Subscribe now to get notified about IU Jharkhand journal updates!

The impact of board characteristics and equity ownership on company performance: An empirical study

Abstract :

To run the business smoothly and efficiently, the business needs to be properly governed and here, the concept of corporate governance comes into the play. An effective corporate governance resolves the agency problem, reduces the agency costs and improves the firm's efficiency to achieve long-term growth and sustainability. Several studies have confirmed the positive relationship between the good governance and the firm's performance. Our analysis also confirms the effectiveness of board structure on firm's performance. The result shows that concentration of ownership significantly improves the firm's performance by better monitoring and controlling over management's activities. While, duality of CEO negatively affects the firm's performance and it is because of the reason of inefficiency of CEO to manage the role of manager's leader and act as a board's chairman to make strategic decision, equally. However, proportion of executive directors on the board does not significantly affect the firm's performance.

Keywords :

business, governance , sustainability firm's performance.Introduction

Corporate governance is a system of running the business smoothly by organizing and controlling the business activities in ethical means to achieve long-term goal. The system sets policies, principles, procedures, responsibilities and accountability of all stakeholders to minimize any conflict of interest and collectively achieve the business objectives. According to Organization of Economic Co-operation and Development (OECD), “Good corporate governance helps to build an environment of trust, transparency and accountability necessary for fostering long-term investment, financial stability and business integrity, thereby supporting stronger growth and more inclusive societies.” Thus, the corporate governance helps in proper utilization of resource and makes the entire business system efficient. It helps to minimize the errors and protect the interest of all stakeholders equally; and nurture the collective participation and role for long term growth and sustainability. Overall costs are also gets reduced substantially.

According to Aimee (2018), some of the key elements of corporate governance are: Independence and performance of Directors; A diversified board structure, Appropriate compensation management at both board and executive level; Transparency and independence of auditors; takeover provisions and shareholders' right; adequate role of shareholders in board meeting. However, in practical, some of the key elements are not found in most of the organisation and therefore, companies face difficulties in smooth running of the business. Whether it is compliance issue, case of fraudulence, gender discrimination, hostile takeover, wastage of resources or ethical dilemma; company faces several challenges in absence of a good corporate governance. Therefore, it becomes imperative to establish a well-functioning corporate governance mechanism to ensure long-term sustainability and growth of business (Castrillon & Alfonso, 2018).

In this paper, the influence of corporate governance on the business performance is studied in general, and impact of the impact of board structure and equity ownership distribution on shareholders' value creation, in particular. The study focuses on reducing the agency problem that is generally arises in the business. Board structure and its efficient working system ensures reducing the agency problem and enhance the business performance in long run. Study is based on the empirical studies with supportive calculation and findings.

Agency problem

A principal-agent relationship is found in most of the organizations and service arrangements. Under this relationship, an agent is obliged to perform the task on the behalf of principal. Agent is supposed to do his duty in the interest of principal and therefore, his course of action should be ethical and according to the terms & conditions agreed between them. However, a situation may arise when the agent doesn't perform the task in the interest of principal. Rather he looks for maximization of his own interest and hence, a conflict arises between them. Such conflict is referred as Agency problem (Hall, 1998).

In most of the companies, a board is formed by directors, both full time and independent directors. Company related all the major decisions are taken by the board. Board members represent shareholders and therefore, their say in board meeting reflects the shareholders' willingness and desire. Therefore, Board act as a principal. Company's other key personnel like CEO, CFO and managers act as agents who are obliged to do according to the decisions taken by the board. Therefore, client's duty is to perform the task in the interest of shareholders and to maximize the shareholders' wealth. However, most of the times, client gives priority to activities other than suggested by board members and hence, agency problem arises (Jensen and Meckling, 1976). For example, in a board meeting it is decided to cut down the greenhouse gas emission by 25% in the next quarter. This decision is supposed to slow down the production of goods and it is highly likely that the cost of goods will also rise. Consequently, the profitability of the business will be affected. Now, if profitability of the business is a major criterion to measure the manager's performance, the manager may not adhere the decision of cutting emission and continue to the same production process to maintain the sales and reduction volume at the earlier level. Hence, agency problem arises here.

