Subscribe now to get notified about IU Jharkhand journal updates!

Government-related Factors behind Success and Failure of Indian CPSEs M D Sreekumar

Abstract :

Central Public Sector Enterprises were established in India to accelerate economic growth and to meet the requirements of key sectors along with employment generation. To a certain extent, this objective has been fulfilled. However, every year one-third of operating CPSEs are ending up with losses. A lot of factors are there behind the spectacular performance of few CPSEs and similarly, the reasons for the poor performance of few other CPSEs are many. A research study was undertaken during 2015-2020 to explore the significant factors leading to success and failure of Indian CPSEs and priorities them based on their influence on performance using statistical tools. The methodology adopted was the review of published literature and survey reports published by Government, review of annual reports available on company websites followed by direct interaction with around 250 company executives from 35 different Indian CPSEs. Discussions were held with few Professors from different Business Schools and also few eminent industrial consultants.

The study has brought out 108 factors controlling the performance of Indian CPSEs. The final research report is now a reference document for all stakeholders for preparing strategies related to Indian CPSEs.

This paper, extracted out of this research study, elaborates in detail about critical factors behind the success and failure of Indian CPSEs for which Government is primarily responsible.

Keywords :

CPSEs, Public Sector Enterprise, Performance, Success, Failure, Turnaround.1. Introduction

In the pre-independence era, public sectors were confined to few key sectors such as Railways, Post & Telegraph, Port Trusts, and Ordnance Factories. Post-independence, PSUs were initially set up only in core and strategic sectors such as Arms and Ammunition, Atomic Energy, Railways. Over the decades, PSUs have forayed into other sectors such as Manufacturing, Engineering, Heavy Machinery, Mining, Pharmaceuticals, Petrochemicals, Oil & Gas, and other service sectors like Banking, Telecom, Trade, Warehouse, and Consultancy.

