Subscribe now to get notified about IU Jharkhand journal updates!

Buy Now Pay Later – A Comparative Study About The Awareness, Perception And Factors Influencing The Usage Of BNPL As A Payment Option

Abstract :

Buy now pay later or BNPL is a payment option which refers to a short-term loan which is offered to customers by service providers, who are mainly focussing in the retail sector to pay for the product or service after a fixed duration with no additional charges. The concept of buy now pay later traces it’s origin to the aftermath of the world war 2 and had a recurrence during the later stages of covid thus emphasizing the fact that it comes as a key during the economic times when there is a peak in inflation leading to higher interest rates. This paper tries to focus on the awareness and perception about the BNPL service among the millennials and Gen z leading to the study of their usage pattern for the same. The paper concludes on the social, psychological and economic factors impacting the usage of BNPL thus understanding the environment which influences the usage of BNPL.

Keywords :

BNPL, Buy now pay later, payment option, perception, awareness, Debt accumulation.Introduction

Buy now pay later or BNPL is a payment option which refers to a short-term loan which is offered to customers by service providers, who are mainly focusing in the retail sector to pay for the product or service after a fixed duration with no additional charges. As every service or product comes with two sides to it and nothing supports a claim to its full and the same case applies to BNPL. The usage of any product must be regulated to avoid falling into traps which include debt accumulation due to excessive credit purchase. BNPL has been organized by multiple service providers which own leading names and significant position in the market and holds a strong brand value as well. The usage of any service among the consumers can be studied through multiple factors as the signal the adoption rate and the scope of the service in long run. It has also been noticed that BNPL has come into picture during the key economic times signifying the essence of it to navigate during turbulent times.

This usage of the product is determined by the way the consumers perceive in the market and the awareness about the service or the product also acts as a key driving force in the market adoption. Trust also plays a significant role in building the confidence to purchase or avail services thus increasing the market consumption which is also analysed in the paper.

The financial behaviour is also widely influenced by the circumstances which one evolves and grows in, the demographics where one belongs and the beliefs running behind certain service usage patterns. Such usage patterns are categorized into three segments which are social, psychological and economical factors and they are studied in the paper to analyse the perception by consumers in regards to the usage of BNPL.

BNPL owning a niche market to being an alternative payment option is a journey whose pace will be determined by the circumstances which builds it and the paper tries to study the perspective in order to determine the pace of the trajectory.

REVIEW OF LITERATURE PERCEPTION AND AWARENESS:

Few of the studies suggests that there is an ambiguity among the usage of BNPL since the service has arrived recently in the market and most of its users are testing the service and experiencing it. In the study conducted in the United States suggested that the demographics of the users are generally low -earning and employed (Akana, 2021). The major reasons for the usage of BNPL are the lack of credit access, convenience and cost. Heavy users do not associate BNPL with being focussed on financial needs than the light users. There is a higher level of ambivalence existing among users as there is a significant amount of concern regarding its impact on the credit level.

According to one of the research projects conducted by Deloitte where a survey with 600 responses were conducted. The studies suggests that there are four types of customers who use BNPL as a service (unlocking the potential of buy now pay later, 2022).

- first one being a fashion maven where consumers generally want to be updated with the latest fashion trends in the market and BNPL is used for the same.

- Second one being a social recreationist; this section of consumers generally compromise the active Gen Z and Millennials use BNPL to finance their social activities and hobbies.

- Third being a consumer section from a conscious family; the younger families finance their necessary essentials and communal experiences and BNPL offers to be a reliable partner.

- Fourth being a deal chaser segment; this part of the customer segment uses BNPL to finance their purchases in familiar brands by being a part of loyalty programme and seasonal discounts. The major challenges which exist and becomes an hindrance in the expansion of BNPL are as follows:

BNPL is not encouraged to be a positive financial tool since most consumers fall behind on the payments thus increasing the existing risk of debts.

The confidence levels on these BNPL firms are very minimal. trust creates loyalty and drives business results. The studies showed that BNPL Consumers trust technological companies more than financial institutions and these financial services perform the lowest in terms of consumer trust.

