Subscribe now to get notified about IU Jharkhand journal updates!

Conceptual model illuminating the factors and constructs influencing the mergers and acquisitions decisions

Abstract :

The concept of Mergers and Acquisitions has mustered enough consideration of the Multinational Behemoths, Industrialists, Government sector and Researchers as a significant mechanism to withstand the gauntlets in the global, complex and transforming epoch. Many positive practices and initiatives have been taken by the professional managers to combat the requisites of the challenging and demanding business world in the form of Mergers and Acquisitions; but the hindrances impeding the fruitful acknowledgement, implementation and further revival of organizations have implicitly and explicitly influenced the possible and productive consequences in the advancing nations. There is dearth of an imperative initiative to provide a conceptual Model illuminating the important factors and constructs, which influence the decisions regarding Mergers and Acquisitions. In order to find the concerned factors and constructs affecting the Mergers and Acquisitions; an in-depth literature review was undertaken by reviewing about 73 scholarly research works from the reputed and peer-reviewed journals along with the sources of open access available online providing the foundational aspects in context to the Mergers and Acquisitions. Hermeneutics and qualitative content analysis were used for defining the factors and constructs.

The constructs and factors constitute the entire conceptual domain reflecting the major aspects influencing the possible Merging initiatives in terms of (E) Economic Turf; (S) Strategic Assets and (C) Cultural Environment. The main aim of the research paper is to propose a new conceptual framework named “ESC” approach, which considers the various factors and constructs that influence the organizational decisions in context to Mergers and Acquisitions (M&As) across the advancing as well as developing economies such as India. The study also revealed that majority of the research works has been reflecting these factors and constructs only. Finally, the propositions for the managers, policy-makers, business intellects, experts, academicians and researchers have been provided to enable the researchers to give a clear cut understanding of these foundational constructs with regard to the Mergers and Acquisitions.

Keywords :

Mergers and Acquisitions (M&A); Conceptual Model; Economic Turf, Strategic Assets and Cultural Environment.1.1. Introduction

The Mergers and Acquisitions (M&A) act as restructuring and reviving phenomenon that prevail throughout all the imperative spheres at the domestic and the global echelon (Baniya&Shah, 2016). The entire process has gained ample magnificence and worth in the highly complex and dynamic Corporate ambience for rejuvenating as well as re-establishing the different organizations on the foundations of their predefined and ever-changing objectives of growth and development; long term sustenance; increase in business turnover; rise in the profitability; stabilization and positive impression on the minds of individuals (Bedi, 2010). The synchronization, amalgamation as well as acquisition entirely aim at enhancing the efficacy of operations and minimizing the cost of production with the adequately crafted strategies and proliferation policies (Saxena, 2012). The need to perplex and expand to move ahead with the pace of economic integration is one of the major causes to get higher extent and intensity to attain the cross border Mergers and Acquisitions (Bjorvatn, 2004). Moreover, the organizational interdependence on the market turf; transformations in the patterns of development; increase in the exigency among the consumers to avail and experiment with new products; impact of research and development initiatives; cross border amicable associations; growing sentience among the people; generation of opportunities and overseas proliferation have been marked as the major stimulators paving way for integrating the global and domestic business firms either by way of takeover, acquisition of ownership of the undervalued firms or by way of collaborations on certain legal and humanitarian grounds (Tamosluniene & Duksaitelet, 2009). An eminent researcher named Young-Han has suggested the Greenfield and the Brownfield investment as the two significant manners for the promotion of economic integration and stabilization at the global level (Young-Ham, 2009).

Keeping the core aspect of environmental sustainability and business stability, there has been strenuous increase in the Mergers and Acquisitions in the Domestic boundaries due to the higher influence of Indian firms over the collaboration with the other global industrial entities (ET Bureau, 2019; Prasad & Sahay, 2018). Many cross border business ventures have proved to be the deals of the year in terms of their stupendously instrumental and multi-dimensional impact over India’s economic status as the target country (Brakman et al., 2016; Sharma, 2016). Moreover, the markets in Latin America, Europe, Asia and Middle East have mustered enough appreciation to lay platforms for promising business practices and ventures to the various advanced economies due to their potential in terms of service and product industries (Sharma, 2016; Reddy, 2015). In addition to it, the need to secure the survival for long span and gain the competitive edge in the complex business environment has stimulated the National companies to adopt for the criterion to sprout and promote the Mergers and Acquisitions in India (Dhillon, 2018). However, the concept of Mergers and Acquisitions in not confined only to the Corporate World; even the public sector has turned to incorporate this instrumental process to combat the ongoing gauntlets and promote the development across diversified domains to facilitate maximum benefits to the public (Dhilon, 2018; Dhanjal, 2018).

The introduction and penetration of Information and Communication Technology across the rural domain has also led to increase in the desire to invest more on the consumer goods and services by way of e-commerce at the unprecedented rate as well as the comparatively undervaluation of Indian currency in the International Capital market have also made significant contributions to promote more Acquisitions than the Mergers in India (Dhillon, 2018). There are many examples of prominent Acquisitions taken place in the last two years in India to act as Push factor to stimulate the economic growth such as Acquisition of Bhushan Steel by Tata Steel; Acquisition of Flipkart by Walmart; Acquisition of ArystaLifeScienceInc (USA) by India’s UPL Limited; Mergers between Bank of Baroda and Vijaya Bank and Merger between the Idea Cellular and Vodafone Network to push the %G services in the Nation (Dhanjal, 2018). Apart from it, Many Public Sector Banks have been merged across India from 10 to 4 major banks to promote the financial stability and enhance the flow of money in the economy by introducing operational flexibility and channelization (ET Bureau, 2019). The research initiatives in the field of Mergers and Acquisitions are mushrooming to gained an insight of the positive and negative consequences over the social, political, economic and institutional domains of the nation; even though the practices are lying fragmented over the multiple research domains entirely focusing on the various constructs resulting in the vague inference (Oberg & Tarba, 2013; Sharma, 2016).

There is an impression of theoretical frameworks introduced in the past to lay a foundational stone to document the various perspectives with regard to the possibilities of Mergers and Acquisitions in the world. Few have been mentioned below:

1.1.1 Review of Theoretical Models and Perspectives

There are numerous notable frameworks introduced in the past in context to the Mergers and Acquisitions. The core ideological perspectives have been discussed as below:

Valuation Theory or Perspective:

As per this perspective, the managers who have better understanding of the target’s value rather than the stock market are capable of planning as well as executing the mergers (Ravens craft and Scherer, 1987; Holderness and Sheehan, 1985 and Steiner, 1975). The managers keep the track of the dying company or the company (apart from the synergies), which is undervalued and ready to sell out its stock as well as have enough knowledge regarding the probable benefits of joining the businesses of targeted entity with their own to increase the value of the firm (Steiner, 1975). The valuation theory works on some distinctive grounds in comparison to the financial synergy framework; where the bidder’s manager possesses some camouflaged internal information that could be fruitful for the bidder later on (Ravenscraft and Scherer, 1975). Wensley on the other hand depicted that the efficacious market never precludes the knowledge regarding the undervalued companies rather the probability to capitalize on the revealed knowledge (Wensley, 1982). Wensley also pointed that the information possessed by the bidder entity brings the uncertain consequences, which are borne by them as well (Wensley, 1982). This uncertain and ambiguous hidden information being possessed by the bidder acts as the foundation of the valuation theory but same time acts as its prominent drawback as it is not possible to derive, assess and evaluate the specific propositions regarding the outcomes of the mergers. In addition to it, this camouflaged information is not at all valuable because the multiple bidders possess different information, which is multidimensional and is influenced by the distinctive considerations.

