social Responsibility and Environmental Management. The cross-disciplinary interaction fostering ESG–capital structure scholarship is reflected in the coexistence of journals with roots in sustainability, ethics, and environmental science, with financial publications. This diversity demonstrates the wide applicability of the field and highlights the difficulty of bringing together ideas from disparate academic communities.

Table 3:Top Contributing Journals

| Journal Name | TP | TC | CPP | H-Index | % of 323 |

|---|---|---|---|---|---|

| Sustainability | 36 | 683 | 18.97 | 16 | 11.146 |

| Finance Research Letters | 17 | 224 | 13.18 | 8 | 5.263 |

| Research in International Business and Finance | 15 | 225 | 17 | 8 | 4.644 |

| Corporate Social Responsibility and Environmental Management | 13 | 597 | 45.92 | 10 | 4.025 |

| Journal of Business Ethics | 11 | 2264 | 205.82 | 9 | 3.406 |

| Environmental Science and Pollution Research | 10 | 370 | 37 | 7 | 3.096 |

| International Review of Economics Finance | 10 | 72 | 7.2 | 4 | 3.096 |

| International Review of Financial Analysis | 10 | 246 | 24.6 | 7 | 3.096 |

| Journal of Cleaner Production | 8 | 382 | 47.75 | 6 | 2.477 |

| Pacific Basin Finance Journal | 7 | 63 | 9 | 3 | 2.167 |

Notes: TP = total publications; TC = total citations; CPP = citations per publication.

Source: Authors’ compilation from Web of Science

4.1.3 Most Productive Authors

The most active researchers in the field of ESG capital structure research are listed in Table 4. With five publications, Zhang J is the most productive author, followed by Sun ZY with four and a group of authors with three publications each. A comparatively small number of researchers are regularly active in the field, reflecting a fragmented authorship landscape.

However, scholarly influence is not solely measured by productivity. Interestingly, despite only having three publications between them, Guedhami and Wong Kwokeach received 2,041 citations, earning them the highest CPP of 680.33 of all the listed scholars. This suggests that their contributions have had a particularly significant impact on the development of the field's theoretical and empirical underpinnings.

Strong citation performance in relation to publication counts is also shown by other authors, including Li Y.H., Raimo N., and Hassan M.K., indicating that their work is highly relevant to audiences interested in sustainability and finance. When combined, these trends show two opposing axes of influence: regular contributors who consistently add to the corpus of work and high-impact writers whose focused contributions reshape the direction of ESG–capital structure research.

Table 4:Most productive Authors

| Author | TP | TC | CPP | H-Index |

|---|---|---|---|---|

| Zhang J | 5 | 59 | 11.8 | 3 |

| Sun ZY | 4 | 34 | 8.5 | 3 |

| Chen HH | 3 | 58 | 19.33 | 3 |

| Guedhami O | 3 | 2041 | 680.33 | 3 |

| Hassan MK | 3 | 69 | 23 | 3 |

| Kwok CCY | 3 | 2041 | 680.33 | 3 |

| Li Y | 3 | 65 | 21.67 | 3 |

| Li YH | 3 | 88 | 29.33 | 2 |

| Paltrinieri A | 3 | 58 | 19.33 | 3 |

| Raimo N | 3 | 367 | 122.33 | 3 |

Notes: TP = total publications; TC = total citations; CPP = citations per publication.

Source: Authors’ compilation from Web of Science

4.1.4 Leading Institutions

The interdisciplinary and global nature of the field is reflected in the distribution of research on ESG and capital structure across Asian, European, and global universities according to institutional-level analysis (Table 5). With seven publications, Zhongnan University of Economics and Law is the most productive,

closely followed by Jinan University and Xiamen University, with six publications each. The country's increasing involvement in sustainability-related financial scholarships is indicated by the concentration of output in Chinese institutions.

However, the impact is not equally dispersed. With CPP values of 47.4 and 54.6, respectively, the Hong Kong Polytechnic University and Xi’an Jiaotong University demonstrated a particularly strong influence. Similarly, despite publishing fewer works, European universities, such as the University of Bath in the United Kingdom and the University of Piraeus in Greece, are recognised as significant contributors.

This demonstrates how a small number of well-placed contributions can have a significant impact on a relatively new field of study. The Indian Institute of Management System's inclusion in the top ten indicates the diversification of knowledge production beyond conventional Western hubs, reflecting the growing involvement of Indian institutions in ESG finance discussions.

These results point to a geographically diverse but unevenly developed research landscape, with Europe making a significant contribution to theoretical depth and citation impact, while Asia leads in terms of research volume.

