Subscribe now to get notified about IU Jharkhand journal updates!

Big Houses Investments: Evidence from Domestic Institutional Investors Investments in India

Abstract :

The paper focuses on the dynamic interaction between Domestic Institutional Investor’s money moves and security yields and Domestic Investors inflows and outflows and Volatility. In the analysis daily data has been analyzed and there exist a negative relation between purchases and returns. After thorough research between Domestic Institutional flows and returns from the market data shows that Domestic flows (sales) are significantly affected by the yield (return) in the market, however, vice-versa case in not applicable. These flows suggests presence of opposite behavior in the market. The analysis has been done using VAR framework and it was found that returns and flows both are influenced by its own lags and return with lags having influence on Domestic fund flows.

Index Terms

Stock Market, Domestic Institutional Investors, Volatility, Domestic fund flows, Nifty Return, Relationship, Vector Auto Regression

- Introduction

India is an emerging market with lots of hopes in its equity market. This market has investors from two major classes of investors one of which is Foreign Institutional Investors and the other is Domestic Institutional Investors. Normally, a positive relationship has been found between flows and yield in the market. The hypothesis suggests that whenever there are changes in return these changes lead to further shift in the fund flows or investments by big Institutions.

The positive relationship between the fund flows (Mutual funds) and security returns does not mean that the former causes the latter or vice-versa. Ila (2013) found out that foreign Institutional investors normally pushes the market in an upward direction. It was also found that a large exit by Foreign Investors in the aftermath of a domestic crisis bring prices closer to their Fundamental value at which the prices should have to be.

The study is different from other studies in the manner that other studies has focused more on trading behavior of Foreign Institutional Investors and Indian stock market.

But this study specifically focuses on the role Domestic Institutional investors play in the development of Indian stock market. Domestic Institutional investors include (Mutual funds, Insurance companies, Banks, Development Financial Institutions and New Pension Scheme). - Literature Review

There have been some studies which focus on role of Foreign Direct Investment on the movement of Stock Market (Areabic,) Gordon and Gupta (2003) through their monthly data analyses various factors which affect the Portfolio investment. From the study, there has been evidence that Portfolio flows are determined by both external and domestic factors. Among external factors, LIBOR and emerging market returns are important whereas at domestic level interest rate plays a very crucial role along with Stock returns.

In quantitative terms, both external and domestic factors are found to be equally important. It has been also found that volatility of portfolio flows into India was small in comparison to other emerging markets. While the data also indicates that Foreign Institutional Investors flows into India have become more volatile. Since, 1998 this applies to other emerging markets as well. Another, interesting fact which comes out from the study was that there has been seasonal impact also on the Investment pattern of Foreign Institutional Investors. They used to invest more in first four months of the year and this could be due to end year bonuses in Unites States. In India, the reason behind that is because of improved sentiments, since reforms are typically announced in the run-up to the end February budget.

The Econometric analysis shows that there are mainly three factors which effect FII flows into the Indian Equity market which includes Domestic, regional and global variables. An increase in external interest rates adversely affects the FII flows into the Indian Stock Market. - Research Gap

The topics on Indian Stock market, its Volatility and impact of various fund flows on the market have been an important part of Behavioral Finance and there have been lots of studies on it. However, Impact of Domestic Institutional Investors on Stock market volatility has not been analyzed so far with especial focus on bidirectional causality relationship. There have been lots of studies which focus on the impact of Foreign Institutional Investors on Indian stock market but none of the study has focused on the role Domestic funds play in Indian stock market. The study is not only going to analyze the bidirectional causality between Domestic Institutional Investors and stock market but it is also going to be analyzed that how DIIs impact the Volatility of Nifty. When we are using the term Indian stock market it means the analyses is going to be made on Nifty. - Objectives

- To understand the role of DIIs in Indian stock market

- To identify the relationship between Domestic Institutional Investors inflows and Nifty return.

H02: Nifty return does not granger cause Purchase

H03: Sales does not granger cause Nifty return

H04: Nifty return does not granger cause Sales

H05: Net Flows does not granger cause Nifty return

H06: Nifty return does not granger cause Net Flows

- Econometric Analysis

In the first step, Unit Root Test of DIIs (Purchase, Sales and Net Investment) was assessed followed by the Unit Root Test Analysis of return of Nifty. The analysis of DIIs purchase, Sales and Net Investments and return series of Nifty consists of finding the order of Integration. Finding order of Integration means checking whether the data is stationary at the level or not. This is the basic necessary condition before applying Vector Auto Regression and Granger Causality test. In order to check the stationarity of DIIs (Purchase, Sales and Net Investments), and Nifty return data, ADF and PP test was employed.

