Subscribe now to get notified about IU Jharkhand journal updates!

A Study on the impact of Real Estate Regulatory Authority (RERA) on the Indian Real Estate

Abstract :

Real estate is the second largest employment generator after agriculture and 4th largest sector in terms of FDI inflows. FDI in the sector stood at US$ 24.54 billion from April 2000 to June 2017. By 2028, India’s real estate market size is expected to reach US$ 853 billion, increasing from US$ 126 billionin 2015. The residential real estate is approximately 80% of the entire real estate in India. India’s housing demand is expected to grow in future primarily due to its increasing population, and an expanding economy. Residential real estate has been one of the major asset classes where people have been buying residential properties either for residing into it or as an investment for future gains. The India residential real estate witnessed an unprecedented demand primarily because of emergence of nuclear families, rapid urbanisation and rising household income. The phenomenal growth of real estate attracted the attention of investors and speculator started pumping money in the sector and increased the buying selling activities. This investor led demand pushed the price of real estate to astronomical heights, which recorded an average of 25% increase in price YoY from 2006 and peaked to 30.6% in 2011.

Keywords :

Real estate, employment generator, household income, demandIntroduction

In spite of being such a large sector that has huge amount of money invested in it, the Indian real estate sector has been highly opaque and marred with unethical practices followed by the developers. False commitments to customers, construction delays, lack of clarity on the configuration of the property and poor construction quality are few of the sore points of this industry. Due to lack of any regulators, the customers were left at the mercy of developers, and they hardly had any option to get their grievance addressed. There are examples where the buyers have booked the flats in 2010 and yet the construction has not started for these projects. As of 2020, approximately5.76 lakh housing units worth Rs 4,64,300 crore are delayed in seven major cities of the country. In the absence of any regulator, the developers were rampantly launching projects just on papers and the money collected from the buyers were being diverted to either spent on accumulating land or were siphoned away to some other business verticals. Amidst this rampant malpractices, the ultimate looser was the common man who had put his hard earned money at stake based on the false claims made by the developer.

To address the rampant malpractices in the residential real estate sector, and protect the buyers’ interest the Real Estate Regulatory Authority (RERA) was formed in 2016. RERA makes it mandatory for all commercial and residential real estate projects where the land is over 500 square metres, or eight apartments, to register RERA for launching a project. The main objective of this act is to provide greater transparency in project-marketing, execution and provide a platform to the buyers for getting their grievances addressed in a time bound manner.

1. Real Estate Regulatory Authority

To bring transparency and protect buyer’s rights in Real Sector, Central Government introduced The Real Estate (Regulation & Development) bill in Aug 2013. Later, it was passed in Lok Sabha and Rajya Sabha and came in force from 1 May 2016. The act proposes establishment of Real Estate Regulatory Authority in each state. It specifies the responsibilities, functions & power of authority to supervise Real Estate transactions, appoint arbitrating officers for settlement of disputes and imposition of penalty.

RERA Rules

The broad objective of the act was to bring transparency in the real estate sector, fix accountability and provide a time bound credible grievance resolutions to the home buyers. Building that are less than eight units or built on less than 500 square meter of plot are outside the purview of RERA. Projects that have received occupation certificate as on 1st May 2017 are not required to be registered under RERA. Apart from these two exception all the under construction residential projects will come under the purview of RERA. The broad rules are as follows:

- Developer cannot start to market a project before getting it registered with RERA- Developers needs to avail all the government approvals for the construction and submit the document to the respective state RERA authority. Post scrutiny of the documents by the RERA, the project will be registered and allotted a registration number. The developer needs to mention the allotted registration number in all the marketing documents of the projects.

- Builders as well as brokers who are dealing in the primary sales of the residential projects need to be registered with RERA- To bring in accountability and a level of filtration, RERA has mandated that the developers and property brokers have to get themselves registered authority after providing the basic details like PAN card number, company names, details of their financial dealings.