Table 5: Leading Institutions

| Institutions | TP | TC | CPP | h-Index | % of 323 |

|---|---|---|---|---|---|

| Zhongnan University of Economics Law | 7 | 91 | 13 | 4 | 2.167 |

| Jinan University | 6 | 76 | 12.67 | 4 | 1.858 |

| Xiamen University | 6 | 138 | 23 | 5 | 1.858 |

| Central South University | 5 | 173 | 34.6 | 4 | 1.548 |

| Hong Kong Polytechnic University | 5 | 237 | 47.4 | 2 | 1.548 |

| Indian Institute of Management Iim System | 5 | 68 | 13.6 | 2 | 1.548 |

| University Of Bath | 5 | 194 | 20.8 | 5 | 1.548 |

| University of International Business Economics | 5 | 99 | 19.8 | 4 | 1.548 |

| University of Piraeus | 5 | 158 | 31.6 | 5 | 1.548 |

| Xi An Jiaotong University | 5 | 273 | 54.6 | 4 | 1.548 |

Notes: TP = total publications; TC = total citations; CPP = citations per publication.

Source: Authors’ compilation from Web of Science

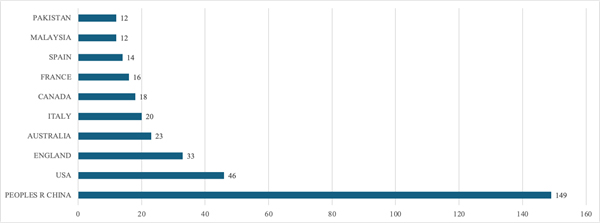

4.1.5 Country-wise Contribution

The United States, China, and the United Kingdom are the three main economies in which the majority of research output on ESG and capital structure is concentrated, as shown in Figure 3. These three nations collectively produce the majority of publications, indicative of their developed financial systems, established academic infrastructures, and vibrant corporate governance and sustainability policy discussions.

Their prominence is also consistent with more general trends in the study of sustainable finance, where theory and practice have historically been influenced by East Asian and Anglo-American economies.

In addition to these major contributors, nations such as Australia, Italy, and India have made notable contributions that demonstrate how ESG finance scholarship has spread into various institutional and regulatory contexts.

The increasing involvement of emerging markets, such as South Africa and India, is especially significant because it points to a slow transition towards greater geographic inclusivity in discussions of capital structuring and sustainable finance.

Two significant dynamics were highlighted by this distribution.

First, the resource advantages and policy pressures of advanced economies are reflected in the geographic concentration of high-volume contributors.

Second, the field's expansion into a wider range of socioeconomic contexts is indicated by the contribution of developing and transitional economies, which adds perspectives from areas with unique sustainability and funding issues to the conversation.

Although leadership is still based in a small number of nations, these trends suggest that the field is expanding globally.

Figure 3:Top Contributing Countries

Overall, the descriptive analysis shows how quickly and globally the fields of ESG and capital structure research aregrowing.

Since 2018, there has been a noticeable increase in publication output, indicating that the field has moved from the exploratory stage to one of rapid growth.

Prominent journals covering topics such as ethics, sustainability, environmental management, and finance demonstrate their interdisciplinary nature.

A similar dual dynamic is highlighted by the author and institutional profiles: a small number of influential scholars provide the intellectual underpinnings, while an expanding contributor pool gradually expands the field.

Geographically, the United States, China, and the United Kingdom continue to hold the majority of research leadership positions; however, the involvement of developing nations, such as South Africa and India, indicates that the field is becoming more inclusive and contextually diverse.

These results lay the groundwork for comprehending the locations of research production and the distribution of influence, cooperation, and thematic priorities within the international academic community.

When combined, these observations offer an essential starting point for the ensuing examinations of co-authorship networks, co-citation trends, and keyword clusters, which explore the field's collaborative frameworks, intellectual foundations, and changing thematic trajectories in greater detail.

4.2 Co-authorship Analysis

Co-authorship analysis offers important insights into scholarly collaboration patterns that support the literature on ESG and capital structure.

It illustrates the level of interconnectedness, knowledge sharing, and internationalization within the field by charting the relationships between authors, organizations, and nations.

A mature and multidisciplinary research community is frequently represented by strong and dense co-authorship networks, whereas the early phases of field development may be reflected by fragmented or weakly connected structures (Donthu et al., 2021).

This study examined co-authorship at three different aggregation levels.

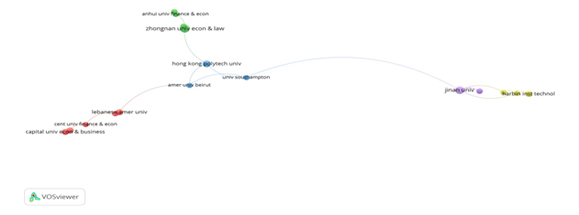

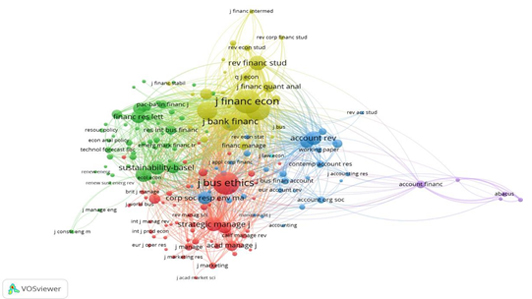

The analysis identifies important researchers, their collaborative clusters, and the degree of concentrated or distributed scholarly influence at the author level (Figure 4).

The network provides insights into regional centres of expertise and cross-institutional collaborations at the institutional level (Figure 5), highlighting the collaborative efforts of universities and research centres in the region.