The non-alignment of manager's and shareholders' interest leads to agency problem that incurs cost to the company as well as to the society and such cost is called Agency cost (Ang, et al. 1999). Agency costs is manifested in various forms like loss of firm's value, low productivity, high perk to CEO etc. Thus, agency cost has multidimensional nature and therefore, difficult to quantify in either absolute or relative term (Craig, et al, 2014). Still, there are certain ways through which the agency cost can be reduced. Few of them are discussed here in brief.

It is largely believing that agency cost can be reduced through executive compensation. The idea here is to compensate the marginal cost arisen by the agency cost with the marginal benefit. However, few studies don't find any positive impact of executive compensation on the agency cost (Crystal, 1991; Bebchuk and Fried, 2003). The argument of such findings favor the compensation for CEO's personal utility rather than optimizing the agent-principal relationship (Bebchuk and Fried, 2003). The rent extraction view of compensation says that a powerful manager may influence the executive's compensation and extract rent from the firm. Thus, a negative relationship is found between corporate governance and CEO's pay level (Hartzell and Starks, 2002).

The risk aversion level of shareholders is different from that of managers and therefore, the agency cost can't be reduced by a single form of compensation. According to Agency theory, the shareholders are risk neutral and therefore, want their agent i.e. manager to take the riskier project for getting better return. On the other side, managers have limited human capital which can't be diversified and hence, they are risk-averse (Frye, 2001). Therefore, managers prefer to undertake less risky projects that provides high portion of fixed part of compensation. To mitigate the agency problem in such situation, and motivate the managers to undertake risky projects, equity compensation like stock options and restricted stocks are granted to shareholders (Datta, et al. 2001).

The agency cost can also be reduced through blockholders i.e., shareholders who hold large stake in the firm. With the large ownership and voting rights, blockholders have greater hold on the board functioning and decision of the firm. Through better monitoring, blockholders have greater incentives to increase the value of the firm and hence, agency cost is reduced (Shleifer and Vishny, 1986). However, few studies show negative relationship between the large concentration of ownership and firm's value. Blockholders enjoy the control over board for their personal benefit that worsens the agency conflict (Morck, Shleifer and Vishny, 1988; Claessens et. al., 2002).

Greater transparency in business operation and decision making; high accountability and lesser degree of information asymmetry are also some of the effective means of reducing the agency cost. To make the business sustainable and increase the firm's value, agency cost must be reduced, and it would be possible only with an effective corporate governance. Therefore, a good corporate governance has direct bearing on the firm's performance. In next section, few empirical studies are discussed here.

Board of governance and firm's performance

Structure of board of directors is central to a good governance mechanism. The board monitors the work of managers and ensure the agency problem shouldn't be arisen. Apart from making strategic decisions, board also reconcile management's decision with shareholders' interest (Chen, et al. 2015). The board consists both internal and independent directors. It is a common believe that independent directors are more effective in protecting the shareholders' interest and thus, improving firm's performance (Filatotchev, et al. 2010). A large number of studies have been conducted to know the relationship between the independence of directors and firm's performance, but results are inconclusive. Few of the studies found a strong positive relationship between independence of directors (for eg. Kumar, et al. 2018; Liu, et al. 2015; Li, et al. 2015) and some studies found negative relationship (For eg. Ben Barka, et al. 2017; Chen, et al. 2015). The positive relationship between directors' independence and firm's performance is based on the arguments that the monitoring and controlling activities of independent directors are better that leads to high performance of the firm. On the other side, negative relationship between independent directors and firm's performance is based on the argument that independent directors have less access to information and therefore, they have poor understanding of firm's day-to-day activities. Hence, they get poor ability to monitor management's action that leads to poor firm's performance (García-Sánchez, 2010).

CEO duality is another important factor that affects the corporate governance mechanism and affects the firm's performance. It refers to a situation when the Chief Executive Officer (CEO) is also the chairman of Board of Directors. Here, also there are different views on the effectiveness of CEO duality on governance and in turn, firm's performance. From the view of Agency theory, the dual role reduces the effectiveness of monitoring and hence, the agency problem gets further aggravates that in turn, leads to poor firm's performance (Jensen, 1993; Tian, et al. 2001). CEO is responsible to implement the strategic decision and monitoring the functioning of overall business. While, the Board takes all the major decision relevant to business's long-term goal and objective. Hence, dual role also reduces the efficiency of CEO that affects the business performance. Hence, concentration of power and authority in one person should be avoided and board leadership should be separated from the business ruling (Report, 2003). On the other hand, the Steward theory suggests that duality of CEO doesn't raise the conflict between managers and shareholders rather, unifying the roles make the business objective more clear and strategically achievable and thus, firm's performance gets improved (Boyd, 1995).