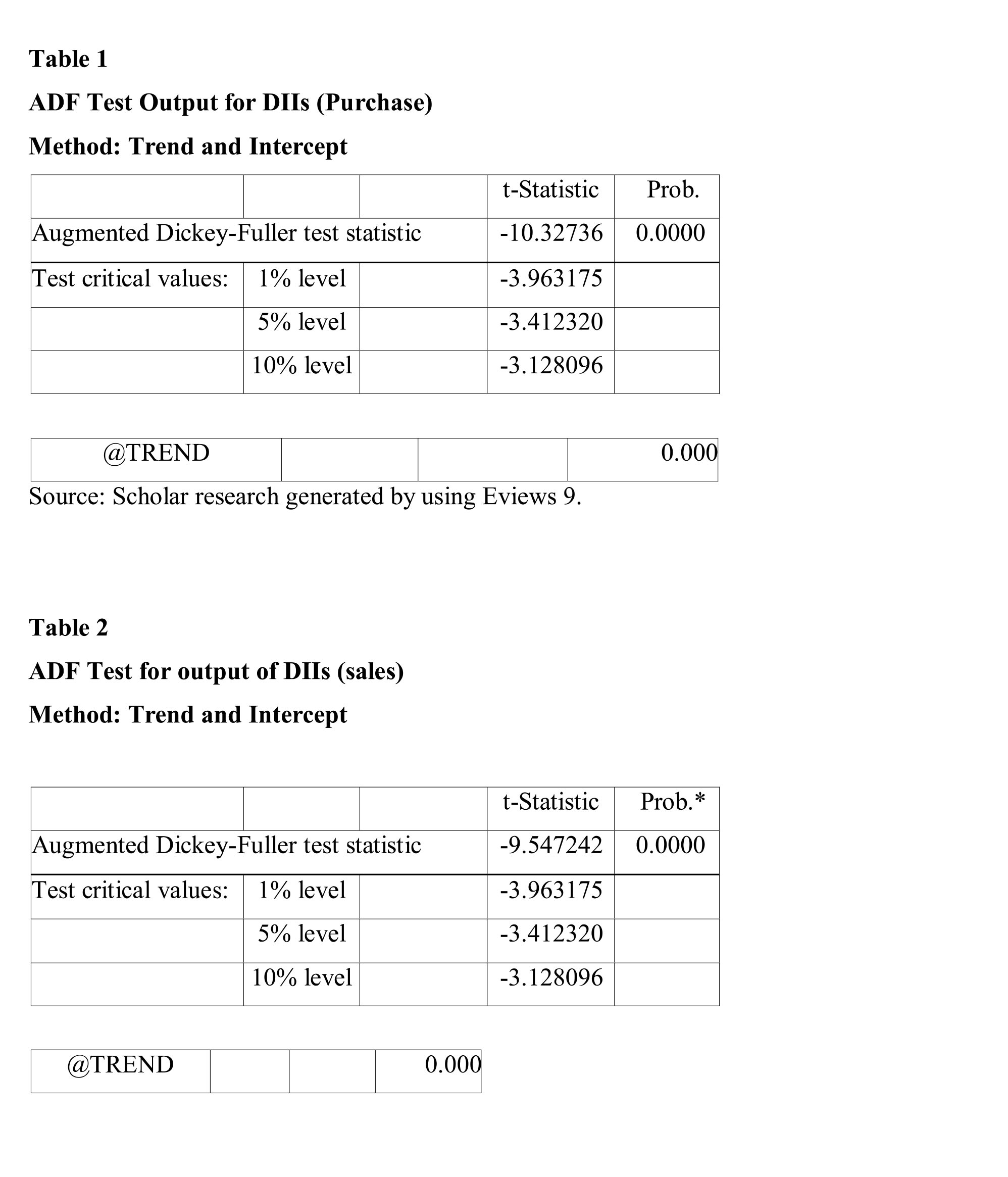

The ADF test was applied to first at Purchase of DIIs with “Trend and Intercept” model of unit root and then to sales, net Investments and Nifty return. The numbers of lags are automatically selected. The output is presented in Table 1.

The result is (10.32 > 3.96, 10.32 >3.41, 10.32 >3.12). Thus, according to ADF test, the conclusion is that DIIs (Purchase) is stationary at level and it is having order 0 i.e DIIs Purchase I (0).

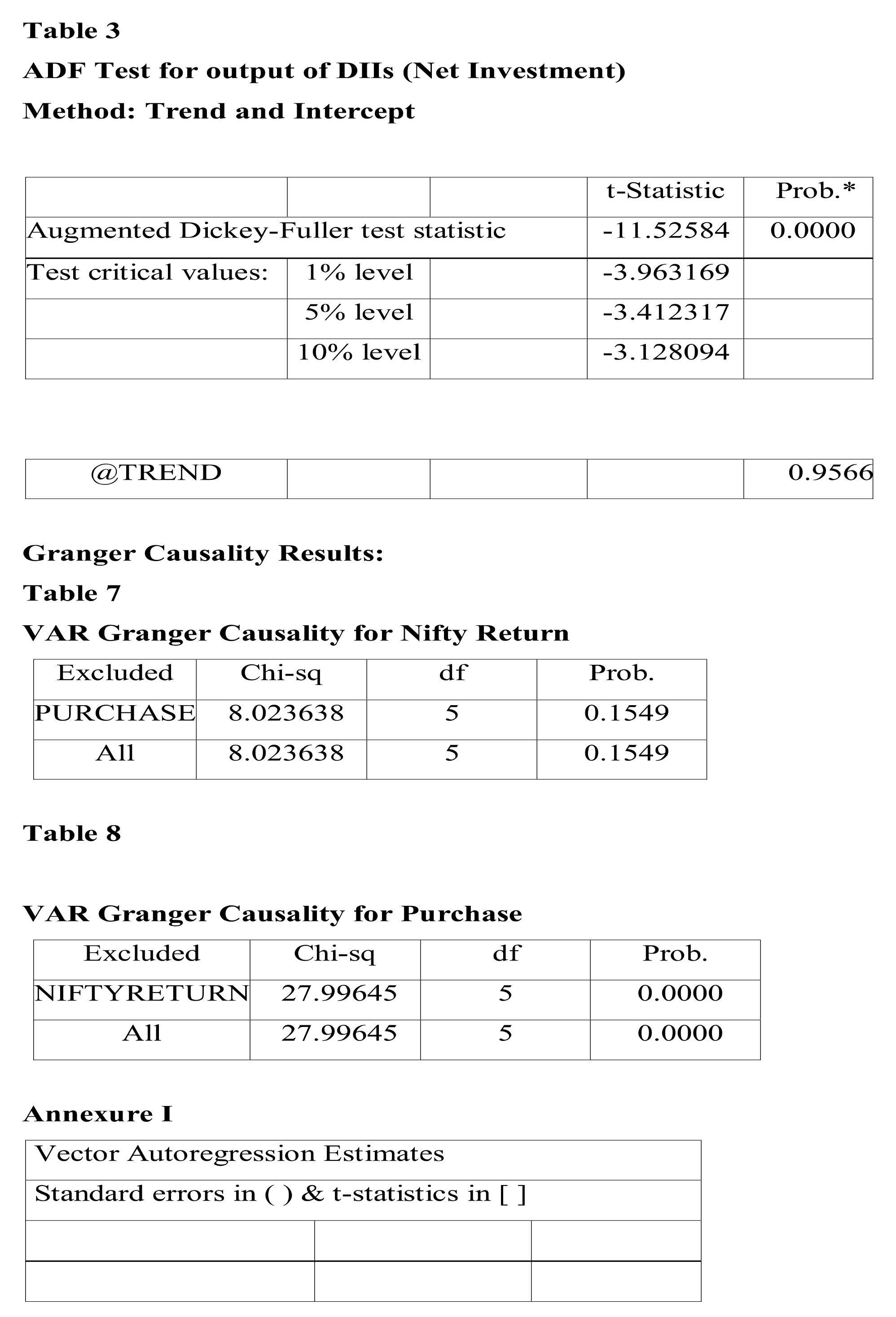

The result in Table 2 shows that trend is significant because prob. value is less than 5% (000.). Also, the absolute t statistic is more than critical values (9.54 > 3.96, 9.54 > 3.96, 9.54 > 3.12). Thus, according to ADF test, the conclusion is that DIIs (Sales) is stationary at level and it is having order 0 i.e DIIs Sales I (0).