Finally, the country-level network (Figure 6) shows how collaborations are distributed globally, providing insight into how advanced and emerging economies are balanced in forming this multidisciplinary field.

Combining these analyses lays the groundwork for understanding the social and intellectual structure of ESG–capital structure research by revealing not only who is making contributions to the field but also how knowledge flows are organised across various tiers of the academic ecosystem.

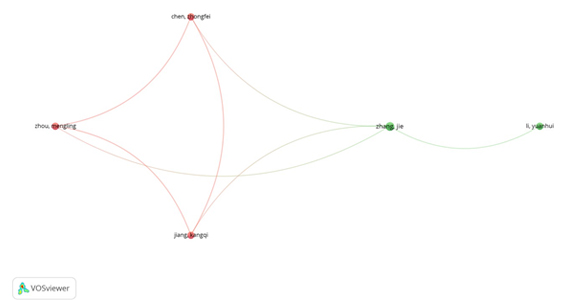

4.2.1 Author Co-authorship

Instead of an integrated scholarly community, the author-level co-authorship network (Figure 4) shows a fragmented collaborative structure with small, disjointed clusters.

Most authors work within institutional or regional boundaries, which restricts cross-group interaction, even though research on ESG and capital structure is growing.

Although some clusters exhibit more robust intra-group relationships, the lack of a prominent hub author indicates the field's nascent and multidisciplinary character.

The lack of a common framework among the various theoretical lenses—agency theory, stakeholder theory, and legitimacy theory—could be partially to blame for this fragmentation of research.

Opportunities and challenges arise from this kind of dispersion, which slows conceptual consolidation and widensperspectives.

Increased cooperation between organisations and nations may improve methodological robustness and theoretical coherence, assisting in the maturation of the field.

Figure 4:Author co-authorship network

4.2.2 Institutional Co-authorship

Although still fairly dispersed, the institutional co-authorship network (Figure 5) seems to be slightly more structured than the author-level network.

The fact that many universities form small clusters but that these partnerships are mostly national in scope suggests that institutional teams working independently, rather than through extensive inter-institutional partnerships, produce a large portion of the research on capital structure and ESG.

Leading Chinese universities, several European establishments, and a few Indian management schools exhibit notable clusters.

Although these groups show new areas of expertise, their lack of robust cross-continental ties indicates a lack of global integration.

According to this pattern, collaboration has not yet expanded to match the interdisciplinary and global nature of the research domain, even though productivity is increasing.

A strategic opportunity exists to strengthen partnerships between high-impact universities in Europe and North America and high-output institutions in Asia.

These collaborations can improve the global conversation on sustainable capital structuring by bridging gaps in financial systems, regulatory frameworks, and ESG practices.

In addition to encouraging methodological innovation and knowledge transfer, increased institutional interconnectedness raises the field's profile and policy relevance globally.

Figure 5: Institutional-level co-authorship network

4.2.3 Country Co-authorship

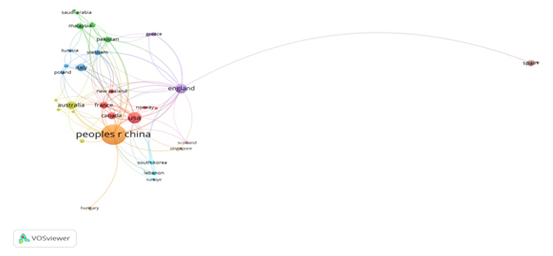

In contrast to the author and institutional levels, the country-level co-authorship network (Figure 6) exhibits a more cohesive and interconnected structure, highlighting the increasing internationalisation of ESG–capital structure research.

The US, China, and the UK stand out as key nodes because of their leadership in encouraging cross-border cooperation.

By connecting disparate regional clusters and enhancing the global visibility of the field, these nations serve as linkages within the global knowledge network.

India, Italy, Australia, and Canada are other active contributors that often have cooperative relationships with major hubs.

The existence of several closely related nations indicates a growing global conversation

and recognition of the ESG–capital structure relationship as a research area with worldwide policy implications.

However, disparities in participation still exist.

There are gaps in the global diffusion of knowledge because many developing and transitional economies are either not included in the network or have weak linkages.

Given that sustainability and capital structuring issues manifest differently in different places, such asymmetry risks limiting the viewpoints that guide ESG finance research.

A more balanced and globally representative research community could be created by integrating under-represented economies through the expansion of international academic exchange, cross-border funding opportunities, and collaborative research projects.

Figure 6: Country-level collaboration patterns

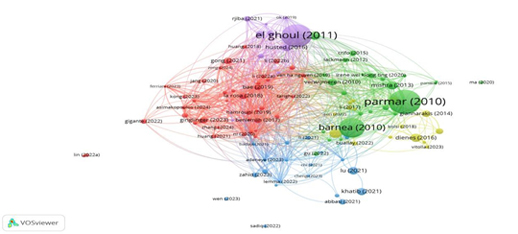

4.3 Co-Citation Analysis

Co-citation analysis offers insights into the intellectual structure and foundational underpinnings of a field by identifying which authors, documents, and sources are frequently cited together.

