Subscribe now to get notified about IU Jharkhand journal updates!

Interdependence of Governance and Financial Performances in Selected Indian Public Sector Undertaking Banks

Abstract :

Corporate governance considers the multiple issues arising from interaction among senior management, shareholders, board of directors, promoters, institutional investors etc. The threat of accumulation of non-performing assets has become a major challenge for Public Sector Undertaking banks. Thus, it has become imperative for banks to implement sound and efficient corporate governance practices. Objective of the research paper is to analyse the interdependence of corporate governance practices of selected Indian PSU banks and their financial performances. The financial year (2015-16) has been taken into consideration for the research paper. 21 PSU banks are taken into considerations such as State Bank of India, Punjab National Bank, Bank of Baroda, Bank of India, Canara Bank, Union bank of India, IDBI Bank Limited, Syndicate Bank, Central Bank of India, Indian Overseas Bank, Oriental Bank of Commerce, Allahabad Bank, Corporation Bank, UCO Bank, Indian Bank, Andhra Bank, Bank of Maharashtra, Vijaya Bank, Dena Bank, United Bank of India and Punjab & Sind Bank. Net profit is taken as dependent variable. Board size, board independence, net NPA, capital adequacy ratio has been considered as independent variables. Pearson’s correlation coefficient and multiple regressions have been used in this study.

Keywords :

governance, non-performing asset, board, capital adequacy, net profit1. Introduction

Governance becomes indispensable as and when the ownership deviates from control that is to say, the particular company or institution is highly concerned with achieving the goals like designing the succession planning, identifying opportunities, facilitating constructive challenges and efficient allocation of scarce resources. Therefore, corporate governance encompasses the several issues arising from interaction among senior management, shareholders, board of directors, promoters, institutional investors etc. The corporate governance mechanism is much more crucial in the banking sector. Banks by virtue of their intermediation function in the allocation of resources play a crucial role in the socio economic growth of the country. Banks exercise a choice in dispensing credit and wrong decisions can have significant consequences in the economy. The threat posed by non-performing assets has been talked about widely and is now familiar to anyone even with a passive interest in the economy. Thus it has become imperative for banks to ensure that the corporate governance practices that they adopt should be sound and efficient. According to Basel III, banks have to maintain at least 11.5% capital adequacy ratio. Simultaneously banks have to pursue their profit maximisation agenda to provide justice to shareholders. The proposed study will examine the relationship between profitability and governance practices of selected PSU banks of India.

2. Survey of Existing Literature

Brahmbhatt et al (2012) conducted a study in order to compare corporate governance practices in public and the private sector banks. The findings of the study revealed the possibility of improvement of corporate governance laws for the betterment of all stakeholders across both the banks. The author collected data from selected Public and Private sector banks (SBI, Bank of India, ICICI, Axis bank etc.) through a survey questionnaire. Parameters based scorecard method was used to conduct the comparative analysis, on the basis of Clause 49. The main findings of the study brought up the score cards and ranking of banks taken in sample. It ranked Bank of India 1, State Bank of India 2, ICICI bank 3, and Axis Bank Ltd 4 and so on for observance of corporate governance within the firm through stringent regulations.

Agarwal (2013) established that corporate governance rating exerted positive impact on financial performance of firms. The study revealed that good governance had fostered better financial performance. Ratings of company along with employees’ related and environmental dimensions also had significantly influenced corporate financial performance.

Bijalwan and Madan (2013) indicated that there was significant relationship between transparency, shareholders’ rights and firm performance in India. Hence it could be said that these factors were correlated and had impact on each other.

Deb (2013) conducted a study among senior managers of public and private sector banks to determine the corporate governance practices and concluded that banks needed to ensure transparency in financial statements, in order to protect their shareholders. Comparative study across the banks revealed that public banks were more transparent in comparison to its private counterparts.

3. Objective

To analyse the interdependence of corporate governance practices of selected Indian PSU banks and their financial performances

4. Research Methodology

The proposed study isexplanatory and empirical in nature and the sources of data are secondary data(inclusive of quantitative and qualitative data) which are collected through websites and annualreports related matter.

Period of the study:The financial year (2015-16)has been taken into consideration for the research paper. So all the data collected is based on the annual reports of this duration only.

Samples of the study: 21 PSU banks are taken into considerationssuch asState Bank of India, Punjab National Bank, Bank of Baroda, Bank of India, Canara Bank, Union bank of India, IDBI Bank Limited , Syndicate Bank, Central Bank of India, Indian Overseas Bank, Oriental Bank of Commerce, Allahabad Bank, Corporation Bank, UCO Bank, Indian Bank, Andhra Bank, Bank of Maharashtra, Vijaya Bank, Dena Bank,United Bank of India and Punjab & Sind Bank .

Data Analysis:Net profit is taken as dependent variable. Boardsizes, board independence, net NPA, capital adequacy ratio are considered as independent variables. Pearson’s correlation coefficient and multiple regressions have been used in this study.

Research hypothesis :

Hypothesis -1

HO: There is no relationship among net profit and board size.

H1: There is a relationship among net profit and board size.

Hypothesis-2

HO: There is no relationship among net profit and board independence.

H1: There is a relationship among net profit and board independence.

Hypothesis -3

HO: There is no relationship among net profit and net NPA.

H1: There is a relationship among net profit and net NPA.

Hypothesis-4

HO: There is no relationship among net profit and capital adequacy ratio.

H1: There is a relationship among net profit and capital adequacy ratio.

