Subscribe now to get notified about IU Jharkhand journal updates!

Digital Finance: A Gateway to Environmental Sustainability

Abstract :

In recent years, digital finance has become a widely discussed public policy due to the innovative nature of new technology. The financial industry, like other industries, typically adopts new and upgraded technology to make tasks more efficient. Digital finance is an example of such technology that is currently in demand. The use of digital payments has been on the rise in recent years, driving the digitization of the financial sector and economy. Digital channels such as UPI, E-Wallets, and m-banking are expected to provide more cost-effective services and better coverage to unbanked rural populations in India. India's JAM Trinity - Jan Dhan, Aadhaar, and Mobile - has enabled the country's digital payment revolution and laid the foundations for a Digital India. This has made government services more accessible to citizens without intermediaries. In addition to financial inclusion, digital finance has the potential to promote sustainability by reducing the environmental impact of financial transactions. Paperless banking and digital payments can significantly reduce the use of paper, thereby reducing the carbon footprint of financial transactions. Digital finance can also promote responsible investment and help to achieve the United Nations Sustainable Development Goals by enabling greater transparency and accountability in financial transactions. This research paper explores the contribution of digital finance to sustainable development through digital financing technology, focusing on developments in digital finance in India. Various financing options have been assessed using a variety of data sources, and our findings suggest that paperless transactions could pave the way towards a greener and more sustainable environment, despite improvements in financing options in India.

Keywords :

Digital Finance, Financial inclusion, Digital Technology, Digital ChannelsIntroduction

Digital finance refers to the use of advanced digital technology in traditional financial services, including payments, transfers, and credit. It also includes actions to promote inclusive finance through digital financial services. In recent years, digital finance has gained significant attention as a public policy, and the financial industry has often embraced new technologies to enhance efficiency. Digital finance is a technology that is essential to modernize the financial sector and the economy. The use of digital payments has steadily increased in recent years, and digital channels like UPI, E-Wallets, and m-banking can offer cost-effective services and coverage to unbanked rural populations of India. Digital finance has also made it possible for individuals and businesses to access credit more easily; online lending platforms provide quick and hassle-free loans. This has created a more inclusive lending environment that enables small businesses and entrepreneurs to access the capital they need to grow their businesses.

The JAM Trinity, comprising Jan Dhan, Aadhaar, and Mobile, has played a significant role in India's digital payment revolution by laying the groundwork for a Digital India. This has made a wide range of government services available directly to citizens with improved accessibility, eliminating the need for intermediaries. The use of digital financial services has enabled paperless banking, which promotes environmental sustainability. The research article is descriptive in nature and aims to examine the contribution of digital finance to sustainable development through the use of digital financing technology. The article reviews the developments in digital finance in India and evaluates a variety of data sources to assess public awareness and various financing options.

The financial industry has been experiencing a rapid digital revolution with significant advancements in digital financial services in recent times. The introduction of new technology typically triggers industry innovation. In all sectors, new technologies are adopted to simplify and streamline tasks, and the financial sector is no exception.

The digital revolution, also referred to as the "Internet economy," is anticipated to create fresh opportunities for market growth and job creation, and become the largest business opportunity for companies in the next 30 to 40 years. Digital channels, such as mobile banking, are expected to offer more efficient services and greater coverage to the unbanked population in India. The Internet revolution is a global trend and current growth statistics suggest that it will continue to expand.

In 2015, the Sustainable Development Goals (SDGs) were adopted by all UN Member States. The 3Ps - People, Planet, and Profits - are crucial for achieving the SDGs. The shift towards green banking is primarily driven and directed by consumer behavior. Although banking has traditionally been considered a pollution-free industry, the current scale of banking operations has significantly increased carbon emissions due to the extensive use of energy for lighting, air conditioning, electronic and electrical equipment, IT, and high paper wastage, among other factors. Thus, digital finance has become essential for sustainable development in the present scenario. In this context, a modest attempt has been made to evaluate the potential and challenges of digital finance, especially Fintech, in promoting financial inclusion and pursuing the Sustainable Development Goals.

Literature Review

With the growing importance of sustainable development, the path to achieve sustainable development such as digital finance and green innovation has gained more attention, and a majority of scholars have paid attention to the relationship between such two.

