Subscribe now to get notified about IU Jharkhand journal updates!

A study on Rural Co-operatives in India with special reference towards a more inclusive financial system

Abstract :

This proposed research paper is to focus on the challenges before the rural co-operative sector. It is

proposed to focus on perspectives before rural co-operative banking sector in India. The revolution in

communication & information technology has turned the world in to a global village. When the

emergence of multinational forms and a global market has led to a deeper integration of economies,

an upgraded co-operative movement may ensure progress of rural India and create the concept of a

new social capital. As rural co-operatives play a significant role in the domestic banking sector,

discipline management of rural co-operatives is a critical issue. This paper also seeks to clarify

whether the effect of the governance-related variables on firm performance varies across rural cooperatives.

We can use cost and profit efficiency scores as performance measures. Whether having a

high ratio of representatives and board members has negative effects on efficiency measures for rural

co-operatives. Presence of outside directors may have a significant effect on efficiency of cooperatives

by strengthening its governance. But implementing corporate governance relates to

various questions: Who should participate in corporate governance? How to solve the collective

action problem of supervising management? How boards should be structured? This study will focus

on if there any scope to find out a restructuring model between co-operative and corporate to bring in

professionalism with higher supervisory and regulatory approach -a comprehensive system with

flexible products and financial services, priority sector lending and its marketing, dynamic human

resource policy to outreach the rural people towards a more effective and inclusive financial system.

Keywords :

: Rural Co-operatives, Inclusive Financial System, Corporate Governance, Information Technology, Flexible Products and Services, Priority Sector Lending and Marketing, Dynamic HR Policy ,Regulation and Supervision, Restructuring and Up gradation.Introduction

In our country, a co-operative based economic development model is very relevant where each member works with a spirit of responsibility. Co-operatives make an important contribution to the country's development and the co-operative movement has to be taken forward by imbibing the spirit of co-operation in work. The path of development of crores of farmers, the deprived, the Backward, Dalits, the poor, the neglected and women can take place through co-operation.

The Ministry of Co-operation has been created to strengthen, bring transparency, modernize, computerize and create competitive cooperatives.Budget allocation for agriculture in 2020-21 was increased to Rs.1,34,499 crore.There are about 91 percent villages in the country, where there is some co-operative which is working, unlike anywhere else in the world. 29% of agricultural credit distribution goes through co-operative system.

There are more than 17 national level cooperative unions, 33 are state level cooperative banks, there are 363 district level co-operative banks. In a way, there is one PACS for every ten villages which is a great achievement and farmer welfare can be done through these PACS. They are transparently doing the work to transfer government money to the accounts of the farmers. These PACS are the medium to make available useful things to the farmers for agriculture and it should be our goal to strengthen these PACS.

As per the data with the National Federation of State Co-operative Banks Ltd. (NAFSCOB) for the year 2019-20, the total number of PACS is 95,509. Total Membership is 13,81,57,550. Number of viable PACS is 65,109 (68.17%) and number of potentially viable PACS is 17,384 (18.20%).

In West Bengal, total number of PACS is 7,405. Total Membership is 1,21,71,850. Number of viable PACS is 3948 (53.32%) and number of potentially viable PACS is 2,248 (30.36%).

As per the data available with the NAFSCOB for the year 2019-20, the ratio of PACS in loss & PACS in profit in West Bengal is 3978: 2347 or 1.69: 1.

There should be equitable and all-inclusive development, the model of development should have the power to touch all and the model of development should be able to encompass all, which is not possible without co-operatives and that is why the Ministry of Co-operation has been established.

The newly formed Ministry of Co-operation proposed to start formulating a new co-operative policy to strengthen the PACS as the number of PACS is not enough for six lakh villages and a target will be set to have PACS in every second village within the next 5 years and to increase this number to 3 lakhs.

The Ministry of Co-operation is also working on what can be done to convert PACS into FPO. and the co-operative training is proposed to be further intensified. Arrangements to be made for skill development. The role of credit societies is proposed to be further strengthened so that even the smallest person can get credit. The role of co-operative in all priority sector lending has to be increased. On the lines of Amul, special legal management is proposed for self-help groups to work by forming their own societies.