The result in Table 3 shows that trend is not significant as the probability value is more than 5% (95%). Therefore, it means that the model would be estimated again with “Only intercept” model.

The result that trend is significant because prob. value is less than 5% (000.).

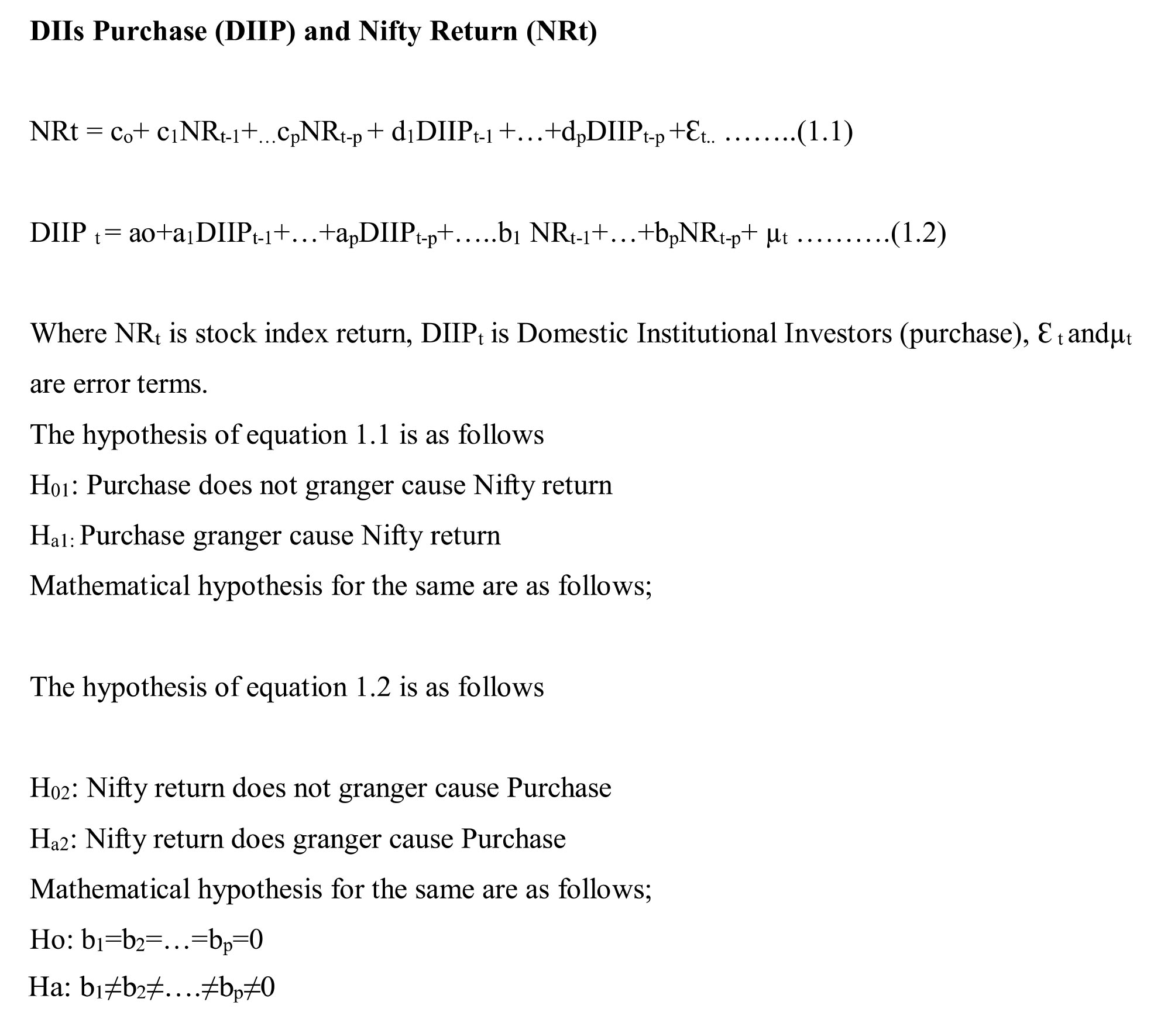

- GRANGER CAUSALITY BETWEEN DIIS PURCHASE AND NIFTY RETURN

The contemporaneous relationship between DIIs Purchase and Nifty return will be analyzed in this section C.

Domestic Institutional Investors and market return have a positive or negative correlation does not necessary mean that the former causes the latter and vice versa since there could be other explanations also for this phenomenon. In order to gain more insights into the relationships between Domestic Institutional Investors (Purchases) and Nifty return, the study employs VAR based test.