This core aspect acts as its major flaw and paves the way with which the problematic assumption related to the efficiency of the capital market could be avoided.

Empire Building Theory or Perspective:

The core foundation of this perspective related to Mergers and Acquisitions (M&As) is the proliferation of profits and benefits associated with the managers instead of the increase in the wealth of Shareholders. Therefore, the Mergers and Acquisitions are planned by the managers in such a way they only lead to the multiplication of their wealth. The roots of this theory could be finding in the major aspect of separation of control and ownership in the corporation introduced in 1933 by Berle and Means (Berle and Means, 1933). There is some other fruitful research works associated with the merger outcomes as well as lay support for the future initiatives. But You et al., (1986) contended in their study that share of management ownership and the number of directors in that entity were not positively linked with the merger consequences (You, 1986). Further, Walsh (1988) revealed that the merging entities have proportionately higher turnover in comparison to the non-merging business organizations, which paves way for the opportunities to the aspirant managers. Ravenscraft and Scherer (1987) undertook some case studies and contended that the empire building aspects are imperative and play a significant role in the major decisions related to mergers. Rhodes (1983) found some more magnificent results after the analysis of 1960s merger wave that the ideological notion of empire building expands its horizon in terms of maximization of growth prospects and the power motives necessary for the elucidation of business approach. Later in 1989, Black said that propounded the theory of managerialism by adding it with the notion of the over optimistic approach of the managers to overpay for the targets (Black, 1989). However, this theory lacks in citing the impressions of managerial objectives to make justification with the concept of mergers. Even then, this approach has been able to pave way for the further investigation.

Process Theory or Perspective:

This perspective is based on the rational decision choices, which are the outcomes of the processes influenced by the multiple factors as propounded by Duhaime and Schenek (1985). Allison (1971) and Roll (1986) suggested that mutual adjustments, tactical considerations and overly good expectations work out the implications of the over-optimistic attitude of the managers. Power (1983) have stated the acquisitions as the incomprehensively rational decision as it has been influenced by the uncertain circumstances, inadequate planning process, political interference, fluctuating behavior of the participants as well as the lack of agreeableness over the criterion of the acquisition. Walsh (1988) revealed that the ideology about the increase in the executive turnover after the merging of the companies leads to the procedural complications. Moreover, Duhaime and Schwenk (1985) emphasized on the work and cognitive simplifications as well as other procedural factors, which influence the mergers. The process perspective has been considered as the ambiguous approach. However, there have been some problems in the far-reaching outcomes.

These three perspectives have underpinned numerous theoretical aspects.

The Valuation Theory basically defines the significant factor that is the value of the any company in terms of profitability, liabilities, assets and stock value in the market as per the scale of operations, turnover and profitability in the domestic and international market. Moreover, risk analysis in terms of stability in the market may it be economic, political, social and organizational, which provides base for stabilizing the entire concept of Mergers and Acquisitions.

Empire Building Theory illustrates the perceptions of the managers to proliferate and maximize their own managers by managing maximum benefits out of the merging prospects and consequences. This theory entirely cites the inspirational and optimistic approach of the individual managers while making decisions in context to reaching the objectives of growth and development in near future.

Whereas the Process Theory explains the various factors that influence the procedures and processes affecting the expected outcomes for the organizations engrossed in the Mergers and Acquisitions such as influence of political parties, psychology of the concerned thespians, unpredictable circumstances, and lack of proper planning and complexities of procedures to proceed with the initiatives. Procedural simplification has been recognized as the major push factor to influence the core decisions.

These perspectives have partially elucidated the various perceptions and factors that steer the individualistic decisions for Mergers and Acquisitions. Moreover, these theoretical perspectives previously used have not elucidated the other core constructs that implicitly and explicitly impact the multiplicity and dynamics of Mergers and Acquisitions. The dire need to introduce a new theoretical lens has been felt to explain the other imperative and core aspects that drive the major ventures in the domestic and international market in the contemporary epoch. Earlier initiatives have only confined themselves to a particular direction or single perspective only. The perceptions and perspectives related to other stakeholders have also been neglected, which have been taken into consideration in the new proposed Model. Hence, the new model would introduce the multi-dimensional constructs that affect the Merging ventures by the Industrial units to meet their own certain grounds.

1.2 Need for the Inception of New Model:

The present research literature imbibes only the research work that highlight the significant of the Mergers and Acquisitions (M&A) in the advancing nations in context to their long tern survival, capital gain as well as strategical development; but less importance has been given to acknowledge; redefine and work on the various factors and constructs that shape up the main aspects in context to the entire procedure and system in the Indian context because only few studies have been undertaken in this particular domain (Bedi, 2010; Prasad & Sahay, 2018). Hence, this paper provides a crystal clear vision to generalize the various factors and constructs that conjoin the Mergers and Acquisitions (M&A) and frame the structural loop reflecting the benediction of entire process in the current scenario (Prasad & Sahay, 2018). The researches undertaken in the past have reviewed the Mergers and Acquisitions from the Financial and Accounting perspectives; but the present research provide a comprehensive overview with regard to the numerous constructs, which affect the cross border Mergers and Acquisitions, which were earlier missed out in the literature (Reddy, 2015; Oberg &Tarba, 2013; Martynova&Renneboog, 2008a).

Hence, the present study endeavor to refill the gap between the past and current literature in context to the various possible factors, challenges, constructs, future prospects as well as suggestive measures in order to promote the acceptance of business knots at domestic and global level by way of Mergers and Acquisitions (M&A) and ascertain the ways to achieve the predefined goals (Reddy, 2015; ET Bureau, 2019). The present research work is an initiative to reflect the factors and constructs influencing the Mergers and Acquisitions in India in the current scenario by undergoing an in-depth analysis of the current literature regarding the contemporary epoch.The research would also segregate the 3 significant factors into 15 constructs; enabling the associated stakeholders have a deep insight of the gauntlets as well as the future possibilities linked with them and ascertain the effective remedial measures as well as interventions to enlighten the benefits for future tie-up ventures.