II. OBJECTIVES OF THE STUDY

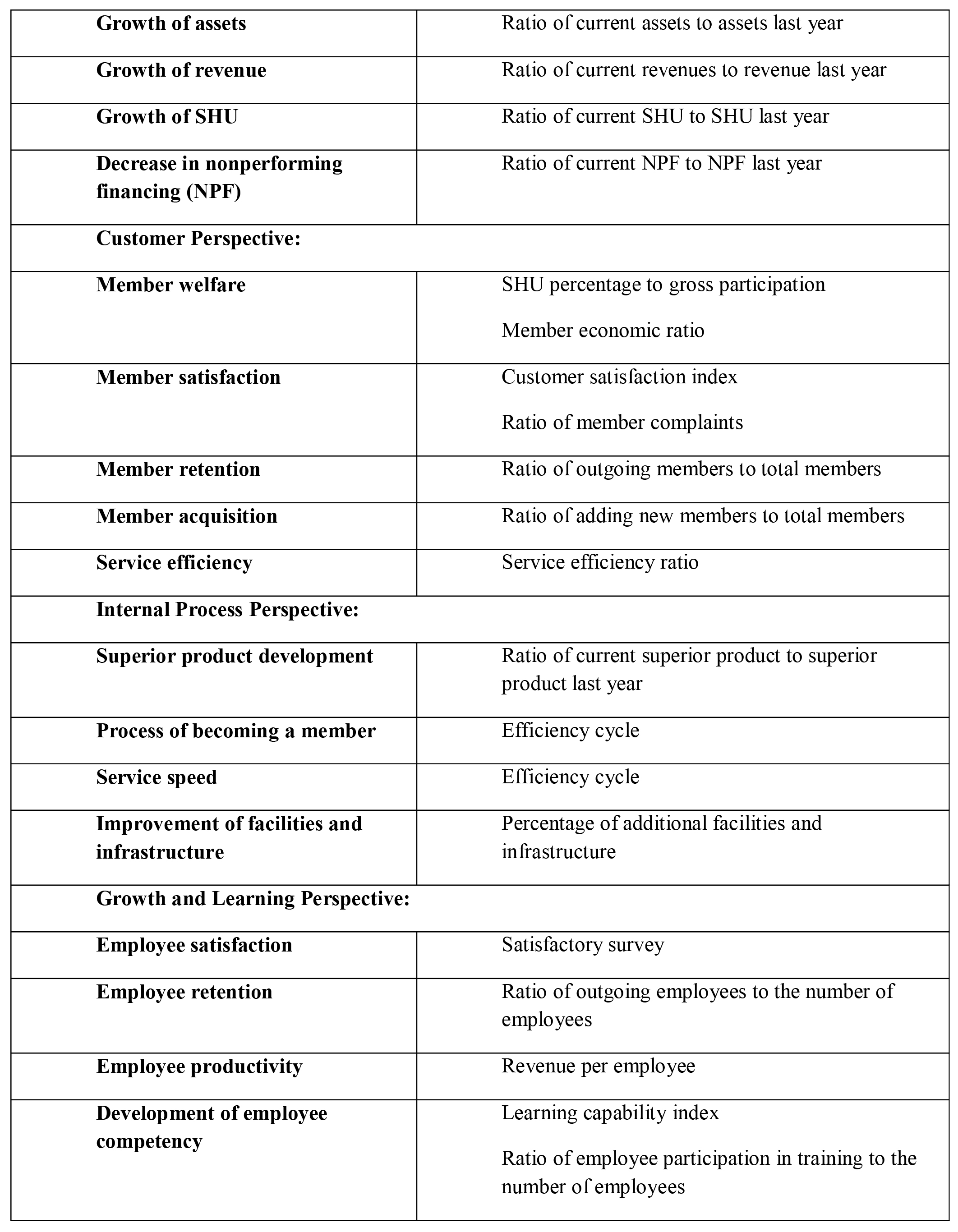

- To study how the Rural Co-operatives can play a major role towards a more inclusive financial system in the overall development of the nation.

- To study whether implementation of corporate governance is possible without affecting the essence of co-operationand if not possible thenwhether a model can be prepared between the co-operative and the corporate.

- To study the challenges before the rural co-operativesincluding rural co-operative bank.

- To measure and compare the efficiency of the rural co-operatives.

- To know the satisfaction level of the customers

- To suggest the measures for problems of ruralco-operatives in India.

III.REVIEW OF THE LITERATURES

H. P. Binswanger & S. R. Khandker (1995) studied India's supply‐led approach to agricultural credit paid off in non‐farm growth, employment and rural wages. They found that the impact of expanded credit on agricultural output has been modest, and the benefits of agricultural income exceed the costs of the programme only if optimistic assumptions are made about repayment rates on farm credit.Policies, institutions and markets are to be transformed for improving efficiency of the formal rural finance sector. More appropriate products and services, simplifying procedures and rethinking of human resource policies are required in the rural co-operative sector.

Goldberg (2005) with an overview of different studies and literature has confirmed that microfinance programmes can increase incomes and lift families out of poverty. Access to microfinance can improve children's nutrition and increase their school enrolment rates among other outcomes.

Coleman (2006) found that the insignificance was limited to general beneficiaries and that a positive impact was found among committee members who received access to financing.

Sarangi (2007) clearly proved that there is positive and significant effect of programme participation on increase in the income of the household.

The study of K. S. Rao (2007) suggests that the impact of the credit policies and financial innovations implemented from time to time with reference to priority sectors is reflected in the decennial household surveys on debt and investment conducted by the National Sample Survey Organisation and also the periodical surveys on small borrowal accounts conducted by the RBI. This article highlights the salient features of these surveys which, inter alia, throw light on the reliance of these groups on institutional and non-institutional sources of finance.

This research by S. Du, B. C. Bhattacharya & S. Sen, (2007)examines the moderating influence of the extent to which a brand's social initiatives are integrated into its competitive positioning (i.e., a CSR positioning) on consumer reactions to CSR. We find that positive CSR beliefs held by consumers are associated not only with greater purchase likelihood but also with longer-term loyalty and advocacy behaviours. More importantly, we find that not all CSR initiatives are created equal: a brand that positions itself on CSR, integrating its CSR strategy with its core business strategy, is more likely than brands that merely engage in CSR to reap a range of CSR-specific benefits in the consumer domain.

This overview of rural credit in 20th century India by M. Shah, R. Rao & P. V. Shankar (2007) finds a remarkable continuity in the problems faced by the poor throughout the period. These include dependence on usurious moneylenders and the operation of a deeply exploitative grid of interlocked, imperfect markets.

The study of K. C. Chakrabarty, (2009) reveals that the focus should be to simplify the technology which can operate on any platform. The technology solution to the business needs should be user-friendly without much third-party or IT vendor intervention or support requirement for operating the same. In this context, the banks need to redesign their business strategies to incorporate specific plans to promote financial inclusion of low-income group treating it both a business opportunity as well as a social responsibility.

Chattopadhyay (2011) classified Indian states into three categories i.e., states having high, low and medium extent of financial inclusion which is based on three basic dimensions -

(1) banking penetration (2) availability of the banking services and (3) usage of the banking system with the volume of outstanding deposit and credit.

The study of A. Raman (2012) states that setting up financial literacy centres and credit counselling at pilot basis launching a financial literacy campaign etc. are some initiatives currently under way of furthering Financial Inclusion. Our national vision for 2020 is to open nearly 600 million new customer's account and services through a variety of channels. Although various initiatives were introduced in India from last two decade but financial inclusion remain distant dreams.

S. L. Akoijam (2013) studied that in spite of several efforts put up by various organisations to increase the rural credit facilities, several challenges will prevail in the years to come.

Lakshmi & S. Visalakshmi (2013) reveals that combination of financial restructuring and institutional reform can only help co-operative banks to improve the efficiency. The provision of uncomplicated, small, affordable products will help to bring the low-income families into the formal financial sector. Technical Efficiency (TE) is considered for analysing the performance of the banks. TE refers to the relationship between scarce factor inputs and outputs of goods and services. Scale efficiency is that component of Technical Efficiency that can be attributed to the size of operation. It has been observed that the Pure Technical Efficiency of Co-operative Banks during the current years have shown a decreasing trend. A similar trend is observed in the case of Scale Efficiency. Changes in the corporate culture will also bring sustainable efficiency and thereby co-operatives can compete with strong private players. Professionalism in the management of the co-operative enterprises will upgrade the quality of the staff with latest developments and also develop a proper and cordial relationship between the managers and members of board of directors. There must be proper and continuous training for both co-operative leaders and professional executives. There are a number of agricultural commodities like rice, sugar, fruits, vegetables; spices etc. that have strong competitive advantage in export markets. Agricultural co-operatives can take this advantage in foreign market.

