Subscribe now to get notified about IU Jharkhand journal updates!

Strategy for Venturing into the Unknown with System Dynamics Approach: Case study of a diversified company

Abstract :

System Dynamics approach can be used to enable business decisions. The paper presents a case study how a company under debt restructuring and at crossroads to decide its business areas can utilize system dynamics for business decisions. It elaborates the external environment like industry, market, competitors and the internal variables like business portfolio and margins. The objective is to place a schema to further develop a model of system dynamics to study this complex organization.

Keywords :

System Dynamics, corporate restructuring, adoption criteria, customer value, shareholder value matrix1. Introduction

We come across tough decisions in our life and business. In reality, we come across the Abilene paradox which states that on a course of action, a group collectively decides which is against the preference of the most or all individuals in the group. The leader of McNally Bharat, Mr.Singh sits in on a flight to Mumbai and is worried if his company may be in such a paradox.

There are two theories for everything and so is for diversification. McNally Bharat Engineering Co. Ltd.(MBE) born out of McNally Pittsburg from USA faced this challenge 20 years back. In the year 2000, MBE was concentrated in building coal handling plants and mining equipment in India. It had a good synergy between the factories which manufactured equipment and the projects which used these equipment. However, when the company started losing tenders in the projects business to competitors, the factories went dry, there was a decision to shut the project business and make factories self-sufficient. The then, head of projects expressed his divergent view and suggested diversification. The company gave him a chance. In 10 years the company forayed into Power Plants, Steel, Cement, Ports, Water and Infrastructure projects. From a share price of Rs. 30 it went uptoRs. 340. The head of projects became the Managing Director. It infused technology in Ash Handling, port cranes and equipment. It acquired two companies in Hungary and Germany. In 2010, the Managing Director retired and a new incumbent took lead.

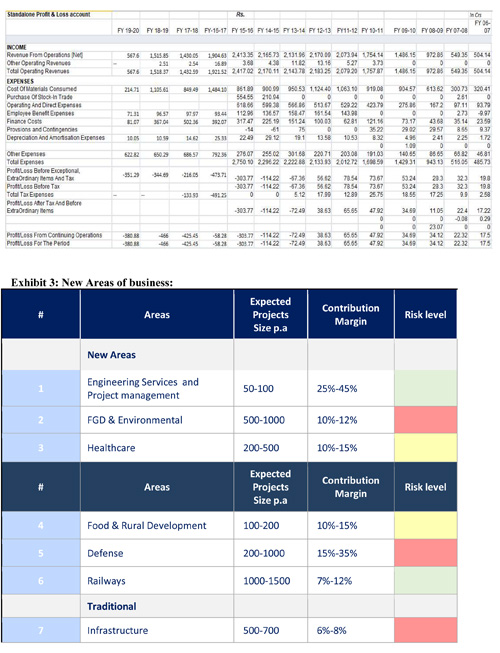

However, there was a management shift in 2012 and a star stock soon fell. By 2016 the company was debt ridden and share price fell to Rs. 3(Figure 5: share price : source money control The company requested the old hand to overhaul the limping horse.