- Builder has to disclose all the project related details- The builder has to mention all the project related details on the RERA website. The details include project plan, layout, all the approvals required to commence the construction, sanctioned floor space index (FSI), the number of buildings and wings, the number of floors in each building, etc.

- The builder needs to mention the price on carpet area- Earlier the builders used lot of different measures like built-up and super built-up, that use to confuse the buyers. Mentioning the price now only on carpet area will bring transparency in the pricing.

- Consent of 2/3rd of the buyers is required for any change in the sanctioned plan- This was quite common as a builder would sell a nine-floor building and then in the middle of the project, they would inform the buyers that now they will be building 15 floors as the permission has arrived. The buyers were left wondering that whether a 15 floors building can sustain on a 9-floor foundation. Now it is mandatory to have the consent of 2/3rd of the buyers of for making any such changes.

- Once a project has been registered the progress detail needs to be updated on RERA website on a quarterly basis- The builder has to regularly update the construction progress details, as well as the number of units sold on the RERA website at the end of every quarter.

- Builders need to keep 70% of the funds in separate account opened in the name of the project- He cannot invest one projects money in another thereby causing a delay in the projects. If money is siphoned and builder is caught, he can be heavily penalized and jailed (max 3 years) too (the penalty clause is different for each state). So, expect more discipline in project completion on time.

- Provide five years guarantee for structural defects- In case any structural defect or deviation in provision of services or any other obligations of the builder as per the agreement for sale is brought to the notice of the builder within a period of five years by the buyer from the date of handing over possession, the builder shall be liable to rectify such defects without further charge, within thirty days.

- Builder will be held accountable for delay in handover of flats-If the builder delays the handover of the flat as per the agreement, he will have to compensate the buyer as per markets linked rates. It is fixed at 2% above SBI’s lending rates (currently it is around 10%). The builder has to give the new date of project completion with the compensation.

- Strict penalty for builders who do not follow RERA guidelines- In case of non-compliance of the RERA guidelines by the builder, RERA recommends a fine of up to 10% of the estimated cost of the project or imprisonment up to three years, or both.