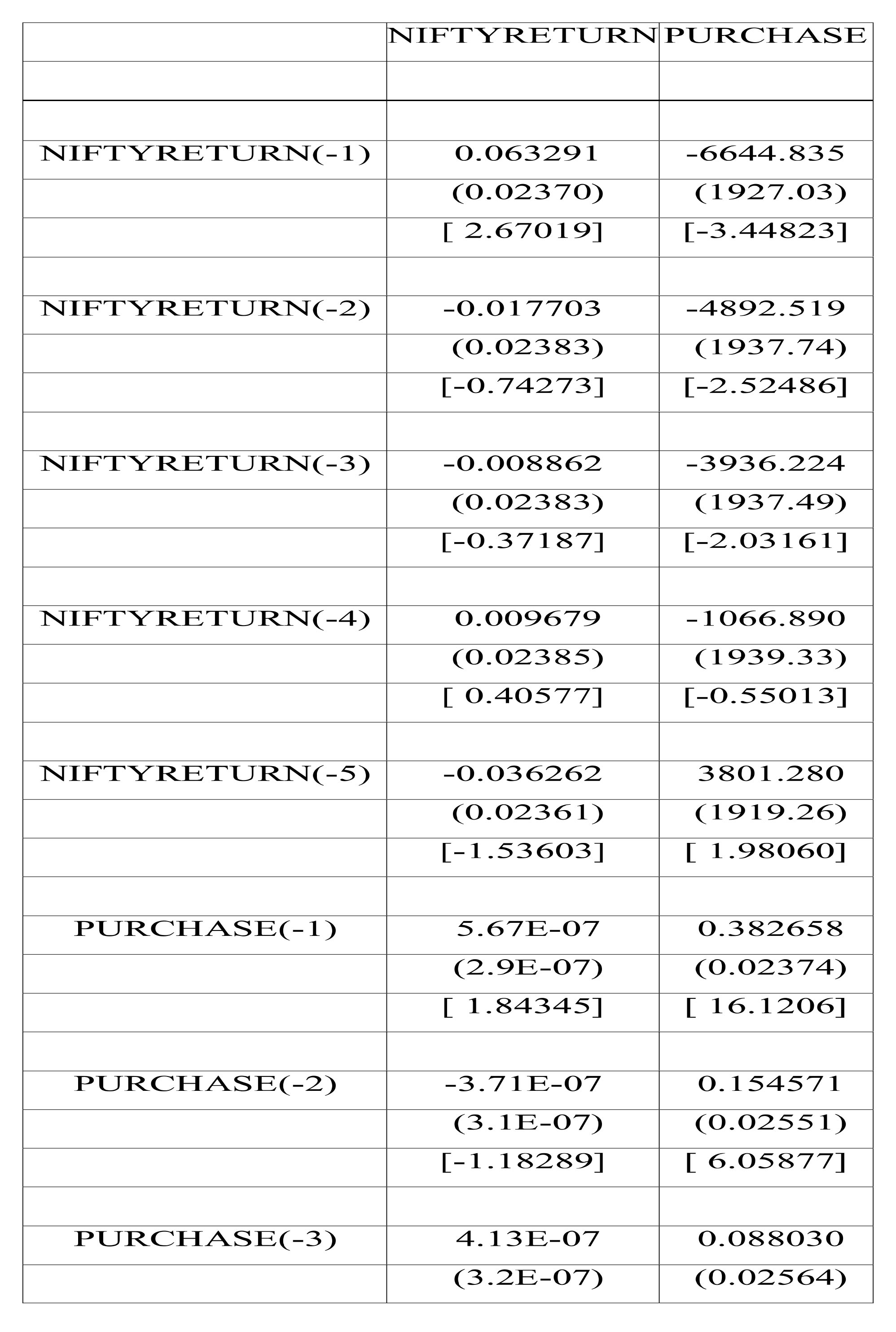

In both the cases rejection of Null hypothesis denotes the presence of Granger causality. Now, to start the causality approach Vector Auto regression (VAR) is set up. We estimate VAR (1, 1),(1,2), (1,3), (1,4), but all prove to be futile as per the detection of Lag length criteria. Thus, the final model was selected at VAR (1,5). The benefit of VAR is that they account for inter-temporal dynamics between variables, without imposing a priori restrictions of a particular model.

