Subscribe now to get notified about IU Jharkhand journal updates!

A study on capital market performance analysis of few selected companies in Indian real estate sector

Abstract :

Capital market performance of a stock can be analysed from different dimensions such as return, risk, liquidity etc.The proposed study will provide emphasis on computation and interpretation of return, risk and coefficient of variation of five selected real estate companies such as Brigade Group Limited , Godrej Properties Limited , DLF India Limited, Housing Development Infrastructure Limited(HDIL) and Oberoi Realty Limited for the financial year 2018-19.Apart from that, financial performances of these companies will be evaluated on the basis of few selected profitability ratios including gross profit margin, net profit margin, operating profit margin, return on asset, return on equity and return on capital employedfor a period of five accounting years such as 2014-15, 2015-16, 2016-17, 2017-18 as well as 2018-19.Annual report of the five companies will be analyzed for a period of five years to discuss their financial performances. Stock price data of these companies will be considered from the website of Bombay Stock Exchange to evaluate their capital market performances.

Keywords :

Return, risk, coefficient of variation , gross profit, net profit, return on equity1. Introduction

Capital market is a mechanism through which fund can be borrowed or lent in the long run. It can be categorised into two broad groups- primary and secondary market. Primary market is the mechanism where fund can be raised by the companies from the market by issuing equity shares. Initial public offer, Follow on Public Offer, Right Issues, Preferential Allotment and Depository Receipts are examples of primary market. Secondary market is the mechanism where already issued shares are being traded. Stock Exchanges such as Bombay Stock Exchange and National Stock Exchange are examples of secondary market. There are different parameters to measure the secondary capital market performances of a stock such as risk, return, coefficient variation etc. The study will focus on capital market performance analysis of few selected real estate companies. Apart from that, financial performances of these companies will be evaluated on the basis of few selected profitability ratios.

2. Survey of Existing Literature

Worzala and Sirmans ( 2003) have advocated an investment strategy that uses ‘indirect’ real estate investments, sometimes called property securities (in the US typically proxied by REITs), as the real estate asset class in an investment portfolio.

Narayan and Reddy ( 2018) studied the impact of traditional (Return on Asset, Return on Equity, Return on Invested Capital) and modern performance measures (Economic Value Added) on stock returns.

Andrei, Hasler and Jeanneret (2019) opined that uncertainty influences investors’ decisions and hence it affects equilibrium asset returns. Investors’ learning amplifies the impact of uncertainty on asset prices. This amplification seems counterintuitive as learning is expected to reduce uncertainty and to attenuate its impact.

Kalev, Saxena and Zolotoy (2019) said that investors demand a higher risk premium for holding stocks with greater exposure to covariation risk, that is, stocks that have low returns when investors simultaneously receive bad news about both future cash flows and future discount rates.

3. Objectives

- To analyze the financial performances of five selected companies of Indian real estate sector.

- To discuss the capital market performance of five selected companies

- To rank the companies on the basis of their financial as well as capital market performances.

This is discussed under different dimensions including methodology, sample of study, time horizon, tools and techniques used as well as sources of data.

Methodology

The proposed study will combine explanatory and empirical research.

Sample of the study

Five real estate companies will be considered for the study such as Brigade Group Limited , Godrej Properties Limited , DLF India Limited , Housing Development Infrastructure Limited(HDIL) and Oberoi Realty Limited .

Time horizon

Study has been made for a period of five accounting years such as 2014-15, 2015-16, 2016-17, 2017-18 as well as 2018-19.

Tool and Techniques used

Different Financial ratios will be calculated such as gross profit margin, net profit margin, operating profit margin, return on asset, return on equity and return on capital employed. Apart from these, different capital market indicators will be computed such as daily return, risk and coefficient of variation.

Sources of data Annual report of the five companies will be analyzed for a period of five years to discuss their financial performances. Stock price data of these companies will be considered from the website of Bombay Stock Exchange to evaluate their capital market performances.

