Subscribe now to get notified about IU Jharkhand journal updates!

Start-up problems of SHGs in Income Generating Activities: A Case Study of SHGs in Kathikund, Dumka, Jharkhand

Abstract :

Self Help Groups (SHGs) have been widely instrumental in poverty alleviation and organizing the poor people. However, quite a few SHGs have not shown encouraging results in some regions of Jharkhand. This case study examined the causes of start-up problems of five SHGs in two villages of Kathikund area of Dumka district. Women of these SHGs could not start or sustain income generating activities even after 5 to 13 years of their formation. The causes of start-up problems of these SHGs are enumerated based on discussions with them. A few insights are also described as a result of participant observation. The findings revealed that the role of development actors was critical for the success of SHGs. It was appropriate to make a few recommendations to address the problems.

Keywords :

SHG, IGA, SHPI, Low-level equilibrium trap, Development actors1.1. Introduction

Self Help Group (SHG) and microfinance have been established and acknowledged in India and other countries as successful innovative experiments in poverty alleviation. The origin of SHGs in India may be traced back to the establishment of Self-Employed Women’s Association (SEWA) by Ela Bhatt in 1972. Rotating Savings and Credit Association (ROSCA)started in some European countries like Germany and Britain in the late 19th century. Muhammad Yunus started pioneering this concept effectively as SHGs in 1970 in Bangladesh. This achievement won him and Grameen Bank of Bangladesh, Nobel Prize in 2006.

NABARD started its pilot project in 1991-92 in consultation with Reserve Bank of India, Commercial Banks and NGOs. Commercial Banks started financing SHGs since 1991. Government introduced Self Help Promoting Institutions (SHPI) under which RRBs, DCCBs, NBFCs, PACs, FCs, NGOs, etc. joined for better outreach of microfinance programmes. Now, SHG-Bank Linkage Programme in India has become the largest microfinance programme in the world, with 100 lakh SHGs involving 12 crore households (NABARD, 2018-19). There were around 2.24 lakh SHGs in Jharkhand.

Quite a few SHGs have worked successfully, particularly in the states of Maharashtra and Gujarat. In contrast, the poor performance of SHGs in the states of Madhya Pradesh (Aradhana Chouksey, 2019), Odisha, Bihar and Jharkhand (Bibhu Mishra, 2018) raised an urgency to examine the causes for poor performance of SHGs in such regions, particularly in Kathikund block of Dumka district, Jharkhand.

Statement of the problem

Some SHGs in Kathikund area could not undertake viable income generating activities (IGA) even after 5 to 13 years of their formation. BhartiSHG, Asanpahari, undertook poultry farming after getting some training from the Block officials in 2009 taking aloan of Rs,40,000/-. They built five chicken-sheds, using only three sheds for raising 300 chicks. They could raise only 65 chickens till sale. It could not resume farming poultry even when their outstanding corpus fund was reported to be Rs.60,000/-. The women did not hold regular meetings. The SHG had not fully repaid the bank loan. Chand-Bhairo SHG of Asanbani started raising exotic breed of pigs and goats which died in a couple of months. Sido-Kanu SHG of Asanbani had not started any economic activity even after 13 years of its formation with outstanding corpus fund of Rs.90,000/-.Ma Saraswati SHG and Chand Tara SHG of Asanpahari had also not started any IGA after 5 years of their formation.

Objective of the study

This case study is undertaken to identify the factors of failure of Bharti SHG, Asanpahari, in managing the poultry farm as well as to understand the problems of the other SHGs in starting viable income generating activities (IGA).

Background of the study

Kathikundis located 22 KMs north of Dumka, the district headquarter. It is 100% rural. Its forest cover (33%) is more than the country’s forest cover (22.54%). It is a scheduled block, comprising mainly Scheduled Tribes(63%); Santals, Paharias, Mahalis and Kols; Muslims (14%) and Scheduled Castes (2.5%). More than 80% workforce are engaged in mono-crop subsistence agriculture with rice, maize and arhar as the staple crops. Some households undertook sericulture also, earning around Rs.25,000/- annually on an average per farmer. They supported their other expenses by raising cattle, pigs, goats, native poultry and daily wage labour earnings in the non-cropping season in the market areas and in MNREGA schemes. Some migrated seasonally to other states. The HDI (0.470), especially literacy (44%), BPL(50%), malnutrition (50%), MPCE (Rs.920/-) and water scarcity in the area, were among the worst in the State.

