Subscribe now to get notified about IU Jharkhand journal updates!

Internet banking adoption among young adults in India: A study of behavioral intentions, perceived usefulness and perceived trust by Integrating TAM

Abstract :

With a rapid growth of internet technology and cost effective access to the internet the banking industry has seen a paradigm shift in terms of how consumers are rapidly accepting internet banking and other banking related services. India is one of those countries where the access to the internet has become relatively cheaper thus resulting in more exposure to the internet and internet banking. This study examines the impact of Trust, Perceived Usefulness and Perceived Ease of Use on the Behavioral Intentions to use Internet banking in college going students. The data were collected from 203 young university students who were in their first and second year of graduation. The results show that the Trust, Perceived Usefulness and Perceived Ease of Use have a positive and significant impact on the Behavioral Intentions to use Internet banking. Further, implications for managers are presented.

Keywords :

Internet technology, banking, consumers, managers1. Introduction:-

Internet banking has become the center of attention and innovativeness across the globe. Hanudin (2007) found out that Internet banking provides flexibility, fast and easy however in India still the lack of trust is still found significantly. Irfan Bashir and Chendragiri Madhavaiah, (2015) found that website design and perceived enjoyment on internet bankin acceptance have significant impact on customers’ acceptance on internet banking in Indian context. Apart from these factors the other critical factors that affect the user adoption rates are offering useful and user-friendly services, they need to build a trusting relationship with customers. The emergence of internet technology has eased the banking process by increasing operational efficiency. With the inception of first internet banking in India in 1990,s its growing at tremendous pace Yiu, et al. (2007). In India, reserve Bank of India (RBI) is the apex regulator of banking and has framed a mission and strategy to ensure that the banking system is safe, efficient, risk proof and in line to the global standards. Currently all the banks are encouraging their customers to switch to online banking, but because of users lack of awareness and lack of trust there is a bit of reluctance from customers end. In spite of being seamless, hassle free and agile net banking is facing some challenges in India in terms of adoption.

In this we will be discussing the Internet banking adoption in young adults in India. The construct of the study will be behavioral intentions, perceived usefulness, and perceived usefulness of Internet banking in India. The constructs of this study have been derived from TAM so the theory that will be supporting our study will be TAM.TAM is the multivariable model that predicts the user’s intention on the basis of their perception, including perceived usefulness (PU), ease of use, intention to use, actual use and attitude.