2. Grievance Redressal Mechanism Under RERA

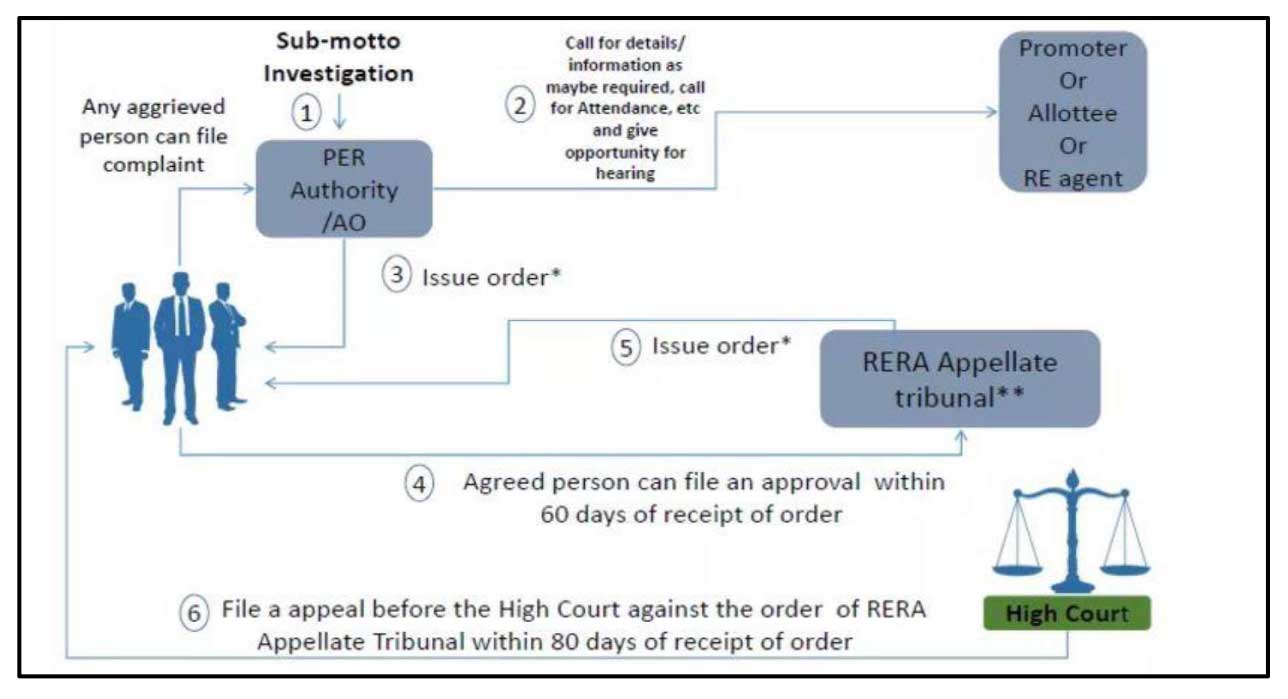

Prior to RERA, there was no time bound credible grievance redressal platform available to the buyers. Though they had option of approaching consumer forum, there was hardly any respite for them against the errant developers. In absence of any dedicated regulator for real estate sector, it was very difficult to penalize the builders for breach of contract and construction delays. However, the scenario has changed post RERA. Now the consumer can file the complaint with RERA against the builder, and it will get addressed in a time bound manner. The following exhibit describes the process of filing of complaint and its resolution under the ambit of RERA.

State RERA will handle all the complaints about the Promoter/Agents/projects under their jurisdiction. The process will be:

- The complainant can make a complaint by visiting the State RERA Office or file a complaint online on the RERA website.

- The RERA Office will conduct their investigation and call for proof or records from all the parties involved. They will also hear the other side and give a fair chance to developers as well as buyers to prove their point.

- Post hearing all the stakeholders, RERA will issue an order of resolution.

- If the complaint is not satisfied, he can escalate the complaint to RERA Appellate Tribunal within 60 days.

- The Tribunal will hear the case and issue its order and resolves the issue.

- If the complainant is still not satisfied, he may appeal to the State High Court within 80 days.

3. Impact of RERA on Various Stakeholders

RERA has addressed the fundamental issue of lack of transparency in the real estate sector. However, this act is expected to have a long-lasting impact on the various stakeholders of the sector, and is expected to reshape the entire real estate industry. Broad impact of RERA on builders, buyers, and property brokers are discussed:

Impact on Builders

- Focus on legal and operational compliance- The builders will now have to adhere to strict norms like getting all the required approvals and registering their projects with RERA before initiating any sales and marketing activity.

- Increase in financial discipline- siphoning of fund collected from buyers and deploying it to some other project or other business vertical was very common practice amongst the developers. This usually led to construction delay and cost overrun of the projects. However, now as per RERA developer has to keep 70% of the money collected from the buyers in a separate account dedicated for that particular project.

- Focus on timely completion of the projects- RERA levies a heavy penalty on the developers if the deadline for project handover is missed without any valid reason. As a result, the developers are now more focused on completing the projects on time rather than just launching new projects.

- Adopt a more customer centric approach- In past the developers have had a dubious track record of dealing with their customers. Now RERA has given immense power in the hand of customers. RERA provides the buyers with a very strong grievance redressal mechanism in the form of RERA appellate tribunal. For issues related to miscommunication, misrepresentation, construction quality issues and delay in handover of the flat, the buyer can file the complaint with RERA against the developer. Now any complaint against the developer is heard in a time bound manner and the repercussions are very severe for the developers if he is proven guilty.

- Consolidation expected in the industry- The compliance cost for the developers have increased significantly post RERA. Also, the provision of severe penalty as well as imprisonment in severe case will force builders with weak balance sheet and poor execution capabilities to either close down or merge with bigger developers. It is expected that more approximately 30-40% of developers will be wiped out of the market in next 2-3 years.