Methodology of study and the source of data

The primary data was collected through interview using a brief questionnaire. The questions covered their income, occupations, skills, training and infrastructure. Discussions were held with the women in group as well as individually. Participant observation was an imperative. References have been made to some government reports, related literature including those in the websites and a few SHGs in Maharashtra. Data analysis and regression were done in Stata Software with robust standard error.

Review of Literature

Dr. A. Devidas Sharma and M. Tangkeswor Sharma in “Microfinance through SHGs – A case study of SHGs in Imphal East District, Manipur have made case studies of one successful SHG and another one of a failing SHG.

They described the following reasons for the success of NingolsinthaSHG which mainly engaged in embroidery and wool knitting: i) members were sensitized about the objectives and given training before they undertook the activity, ii) more than 80% women were educated above high school, iii) a good rapport with the supporting agency (NCUI-Women Cooperative Education Project), iv) 50% members were young, unmarried and energetic, v) working together gave a good working environment, vi) machinery were new and suitable, vii) established marketing of the finished goods, viii) the group procured raw materials in bulk and thus enjoyed economies of scale, ix) their group leader (45 years old) was calm, cool, and wise.

They mentioned the presence of local institutions like ‘Marup’, which was a kind of rotating, saving and credit association (ROSCA) of Europe. They also undertook a case study of an unsuccessful group, Laima SHG which mainly engaged in Bori (nuggets) making business.

This SHG faced the following major problems: i) inadequate training, ii) ignorance about availability of raw material (black lentil, urad dal) which was not produced indigenously,iii) problems of marketing, competition with organized market, and lack of organized distribution channel, iv) lack of timely credit, v) instability; post-marriage commitments, change in their address, vi) exploitation by the strong member; vii) weak financial management, fund diversion to consumption, marriage, house construction, viii) non cooperative attitude of the financial institution, ix) inadequate support from the line departments.

Katharine Esty in an article, “Lessons from Muhammad Yunus and the Grameen bank” enumerated factors of path-breaking success of Grameen Bank, Bangladesh, founded by Muhammad Yunus: i) Leadership and commitment to a vision: This was an overarching factor of success. As a visionary and an eminent economist, he conceived, built, guided, nurtured and even restructured Grameen Bank when time demanded. ii) challenged and changed the prevailing practices and tradition, iii) built a team that owned the dream, iv) relentless communication, v) flexibility and resilience, and vi) patience and perseverance.

Aradhana Chouksey in “Investigations of Issues of Self Help Group Promoting Institutions” pointed out a key issue, i.e. the absence of professional knowledge with SHPIs to identify suitable business opportunity and proper marketing network. SHPIs were incapable to mentor SHGs in setting up income generating activities. Bibhu Mishra in TOI blog “What is next for Self Help Group in India?” reminded that SHGs are institutions of participation (Jairam Ramesh). He reiterateda vision that SHGs could expedite India’s economic growth as business units, as network for delivering Government services and as tools for combating social problems.

Significance of the study

This study has pointed out specific problems faced by the SHGs in this region, particularly the start-up problems caused by inability to identify IGA, inadequate training, unorganised market linkage, etc. The findings of this case study could be used as inputs to align the policies and approaches to such SHGsin the right way.