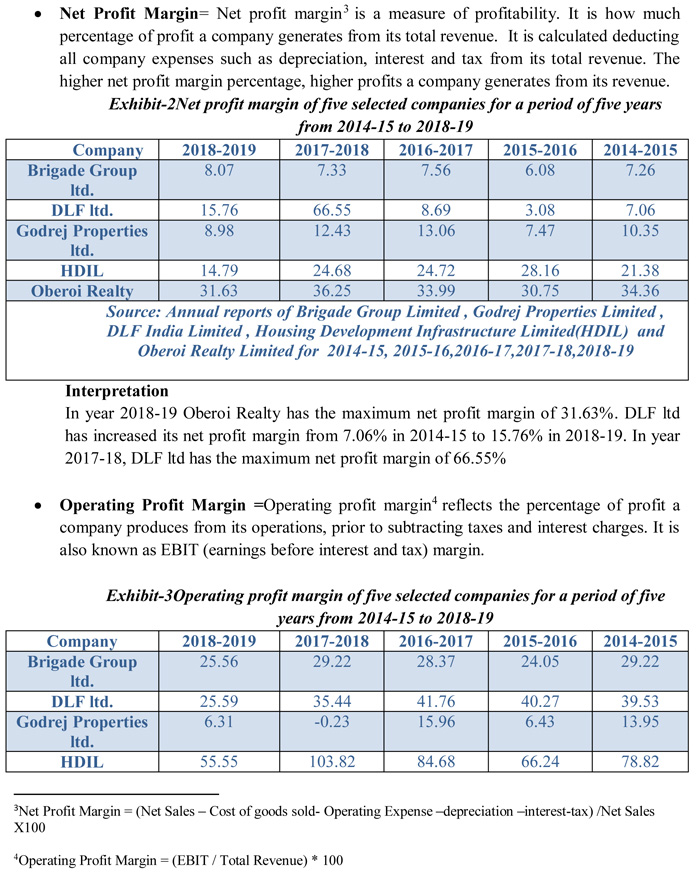

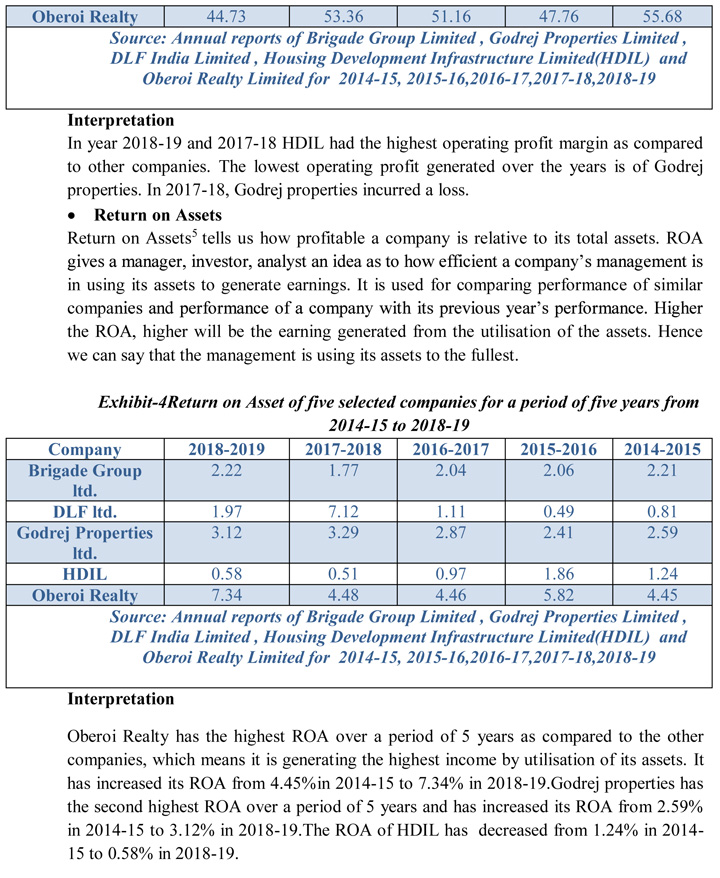

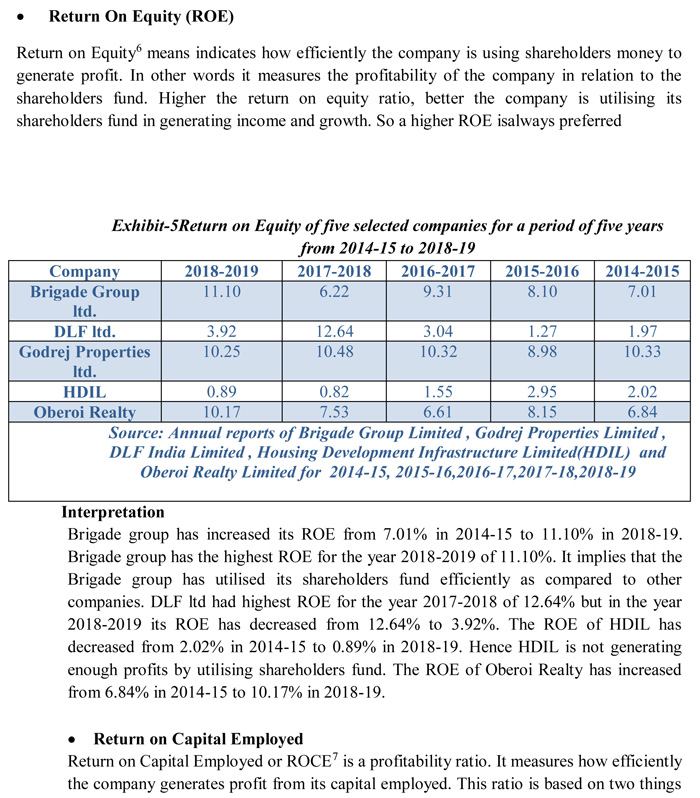

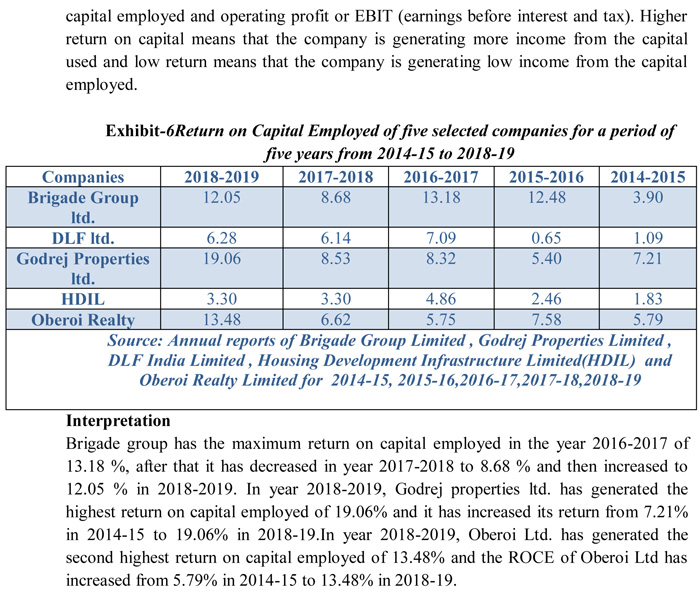

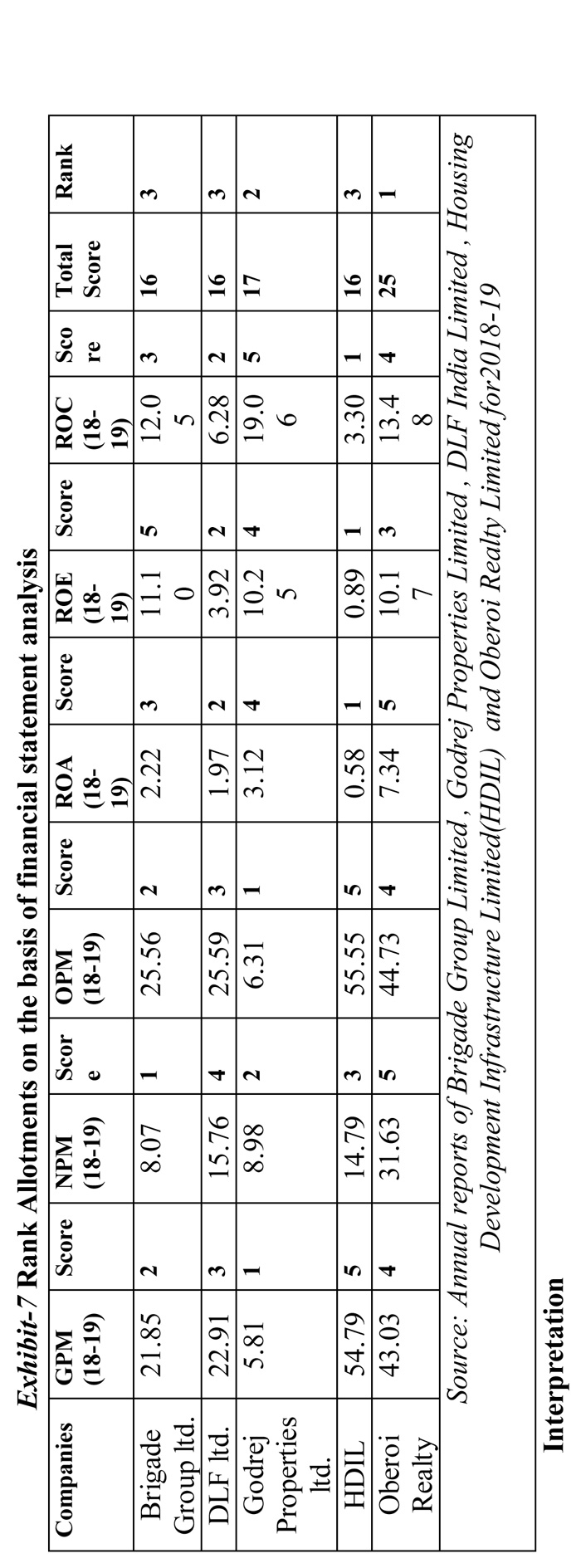

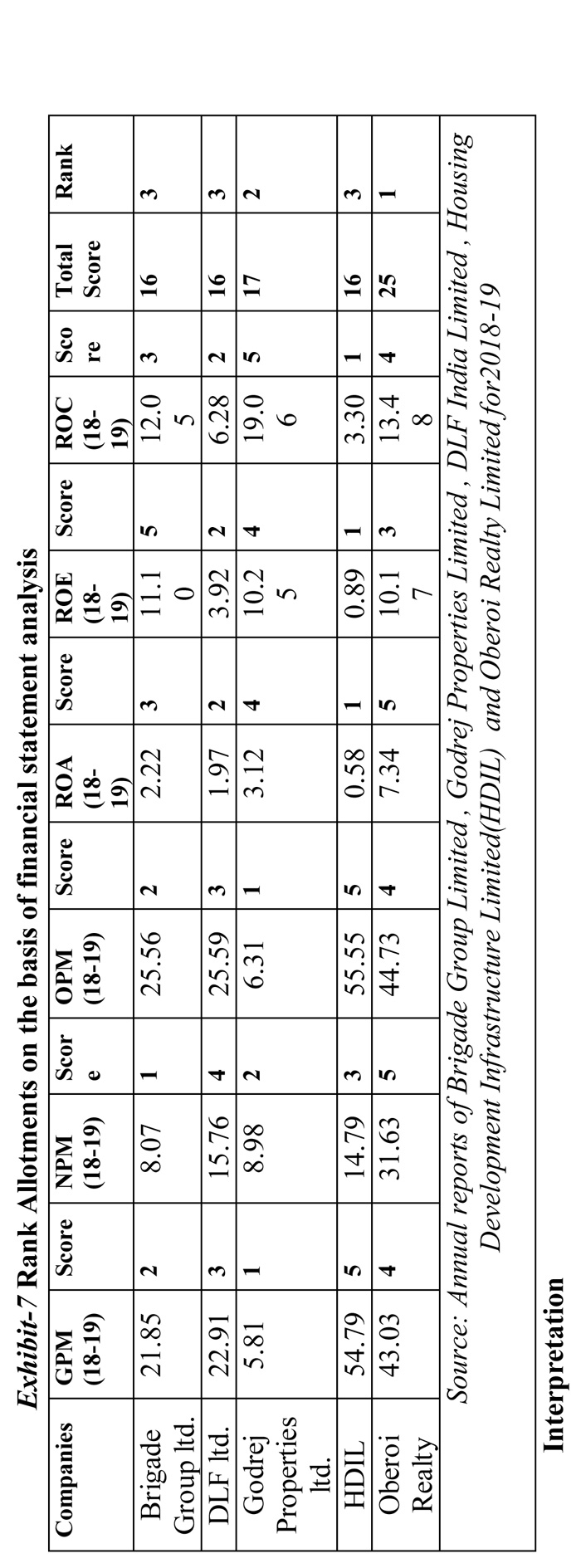

5. Financial Statement Analysis It incorporates computation and interpretation of different ratios such asgross profit margin, net profit margin, operating profit margin, return on asset, return on equity and return on capital employed of Brigade Group Limited, Godrej Properties Limited, DLF India Limited, Housing