Yu et al. (2022)conducted a study on the use of digital finance, especially Fintech, for financial inclusion and sustainable development. The authors begin by highlighting the Sustainable Development Goals (SDGs) set by the United Nations in 2015, with a focus on the 3Ps- People, Planet and Profits- for achieving sustainable development. They argue that while banking has traditionally been considered a pollution-free industry, the present scale of banking operations has increased carbon emissions due to energy consumption, paper wastage, and lack of green buildings. As a result, the authors suggest that digital finance has become essential for promoting sustainable development.

Yao and Yang (2022)examines the development and challenges of digital finance in China. The authors provide an overview of the history and evolution of digital finance in China, highlighting key events such as the launch of Alipay and WeChat Pay. They also discuss the regulatory framework governing digital finance in China, including the role of the People's Bank of China (PBOC) and other government agencies. Finally, the study identifies several challenges and risks associated with the development of digital finance in China. These include concerns around data privacy and security, systemic risk in the financial system, and potential disruptions to traditional financial institutions. The authors also highlight the need for ongoing regulatory oversight and policy guidance to ensure the sustainable and responsible development of digital finance in China.

Chandrlekha Ghosh and Rimita Hom Chaudhury's study (2019) examines the determinants of digital finance in India using a panel data set from 2012-2016. The authors investigate the impact of financial inclusion, institutional quality, and mobile network coverage on digital finance adoption. The study finds that financial inclusion has a significant positive impact on the adoption of digital finance, indicating that improving access to formal financial services can drive the uptake of digital financial services. The study also finds that institutional quality has a positive impact on digital finance adoption, suggesting that a supportive regulatory environment can promote the growth of digital finance. Finally, the study finds that mobile network coverage has a significant positive effect on digital finance adoption, highlighting the importance of technological infrastructure in promoting the uptake of digital financial services.

Another study conducted by Alok Kumar Mishra and Swati Tripathi (2019) examines the role of digital finance in promoting financial inclusion in India. The authors review the regulatory environment for digital finance in India, highlighting the measures taken by the government to promote digital payments and financial inclusion. The study finds that digital finance has the potential to increase access to formal financial services, reduce transaction costs, and promote financial inclusion, particularly for underserved segments of the population such as rural and low-income households.

R. Uma and K. Jayasudha (2018) investigates the impact of digital finance on financial inclusion in India. The authors examine the various digital financial services available in India, including mobile banking, e-wallets, and mobile payments. The study finds that digital finance has the potential to promote financial inclusion by increasing access to formal financial services, reducing transaction costs, and improving convenience for customers. The study also highlights the need for greater awareness and education about digital financial services among consumers to promote adoption and usage.

Rao et al. (2022) conducted a literature review on the role of digital finance in promoting financial inclusion in India. The study aims to identify the various factors that have influenced the adoption of digital finance in India and to evaluate its impact on financial inclusion.The study also highlighted the challenges and barriers to the adoption of digital finance in India, including low levels of financial literacy, concerns over security and privacy, and the digital divide between urban and rural areas.

Dash, S. R., & Gopalan, S. (2020) The impact of digital finance on financial inclusion in India. Journal of Financial Economic Policy, 12(4), 801-816. This study analyzes the impact of digital finance on financial inclusion in India, using data from a survey of 1,200 individuals across five states. The authors find that digital finance has a significant positive impact on financial inclusion, particularly among individuals who have limited access to traditional banking services.

Song et al. (2021) found in their study that digital finance can contribute to reducing environmental pollution indirectly by promoting industrial upgrading. The study suggests that increased digital industrialization can lower the cost of production by eliminating the need for purchasing new equipment and introducing new technology, thereby motivating manufacturers to allocate resources more efficiently.

Gomber, P., Koch, J., & Siering, M. (2020) conducted a study on Financial technologies and sustainability. This study provides a comprehensive review of the literature on financial technologies and sustainability. The authors find that digital finance can contribute to environmental sustainability by promoting green investments and reducing the carbon footprint of financial transactions.

A study by Rahman, M. R., & Bhuiyan, M. H. (2021) entitled the potential of digital finance in promoting environmental sustainability in developing countries: examines the potential of digital finance in promoting environmental sustainability in developing countries. The authors argue that digital finance can help overcome the barriers to green investments by providing access to finance, reducing transaction costs, and enhancing transparency and accountability.