5. Analysis

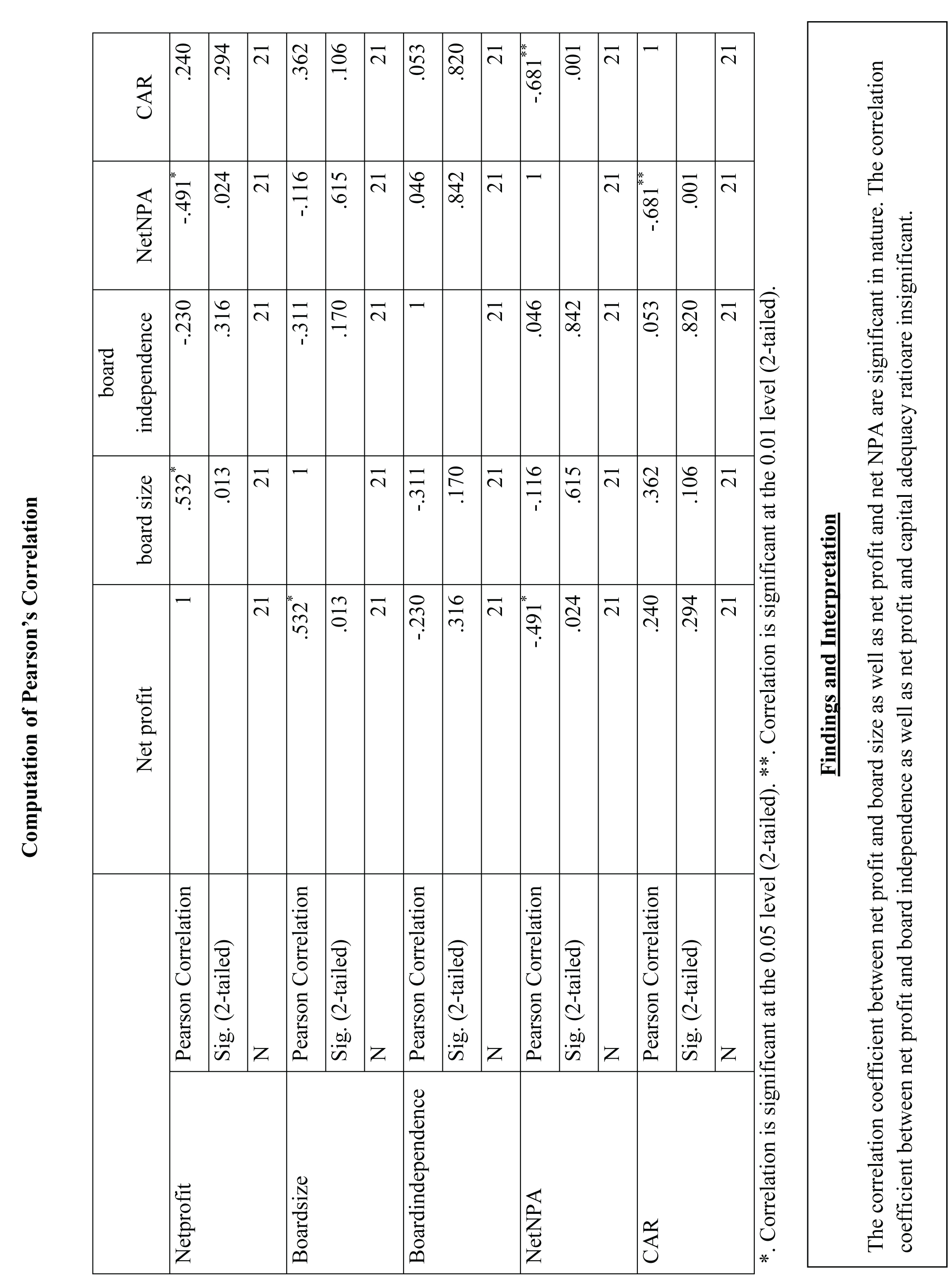

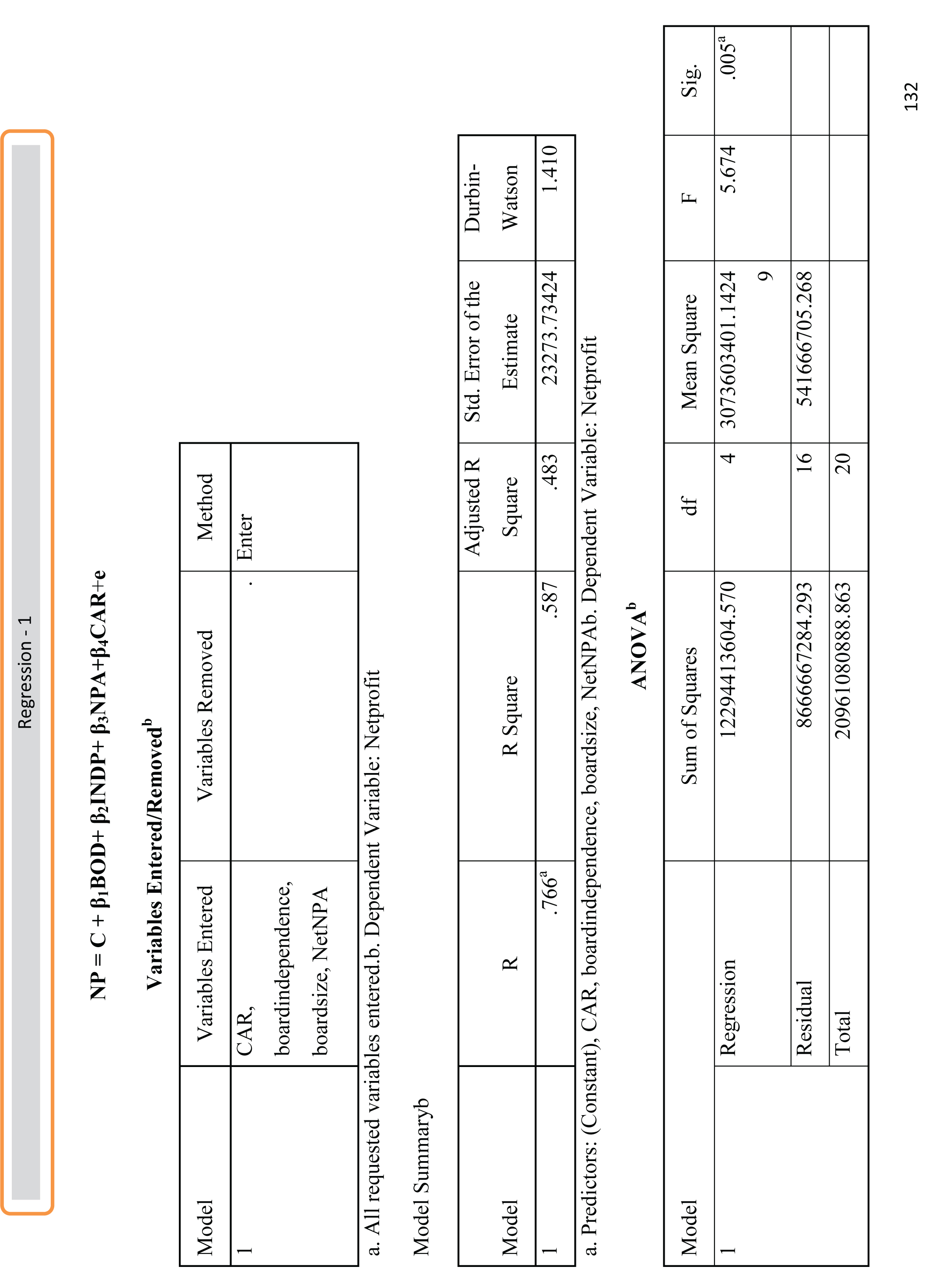

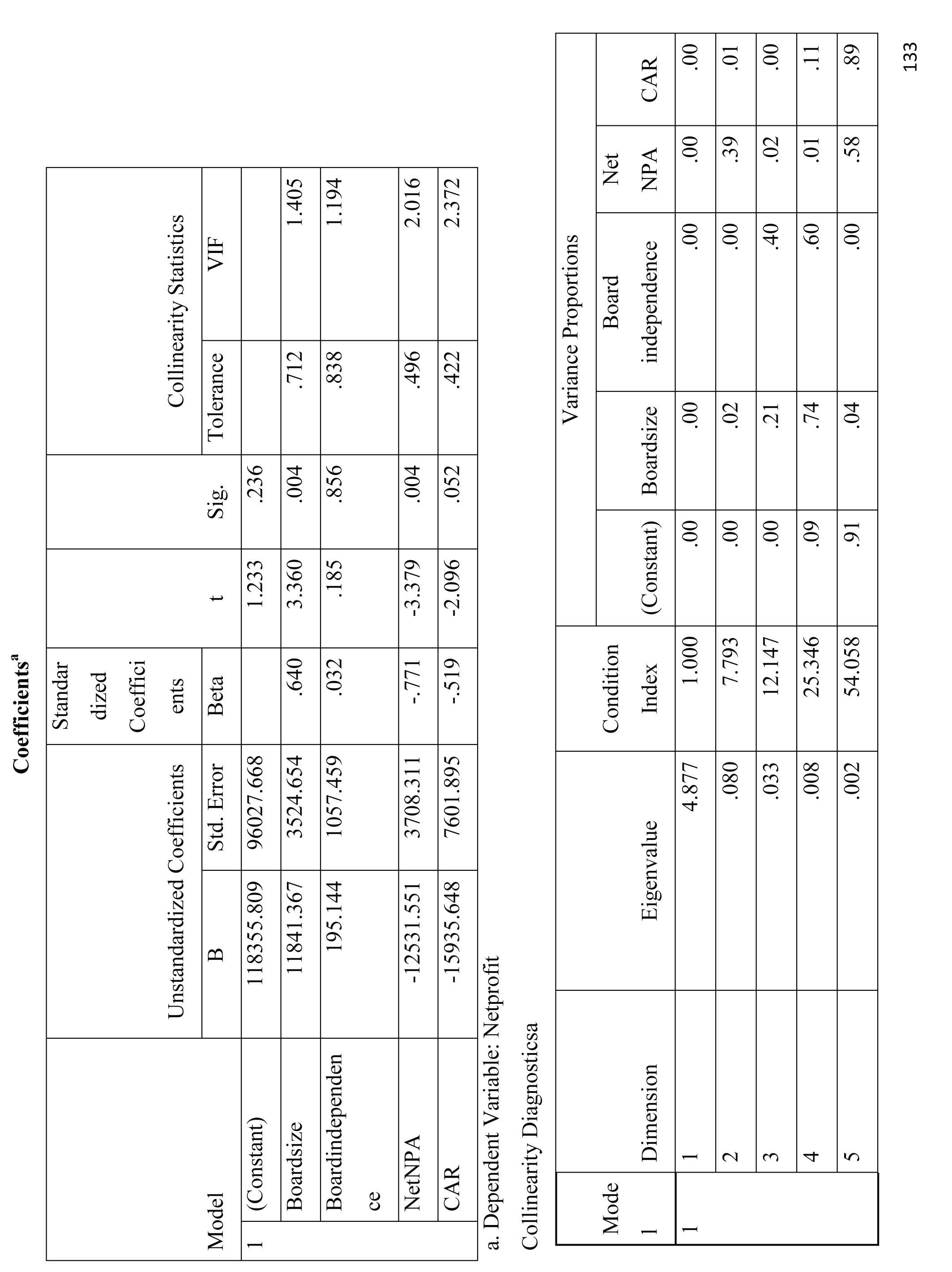

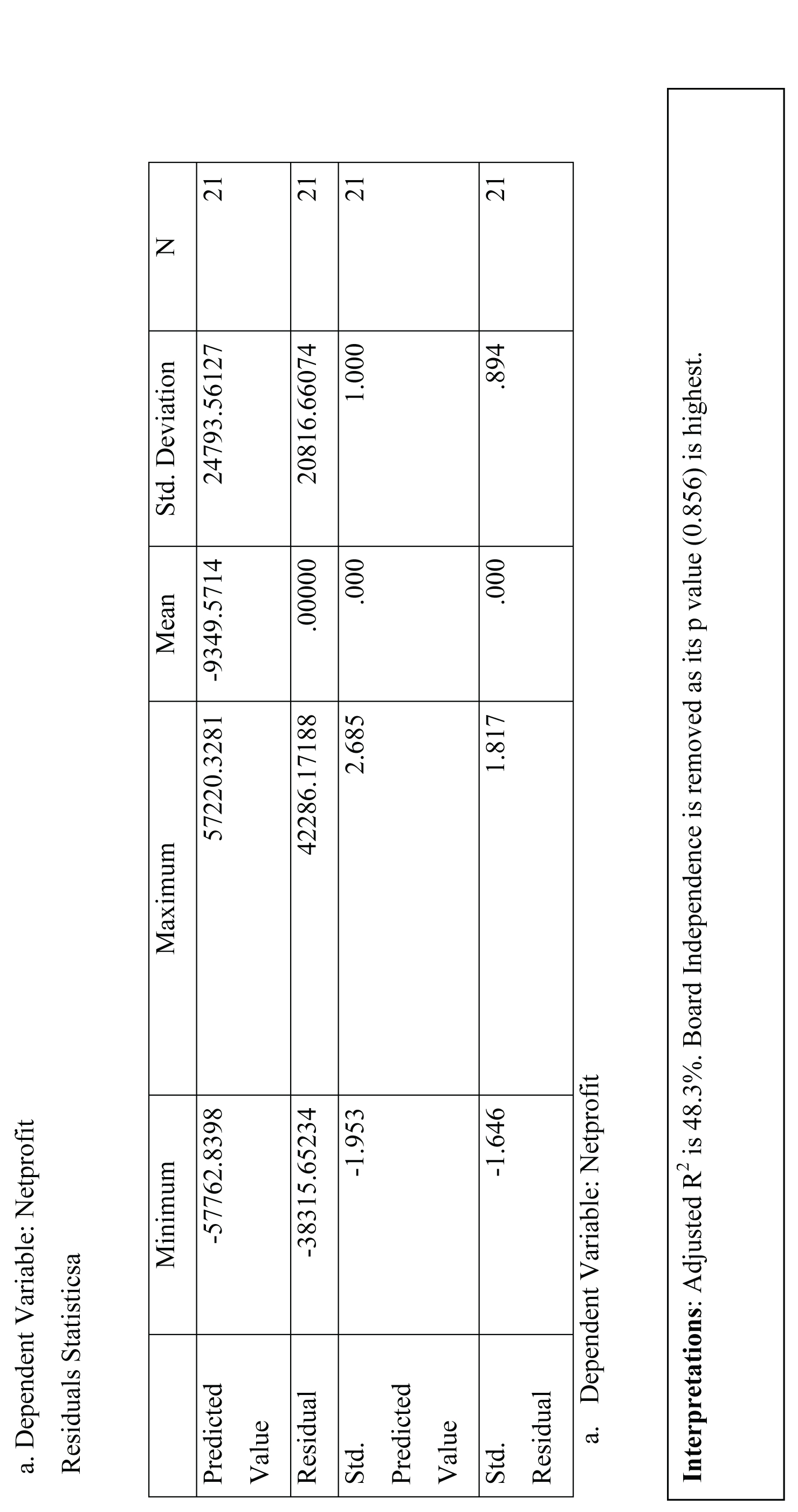

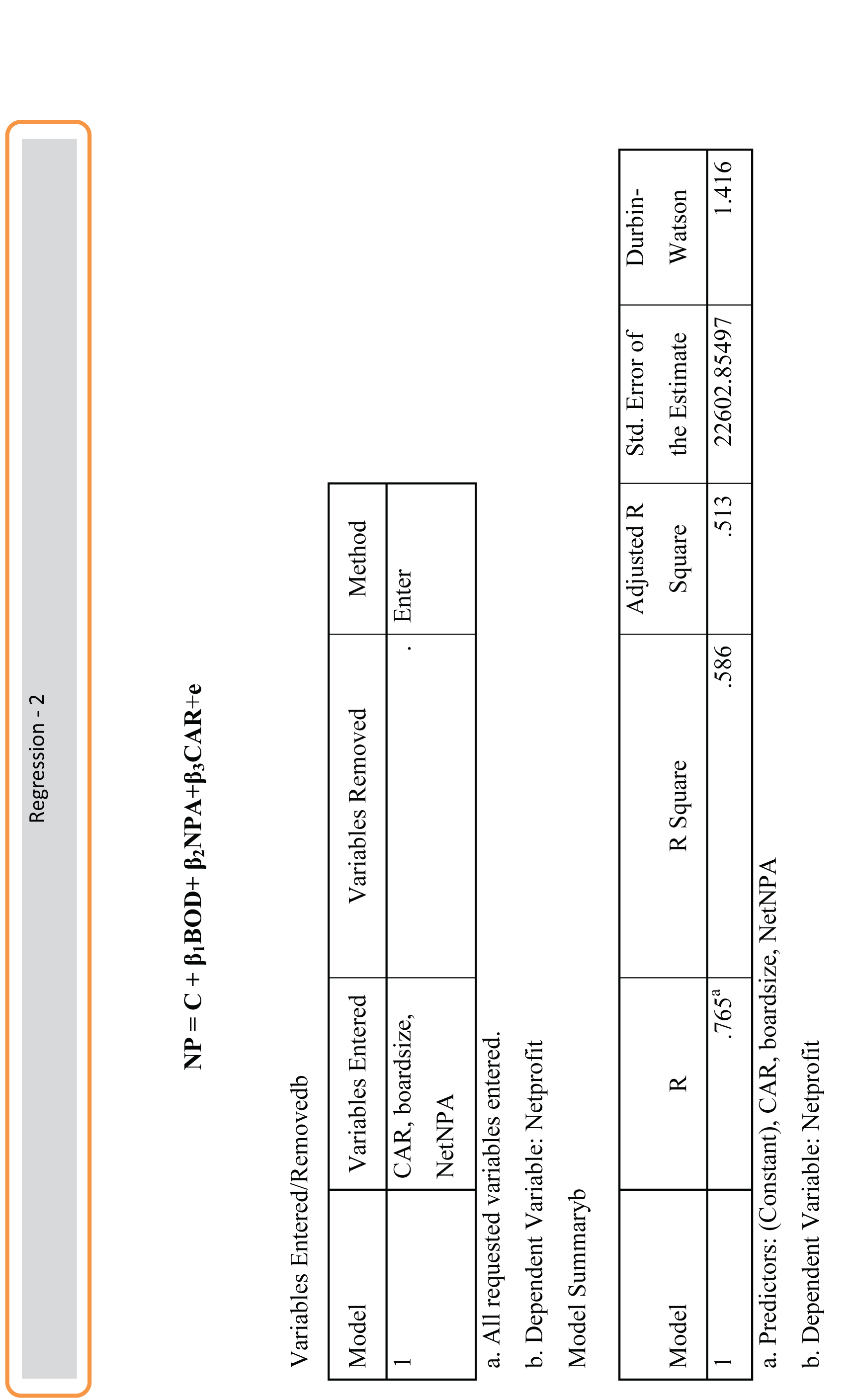

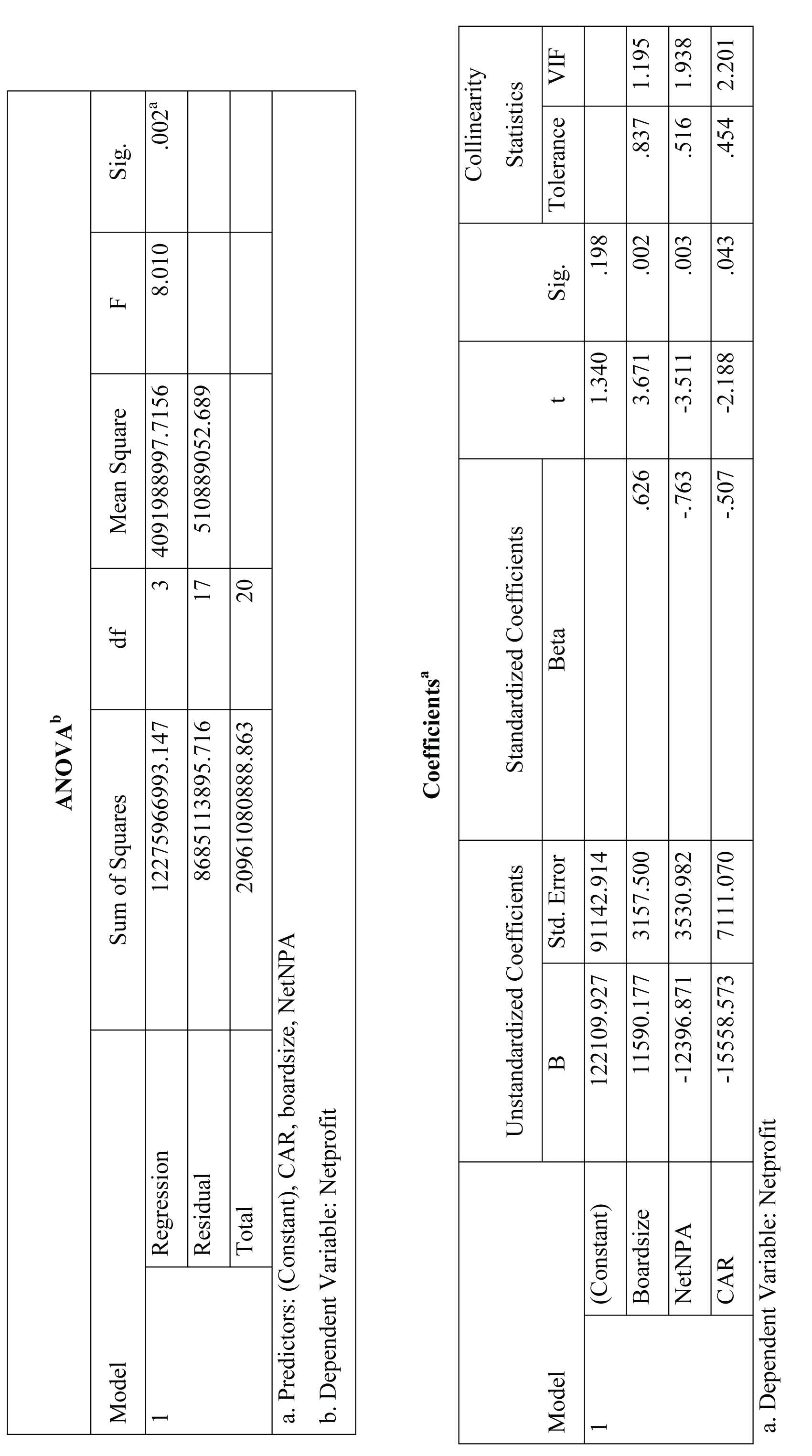

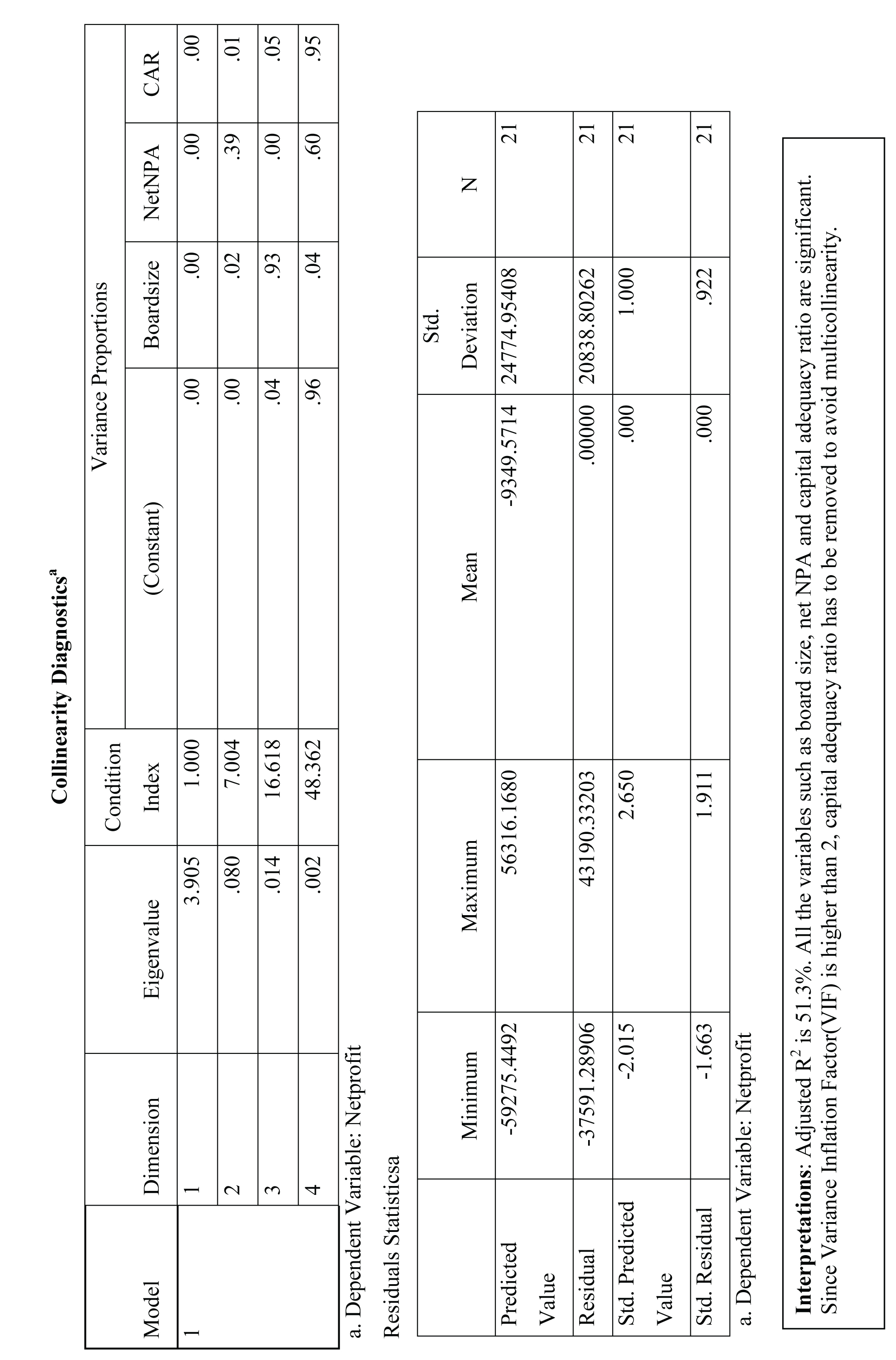

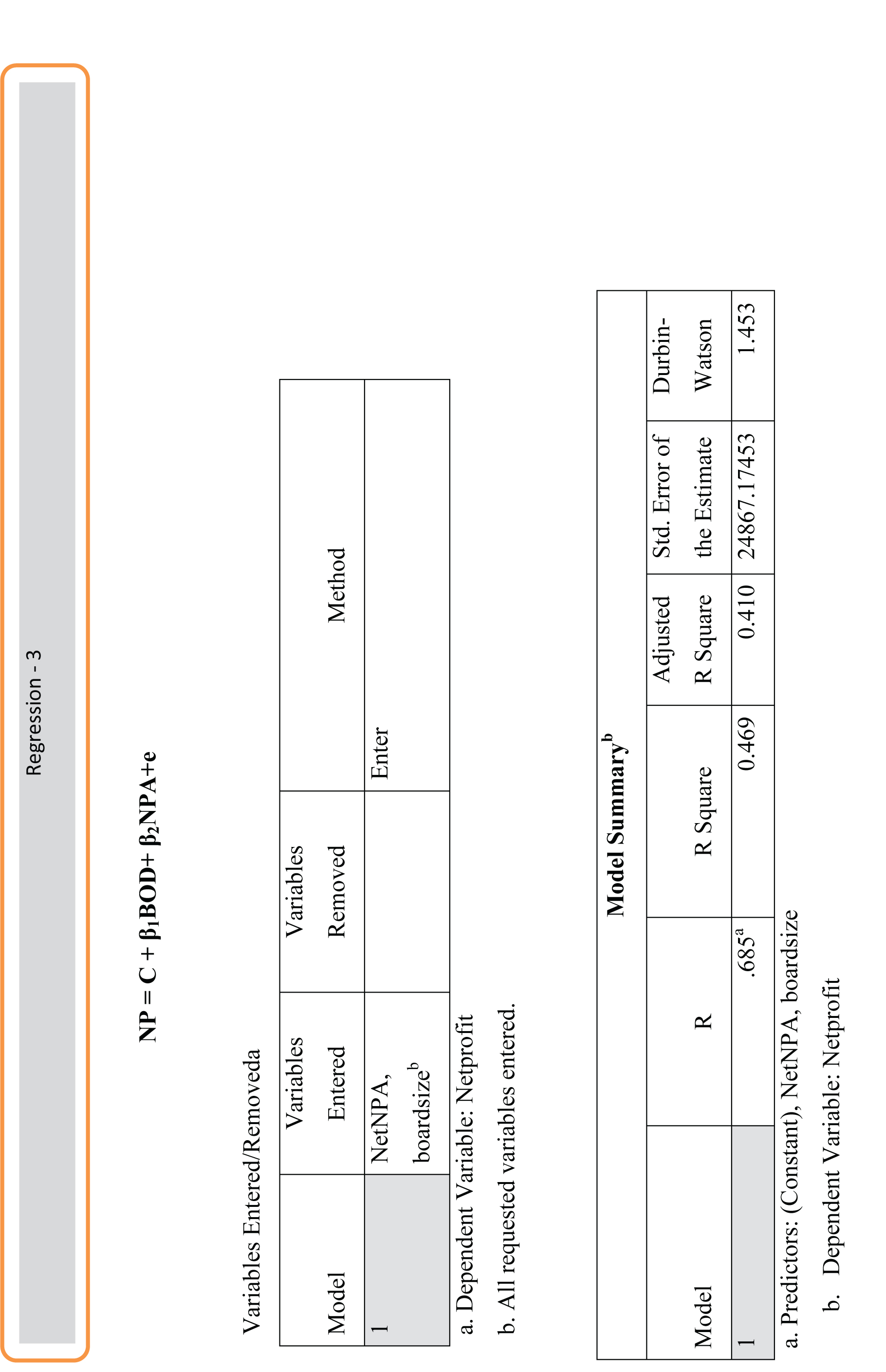

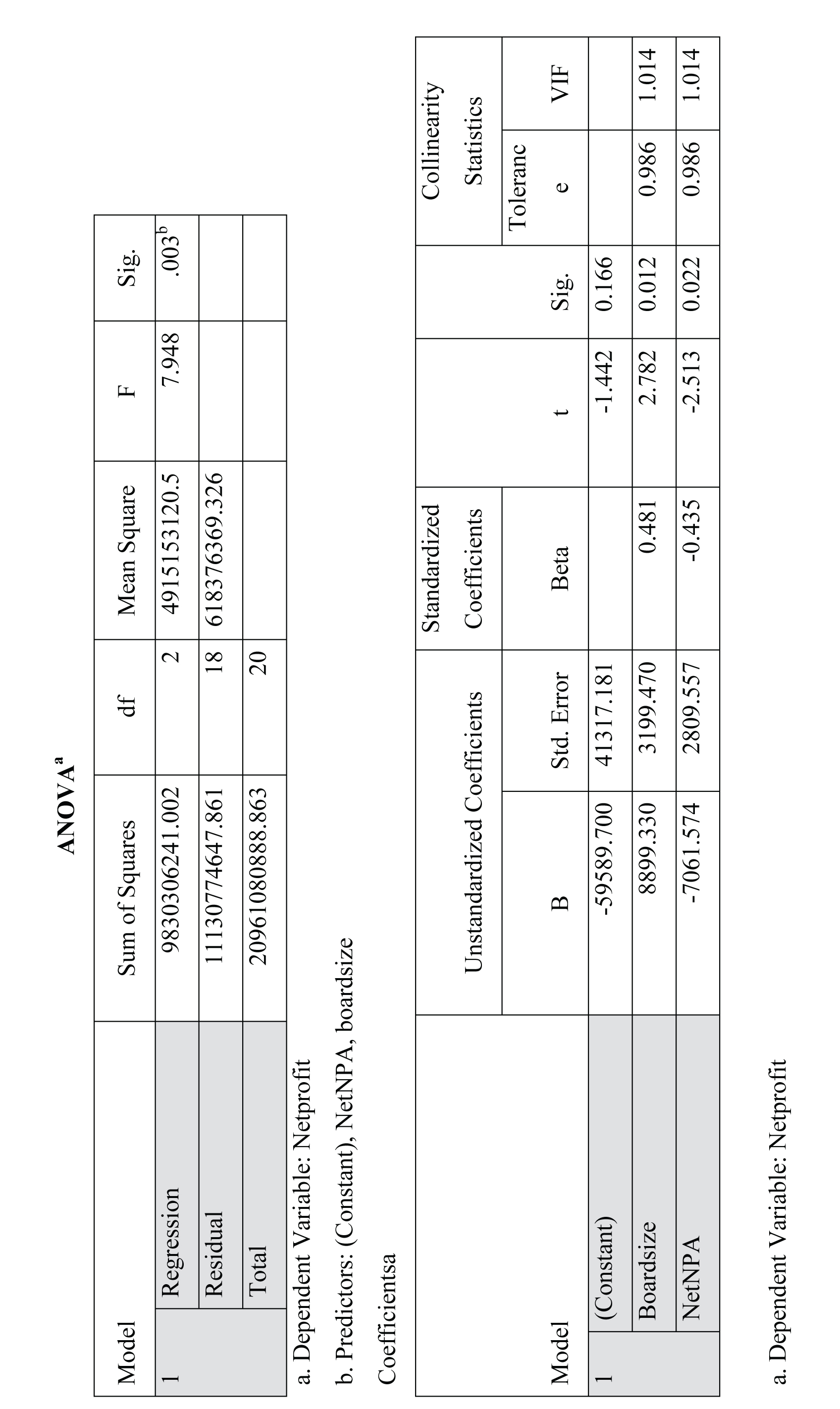