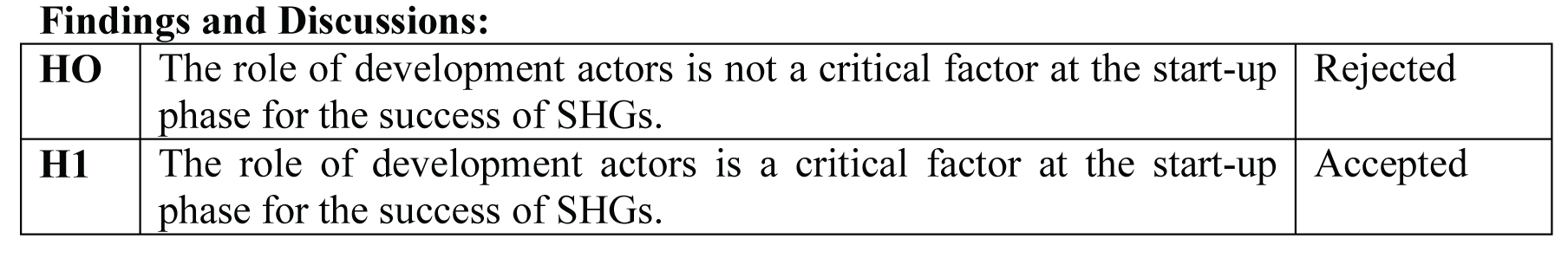

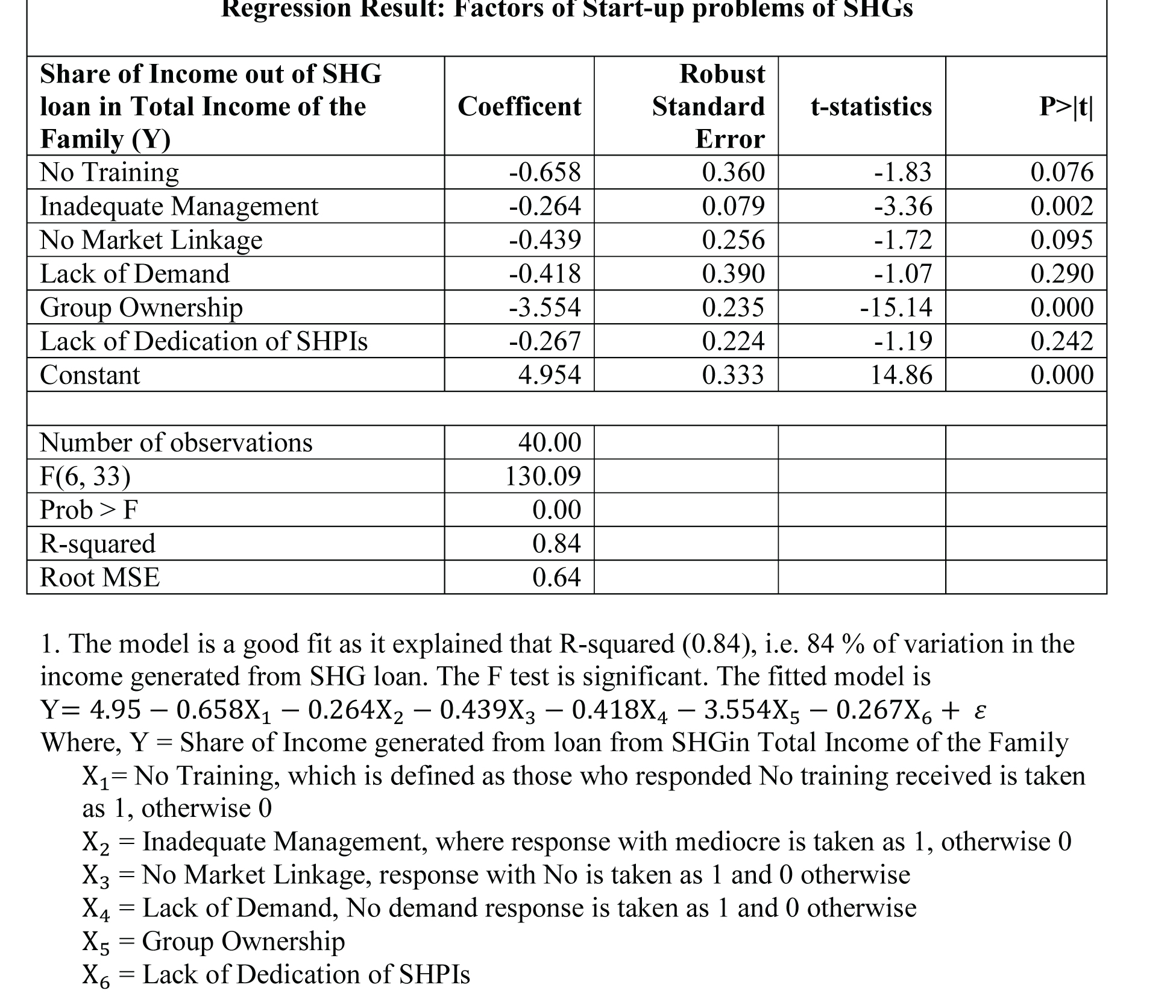

An R-squared of 0.84 indicated that the regression was a good fit. The F-test (0.00) was significant. Therefore, the null hypothesis (HO) was rejected and the alternative hypothesis (H1) was accepted, i.e. the role of development actors (aggregate facilitating functions and facilities/independent variables) is a critical factor at the start-up phase for the success of SHGs.

2.All the explanatory/independent variables are negatively related with the dependent variable, indicating that these factors pulled down the income generated from the SHG loan.

3. Among the factors, Inadequate Management and Group Ownership were found high at 5% level of significance, while No Training and No Market Linkage were found to be at 10% level of significance.

4. Although the lack of Demand and Lack of Dedication of SHPIs were found to be statistically insignificant, they had negative impact on income generated from the SHG loans.