Chakraborty, D., & Mazzanti, M. (2020) Environmental performance, environmental innovation and digitalization. This study examines the relationship between environmental performance, environmental innovation, and digitalization in European countries. The authors find that digitalization can positively influence environmental performance and innovation by improving the efficiency of resource use and reducing environmental impact.

Steffen et al. (2020) proposed that the digital finance could impact energy consumption through two distinct categories: a restraining effect and a growth effect. Under the growth effect, the increase in energy consumption resulting from digital finance was further divided into two subcategories. The first being the direct increase in energy consumption that arises from the production, use, and disposal of digital technology. The second being the indirect increase in energy demands that is driven by economic development.

Sun (2020) titled "The impact of digital finance on energy consumption: An empirical analysis," This study examines the impact of digital finance on energy consumption in China using panel data analysis. The authors argue that digital finance has a dual impact on energy consumption, which can be either positive or negative. On the one hand, digital finance may contribute to the growth of energy consumption by enabling more economic activities and increasing the demand for digital devices and services. On the other hand, digital finance can also lead to more efficient and flexible use of energy resources, which may ultimately reduce energy consumption.

The paper authored by Suresh Aaluri, Dr. M. Srinivasa Narayana, and Dr. P. Vijay Kumar (2016) is titled "Digital finance and financial inclusion: The Indian scenario." The paper aims to provide a comprehensive understanding of digital finance and its potential to promote financial inclusion in India. The recent initiatives taken by Government of India boost to promote financial inclusion and surely leading to the position where all Indians have their bank accounts, using Information Technology enabled services.

Dr. N. Sundaram and M. Sriram (2016) present a comprehensive literature review of the impact of digital financial services on financial inclusion and poverty alleviation. The study starts by defining digital financial services as the use of digital technologies such as mobile phones and the internet to provide financial services. The authors highlight the advantages of digital financial services, such as cost-effectiveness, convenience, and accessibility.

Thepaper authored by Gurpreet Kaur (2015) is titled "Role of digital finance in financial inclusion: A review of the literature". The literature review presented in the paper aims to provide an understanding of the role of digital finance in promoting financial inclusion. The digital India initiative can easily connect the different groups of society and can help to achieve the objective of financial inclusion through digital banking.

Objectives of the Study:

- To understand the concept of digital finance.

- To know the various types of financial technologies to support digital finance.

- To study the impact of digital finance on environmental sustainability.

Research Methodology

The proposed article is descriptive in nature. The study is based on the secondary data collected from different journals, magazines, research articles, periodicals, websites.

Result and Discussion

The global community has adopted the United Nations Sustainable Development Goals (UN SDGs), which consist of 17 goals and 169 targets to achieve environmental sustainability by 2030. One key area of focus is financial inclusion through digital finance, which has garnered significant attention from policymakers worldwide. The aim is to achieve sustainable financial inclusion by leveraging technology and adopting a multi-stakeholder approach. FinTech companies are well-positioned to drive financial inclusion by utilizing their technological capabilities. The FinTech4FI initiative by the Alliance for Financial Inclusion highlights the potential of strategies for digital financial transformation. Today, sustainable finance, financial inclusion, and FinTech are key policy priorities for most national governments and regulators. For instance, Fintech has enabled 80% of adults in India to access credit, while 350 million people are gaining access to accounts for the first time. Additionally, digital footprints are generating formal and informal data.

The Environmental Performance Index (EPI) report for 2022, which evaluates 180 countries on their performance across 40 indicators in 11 policy categories related to climate change, environmental health, and ecosystem vitality, shows that India ranks last at 180 with an EPI score of 18.9. Therefore, it is crucial for India to adopt financial technologies that promote digital finance to meet the requirements of environmental sustainability. Given that India aims to achieve high-quality development, green development has become a shared goal, and innovation should be the driving force for sustainable development. Green innovation combines technology innovation and environmental protection, and has two distinctive features: innovation-driven and green development. To achieve environmental sustainability, green innovation is essential, which includes energy savings, emission reduction, and environmental management through technology-driven innovation in the financial sector, with a focus on environmental management.

