Subscribe now to get notified about IU Jharkhand journal updates!

Status of M-Payment and its adoption by consumers

Abstract :

India has witnessed a tremendous growth in digital payments in the recent past. Smart phone has become an integral part of the Indian society and with the growth in the use of smartphones in the country m- payment has gained both opportunity and popularity. India is home of largest youth population so it is obvious to expect a large number of users for m-payment but still the growth in adoption of m-payment is at a tortoise speed which makes us to understand the con-sumer perception towards mobile payment and the barriers faced by them so the objective of this research is to study the perception of the consumer about the mobile payment system. The pre-sent paper focuses on the analysis of the adoption level of the m-payment systems by customers. Primary data was collected from 150 respondents in Ranchi. The collected data through the questionnaire were analyzed statistically by using chi- square technique using SPSS.

Keywords :

m-payments, consumers, barriers, adoptionIntroduction

M-payment is a type of payment which is done through mobile phone, and no cash or cheque is exchanged. M-payment in India has its history back from 2000 but only few people used it. Due to demonetization and continuous enormous effort made by the government to create awareness about the digital payments, its impact on economy and benefits of e-payments more people are coming on board. Government initiative such as Digital India and move such as demonetization has rapid up the use of m-payment in Indian market backed with the high speed mobile internet. Government’s urge to make India a cashless economy has opened various new platforms for the users from the launch of phone pe , UPI apps, e-aadhaar pay thus making more options for the digital platform and encouraging people to move towards a transparent payment mode empower-ing the country’s economy.

M-payment has gained popularity in India also because of its benefits such as replacement of physical wallet by virtual wallet, 24*7 accessibility from anywhere, no load of change , cash backs etc. M-payment goes well with the current lifestyle making it easier to make payments for utilities conveyance shopping dining etc. M-payment has seen growth in both volume and value of transaction every month in the last 1 year as per the RBI bulletin. Mobile service providers also claims constant rise in the numbers of downloads of their app by the users. UPI crossed the Rs one trillion milestone for monthly value in December, growing nearly eight times over the previous year. It also achieved a monthly volume of over 600 million, four times the volume of UPI transactions in December 2017, according to data released by National Payments Corpora-tion of India (NPCI).These shows the shift in inclination of the people towards m-payment.

Research Problem

India has the second largest population in the world still there is largest unbanked population. Even after success of PM Jan Dhan Yojna scheme, still 190 million of Indian adults don’t have a bank account. 60 % of Indian GDP comes from unorganised sector where most of the payment settlements are still done in cash which shows high dependency of cash in India. Moreover we don't see easy availability of m-payment option everywhere in the market. Majority of rural areas are still deprived of these platforms. These problems make us to understand the level of aware-ness and adoption of such payments among consumers. Also we need to understand the barriers in adoption of m-payments.

Objective

- To overview various m-payment options available in India.

- To find the level of awareness towards mobile payment.

- To find the barriers in the adoption of m- payments.

- To analyse the impact of customers gender and age on use of m-payment.

Hypothesis

- H10- Gender has no influence on use of mobile payment system

- H11- Gender has influence on use of mobile payment system

- H20- Age has no influence on use of mobile payment system

- H21- Age has influence on use of mobile payment system

Literature review

Am-payment is “where a mobile device is used to initiate, authorize and confirm an exchange of financial value in return for goods and services”. (Au and Kauffman, 2007, p1). Of all the mobile applications m-payments is the one in which security is of paramount importance because of the financial value at stake. (Shivani Agarwal et al)The Payment Systems developed should provide the security at each and every level to improve the customer satisfaction as well as value chain of an organization.(Raina , 2014). India cannot completely become a cashless economy considering its high proportion of digital illiteracy and cash transaction but Indian government is working towards increasing the share of cashless transitions which is a good thing for any economy. But this method have so many problems such as network problem, illiteracy, security problems, cyber security, internet cost, phone battery etc. ( Rajanna, 2018).The government needs to take the necessary steps and make some policy considerations when they are preparing for a cashless economy. The payment systems have to be protected from the cyber-attacks which are the major threat for cashless transactions.(Tawade ,2017). Improved solutions in terms of digital transac-tions with more secured features, ease of transactions and reduced cost of managing the digital payments could lead to more potential developments and supporting in improved conditions of digital payments processing. (Kulkarni& Abdul, 2019).There exists a huge untapped market for digital wallets both in terms of increasing awareness as well as its usage. Also, the frequency and value of each transaction using digital wallets remains limited. Online shopping emerged as the prime purpose for usage of digital wallets. (Batra & Kalra, 2016) .The e- wallet service providers need to strategize targeting not only at students and the youth, but also other age groups .(Varsha & Thulasiram, 2016). It is up to the governing bodies of the countries to provide a push to banks and telecom companies to improve the mobile and net banking ecosystem so as to provide a seamless end solution to customers as well as traders (Sparrow, 2016) For economic develop-ments could be feasible only with rural India too embracing the digital payments and digital transactions. ( Ali et al.,2017) Security issues in terms of fear of cash loss and lack of usability for international transactions are the prime barriers to its adoption. (Batra & Kalra, 2016).The e- wallet service providers need to strategize targeting not only at students and the youth, but also other age groups . (Varsha&Thulasiram, 2016).The age of the respondents had a strong influence on the use of mobile payment services in Kenya which resonate with the study results of (Chan& Chong 2013 ; Tech et al., 2014) which states that age is a strong predictor in the use of mobile commerce applications such as mobile payment services( Kabata, 2015). The success of Digital India Campaign project lies not only in the hands of government but it requires all round support from the all citizens and other stake holders of the nation. (Mohanta et al., 2017). Cus-tomer have to use more and more this online payment system.E-payment system in India, has shown tremendous growth, but still there has lot to be done to increase its usage. Still 90% of the transactions are cash based. So, there is a need to widen the scope of electronic payment. Innova-tion, incentive, customer convenience and legal framework are the four factors which contribute to strengthen the E- payment system. ( Roy&Sinha,2014). The move towards cashless economy is definitely a good one but it will take much time to have I completely cashless economy. The efforts are going well by the government as well as the private sector companies having there e-wallets apps such as PayTM, PhonePe etc. The biggest challenge in front of government is the lack of knowledge and awareness among people and fear of loss of money by use of digital pay-ment methods risk of hacking. The government needs to tackle these challenges to have cashless economy and to give a boost to digital payments to provide sustainable economic development to the country in the long run.( Bagla,2018 ).