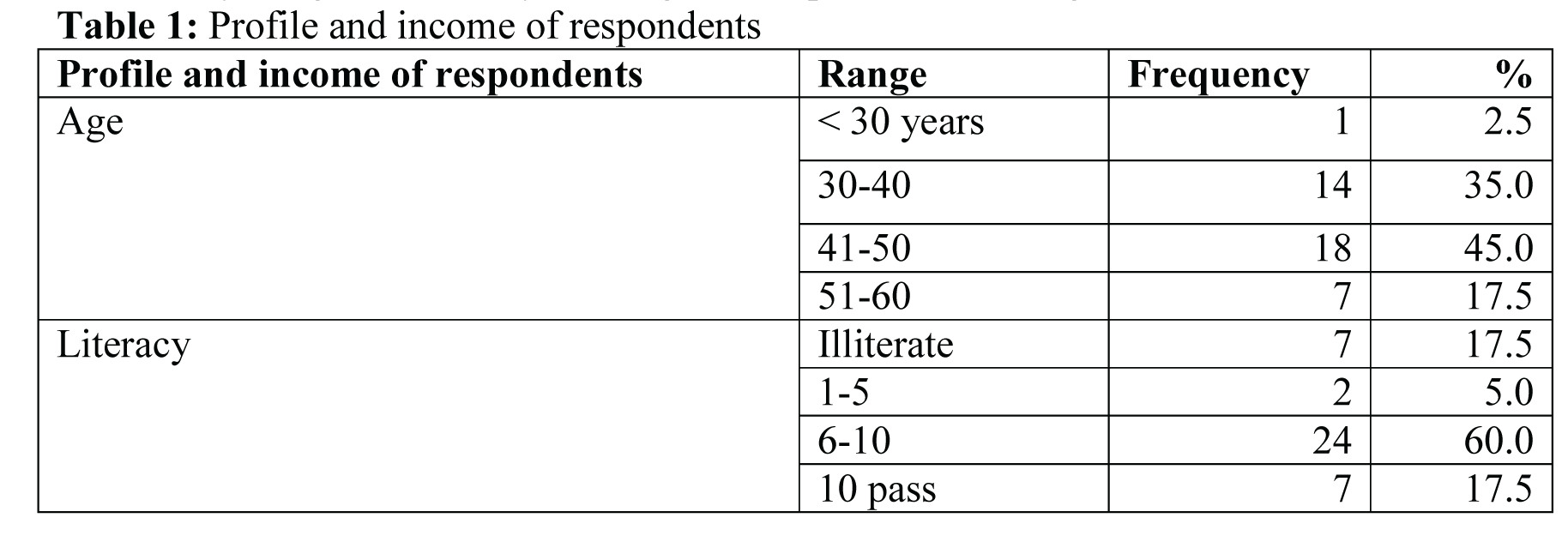

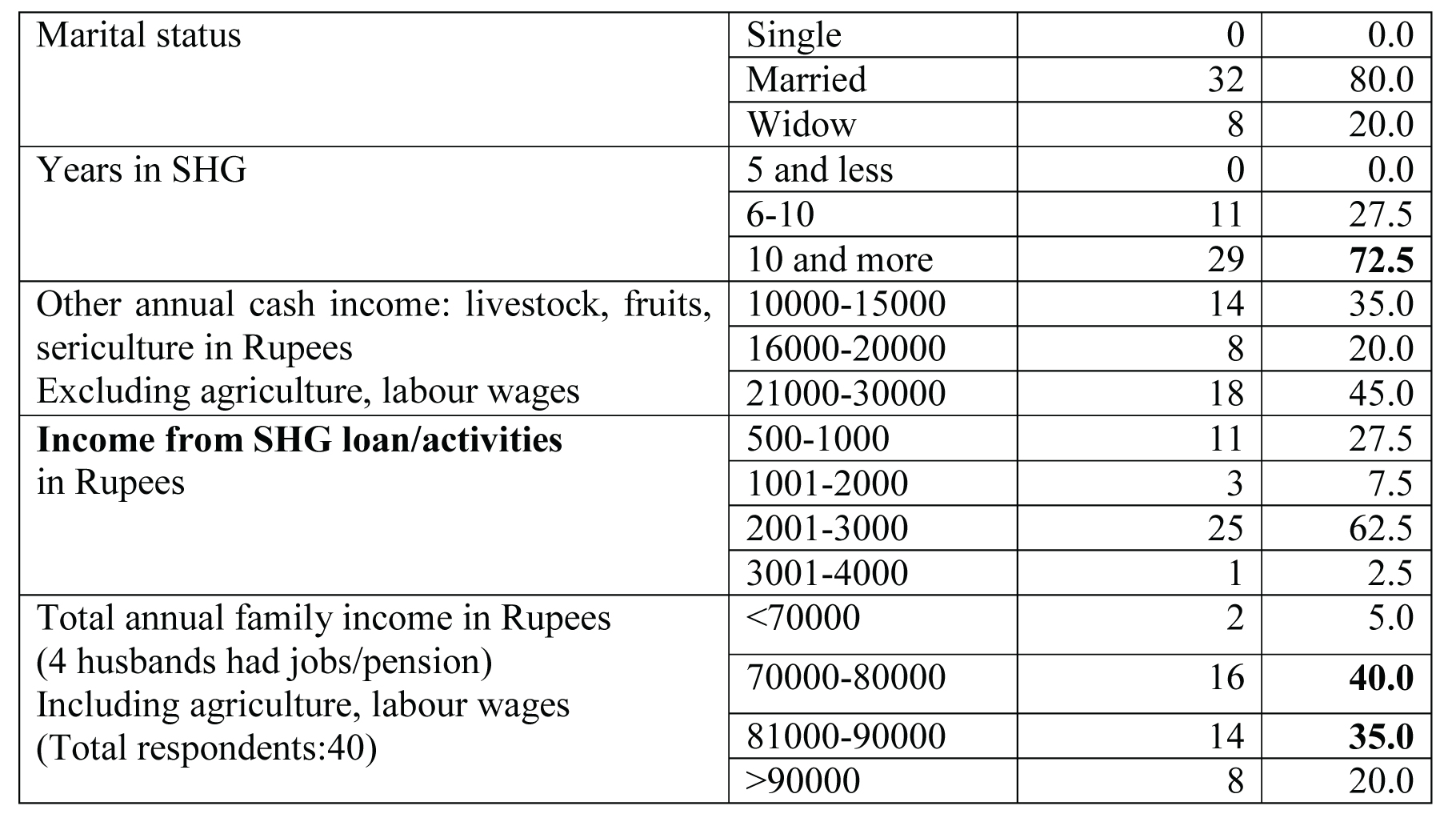

i) 65% women were school drop-outs before class 10; 17% were illiterate. ii) Average annual family income of the families was around Rs.80,000/- which was in the borderline of BPL, iii) The average annual income of Rs.2000/- per woman from loan taken from SHG indicated that they had start-up problems even after 7-13 years. iv) Some households supplemented their annual income by Rs.12,000/- to Rs.20,000/- raising goats, pigs, and cattle, v) Those who engaged in sericulture supplemented their annual income nearly by Rs.25,000/-.