Ownership structure is another major factor that affects the business performance. According to Agency theory, the large concentration of ownership effectively performs monitoring activity, reduce information asymmetry and minimize Agency costs (Shleifer, et al. 1997). Most of the studies have confirmed the positive impact of concentration of ownership and firm's performance. High concentration of ownership has great incentive and influence over management's activities to perform in the interest of shareholders (Daily, et al. 2003). It also reduces managerial opportunism and thus, reduces agency problem (Shleifer, et al. 1986). However, few studies don't favor large concentration of ownership. They argue that large shareholders abuse their position at the cost of minority shareholders (Filatotchev, et al. 2002). They have strong incentive to use business resources in a way that makes him better off. Hence, form's performance gets reduces.

Corporate governance is also affected by several external factors including size of the firm and the industry in which business is operating. Large firms need better and comprehensive governance structure to effectively monitor management's activities (Madhani, 2016) and therefore, size of the firm has direct bearing on the firm's performance. The firm's size affects the business in different ways like compensation to executives (Agarwal, 1981), innovations (Damanpour, 1992; Forés, et al. 2016), functional complexity (Anderson, 1961), Corporate Social responsibility (Wickert, 2013), capital structure (Frank, et al. 2003), leverage (Rajan, et al. 1995), dividend policy (Baker, et al. 2007), Merger and Acquisition (Moeller, et al. 2004) and many more. Overall, it is concluded that the firm's size affects the firm's performance in either positive or negative way.

Data and Methods

The impact of corporate governance on the firm's performance is analyzed through secondary research. Around 380 small and medium sized firms are selected in our study from industries like Energy, Transportation, Manufacturing and other services. The data is gathered on the following parameters:

Equity concentration, percentage shares of the largest owner.

Proportion of executive directors on the board (%)

Duality of CEO

Size of the firm (£ million)