This triangulated view helps reveal dominant theories, seminal works, and schools of thought shaping the domain of ESG performance and capital structure.

4.3.1 Author Co-citation

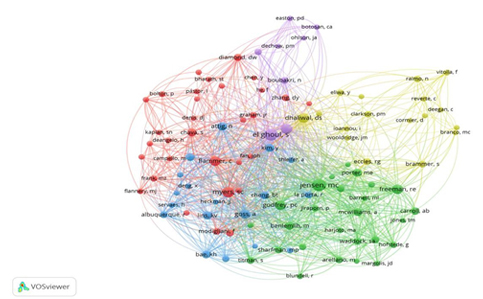

Several distinct clusters can be seen in the author co-citation network (Figure 7), each representing a different theoretical and thematic lineage within the field of ESG–capital structure research.

The presence of sustainability-focused thinkers like Freeman R.E., Friede G., and Orlitzky M. alongside foundational finance scholars like Jensen M.C. and Myers S.C. highlights their crucial role in forming the intellectual landscape.

Their prominence is a result of the combined influence of stakeholder and sustainability-based viewpoints, as well as traditional capital structure theories, particularly agency theory and the trade-off framework.

The fact that thought leaders in sustainability and finance are grouped together in the same

network emphasizes the interdisciplinary nature of the field.

The emergence of a hybrid knowledge base that combines conventional financial justifications with more extensive social and environmental considerations is suggested by the frequent co-citation of authors from various fields, including corporate governance, corporate social responsibility, and sustainable finance.

This conceptual framework suggests that the field is both developing and maturing.

Although traditional theories are still widely used, they are increasingly being reinterpreted in light of stakeholder legitimacy and ESG performance.

The coexistence of these clusters indicates a shift towards a more integrated framework for comprehending the capital structure in an economy focused on sustainability, reflecting both the strength of long-standing theoretical anchors and the continuous negotiation of new paradigms.

Figure 7: Author co-citation network

4.3.2 Document Co-citation

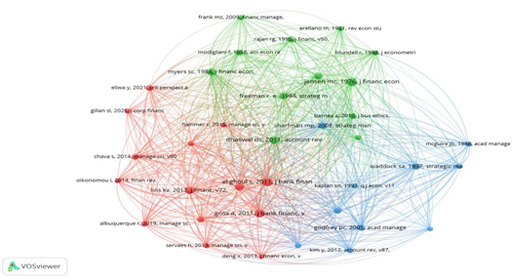

Several high-impact publications that serve as intellectual pillars for ESG–capital structure research are highlighted by the document co-citation network (Figure 8).

These works include empirical studies examining the connection between ESG performance, firm value, and financing decisions, as well as conceptual contributions such as theories of capital structure determinants.

These documents' clustering

highlights the field's dedication to bridging conceptual depth with practical relevance by demonstrating a dual reliance on theoretical models and evidence-based research.

Interestingly, studies that combine ESG or CSR viewpoints with corporate finance results are the most often co-cited, especially those that relate sustainability practices to decisions about leverage and the cost of capital.

The idea that ethical governance and financial structuring are becoming increasingly interdependent is reinforced by these documents, which occupy a visible thematic core.

The prominence of these publications also implies that studies combining theoretical rigor with practical implications maximize their research impact.

The applied significance of ESG in influencing capital allocation and corporate strategy is reflected in highly cited works that frequently appeal to practitioners and policymakers, in addition to academics.

When taken as a whole, the co-citation structure shows a developing intellectual framework in which traditional finance research is gradually being reinterpreted from the perspectives of governance, ethics, and sustainability.

Figure 8: Document-level co-citation network

4.3.3 Source Co-citation

A core group of journals that predominates in the intellectual framework of ESG–capital structure research is highlighted by the source co-citation network (Figure 9).

Prominent publications include the Journal of Cleaner Production, Sustainability, Corporate Social Responsibility and Environmental Management, Journal of Business Ethics and Journal of Corporate Finance.

The strong co-citation relationships of these journals show how the once-distinct fields of finance, business ethics, and environmental management are increasingly overlapping.

Interestingly, the co-citation map shows that the field has two anchors.

On the one hand, journals that focus on finance, such as the Journal of Corporate Finance, offer theoretical foundations and methodological rigor in capital structure determinants.

Conversely, publications that concentrate on sustainability and ethics, such as the Journal of Business Ethics and Sustainability, present viewpoints grounded in stakeholder engagement, legitimacy, and governance.

This combination produces a balanced intellectual environment in which socially conscious agendas and market-based logiccoexist and increasingly converge.

The existence of interdisciplinary journals such as the Journal of Cleaner Production emphasizes the interdisciplinary scope of the ESG–finance nexus.

All these trends point to the evolution of the field through a pluralistic discourse that combines financial economics with sustainability and ethical governance issues, rather than being dominated by a single disciplinary tradition.