Digital Finance Ecosystem in India

Digital India has set a crucial goal to achieve a "Faceless, Paperless, Cashless" status. The Government of India is according the highest priority to promote digital finance, aiming to bring every segment of the country under the umbrella of formal digital payment services. The vision is to offer all citizens of India with a seamless financial transaction experience that is convenient, easy, affordable, quick, and secure through financial technologies, in line with the commitment to environmental preservation.

Digital Finance

Digital finance refers to the delivery of financial services through digital infrastructure, such as mobile phones and the internet, with minimal reliance on cash and conventional bank branches. This method of transaction involves reduced use of cash and traditional bank branches, and instead, involves the use of computers, mobile phones, or cards, which can be utilized over point-of-sale (POS) devices to connect individuals and businesses to a digitized national payments infrastructure. This allows for seamless transactions between all parties involved.

Digital Financial Services

The broad range of financial services accessed and delivered through digital channels, including payments, credit, savings, remittances and insurance are known as digital financial services. The Digital Financial Services (DFS) concept includes mobile financial services. In this context, the term "digital channels" refers to the internet, mobile phones (both smartphones and digital feature phones), ATMs (Automated Teller Machines), POS (Point-of-Sale) terminals, NFC (Near Field Communication)-enabled devices, chips, electronically enabled cards, biometric devices, tablets, phablets and any other digital system.

A digital financial service comprises three fundamental elements: a digital platform for transactions, retail agents, and the use of a device, commonly a mobile phone, by both customers and agents to carry out transactions via the platform. This method is enabling the unbanked population to access financial services through digital channels. Banks, microfinance institutions, mobile operators, and third-party providers are utilizing mobile phones, point-of-sale devices, and networks of small-scale agents to offer basic financial services that are more convenient, scalable, and cost-effective than traditional banking.