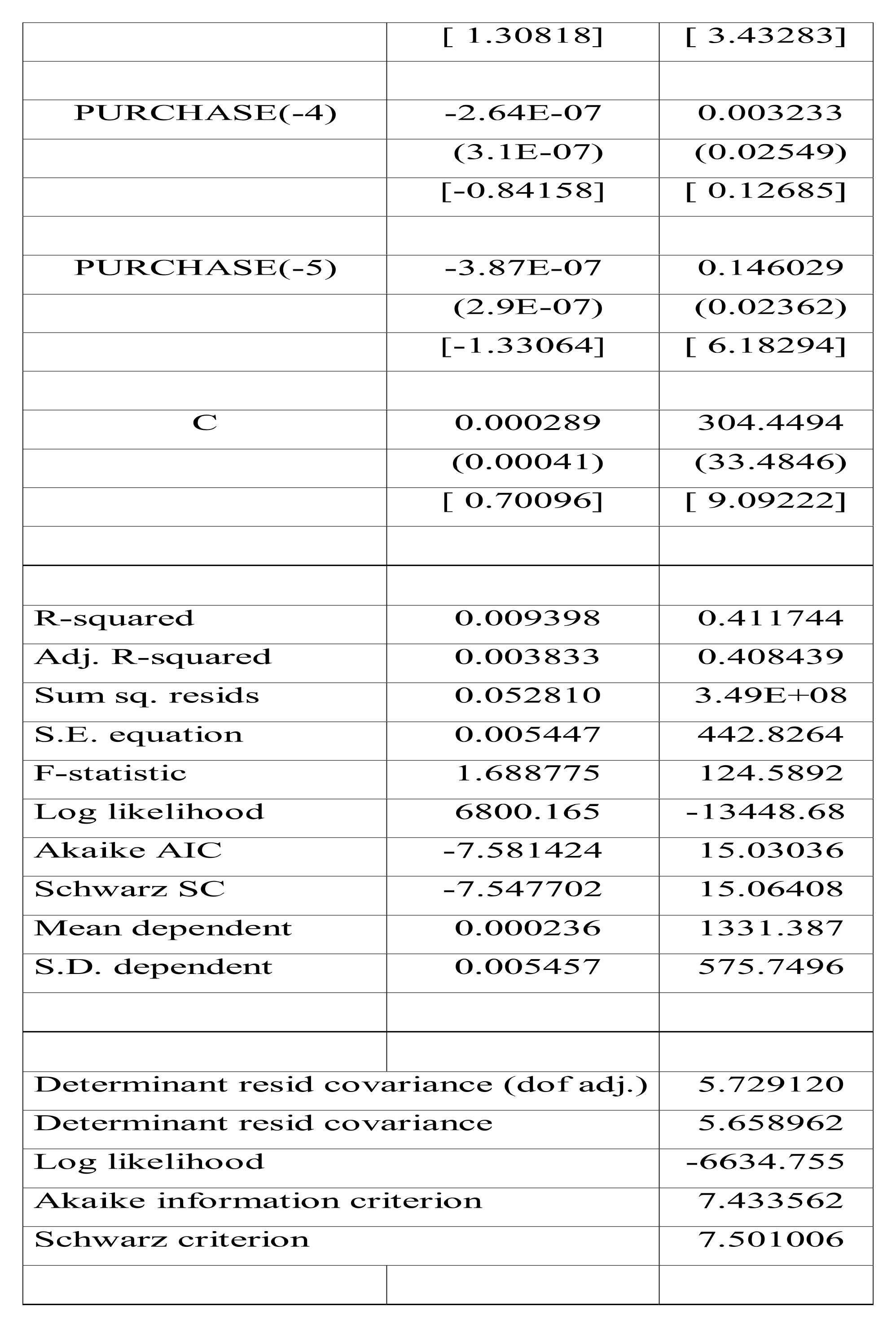

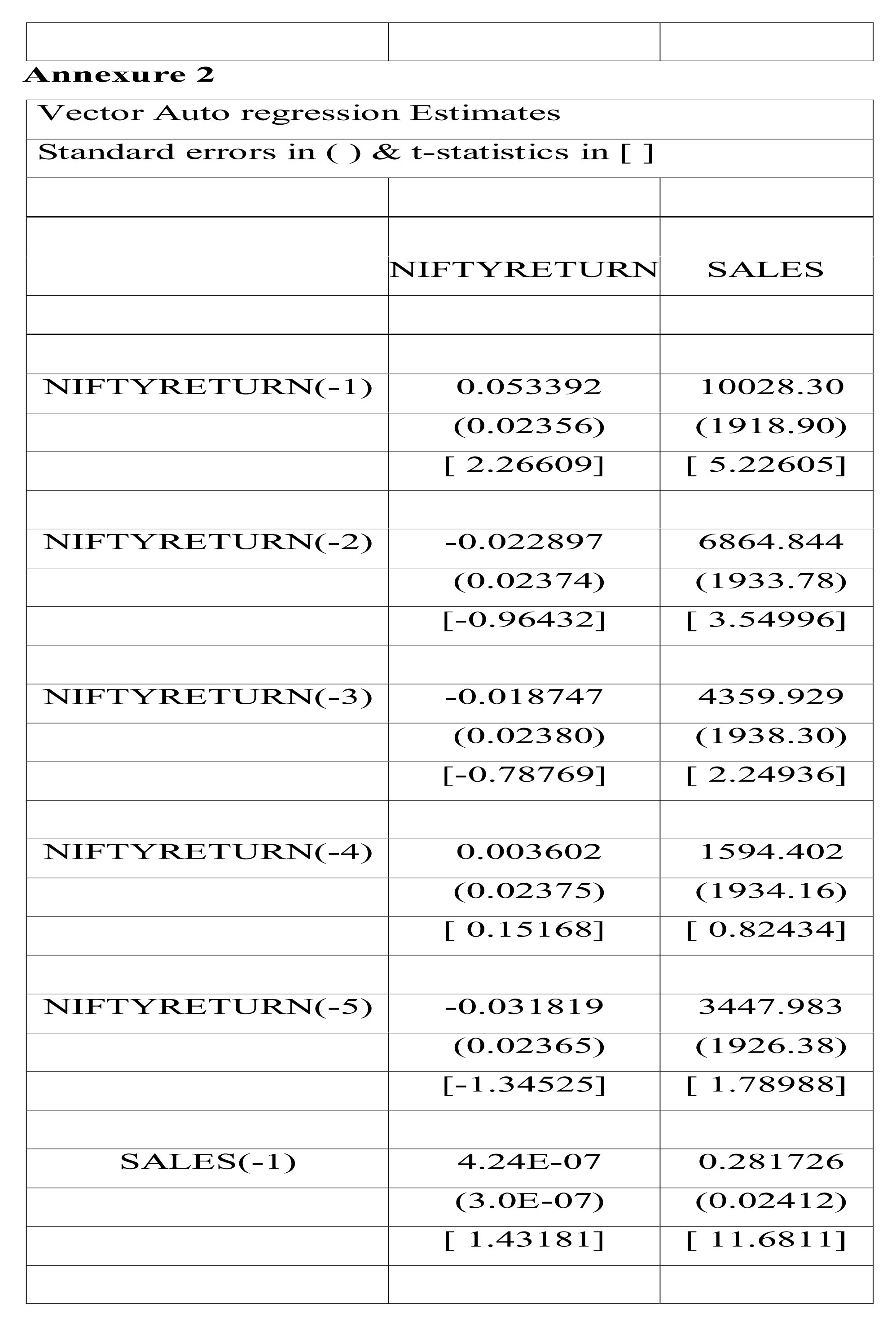

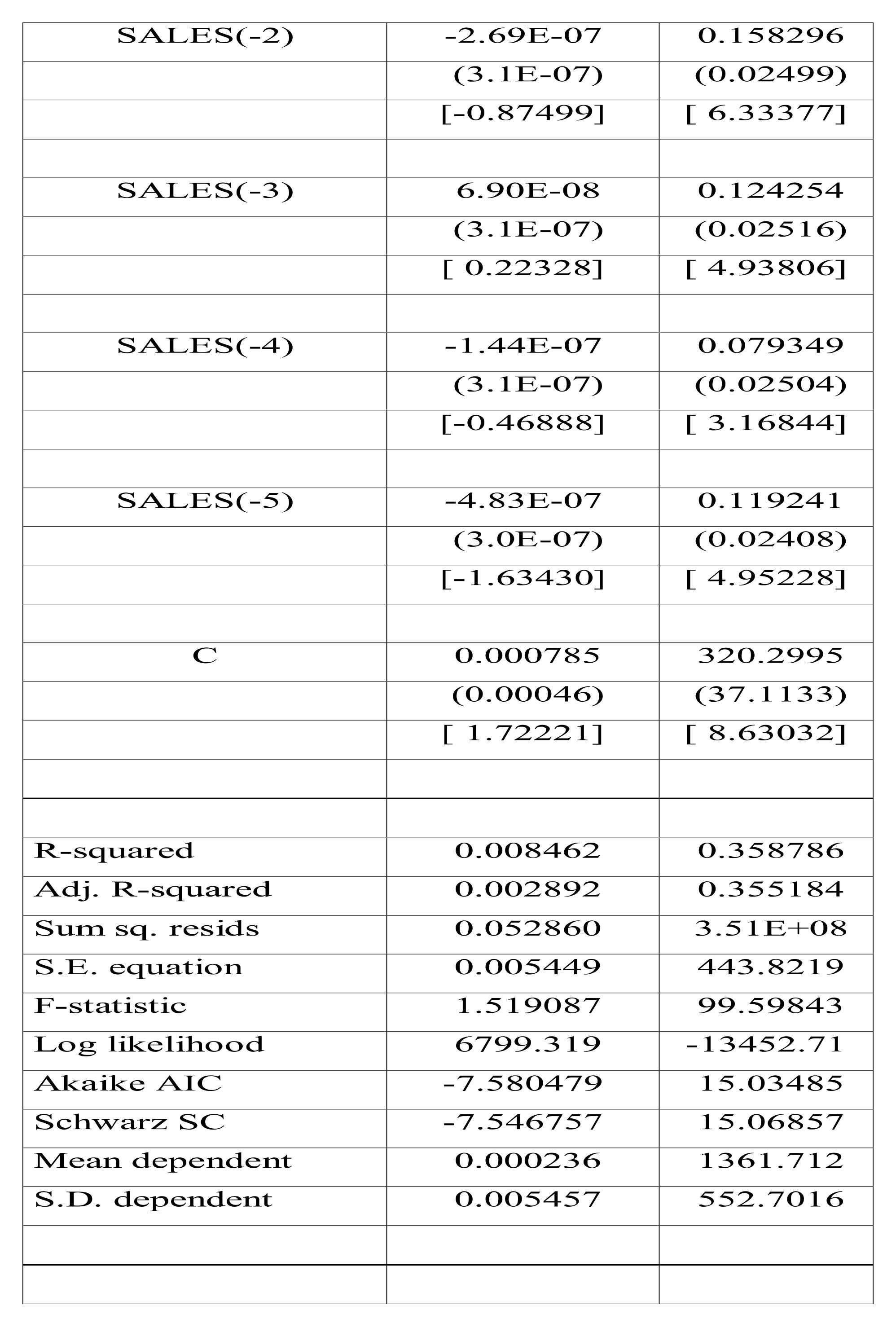

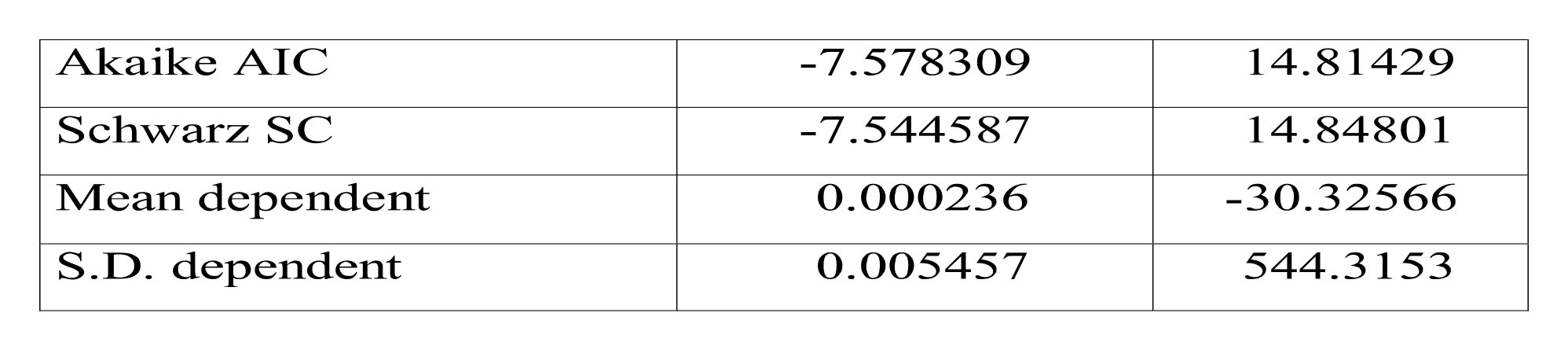

The output for VAR is presented in Annexure I (VAR 1). The results in annexure I whose columns designates the dependent, or “caused,” variables and whose rows define the independent, or “causing” variables shows that Domestic Institutional Investors (Purchases) does not show much significant impact on the Nifty returns as t- statistics is not significant with value 1.82. Even, the R2 is low, which implies that DIIs purchases capacity to explain the market return is low.

On the other hand, nifty returns have a negative and strong impact on purchases made by Domestic Institutional Investors (DIIs). It means when market is low Domestic Institutional Investors used to purchase a lot as t value is -3.44.

Another interesting fact is that market return is positive and significant with its one lag; while DIIs purchases are highly significantly influenced by its past two lags as t- statistics is 16.12 at lag one. This result implies that an increase or decrease in DIIs purchases tends to spur other fund investors to act in the same direction.

Our Hypothesis for DIIs (Purchase) and Nifty return were as follows

H01: Purchase does not granger cause Nifty return

H01: Nifty return does not granger cause Purchase

From Table 8 it can be revealed that the null hypothesis Purchase does not Granger Cause nifty return is accepted with Nifty return as dependent variable as the probability value is more than 5% i.e.0.15

From table 9 it can be revealed that the null hypothesis Nifty return does not granger cause Purchase return is rejected with DIIs purchase as dependent variable. It means that Nifty is causing or having impact on DIIs purchase. It is revealed from the prob. Value which is 0.00. In the same manner the analysis has been done on sales and net investments. Annexure are attached.

- FINDINGS, SUGGESTIONS AND CONCLUSION

- Domestic Institutional Investor’s (DIIs) purchase doesn’t have any impact on Nifty return whereas Nifty returns (with lags) do influence the Domestic Institutional Investor’s purchases. It means DIIs use to invest with the movement of Nifty. Their purchase or investment strategies are followed by the direction of the market and its return.