Figure 9: Co-citation network of journals and sources

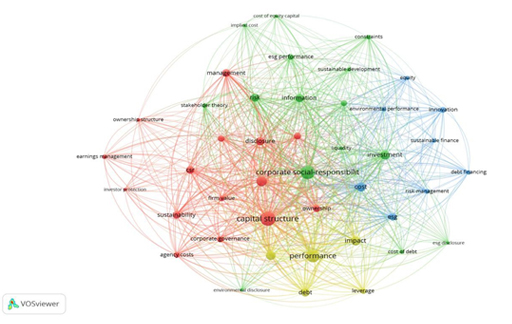

4.4 Keyword Co-occurrence Analysis

Keyword co-occurrence analysis is a useful lens for analysing the thematic dynamics and cognitive structure of ESG–capital structure research.

The analysis draws attention to the fundamental problems, changing priorities, and intellectual silos that characterize the field by mapping terms that frequently occur together.

Using the 323-article dataset, a network was created in VOSviewer for this investigation.

A minimum occurrence threshold was applied to eliminate irrelevant terms and concentrate on conceptually significant patterns.

Four unique thematic clusters that each represent a different aspect of scholarly attention can be seen in the co-occurrence network (Figure 10).

Collectively, these clusters show how traditional capital structure discussions increasingly overlap with the more general issues of governance, sustainability, and stakeholder accountability.

While clustering identifies areas where conceptual integration is progressing and fragmentation continues, the coexistence of financial, ethical, and environmental terminology reflects the interdisciplinary nature of the domain.

Each cluster was named based on the conceptual affinity of its keywords for clarity, and its interpretation reflects its intellectual contribution to the literature.

This method offers a nuanced perspective on the changing ESG–finance relationship by facilitating the identification of dominant themes and new research areas.

Figure 10: Keyword co-occurrence network

Cluster 1: Traditional Capital Structure and Firm Performance Nexus (Red Cluster)

The first cluster represents the traditional finance-centric research strand, which focuses on the connection between capital structure, leverage, and firm performance.

Classical frameworks such as the trade-off, pecking order, and agency theories continue to have an impact, as evidenced by representative keywords such as capital structure, financial performance, firm value, leverage, profitability, agency theory, debt, firm size, and return on assets (ROA) (Jensen & Meckling, 1976).

This cluster of studies mostly examines how debt-equity arrangements impact firm valuation and shareholder wealth, frequently using profitability and return on assets (ROA) as performance metrics.

The fact that phrases such as "firm size" and "debt" are frequently used emphasizes how structural firm characteristics influence financing behaviour, with larger firms generally having more debt capacity and smaller firms having more financing constraints.

By offering a theoretical framework and empirical standards for evaluating ESG-related dynamics, this cluster serves as the analytical centre of corporate finance.

The field's strong quantitative orientation is reflected in this, but it also highlights a drawback: non-financial aspects such as sustainability, governance, and stakeholder legitimacy are comparatively underemphasized.

This cluster establishes the standard by which ESG-linked frameworks are evaluated and guarantees continuity with mainstream finance by grounding conversations in accepted financial reasoning.

Its tenacity highlights the conflict between maximizing shareholder value and more general sustainability requirements, which are being addressed increasingly in the clusters that follow.

Cluster 2: ESG Integration and Sustainability-Driven Financial Structuring (Green Cluster)

The ESG-focused aspect of capital structure research, in which sustainability metrics are increasingly used to inform financial decision-making, is encapsulated in the second cluster.

According to Friede, Busch, and Bassen (2015), representative keywords such as ESG performance, sustainability, environmental performance, governance, ESG disclosure, ESG score, and sustainable finance show that academics are becoming more interested in how non-financial performance indicators affect a company's ability to raise capital, control risks, and lower financing costs.

ESG disclosure is a major theme in this cluster, reflecting the increased significance of accountability and transparency in sustainability practices.

Companies with credible ESG reporting are seen as lower-risk investments and frequently have easier access to debt and equity markets.

Governance also appears as a crucial anchor, both as a stand-alone factor influencing financing outcomes and as one of the pillars of ESG.

It is commonly known that effective governance practices boost investor confidence and enable advantageous financing terms.

This cluster serves as an example of a paradigm shift in capital structuring, moving away from a sole emphasis on financial optimization towards a more stakeholder- and sustainability-oriented approach.

According to Eccles and Klimenko (2019), the prevalence of ESG-related keywords highlights the impact of institutional pressure, regulatory frameworks, and international investor expectations on the integration of sustainability into corporate finance.

Overall, this cluster shows how traditional capital structure discussions are being reframed by ESG factors, indicating the development of a hybrid finance–sustainability research agenda.

Cluster 3: Corporate Social Responsibility and Stakeholder Governance (Blue Cluster)

The third cluster emphasizes the socio-ethical underpinnings of ESG–capital structure research, focusing on topics such as corporate social responsibility (CSR), stakeholder theory, ethics, social performance, corporate governance, and the triple bottom line.

Beyond the limited scope of maximizing shareholder wealth, this cluster highlights the importance of ethical behaviour and stakeholder engagement as crucial factors in financial strategies.

This theme examines how stakeholder-oriented governance and CSR pledges impact investor perceptions, capital access, and debt and equity costs.