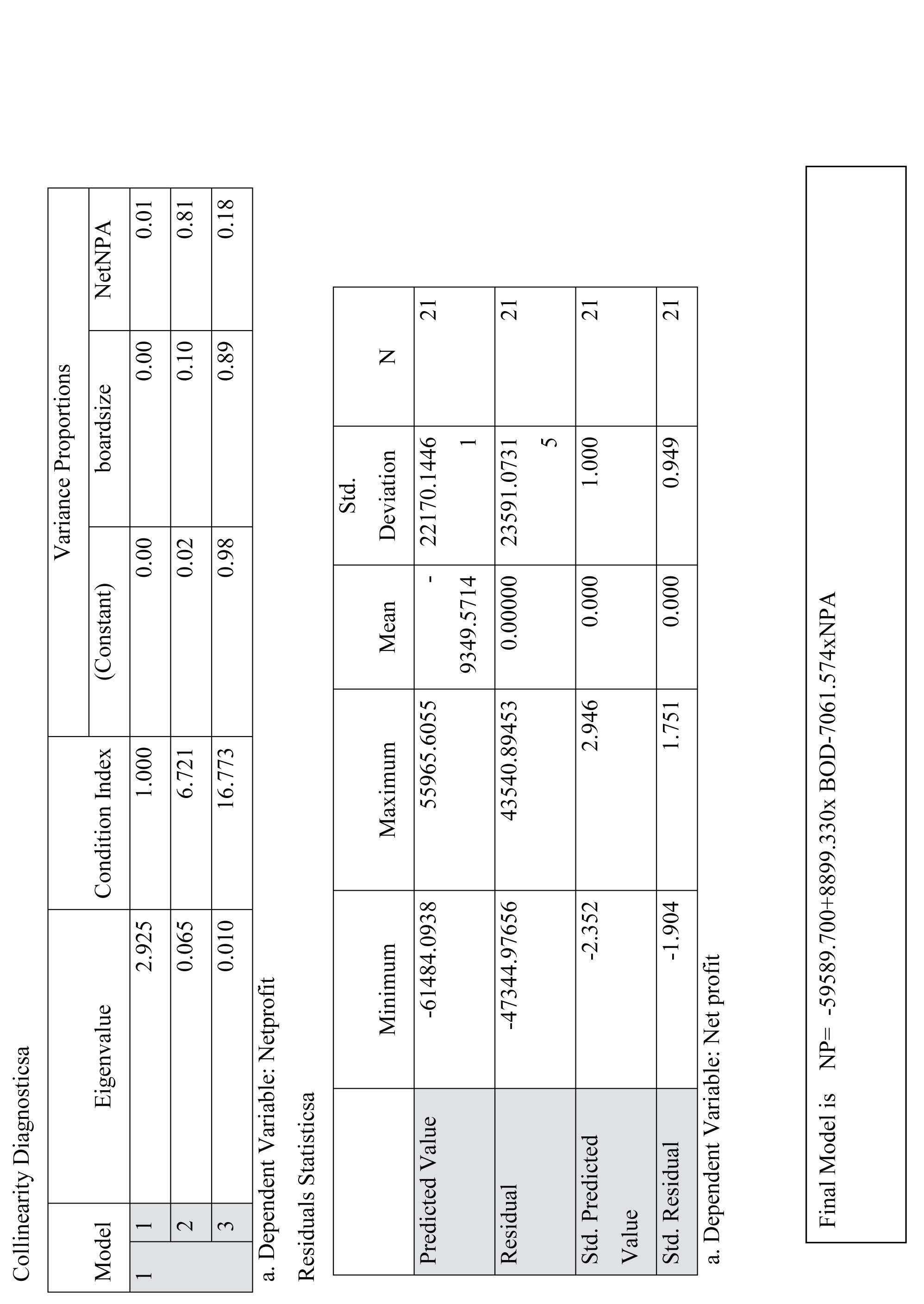

To test the hypothesis no. 1 -4 as shown above, Pearson’s Correlation coefficient and multiple regressions have been used.

6. Conclusion

H1is accepted for hypothesis1. There is a positive relationship betweennet profit and board size at 5% level of significance. Correlation coefficient between net profit and board size is 0.532.According to the multiple regressions, the