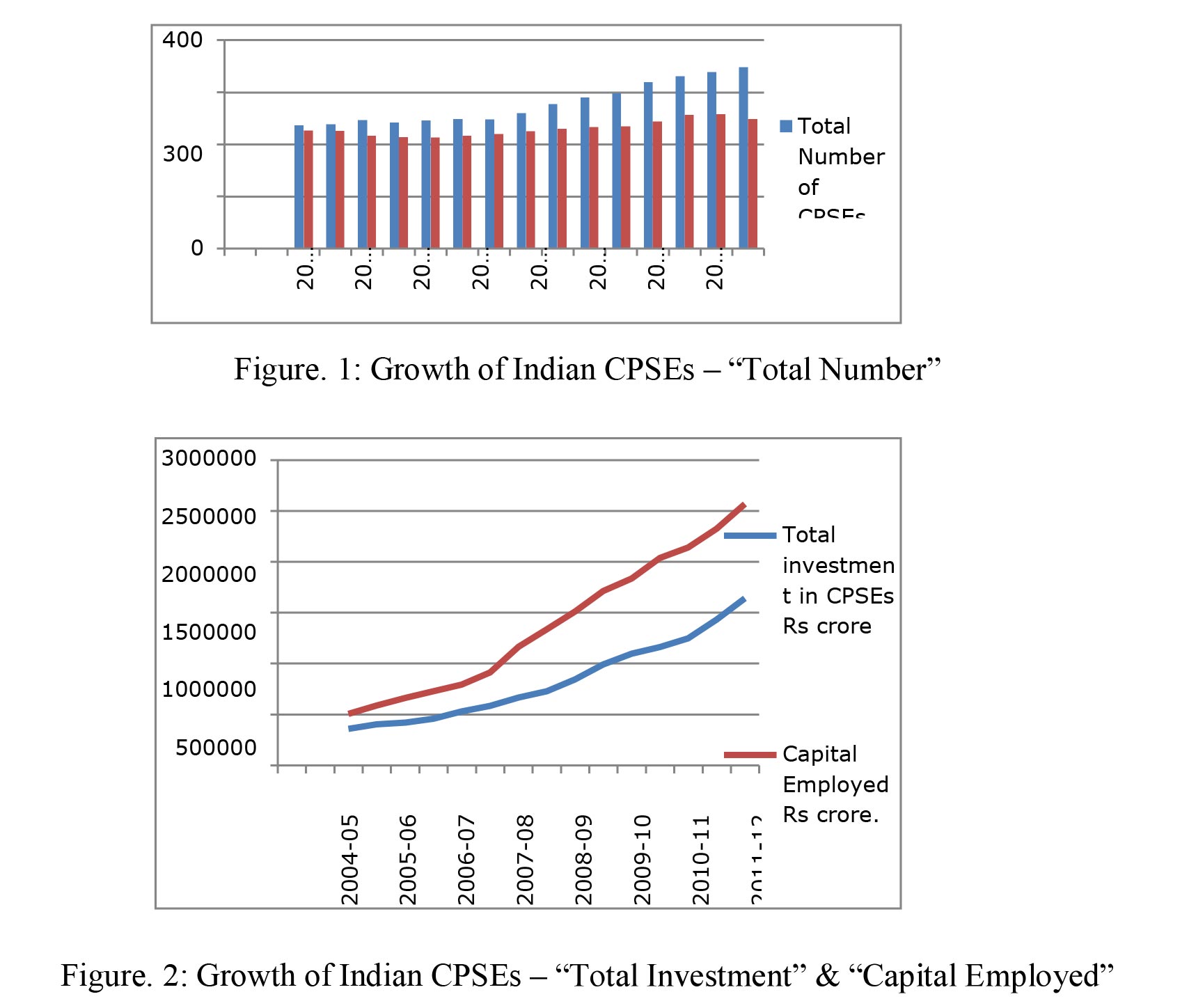

Five CPSEs and a total investment of Rs. 29 crore – this was the status at the beginning of the 'First Five-year Plan'. There was a substantial rise in these figures during the past seventy years

- 348 CPSEs with a total investment of Rs. 16,40,628 crores as on 31-03-2019.[3,4]

Also, it is observed that few Indian CPSEs are continuously performing well, at the same time few others are continuously producing losses. Few CPSEs could be turned around during the past three decades whereas few others continue to be sick. It is observed that around 40% of operating CPSEs are incurring losses for the past few years, the number being 70 during 2018- 19.

A lot of factors are there behind excellent or poor performance of CPSEs. Financial performance resulting in losses and characteristics of sickness in different companies are different. There are historical reasons behind a few of them.

Methodology adopted:

Available published literature, several reports released by the Government, and annual reports published by various CPSEs were studied and analyzed. This was followed by direct interaction with different stakeholders (Board members, executives, workmen, trade union leaders, vendors…) of 35 CPSEs selected from cognate groups under Manufacturing sector. Few academicians from reputed institutes and consulting organizations were also interviewed. Based on these interactions and data collected from other sources, 108 significant factors

influencing the performance of Indian CPSEs were identified, defined, listed, and elaborated in detail.

Grouping of Factors:

Factors identified were grouped based on their nature/characteristics as Government-related, Finance-related, Operation-related, HR-related, Strategy-related, etc. Following are the critical factors behind the success and failure of CPSEs for which Government is primarily responsible.

Government-related Factors affecting Performance:

Out of 108 factors identified behind the success and failure of Indian CPSEs, around 25% are Government related.

1. Government Policies:

Ajit Singh (2009)[5] has commented that changing industrial policies released by different Governments since independence had a great impact, both positive and negative impact on the performance of CPSEs.

Sumit K. Majumdar (1996)[6] has found that the performance of CPSEs was better in the 1950s when the industrial policy regime was of development orientation but dropped during 1960s when the policy changed to regulation type and again in 1970s when the regulation and control regime turned authoritarian. For most of the period during the 1960s and 1970s, decision- making power was not vested with industrialists. This again affected performance. Again by 1980, the Government became more liberal. Micro-level services were renowned as the means towards the manufacturing and trading progress of the country. The performance started improving again.

The Government of India has released its comprehensive shipbuilding policy in 2017, envisaging increasing the share of Indian shipyards globally to 2. Infrastructure status granted to shipbuilding industries has enabled them to avail loans at better terms.

The shift in Government policies has negatively affected the performance of all the five CPSEs under the Pharma sector. GoI's decision to change the canalization agency for the bulk drug from IDPL to STC was one of the prime reasons which let down IDPL.