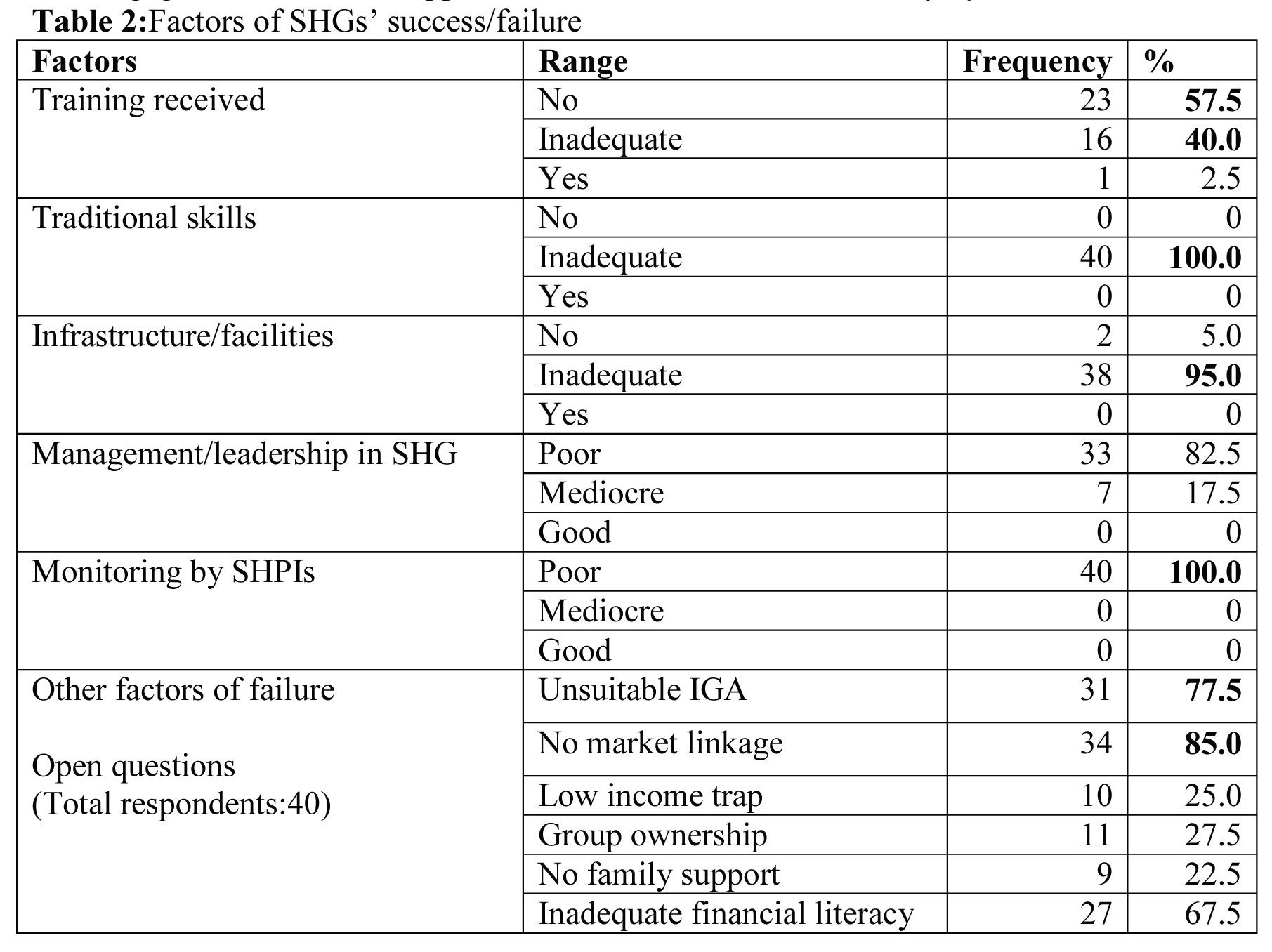

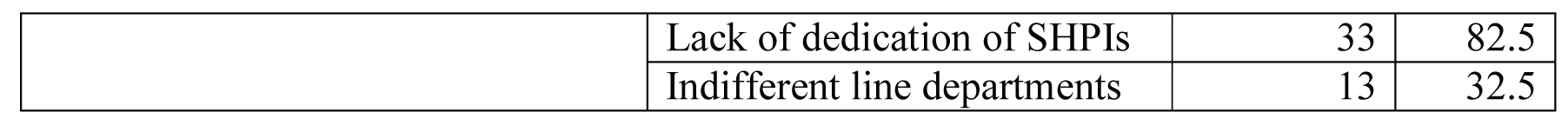

Discussions: After data analysis and empirical observations, following inferences could be drawn as the causes of the start-up problems of the SHGs:

i) Inability to identify suitable IGAs

There was a lack of professional aptitude in identification of suitable business opportunity (Aradhana Couksey, 2018) by the SHPIs. Women (77.5%) said that suitable IGA had not been identified. World vision distributed exotic(bideshi) breed of pigs and goats to Chand-Bhairo SHG. The livestock died within a couple of months. Some NGOs trained some women in mushroom cultivation. But such cultured mushroom neither had local market nor was it linked to urban market. Mushroom is fast perishable. A few ladies were trained to make incense stick, agarbatti, which they did not start. The women expressed that the local breed of pigs, goats and chicken would be more practicable as they would adapt to the local conditions, and their feed and maintenance would be cost effective. SHGs promoted by Jalgaon Janata Co-operative Bank, Maharashtra, managed, facilitated market linkage, and monitored the SHGs through the animators on an ongoing basis.

ii) Inadequate training

57.5% women did not receive training while 40.0% received inadequate training. They wanted capacity building with market linkage. The training imparted mainly focused on maintaining register of accounts, holding regular meeting and SHG-bank linkage. At the start-up phase, they did not express need for credit linkage.

iii) Inadequate economic infrastructure

95% women found the infrastructure and related facilities inadequate: scarcity of irrigation water, deficiency in services like animal husbandry, veterinary care and transportation. Inadequacy in veterinary support was said to be major cause of the failure of the poultry farm in Asanpahari. This inadequacy also demotivated the other women to raise more goats or pigs lest they should die of diseases en masse.

iv)Absence of organized agricultural market linkage

85% women pointed out difficulties in selling their produce. They sold their agri-products in the retail local markets/hatia. The IGAs of SHGs would scale up only when organized bulk marketing is ensured. Not much effort was visiblein this department. Incidentally, sericulture in the area had flourished because the Silk Board of India, Pilot Project Centre (PPC), and PRADAN (an NGO) had created an organized market with remunerative price.

v)Dearth of development actors in SHPIs

Lack of dedication of SHPIs (82.5% women) and poor monitoring (100% women) were stated to be among the major causes of SHGs’ start-up problems. SHGs in Bangladesh achieved success because of the vision, guardianship and dedication of Muhammad Yunus. In Icchalkaranji, Maharashtra, a co-operative bank had an SHG cell headed by an officer with expertise and experience in the functioning of SHG. The General Manager of the bank possessed a high level of dedication for poverty alleviation. He played a proactive role in marketing and market linkage of the products of the SHGs. In the West Garo Hills district of Meghalaya, the attitude of SHPIs towards SHG members (90.67% respondents) was not forthcoming (Veenita Kumari, 2010).

vi) Indifference of line departments

The block officials and the NGOs generally lost interest in the SHGs beyond formation, training and SHG-bank linkage. Kanan Devi, the leader of Bharti SHG, complained of bank officials for not responding to her queries. “It is often said that SHGs have to be linked with income generating activities, but it is far from reality” (Bibhu Mishra, 2018).

vii) Problem of group ownership of asset

All the 11 women of Bharti SHG said that group ownership of asset, especially the livestock, was impractical. It was difficult to distribute work and fix clear accountability. Individual ownership would allow one to see the impact of one’s contribution to work and thereby improve and realise satisfaction. P-value of group ownership indicated high significance (0.000).

viii) Weak leadership

82.5% women reported their leadership to be poor. In Sido-Kanu SHG, no member could enforce discipline when some women defaulted in repayment. In case of the poultry farm in Asanpahari, some women suspected their leader of misappropriating the fund.