Industry from which the firm belongs

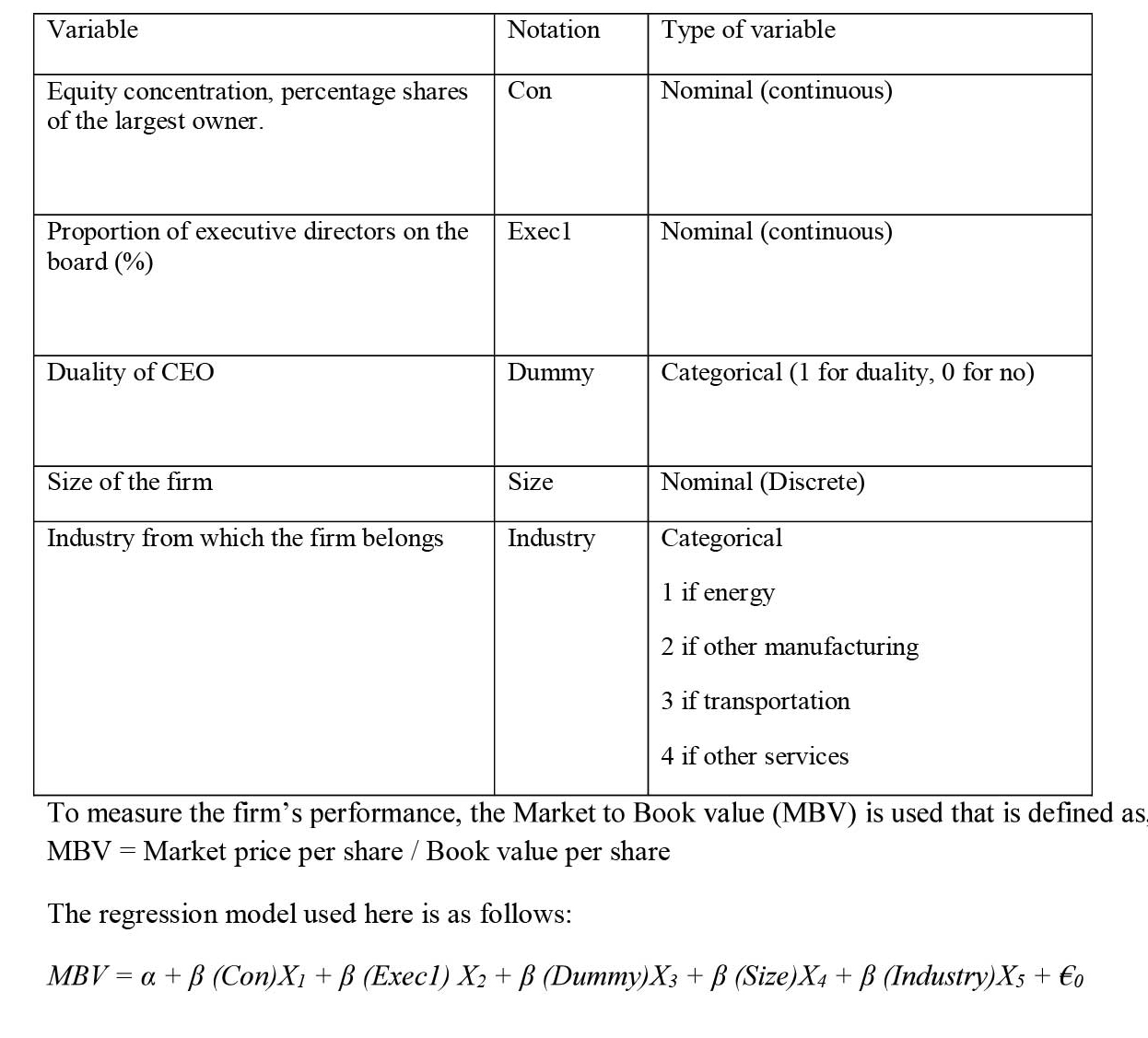

The variables and their characteristics used in the study are as follows:

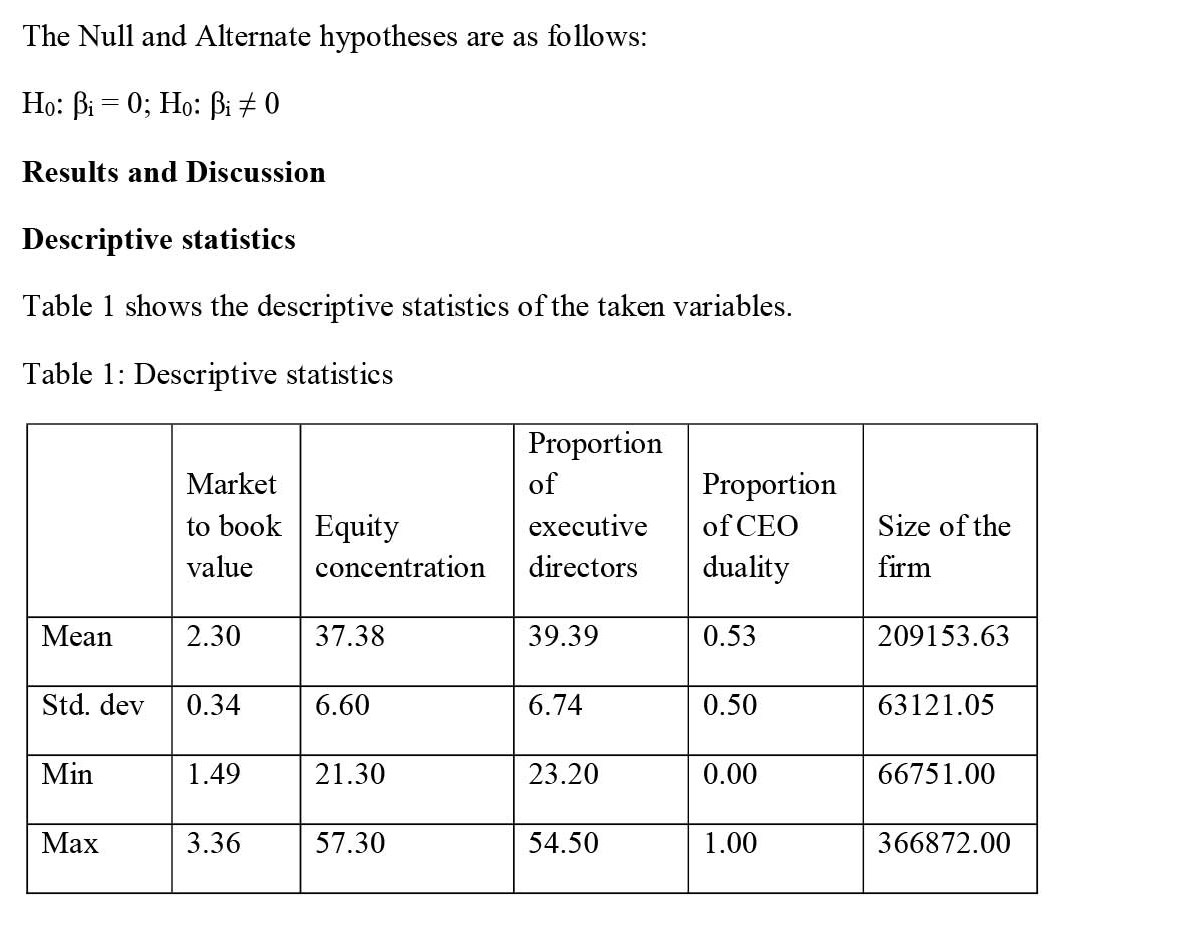

The mean 'Market to Book Value (MBV) is calculated at 2.30 with Std. deviation of 0.34. The minimum and maximum MBVs are 1.49 and 3.36 respectively. Equity concentration has mean value of 37.38% with Std. deviation of 6.60%. The minimum and maximum values are 21.305 and 57.30% respectively. Thus, a large variation in equity concentration is observed across firms. The mean proportion to executive directors are found to be 39.39% with Std. deviation of 6.74%. The minimum and maximum value are 23.20% and 54.50% respectively. Here also, a large variation is observed. The mean proportion of CEO duality is found to be 0.53 which means, the number of firms with dual role of CEO is higher in our study. The The minimum and maximum values are obviously 0 and 1. Size of the firm is another variable with mean value of £209,153.63 million with Std. deviation of £63,121.05 million.

Correlation Matrix

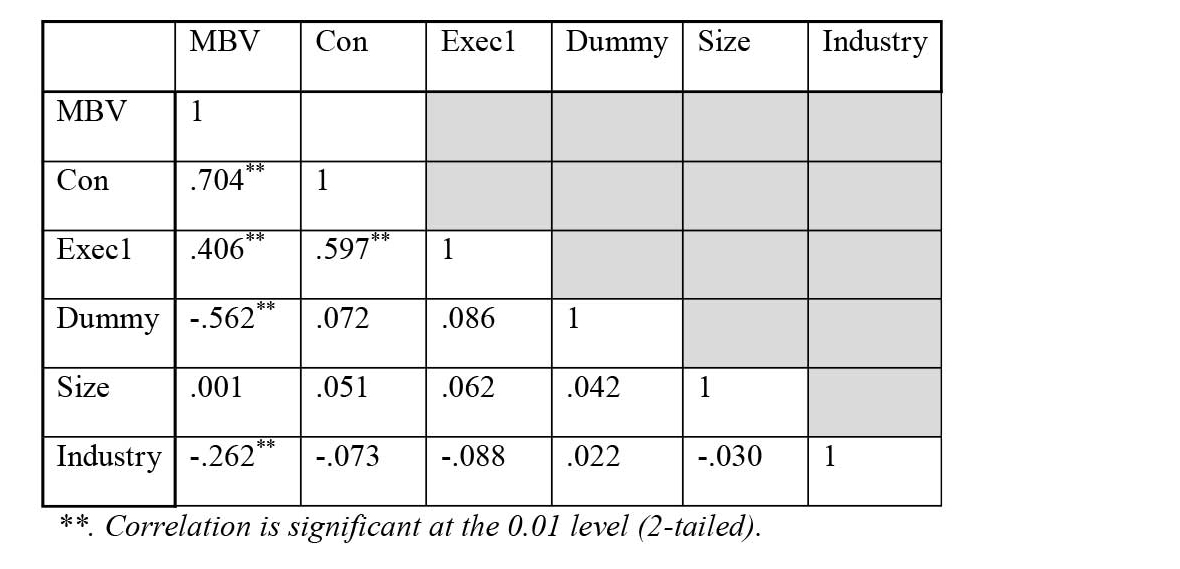

To check the association between two variables, correlation matrix is formed that is given in table 2 below.