In the current proposed study, the entire literature has been concocted and framed in two major aspects; one is associated with ascertaining genuine, rich and relevant research works undertaken in the past connected to the core study through established journals from the genuine publishers encompassing the Jstor, Science Direct, Emerald Insight and Taylor-Francis etc. Moreover, Google Scholar was also considered to get the valuable and peer-reviewed research initiatives for widening the sphere as well as improving the multiplicity of the various research practices conducted while looking for the precise research work. The research has been made more genuine and relevant by undergoing through the qualitative and quantitative research works. The factors and constructs stimulating the prospects for Mergers and Acquisitions (M&A) across different nations have formed the significant aspect of the study. All the research works were available in English dialect and the research papers were analysed published during the span of 2005 and 2019 i.e. for 15 years because this duration has marked the initiatives with regard to Mergers and Acquisitions in India (Prasad & Sahay, 2018). In the Second phase, the abstract, title, introduction and inference of each article were reviewed meticulously to include only genuine and celebrated research works in research and discard the irrelevant ones.

Later, the constructs were arranged under three significant factors by using the Hermeneutic Phenomenology and in-depth content analysis to avoid the repetition of ascertained constructs. The rich literature also suggested some notable questions in order to attain final objective with the proper analysis of the artefacts such as:

How have been the significant factors concocted?

On what grounds, the productive constructs have been fragmented under the enlisted factors?

What criterion has been followed to decide the universe of the research papers?

How has been the domain and context of the experimentation decided?

What have been the boundaries of the so research and experiment?

What is the crux of the research work and the inference drawn from it?

After going through the several research papers and coding the range of 3 significant factors; the decoded variables have been placed into 15 constructs under relevant heading to yield productive output.

1.3 A New Model Representing the Factors Affecting Domestic and Cross Border Mergers &Acquisitions

Majority of the research work undertaken in the past has depicted the specific constructs in accordance with the perceptions and perspectives of Government authorities; economists; market analysts as well as businessmen. The present research work has been adequately concocted with the experimentation; decoding the management of strategically decisions of the business managers and coding the information mustered through International as well as National market. As the concerned stakeholders are required to have a brief and detailed sentience with regard to the present initiatives, challenges and future prospects that completely suit the existing research turf in the contemporary epoch. The well managed and multitudinous framework is the need of the hour to provide detail gleanings about the aspects linked to the practices and initiatives with regard to the indulge in business associations with across the border in order to provide maximum benefits to the business strategists, industrialists, practitioners, social scientists, academicians and government for contextualizing their active and realistic activities and initiatives in the present scenario.

Keeping in view the rich studies undertaken in the past, there are numerous significant factors and constructs that directly and indirectly influence the Mergers and Acquisitions have been proposed by the study. These constructs basically aim at maximizing the wealth of the concerned thespians by expanding the horizons of the practices in context to the concerned business practices across the entire nation. “ESC” Model depicting the important factors and variables affecting Mergers &Acquisitions has been proposed by providing a comprehensive view of all probable constructs with the review of 60 research papers and segregating them as the Economic Turf, Strategic Assets and cultural Environment depicting all kind of activities that take place at the domestic and global level.

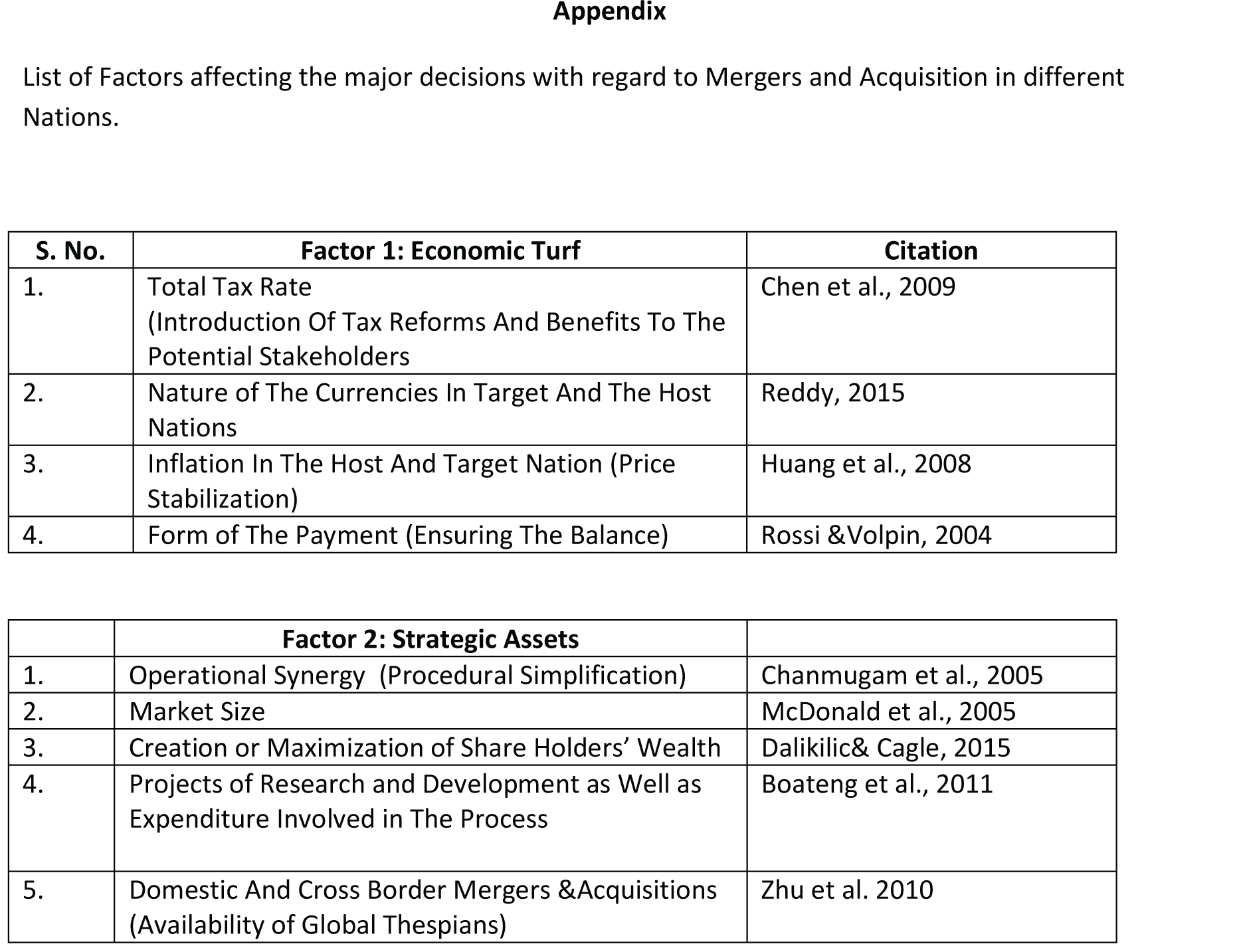

The first category of the “ESC” Model document the ‘Economic Turf ‘in terms of the taxation policies, relaxations, benefits, reforms, stability across multiple foundational domains, level of price fluctuations and regulations in context to the trade agreements that implicitly and explicitly affect the trade agreements in the market. Total Tax Rate(Introduction of Tax Reforms and Benefits to The Potential Stakeholders in order to motivate the shareholders to get the maximum benefits with the reduction of tax rates. The tax reforms introduced by the Government also influence the various business ventures introduced for benefitting the whole economy (Prasad & Sahay, 2018; Reddy, 2015; Barkema&Schijven, 2008; Boeh, 2011; Chen et al., 2009; Nangia& Aggarwal, 2014; Giovanni, 2005; Mosaklev, 2010; Becker &Fuest, 2011b; Huizinga &Voget, 2009).