2. Liberalization, Privatization & Globalization[7]:

"Liberating the economy from different regulatory and control mechanisms of the state" is often referred to as 'Liberalization'. In other words, "Unilateral or multilateral reductions in tariffs and other measures that restrict trade" is termed as 'Liberalization'. Objectives of 'Liberalization' were

☐ Globalization

o Better quality of products & services by forcing Indian companies to compete with global players

o Increased investment in India from global organizations

o Increased exports business

☐ More flexibility in business operations

☐ More freedom to private enterprises and a level-playing field in markets.

☐ Improved productivity and profitability of every organization

Impact of Liberalization on the Indian Economy: Economic reforms implemented in July 1991 is referred to as economic liberalization in India. Foreign investment went up significantly during the period 1991-96. Indore, Noida, Ghaziabad, Gurugram, Ahmedabad, Pune, Hyderabad, Bangalore, and Chennai were the destinations for global players. The negative impact of liberalization was the deepening of income inequality. GDP growth was merely 5% during 2012-13. Fall in job opportunities, nutritional intake, exports were other effects.

The most significant factor behind the failure of HMT Machine Tools Ltd. is 'Liberalization' as per the study report submitted by the Tariff Commission. New industrial units which came up in the sector, availability of equivalent products and services, increased choice for the customers, increase in their bargaining power, increase in the opportunities for the component suppliers, etc. intensified HMT's problems. Added to this low-price realization for its products, stiff competition from both domestic and international players, import of reconditioned secondhand machines, and brain drain put HMT in great difficulties which all led to losing the monopolistic position which HMT was enjoying during the pre-liberalization era.

HMT Watches failed because the company could not compete with counterparts in the private sector like TITAN and Alwyn as a consequence of the liberalization policy announced by the Government of India.Before liberalization, IL had a working tie-up with few foreign companies. Post liberalization, the same foreign companies became IL's competitors. IL found it difficult to match their price structure with that of their earlier partners which put them in losses thereafter.

BSNL is the latest casualty of economic reforms and Liberalization.

3. Disinvestment Policy:

‘Disinvestment’ refers to the process of transferring the ownership of a CPSE from the Government to a Private sector aiming at better management, more focused objectives, and improved performance.

Ritika Jain (2016)[8] had found that disinvestment as a policy intervention had a positive impact on the organizational overall performance. Gupta Seema et al. (2011)[9] have studied the financial performance of disinvested CPSEs for the period 1986 - 2010 based on several dimensions such as productivity, efficiency, profitability, and liquidity. The research has found that partial disinvestment has not yielded expected results, which may be because of other known factors. Chiranjib Neogi and Buddhadeb Ghosh (1998)[10] studied the impact of disinvestment on the performance of selected Indian industries for the period 1989 to 1994 and found no improvement in productivity as expected. Gagan Singh (2015)[11] has studied how the disinvestment policy has affected the performance of Indian CPSEs. The case studies considered are regarding SAIL, MTNL, ONGC, and Shipping Corporation of India Ltd. The author has found improvement in the capacity utilization, employee efficiency, and productivity of the organization as a result of partial disinvestment. But there was a drop in the total profitability. No improvement in profitability and operational efficiency was observed in firms wherein partial divestiture has been adopted and further endorsed the policy of strategic sale through which management control is handed over to the strategic partner. (Sudhir Naib, 2003)[12].

The three loss-making units of SAIL have been proposed for strategic disinvestment. Few other subsidiaries also were identified for either disinvestment or strategic sale.

4. Captive Status:

Few CPSEs under different Ministries enjoy captive status and their products are procured for Government requirements/programs either fully or partially. Typical examples are Integrated Coach Factory under the Ministry of Railways, Ordinance Factories under Defence Ministry, and HLL Lifecare Ltd under the Ministry of Health and Family Welfare.

HLL's success story has to be identified with its captive status. Also, they get their orders well in advance ensuring utilization of their plant capacity and that too at better prices and also with advance payment.

5. Government Order share:

Lack of orders from the Government for whom the plant was installed was the problem faced by HIL. Palakkad unit of Instrumentation Ltd. could perform well just because around 60% of their products were procured by another CPSE, BHEL. HMT's order book and market share dropped down only because so many Defence orders were getting shifted to the private sector through an open tender process. All pharmacy CPSEs also faced this problem. Even successful organizations like BHEL and BEML had experienced this problem.