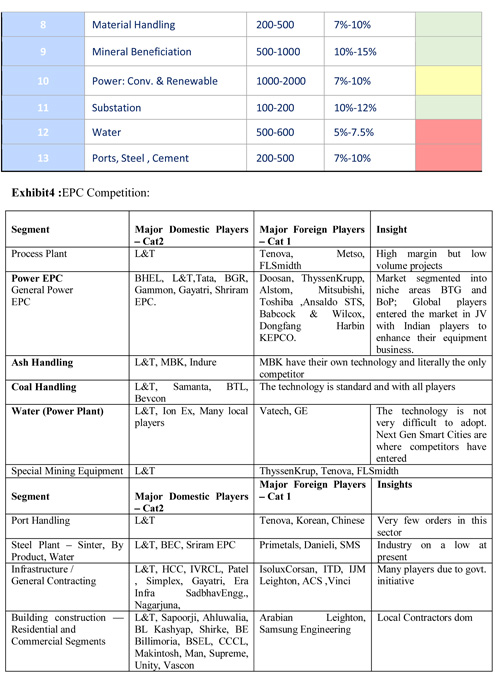

In 2016, the core industries Power, Coal, Steel etc. all were at the rock bottom. The Govt. was giving priority to infrastructure building in Highways than to the industrial sector. The company has a choice again, to foray into the infrastructure sector of Roads, Solar Power, Railways and Defence where the Government spending is directed or to stay in the core sector. (Annual report MBE 2016-17)

The leader has a two pronged question, one, how to come out of the debt trap of (Business Line, 2020)Rs. 3000 Cr. and second which way to go? Recently formed strategy cell has proposed a system dynamics approach to the Managing Director. While on the way to Mumbai for a bankers meet, Mr. Singh reads the proposal and is introspected how useful a new method would serve in this crisis and will people understand it.

System Dynamics was introduced by JW Forrester in 1950’s with his works Industrial Dynamics(Vijay2, 2001).It was used by General Electrics, US Navy and NASA, however, it is still not there in mainstream industry application.(McKinsey, 1995)

The Industry

There has been a slow down in the sectors MBE works. No new steel plant, power plants, cement plants and very few projects have come in the core sectors where MBE works. This has challenged the organization to foray into new sectors. Moreover, with the weak financials, competitors have influenced clients to put conditions in tenders where MBE is disqualified on financial grounds. This has lead to MBE loosing tenders in the core sectors to competitors.

The Process Business Uniti.e mineral processing sector is heavily dependent on one customer. The reason is a lack of projects in other minerals like Aluminium, Copper etc. Here the customers are Vedanta, Aditya Birla, NALCO, Hindustan Copper and the iron ore mine owners. The active client is now Vedanta and in particular Hindustan Zinc. This has lead MBE to venture abroad get projects in Iran, Oman, Turkey and Morroco. This sector gets a business of INR 500- INR 800 Cr. per year. A adjacent technology area where MBE has entered is the paste fill for mines. This is a market of around USD 45 Billion worldwide.

Market Overview:

With the government spending directed in Roads, Highways and infrastructure segments, MBE has formed strategic alliances with Turkish, Maltese and Polish partners. In these sectors too there are hurdles of financial criteria and risks pertaining to lack of experience.

Despite the above weaknesses, MBE has forayed into a 100MW solar power project and successfully commissioned the same. With this MBE has entered the renewable energy sector. With the mining sector on a slowdown, the requirement for mining products in MBEs product range has declined. MBE has introduced a new product Bailey Bridge widely used in the Defence sector.

The Govt. intends to privatize the railway and defense sector and this had provided an opportunity to MBE. A new product line in undercarriage frames for loco and shell manufacturing for locomotives is under development by MBE. In the defence sector, MBE is penetrating the Maintenance and Repair works for Army.

For environmental issues all power plants are now required to install Flue Gas Desulpherizing plants (FGD). This wave came in 2015 and still going. However, due to the financial weakness, MBE could not bag projects. This sector is ideal for MBE. It provides the same strengths MBE has in Process and material handling sectors where MBE provides the EPC solutions and manufactures key components at its works. In a FGD plant 75% of equipment are in MBE’s product range. This is a sector MBE shall be active in the coming future, but unfortunately has missed the first wave.

The global EPC market is estimated to be USD 1.67 Trillion (INR 117 Trillion) by 2020 and growing at CAGR 4.5%. Of this Asia Pacific accounts for 42% MENA 43% and EU 15%. The EPC market in India is estimated to be INR 20-25 Trillion by 2020. (EPCMArket) (EPCIndia).