- Domestic Institutional Investors out flows (sales) are significantly affected by lagged value of market return; however, the latter is not significantly influenced by variation in these flows. It means that a positive relationship has been seen between Market return and DIIs (Sales). Annexure II

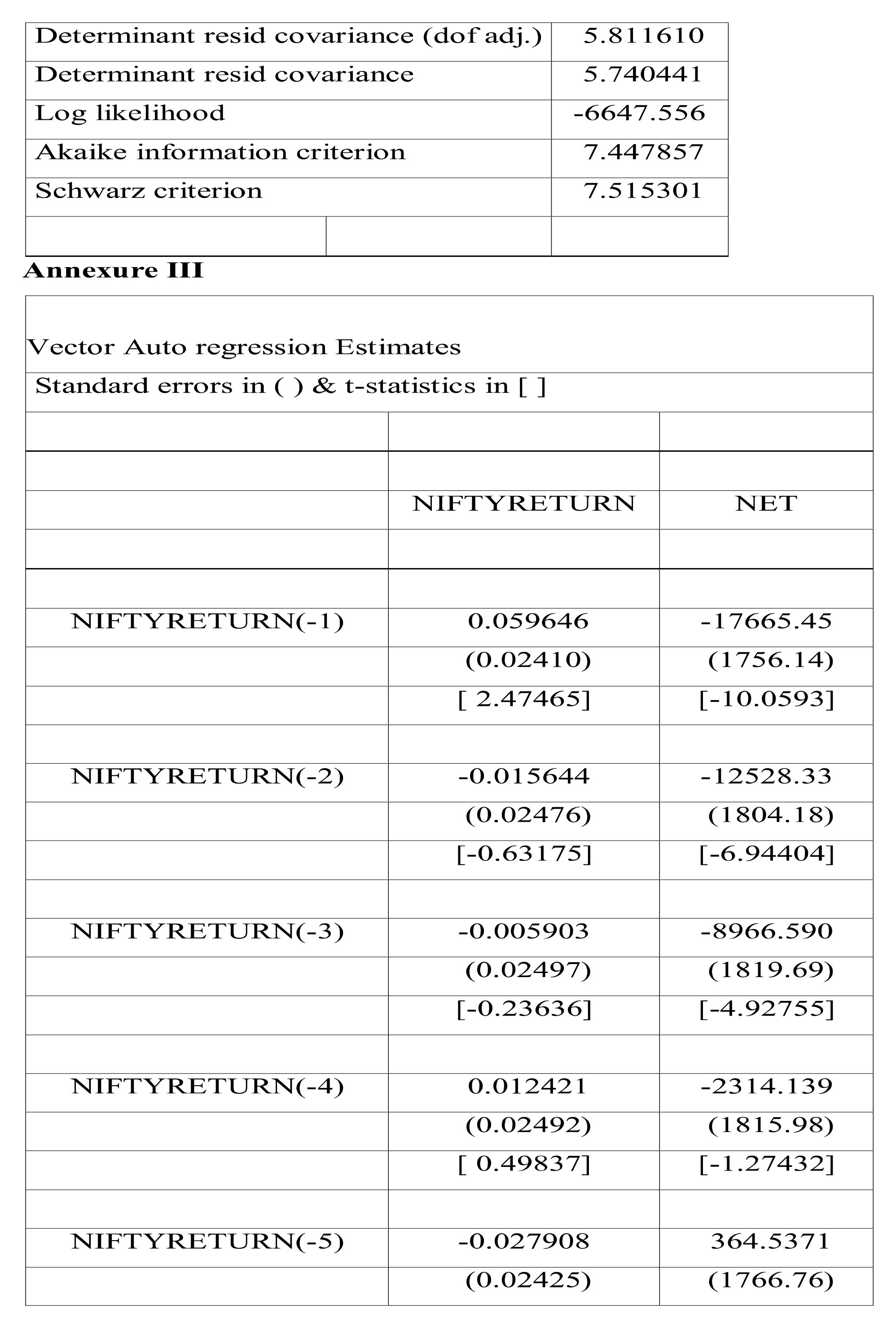

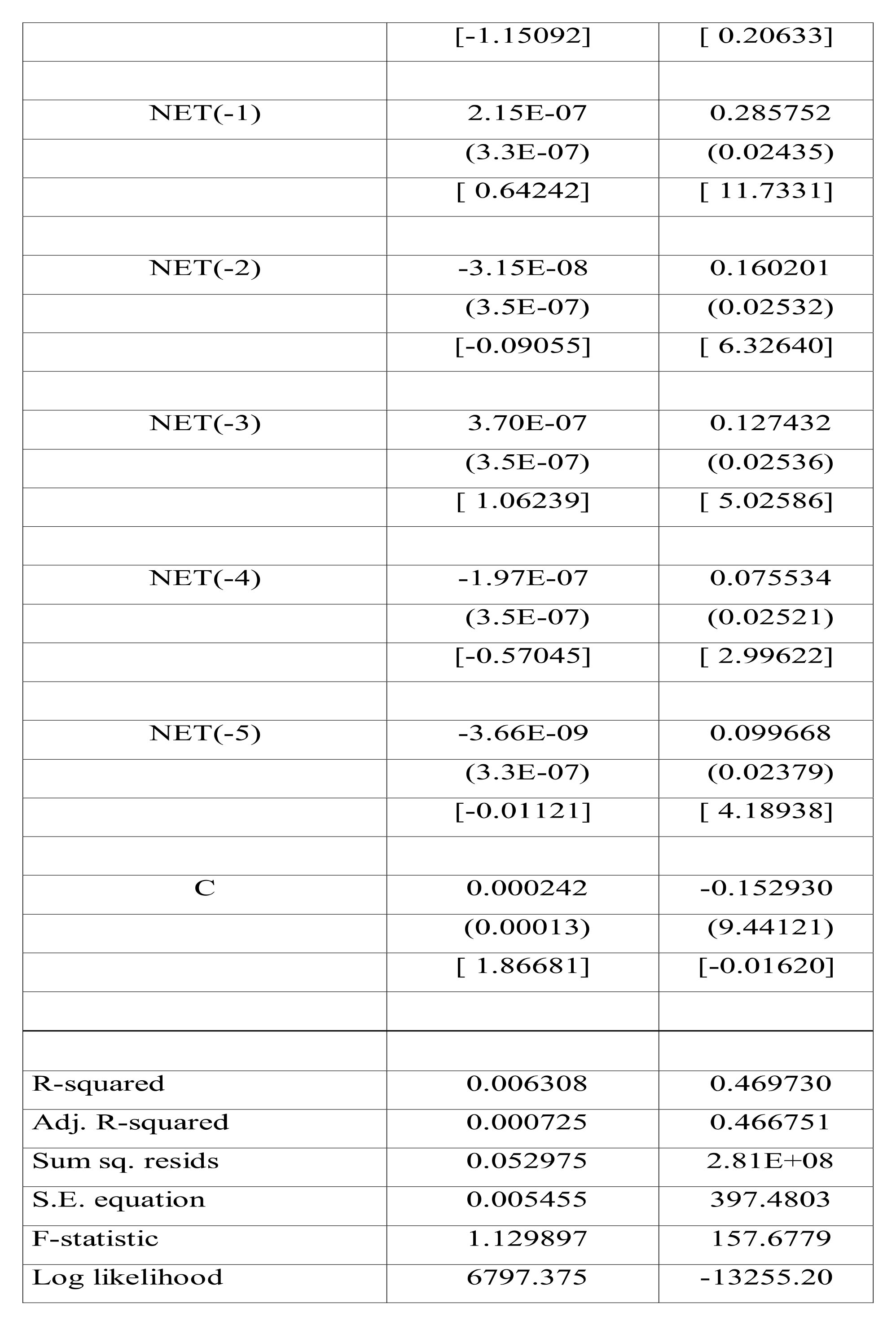

- As far as, net flows of DIIs are concerned negative correlation has been seen between market return and DIIs net flows. Market return with lags is having huge negative impact on DIIs net outflows where DIIs fail to make any impact on market return. Annexure III

- Granger causality analysis signifies unidirectional causality between Market return and DIIs flows. The causality moves from Return to flows. It means that market return do have huge impact on Purchase, sales and net flows of Domestic Institutional Investors where Domestic funds does not have any impact on Nifty return.

- Domestic Institutional Investors (Purchase, sales and Net Flows) are significantly influenced by its own lagged values it means that previous values of DIIs flows can predict the future values of Flows. This result implies that an increase or decrease in Domestic fund flows tends to spur other Domestic investors to act in the same direction. In other words, we can say that Domestic Institutional Investors use to chase their past investment strategies.

- Over all we can say that Domestic Institutional Investors buys more and sell less when market is down and on the opposite side sell more and buy less when market is high. It means overall a negative trading behavior has been seen by Domestic Institutional Investors.

- Market returns are also hugely influenced by its past lagged values. It means that previous days return of nifty play an important role in deciding the direction of the market on next day.

- Indian stock market is still depends largely on Foreign Institutional Investors and these foreign institutional investors have the capability to disturb the market with their trading activities, so policy makers should make such norms which make a bit difficult for these types of investors to pull their money back from the Indian stock market.

- Domestic Institutional Investors holding in companies listed in Indian stock market is still not more than 15 % which make them less effective as compared to foreign institutional investors. Policy makers should make such policies which will increase the participation of Domestic Institutional Investors more in Indian stock market.

- Mutual funds which are an important and major component of Domestic Institutional Investors should aware people to educate and motivate people so that they can start investing in Indian stock market.

7.1 Suggestions

The paper focuses on institutional investments and their relationships with equity returns.

Vector Auto Regression have been used to study and data from 1st January 2009 to 31st March 2016. The analysis has been done in two steps. First, it examines the dynamic relationship between aggregate stock returns and institutional investment flows, and second, it measured the impact of Domestic Institutional Investors on Indian Stock Market. The analysis provides several observations.