6. Government's Procurement Policy:

Most of the semi-finished and finished goods especially capital goods required by many CPSEs are manufactured by other CPSEs. E.g.: Machine Tools, Earthmoving equipment, Electrical equipment. But always they go for open tenders wherein CPSEs have to compete with private sectors that do not carry any social burden with them. In the process, the CPSEs get defeated. Quality-wise goods from CPSEs are guaranteed. If the Government announces a policy that CPSEs can or rather shall purchase their requirements from other CPSEs only, if available, then that could bail out so many CPSEs. As far as prices are concerned, it can be settled through negotiations or if required even Government agencies like Tariff commission could be involved. In such an arrangement, Government money goes from one of its organizations only to another one. Such an arrangement could bail out organizations like BEML, HMT, HEC, BPCL, etc. More than that, the chances of corruption could be eliminated.

Payment terms for most of the tenders released by Government organizations including CPSEs are with no advance. The Government should direct all profit-making CPSEs that they shall place the orders on other CPSEs with necessary advance too. This will support sick CPSEs in their journey towards the turnaround.

In the purchase process of Government-owned organizations, there were many cases wherein CPSEs were rejected because of the deviation statement submitted along with tenders, even though those deviations do not affect the customer requirements or most of the cases the deviations are to their advantages only. A solution to this problem can be an instruction to all Government-owned organizations to take the supplier CPSE into confidence while they identify their requirements and finalize the tender documents.

In India Government controlled bodies like CPSEs procure a huge amount of goods and services. Vijay Rajmohan (2015)[13] has suggested that India shall also adopt a policy like US and China for their procurement of goods. Through such a provision foreign investment and technology will flow into the country if we assure that anything produced, serviced, and conceived in India will be treated as domestic products and services to encourage the flow of technology and investment into the country.

GoI has released a PPP (Public Procurement Policy) effective from 1-04-2012, but the beneficiary is only MSEs (Micro & Small Enterprises). As per the policy every CPSE/ Department has to set a yearly target for procurement of goods from MSEs. The target proposed is 20% on an average for 3 years (20% increased to 25% w.e.f. 1-4-2012).

Following the footsteps adopted for MSEs, GoI may amend the PPP that would support all CPSEs, directing that all CPSEs and central Government- funded projects shall procure goods, projects, and services from Indian CPSEs exclusively, subject to a mutual agreement on prices and technology level of the product as per the requirements of the buyer. A mechanism has to be established at the GoI level to settle the disputes, if any, regarding the terms and conditions unfavorable to the buyer. Obtaining clearance has to be made mandatory for procurement from private sectors especially in the case of imports.

7. Government Pricing Policy:[1,2]

In earlier years of rapid industrialization, pricing of products and services from CPSEs was determined by the Government through its mechanism APR (Administered Price Regime). 'Tariff Board' which existed under the Department of Commerce during the pre-independence era was reorganized as 'Tariff Commission' by an act of parliament in 1951. This Commission was wound up in 1976 by another act of parliament and the functions were assigned to BICP (Bureau of Industrial Costs and Prices), which was existing since 1970. The Tariff Commission in the present form was established on 2nd September 1997. And later BICP was merged with the Tariff Commission in 1999. But by 1990s, most of the CPSEs were empowered for the estimation of price for their products and services competitively. The Government still was watchful and was monitoring the price fixation in CPSEs engaged in critical areas such as petroleum and Pharma products. Still, pricing is controlled by NPPA in the case of Pharma products, but as far as Petroleum is concerned it is left to the respective CPSEs.

Formal and informal pricing policies of the Government considering the interest of the economy and consumers have often led to huge losses of many CPSEs.

Pricing policies adopted by many CPSEs are not with well-defined objectives. Optimum utilization of plants and other resources could be achieved only if there is a clear pricing policy. Also, it should be noted that CPSEs in steel and other similar sectors where the output is maximum utilized by other CPSEs, pricing policy should be appropriate to ensure trouble-free operation for the consuming CPSEs (Swati Kumari, 2019)[14]. Wherever prices were determined by the Government, it had led to a lower return and financial losses to the related CPSE (Mathews John, 2019)[15]. There are many socioeconomic objectives too for CPSEs. They don't enjoy complete freedom for fixing the price of their products and services. At the same time, CPSEs are answerable for losses (Ram Kumar Mishra, 2014)[16].