Terms such as stakeholder theory and ethics are frequently used, reflecting an intellectual heritage rooted in Freeman's (1984) stakeholder perspective, which acknowledges that businesses are answerable to a wide range of stakeholders.

Likewise, the triple bottom line concept (Elkington, 1998) underscores the increasing demand for corporate strategies that incorporate social, financial, and environmental aspects.

Within the larger ESG–finance conversation, this cluster acts as a philosophical and moral focal point.

It presents financing choices as both economically sound actions and indicators of a company's integration into larger environmental and social ecosystems.

This line of inquiry strengthens the interdisciplinary nature of the field and offers a counterpoint to interpretations that are solely based on the market by integrating stakeholder-driven and ethical reasoning into financial decision-making.

Cluster 4: Green Finance and Climate Risk Instruments (Yellow Cluster)

The fourth cluster, which focuses on how financial innovations are mobilized to address climate change, represents the instrumental and policy-driven dimensions of the ESG–capital structure nexus.

Climate imperatives are increasingly being incorporated into capital structuring strategies, as evidenced by representative keywords such as green bonds, climate risk, carbon emissions, environmental finance, low-carbon economy, and renewable energy.

Among these, green bonds stand out as a distinctive tool, illustrating the swift growth of debt markets targeted at funding environmentally friendly initiatives.

Terms such as climate risk and carbon emissions are frequently used interchangeably, emphasizing how financing strategies fit into international policy frameworks and more general climate mitigation objectives.

This stream of research frequently examines how companies adjust their capital structures to meet emission reduction goals and adhere to disclosure frameworks, such as the Task Force on Climate-related Financial Disclosures (TCFD) and regulatory initiatives, such as the EU Green Deal (Flammer, 2021).

This cluster is a prime example of how capital markets actively influence corporate sustainability strategies, in addition to providing funding for climate action.

This thematic stream exhibits one of the most dynamic and policy-relevant trajectories in the literature by linking capital structure decisions to investments in renewable energy and carbon reduction.

It represents a field that is becoming increasingly influenced by the interaction between the market and policy, indicating a move towards integrated frameworks where financial instruments support both environmental and financial goals.

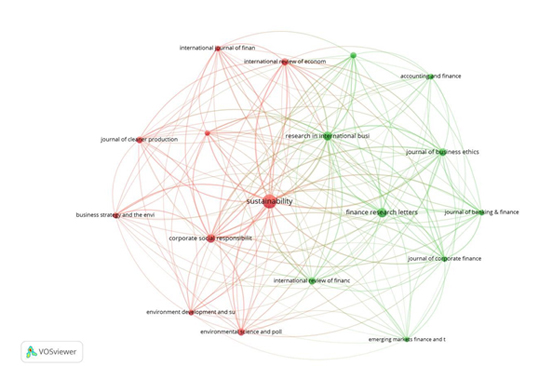

4.5 Bibliographic Coupling

Bibliographic coupling provides a contemporary perspective by identifying documents and sources that share common references, thereby revealing current research trends and thematic clusters.

It complements co-citation analysis, which is backward-looking, by offering a forward-facing view of scholarly alignment.

4.5.1 Coupling of Documents

As a result of consolidating research streams around particular facets of the ESG–capital structure nexus, distinct thematic clusters have emerged, as shown by the document coupling analysis (Figure 11).

Studies on financial leverage and ESG disclosure, capital structure dynamics and sustainable finance, and the application of stakeholder theory to financing choices are prominent.

The field was gradually organised into identifiable research traditions, as evidenced by the fact that documents in the same cluster frequently shared methodological approaches, regional emphases, or theoretical orientations.

The multidisciplinary integration of the field is also demonstrated by clustering.

To create more comprehensive view points, authors are increasingly consulting literature from the fields of business ethics, economics, finance, and environmental science.

This blending of disciplinary insights indicates that the ESG–finance debate is becoming an interdisciplinary discussion that considers both financial justifications and socio-environmental factors, rather than being limited to specialised subfields.

Additionally, the network identifies several closely related documents that serve as the field's intellectual pillars.

In addition to being frequently cited, these works also act as starting points for novice researchers, offering clear summaries of important arguments and approaches.

When taken as a whole, the collection of documents represents a field that is both expanding its scope through interdisciplinary discussion and uniting around central themes.

Figure 11: Bibliographic coupling of documents

4.5.2 Coupling of Sources

A core set of journals that serve as the foundation for contemporary research on ESG and capital structure is identified by source-level bibliographic coupling analysis.

Prominent journals such as the Journal of Business Ethics, Corporate Social Responsibility and Environmental Management, Sustainability, and Finance Research Letters show strong coupling strengths, suggesting that new work in these fields draws from comparable foundational sources.

This convergence reflects the consolidation of a new area of study at the nexus of corporate finance, governance, and sustainability.

It is interesting to note how interdisciplinary the field is, as evidenced by the concentration of journals with a finance focus next to those with sustainability and ethics themes.

While sustainability and ethics journals offer insights into legitimacy, governance, and stakeholder accountability, finance journals offer methodological and theoretical depth.