Table 2: Correlation matrix

A positive and high correlation is found between MBV and Equity concentration. The correlation coefficient is calculated at 0.704 which is significant at 0.01 significance level. MBV is also positively and significantly associated with 'Proportion of executive directors on the board' with correlation coefficient of 0.406. However, MBV is negatively but significantly associated with 'Duality of CEO' and 'Industry type'. Their correlation coefficients are -0.562 and -0.2623 respectively, which are moderate. 'Concentration of equity ownership' is also positively and significantly associated with 'Proportion of executive directors on the board' and the correlation coefficient is 0.597. Among the rest other variables, either positive or negative correlation exists but the association is not statistically significant.

Regression result

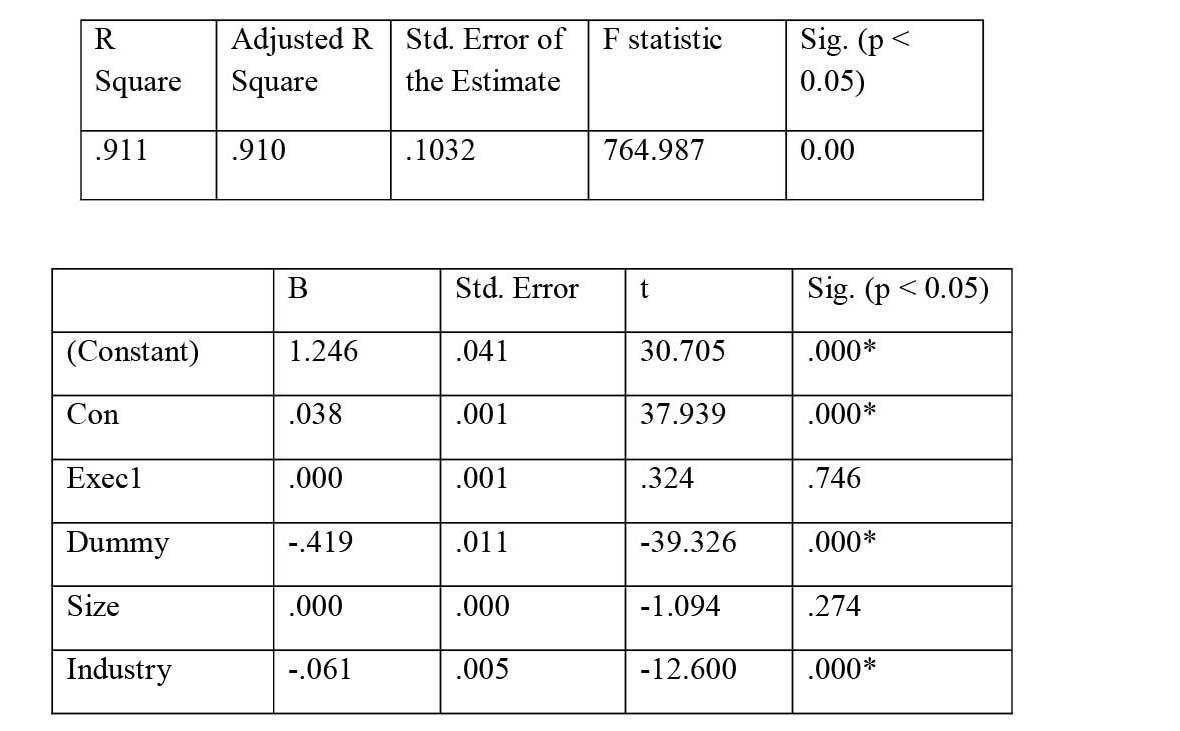

Table 3 shows the regression result on impact of corporate governance on firm's performance

Table 3: Regression result

The R-square is calculated at 0.911 which is high and shows that 91% variation in MBV is explained by variation in underlying variables. F-statistic is also significant which shows model fits good with the given variables.