Modes of m payment:

- USSD: Unstructured Supplementary Service Data is a digital payment service used by GSM technology users to connect with application hosted by the banks without requirement of data facility in the phone. This service helps to digitally include non smartphone using sec-tion of the society. This service can be used by dialing *99# from the registered number linked with bank, and services such as fund transfer, bank statement and balance queries can be accessed.

- UPI: Unified Payment Interface is a-single-window mobile payment system developed by the National Payments Corporation of India (NPCI). It is real time payment system which works on 24x7x365 days basis. To use this service one should have a valid bank account, registered mobile number and UPI app linked to the bank account installed in a smartphone. Interesting part is, one does not need another person’s bank account number or IFSC code, a VPA (Virual Payment Address) is enough to send and receive funds, and with no transaction charges.

- Mobile wallets: It is a digital wallet service mostly provided by various private players, which can be used by downloading their specific app. The app stores debit/credit card or bank account information in digitally encrypted format, and using this information payment can be done directly on various platforms, without the need of CVV or pin/passwords. Alter-natively, money can be added to the mobile wallet, and it can be used for payment as re-quired. The app provider may sometimes charge for their services. Some of the major e-wallet service providers in the market are PayTm, Freecharge, MobiKwik etc,

- NFC: It stands for Near Field Communication. NFC is a growth area in the field of mobile payments. NFC phones communicate with each other and with NFC enabled points of sale, using radio frequency identification. The mobile phones don’t have to touch the point of sale or each other to transfer information, i.e. money, but they have to be fairly close within four inches/ten centimeters of each other.

Research methodology

A sample of 150 consumers was collected on the basis of convenience from Ranchi city. A struc-tured questionnaire was designed for primary data collection.