2. Review of literature and conceptual background

Suh, B., & Han, I. (2002) suggested that ease of use and usefulness have been fundamental in accepting Internet banking technology. Trust remains to be a primary and dominant factor while adopting any new kind of banking services. Alsajjan et al. (2006) in their research have attempted to extend a model to better predict and explain user’s acceptance of online banking. Nadim Jahangir & Noorjahan Begum (2008) have presented a conceptual frame work reflecting how perceived usefulness, ease of use, security and privacy affect customer adaptation to e-banking services through customer attitude. Sonja Grabner‐Kräuter and Rita Faullant, (2008) conclude that propensity to trust does not only lie on interpersonal relationships but on technological systems. Internet trust has a specific role to play in contributing the success of internet banking, banks have a responsibility to create awareness regarding the risk in internet banking and at the same time build the trust in consumers continuously. M.C.Lee (2008) in this research explored and integrated various advantages of online banking to form positive factor named perceived benefit. The results suggested that the intention to use online banking is crucially affected by security as well as financial risk and is positively affected mainly by perceived benefit, attitude and perceived usefulness. Medyawati.H et al (2011) in their study indicated that the person's ability to use computers does not significantly influence perceived ease of use. Security and privacy, interface design, and perceived ease of use significantly influence the perception of its usefulness. Perceived ease of use significantly influences the attitude of its use. Attitude for its use significantly influence the real usage and acceptance of e-banking. Mansour (2016) provided a detailed study about determinants of internet banking acceptance. In this study trust has been understood to be most important factor in the success of internet banking. H. L. Song,(2015) proposed to identify the factors a model to identify the factors affecting the successful adoption of mobile banking technology.TAM,trust perception, social influence perceived usefulness strongly affect user adoption. Marakarkandy.B et al (2017) in their research suggested that target specific marketing by customizing the marketing campaign that focus on the factors were found to be strong influencers leading to the adoption of internet banking. In their research they also studied augmented technology accepted model to understand the relationship between driver factors and inhibitor factors that lead to internet banking usage. Hussain et al.(2016) in their study examined that Perceived usefulness, perceived ease of use, and perceived enjoyment each have significant positive influence on user acceptance behavior Perceived usefulness, perceived ease of use, and perceived enjoyment each have significant positive influence on user acceptance .Al-Sharafi, Mohammed A. et al (2017) in their study aimed to prove the influence of perceived ease of use (PEOU) and perceived usefulness(PU) and their trust to accept and use the online banking services. Perceived trust was found to be a mediator for the consumer to use the online banking services. Ahmed .m (2018) in his research did the extended literature review of TAM in banking sector. In his study he mentioned all the factors that are prove useful to adopt technology-assisted model in banking. These factors are perceived ease of use, perceived security, awareness and self-efficacy. Kiran J. Patel and Hiren J. Patel, (2018) highlighted that intention to use internet banking is positively influenced by perceived security followed by other significant factors like ease of use,trust,perceived usefulness. Inrawan.I et al (2017) in their study concluded that trustworthiness is the critical factor in success of internet banking. Besides this there are some constructs that directly affect user’s behavioral intention in using internet banking such as financial risk, perceived usefulness and attitude towards using internet banking. Minimizing perceived risk is also a very important dimension that may contribute to increased adoption of banking services. Ghani et al,(2017) in their study revealed that along with other factors customer satisfaction plays a mediation role in adoption of internet banking.Percieved usefulness has positive influence on customer satisfaction. Customers are also likely to adopt internet banking if there is ease in the operations and processes. This research further aims to integrate TAM with customer service and customer satisfaction.to predict behavioral intention of customers towards adoption of internet banking.

internet banking in Pakistan could be motivated by perceived usefulness, perceived ease of use, customer service and customer satisfaction. Furthermore, customer satisfaction played a significant mediating role among proposed variables. internet banking in Pakistan could be motivated by perceived usefulness, perceived ease of use, customer service and customer satisfaction. Furthermore, customer satisfaction played a significant mediating role among proposed variables.

Mahmoud (2016) in his study concluded that perceived risk and perceived trust have strong coo relationship with internet banking adoption. Perceived ease of use and perceived usefulness were also statistically significant. Lule et al (2012) in their study analyzed that Perceived Ease of Use, Perceived Usefulness, Perceived Self Efficacy and Perceived Credibility significantly influenced consumers attitude towards using and adopting internet banking. Candra(2013) in her research found out that in TAM four main dimensions are important for contributing to the success of internet banking which are perceived usefulness, ease of use, perceived level of risk, and behavioral intention to use the services. Muhammad Tahir Jan & Ahasanul Haque (2014) in their research explored that quality of internet and perceived enjoyment along with perceived ease of use affects the online banking. Based on the review of literature, following research propositions have been framed:

H1: Trust positively influences the Behavioral intentions to use Internet banking.

H2: Perceived usefulness positively influences the Behavioral intentions to use Internet banking.

H3: Perceived ease of use positively influences the Behavioral intentions to use internet banking.

3. Methods

3.1. Research sample and data collection:

The sample consisted of college going students of 3 universities. Survey questionnaires were distributed among 350 respondents out of which 203 usable responses were received. Convenience sampling method was adopted based on the reach and contacts of the researchers.