Nature of The Currencies in Target and The Host Nations mentions the initiatives on the part of Host countries to invest in those target nations whose currencies are stable and possibility to grow by leaps and bounds. The entities are ready to target those firms whose parent nation have possibility of currency appreciation(Reddy, 2015; Sharma, 2016).Inflation In The Host And Target Nation or Price Stabilization defines the objectives of every Government or Corporate entities to make trade associations with those Target nations which have secured value of currency, balanced prices of goods and services, good faith of consumers and possibility of consumer value to avoid annihilation, making proper wealth calculations and bring stability in the deals (Reddy, 2015; Boateng et al., 2011; Goergen&Renneboog, 2004; Nagano, 2013; Huang et al., 2008).Form of The Payment to ensuring the balance becomes substantial to ascertain the flow of income from one organization to the other to overcome the problems being imposed by the Government authorities (Rossi &Volpin, 2004; Dalikilic& Cagle, 2015; Reddy, 2015; Moeller &Schlingemann, 2005; Boateng et al., 2011; Sharme, 2016).

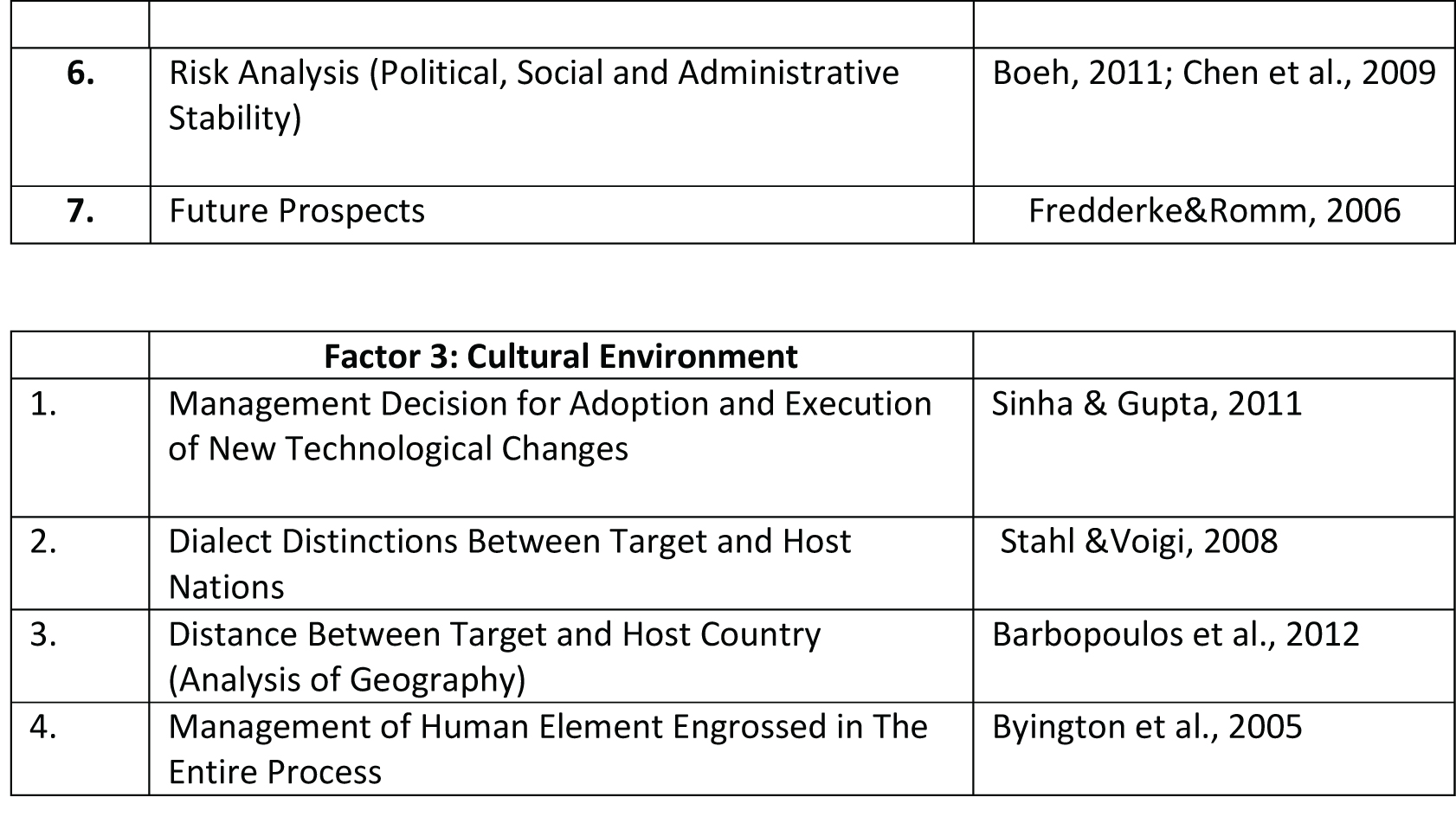

* The second category of “ESC” Model elucidated the ‘Strategic Assets ‘in terms of synergies, wealth proliferation and possibilities of Research and Development, which aim at increasing the wealth of all stakeholders. As at some intervals of time, an entity is not capable ample to expand itself in a desirable manner; then synchronization or collaboration with other entities has been considered fruitful to enhance the market values of shares; capturing the maximum horizon of the market and raising the echelon of profitability in the market. It becomes possible to attain such kind of motives by mingling with the suitable entities, which match with the parametric norms of the concerned business entity. A positive acceptance of transformations and attitude to modernize the work patterns with the introduction as well as acceptance of the measures proposed by the research and development initiatives pave way for the Mergers and Acquisitions. The major constructs related to the strategic assets are: Operational Synergy or Procedural Simplification supports the mergers and acquirers to muster the maximum benefits by way of increase in the pricing clout, sales volume, turnover and profitability in the market as well as ensure the scale of operations (Naude et al., 2002; Petitt& Ferris, 2013; Bedi, 2010; Chanmugam et al., 2005; Ravenscraft&Schener, 2011, Dalkilic& Cagle, 2015; Sevenious, 2003 as cited in Pettterson et al., 2013; Guruswamy, 2009).Market Sizereflects thesegment of the market controlled by the concerned and potential organization in the business turf(Mcdonald et al., 2005; Prasad & Sahay, 2018;Pavkov, 2005;Baniya& Shah, 2016; Dash, 2010; Reddy, 2015; Boateng et al., 2011). Creation or Maximization of Share Holders’ Wealth depicts the maximization of profitability out of the investment projects initiated to create the wealth, which bring the major increase in the profits of the mergers and acquirers (Chanmugam et al., 2005; Dalikilic& Cagle, 2015; Makamson, 2010; Baniya& Shah, 2016; Prasad & Sahay, 2016; Bedi, 2010; Weiner, 2010).Domestic and Cross Border Mergers & Acquisitions or Availability of Global Thespians defines the presence of the global thespians which is the fair play of the decisions taken at the top brass level (Sinha & Gupta, 2011; (Rossi &Volpin, 2004, Dalkilic& Cagle, 2015; Bedi, 2010; Zhu et al. 2010; Dalikilic& Cagle, 2015; Reddy, 2015; Krug & Nigh, 2001).Risk Analysis or Political, Social and Administrative Stability acts as the most important construct as there are several aspects such as political scenario, the nature of administrative procedures, government