Their reference bases frequently overlap, indicating a growing exchange of ideas and a sign that research on ESG and capital structure is evolving into a shared intellectual ecosystem, rather than being restricted to disciplinary silos.

Figure 12: Bibliographic coupling among journals

Overall, the co-citation, keyword, and bibliographic coupling analyses show a constantly changing field.

The fields of ESG and capital structure are characterised by thematic diversity, interdisciplinary breadth, and growing global relevance.

It is rooted in traditional finance theories but is increasingly infused with sustainability logic.

These observations offer a strong foundation for the discussion and implications that follow, which critically assess the field's intellectual and practical significance.

4.6 Discussion and Implications

4.6.1 Academic insights

The evidence shows a convergence between classical capital structure theory and sustainability logics.

Co-citation patterns retain agency, trade-off, and pecking-order anchors while integrating stakeholder and legitimacy perspectives (Jensen & Meckling, 1976; Elkington, 1998).

Keyword and coupling maps locate four complementary domains: traditional leverage–performance work, ESG disclosure/governance quality, CSR–stakeholder governance, and green-finance instruments, signalling a hybrid intellectual core.

The field’s centre of gravity has shifted post-2018 toward data-driven empirical work; however, collaboration at the author and institution levels remains modular, slowing theoretical consolidation.

The scholarly opportunity is to specify mechanisms (e.g. disclosure → information risk → debt pricing) rather than re-assert broad ESG correlates.

4.6.2 Managerial implications

For managers, ESG has become a financing variable rather than a peripheral label.

Strong ESG and credible disclosure quality are associated with better market access and lower financing costs, expanding the feasible debt–equity set (Friede, Busch, & Bassen, 2015; Flammer, 2021).

Governance—board oversight, audit quality, and incentive alignment—acts as a transmission channel from ESG practices to capital market outcomes.

Practical priorities include upgrading assurance-ready ESG reporting, aligning financial policy (target leverage, maturity, covenants) with transition plans, and evaluating instrument choice (use-of-proceeds versus sustainability-linked debt) against strategy and verification capacity.

4.6.3 Policy implications

Policy clusters highlight the growing role of standards and taxonomies in reducing information friction and enabling green financing.

Regulators should prioritise the comparability and credibility of metrics and develop market infrastructure that lowers issuance frictions for green and sustainability-linked instruments.

Inclusion matters: targeted support in emerging markets through guarantees, blended finance, and taxonomy roadmaps can crowd in private capital and avoid a two-tier market.

Coordination with global frameworks such as ISSB/IFRS sustainability standards and TCFD-type risk disclosures aligns private incentives with public goals.

4.6.4 Research implications

The current work often juxtaposes finance and ESG logics; the next step is unified models that map ESG inputs to priced risks, cash-flow resilience, and financing constraints.

Understudied contexts such as Africa, Latin America, and Southeast Asia, as well as organisational forms like SMEs and family firms, remain thin.

Promising avenues include crisis regimes, behavioural channels, rating divergence as identification variation, and data science methods to parse unstructured disclosures.

1 Conclusion, Limitations, and Future Research

1.1 Conclusion

Using 323 WoS articles, this study integrates descriptive indicators, co-authorship, co-citation, keyword co-occurrence, and bibliographic coupling to map the ESG–capital-structure domain.

The literature comprises four interacting streams: leverage–performance foundations, ESG disclosure and governance, CSR–stakeholder governance, and green-finance instruments.

Together, they mark a shift from purely firm-centric optimisation to stakeholder-aware, sustainability-conditioned financing logic.

Collaboration is globally distributed but locally clustered, which supports exploration but slows theoretical consolidation.

Source coupling shows that finance, ethics, and sustainability journals share a common reference base, evidencing genuine interdisciplinarity.

Overall, ESG is no longer peripheral to financing; it conditions access, pricing, and instrument choice, offering both a research challenge and a strategy lever for practice and policy.

1.2 Limitations

Database scope: WoS-only coverage may omit relevant Scopus, SSRN, and grey literature.

Recency bias: 2024–2025 papers are citation-disadvantaged in co-citation and coupling analyses.

Keyword noise: Author keywords vary in precision, and some themes may be under-captured.

Method balance: Bibliometrics provides macro-level structure, not fine-grained theory appraisal.

1.3 Future research directions

Mechanism-first models linking ESG disclosure quality to information risk, debt spreads, and maturity choice.

Rating divergence as identification by exploiting cross-rater ESG disagreement.

Context and ownership effects in SMEs, family firms, and state-influenced entities.

Crisis and transition finance examining ESG cushioning during shocks.

Instrument design comparing green bonds and sustainability-linked loans.

Behavioural channels related to managerial cognition and investor sentiment.

Data and assurance impacts on debt covenants and loan syndicate composition.