3.2. Reliability

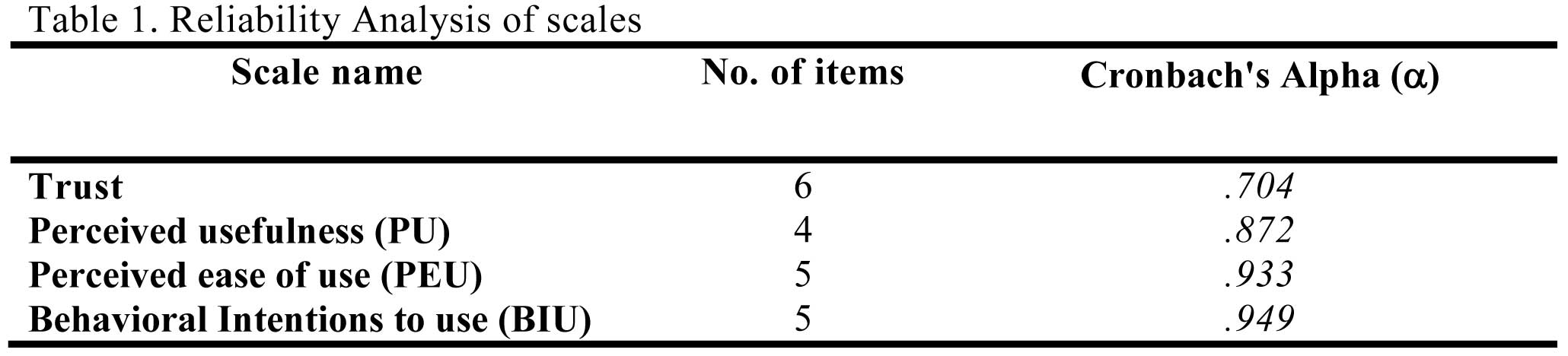

All the scales used in this study were adapted from different studies and have been already validated in their original research settings. However, we for the initial validity assessment we checked the reliability of each sale with Chronbach’s Alpha. The values of Chroncbach’s alpha for these scales are presented in the table 1.

By looking at the values of the Cronbach's Alpha () of four scales it is clearly indicated that the values are very high and more than 0.7 in each case. Thus all the scales show a high level of internal consistency in current research context.