The misconceptions regarding BNPL hamper the trust which is already very minimal. The major misconceptions are as follows:

- 43% of the consumers believe BNPL providers unfairly make money through interest rates

- 26% of the consumers believe that the products sold through BNPL are marked up to generate profit

- 21% of consumers believe BNPL firms earn money through unadvertised fees

There is the concept of systemic financial exclusion which makes a section of customers discriminated against the race due to the non- availability of the credit score which is offered to the same. Working towards making BNPL a success would require 3 parameters to be worked on which are wellness, trust and inclusion which is delivered through innovative portfolio and holistic experience.

According to the liberty street economics, the consumer financial protection bureau has identified several domains which causes harm to the consumers in terms of payments which can be inconsistent consumer protection, the risk of debt accumulation and over extension. This study on the contradictory states that BNPL expands financial inclusion especially to those low on credit scores and this leads to excessive debt accumulation and over extension.

FACTORS WHICH INFLUENCE BNPL USAGE

This paper focusses on establishing a link between impulsive buying behaviour and its impact on overconsumption on a targeted group of society which are the Gen Z who are born between the years of 1997-2012. This research is conducted with respect to the Indonesian population which is the 4 th largest population across the globe and their 30 percent of the population constitute the Gen z (lia, 2021). Impulsive purchasing has multiple determinants which are mostly a result of psychological factors. Impulsive purchasing is the shift in the regular purchasing; an encounter which demands an abrupt desire to purchase. The utilization of buy now pay later services had increased the number of users thus widening the market as it is not regulated and ungoverned by any organization. Compared to the bank credit system, BNPL offers flexible usage of service since the lending feature of banks is based on the users limit to repay thus preventing financial overextension.

The increasing demand of BNPL are due to the following reasons:

- The credit card penetration In Indonesia is slow. There is a high requirement to install online credit system among the Gen Z.

- Varied organizations offering diverse credit financing system thus expanding the market to reach out to all

The study of the paper concludes that there is a significant impact on the consumption due to the impulsive buying behaviour pattern which must be restricted as there is a dire need for the presence of a fixed income or towards being financially independent to avail such services as buying practices utilizing debt will lead to a vacuum which can never be cleared. The financial literation and risk management towards the easiness to access BNPL services must be made clear to the Gen Z users.

Family communication patterns theory is based on two ratios. Higher the conversation orientation among a family encourages all it’s members to equally participate in all discussion where opinions are expressed without any bias on any topics(Thorson, 2014) .The lower the conversation orientation ratio have fewer interactions.

Conformity orientation is the degree to which the homogeneity of attitude and beliefs are emphasized among the family members. A higher conformity orientation practices interaction where homogeneity of attitudes is forced on all the members of the family and such families follow a hierarchical structure. Family interests are placed before personal or individual preferences. A lower conformity ratio promotes equality among members and lays higher preference on individual opinion. It leads to independent growth of family member.

A mother’s conversation orientation has been positively linked to their children’s decision making and the personal preferences while the conformity orientation mostly leads to confusion while taking the purchasing decisions. This paper thus sheds light on the openness of adults regarding the credit card awareness and usage.

In order to have secure and safe financial expenses; there needs to be open terms of communication with the family. Studies show that the debt for emerging adults will be at a lower limit if the communication channels a4re more open. The topics about the credit valuation and the respective balances is considered a taboo and not discussed openly about it among families thus the awareness remains to be very minimalistic.

There are contradictory studies which suggests that boys are given financial education a year earlier compared to girls and girls who are more open to communicate with their families are more financially independent compared to boys. The gender-based study on the impact of spending patterns have different aspects and dimensions which influence the spending patterns and the debt levels. The final parameter taken into consideration for the study is age. Many paper poses a argument that aged collaged students have more financial situations since parents discuss more finances with senior students and they already had the time to accumulate debts than students who have just entered the college.

The study suggests that conversation orientation plays a crucial role in openness about credit card behaviour and usage.