policies, impact of institutional practices as the social structure and legal aspects in the Target and Host countries that lay foundation to decisions regarding the Mergers and Acquisitions(Rossi & Volpin, 2004; Reddy, 2015; Dalikilic& Cagle, 2015; Bedi, 2010; Barbopoulos et al., 2012; Barkema & Schijven, 2008; Boeh, 2011; Chen et al., 2009; Nangia& Aggarwal, 2014; Giovanni, 2005; Mosaklev, 2010; Fredderke&Romm, 2006; Reddy, 2015; Boateng et al., 2011; Barkema&Schijven, 2008; Boeh, 2011; Chen et al., 2009; Nangia& Aggarwal, 2014; Giovanni, 2005; Mosaklev, 2010; Fredderke&Romm, 2006; Barbopoulos et al., 2012; Goyal& Joshi, 2012; Delkilic& Cagle, 2015; Bedi, 2010; Reddy, 2015; Boateng et al., 2011; Barkema &Schijven, 2008; Boeh, 2011; Chen et al., 2009; Nangia& Aggarwal, 2014; Giovanni, 2005; Mosaklev, 2010; Fredderke&Romm, 2006).Future Prospects helps in paving way for enhancing and contouring the will on the part of interested organizations to engage in further development and revival for future prospects. They are important to decide the course of future actions(Goergen&Renneboog, 2004; Nagano, 2013; Huang et al., 2008; Ravenscraft&Schener, 2011; Baniya& Shah, 2016; Dalikilic& Cagle, 2015; Gitman, 2012; Reddy, 2015; Boateng et al., 2011; Barkema&Schijven, 2008; Boeh, 2011; Chen et al., 2009; Nangia& Aggarwal, 2014; Barbopoulos et al., 2012; Giovanni, 2005; Mosaklev, 2010; Fredderke&Romm, 2006) and Projects regarding Research and Development as well as Expenditure involved in the entire process defined the enthusiasm and active involvement in futuristic opportunities for conducting research and development to adopt positive transformationsand technological advancements(Saxena, 2012; Dalikilic& Cagle, 2015; Byington et al., 2005; Reddy, 2015; Boateng et al., 2011; Goergen&Renneboog, 2004; Nagano, 2013; Huang et al., 2008).

*The Third segment of the “ESC” Conceptual Model elucidate the ‘Cultural Environment’ in theform of enabling and supportive provisions that makes it possible to amalgamate the business groups, exchange of cultural practices and revival of distinctive values. Most of the ventures become possible due to the synchronization of cultural and geographical knots. Management Decision for Adoption and Execution of New Technological Changes act as prerequisite for various associations at the domestic and global echelon as decision making is the significant factor that depict the positive as well as negative approach of the management (Sinha & Gupta, 2011; Prasad & Sahay, 2018; Knilans, 2009; Reddy, 2015; Dalikilic& Cagle, 2015; Barbopoulos et al., 2012). Dialect Distinctions Between Target and Host Nationsreflects thatmost of the Collaborations as well as the Acquisitions take place keeping the English language as the foundational requisite to carry out the operations in the Host and Target nations (Prasad & Sahay, 2018; Stahl &Voigi, 2008; Barbopoulos et al., 2012; Mckinsey 2010; Dalikilic& Cagle, 2015; Knilans, 2009; Reddy, 2015). Distance Between Target and Host Country or Analysis of Geography is necessary to analyzed before making any decision with regard to indulgence into collaboration because less distance enhances the healthy ties and provides opportunities to the business to manage their potential overseas(Stahl &Voigi, 2008; Dalikilic& Cagle, 2015; Mckinsey, 2010; Knilans, 2009; Reddy, 2015; Boateng et al., 2011; Barbopoulos et al., 2012; Hebous et al., 2011). Management of Human Element Engrossed in The Entire Processreflects the effectiveness and capability of the organizational managers to manage the human resources in a well manner, which is quintessential for getting the productive yields (Sinha & Gupta, 2011; Dalkilic& Cagle, 2015; Tamosluniene&Duksaitelet, 2009; Reddy, 2015; Dalikilic& Cagle, 2015; Barbopoulos et al., 2012; Byington et al., 2005).