The study by H. M Bollas-Araya & E. Seguí-Mas (2014) on sustainability reporting in cooperative banks an analysis of their disclosure in Europe, it reports that despite the late incorporation of cooperative banks to sustainability reporting, there are no significant differences compared with banks. Finally, cooperatives banks provide greater social information than economic or environmental. regarding to the content of sustainability reports, the cooperative banks provide greater social information than economic or environmental. The most popular contents are usually related to local development, financial inclusion, ethical investments, cultural activities, etc. This bias seems to stem from its traditional social action, often linked to education funds, etc.

By means of sustainability reports, companies disclose their economic, environmental and social performance.

Implementation of sustainability practices in business management adds value to products or services (Mitchell et al., 1997, Knox et al. 2005, McWilliams and Siegel, 2001; Porter and Kramer, 2006; Weber, 2008). That is, a responsible management realizes the potential of a latent value insofar as it can be exploited through effective communication with stakeholders. A communication that should serve to enhance the reputation (Cochran and Wood, 1984) or build a corporate advantage (Porter and Kramer, 2006). The building of reputation implies a value judgment of stakeholders, and this is influenced by coherent action and appropriate communication by the company (Weber, 2008). Moreover, several empirical studies show that sustainability stakeholder engagement has a positive effect on brand value and enhances the credibility of the company (Torres, Bijmolt, Tribó and Verhoef, 2012). Regarding consumers, positive beliefs in sustainability are associated with a greater likelihood of purchase and bigger loyalty to the company in the long term (Du, Bhattacharya and Sen, 2007). The benefits of a proper sustainability strategy also include positive effects on employees and investors (Sen, Bhattacharya and Korschun, 2006). Firms use a great variety of communication channels for sustainability reporting, including social reports, thematic reports, codes of conduct, web sites, stakeholder consultations, internal channels, prizes and events, cause-related marketing, product packaging, interventions in the press and on TV, and points of sale (CSR Europe, 2000a, b; Birth et al, 2008; Illia et al., 2010). However, social reports are the main channel for communicating “the social and environmental effect of organizations' economic actions to particular interest groups within society and to society at large" (Gray et al., 1996). This practice has quickly become the medium through which companies around the world communicate their economic, social and environmental performance to stakeholders.

Research Gap: 1

This exploratory study, due to the small sample of co-operative banks' standardized sustainability reports in Europe, should continue to set more specific goals, which allow know the financial, human, organizational and corporate governance features that determine communication of sustainability in cooperative banks as a whole in our country as well.

According to a study by T. Roy & K. Sen (2015), District cooperative banks are playing a major role in deposit mobilisation and disbursal of microcredit for SHGs in backward areas. They also infuse repeat credits for timely repayment of loans. The revolving fund and Community Investment Fund (CIF) are provided by NRLM to SHGs to build financial confidence and a healthy track record to attract mainstream bank finance.

The study of Egwu, N. P. (2016).reveals that there exists no significant difference between the perceptions of beneficiaries belonging to different age groups regarding the access to financial services through cooperative banks.

S. Senapati & A. Bhatia, (2018) attempts to study the growth of co-operative credit particularly Primary Agricultural Credit Society (PACS) in terms of number of societies, membership, deposits, number of borrowers, loan advanced in India. It also focuses on the measures taken by different committees including the Vaidyanathan Committee to revamp and revitalize the PACS.

The results of the study of T. Lal (2018) reveal that financial inclusion through co-operative banks has a direct and significant impact on poverty alleviation. The study highlights that access to basic financial services such as savings, loans, insurance, credit, etc., through financial inclusion has generated a positive impact on the lives of the poor and help them to come out of the clutches of poverty.

Research Gap: 2

The study by T. Lal (2018) was conducted amidst few limitations. The study is limited to the perception of financial inclusion beneficiaries only, which could be carried further on the perception of other stakeholders such as bank officials, business correspondents, village panchayats, etc.

The study titled 'The Effects of Corporate Social Responsibility on Customer Loyalty: The Mediating Effect of Reputation in Co-operative Banks Versus Commercial Banks in the Basque Country' by A.I. P Aramburu & G.I. Pescador (2019) reveals that corporate reputation partially mediated the relation between corporate social responsibility and customer loyalty. On the other hand, bank type is shown not to moderate the mediation effect. The results have important implications for practitioners wishing to manage their relations with customers.

B. Holmstrom, Liiketaloudellinenaikakauskirja (1999) in the 'Future of cooperatives: A corporate perspective' suggested that the 'Ownership of Enterprise' is an excellent book by Professor Hansmann, which has gotten economists interested in non-corporate forms of organization and helped them see these organizational forms, not as anomalies, but as competitive institutions that form an integral part of a healthy market economy. They also argued that Cooperatives have traditionally developed where life has been more stable and where change may still be less pressing. Also, cooperative activities have been chosen to dampen the impact of change. The ease of exit and entry can be altered in response to increased needs for mobility and preference alignment; rules for investor participation can be changed, bringing in new forms of capital; the extent and form of voice can be varied, allowing new forms of participation in decision making; and so on. Like political constitutions, cooperative governance can take a lot of different shapes, most of which haven't been tried or envisioned yet.