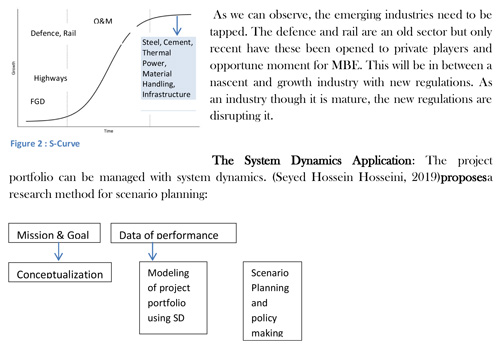

If we look at the core sectors they are in the mature phase and the emerging technologies for Solar and FGD. Below is the S-curve for the sectors:

Modelling & Simulation

In this study we aim to focus on corporate restructuring to affect both assets and liabilities of the company along with creating value. The restructuring may be classified into Sell-offs, Spin-offs or split-offs and liquidation(Anreas Kremper, 2004). A similar concept may be applied to product, lines or sectors in which MBE is operating and wants to enter.

We can do this with a simplified discounted cashflow model to identify corporate value. To select variables, we will narrow down the complexity of the model by reducing decision conditions. We consider the raw material costs, market size & market share as important factors to drive earnings. The model development is beyond the scope of the article, but we elaborate the method for such a model. The model will allow the option to observe scenarios before and after restructuring. This will elucidate the change in variables after restructuring. For sensitivity analysis, the variation in market share will be allowed. This will allow the management to decide which areas to pursue and which to leave.

Conclusion

The article tries to present the complexity of a project-based company and how system dynamics can be a tool to make informed decisions. It elaborates why the method is critical to a complex organization and how it can help manage project portfolios, R&D initiatives and corporate restructuring. A holistic approach can therefore be developed.

Further work can be done to to study the choice of risky projects to determine an optimal portfolio. It is interesting to note that human factors have not been studied by the paper and that is another scope of research with this company.

Exhibit 1: History of MBE - Goodwill Hunting

"We shall be a growth-oriented global organization, delighting our stakeholders through innovation and excellence in all our activities."(Vision Statement MBE)

McNally Bharat Engineering Co.Ltd.has its humble origins in 1961 at Kumardhubi (Jharkhand) by a joint venture between McNally Pittsburg USA and Bird & Co. UK. The first cross country conveyor belt 800TPH was built in 1968. In 1970, the flouspar beneficiation technology was indigenized by MBE and First Carbon paste plant was commissioned. In 1972 the company was completely indiginzed and rechristened McNally Bharat Engg. Co. Ltd. From 1972-1998 MBE became a well recognized in the coal mining sector with many installations of conveyors, Bucket Wheel Excavators, Spreaders, Rapid Loading Systems, Wagon Tippler installation. It absorbed the Vibrating Grizzly Technology from AUMA, acquired Sayaji Engineering, EWB Hungary for pneumatic conveying technology, KHDHumbolt for beneficiation technology.

MBE has a diversified portfolio of projects executed in Material Handling, Ports, Steel, Cement, Mineral Beneficiation, Aluminium, Zinc, Copper, Balance of Plant in Power sector, Water treatment projects, Roads and Infrastructure. With more than 3000+ employees and multidisciplinary engineers, MBE brings in one-stop EPC (Engineering, Procurement and Construction) Capabilities. It has completed more than 350 projects in India and abroad. This was possible by a through a series of collaborations and technical tie-ups with world class technology providers. Some of its associates include SOLIOS in France, Poltegor and Famac in Poland, TPE in Russia, DMT in Germany, Siemens Vai in France, KCI Cranes in Finland, CODCO and MCC in China, GRD Minproc in Australia, GeaMesso in Swiss, UralmashEngg. in Russia, MekhanobrChormet (Ukraine) etc. MBE rose to become a 2000 Cr. Company from 1998-2010. However since 2010, it tripped down to a debt ridden company and presently in a financial trap (Exhibit 2). Since 2016 the revival and restructuring of the organization is underway. This is being done by introducing a strategic investor and closing all loss making old projects. There were 200 old projects of which 140 have been closed and 60 nos expected to be completed in next 9 months. With closing of old loss projects, now MBE can strategically place itself in a niche position in EPC sector

References

References

- (1995, Nov 1). Retrieved from McKinsey: https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/the-beginning-of-system-dynamics (2020, Dec 10). Retrieved from https://www.moneycontrol.com/india/stockpricequote/engineering/mcnallybharatengineering/MBE (n.d.). Annual report MBE 2016-17.