Impact on Buyers

- Consumer will now have an upper hand- As now the project related verified information will be easily available on the RERA website, the buyer now can take a more informed decision. The buyers now can expect a timely delivery of his flat as well as improvement in the quality of construction. The buyer now has an upper hand when it comes to the matters of dispute resolution.

- The buyers might witness a slight increase in the price- RERA has increased the compliance cost for the developers. Also, the holding cost for the developers have increased as now they cannot start to sell till the time, they have got all the approvals and registration number from RERA. The developer is expected to pass on this cost to the buyer, and hence there might be a slight increase in the price for the buyers in coming future.

Impact on Property Brokers

- Formal Recognition as Key Stakeholder- RERA has formalized the role of broker in the industry by making it mandatory for them to get registered with RERA of their respective states. Now a property broker, whether individual or an institution cannot deal in purchase of new projects until and unless he does not have a registration number. The developers now have to mention the property brokers who have tied up with him for the sale of flat, thus formally acknowledging him as an important part of the network.

- Brokers will be held accountable for misrepresentation of facts- Brokers were not governed by any regulation earlier and often wentunpunished in case of misrepresentation of the facts. Now the broker will be governed under RERA there are severe penalties in case if he is found guilty of misconduct. He will also be accountable for misrepresentation of ay facts by the builders whose project the broker is selling, thus ensuring that the broker does some level of due diligence himself before undertaking the sales of any project.

- The brokerage industry will become more transparent- The broker will have to maintain and regularly submit their audited books of accounts to the RERA. They will have to follow a more customer centric approach in the new RERA environment, as they can also be taken to the RERA appellate tribunal by the buyer in case of any fraudulent dealing.

- Cleansing of the industry- The property brokerage sector has been highly unorganized with a track record of fraudulent dealing by brokers. However, they are some good intentioned players who follow the rules and are transparent in their dealings, however, they are overshadowed by the unscrupulous players. In post RERA regime all these non-compliant and fringe players will be eliminated, and the industry is expected to emerge as more compliant and transparent.