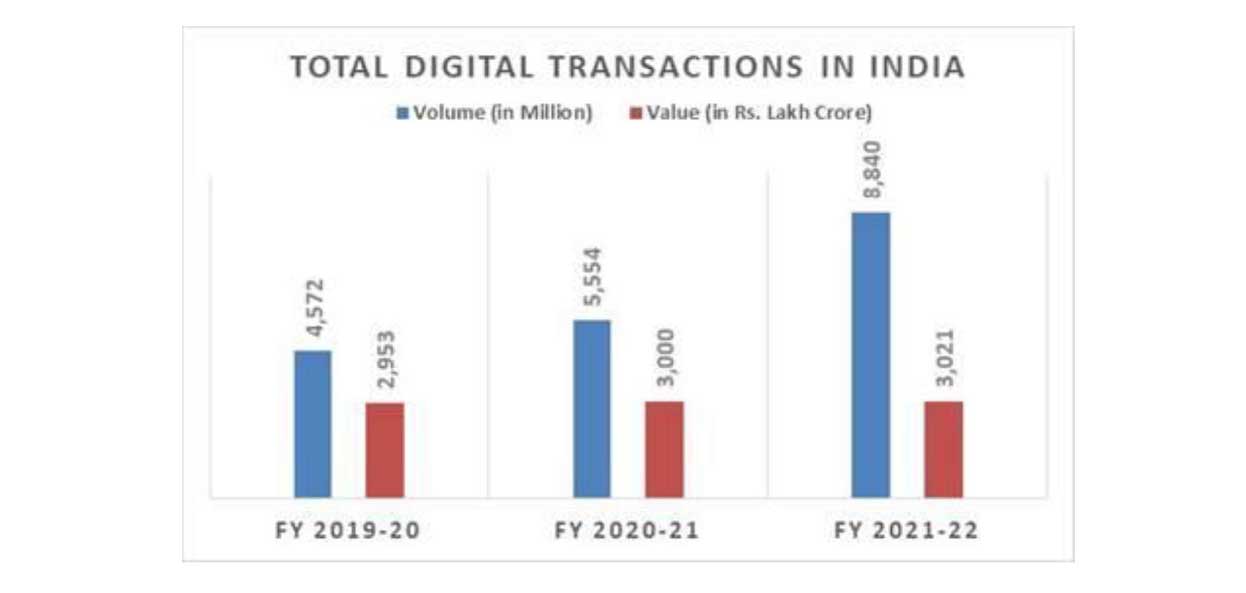

In the past three years, there has been an unprecedented growth of digital payment transactions in India. Digital payment modes, such as Bharat Interface for Money-Unified Payments Interface (BHIM-UPI), Immediate Payment Service (IMPS), pre-paid payment instruments (PPIs), and National Electronic Toll Collection (NETC) system have shown significant growth and transformed the digital payment landscape by facilitating both Person-to-Person (P2P) and Person-to-Merchant (P2M) payments. Meanwhile, existing payment modes like debit cards, credit cards, National Electronic Funds Transfer (NEFT), and Real-Time Gross Settlement (RTGS) have also grown rapidly. BHIM-UPI has emerged as the most preferred payment mode among users. The Government of India has launched e-RUPI, a contactless and cashless digital payment instrument that is expected to make Direct Benefit Transfer (DBT) more effective in digital transactions. These facilities have created a strong ecosystem for a digital finance economy.

UPI: Revolutionizing Digital Payments

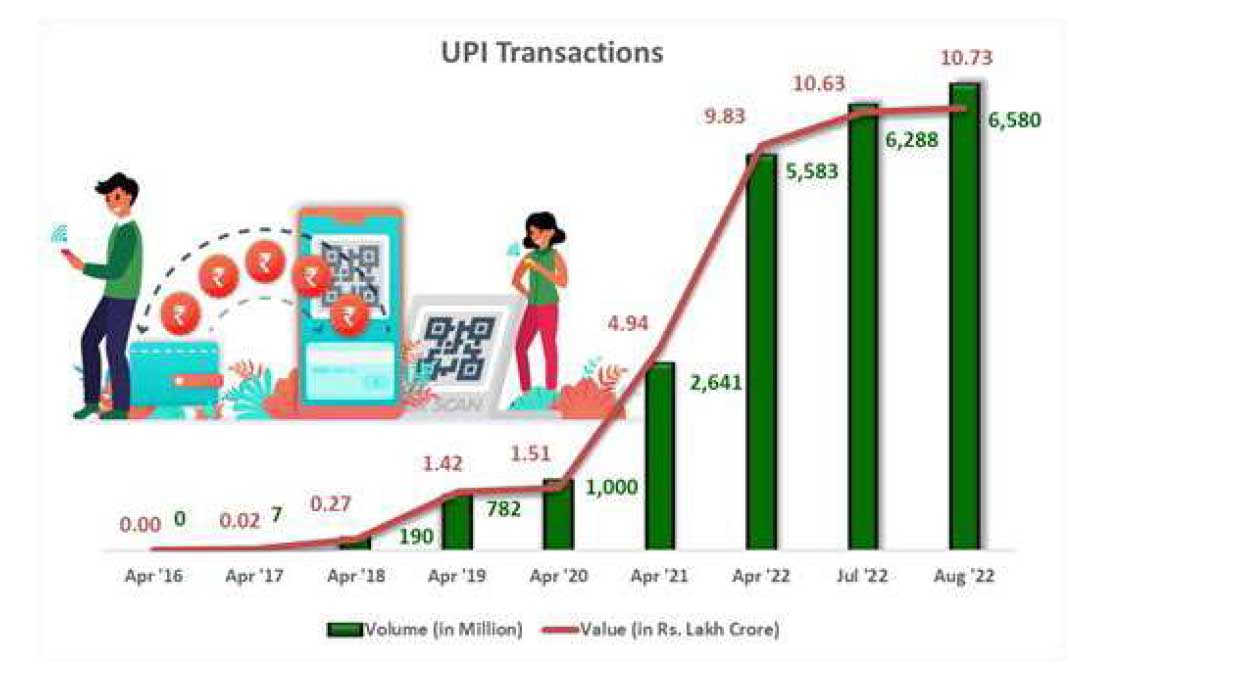

UPI was launched in 2016 and since its launch; it has been recognized as a game-changing product in the payment ecosystem and has become a widely used tool for digital transactions in India. Developed by the National Payments Corporation of India (NPCI), UPI is an instant payment system that consolidates multiple bank accounts into a single mobile application, offering a range of banking services, including seamless fund routing and merchant payments under one roof. To further strengthen and popularize the interface, Prime Minister NarendraModi launched the BHIM-UPI App during the inauguration of the ‘DigiDhanMela’ on December 31, 2016.