- Anreas Kremper, F. K. (2004). Corporate restructuring dynamics : A Case Analysis.

- Burcu Tan, a. E. (2010). Evaluating system dynamics models of risky projects using decision trees: alternative energy projects as an illustrative example.

- Business Line. (2020, July 21). Retrieved from Business Line: https://www.thehindubusinessline.com/news/mcnally-awaits-lenders-nod-for-resolution-plan/article32148920.ece

- Fernando José Barbin Laurindo (POLI/USP) Cláudio Roberto Leandro (POLI/USP) crleandro@terra.com.br, f. (2006). Using System Dynamics to Identify Competitive Movements. A Case Study in a Small Hardware Manufacturer.

- Fordb, J. M. (2000). Strategic management of complex projects:a case study using system dynamics. System Dynamics Review, 237-260.

- Metawie, M. R. (n.d.). A Rationale forUsingSystemDynamicsinMarketingAnalysis. ICBR.

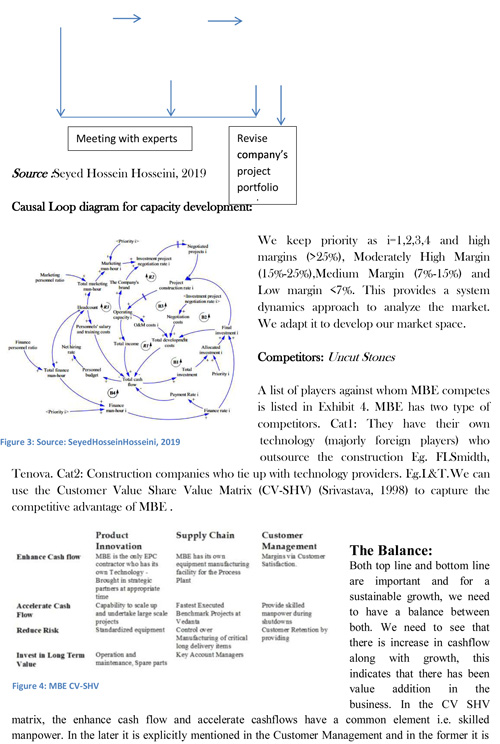

- Seyed Hossein Hosseini, H. S. (2019). A system dynamics investigation of project portfolio management evolution in theenergy sector: Case study: an Iranian independent power producer.

- Singh, B. &. (2007). Corporate restructuring: Reconfiguring the firm. Strategic Management Journal 14(S1):5 - 14.

- Srivastava, S. a. (1998). Market Based Assets and Shareholder Value: A Framework for Analysis. Vol 62, Journal of Marketing .

- Vijay2, V. T. (2001). Research Seminar in Engineering Systems.

- Wang, J. (n.d.). A System Dynamics Model for R&D Portfolio Management. Technology and Social Science 2019 (ICTSS 2019).

- Warren, K. (2005). Improving strategic managemnt fundamental principles of system dynamics†. System Dynamics, 329-350.