Research Gap: 3

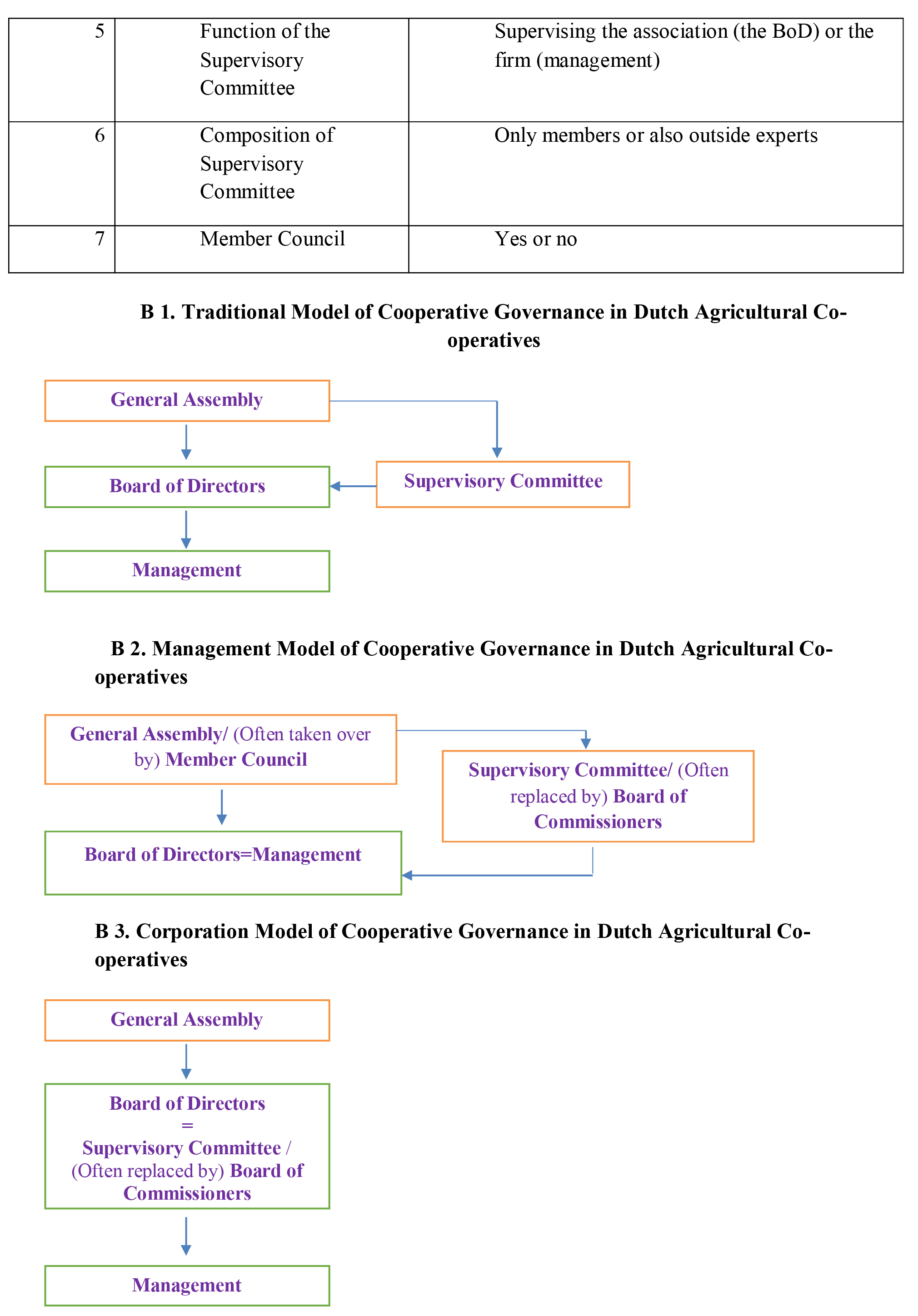

The study made by J Bijman, G Van Dijk (2009)on 'Corporate governance inagricultural cooperatives: A perspective from the Netherlands' explores the changes in corporate governance in agricultural cooperatives in the Netherlands. The new governance models seem to put members at a greater distance from the firm, member commitment could be at stake, so one empiricalissue is about how cooperatives actually deal with the disadvantages of the new governance elements.

Most economic organisation literature on cooperatives has focused on changes in income rights, Jos Bijman, George Hendrikse, Aswin van Oijen (2012) studied'Accommodating Two Worlds in One Organisation: Changing Board Models in Agricultural Cooperatives' on changes in the allocation of decision rights between board of directors (representing members) and managers. They identified three corporate governance models: traditional, management and corporation and presented an empirical illustration showing a relationship between the choice of board model, product portfolio and performance.

The study by Nobuyoshi Yamori, Kozo Harimaya, Kei Tomimura (2017) on 'Corporate governance structure and efficiencies of cooperative banks' suggests that outside directors' discipline is more necessary for cooperative banks than for stock banks, which are under strong pressure from shareholders. For cooperative banks, a high ratio of representative council members, has negative effects on efficiency measures. Their findings support the proposals of the financial regulatory authorities' council of Japan to appoint outside directors to the board as a means for strengthening governance of the co-ops.

Research Gap: 4

Findings of Hendrikse and Van Oijen, 2006; Hendrikse et al. (2009) lead to a number of interesting questions for future research.Thus, the relationship between changes in corporate governance and member commitment is worthwhile studying. A second question relates to diversification of the cooperative. Does diversification lead to a need for more managerial authority, or is the change in corporate governance a result of cooperative diversification? Third, is there a relationship between the type of corporate governance and the age of the cooperative, or the stage of the life cycle of the cooperative? Hind (1997) found that organizational focus of cooperative businesses changes over time. She also found a positive relationship between business age and increasing corporate, as opposed to member orientation. Finally, a key issue is the impact of changes in corporate governance on the performance of the cooperative.

IV. PROPOSED RESEARCH METHODOLOGY

Collection of data:

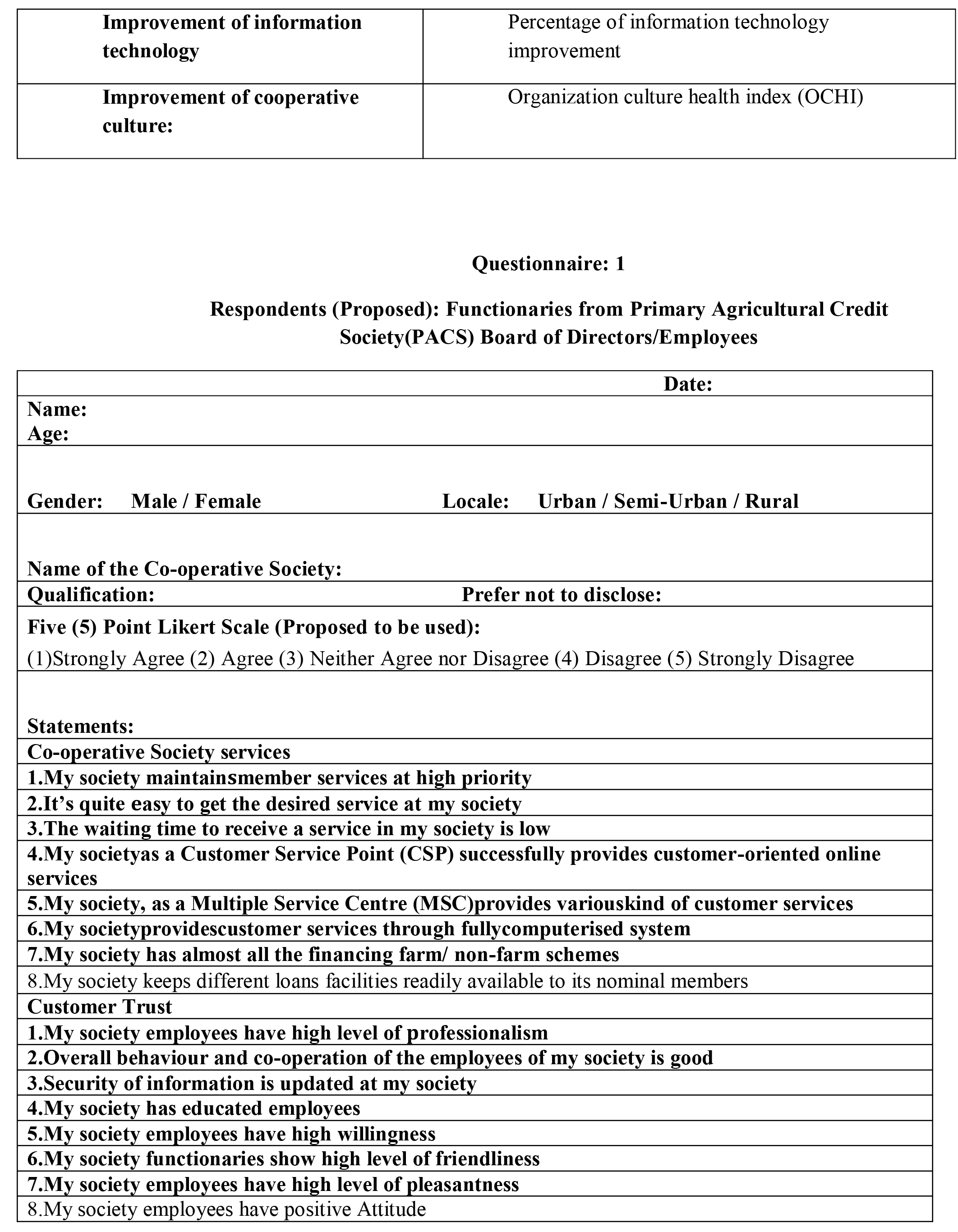

Primary Data: [A] Observation Method [B] Interview Method [3] Structured Questionnaire

Secondary Data: [A] Annual reports of the Rural Co-operatives [B] Books [C] Articles and Research Papers [D] Internet [E] RBI Circulars & Notifications [F] NABARD Circulars & Notifications [G] PIB[H] GOI, Ministry of Co-operation [I] NAFSCOB [J] GOWB, Ministry of Co-operation, [K] The WBSCB [L] IIBF [M] Policies adopted by Rural Co-operative Banks.

