Subscribe now to get notified about IU Jharkhand journal updates!

Analysis of Equity Linked Savings Scheme (ELSS) of Public Sector Banks Mutual Funds in Pre and Post Covid -19 Period

Abstract :

Investors can make good returns by investing in different types of mutual fund schemes. For tax savers ELSS funds are one of the sources to save tax and to get long term wealth creation.

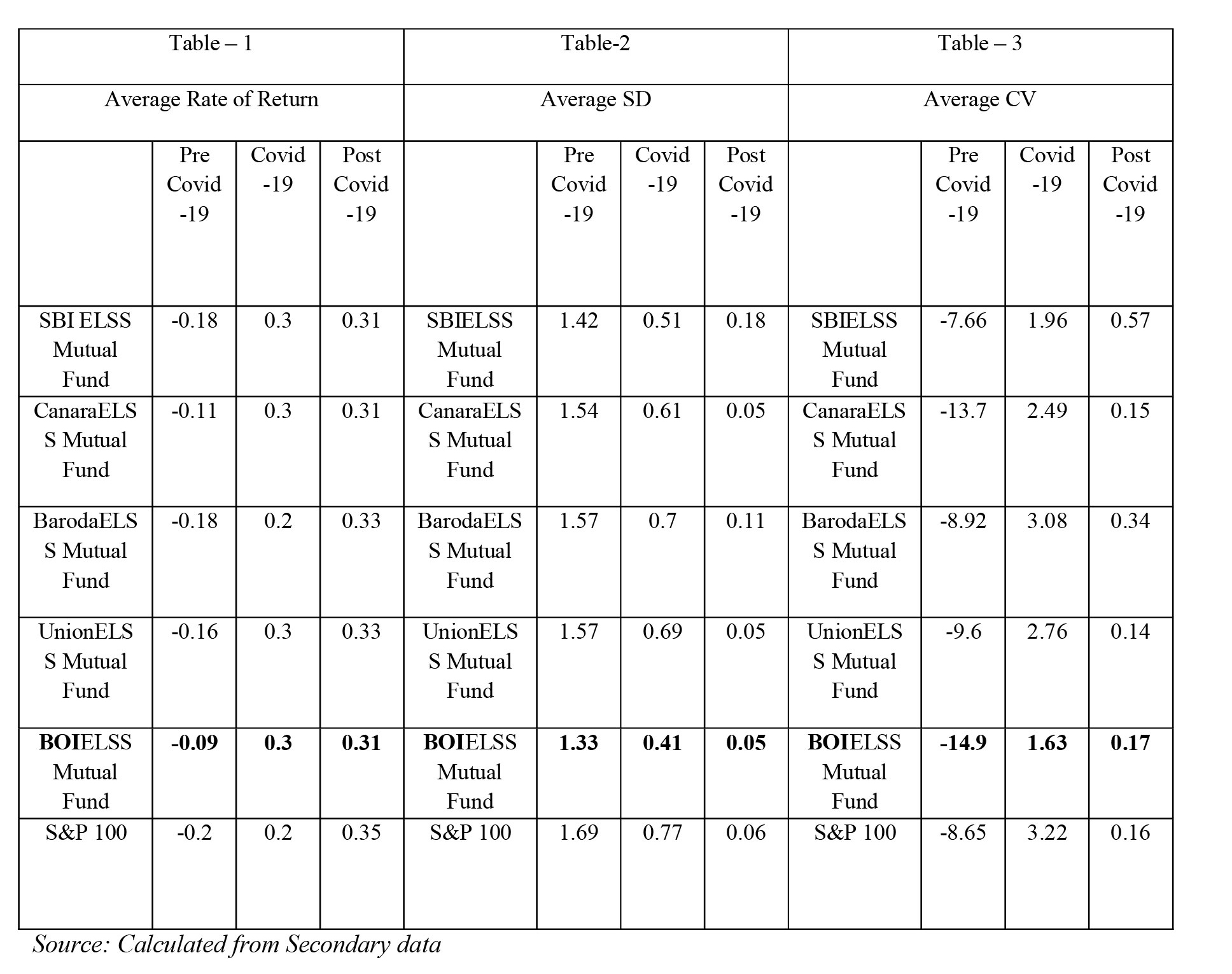

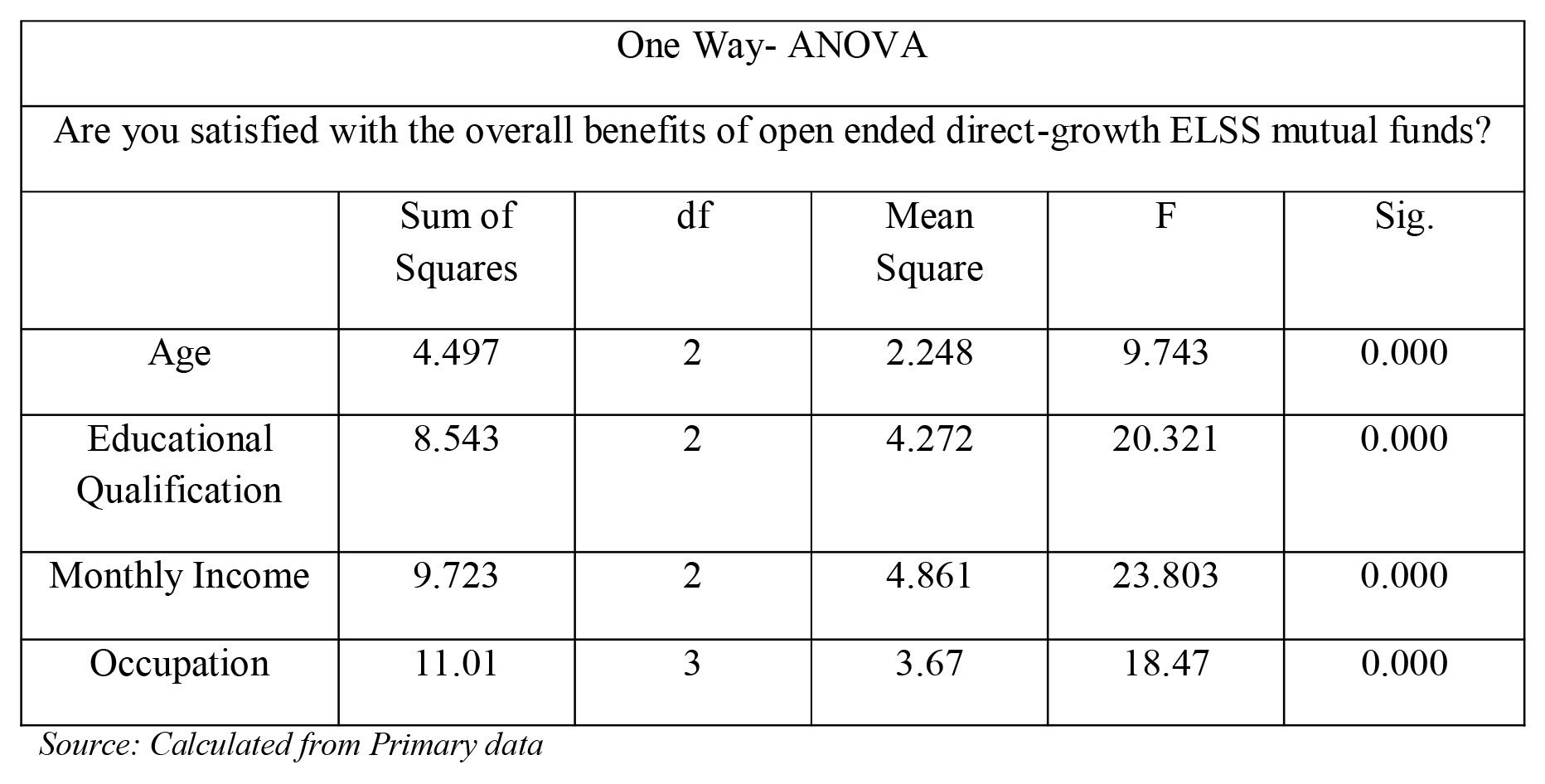

This study aims to assess the performance of the top five public sectors ELSS in India during the pre and post Covid-19 Period from (01-10-2019 to 31-12-2020) using various statistical tools like Mean, Standard Deviation (S.D.), and Coefficient of Variation (CV), as well as to analyze the mean difference of demographic variables on the satisfaction levels of Equity Linked savings scheme (ELSS) mutual fund investors in Hyderabad and its sub urban areas.A one-way analysis of variance is applied to the dataset to validate the hypothesis that was proposed for this research. Participants in open-ended tax-saving mutual funds made up the study's sample of two hundred people. The demographic factors of individual investors were taken into consideration as independent variables, and the level of satisfaction was taken into consideration as a dependent variable.In this major Covid-19 crisis, the study finds that public sector tax saving mutual fund schemes are performing very well compared to the benchmark (S&P 100 BSE). This proves that mutual fund investments are suitable for small investors. According to the findings, there is a discernible gap between the levels of satisfaction and the demographic factors. The level of education qualification, monthly income, occupation, and age of a person are key factors that have a very significant impact on the level of satisfaction they report.