UPI has gone a long way in making digital payments a habit and become a matter of routine for any financial transaction and thereby promoting India on the track toward a cashless economy. In the month of August 2022 alone, 346 banks were live on the UPI interface, with 6.58 billion financial transactions being carried out for a total value of nearly Rs. 10.73 lakh crores.

UPI currently constitutes well over 40% of all digital transactions taking place in India. It has given a boost to small businesses and street vendors as it enables fast and secure bank-to-bank transactions even for considerably small amounts. It also facilitates quick money transfers for migrant workers. The technology is convenient to use as it requires minimum physical intervention, making it possible to transfer money simply by scanning a QR code. UPI has also been a saviour during the Covid-19 pandemic, with its adoption expanding rapidly due to its ability to allow easy, contactless transactions.

The digital payment landscape in India has undergone a significant transformation, and the credit goes to both the government's efforts and the citizens' willingness to adopt new technologies. Unlike some developed nations struggling with inadequate digital infrastructure for transferring funds to their citizens' accounts, India has excelled in creating digital assets, setting an example for other nations. The Indian Government is committed to making the country a global leader in digital payment systems, aspiring to create one of the world's most efficient payment markets. Going forward, the emerging Fin-Techs will have a vital role to play in the continued growth of digital transactions, fostering transparent, secure, quick and affordable mechanisms that will benefit the entire digital payment ecosystem.

A platform for digital transactions allows customers to use a device to conduct electronic payments and transfers, as well as store value electronically with a bank or authorized non-bank entity. Retail agents equipped with a digital device connected to communication infrastructure enable customers to convert cash into electronically stored value and vice versa. These agents may also perform other functions depending on applicable regulations and their arrangement with the principal financial institution.

The customer device can be digital (e.g., mobile phone) that is a means of transmitting data and information or an instrument (e.g., payment card) that connects to a digital device (e.g., POS terminal).

Types of Digital Financial Tools

1. Cards

2. Unstructured Supplementary Service Data

3. Aadhaar Enable Payment System

4. Unified Payments Interface

5. E-Wallet

- Cards:

These are usually issued by banks and can be classified based on their issuance, usage and payment by the card holder. There are three types of cards. These are:

Debit Cards:

Debit cards are cards issued by the bank where the account holder has an account, and they are linked to the same account. These cards are issued to account holders such as those with current, savings, or overdraft accounts, and any expenses made with the card are immediately deducted from the user's account. With a debit card, users can withdraw cash up to the limit present in their bank account.

Credit Cards:

Banks and other entities authorized by RBI issue these cards, which can be used both domestically and internationally (if international usage is enabled). Credit cards differ from debit cards in that a customer can withdraw an amount greater than the balance in their bank account. However, there is a limit to how much extra money can be withdrawn using a credit card, and a specific timeframe in which the additional amount must be paid back. If this repayment is delayed beyond the specified period, the amount borrowed plus interest charges, as determined by the issuer of the card, must be paid back to the bank.

Prepaid Cards:

These are pre-loaded from a customer’s bank account. These can be used for limited amount of transaction. These can be recharged like mobile recharge and are safe to use. - USSD (Unstructured Supplementary Service Data):

The goal of this service is to make banking accessible to every individual in the country. It enables customers to access banking services through a single number, regardless of their telecom service provider, mobile handset make or region. This service is provided through a National Unified USSD Platform (NUUP) on a short code *99#. Transactions up to ₹5000 per day per customer can be made using this service. USSD offers two types of services. These are:

Non- Financial Services:- Balance Enquiry-User can check the available balance of the bank account

- Linked to the mobile number.

- .Mini Statement-User can generate mini account statement for the bank account linked to the mobile number.

- Know MMID (Mobile Money Identifier)-User can know the MMID allotted by the bank to the account during mobile banking registration.

- Generate/Change M-PIN-User can Generate/Change the M-PIN (Mobile PIN) which is like a password and used for authenticating financial transactions.

Financial services: - Fund Transfer using Mobile No. and MMID-User can transfer funds by using MMID and Mobile number of the Beneficiary.

- Fund Transfer using IFSC and Account No.-User can transfer fund by inputting IFS code and Account number of the Beneficiary.