First, consistent with previous research it is found that institutional investors chase their past investment strategies. Second, the independent analysis for Domestic Institutional Investors reveals that, the DIIs fund flows (purchase, sales and net) are insignificant in determining stock returns.

Third, it is observed that the domestic mutual funds sell more and purchase less when market rise and purchase more and sell less when market falls down. This indicates that in an aggregate level, Domestic Institutional Investors follow a negative feedback trading strategy.

However, Domestic funds purchases and net flows positively influence the market volatility suggesting that increase in institutional inflows increase the market volatility. But, it has also been found that Domestic investor’s outflow doesn’t make any impact on volatility of Indian stock market.

It is found that the domestic funds net flows have a positive impact on market volatility.

While this study provides evidence that institutional investors adopt different trading strategies and their net investment flows are significantly associated with the market movements. Thus, the findings should be considered with some caution thereby the distinct applications in practice as there is a possibility that including all type of domestic institutional investments individually may provide more robust findings. Further, considering the fund investors at individual level and a comparison of institutional investors and individual investors in influencing the stock market and vice-versa may provide a better understanding of the dynamic relationship between market volatility and investor behavior.

Analyst, A. (2014). Performance Evaluation of UTI Mutual Funds ( On Selected Diversified Equity Schemes ), (December), 15–18.

Anshuman, V. R. (n.d.). Trading Activity of Foreign Institutional Investors and Volatility +, 1–28.

Arčabić, V., & Raguž, I. (n.d.). The relationship between the stock market and foreign direct investment in Croatia : evidence from VAR and cointegration analysis. http://doi.org/10.3326/fintp.37.1.4

Bahl, S., & Rani, M. (2012). A Comparative Analysis Of Mutual Fund Schemes In India, 1(7).

Bansal, A., & Pasricha , J.S. (2009), Foreign Institutional Investor’s impact on stock prices in India, Journal of academic research economics,1(2).

Online]available:http://www.jaresh.com/downloads/num_1_issue_2_2009/bansal.pdf.

Gourzi, H., & Ramanarayanan, C.S. (2011) . Empirical Analysis of the Impact of Foreign Institutional Investment on Indian Stock MArket Volatiltiy during world Financial crisis 2008-09. International Journal of Economics and Finance,3(3).214-226.doi:10.5539/ijef.v3n3p214.

Patnaik, I., Shah, A., and Singh, N. (2013). Foreign Investors under Stress: Evidence from India, IMF Working Paper series.

Gordon, J., & Gupta, P. (2003). Portfolio Flows into India: Do Domestic Fundamentals Matter? IMF Working Paper NumberWp/03/02.

Warther, V. A., (1995). Aggregate mutual fund flows and security returns, Journal of Financial Economics, 39, 209–235.