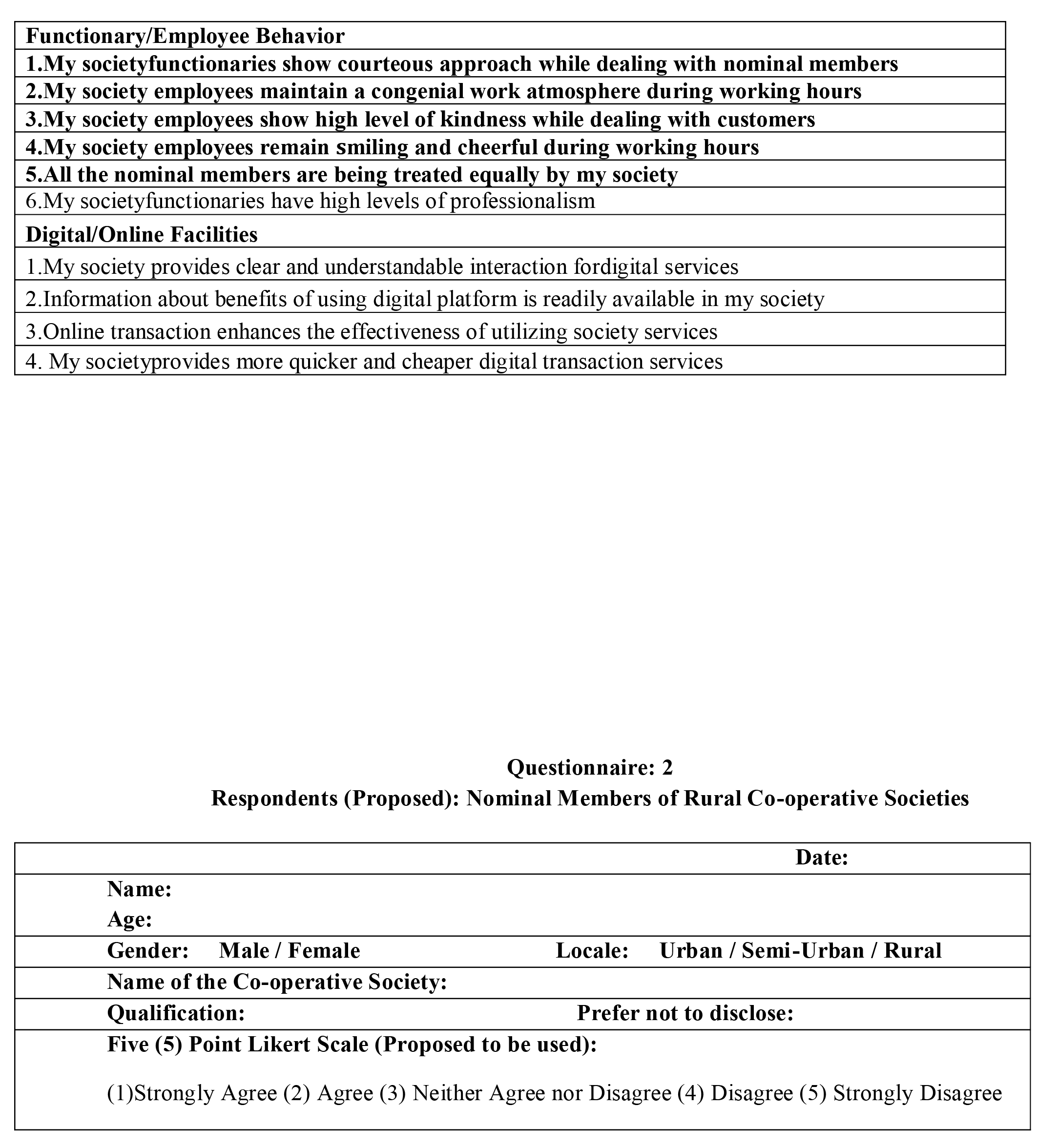

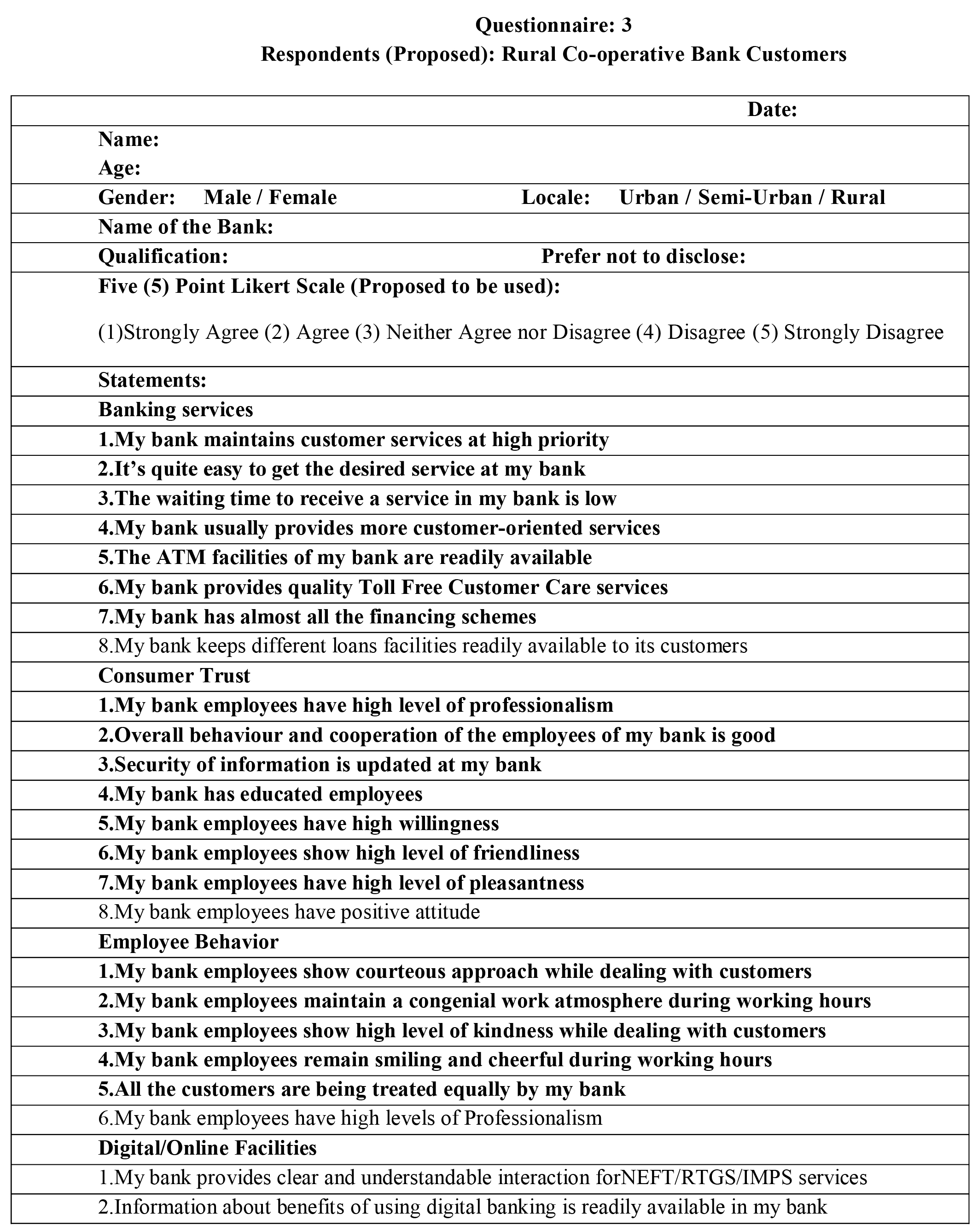

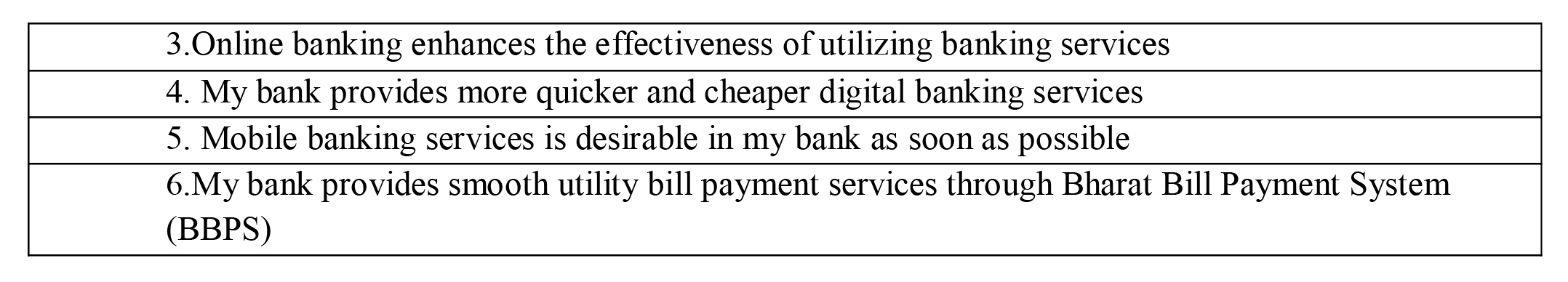

PROPOSED SAMPLING UNIT:The proposed study population includes the stake holders: Functionaries andNominal Membersof Rural Co-operatives and Customersof Co-operative Bank and proposed Sampling Unit for Study is individual Functionary, Nominal Member and Customer.