- Warren, K. (n.d.). System Dynamics. Retrieved from https://strategydynamics.com/books-and-papers/strategy-dynamics-essentials/

- (n.d.). Retrieved from http://www.mcnallybharat.com/about/company-profile

- (n.d.). Retrieved from https://www.researchandmarkets.com/reports/4386363/global-oil-and-gas-epc-market-market-analysis

- (n.d.). Retrieved from https://www.mordorintelligence.com/industry-reports/india-power-epc-market

- (n.d.). Retrieved from www.moneycontrol.com

- MBE. (n.d.). Retrieved from http://www.mcnallybharat.com/about/vision-mission

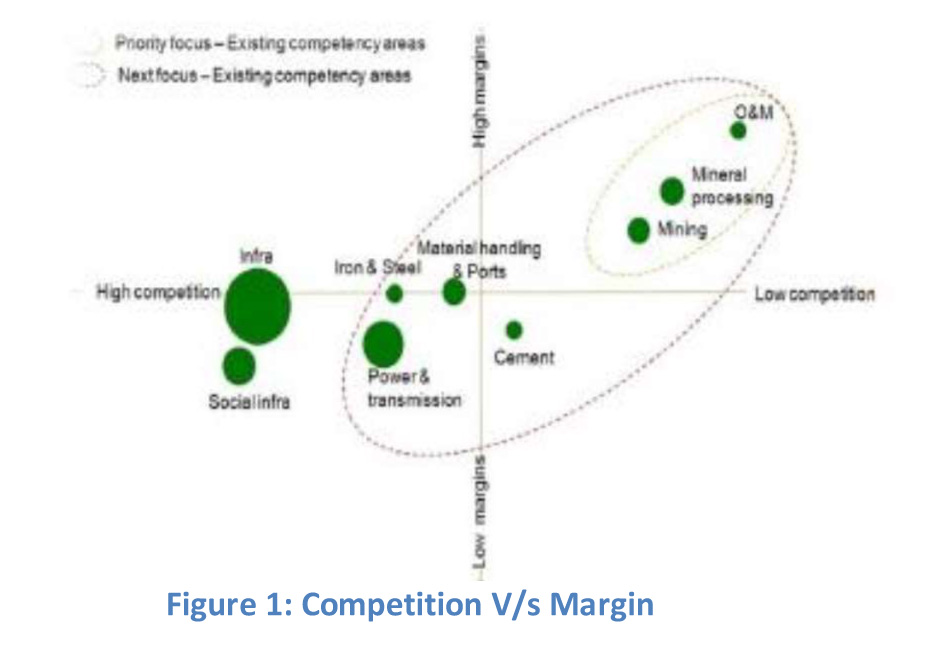

- Figure 1: Competition V/s Margin

- Figure 2: S-Curve: Stages of sectors in competition

- Figure 3: Source : Project portfolio Management with system dynamics.(Seyed Hossein Hosseini, 2019)

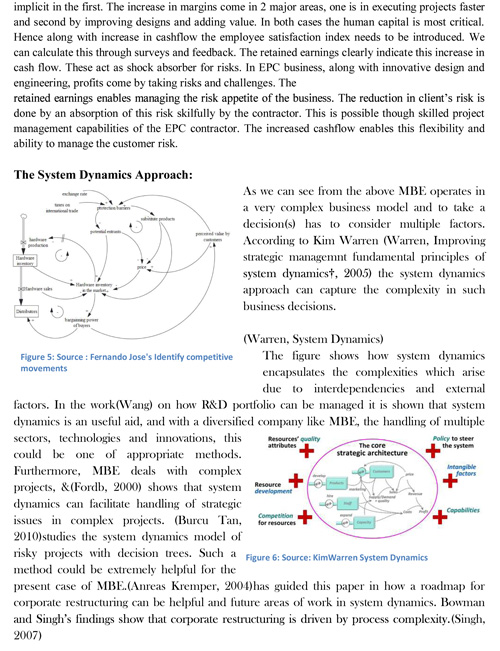

- Figure 4: Customer Value-Shareholder Value Matrix (CV-SHV)

- Figure 5: Source : Fernando Jose's Identify competitive movements

- Figure 6: Source: KimWarren System Dynamics

- Figure 7: Source: www.moneycontrol.com, mbe historical stock price trend