Data analysis and interpretation

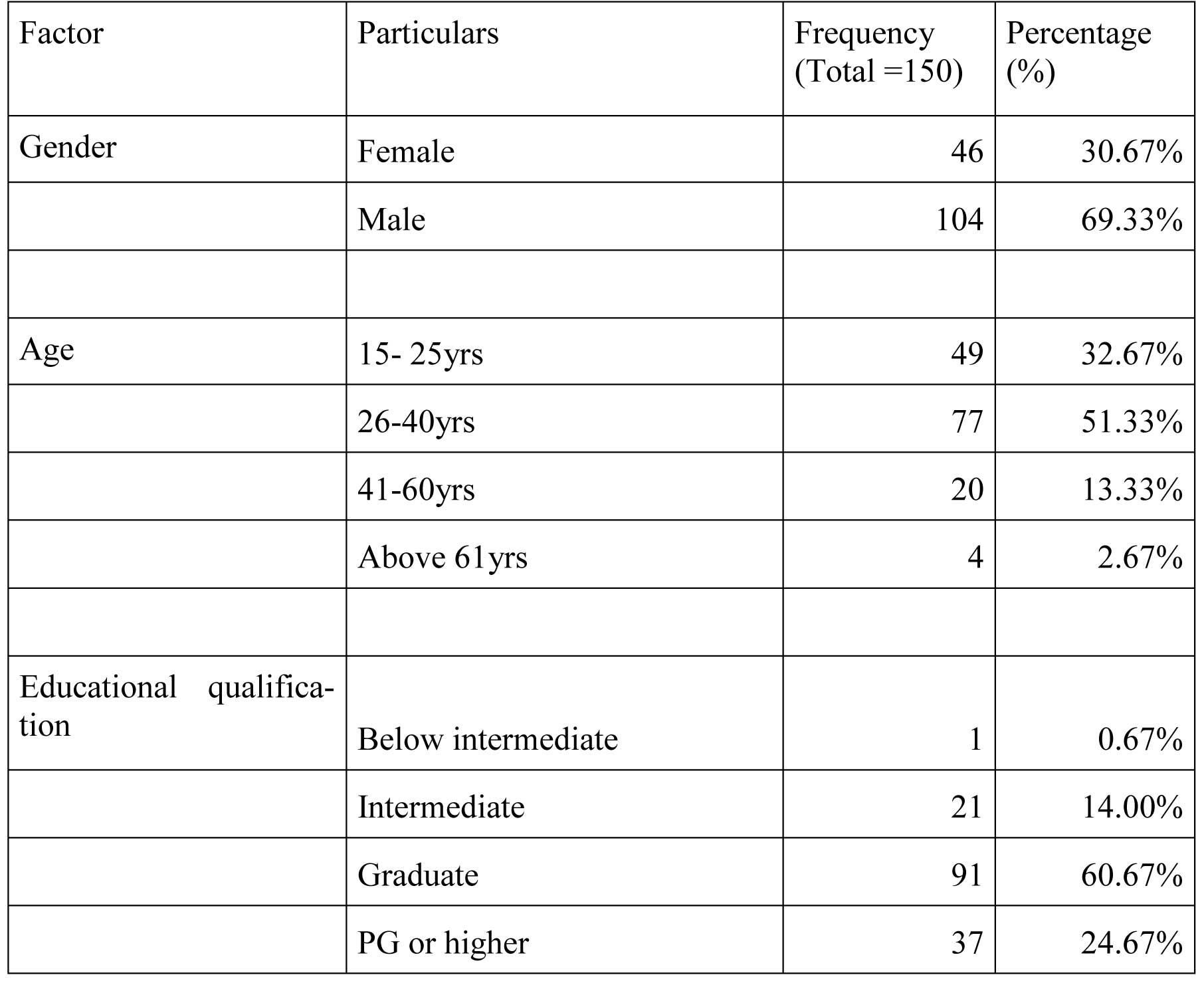

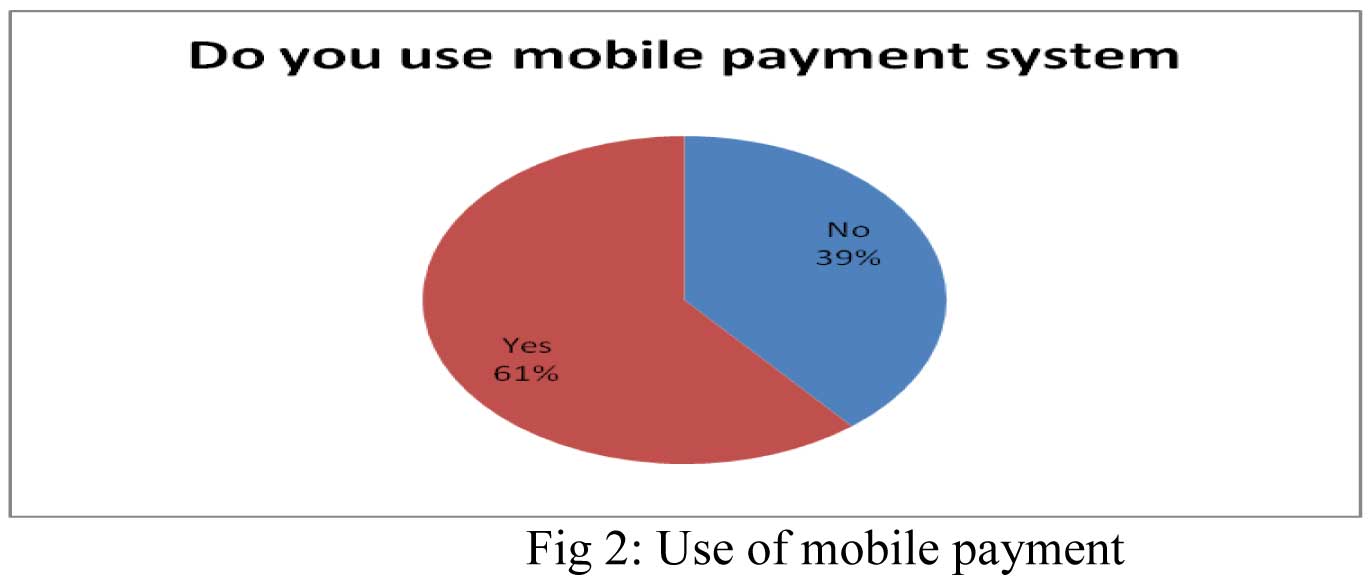

150 responses were used in the analysis, table 1 shows demographic profile of the respondents.

Out of total population, 30% of the sample was females and 70% was males. Half of the sample belonged to the age group between age of 26 to 40 years, and 33% were in age group of 15 to 25 years. 60% of the population are graduates, where as 25% possess PG or higher degrees. Majori-ty of the population fall under the income group of below Rs. 30,000. Almost 50 % of the popu-lation were private employees and students. Majority of the respondents were early adopters or innovators.

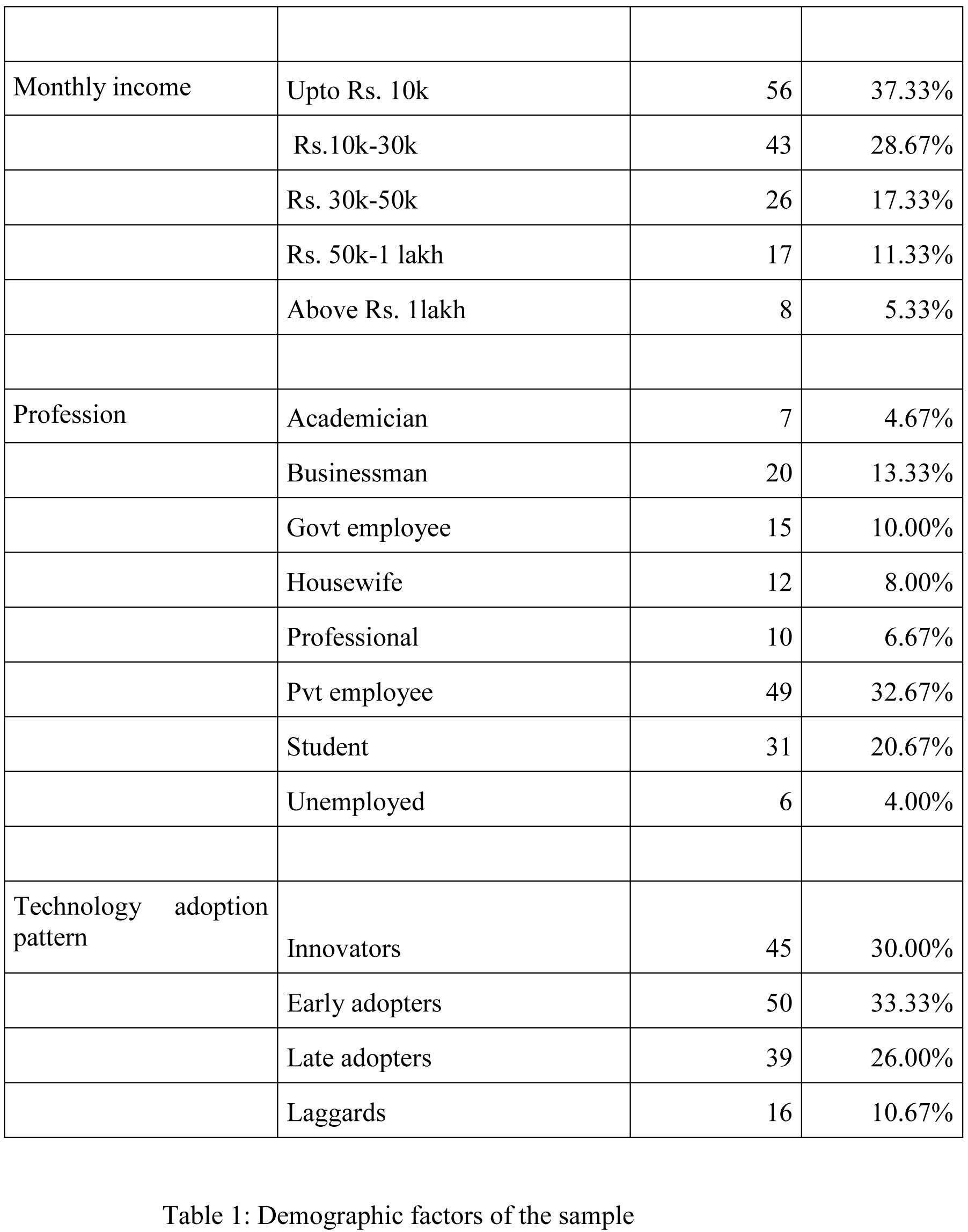

As shown in fig 1, there is a high level of awareness among respondents where 91% of the popu-lation is aware about mobile payment. .