BNPL impacts customer in many numbers of ways as additional access to credit leads to frequent purchases resulting in higher consumption thus leading to financial constraints for individuals with limited financial reserves. The paper mainly studies the usage of BNPL and the impact it has on the user in terms of liquidity, savings and increased unsecured borrowing elsewhere down the line. (marco di maggio, 2022)

The study concludes that the individuals using BNPL are facing limited liquidity and prefer its usage to increase spending in other domains. It impacts both on the spending levels and retail composition in the market. The paper in detail colludes with the liquidity flypaper effect which is a scenario where the consumers use the service to increase the spending on retail goods. Most of the BNPL users are low to middle income individuals and it was observed that the usage is minimal in low- and high-income groups. BNPL access leads to increased chances of overdraft, low balance fees and increased use of the savings.

RESEARCH METHODOLOGY:

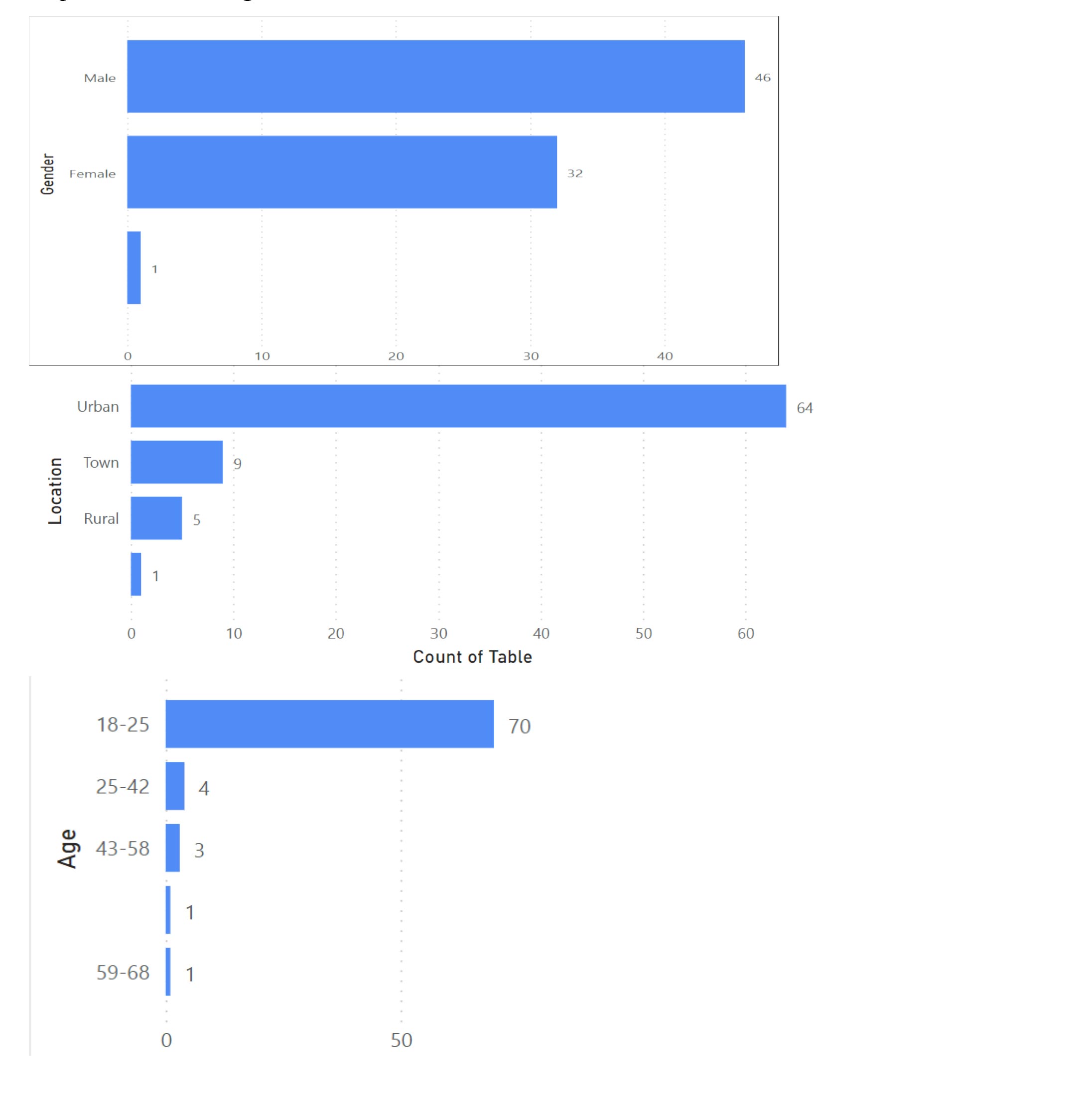

The research was conducted across all age groups thus resulting in majority of responses from student sector aged between 18-25. The total responses achieved were 80. The research was carried out through a questionnaire which consisted of seven sections and 33 questions in all. The first section is demographics which aims in knowing the demographics of the respondent to relate it to other parameters in the following up sections. The demographic section enquired about the gender, occupation, location and age.