relationship between net profit and board size is significant. H0 is accepted for hypothesis 2. Correlation coefficient between net profit and board independence is insignificant. H1 is accepted for hypothesis 3. There is an inverse relationship between net profit and net NPA. Correlation coefficient between net profit and net NPA is -0.491. According to the multiple regressions, the relationship between net profit and net NPA is significant. H0 is accepted for hypothesis 4. Correlation coefficient between net profit and capital adequacy ratio is insignificant. Hence PSU banks should have large board size. Higher NPA results for more provisioning and it reduces profitability of bank. Therefore sound corporate governance practices are necessary conditions for profitability of PSU banks.

Refrences

- Agarwal, Priyanka. (2013). 'Impact of Corporate Governance on Corporate Financial Performance'.Journal of Business and Management, 13 (3), 1-5.

- Al-Tamimi, Hussein, A. Hassan. (2008),'Implementing Basel II: An Investigation of the UAE Banks’ Basel II Preparations',Journal of Financial Regulation and Compliance, 16 (2), 173-187.

- Bapat, Dhananjay. (2013), ‘Growth Profitability and Productivity in Public Sector Banks: An Assessment of Their Interrelationship’, TheIUP Journal of Bank Management, 12 (3), 49-57.

- Bijalwan, Jyostna and Pankaj Madan.(2013). 'Corporate Governance Practices, Transparency and Performance of Indian Companies'. The IUP Journal of Corporate Governance, 12 (3), 45-79.

- Brahmbhatt, M, Patel R and Patel S. (2012). 'An Empirical Investigation of Corporate Governance Scenario in Public Vs Private Banks in India'. International Journal of Marketing, Financial Services and Management Research, 10 (1), 12-28.

- Chatterjee, Goutam. (2006), ‘Is Inefficiency of Banks in India a Cause for Concern? Evidence from the Post-reforms’, J Emerg Mark Finance, 151–182.

- Deb, R. (2013). 'Corporate Governance Practices in Indian Banks’. Journal of Business Management & Social Research, 2 (5), 36–50.