- AEPS (Aadhaar Enabled Payment System):

This payment service enables a bank customer to utilize their Aadhaar number as their identity to access their Aadhaar enabled bank account and perform essential banking transactions. It facilitates bank-to-bank transactions at PoS (MicroATM) with the assistance of a Banking Correspondent (BC). To use this service, the user has to link their Aadhaar number with their account at the bank or with the help of a BC. The user can carry out multiple transactions at any AEPS point without requiring a PIN or password.

Types of banking transactions with Aadhaar Enable Payment System:

- Balance Enquiry

- Cash Withdrawal

- Cash Deposit

- Aadhaar to Aadhaar Funds Transfer

- Purchase at Fair Price Shops with AEPS

- UPI (Unified Payments Interface): Unified Payments Interface is a system for instant, electronic payments through user’s smart phone. It is an advanced version of Immediate Payment Service (IMPS) which was used to transfer money between bank accounts. Like IMPS, UPI will facilitate round-the-clock funds transfer service.

- E-Wallet:

An electronic wallet, also known as an e-wallet, is a digital card that allows for online transactions through a computer or smartphone. It serves the same purpose as a credit or debit card and must be linked to the user's bank account in order to make payments. The primary goal of e-wallets is to simplify paperless money transactions. In India, e-wallets are considered Prepaid Payment Instruments (PPIs) under regulation, which means they facilitate the purchase of goods and services and allow for funds transfer using the value stored in them. PPIs can be in the form of smart cards, magnetic stripe cards, internet accounts, internet wallets, mobile accounts, mobile wallets, paper vouchers, or any other instrument that can access the pre-paid amount.

A mobile wallet is the digital equivalent to the physical wallet that we have in our pockets today. It is a vault to store digitized valuables for authorization. It is an online platform which allows a user to undertake various transactions without physical money transactions. It provides mobile-based financial services to the unbanked and those living in the remote geographical locations.

Role of Digital Finance in Environmental Sustainability

India has been actively promoting inclusive finance and adopting digital technologies to facilitate traditional finance. This has resulted in the expansion of inclusive financial services, benefiting a wider economic group. Digital inclusive finance has the potential to overcome some of the limitations of traditional finance, thereby stimulating research and development in green technologies. However, it is important to investigate whether the growth of digital finance has any impact on green innovation. Only with the answers to such questions, governments can effectively promote green technologies through the development of digital finance. Given the rapid growth of digital finance, it is reasonable to assume that it will play a key role in the financial market in the future. India, in its pursuit of sustainable development and better environmental quality, must prioritize innovation and ecological civilization. Green innovation is essential for achieving an innovation-driven development strategy, which is in line with the new development concept and promotes coexistence between humans and the natural environment. Therefore, it is significant to explore the impact of digital finance on green innovation and identify the factors that can influence this impact.

In our view, digital finance promotes green innovation through the following ways.

First, Digital finance plays a crucial role in mitigating information asymmetry between financial institutions and firms involved in green technology projects. This can lead to increased financial support for innovative green enterprises and reduce their financing constraints, ultimately promoting green technological innovation, as noted by several studies (Rao et al., 2022; Yao & Yang, 2022).

Secondly, According to Tang et al. (2020) and Yu et al. (2022), there is a positive correlation between digital finance and increased green innovation, as digital finance can lower the costs associated with financial transactions and operations.

Thirdly, It can be inferred that digital finance has a positive impact on green innovation by speeding up the green transformation of traditional industries. Therefore, digital finance is contributing to the development of green innovation.

Fourthly, After confirming the impact of digital finance on green innovation, we need to focus on specific aspects of digital inclusive finance, such as its coverage, depth, and usage, to examine their influence on green innovation.

Conclusion:

The shift towards digitalization in the core business requires finance to facilitate and drive the change. Collaborative efforts between consumers and the government can provide a roadmap for unlocking the true potential of digital finance and financial inclusion. The use of technology can enhance the efficiency and transparency of payment systems. The Digital India flagship scheme also targets digital financing as one of its pillars, highlighting the enormous potential of digital finance. This study aims to fill the research gap by investigating the relationship between digital finance and green innovation. Digital finance has the potential to promote green innovation in several ways. Firstly, green innovation requires significant financial resources as it involves sunk investments, uncertain outcomes, and high adjustment costs. Traditional financial institutions are often reluctant to lend to green companies due to limited information about their production. Consequently, financing green enterprises can be difficult and expensive, and their green innovation activities may be impeded (Fan et al., 2022; Ferreira et al., 2019).