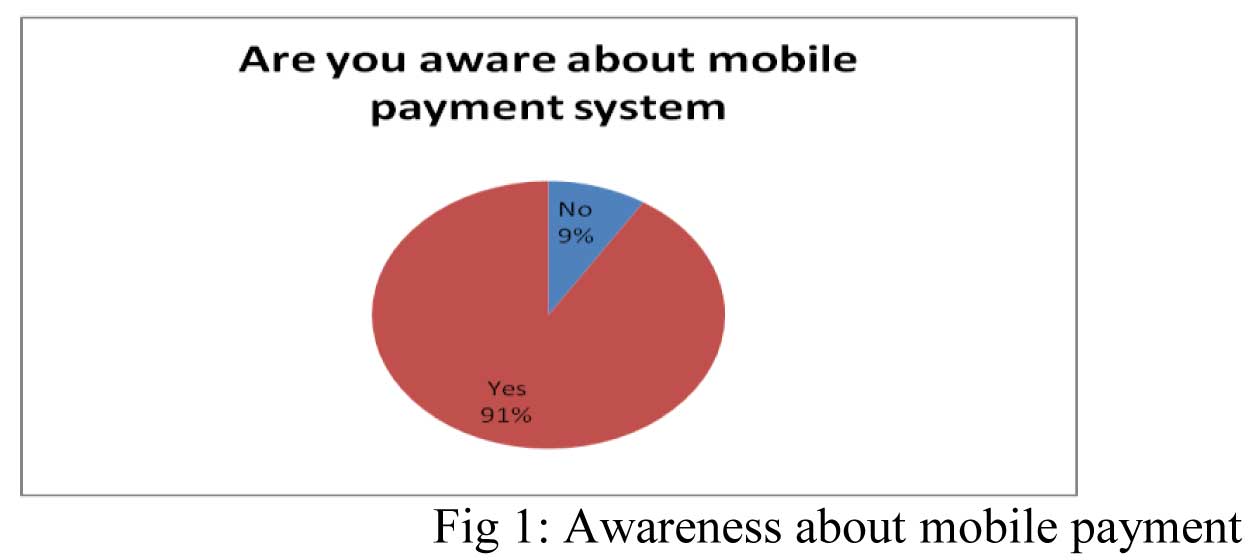

As shown in fig. 2, 61% of the sample use mobile payment, whereas 39% are non users

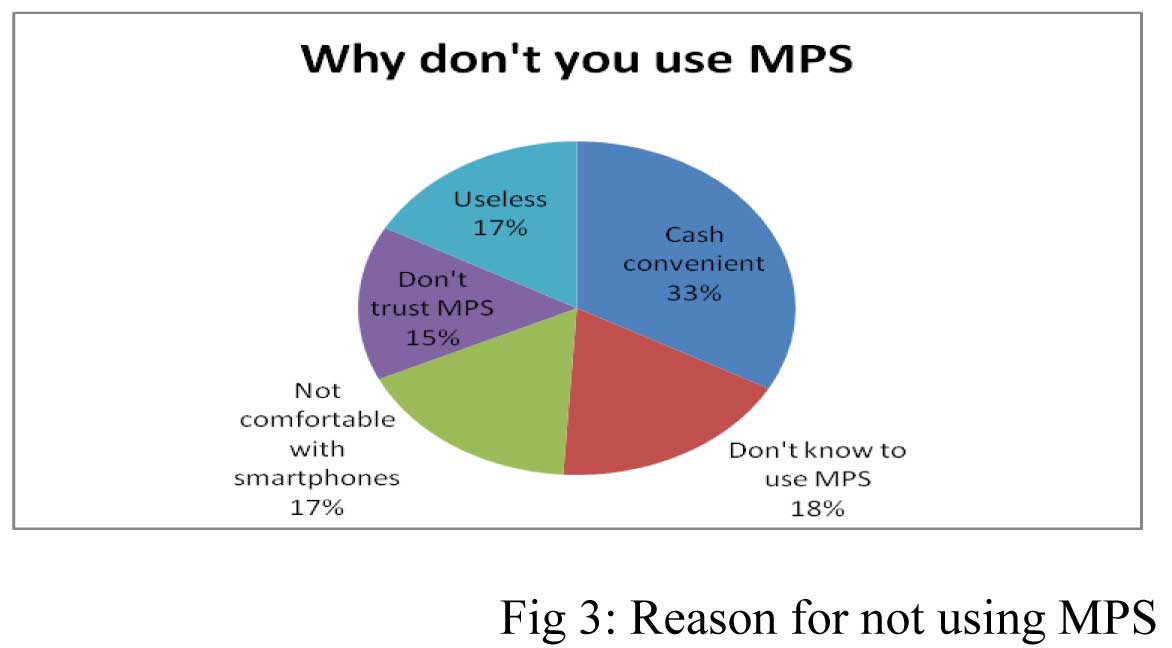

Non users provided mixed opinions regarding not using mobile payment, which are shown in fig 3. Majority of the sample felt convenient paying through cash. 18% people also did not know how to use MPS.