3.3. Exploratory Factor Analysis

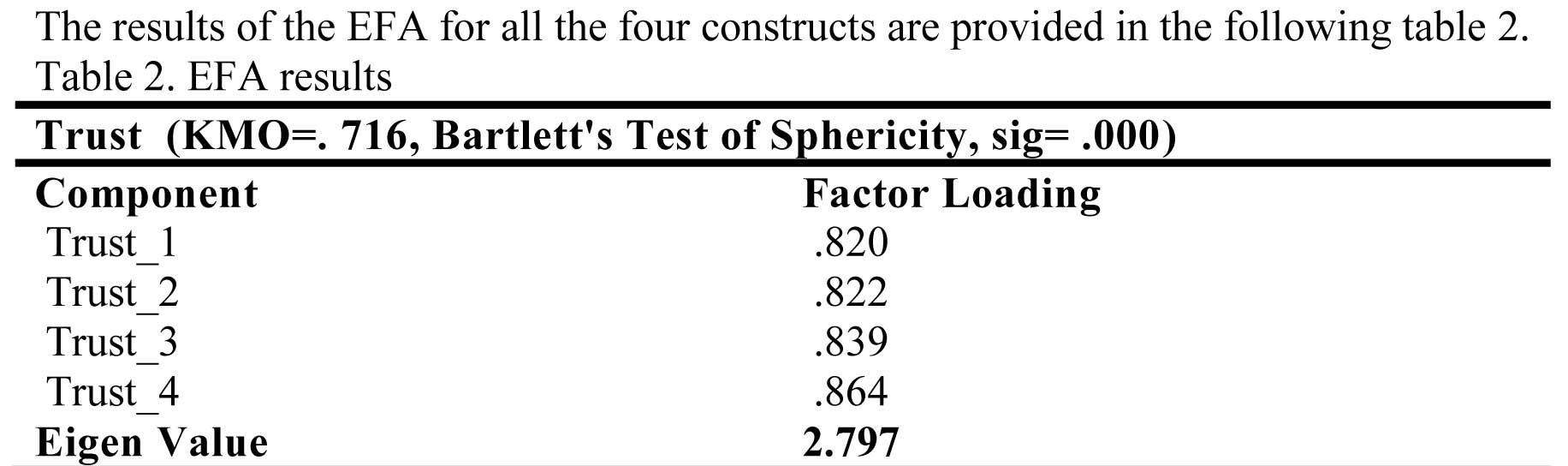

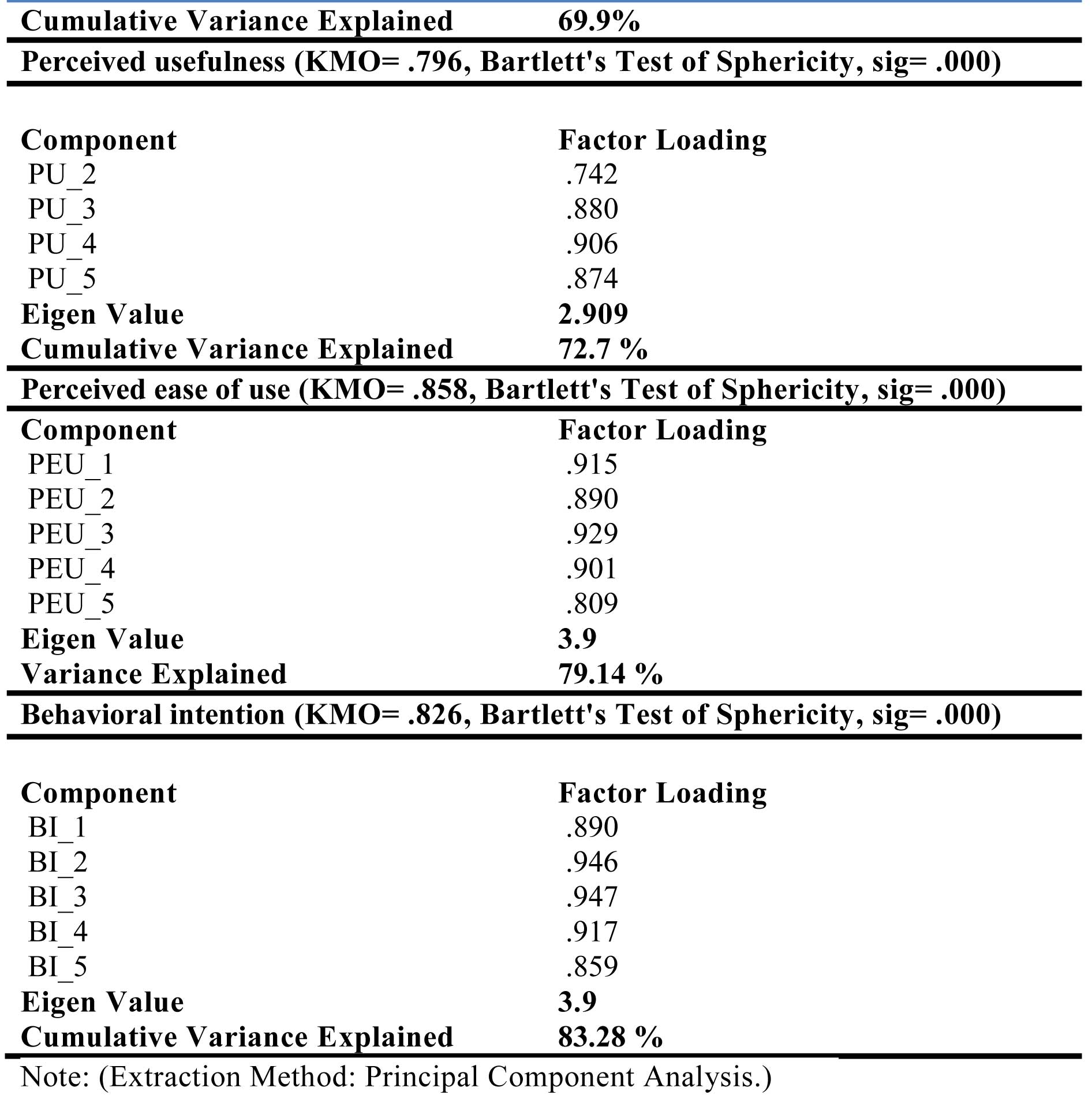

Exploratory Factor Analysis (EFA) provides a better measure of the item to item correlation and how well the items of a scale fit together. EFA was performed with the help of SPSS 20 software. The following parameters have been used used to check the fit of data for EFA:

- Kaiser-Meyer-Olkin measure of Sampling Adequacy (KMO > 0.5).