Prices for the products produced by five CPSEs under the pharma sector were fixed by DPCO which remained by and large constant and caused heavy losses for them. For example, the price for the Penicillin produced by HAL was fixed by DPCO in 1970. This remained unchanged till 1976. Then with a marginal increase of 8%, it remained constant till 1981. This incurred a heavy loss for HAL till 1987-88. Before liberalization IDPL also had to face this issue. Even today pharmacy CPSEs are supplying high-quality essential drugs as Generic medicines at a very reasonable cost, affordable to the common man whereas their counterparts in the private sector are selling branded products at higher prices with profit motives.

However, in HLL, prices for Government procurement were fixed by the Tariff commission and they used to get reasonably good prices which is one factor behind their spectacular performance.

8. Obligation towards different Acts:

CPSEs are expected to follow religiously various acts such as Companies Act 1956, Competition Act 2002, Right to Information Act 2005, Securities Regulations, Insolvency laws Labour laws, etc. (Lalita Som, 2013)[17].

9. Fear towards administrative Ministry, CVC, CAG, CBI, etc.:

Executives in CPSEs are always scared of action against oversight or unintentional slips from multiple authorities like their administrative Ministry, CVC, C&AG, CBI, Parliamentary committee, etc. (Ram Kumar Mishra, 2014)[16]. This often leads to a situation of over-cautious decisions.

Many senior executives of CPSEs had to undergo vigilance cases. There would have been many cases where these were warranted. But at least in a few cases, the cases appear not deserving

any merit. There were instants of minor slippage in different processes. Genuine errors were not differentiated from deliberate deeds while deciding the seriousness of the corruption cases. No differentiation was applied between decisions taken in good faith keeping the best interest of the organization and intentional mala-fide decisions. But the way vigilance cases were framed by CVO of different Ministries against senior executives of CPSEs and the allegations raised in each case have never yielded any positive results in CPSEs. Rather it has only retarded the growth of the organization.

HMT is a typical example of this case. In HMT CEOs were booked for decisions taken in the best interest of the company based on the prevailing situation. A distinction was not made between mala-fide action and business decisions that are taken with good intention. CEOs of HMT lacked the required support at the time it was needed. This has been creating a psycho of fear among top executives of HMT which has contributed a lot to its continuous poor performance which led the CPSE to the present state of affairs.

For every ten decisions we take, two may go wrong. But the situation would be worse if the eight right decisions are not taken at right time. Officials in Indian Bank were scared to deal with credit proposals during early 2000. They have to be motivated to exercise their power through an assurance that bonafide actions would not land them in trouble. This assurance was recorded through a board resolution. (Ranjana Kumar, 2008][18].

10. Government's support through Bridge Loans:

Government, whenever decide to support a CPSE to overcome their financial crunch, extend a loan for which CPSE has to pay interest at a predetermined level as per DPE guidelines. This is generally provided as a part of a revival package or as and when required for meeting investment against new projects or paying salary and statutory dues. When interest is not paid on time and gets accumulated, it leads to the sickness of the firm. Later, if the CPSE still finds it difficult to come out of the financial crunch, the loans may be converted to equity capital as a part of financial restructuring. During the past many years GoI has extended loans to many CPSEs which in turn had led to their turnaround.

For HEC Ranchi, an earlier nonplan loan was written off. Also, the interest due as of 31-03- 2005, against the loans was waived off. Another Rs. 102 crore had been extended as a bridge loan to mobilize working capital.

11. Government Guarantee for rising Loans:

The government used to support CPSEs by providing a guarantee for availing loans from financial institutions. The requirements could be for new projects or for overcoming the financial crunch. But the surprise is that the Government was charging a one percent fee from their own sick companies for this and that too for a limited period of one-year guarantee.

It is learned that HMT Machine Tools could have completed and dispatched few more machines provided they were timely extended financial support by the UCO Bank-led consortium of Banks. The government also didn't come forward with any alternative. IDPL also faced a lot of difficulties in raising loans from financial institutions. But this support was extended to HEC Ranchi as a part of their revival package.