The second section in the questionnaire was targeted to get insights about the awareness regarding BNPL, buy now pay later. This section had a series of four questions. The section mainly aims in achieving the following objectives:

ul>

The section three aims to get insights regarding the perception of BNPL among the respondents. This section had a series of 12 questions addressing the myths and view points regarding BNPL and the degree to which the respondents agree to each of the statement. The section has questions aiming for the following objectives:

The fourth section is aims to study the factors influencing the usage of BNPL. The fourth section is further divided into three sections where each section addresses each of social, psychological and economic factors influencing BNPL. Each of the section carries a series of five questions. The section addressing social factors tries to get insights about the degree or the frequency at which the topic of BNPL is discussed in social circle. The second section discusses the psychological factors influencing the usage of BNPL. The questions in this section are related to the fear every individual has in respect to achieving financial goals and the fear of debt accumulation which is contradictory with regards to impulsive spending which is associated with BNPL. The third and the last section of the questionnaire tries to get insights regarding the economic factors associated with BNPL usage by addressing questions about the frequency of payments to their debts, the debts the have accumulated and if they are saving a portion of their salary. The section also tries to understand the user’s perspective on saving and owning debts. Power BI is used to derive to interpretative charts and find the relation between two or more parameters.

ANALYSIS AND RESULTS:

DEMOGRAPHICS:

Out of the 80 respondents, 77% accounted the student population across the urban regions. This was followed by 16 respondents who are from the working section from the urban areas. The number of male respondents were 46 and the female respondents were 32. The male respondents were higher in number.

AWARENESS:

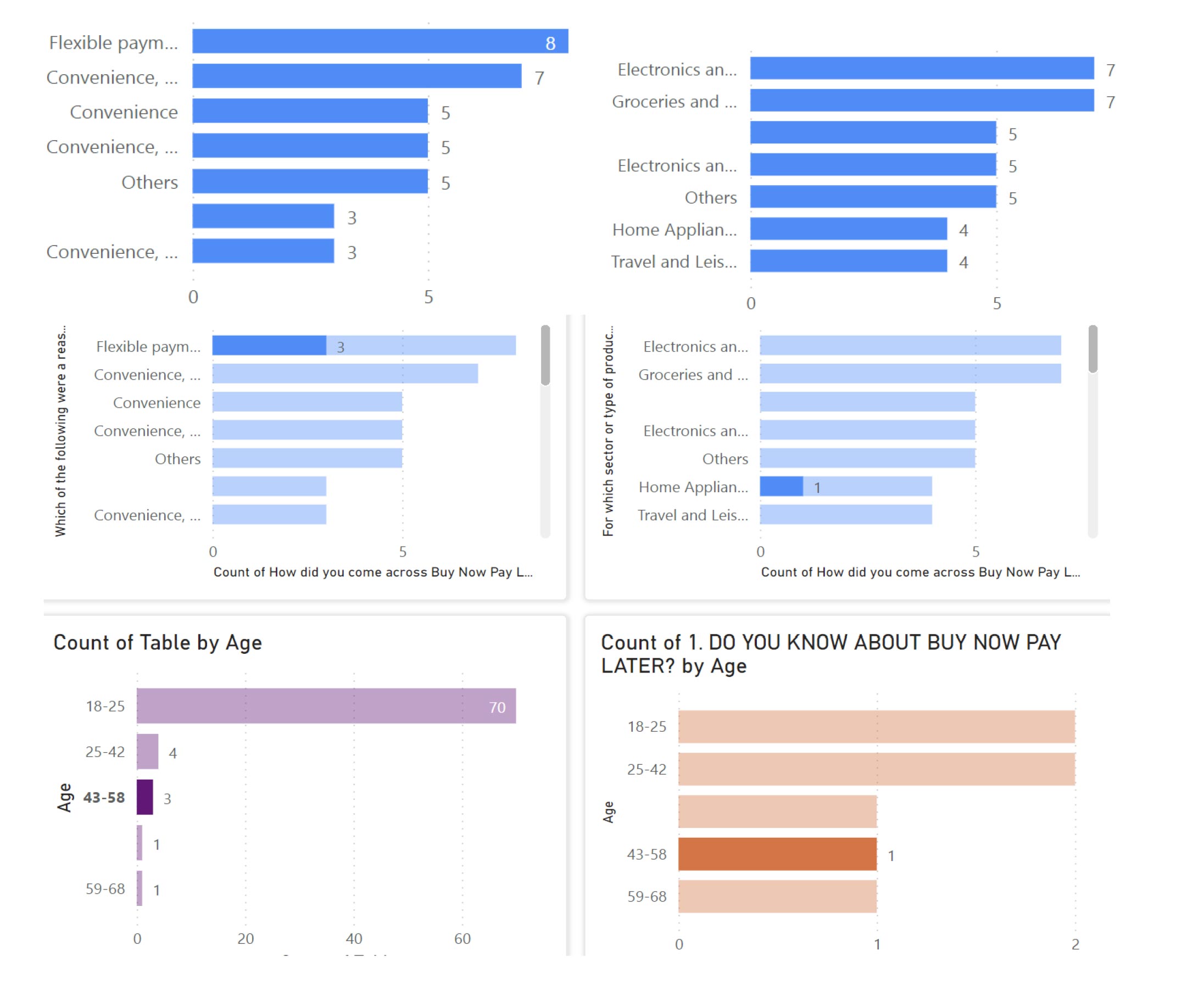

Most of the respondents were aware about the BNPL service. The consumers prefer BNPL service due to the flexible payments it provides. The younger sections of the society; which is 18-25 age section usually uses BNPL to avail electronics goods whereas most of the older sections; the Gen X and the millennials are not aware about the BNPL service which is provided and the section of millennials who are aware about the service use BNPL to purchase home appliances.

PERCEPTION AND FACTORS:

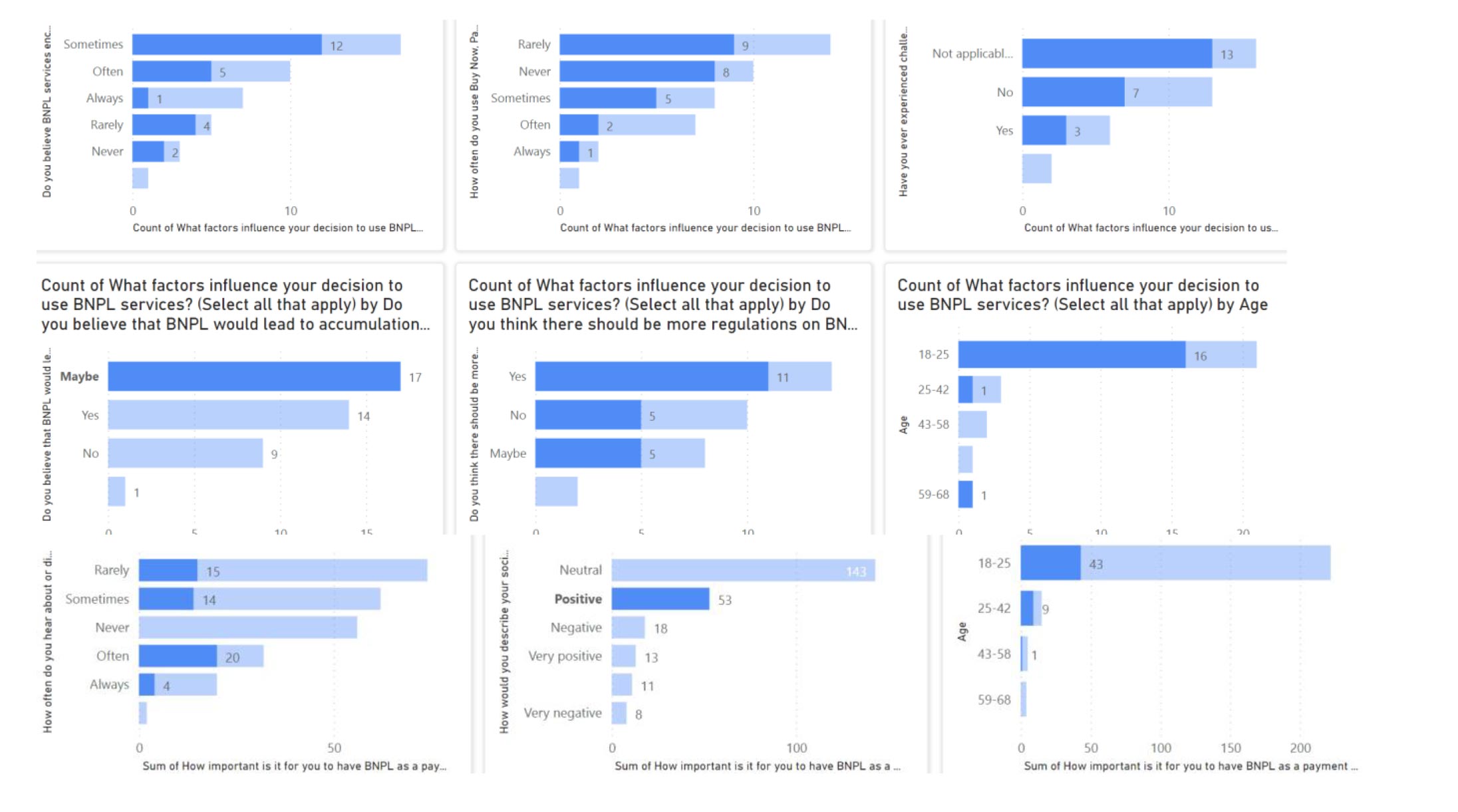

Most of the respondents strongly agree to the fact that use of BNPL is situation or scenario based and cannot be used in all cases as that would lead to impulsive spending. The impulsive spending depends on the nature of individual as well as it relates to the concept one gives importance to. The social psychological and economical factors influence the decision regarding the usage of BNPL.

The social, psychological and economic factors are discussed and interpreted using the charts. Most of the younger social circles have a positive attitude towards the usage of BNPL as they believe it can be used in few scenarios. It is not discussed very often. Most of the younger sections of the age group believe that it is very necessary to provide the option of BNPL as a service in shopping websites.

The fear of missing out often leads to impulsive spending at certain scenarios was a statement for which most of the respondents agreed. It is extremely important to have a control on the amount being spend as it influences the financial well-being of a person there are a lot of debts accumulated.

DISCUSSION AND CONCLUSION:

Most of the respondents of the questionnaire were the younger sections of the society aging between the age groups of 18-24 from the urban sector and theses respondents were majorly students. They have a positive attitude towards the usage of BNPL and it is felt necessary to use BNPL for certain sections of goods purchased which is electronics for the younger sections and the respondents from the older sections believe that it is necessary to use BNPL for purchasing goods under the section of home appliances and furniture. The impulsive spending is determined by many factors which are social, psychological and economic. The spending pattern thus being a cumulative effect of all of them. It can be analysed that BNPL is a positive tool with regards some section of goods and can be used a limited number of times to ensure there is no debt accumulation though BNPL is not encouraged to be used for day-to-day affairs or the regular groceries which are purchased.

- https://files.consumerfinance.gov/f/documents/cfpb_buy-now-pay-later-market-trends-consumer-impacts_report_2022-09.pdf

- https://www.deloittedigital.com/content/dam/deloittedigital/us/documents/offerings/offering-20230127-buy-now-pa

- https://libertystreeteconomics.newyorkfed.org/2023/09/who-uses-buy-now-pay-later/

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4085867

- https://www.linkedin.com/pulse/buy-now-pay-later-vs-traditional-credit-comparative-analysis-ann/

- https://www.linkedin.com/pulse/india-buy-now-pay-later-market-outlook-2026-ken-research-/

- https://brandequity.economictimes.indiatimes.com/blog/how-buy-now-pay-later-model-is-changing-consumer-shopping-habits-in-india/89762711