Development Infrastructure Limited (HDIL) and Oberoi Realty Limited fora period of five accounting years such as 2014-15, 2015-16, 2016-17, 2017-18 as well as 2018-19. Thereafter these five selected companies have been allotted ranks on the basis of their financial performance in 2018-19.

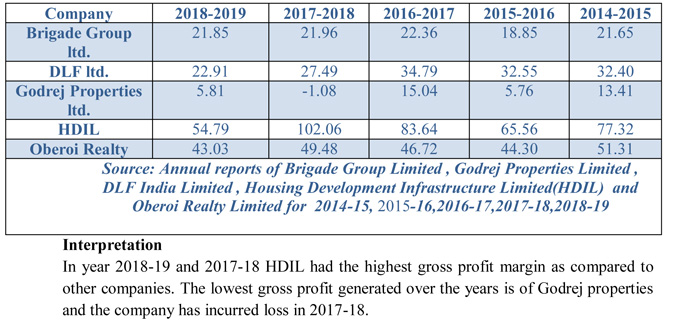

Gross Profit Margin =Gross Profit Margin is a profitability ratio that measures how much of revenues is left after deducting the cost of goods sold (COGS). The higher the percentage, the more the company retains as revenue of sales after deducting the COGS.

Exhibit-1 Gross profit margin of five selected companies for a period of five years from 2014-15 to 2018-19

Here companies are ranked based on their profitability ratios such as Gross Profit Margin, Net Profit Margin, Operating Profit Margin, Return on Asset (ROA), Return on Capital Employed (ROC) as well as Return on Equity (ROE) in 2018 -19. Higher the Gross Profit Margin, Net Profit Margin, Operating Profit Margin, Return on Asset (ROA), Return on Capital Employed (ROC), Return on Equity (ROE) , companies are doing good and vice versa.5 is the highest score and 1 is the lowest. The total score is nothing but the sum total of scores obtained on the basis of these six ratios. Higher the total score company is doing well and vice versa. As per the financial performance of these selected companies, Oberoi Realty has the highest score and so is ranked 1st.Godrej Properties is allotted 2ndrank. Brigade Group, DLF and HDIL have scored the lowest .Jointly these three companies have been allotted 3rd rank. So

Oberoi Realty is the top performer followed by Godrej Properties in terms of financial performance.