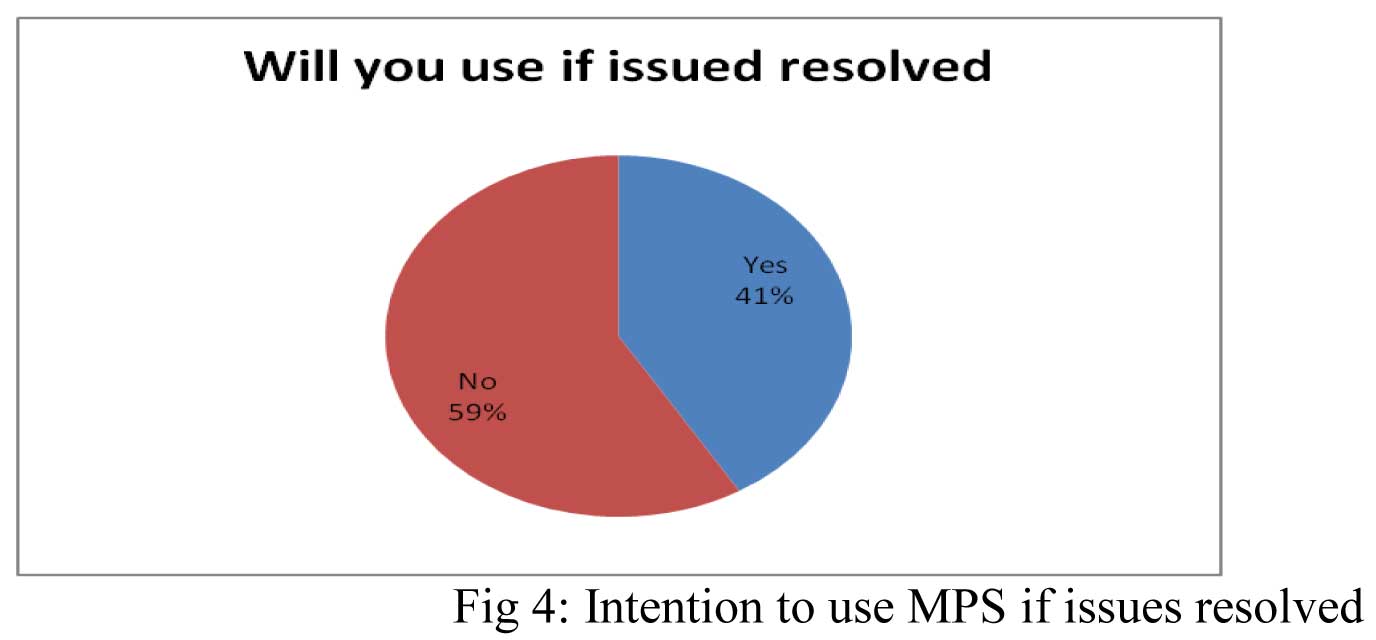

Majority of people showed no interest in MPS even if their problems are resolved.

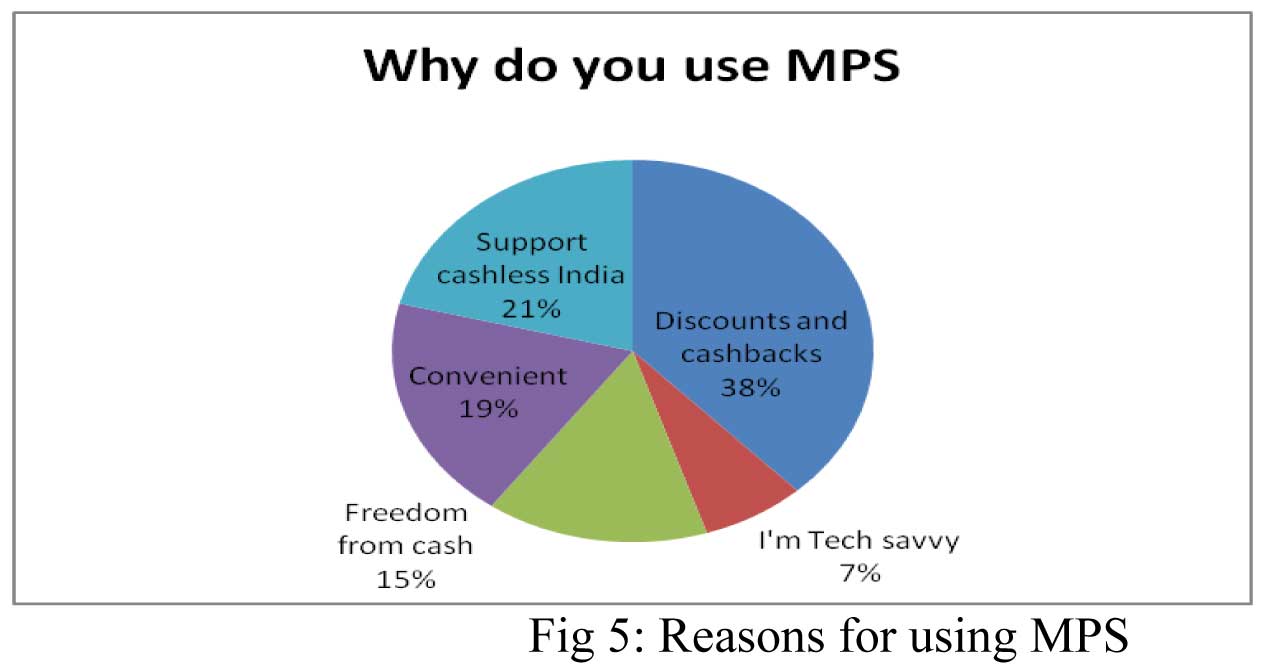

Mobile payment showed mixed opinion regarding use of mobile payment. 42% of people use mobile payment so that can enjoy cashbacks, discount coupons etc., whereas 21% of users sup-port cashless.