- Bartlett's Test of Sphericity (sig, <0.05)

- Factor loading of greater than 0.4 and Eigen value of greater than 1. EFA was run on each construct separately.

- Cumulative variance explained > 60 percent.

3.4. Linear Regression:

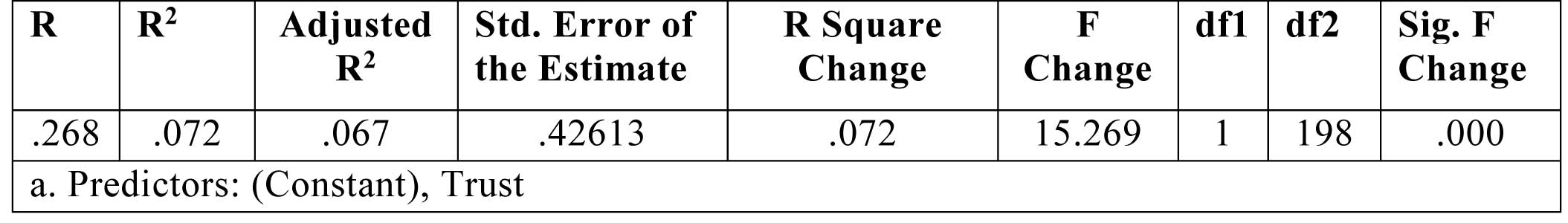

First of all the items that were retained during EFA were converted as summated variables. In order to test the hypothesized relationship

we ran three separate Linear regression models with Behavioral Intentions to use as dependent variable and Trust, Perceived Usefulness (PU),

and Perceived ease of use (PEU) as the explanatory variables. Table 3 presents the results of first regression model with Trust as the

predictor variable and Behavioral Intentions to use as the dependent variable.

The results of the first model clearly indicate that Trust has a positive and significant impact on the Behavioral intentions to use, when

it comes to Internet banking. Though the value of R squared is very small but Trust explains 7 percent of the variation in BIU,

F (1,198) = 15.269, p < 0.00.

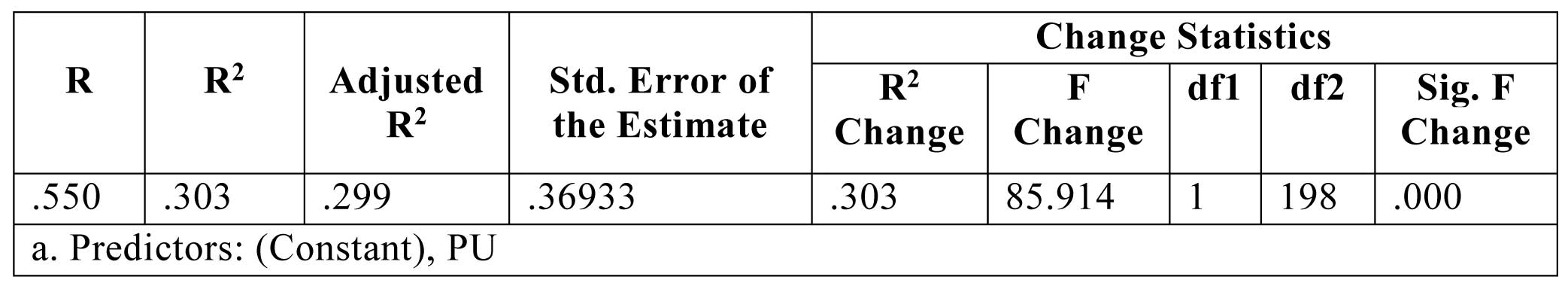

Similar results were found from second regression model, which reveal that Perceived Usefulness has very

strong and significant impact on BIU. PU explains 30 percent of the variation in BIU, F (1,198) = 85.914, p < 0.00. The results of this model

are presented in table 4.