4. The Current State of RERA

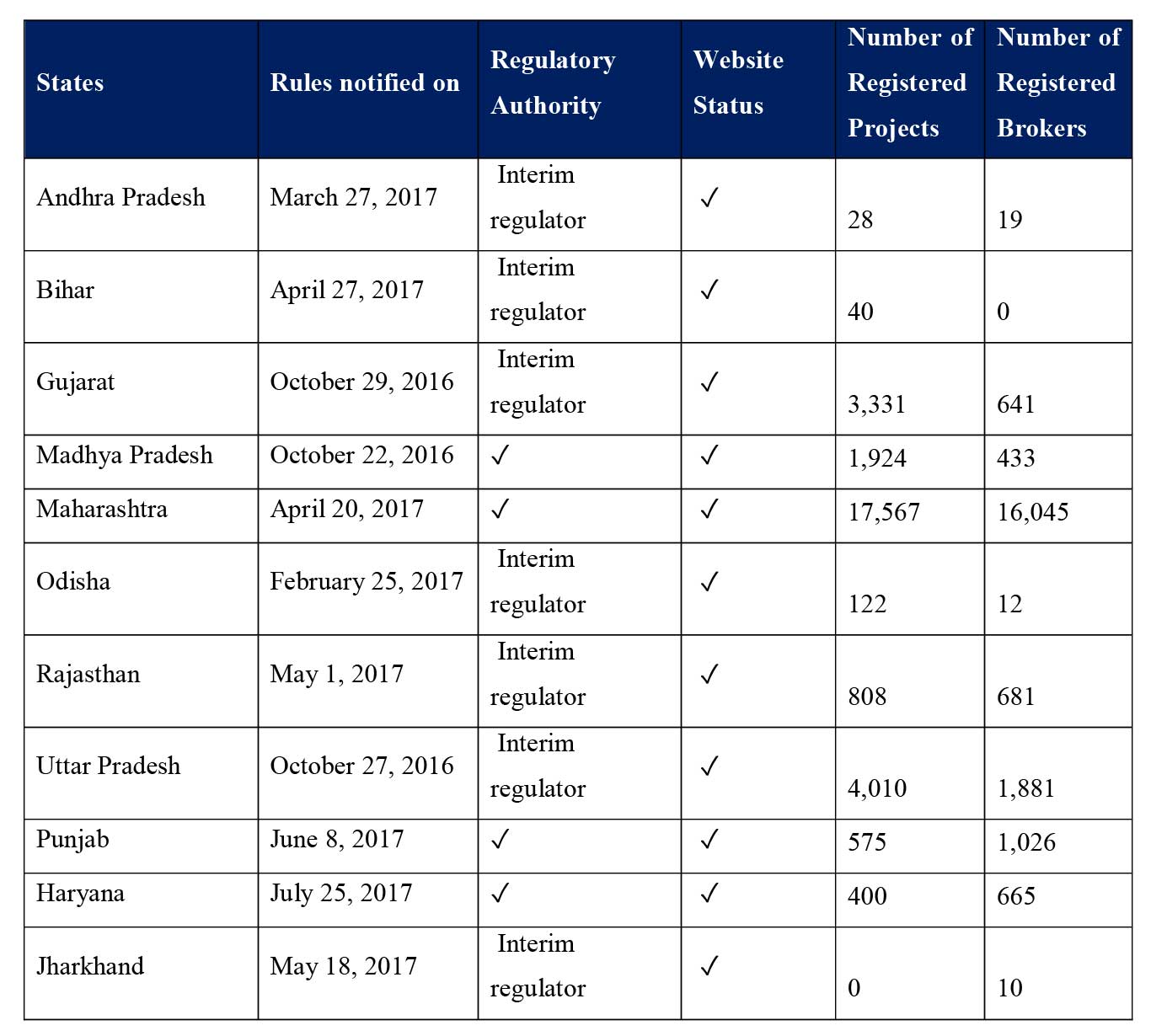

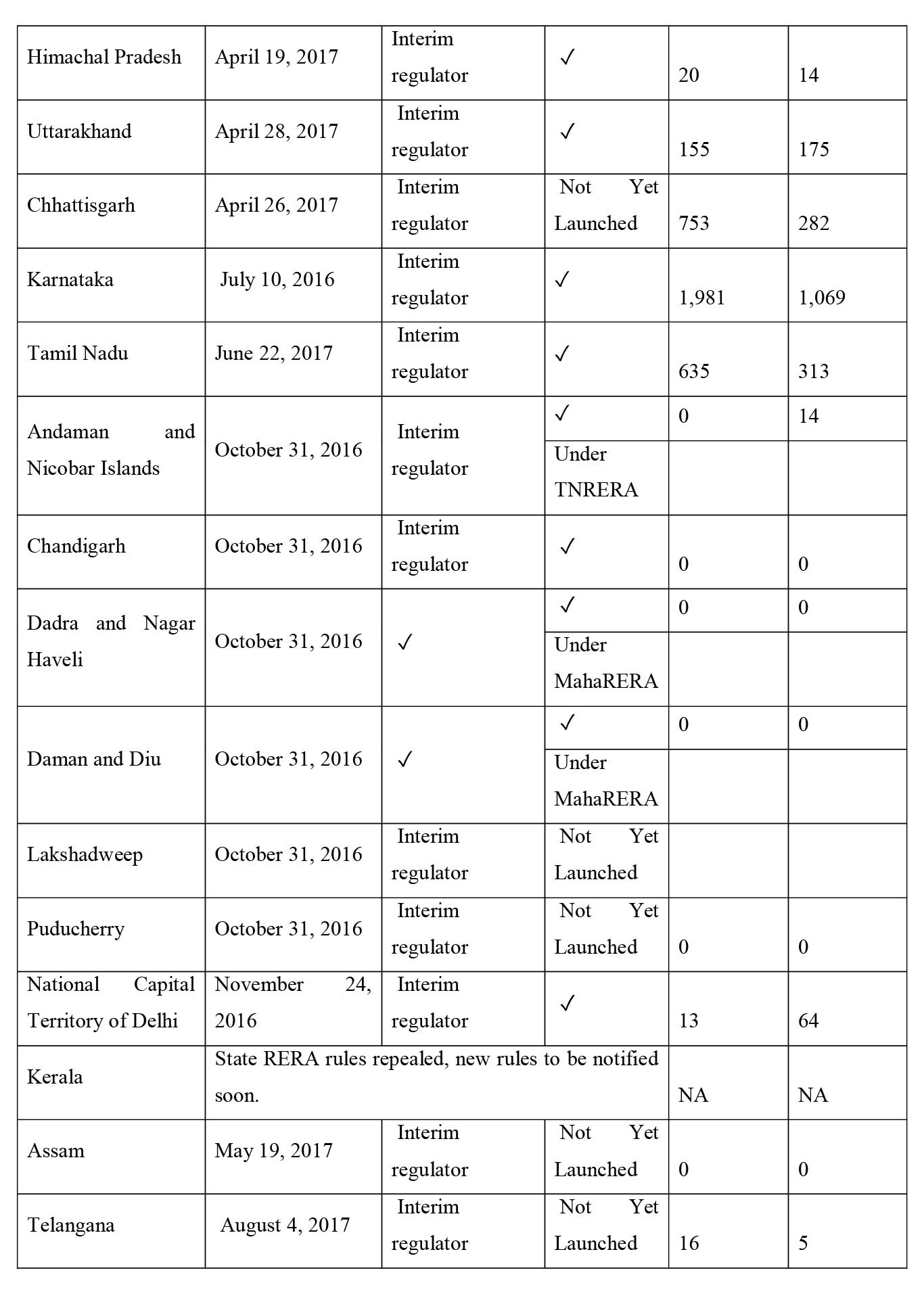

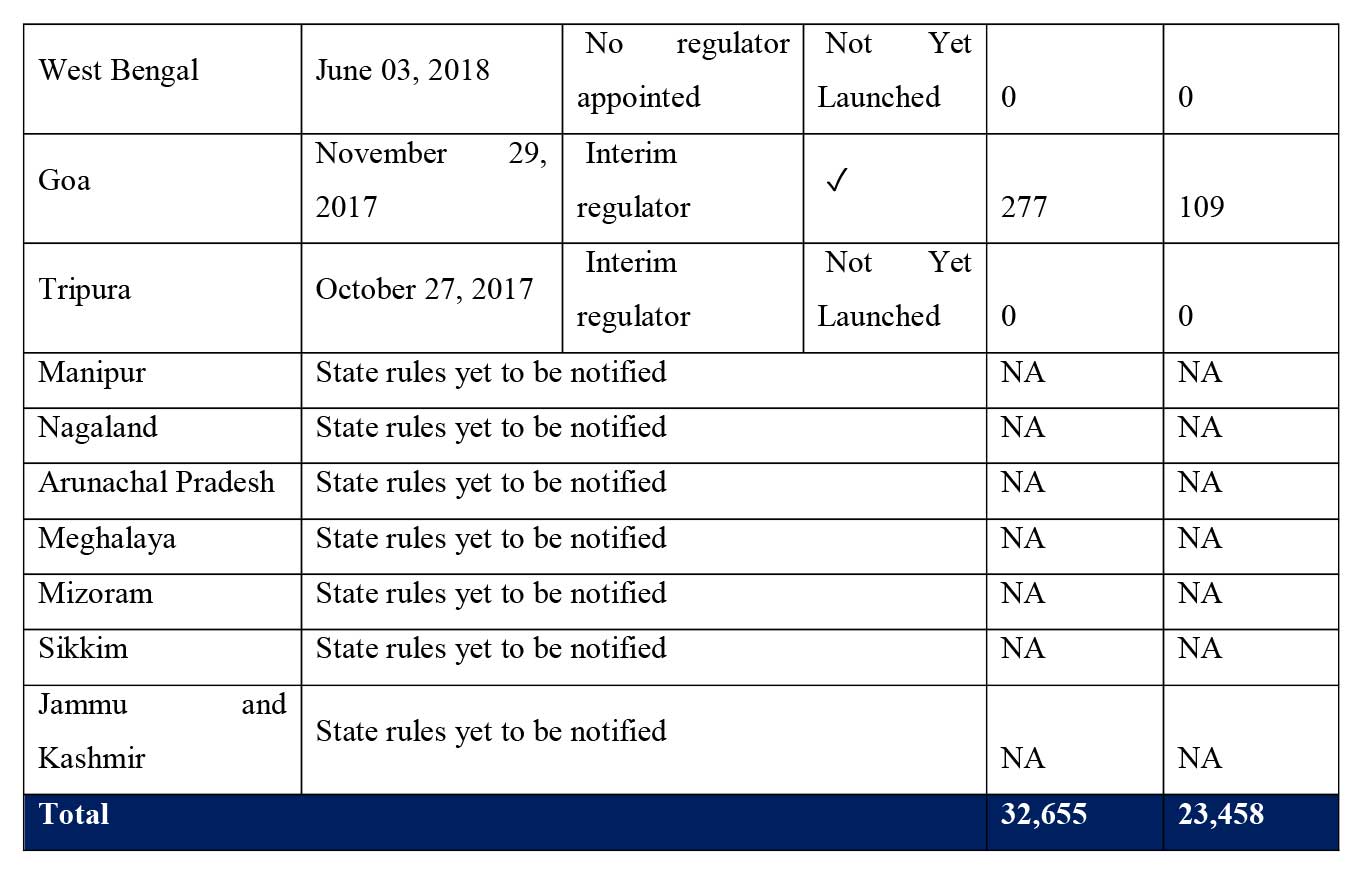

It has been more than a year since RERA came into force. While it has made a good progress since inception, a lot more needs to be done to expedite the nationwide implementation. As of now out of 36 states (including union territories), 28 states have notified RERA, and 24 states have a functional website. Out of the 28 states that have notified the RERA, only 6 have a full time duly appointed regulator whereas, rest of the states still have an interim regulator. There still needs to be a lot of work done in terms of enhancing the website for smooth functioning. There are still nagging problems related to uploading of information like quarterly progress report by the developers. Also, most of the states still needs to hire fully functional professionals to manage the entire work of RERA. As of now many of the states do not have