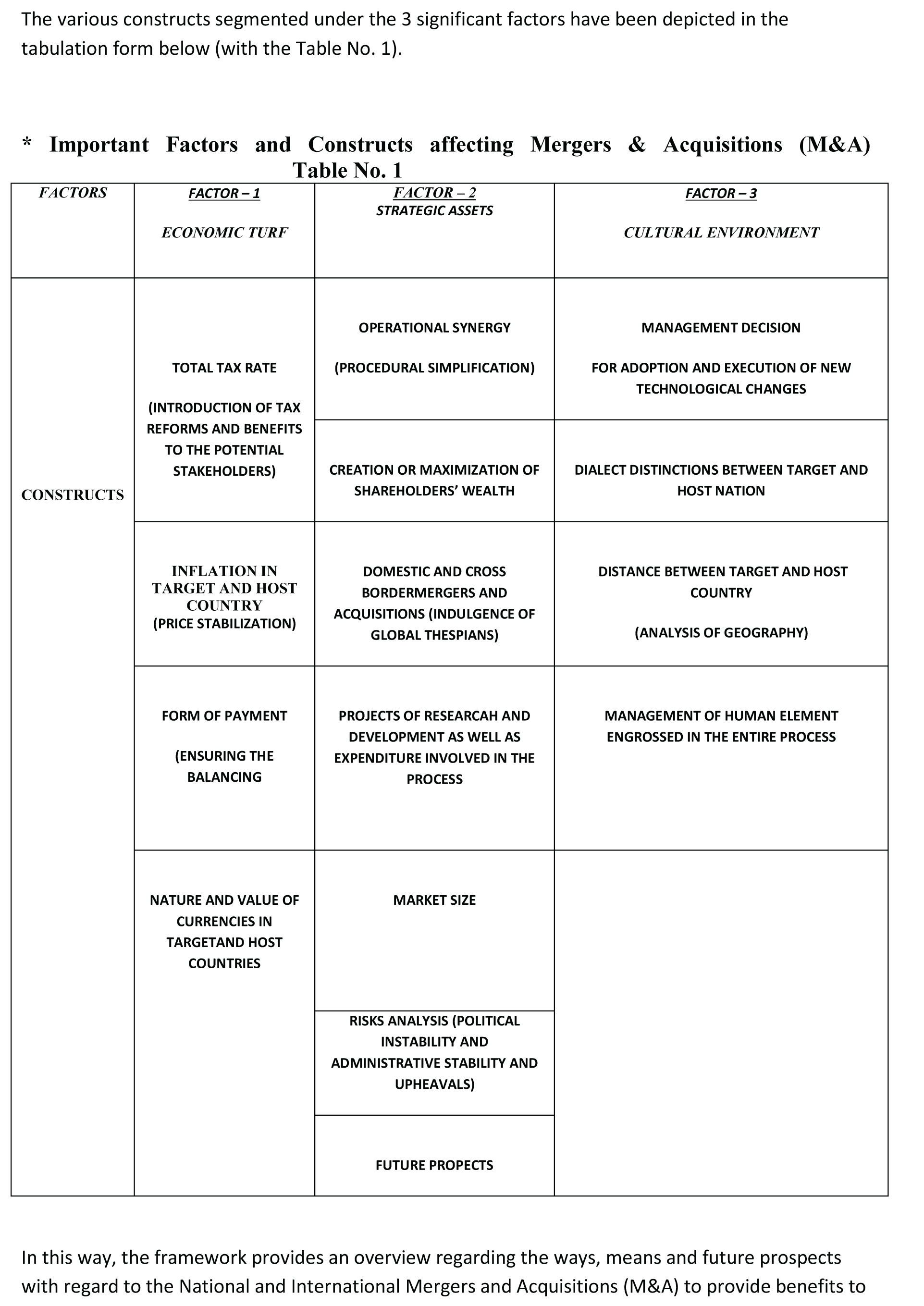

The various constructs segmented under the 3 significant factors have been depicted in the tabulation form below (with the Table No. 1).

In this way, the framework provides an overview regarding the ways, means and future prospects with regard to the National and International Mergers and Acquisitions (M&A) to provide benefits to the stakeholders and nation as a whole. The present framework is considered as instrumental framework that consolidates the research work in order to enable the core stakeholders precede with their activities by recognizing and acknowledging the flaws and things in context to the Mergers and Acquisitions (M&A) in the modern times.

In this way, the framework provides an overview regarding the ways, means and future prospects with regard to the National and International Mergers and Acquisitions (M&A) to provide benefits to the stakeholders and nation as a whole. The present framework is considered as instrumental framework that consolidates the research work in order to enable the core stakeholders precede with their activities by recognizing and acknowledging the flaws and things in context to the Mergers and Acquisitions (M&A) in the modern times.

1.4 Implications of the “ESC” Model

The research could be beneficial to the several other domains if they have to proceed with decisions regarding Mergers and Acquisitions to enhance their operational capability. The Government authorities could get the benefits of the research in terms of framing the various tax reforms, market strategies and policies in order to get exposure and future prospects for the potential investors as well as big industrial ventures to muster the new opportunities to maximize the benefits in the short as well as long span of time (Boeh, 2011; Chen et al., 2009; Nangia& Aggarwal, 2014; Barkema & Schijven, 2008; Boateng et al., 2011). The government officials and business personnel are capable of heading development plans following the new perspectives to make the Mergers and Acquisitions (M&As) over distinctive domains and segments of the country and engrossed in the collaborations over the global (Chen et al., 2009).Moreover, the practitioners, academicians, social scientists would be able to have s detailed glimpse with the present research work in the concerned domain and proceed further for possibilities by way of hands-on engagement in regular research practices (Boateng et al., 2011).

1.5 Discussion and Conclusion

The research work has highlighted that Mergers and Acquisitions have really been fruitful for the business entities in many ways such as reducing their overhead cost of production, diversification, sustainability, increased participation, strong and wide clientele base, enhanced market share as well as gain in the tax benefits (Prasad & Sahay, 2018).The research has depicted that the aspect of Mergers and Acquisitions (M&As) has been entirely incepted from the theoretical and ideological perspectives i.e. theories. In the words of Dalkilic& Cagle (2015) and Andrade & Stafford (2004), the Mergers and Acquisitions play an important role to improvise the status of the economies in terms of flawless return to their potential stakeholders i.e. owners as well as investors. Many eminent thinkers have propagated the productive gains from the Mergers and Acquisitions in the form of increasing the economies of scale, reduction in the production cost, platform of further research initiatives, product diversification, increase in the product competencies, long term benefits, goodwill on the global turf, expansion of business networking, improved management capacity, increase in the efficacy of managers, gain of market share and more opportunities ahead to withstand business gauntlets, which are reckoned substantial for the development of Corporate ventures as well as a mechanism to muster stability by Government authorities across the nation (Gaughan (2007; Faulkner & Campbell 2003).

Apart from it, there is dire need to take some imperative initiatives to enhance the benefits from the various ventures and they are discussed below:

It is necessary on the part of Government of the nations to make suitable provision of the productive platform to give supportive environment to its manpower in terms of their diversification, empowerment and engagement in the entire process. Moreover, their active indulgence leads to constant research and development, which is necessary to accept and act in the highly challenging business environment (Saxena, 2012; Dalikilic& Cagle, 2015).

The organization may it be at national and international echelon must be pliable enough to accept and incorporate the changes taking place round the world and their incorporation is must to get along with the environmental transformations for the long run survival. As the engagement in such opportunities enhances the initiatives on the part of Government and Corporate world to work in collaboration along with each other by acting as a catalyst to revive and redefine the contours of the world (Reddy, 2015; Dalikilic& Cagle, 2015; Knilans, 2009).

The tax rates should be revised at regular intervals of time and Government has to act liberal with regard to the rules and regulations in order to enhance the possibilities of global mergers and collaborative ventures to provide maximum benefits to the concerned stakeholders (Nangia & Aggarwal, 2014; Giovanni, 2005; Chen et al., 2009).

Moreover, it is also imperative to maintain stability in the governance and legal aspects both in the Host and the Target Country, which is reckoned as necessary measure for the existence in the long span of time (Giovanni, 2005; Nangia& Aggarwal, 2014).

The political sphere is supposed to be stable enough to provide a platform to ensure political stabilization, peace and prosperity in the business environment for building and retaining the trust of the investors (Fredderke&Romm, 2006). A Stable political domain provides better possibilities of bilateral ties and business relationships to benefit both the Host and Target economies (Barbopoulos et al., 2012).

The strategists should prepare effective policy measures to positively influence the frequency and intensity of the Mergers &Acquisitions (Baniya& Shah, 2016).

Edwards (2014) and Dalkilic& Cagle (2015) suggested that the business leaders must reckoned and include the best alternatives formed on the basis of their rationality for making better choices of Mergers and Acquisitions to relocate the asset in the nation and use them to get the maximum gains. Therefore, every country should plan in such a manner to grow ahead and ensure its survival in the challenging environment by getting along with the business trends and embracing the changes as necessary for development in the dynamic environment. In addition to it, all the resources should be utilized in an effective manner to attain the stability, economy, efficiency and involvement in the diversified environment.