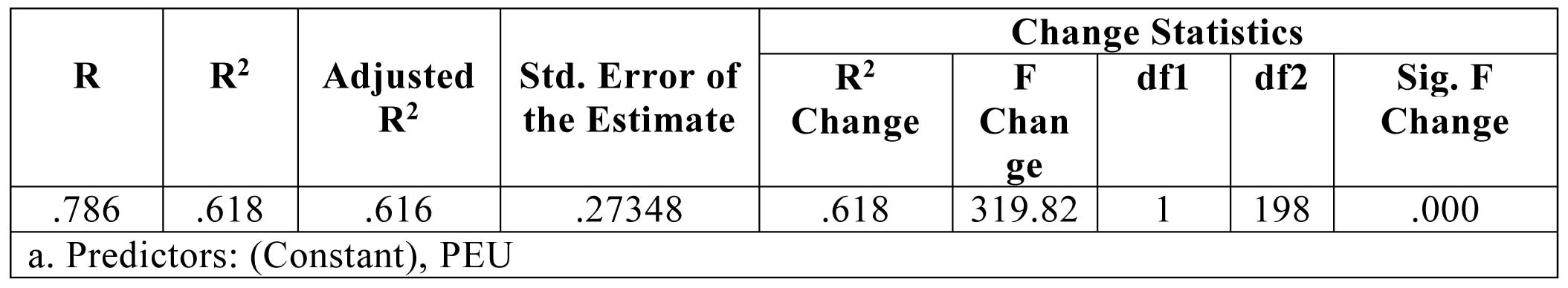

While examining the results from the third regression model, it is evident that Perceived ease of use (PEU) is the strongest predictor of Behavioral intentions to use Internet banking. With an R squared value of 0.616. It means that 61 percent of the change in BIU variable is due to PEU, F (1,198) = 319.82, p < 0.00. Table 5 shows the regression results of PEU and BIU.

4. Discussion and conclusion

One of the important objectives of this study was examine the role of trust in influencing the college going students in terms of whether they intend to use internet banking or not. The results show that there is a positive association between trust and BUI as expected, however the impact seems to be of smaller magnitude. Therefore, as an important implication for managers it is needless to mention here that banks need to devise strategies which can make their web based applications more trustworthy. If the banks work in improving the security of the Internet banking technology, the same needs to be communicated to its customers through various means. Due to the prevailing environment in this part of the world, the internet technology based services are least sought things and most of customers willingly opt out of using such services. However, the young educated consumers have shown a paradigm shift in acceptance of these technologies and the banks need to first target this young population through advertisements whereas the adult population may be exposed to awareness camps and modules. We also tested the impact of Perceived Usefulness on BUI and it showed that there is a stronger influence of this variable on BUI. This fact has been researched earlier also by a lot of people in different contexts and our results are consistent with the same. Perceived ease of use (PEU) was the most important and strongest predictors of BUI. This finding is also consistent with the earlier studies and undoubtedly if the people can understand technology easily and can access it conveniently, they accept it with faster pace and become habitual of using it. It is important to mention here that a lot of young respondents were very happy with the m-Pay application of J & K bank limited which is the web based application developed for convenient banking. It is a user-friendly application that requires very little details for faster banking. Other banks may take a lead in developing consumer friendly applications and websites for smooth banking activities.

References:

- A.Alsajjan, B & Dennis, C. (2019). The Impact of Trust on Acceptance of Online Banking. Retrieved on 26th of February, 2019 from https://bura.brunel.ac.uk/handle/2438/738.

- Ahmad, M. (2018). Review of The Technology Acceptance Model (TAM) in Internet banking and Mobile banking. International Journal of Information Communication Technology and Digital Convergence. 3(1), 23-41.

- Al-Sharafi, M. A., Arshah, R. A., Herzallah F, & Alajmi, Q. (2017). The Effect of Perceived Ease of Use and Usefulness on Customers Intention to Use Online Banking Services: The Mediating Role of Perceived Trust. International Journal of Innovative Computing. 7(1), 9-14

- AlKailani, M. (2016) Factors Affecting the Adoption of Internet Banking in Jordan: An Extended TAM Model, Journal of Marketing Development and Competitiveness, 10 (1), 39-52.