6. Capital market performance analysis

It incorporates computation and interpretation of different indicators such asreturn, risk and coefficient of variationof Brigade Group Limited, Godrej Properties Limited, DLF India Limited, Housing Development Infrastructure Limited (HDIL) and Oberoi Realty Limited for2018-19. Thereafter these five selected companies have been allotted ranks on the basis of their capital market performance in 2018-19.

- Return

Return of a share is defined as the difference between today’s closing price and yesterday’s closing price divided by yesterday’s closing price. Rational investors prefer to sacrifice current conspicuous consumption and block their hard earned money in different equity shares in order to derive a higher rate of return in the future. Higher the return, security is doing well and vice versa. Return is normally measured by arithmetic mean. - Risk

The rate of return from investments in equity shares vary widely. The risk of an investment refers to the variability of its rate of return. The total risk is measured by standard deviation which is considered as an absolute measure of dispersion. Rational investors prefer to invest in a security where risk is less. Lower the risk, security is doing well and vice versa. - Coefficient of Variation

Risk premium implies additional return investor is enjoying due to taking additional risk. It indicates higher return is accompanied by higher risk. To do a tradeoff between risk and return, Coefficient of Variation (CV) is calculated for the stocks. CV is measure of relative measure of dispersion. It is calculated as standard deviation divided by mean multiplied by 100. Therefore CV is used to compute risk per unit of return from the stock. Lower the CV, stock is doing good and vice versa. If investors have to choose between few stocks on the basis of their invest-worthiness stocks will least CV should be selected as it ensures minimum risk per unit of return.

Here companies are ranked based on the basis of different capital market indicators such as daily return, daily risk, coefficient of variation in 2018 -19.Higher the return, company is doing well in capital market. Lower the coefficient of variation, company is doing well. Least coefficient of variation implies risk per unit of return is the minimum. 5 is the highest score and 1 is the lowest. The total score is nothing but the sum total of scores obtained on the basis of return and coefficient of variation. Higher the total score company is doing well and vice versa. As per the capital market performance of these selected companies, Godrej Properties has the highest score and so is ranked 1st.Oberoi Realty has ranked 2nd. Brigade Group and HDIL have scored the lowest and so they are ranked4th.So Godrej Properties is the top performer followed by Oberoi Realty in terms of capital market performance.

7. Conclusion

Oberoi Realty has been allotted 1strank and Godrej Properties is allotted 2nd rank on the basis of their financial performances. Godrej Properties has been allotted 1st rank and Oberoi Realty has scored 2ndpositions on the basis of their capital market performances. Brigade Group and HDIL are providing negative return in capital market so these two companies will not be considered for investment. Therefore investors can invest their hard-earned money in the stocks of Godrej and Oberoi Realty without any ambiguity. Both the companies are doing well in terms of financial as well as capital market performance. It can also be concluded that there is a strong interdependence between financial and capital market performance of the companies. Companies having good financials are outperforming in capital market and vice versa. Hence, investor should take into consideration the financial as well as capital market analysis before judging invest-worthiness of a stock.

References

- Andrei, D. (2019 ). Asset Pricing with Persistence Risk. The Review of Financial Studies , 2809-2849.

- Kalev, P. S. (2019). Coskewness Risk Decomposition, Covariation Risk and Intertemporal Asset Pricing. Journal of Financial and Quantitative Analysis, 335-368.

- Narayan, P. a. (2018). Impact Of Financial Performance Indicators On Stock Returns: Evidence From India. International Journal of Business and Society, 762-780.

- Worzala, E. a. (2003). Investing in International Real Estate Stocks:A Review of the Literature. Urban Studies, 1115-1149.