1.6 Limitation of the Study

Only succinct research work has been undertaken in context to the Mergers and Acquisitions in India. Therefore, it has been quite complicated to gather relevant literature on this significant aspect of nation building. However, certain companies have restrained strategy and it is quite complex to muster adequate information and knowledge with regard to their initiatives and practices. The span of time has also been a major constraint for the research work.

References

- Andrade, G., & Stafford, E. (2004). Investigating the economic role of mergers. Journal of Corporate Finance, 10(1), 1-36.

- Allison (1971), “Mergers and Acquisitions: A Theoretical Framework”, available at http://shodhganga.inflibnet.ac.in/bitstream/10603/26650/8/08_chapter%202.pdf, Retreived on 12.11.2019.

- Abington, J. R., Christensen, J. A., & McGee, W. J. (2006). M&A checklists for a post‐ SOX world. Journal of Corporate Accounting & Finance, 17(2), 31-36.

- Baniya, D., & Shah, M. (2016). A Study on the Factors Affecting Merger and Acquisition Decision in Nepalese Banking Sector. Thesis Submitted in Department of Economics and Business Administration, University of Agder, 1-95.

- Barbopoulos, L., Paudyal, K., &Pescetto, G. (2012). Legal systems and gains from cross- border acquisitions. Journal of Business Research, 65(9), 1301-1312.

- Barkema, H. G., &Schijven, M. (2008). How do firms learn to make acquisitions? A review of past research and an agenda for the future. Journal of Management, 34(3), 594-634.

- Becker, J., &Fuest, C. (2010). Taxing foreign profits with international mergers and acquisitions. International Economic Review, 51(1), 171-186.

- Becker, J., &Fuest, C. (2011a). Source versus residence based taxation with international mergers and acquisitions. Journal of Public Economics, 95(1-2), 28-40.

- Bedi, H. (2010). Merger & Acquisition in India: An Analytical Study. Emerging Markets: Finance eJournal, 15-46.

- Berle and Means (1981), The Modern Corporation, pp. 313.

- Boateng, A., Naraidoo, R., & Uddin, M. (2011). An analysis of the inward cross-border mergers and acquisitions in the UK: A macroeconomic perspective. Journal of International Financial Management & Accounting, 22(2), 91-113.

- Boeh, K. K. (2011). Contracting costs and information asymmetry reduction in cross- border M&A. Journal of Management Studies, 48(3), 568-590.

- Bjorvatn, K., 2004, Economic integration and the profitability of cross-border mergers and acqui- sitions, European Economic Review 48 (6), 1211- 1226.

- Brakman, S., H. Garretsen and C.V. Marrewijk, 2006, Cross Border Mergers and Acquisitions: The Facts as a guide for International Economics, CESIFO Working Paper No. 1823, Category 10: Empirical and Theoretical Methods.

- Black, T. (1989), “Mergers and Acquisitions: A Theoretical Framework”, available at http://shodhganga.inflibnet.ac.in/bitstream/10603/26650/8/08_chapter%202.pdf, Retreived on 12.11.2019.

- Chanmugam, R., Shill, W., Mann, D., Ficery, K., &Pursche, B. (2005). The intelligent clean room: ensuring value capture in mergers and acquisitions. Journal of Business Strategy, 26(3), 43-49.

- Chen, Y. -R., Huang, Y. -L., & Chen, C. -N. (2009). Financing constraints, ownership control, and cross-border M&As: Evidence from nine East Asian economies. Corporate Governance: An International Review, 17(6), 665-680.

- Dalkilic, A. F., & Cagle, M. N. (2015). Critical Success Factors in Merger & Acquisition Strategies: Evaluation of Turkish Market, IsletmeFakultesiDergisi, 16(2), 117-133.

- Dash, A. P. (2010). Mergers and Acquisitions. IK International Pvt. Ltd, 23.

- Dhillon, D. (2018). 2018 was A Big Year for Mergers and Acquisitions in India. Here are the Top Deals. Available on https://www.businessinsider.in/2018-was-a-big-year-for-mergers-and-acquisitions-in-india-here-are-the-top-deals/articleshow/67127132.cms. Retreived on 1.09.2019.

- Dhanjal, s. S. (2018). Indian Companies Log Record $129 Billion in M&A Deals in 2018. Available on https://www.livemint.com/Companies/VD0HHHQHCUwiCjsxeTGCLN/Indian-companies-log-record-129-bn-in-MA-deals-in-2018.html. Retrieved on 2.09.2019.

- Duhaime and Schneck (1985), “Mergers and Acquisitions: A Theoretical Framework”, available at http://shodhganga.inflibnet.ac.in/bitstream/10603/26650/8/08_chapter%202.pdf, Retreived on 12.11.2019.

- Edwards, J. B. (2014). The Urge to Merge. Journal of Corporate Accounting & Finance, 25(2), 51-55.

- ET Bureau. Big Banks Mergers: Government Turns Ten PSBs into Four. Available at https://economictimes.indiatimes.com/news/economy/policy/big-bank-mergers-government-turns-ten-psbs-into-four/articleshow/70918585.cms?from=mdr. Retrieved on 03.09.2019.

- Faulkner, D.O., Campbell, A. (2003). Oxford Handbook of Strategy, Volume II: Corporate Strategy. Oxford University Press. 26.

- Fedderke, J. W., &Romm, A. T. (2006). Growth impact and determinants of foreign direct investment into South Africa, 1956–2003. Economic Modelling, 23(5), 738-760.

- Goyal, K. A., & Joshi, V. (2012). Merger and Acquisition in Banking Industry: A Case Study of ICICI Bank Ltd. International Journal of Research in Management, 2(2), 30-40.

- Goergen, M., &Renneboog, L. (2004). Shareholder wealth effects of European domestic and cross-border takeover bids. European Financial Management, 10(1), 9-45.

- Gitman, L. J., &Zutter, C. J. (2011). Principles of Managerial Finance 13th Edition. Prentice Hall. 34-49.

- Giovani, R. (2015). The determinants of merger wave: An international perspective. International Journal of Industrial Organization, 30(1), 1-15.

- Gaughan, P.A. 2007. Mergers, Acquisitions, and Corporate Restructurings. John Wiley & Sons.

- Gurusamy, S. (2009). Financial services and system. Tata McGraw-Hill Education Private Limited. 34-40.

- Hebous, S., Ruf, M., &Weichenrieder, A. J. (2011). The effects of taxation on the location decision of multinational firms: M&A versus greenfield investments. National Tax Journal, 64(September), 817-838.

- Holderness and Sheenlan (1985), “Mergers and Acquisitions: A Theoretical Framework”, available at http://shodhganga.inflibnet.ac.in/bitstream/10603/26650/8/08_chapter%202.pdf, Retreived on 12.11.2019.