PROPOSED SAMPLING SIZE:

Proposed Respondents: Rural Co-operative'sFunctionaries:100

Rural Co-operative's Nominal Members:100

Rural Co-operative Bank'sCustomers:400

V. CHALLAENGES BEFORE THE RURAL CO-OPERATIVES

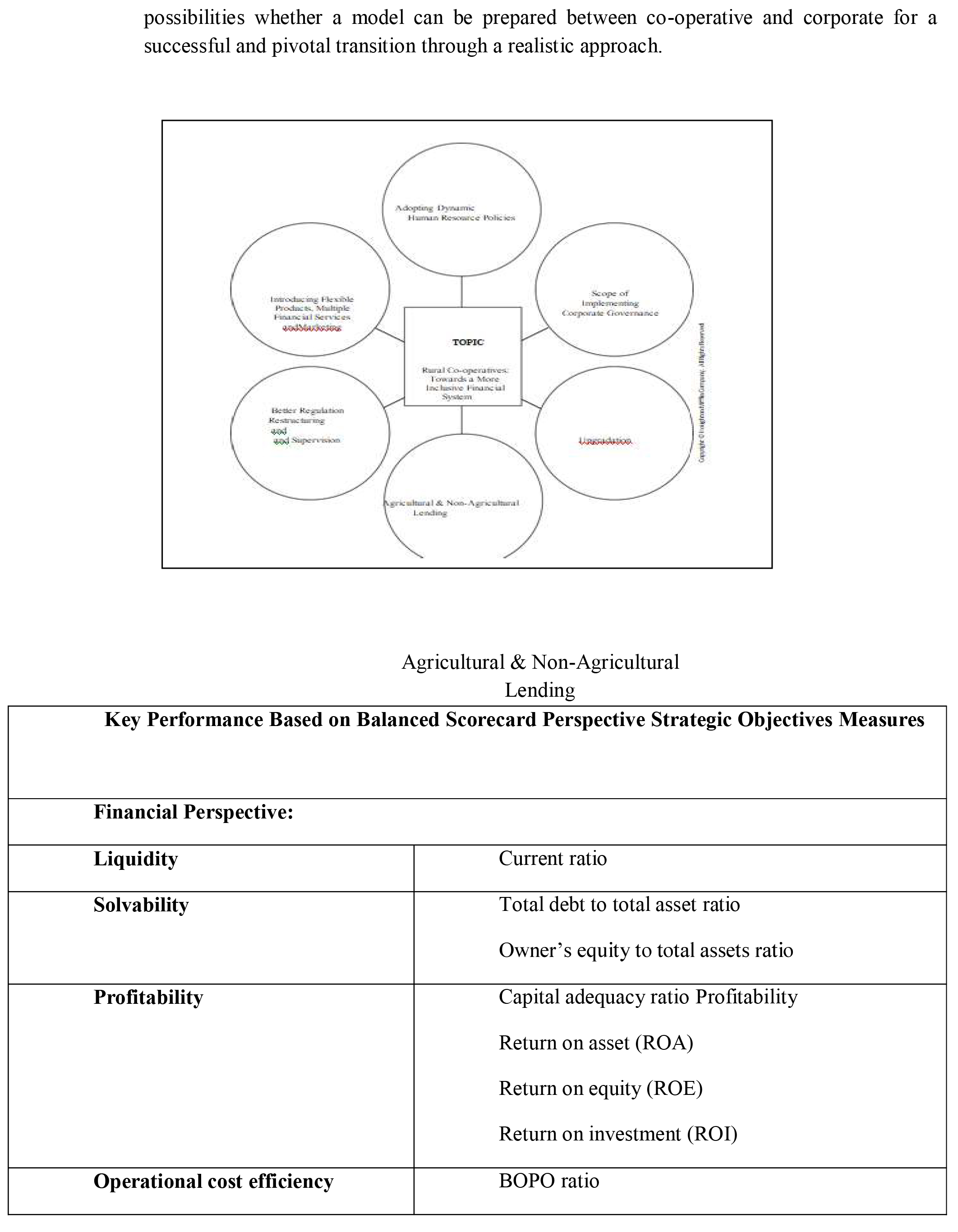

Introducing flexible products:

The rural people have irregular/volatile income streams and expenditure needs, and therefore prefer to borrow frequently and repay in small instalments. Rural cooperative banks and PACS have to introduce products and services that are better tailored to the needs of the poor. Innovative financial products like micro-ventures are essential for the upliftment of agricultural society. This can be effectively done by implementing the microfinance model in the co-operative system. To implement the microfinance model in co-operative societies, we must integrate the services of self-help groups.

Introducing multiple financial services:

The rural co-operatives must introduce multiple financial services including life, health and home insurance, pension schemes etc. for the financial inclusion and upliftment of the rural people.

Priority sector lending obligation:

The agricultural lending rate of rural co-operative banks are predetermined by the Govt. But many of these banks are often not in a financial position to make the lending 'tradable'. The priority sector lending obligation has to be revisited and has to be more flexible.

Competitive Interest rate on deposit:

The deposit base of rural co-operative banks is mostly formed by the PACS and thus these banks have predominantly high volume of high-cost deposit. Due to vulnerability, these banks never get any big size low-cost deposit account of the Govt. The Govt. or Semi-Govt. employees are reluctant to open salary accounts with the rural co-operative banks. So, unlike the commercial banks, it's become difficult for the week rural co-operative banks to manage the deposit mix and offer variety of flexible deposit products with wide range of added facilities and with a competitive rate of interest to its retail depositors.

Better regulation and supervision:

Weaknesses in regulatory standards, poor enforcement and regulatory forbearance, have contributed to the deep financial distress that characterizes many rural co-operatives. Effective and corrective measures have to be taken by forming a prompt corrective framework. Let the Government be tough against the inefficient rural co-operatives so that the rural people should not be denied access to the finance.

Restructuring and upgradation:

Due to the regulatory bindings, no direct membership for Indian Financial System Code (IFSC) is allowed to the rural co-operative banks. Looming volume of NPA inhibits a number of rural co-operative banks from implementing advance technologies like mobile banking. Infusion of capital in the co-operative system is also rare. The weak rural co-operatives are to be restructured and upgraded to match with the standards of commercial banks and financial institutions. Rapid digitisation and reducing transaction cost of co-operatives has become most essential.

Adopting dynamic human resource policies:

The role of managers or leaders is considered to be very crucial in successful operations of individual PACS. P. Basu& S. Basu (2007) concluded that outcomes were better in PACS where managers created an atmosphere of trust through participation in informal activities. Dynamic human resource policy is to be adopted by the rural co-operatives for deep penetration in the financial system.

Lending by Co-operatives:

Attempts to strengthen Indian agriculture must address not only farm production (farmers) but also processing, marketing, trade, and distribution. We must link farmers to markets. In this endeavour, marketing and rural credit systems are extremely important. Indian agricultural marketing and rural credit systems have undergone several changes during the last decade. However, in the emerging environment, these need many more changes for making the agricultural sector vibrant and responsive to the aspirations of the rural masses

VI. CONCLUSION

Marketing and institutional credit systems have always remained critical for development of agricultural and allied sector. Their role has been enhanced in the liberalized economic environment. The set of reforms and strategic actions proposed to be suggested in this paper will help these systems strengthen rural Indian economy.