The constant term is 1.246 and it is significant. It means, the MBV of the firm would be 1.246 when there is no other variable in the model. Coefficient of variable, 'Concentration of ownership' is 0.038 and it is significant. Hence, ownership concentration contributes by 0.038 to MBV when other variables remain constant. So, there is a positive relationship between 'Concentration of ownership' and firm's performance. The variable, 'Duality of CEO' is also significantly related with the MBV, although, negatively associated. If CEO and Chairman are same person, the MBV reduces by 0.419. Hence, a 'Duality of CEO' negatively affects the firm's performance. The variable 'Industry' is another significant variable which is negatively associated with the MBV and hence, reduces firm's performance. Variables, 'proportion of executive directors' and 'size of firm' are not significant but they are positively associated with firm's performance.

Overall, it is concluded that 'Concentration of ownership' and 'Duality of CEO' are significantly associated with firm's performance. 'Concentration of ownership' improves the firm's performance while 'Duality of CEO' reduces the firm's performance.

Conclusion

An effective corporate governance mechanism is essential for smooth running of business. It resolves the agency problem, reduces the agency costs and improves the firm's efficiency to achieve long-term growth and sustainability. The past empirical studies have found significant association between corporate governance and firm's performance. Our analysis also confirms the effectiveness of board structure and firm's performance. The result shows that concentration of ownership significantly improves the firm's performance by better monitoring and controlling over management's activities. However, duality of CEO negatively affects the firm's performance and it is because of the reason of inefficiency of CEO to manage the role of manager's leader and act as a board's chairman to make strategic decision, equally. However, proportion of executive directors on the board doesn't significantly affect the firm's performance.

References

- Agarwal, NC (1981). Determinants of executive compensation. Ind Relat J Econ Soc. Vol. 20, No.1, pp. 36–45

- Aimee, B (2018). Six Essential Elements of Effective Corporate Governance. Retrieved from: https://www.cambridgetrust.com/insights/investing-economy/six-essential-elements-of-effective-corporate-gove

- Anderson, TR., Warkov, S (1961). Organizational size and functional complexity: a study of administration in hospitals. Am Sociol Rev. Vol. 26, No.1, pp. 23–28

- Ang, J; Cole, R and Lin, J (1999). Agency costs and ownership structure. The Journal of Finance. Retrieved from: https://www.researchgate.net/publication/2510694_Agency_Costs_and_Ownership_Structure

- Baker, KH., Saadi, S., Dutta, S., Gandhi, D (2007). The perception of dividends by Canadian managers: new survey evidence. Int J Manag Finance. Vol.3, No.1, pp. 70–91

- Bebchuk, L. and J. Fried (2003). Executive compensation as an agency problem, Journal of Economic Perspectives. Vol. 17, No.3, pp.71 – 92.

- Ben Barka, H. , Legendre, F (2017) Effect of the board of directors and the audit committee on firm performance: a panel data analysis. J Manage Governance. Vol.21, No.3, pp. 737–755

- Boyd, BK (1995) CEO duality and firm performance: a contingency model. Strateg Manag J. Vol. 16, No. 4, pp. 301–312

- Castrillon, G & Alfonso, M (2021). The concept of corporate governance. Revista Científica "Visión de Futuro", Vol.25, No.2. Retrieved from: https://www.redalyc.org/journal/3579/357966632010/357966632010.pdf

- Chen, A., Lu, SH (2015). The effect of managerial overconfidence on the market timing ability and post-buy back performance of open market repurchases. North Am J Econ Finance. Vol.33, pp. 234–251

- Chen, A., Lu, SH (2015). The effect of managerial overconfidence on the market timing ability and post-buy back performance of open market repurchases. North Am J Econ Finance. Vol.33, pp. 234–251

- Claessens, S., S. Djankov, J. Fan, and L. Lang (2002). Disentangling the Incentive and Entrenchment Effects of Large Shareholdings, Journal of Finance. Vol. 57, pp. 2741 – 2771

- Corporate governance. Retrieved from: https://www.oecd.org/corporate/

- Craig, A; Nguyen, G and Sarkar, S (2014). Agency Costs, Executive Compensation, Bonding and Monitoring: A Stochastic Frontier Approach. Retrieved from: https://pages.charlotte.edu/wp-content/uploads/sites/866/2014/11/agencycosts.pdf

- Crystal, G. (1991). In search of excess: The overcompensation of American executives. W. W. Norton & Company, New York.

- Daily, CM., Dalton, DR., Cannella, AA (2003). Corporate governance: decades of dialogue and data. Acad Manag Rev. Vol.28, No.3, pp. 371–382

- Damanpour, F (1992). Organizational size and innovation. Organ Stud. Vol.13, No.3, pp. 375–402.