- Huang, T. -Y., Hu, J. -S., & Chen, K. -C. (2008). The influence of market and product knowledge resource embeddedness on the international mergers of advertising agencies: the case-study approach. International Business Review, 17(5), 587-599.

- Huizinga, H., Voget, J., & Wagner, W. (2012). Who bears the burden of international taxation? Evidence from cross-border M&As. Journal of International Economics, 88(1), 186-197.

- Knilans, G. (2009). Mergers and acquisitions: Best practices for successful integration. Employment Relations Today, 35(4), 39-46.

- Krug, J. A., & Nigh, D. (2001). Executive perceptions in foreign and domestic acquisitions: an analysis of foreign ownership and its effect on executive fate. Journal of World Business, 36(1), 85-105.

- Makamson, E. L. (2010). The reverse takeover: implications for strategy. Academy of Strategic Management Journal, 9(1), 111.

- Martynova, M., &Renneboog, L. (2008a). A century of corporate takeovers: What have we learned and where do we stand? Journal of Banking & Finance, 32(10), 2148- 2177.

- McDonald, J., Coulthard, M., & De Lange, P. (2005). Planning for a successful merger or acquisition: Lessons from an Australian study. Journal of Global Business and Technology, 1(2), 1-11. 131

- Mckinsey, F. (2010). Economics and the Interpretation and Application of US and EU Antitrust Law. Springer. 45.

- Moeller, S. B., &Schlingemann, F. P. (2005). Global diversification and bidder gains: a comparison between cross-border and domestic acquisitions. Journal of Banking & Finance, 29(3), 533-564.

- Moskalev, S. A. (2010). Foreign ownership restrictions and cross-border markets for corporate control. Journal of Multinational Financial Management, 20(1), 48-70.

- Naudé, A., Heyns, D., Bester, C., Puig, J., & Tucker, G. (2002). Synergies within Barloworld. Unpublished manuscript, Barloworld Executive Development Programme, Gordon Institute of Business Science, Johannesburg. 56-78.

- Nagano, M. (2013). Similarities and differences among cross-border M&A and Greenfield FDI determinants: Evidence from Asia and Oceania. Emerging Markets Review, 16(September), 100-118.

- Nangia& Aggarwal (2014). Learning to internationalise: the pace and success of foreign acquisitions. Journal of International Business Studies, 38(7), 1170-1186.

- Öberg, C., &Tarba, S. Y. (2013). What do we know about post-merger integration following international acquisitions?Advances in International Management, 26, 469-492.

- Petitt, B. S., & Ferris, K. R. (2013). Valuation for mergers and acquisitions. FT Press.

- Pavkov, A. R. (2005). Ghouls and Godsends-A Critique of Reverse Merger Policy. Berkeley Bus. LJ, 3, 465-475.

- Power, A. (1983), “Mergers and Acquisitions: A Theoretical Framework”, available at http://shodhganga.inflibnet.ac.in/bitstream/10603/26650/8/08_chapter%202.pdf, Retreived on 12.11.2019.

- Prasad, K., & Sahay, M. (2018). Mergers and Acquisitions: Analysis on Indian Merger and Acquisition in India with Reference from 2005-2015. International Journal of Pure and Applied Mathematics, 118(20), 4411-4417.

- Pettersson, A., Pop, C., Petersson, T., &Svanberg, J. (2013). Who benefits?

- Rossi, S., Volpin, P. F. (2004) Cross-country determinants of mergers and acquisitions. Journal of Financial Economics, 74(2), 277-304.

- Ravenscraft, D. J., & Scherer, F. M. (2011). Mergers, sell-offs, and economic efficiency. Brookings Institution Press. 34.

- Rhodes (1983), “Mergers and Acquisitions: A Theoretical Framework”, available at http://shodhganga.inflibnet.ac.in/bitstream/10603/26650/8/08_chapter%202.pdf, Retreived on 12.11.2019.

- Reddy, K. S. (2015). Determinants of Cross-Border Mergers and Acquisitions: A Comprehensive Review and Future Direction. Munich Personal RePEc Archive, 1-41.

- Roll, P. (1986), “Mergers and Acquisitions: A Theoretical Framework”, available at http://shodhganga.inflibnet.ac.in/bitstream/10603/26650/8/08_chapter%202.pdf, Retreived on 12.11.2019.

- Sharma, M. (2016). Cross Border Mergers and Acquisitions and the Exchange Rate. Journal of Business Management and Social Science Research, 5(9), 272-292.

- Saxena, S. P. (2012). Mergers and Acquisitions as a Strategic Tool to Gain Competitive Advantage by Exploiting Synergies: A Study of Merging & Non Merging Firms in Indian Aluminium Industry. This paper was published in edited volume titled Innovation and Adaptability: Twin Engines of Sustained Growth, by Bhakar SS and Pandey VK, Excel Books, New Delhi (2010) ISBN, 978-81.

- Sherman, A.J., Hart, M.A. 2006. Mergers and Acquisitions from A-Z. Amacom. 67-70.

- Servaes, H. (1996). The value of diversification during the conglomerate merger wave. Journal of Finance, 1201-1225.

- Sinha, P., & Gupta, S. (2011). Mergers and Acquisitions: A Pre-Post Analysis for the Indian Financial Services Sector. Corporate Ownership and Control, 13(1), 858-869.

- Stahl, G. K., &Voisi, A. (2008). Do Cultural Differences Matter in Merger and Acquisitions? A Tentative and examination. Organization Science, 19(1), 160-176.

- Steener, P. (1975), “Mergers and Acquisitions: A Theoretical Framework”, available at http://shodhganga.inflibnet.ac.in/bitstream/10603/26650/8/08_chapter%202.pdf, Retreived on 12.11.2019.

- Tamosiuniene, R., &Duksaite, E. (2003) The Importance of Mergers and Acquisitions in Today’s Economy. Prentice Hall. 20-30.

- Walsh (1988), “Mergers and Acquisitions: A Theoretical Framework”, available at http://shodhganga.inflibnet.ac.in/bitstream/10603/26650/8/08_chapter%202.pdf, Retreived on 12.11.2019.

- Weiner, Jeffrey (2010). Due Diligence in M&A Transactions: A Conceptual Framework. Springer, 34-40.

- Wensley, J. (1982), “Mergers and Acquisitions: A Theoretical Framework”, available at http://shodhganga.inflibnet.ac.in/bitstream/10603/26650/8/08_chapter%202.pdf, Retreived on 12.11.2019.

- Young-Han, K., 2009, Cross-border M&A vs. Greenfield FDI: Economic integration and its wel- fare impact, Journal of Policy Modeling 31 (1), 87- 101.

- You, T. (1986), “Mergers and Acquisitions: A Theoretical Framework”, available at http://shodhganga.inflibnet.ac.in/bitstream/10603/26650/8/08_chapter%202.pdf, Retreived on 12.11.2019.

- Zhu, P. C., Jog, V., Otchere, I. (2010) Partial acquisitions in emerging markets: A test of the strategic market entry and corporate control hypotheses. Journal of Corporate Finance, 288-305.