Digital finance, which is an emerging finance brought about by the rapid development of digital information technology and financial development, has the potential to improve the availability of financial resources for green enterprises. Financial institutions can effectively evaluate a borrower's credit rating and track the flow of financial resources and usage. This allows them to provide financial support to green enterprises that are excluded from traditional financial services. As a result, digital finance offers green enterprises a chance to allocate more financial capital to research and development on projects referring to green technologies, which can eventually improve the level of green innovation.

Moreover, digital finance can reduce the cost of financial operations and transactions, which is usually associated with a higher level of green innovation. As a combination of digital information technology and financial development, digital finance can provide support to enterprises that are engaged in green innovation to obtain financial services. It enables green enterprises to efficiently and low-cost match with appropriate lenders, thus reducing the financing cost of innovative green enterprises, and lowering the pressure for their green technological innovation activities. Eventually, the level of green innovation will rise due to the support of digital finance.

Finally, the digital finance may induce the transformation of green development and industrial upgrading, which can eventually contribute to green innovation. This transformation can lead to the development of new green technologies and practices, ultimately promoting sustainable development.

References:

- N.Sireesha(2012) Financial Inclusion through Innovations in ICT- Financial Inclusion & Inclusive Growth –Prospects & Retrospect(edited )pg no -78- 83.

- World Bank(2014) Digital Finance: Empowering the poor via new technologies.

- SireeshaNanduri (2016) "Banks- Tell-Talk- Listen –Action: Banking on Social media"- in Emerging Trends in Banking published by Academic Foundation and IPE, pg no- 291-299.

- SimpliceAsongu, Jacinta Nwachukwu --Recent Finance Advances in Information Technology for Inclusive Development: A Survey African Governance and Development Institute.

- Guild, James, Fintech and the Future of Finance (August 18, 2017), Asian Journal of Public Affairs, 2017 , Lee Kuan Yew School of Public Policy Research Paper No. 17-20.

- Cao, S., Nie, L., Sun, H., Sun, W., &Taghizadeh-Hesary, F. (2021). Digital finance, green technological innovation and energy-environmental performance: Evidence from China's regional economies. Journal of Cleaner Production, 327, Article 129458.

- Chakraborty, S. K., &Mazzanti, M. (2020). Energy intensity and green energy innovation: Checking heterogeneous country effects in the OECD. Structural Change and Economic Dynamics, 52, 328–343.

- Chang, C.-H. (2011). The influence of corporate environmental ethics on competitive advantage: The mediation role of green innovation. Journal of Business Ethics, 104(3), 361–370.

- Chang, K., Cheng, X., Wang, Y., Liu, Q., & Hu, J. (2021),The impacts of ESG performance and digital finance on corporate financing efficiency in China, Applied Economics Letters, 1–8.

- Dai, L., Mu, X., & Lee, C. (2021),The impact of outward foreign direct investment on green innovation: The threshold effect of environmental regulation. Environmental Science and Pollution Research, 28(26), 34868–34884.

- Du, K., & Li, J. (2019),Towards a green world: How do green technology innovations affect total-factor carbon productivity. Energy Policy, 131, 240–250.

- Fan, W., Wu, H., & Liu, Y. (2022), Does digital finance induce improved financing for green technological innovation in China? Discrete Dynamics in Nature and Society, 2022.

- Feng, S., Zhang, R., & Li, G. (2022), Environmental decentralization, digital finance and green technology innovation. Structural Change and Economic Dynamics, 61, 70–83

- Gurpreet Kaur (2015); Financial Inclusion and Digital India, International Journal of Business Management, ISSN 2349-3402, Vol. 2 (2).

- Dr. N. Sundaram and M. Sriram (2016); Financial Inclusion in India: A Review, International Journal of Applied Engineering Research, ISSN 0973-4562, Vol. 11, No. 3, pp 1575-1578.

- Suresh Aaluri, Dr.M.Srinivasa Narayana, Dr. P. Vijay Kumar (2016); A Study on Financial Inclusion Initiatives and Progress with reference to Indian Banking Industry in digital era, International Journal of Research in Finance and Marketing, ISSN (o) 2231-5985, Vol. 6, Issue. 10, pp. 125-134