12. GoI Loans and Interest

As a part of the revival package Government sometimes convert the loans to equity or sometimes loans along with interest are waived off as a part of the turnaround strategy. For HEC Ranchi, an earlier nonplan loan was written off. Also, the interest, due as of 31-03-2005, against the loans were waived off.

13. Heavy Interest burden:

Interest paid/payable against different advances like current account loan availed from commercial banks, loan received from GoI, advance received from customers in certain cases, defaulted payments to vendors, etc. are sometimes burden to organizations. To a certain extent only it can be controlled through proper finance management.

Heavy interest burden was one of the reasons behind the sickness of many organizations like Air India, HEC, HMT Machine Tools Ltd, CCI, HIL, and all the five CPSEs under the Pharma sector.

14. Wage settlement / Pay revision:

Remuneration is a strategic factor determining the performance of the employees in an organization, as it has become a vital tool in creating a competitive advantage over the rivals (R. K. Mishra and A. Sridhar Raj, 2008)[19].

Many talented executives who were contributing effectively in CPSEs left their organization and joined other CPSEs which have implemented 1997/2007 pay packages. Some of them have even joined private sector companies or shifted to other fields.

Wage revision sometimes deteriorates the financial status of the companies especially when it is implemented very late with retrospective effect. For example, Air India faced a financial crunch in 2007 because of wage revision.

In BPCL implementation of the 1997 pay scale and raising the retirement age from 58 to 60as a part of the revival package 2006 have boosted the morale of the employees and led to turn around of the company.

In many CPSEs like HMT, non-implementation of even the 1997 pay package has led to large- scale frustration among employees which has affected the performance of the organization. An exodus of talented executives and skilled workforce has affected the performance of HMT Machine Tools very badly.

In CPSEs like HEC Ranchi, Braithwaite & Co Ltd, CCI, 1997 scales were implemented as a part of revival package which has resulted in the increased morale of the employees and led to turn around of the company.

15. Board of Directors:

Board-level appointments in CPSEs are not finalized at the Company level. Selection to the post of CEO and other Functional Directors is assigned to PESB (Public Enterprises Selection Board) subjected to the approval of the Cabinet Committee of Appointments. Board has to just endorse the same. Board members of CPSEs do not enjoy any special privileges like private companies. Investors can not involve or play much in the governance of the company. Key decisions including major transactions are made by the Board with the Ministry's approval only. Changes to the articles and other major decisions requiring majority voting are taken by the Board members.

Members of the board are responsible and accountable for their acts of omission and commission to various external watchdogs like concerned administrative ministries, C&AG, CVC, and finally Parliament. Whereas in the private sector, the board members do enjoy a high degree of functional freedom and functional security.

A wide disparity exists between the compensation packages of the board-level executives of CPSEs and their counterparts in the private sector. Addressing this issue can attract more talents towards CPSEs which only can lead to their performance improvement. Also, such an initiative can reduce the attrition rate of efficient board members (R K Mishra and A. Sridhar Raj, 2008)[19].

Added to that, Board members of CPSEs do not enjoy a life tenure followed by any pension, like civil servants sitting in their administrative ministries. It is in these circumstances that the board members have to perform competing with their private counterparts.

16. Deputation of Civil servants to CPSEs:

Sometimes civil servants are deputed to different enterprises. They continue to perform like they used to perform in their parent organization. This approach sometimes affects the performance of the organization (Ram Kumar Mishra, 2014)[16]

17. Monetization of Land:

The majority of the CPSEs, when they started were provided with many acres of land on a long-term lease basis by the respective State Government. Some of them are at prime locations. Loss-making CPSEs were sometimes permitted to transfer a portion of their land back to State Government for settlement of various dues. Instances were there when few CPSEs were permitted to sell a portion of their land to overcome their financial crisis too. But now as per the Government policy, CPSEs do not have the freedom to sell any land and buildings; instead, loss-making CPSEs can identify and submit the details to their Ministry. The Government has appointed NBCC (National Building Construction Corporation) as LMA (Land Management Agency).

Earlier CPSEs like HMT, HEC Ranchi have utilized this opportunity for overcoming their financial crunch and to turn around. HEC had transferred few buildings and 2342 acres of land

to the State Government of Jharkhand against which all dues against the State Government like water charges, electricity charges including a fine for delayed payment, commercial tax, etc. were adjusted. Another 158 acres were transferred to CISF against their dues.