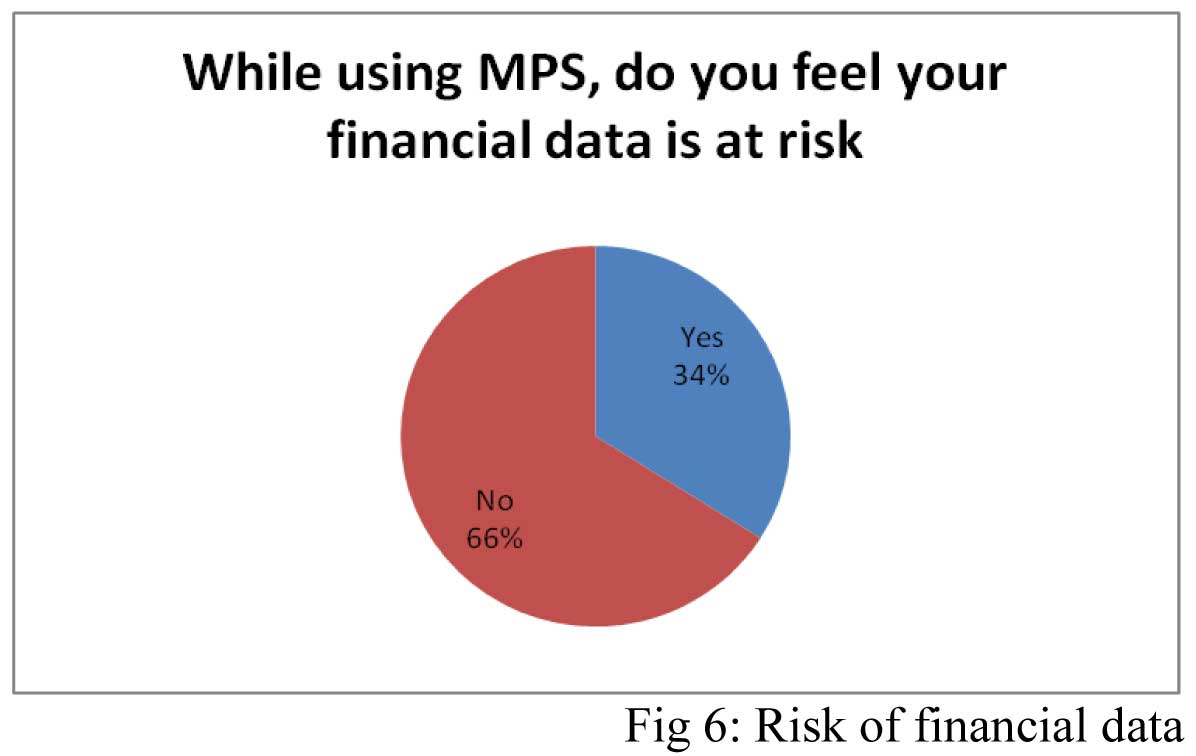

Majority of people are not worried about their financial data while using mobile payment.

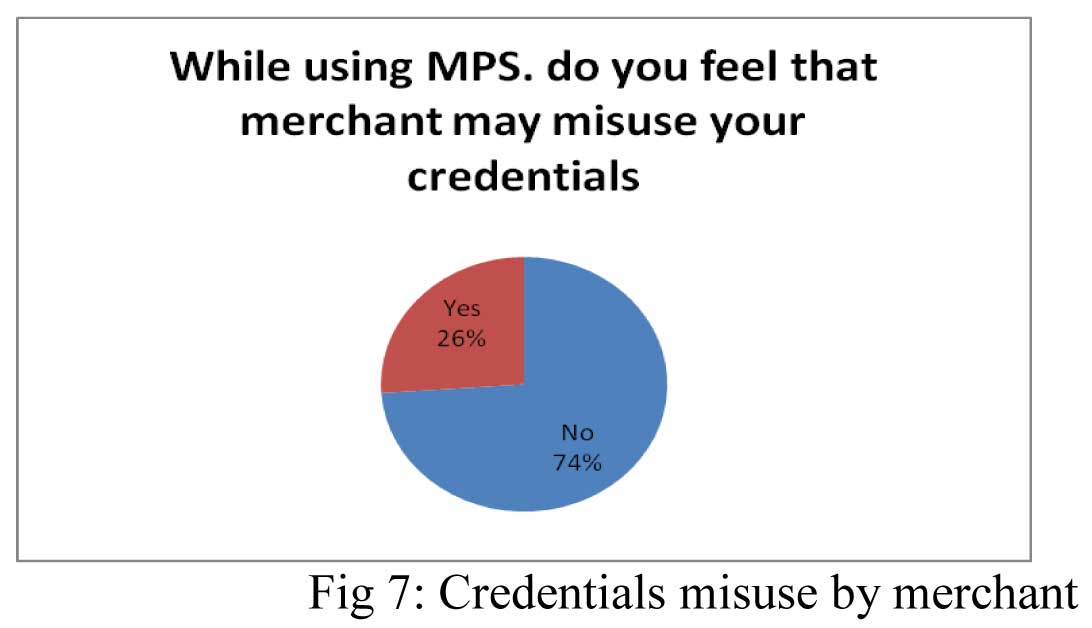

Majority of users showed trusted their merchants, as 74% of people felt that merchants will not misuse their credentials as shown in fig 7.

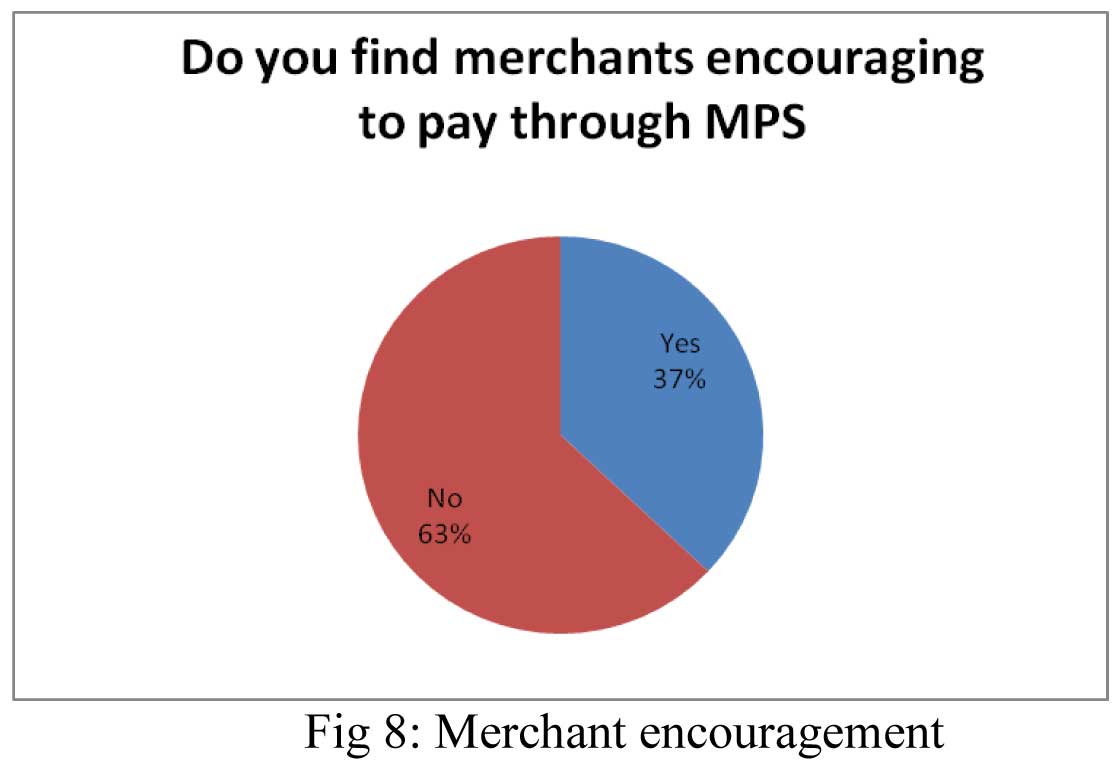

Majority of people, i.e. 63% people felt that merchant do not encourage them to pay through mobile payment.