References

- Aria, M., & Cuccurullo, C. (2017). bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics, 11(4), 959–975. https://doi.org/10.1016/j.joi.2017.08.007

- Atan, R., Alam, M. M., Said, J., & Zamri, M. (2018). The impacts of environmental, social, and governance factors on firm performance: Panel study of Malaysian companies. Management of Environmental Quality: An International Journal, 29(2), 182–194. https://doi.org/10.1108/MEQ-03-2017-0033

- Auer, B. R., & Schuhmacher, F. (2016). Do socially (ir)responsible investments pay? New evidence from international ESG data. The Quarterly Review of Economics and Finance, 59, 51–62. https://doi.org/10.1016/j.qref.2015.07.002

- Bae, K. H., Kang, J. K., & Wang, J. (2011). Employee treatment and firm leverage: A test of the stakeholder theory of capital structure. Journal of Financial Economics, 100(1), 130–153. https://doi.org/10.1016/j.jfineco.2010.10.019

- Bui, B., & de Villiers, C. (2023). ESG disclosure and firm financing: Evidence from global markets. Business Strategy and the Environment, 32(2), 556–572. https://doi.org/10.1002/bse.3310

- Cheng, B., Ioannou, I., & Serafeim, G. (2014). Corporate social responsibility and access to finance. Strategic Management Journal, 35(1), 1–23. https://doi.org/10.1002/smj.2131

- Dhaliwal, D. S., Li, O. Z., Tsang, A., & Yang, Y. G. (2011). Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. The Accounting Review, 86(1), 59–100. https://doi.org/10.2308/accr.00000005

- Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., & Lim, W. M. (2021). How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research, 133, 285–296. https://doi.org/10.1016/j.jbusres.2021.04.070

- Eccles, R. G., & Klimenko, S. (2019). The investor revolution: Shareholders lead as sustainability raises the stakes. Harvard Business Review, 97(3), 106–116. https://hbr.org/2019/05/the-investor-revolution

- Elkington, J. (1998). Cannibals with forks: The triple bottom line of 21st century business. Gabriola Island, BC: New Society Publishers.

- Flammer, C. (2021). Corporate green bonds. Journal of Financial Economics, 142(2), 499–516. https://doi.org/10.1016/j.jfineco.2021.05.012

- Freeman, R. E. (1984). Strategic management: A stakeholder approach. Boston, MA: Pitman.

- Friede, G., Busch, T., & Bassen, A. (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment, 5(4), 210–233. https://doi.org/10.1080/20430795.2015.1118917

- Goss, A., & Roberts, G. S. (2011). The impact of corporate social responsibility on the cost of bank loans. Journal of Banking & Finance, 35(7), 1794–1810. https://doi.org/10.1016/j.jbankfin.2010.12.002

- Hillman, A. J., & Keim, G. D. (2001). Shareholder value, stakeholder management, and social issues: What’s the bottom line? Strategic Management Journal, 22(2), 125–139. https://doi.org/10.1002/1097-0266(200101)22:2<125::AID-SMJ150>3.0.CO;2-H

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

- Khan, M., Serafeim, G., & Yoon, A. (2022). Corporate sustainability: First evidence on materiality. The Accounting Review, 97(3), 107–136. https://doi.org/10.2308/accr-2018-0183

- Kumar, S., Sharma, R., & Lim, W. M. (2022). Research in sustainable finance: A bibliometric analysis and future research agenda. Business Strategy and the Environment, 31(8), 3785–3802. https://doi.org/10.1002/bse.3084

- Li, Y., Wang, H., & Zhou, Y. (2023). ESG performance and financing constraints: Evidence from global capital markets. Finance Research Letters, 52, 103556. https://doi.org/10.1016/j.frl.2022.103556

- Modigliani, F., & Miller, M. H. (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3), 261–297. http://www.jstor.org/stable/1809766

- Myers, S. C. (1984). The capital structure puzzle. The Journal of Finance, 39(3), 575–592. https://doi.org/10.1111/j.1540-6261.1984.tb03646.x

- Orlitzky, M., Schmidt, F. L., & Rynes, S. L. (2003). Corporate social and financial performance: A meta-analysis. Organization Studies, 24(3), 403–441. https://doi.org/10.1177/0170840603024003910

- Singh, D., & Aggarwal, R. (2022). ESG disclosures and capital structure decisions in emerging economies: Evidence from India. Emerging Markets Review, 52, 100947. https://doi.org/10.1016/j.ememar.2022.100947

- Van Eck, N. J., & Waltman, L. (2010). Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics, 84(2), 523–538. https://doi.org/10.1007/s11192-009-0146-3

- Wang, C., Xu, L., & Huang, Y. (2023). Mapping ESG research: A bibliometric analysis of sustainability and finance literature. Sustainability, 15(2), 1205. https://doi.org/10.3390/su15021205

- Yang, X., Yang, T., Lv, J., & Luo, S. (2024). The impact of ESG on excessive corporate debt. Sustainability, 16(16), Article 16066920. https://doi.org/10.3390/su16166920

- Zhang, L., & Luo, X. (2024). ESG investment and corporate financing: Insights from bibliometric and empirical perspectives. Technological Forecasting & Social Change, 198, 122987. https://doi.org/10.1016/j.techfore.2023.122987

- Zupic, I., & Čater, T. (2015). Bibliometric methods in management and organization. Organizational Research Methods, 18(3), 429–472. https://doi.org/10.1177/1094428114562629