In the case of a few other CPSEs like HMT Machine Tools, IDPL, HAL, land could not be sold for obvious reasons even though the proposal was there in the rehabilitation scheme approved by BIFR.

18. Reliefs and Concessions sanctioned by BIFR:

Reliefs and concessions to be extended, as per the order of BIFR, by different agencies like GoI, respective State Governments, local bodies, statutory agencies like PF, ESI, sales tax, service providers like Electricity Board, Water authority, CISF, financial institutions, and waiver of LD clause by customers, etc. were of great relief for many CPSEs for their successful operations/turnaround. Organizations like AYCL, HEC were benefitted from these reliefs and concessions.

In the case of HMT Machine Tools Ltd., out of BIFR’s sanctioned reliefs and concessions to the extent of Rs 87.18 Crore, the actual realization was only around Rs.8 crore. Had all the reliefs and concessions sanctioned by BIFR realized, HMT MTL would have been turned around.

19. Proposals submitted to GoI:

Justice delayed is justice denied, so also is the situation in an industrial environment. Delayed decisions always destroy the very purpose of putting up any proposal. Delay in according approval by GoI for revival proposals being submitted by CPSEs had affected the performance of the organizations and the morale of its employees adversely. The result is something like treating diabetic patients based on clinical evaluation conducted before weeks or months.

GoI approved a capital restructuring plan for HAL in Mar 1994 w.e.f. 1-4-1992. But for converting the outstanding loan into equity, certain statutory procedures had to be followed. This took very long and by that time HAL incurred huge financial loss and was declared sick in March 1997. If decisions were taken fast and the capital restructuring plan was implemented on time, HAL would have improved with a reasonable profit.

A revival package for FACT was under consideration of BRPSE in 2013. Based on their recommendations, a Cabinet Note was put up in April 2014. Unfortunately, the subject note could not be included in the cabinet agenda due to Parliament elections. This delay in implementing the revival package caused lots of hardship for the company. Continued losses affected the financial position during the succeeding years. The acute financial crisis ended up with a shutdown of the production during Jan–Mar 2015-16.

Release of funds for the revival of any of the Pharma CPSEs did not yield the expected results just because the decisions were delayed too much. So also, was the case with HMT Machine Tools Ltd.

"Red tapism and bureaucratic management has caused a delay in decision-making in few organizations", (Mathews John, 2019)[15].

20. Co-ordination at Ministries level:

CPSEs are dependent on one another about their input and output. (Ram Kumar Mishra, 2014)[16]. For example, Ordinance factories can complete their yearly target only on receipt of machines from HMT. BEML can complete coaches only on timely receipt of wheels from Wheel & Axle plant. Steel plants are dependent on the receipt of coal which in turn is dependent on heavy machinery. Receipt of these items always decides the purpose at the user's ends. Unfortunately, there was, even now no coordination at the Ministry level between these CPSEs.

21. MoU system:

Yearly performance evaluation of CPSEs is conducted based on MoU. MoU is the agreement entered into by every CPSE management and their respective administrative Ministry indicating the mutually agreed performance targets for the specified financial year. MoU rating is awarded to CPSE based on which so many sanctions to CPSEs including performance-linked incentives, PRP, are linked. The number of CPSEs rated as 'Excellent' increased from 45 (2004-5) to 75 (2012-13) and 'Very Good' from 31 to 39 which indicates that the MoU system has strengthened the performance CPSEs. Performance of many CPSEs has improved on implementation of MoU system (Venkatesan R, 2008)[20].

22. Performance Related Pay:

Incentives are always an attraction for more productivity. The Government of India has introduced PRP (Performance Related Pay) as a part of the 2007 pay revision. (Punam Singh & Mishra R K, 2013)[21]. This has led to improved performance of many organizations.

23. Accountability:

Accountability without freedom and required powers is meaningless. Always there is a risk element in any decision being taken if it has to be taken on time. CEO of any company has to take critical decisions based on the available facts and situations to save the organization and to take it forward. At that time any CEO would wish that he will get a handhold from the respective Ministry, but it has not happened in many cases. Wherever things went wrong the whole blame was put on the CEO. This accountability sometimes takes the form of fear towards the job itself which often restricts the executives in taking appropriate decisions at the appropriate time.