dedicated offices for their state RERA and are currently operating from temporary offices. However, the Central as well as state government are working to ensure that in couple of quarter all the issues related to infrastructure required for smooth functioning of RERA is resolved. The table below exhibits the implementation status of RERA across the country.

5. Conclusion

The Indian Real Estate sector which is the second largest employment generator after the agriculture sector had remained largely unregulated for a quite long time. As a result, the sector was mired in the issues of construction delays, lack of transparency and trust deficit amongst the stakeholders. However, with the implementation of RERA, transparency, accountability, and financial discipline have now been infused into the real estate sector, and the buyers now have a strong regulator to fight against any malpractices and this has instilled a sense of hope amongst them. It is expected that under the stringent RERA regime, the unorganized and fragmented nature of the business will disappear, and the sector will set on a path of transparency, financial discipline, consolidation and most importantly buyer-centricity.The stringent provisions of RERA and GST willalso set the stage for a major consolidation in the industry. This is in a way is good for the industry’s long-term growth as dubious and financially weaker player will either be wiped out or merge with a stronger player.

References

- Indian Real Estate Residential Annual Report 2017 – Anarock Property Consultants

- Decoding Housing for All. KPMG Research Report

- Making Affordable Housing work in India- RICS Research Report 2017. RICS

- Indian Real Estate Industry – IBEF. Accessed 08/10/2018 https://www.ibef.org/industry/real-estate-india.aspx

- India’s Real Estate Milestones- A 20 Years Narrative. JLL Research Report

- The Real Estate (Regulation & Development) Act, 2016. Ministry of Law and Justice (Legislative Department)