- Amin, Hanudin. (2007). Internet Banking Adoption among Young Intellectuals. Journal of Internet Banking and Commerce. 12(3)

- Bashir, I., & Madhavaiah, C. (2015). Consumer attitude and behavioural intention towards Internet banking adoption in India. Journal of Indian Business Research, 7(1), 67-102.

- Bijith M., Yajnik, N., & Dasgupta, C. (2017). Enabling internet banking adoption: An empirical examination with an augmented technology acceptance model (TAM). Journal of Enterprise Information Management, 30(2), 263-294.

- Candra, S. (2013). Revisit Technology Acceptance Model for Internet Banking International Conference on Computer, Networks and Communication Engineering (ICCNCE 2013).

- Dhananjay B, Suresh C. B. (2015). The Electronic Banking Revolution in India. Journal of Internet Bank Commerce 20.

- Grabner-Kräuter, S., & Faullant, R. (2008). Consumer acceptance of internet banking: the influence of internet trust. International Journal of Bank Marketing, 26(7), 483-504.

- Hussain, A., Mkpojiogu, E. O. C., & Yusof, M. M. (2016). Perceived usefulness, perceived ease of use, and perceived enjoyment as drivers for the user acceptance of interactive mobile maps. Proceedings of the International Conference on Applied Science and Technology (ICAST’16), Kedah, Malaysia. 10.1063/1.4960891

- Jahangir, N., & Begum, N. (2008). The role of perceived usefulness, perceived ease of use, security and privacy, and customer attitude to engender customer adaptation in the context of electronic banking. African Journal of Business Management, 2(1), 32-40.

- Jan, M. T., & Haque, A. (2014). Antecedents of the Use of Online Banking by Students in Malaysia Extended TAM Validated Through SEM. International Business Management, 8, 277-284.

- Kiran J. P., & Hiren J. P. (2018). Adoption of internet banking services in Gujarat: An extension of TAM with perceived security and social influence. International Journal of Bank Marketing, 36(1), 147-169.

- Lee, M. (2008). Factors influencing the adoption of internet banking: An integration of TAM and TPB with perceived risk and perceived benefit. Electronic Commerce Research and Applications, 8(3), 130-141.

- Lule, I., & Omwansa, T., & Mwololo, T. (2012). Application of Technology Acceptance Model (TAM) in M-Banking Adoption in Kenya. International Journal of Computing and ICT Research, 6(1).

- Mansour, K. B. (2016). An analysis of business’ acceptance of internet banking: an integration of e-trust to the TAM. Journal of Business & Industrial Marketing, 31(8), 982-994.

- Mazuri, G., Samar, R., & Norjaya, Y., & Feras, A. (2017). Adoption of Internet Banking: Extending the Role of Technology Acceptance Model (TAM) with E-Customer Service and Customer Satisfaction. World Applied Sciences Journal, 35 (9), 1918-1929.

- Medyawati, H., Christiyanti, M., & Yunanto, M. (2011). E-banking adoption analysis using technology acceptance model (TAM): empirical study of bank customers in Bekasi city, International Conference on Innovation, Management and Service IPEDR.

- Song, H. L. (2015). Customer Adoption of Mobile Banking: An Integration of TAM with Trust and Social Influence. Applied Mechanics and Materials, 701, 1323-1327.

- Suh, B., & Han, I. (2002). Effect of trust on customer acceptance of Internet banking. Electronic Commerce Research and Applications, 1, 247-263.

- Wiratmadja, I. I., Dameria, N., & Kurniawati, A. (2017). The Role of Perceived Trust of Physical Bank towards Perceived Risk on Internet Banking Acceptance from the User Perspective. Journal of Economics, Business and Management, 5(4), 168-172.

- Yiu, C. S., Grant, K., & Edgar, D. (2007). Factors affecting the adoption of Internet Banking in Hong Kong—implications for the banking sector. International Journal of Information Management, 27(5), 336–351