Imparting corporatisation in rural co-operatives is essential but then there is the possibility that it may affect the essence of co-operation. This paper will make an attempt to find out the possibilities whether a model can be prepared between co-operative and corporate for a successful and pivotal transition through a realistic approach.

REFERNCES:

[1] Crook, R. C., & Sverrisson, A. S. (2001). Decentralisation and poverty-alleviation in developing

countries: a comparative analysis or, is West Bengal unique?

[2] Goldberg, N. (2005). Measuring the impact of microfinance: taking stock of what we know. Grameen

Foundation USA publication series, 1-52.

[3] Pat, A. K. (2005). A poverty eradication mission in Kerala. Economic and Political Weekly, 4991-

4993.

[4] Basu, P., &Basu, S. (2007). Role of Managers in Success of an Organization: The Case of Rural

Cooperative Credit Societies in India. In Poverty, poverty alleviation and social disadvantage:

Analysis, case studies and policies (pp. 532-550). Serials Publications.

[5] Rao, K. S. (2007). Financial inclusion: An introspection. Economic and political weekly, 355-360.

[6] Karmakar, K. G. (Ed.). (2008). Microfinance in India. SAGE Publications India.

Lakshmi, P., &Visalakshmi, S. (2013). Impact of cooperatives in financial inclusion &

comprehensive development. Journal of Finance and Economics, 1(3), 49-53.

[7] Chakrabarty, K. C. (2009). Technology, Financial Inclusion and Role of Urban Cooperative

Banks (No. id: 2166).

[8] Raman, A. (2012). Financial inclusion and growth of Indian banking system. IOSR Journal of

Business and Management, 1(3), 25-29.

[9] Norhatan, H. (2014). Cooperative Movement Impacts on Poverty Eradication in Indonesia: 2007-

2011 Archival Research.

[10] Bollas-Araya, H. M., &Seguí-Mas, E. (2014). Sustainability reporting in cooperative banks an

analysis of their disclosure in Europe.

[11] Roy, T., & Sen, K. (2015). SHGs-a Positive Leap towards Poverty Eradication. The Management

Accountant Journal, 50(7), 12-15.

[12] Das, R. (2015). “Emergence and Activities of Self-Help Group (SHG)-A Great Effort and

Implementation for Women" s Empowerment as well as Rural Development."-A Study on Khejuri

CD Blocks in Purba Medinipur, West Bengal. IOSR Journal Of Humanities And Social

Science, 20(1), 28-39.

[13] Egwu, P. N. (2016). Impact of agricultural financing on agricultural output, economic growth and

poverty alleviation in Nigeria. Journal of Biology, Agriculture and Healthcare, 6(2), 36-42.

[14] Andotra, N., & Lal, T. (2016). MEASURING AGE-WISE PERCEPTION OF DIFFERENT

BENEFICIARIES REGARDING ACCESS TO FINANCIAL SERVICES THROUGH

COOPERATIVE BANKS. Journal of Commerce & Accounting Research, 5(2).

[15] Mitra, S. (2017). Relation between Financial Inclusion and Poverty Reduction: A Study in Hooghly

District of West Bengal.

[16] Lal, T. (2018). Impact of financial inclusion on poverty alleviation through cooperative

banks. International Journal of Social Economics.

[17] Senapati, S., & Bhatia, A. (2018). A Study on the Contributions of PACS towards Inclusive Growth

of Rural Economy. Theoretical Economics Letters, 8(13), 2818.

[18] Aramburu, I. A., & Pescador, I. G. (2019). The effects of corporate social responsibility on customer

loyalty: The mediating effect of reputation in cooperative banks versus commercial banks in the

Basque country. Journal of Business Ethics, 154(3), 701-719.

[19] Du, S., Bhattacharya, C. B., & Sen, S. (2007). Reaping relational rewards from corporate social

responsibility: The role of competitive positioning. International journal of research in

marketing, 24(3), 224-241.

[20] Shah, M., Rao, R., & Shankar, P. V. (2007). Rural credit in 20th century India: overview of history

and perspectives. Economic and Political Weekly, 1351-1364.

[21] Ravichandran, K., Seenivasan, G., & Vijayakumar, M. (2014). Revival Package for PACS in Tamil

Nadu: Emerging Challenges. Journal of Rural Development, 32(4), 439-449.

[22] Akoijam, S. L. (2013). Rural credit: a source of sustainable livelihood of rural India. International

journal of social economics.

[23] Binswanger, H. P., &Khandker, S. R. (1995). The impact of formal finance on the rural economy

of India. The Journal of Development Studies, 32(2), 234-262.

[24] Ayadi, R., Llewellyn, D. T., Schmidt, R. H., Arbak, E., & Pieter De Groen, W. (2010). Investigating

diversity in the banking sector in Europe: Key developments, performance and role of cooperative

banks.

[25] Sadashiv, Z. A. URBAN CO-OPERATIVE BANKS IN INDIA: CHALLENGES AND

PERSPECTIVES. In Seventh National Conference (p. 21).

[26] Yamori, N., Harimaya, K., &Tomimura, K. (2017). Corporate governance structure and efficiencies

of cooperative banks. International Journal of Finance & Economics, 22(4), 368-378.

[27] Bijman, J., & Van Dijk, G. (2009, June). Corporate governance in agricultural cooperatives: A

perspective from the Netherlands. In International Workshop" Rural Cooperation in the 21st

Century: Lessons from the Past, Pathways to the Future", Rehovot, Israel.

[28] Gorton, G., & Schmid, F. (1999). Corporate governance, ownership dispersion and efficiency:

Empirical evidence from Austrian cooperative banking. Journal of Corporate Finance, 5(2), 119-

140.

[29] Holmstrom, B. (1999). Future of cooperatives: A corporate perspective. Liiketaloudellinen

aikakauskirja, 404-417.

[30] Bijman, J., Hendrikse, G., & Van Oijen, A. (2013). Accommodating two worlds in one organisation:

changing board models in agricultural cooperatives. Managerial and decision economics, 34(3-5),

204-217.

[31] Kumar P. Baba Gnana & Justin Nelson Michael (2020). Transforming Rural Agricultural

Cooperative Banks with Microfinance Model -A Ubiquitous way of Banking Resurgence [IIBF].

[32] http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.375.5311&rep=rep1&type=pdf

[33] https://pib.gov.in

[34] https://socialjustice.nic.in

[35] https://www.nafscob.org