Executives in CPSEs have to function in a very competitive environment against a great number of odds. (Ram Kumar Mishra, 2014)[16].

24. Powers vested with company Board:

Delegation of powers is good enough only for ‘Ratna’ companies. Boards of sick companies do not have any powers. They don’t enjoy absolute powers even to generate income from unutilized non-performing assets like buildings and land. Similarly, they do not enjoy authority in finalizing any type of joint working arrangements with other companies.

Deficiencies in the delegation of authority to board, CEO, and down the line was one critical factor behind Air India's failure.

Non-obtaining of approval from the Ministry for a new project, CNC System, left HMT Machine Tools Ltd failing to take advantage of available joint venture opportunities.

Subjected to a few relaxations, major investment decisions are to be approved by PIB and Cabinet (Lalita Som, 2013)[22].

25. Too much Government Interference:

CPSEs are answerable not only to concerned Administrative Ministries, but they are monitored and evaluated by other agencies too such as DPE (Department of Public Enterprises) and several other statutory bodies such as CVC, C&AG, various Parliamentary committees, and finally the Parliament itself. Several other regulatory authorities such as SEBI, MCA (Ministry of Company Affairs), CCI (Competition Commission of India) are also over-seeing CPSEs.

Sometimes CPSEs are assigned the task of implementing different GoI programs or some other additional social responsibilities through special orders by the concerned Ministries (Lalita Som, 2013)[22]. Precise and unambiguous demarcation is not there between Ownership and Management. Powers vested with CEOs and decisions taken by them are always subjected to scrutiny and acceptance from the bureaucrats. (Ram Kumar Mishra, 2014)[16]. Lalita Som (2013)[22] has studied the performance of CPSEs over the years and has noted that the performance has improved as a result of a range of reforms implemented. Still, state ownership and government control are causing governance challenges. When the Government is the controlling shareholder, the government may pursue a political and populist agenda at the expense of the firm. Too much Government interference in the operations of CPSEs has strongly affected their performance (Economic Times, 23rd April 2014).

The most accused factor behind the downfall of 'Air India' was the interference of the Government in the decision-making process of the company (Jitender Bhargava, 2013)[23].

"The business of the Government is not to do business…. There is a lot of interference happening…. There has to be a separation of ownership and management. Government directors talk ownership sans responsibility", said Mr. C.S. Verma, former CMD, Steel Authority of India Ltd at the CII annual meeting 2014. (The Economic Times, 8th June 2014).

Government's interference in the decision-making process making it prolonged and difficult was one significant problem BSNL had experienced

26. Social objectives:

While formulating policies related to public sectors, the policymakers conveniently gave higher emphasis on social obligations over profit-making. However, now the term profitability is duly recognized (Swati Kumari, 2019)[14].

BSNL spent a huge amount on services for social obligations. Network in rural areas like VPTs and fixed-line telephone exchanges were not earning even the expenses towards them. Similarly providing services in remote areas like Andaman & Nicobar and Lakshadweep islands were not generating income to meet expenses.

27. Takeover of Sick units from the Private sector:

CCI had to incur a heavy loss due to the acquisition of sick units from the private sector as per the decision of the Government of India. This was the fate of National Textiles Corporation too.

28. Wrong location of the Manufacturing units:

Wherever political considerations were given higher weightage over economic criteria in finalizing the location of the enterprise, it has led to low profitability (Swati Kumari, 2019)[14].

Political interference led to Central Government deciding to divide the MIG aircraft project into two units, one in Nasik and the other in Koraput. These two locations are 900 km apart and are situated in two different States. This has resulted in the drainage of the country's capital resources.

CCI incurred a huge amount for the transportation of raw materials and finished goods because of the location of its few units. HIL is another CPSE that has faced a location disadvantage.

Because of political pressure, HMT had to put up watch factories at places like Srinagar, Ranibagh, etc. where there was no infrastructure or skilled labour. These units were not at all productive and pulled down the overall profit of HMT.

Conclusion:

Out of 108 factors identified behind the success and failure of Indian CPSEs, 28 are Government related, for which Government has to initiate corrective measures.

This study was oriented towards the Manufacturing sector. More factors can be identified if a similar study is extended to other sectors too.