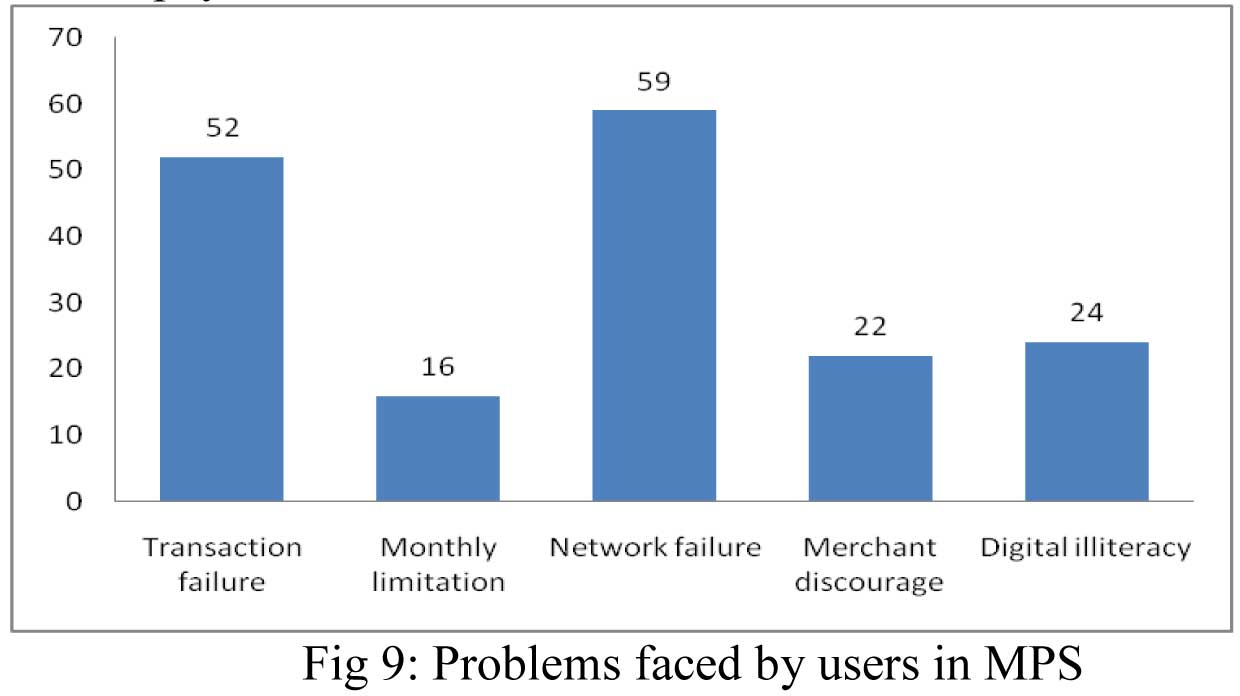

Users provided with five problems faced during mobile payment transaction. Network failure was found out to be most common issue faced by the people while using MPS. Transaction fail-ure was also a major issue, not lagging much far behind. Digital illiteracy, merchant discourage-ment and monthly limitation were also issues found in order.

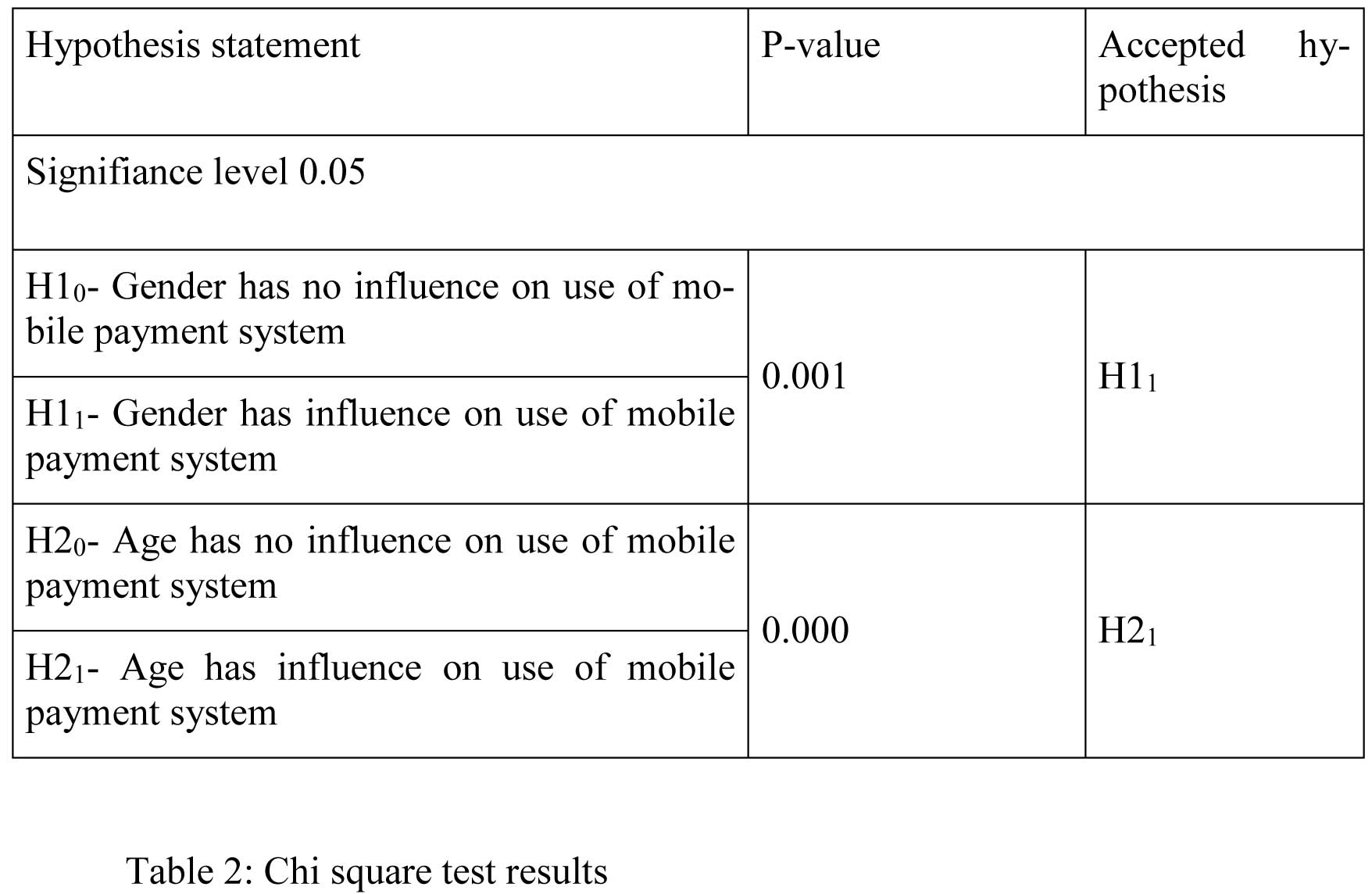

Chi square analysis for testing hypothesis for association of gender and age with usage of mobile payment