ix) Low-level equilibrium trap

The women (25%) and their men expressed that their current level of income was too low for saving and investing in some economic activities, especially when return on such investments was un-remunerative or uncertain. They refrained from taking loan because they could not see viable economic activities. [Jharkhand PCI: Rs.20,106/- (2010), Dumka MPCE: Rs.920/- (2011), Govt. of Jharkhand report of the area: as on 2011-12]

x) Inadequate financial literacy

The SHG women (67.5%) did not understand market; the demand, supply and price. This deterred them to make informed and effective decisions with their resources. The Bharti SHG borrowed Rs.40,000/- from a bank at the first go, without assessing their repaying capacity. The training content for SHGs should include the basics of risk mitigation / management and guidance like “Start small”.

xi) Lack of family support

Some women (22.5%) talked of their non-cooperative alcoholic husbands. A few other reported that their grown-up children were addicted to mobile phones and did not cooperate. Most of these women had to manage household chores alone.

Inspite of the limitations in the functioning of the SHGs in these villages the following positive outcomes of forming SHG were observed;

i) Involvement in SHGs had made women appreciate thrift habit and saving. They showed improved responsiveness to financial literacy, ideas of self-reliance and resource management.

ii) They carried out the work of distribution of the subsidized rice, sugar and oil efficiently as “network for delivering Government services” (Bibhu Mishra, 2018).

iii) They looked more organized, positive and motivated than before.

Concluding statement

Identification and establishment of viable income generating activities for SHGs are paramount for promoting self-employment and organizing rural poor. Otherwise, the vision of National Rural Livelihood Mission (DAY-NRLM)shall crumble and collapse. It was essential for SHPIs to become development actors. This entails identifying IGA, appropriate training and capacity building, handholding, market linkage and close monitoring; whose dearth was the weak link in the effective functioning of SHGs in Kathikund area.

Recommendations

1. Professionalism in identification of suitable potential income generating activities for SHGs and market linkage of SHGs’ produce should be accorded priorityat the start-up phase.

2. The SHPIs should take responsibility beyond forming SHGs, imparting training and SHG-bank linkage and guide and monitor SHGs till maturity, i.e. becoming development actors.

3. Under National Rural Livelihood Mission (now DAY-NRLM) a special cadre should be created involving officers/experts with interest and aptitude for rural development, to monitor the schemes for SHGs.

(Dedication is essential for the success of any scheme, particularly rural development. Behind the success of SHGs there were people/agencies with great dedication: Muhammad Yunus (Bangladesh), Varghese Kurien (AMUL), Ela Bhatt (SEWA), Indira Kranti Pathaam (Andhra Pradesh), Kudumbashree (Kerela), Dr. Spencer Hatch (YMCA, Marthandam, Tamil Nadu), etc.

4. The Government could take initiative for consolidation (Chakbandi) of dispersed small landholdings (discrete land use) of the farmers to facilitate farming in enclosed structure which would be similar to controlled-environment agriculture (CEA), e.g. a greenhouse, to augment productivity of the land.

References:

- Sharma, A. Devidas and Sharma, M. Tangkeswor. Microfinance through SHGs – A case study of SHGs in Imphal East District, Manipur. International journal of basic and applied research.July 2019. Volume 9, number 7.

- Esty, Katharine. Lessons from Muhammad Yunus and Grameen Bank. 2011. OD PRACTITIONER, Vol.43 No.1.

- Mishra, Bibhu. What is next for Slef Help Group in India?. June 29, 2018. Times of India, Blogs.

- Chouksey, Aradhana. Investigations of Issues of Self Help Group Promoting Institutions. Pramana Research Journal. February 2019.

- Trends and Progress. Reserve Bank of India. Box vii.3, September 04, 2008.

- NABARD.Status of Microfinance in India 2018-19. Mumbai

- Meena, M.S., Singh, K.M., Singh, R.K.P., Kumar, Abhay., Kumar, Anjani. Dynamics of Income in Jharkhand: Evidences from Village Studies. Article in SSRN Electronic Journal. October 2013.

- Kumari, Veenita. Assessing role of self-help promoting institutions (SHPIs) in empowering women through SHGs. Asian Journal of Home Science (June, 2010) Vol. 5 No. 1: 165-169