- Datta, S., M. Inskandar-Datta, and K. Raman (2001). Executive compensation and corporate acquisition decisions, Journal of Finance, Vol. 56, pp. 2299 – 2336

- Filatotchev, I., Bishop, K (2002). Board composition, share ownership and underpricing of UK IPO firms. Strateg Manag J. Vol. 23, pp. 941–955

- Filatotchev, I., Nakajima, C (2010) Internal and external corporate governance: an interface between an organization and its environment. Br J Manag. Vol.21, pp. 591–606

- Forés, B., Camisón, C (2016). Does incremental and radical innovation performance depend on different types of knowledge accumulation capabilities and organizational size? J Bus Res. Vol.69, No.2, pp. 831–848

- Frank, MZ., Goyal, VK (2003). Testing the pecking order theory of capital structure. J Financ Econ. Vol. 67, No.2, pp. 217–248

- Frye, M (2001). Equity-based compensation for employees: Firm performance and determinants, Unpublished Paper, University of Central Florida.

- García-Sánchez, IM (2010) The effectiveness of corporate governance: board structure and business technical efficiency in Spain. Central Eur J Oper Environ Manag. Vol. 24, No.1, pp. 28–43

- Hall, J (1998). The agency problem, agency cost and proposed solutions thereto: A South African perspective. Meditari Accountancy Research. Vol.6, pp. 145-161. Retrieved from: https://repository.up.ac.za/bitstream/handle/2263/15315/Hall_Agency%281998%29.pdf

- Hartzell, J. and L. Starks (2002). Institutional investors and executive compensation, Working Paper, New York University Stern School of Business.

- Jensen MC, Meckling WH (1976). Theory of the firm: managerial behavior, agency costs and ownership structure. J Finan Econom, Vol.3, No.4, pp. 305–360

- Jensen, MC (1993). The Modern Industrial Revolution exit and the failure of internal control systems. J Financ. Vol.48, No.3, pp. 831–880

- Kumar, P., Zattoni, A (2018) Corporate governance, firm performance, and managerial incentives: corporate governance. Int Rev. Vo. 26, No.4, pp. 236–237

- Li, K., Lu, L., Mittoo, UR., Zhang, Z (2015) Board independence, ownership concentration and corporate performance-Chinese evidence. Int Rev Financ Anal. Vol. 41, pp.162–175

- Liu, Y., Miletkov, MK., Wei, Z., Yang, T (2015) Board independence and firm performance in China. J Corporate Finance. Vol.30, No.2, pp. 223–244

- Madhani, Pankaj M (2016). Firm Size, Corporate Governance and Disclosure Practices: Inter-Relations. SCMS Journal of Indian Management, Vol. 13, No. 2, pp. 17-39. Retrieved from: https://ssrn.com/abstract=2803036

- Moeller, SB., Schlingemann, FP., Stulz, RM (2004). Firm size and the gains from acquisitions. J Financ Econ. Vol.73, No.2, pp. 201–228

- Morck, R., A. Shleifer and R. Vishny (1988). Management ownership and market valuation: An empirical analysis, Journal of Financial Economics. Vol. 20, pp. 293 – 316

- Rajan, R., Zingales, L (1995). What do we know about capital structure? Some evidence from international data. J Finance. Vol.50, pp. 1421–1460

- Report, H (2003). Review of the role and effectiveness of non-executive directors. The Department of Trade and Industry, London

- Shleifer, A. and R. Vishny (1986). Large shareholders and corporate control. Journal of Political Economy, Vol. 94, No. 3, pp. 461 – 88.

- Shleifer, A., Vishny, R (1986). Large Shareholders and Corporate Control. J Polit Econ. Vol.3, pp. 461–488

- Shleifer, A., Vishny, RW (1997). A survey of corporate governance. J Financ. Vol.52, no.2, pp. 737–783

- Tian JJ, Lau, CM (2001). Board composition, leadership structure and performance in Chinese shareholding companies. Asia Pacific Journal of Management. Vol.18, No.2, pp. 245–263.

- Wickert, C., Scherer, AG., Spence, LJ (2013). Implementing and communicating corporate social responsibility: implications of firm size and organizational cost. University of Zurich, Institute of Business Administration, UZH business working paper (339)