Since p-value in case of gender (0.001) is less than the significance level (0.05), we reject the null hypothesis. Thus, we can say that gender do influence use of mobile payment. In case of age, p-value(0.000) is less than the significance level, we reject the null hypothesis. Thus, we can say that age does influence use of mobile payment.

Findings and Conclusion

The finding of research shows high level of awareness among consumers about MPS and more than half population have adopted mobile payment in their lives. But still there is huge untapped market for mps who still prefers cash to m-payments. This dependency on cash is the major ob-stacle in Indian goal of becoming digital economy. Most of non users find m-payment to be use-less or don't know how to use m-payments and they lack trust on these new modes of payments being convenient with cash only so it is of utmost important to create new business opportunities for m-payments to cater the need of non users to bring them on board. Whereas the cash backs and discounts attracts the users most. Some people also support cashless India. Most people in Ranchi do trust that their data is safe but still some people fear loss of their data so security needs to be taken care of by the service providers. Transaction failure and network failure was found to be the most important barrier while using m- payments so service provider and network provid-ers need to work hard on eliminating these failures to boost smooth transactions. Digital illitera-cy still hinders the success path of m-payment so government needs to create more awareness among the people about the use and benefits of the m-payments. Most of people suffer from merchants discouragement at Pos. Merchant need accept more and more mobile payment, then only customers will also be prone to pay through it. Facilities should be given to merchants by government and service providers so that they incline towards accepting mobile payment.

Majority of users fall under the young group so focus need to be shifted towards the older gener-ation too, as age influences the use of mobile payment. Gender difference in the adoption of mo-bile payment was also established where men are more inclined to use m-payment than and women. Females also need to use mobile payment more and more, then only whole society can be said to be cashless.

Limitations and scope of the Study

The research is limited to only consumers of Ranchi city. The research is also limited in the number of respondents. Future research could be done to understand the issues of all the ele-ments of the ecosystem of m-payments to understand the broader issues related to m-payments. Also multiple city could be taken by the future researchers.

References:

- Ali, M.S., Akhtar. W., & Safiuddin. K., (2017). Digital Payments for Rural India - Chal-lenges And Opportunities. International Journal of Management and Applied Science. Vol 3(6). P35-40

- Aparna, R. R., Ostwal, T., Baliga, T., & Sreekumar, N. (2015). Overview of Digital wal-lets in India.International Journal of Advanced Research in Computer Science, 6 (8), Nov–Dec, 2015,28-31

- Au, Y. A., & Kauffman, R. J., (2008). The economics of mobile payments: Understand-ing stakeholder issues for an emerging financial technology application. Electronic Commerce Research and Applications 7 (2), 141–164

- Joubert, Janine., & Van ,Belle. J.P.,( 2009). The importance of trust and risk in m-commerce: A South African perspective. Pacific Asia Conference on Information Sys-tems

- Kaur, K.(2015). E-Payment system on e-commerce in India. Inst. Journal of Engineering Research and Application. ISSN: 2248-9622, vol 5, Issue 2, (Part- 1), February 2015,pp.79-87

- Kulkarni, Srihari., & Taj, S. A., (2019). Digital Payments: Challenges and Solutions .IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668

- Kumari. N., & Khanna. J.,(2017)|. Cashless Payment: A Behaviourial Change To Econom-ic Growth. International Journal for Science and Research, Vol 5(7). P6701-671

- Mamta., Tyagi, H., & Shukla, A., (2016). The Study of Electronic Payment Systems. In-ternational Journal of Advanced Research in Computer Science and Software Engineer-ing. Vol 6(7). P297-300

- Manikandan. M., & Chandramohan. S., (2015). Mobile Wallet- A Virtual Physical Wallet to the Customers. Paripex - Indian Journal of Research. Vol 4(9). P 146-147

- Mohanta. G., Debasish. S.W., & Nanda S.K., (2017). Saudi Journal of Business and Man-agement Studies. Vol 2(7), P727-731

- Ondrus, J., Lyytinen, K., & Pigneur, Y., (2009). Why mobile payments fail? towards a dynamic and multi-perspective explanation. In: Proceedings of the 42nd Annual Hawaii International Conference on System Sciences (HICSS). IEEE Computer Society Press, Washington, DC.

- Rachna., & Singh. P., (2013). Issues and Challenges of Electronic Payment Systems. In-ternational Journal for Research in Management and Pharmacy. Vol 2(9). P25-30

- Rajanna. K.A., (2018) . Growth Of Cash-Less Transactions In India: Challenges And Pro-spects. International Journal of Engineering Development and Research. Vol 6(1). P199-204

- R, Varsha., & M. Thulasiram.,(2016). Acceptance of e-wallet services: A study of con-sumer behavior. .International Journal of Innovative Research in Management Studies (IJIRMS) ISSN (Online): 2455-7188. Vol 1,Isuue 4, May 2016

- T. S. Sujith., &C. D. Julie., (2017). Opportunities and Challenges of E- Payment System in India. Vol 5(9). P6935-3643

- Tawade. P.H., (2017). Future And Scope Of Cashless Economy In India, IJARIIE, Vol 2(3). P177- 181

- Vally. K.S., & Divya,K.H., (2018) A Study on Digital Payments in India with Perspective of Consumer’s Adoption. International Journal of Pure and Applied Mathematics. Vol 119(15). P1259-1267

- Varsha. R., & Thulasiram. M., (2016). Acceptance of E-Wallet Services: A Study Of Consumer Behavior. International Journal of Innovative Research in Management Stud-ies, Vol 1(4). P133-141