This study is the first attempt by adopting ELSS mutual fund schemes of the public sector banks.

Keywords :

Equity Linked Savings Scheme (ELSS), Public Sector, Investors and Satisfaction level.1. Introduction

Now a day’s most popular investment is mutual fund investments. These mutual funds offer to investors an opportunity to invest in various diversified portfolio investment through their respective fund manager. These investments have the better advantage to offer better returns compared to fixed deposits. Through the mutual fund investments investors to achieve their financial objectives by investing in a well-adjusted debt securities and equity instruments portfolio, etc. In addition, tax saving mutual funds also provides long term benefits by investing in equities, debt and specialty funds etc.Investors can select any fund based on their investment goals and risk tolerance. High-risk investments typically yield high returns, while medium-risk investments yield medium returns and low-risk investments yield low returns. However, it is up to the investors to choose the fund that they believe has the best chance of meeting their goals. Making a mutual fund investment and reaping the benefits is certainly appealing. Are there any tax advantages to investing in mutual funds?The truth is that if a mutual fund investor invests up to Rs. 1,50,000 in a tax-saving mutual fund, they will receive tax benefits of up to Rs. 46,800 under Section 80C of the Indian Income Tax Act, 1961 (assuming a tax bracket of 30% +cess) compared to non ELSS investor.

2. Literature Review

Pastor, L. et al. (2020), during the 2020 COVID-19 crisis, studied U.S. actively-managed equity mutual funds' performance and flows. Most active funds are underperforming passive benchmarks during the crisis. Funds with high ratings for sustainability perform well, as do high star rating funds.Aruna, P. (2020), the mutual fund industry was doing pretty well until the pandemic conditions altered the whole game. In the same period in 2019, SIP contribution from January to June 2020 rose to Rs. 50.102 crores from Rs. 48.757 crores.Vijaya, K. M. et al. (2020), from their study, said that mutual fund market industry growth is significant due to the Systematic Investment Plan (SIP) inflows into the mutual fund industry lump sum even though tightening of employment and salaries.

Sakshi, T., & Ramesh, C. B. (2019),the findings of the study, the ability of investors to take risks varies according to their income level, and the study also found that certain economic factors influence the choice of funds from the perspective of the investor and there is a need for a higher level of awareness regarding mutual funds among the public in Kolkata.Nittan, A., & Sonia, C. (2019),the findings of their research, the factors of education, income, and occupation are significantly associated with the risk perception of investors in mutual funds for the purpose of making investment decisions, whereas neither gender nor age are associated.

3. Research Gap

From relevant literature, there are no studies that have been conducted on the efficiency of Equity-Linked Savings Schemes (ELSS) Mutual Funds both before and after the Covid-19 crises (01-10-2019 to 31-12-2020).In this section of the study, the gap is filled by an analysis of the performance of various Direct-Growth Equity-Linked savings schemes (ELSS) mutual funds from the public and private sectors.There has been a significant amount of research conducted on the influence that demographic profile has on the selection of mutual fund schemes. It is very important to note that the majority of the research has been done by focusing on the impact of demographics profile on Mutual Fund Schemes. However, no study has been done on the impact of demographics profile on open ended direct growth Mutual Fund Schemes. This is something that needs to be looked into.

4. Objectives of the Study

1. To analyze the performance of selected public sector Equity Linked Savings Schemes (ELSS) during the Covid-19 crises.

2. To study the mean difference between the factors of demographic and satisfaction levels.

3. To give the investors suggestions to achieve their satisfaction levels & financial objectives by selected public sector Equity Linked Savings Schemes (ELSS).

5. Hypothesis of the Study

1. There is a significant mean difference between demographic factors and their satisfaction level

6. Research Methodology

6.1 Target population: In the present study, the population represents open ended direct-growth ELSS mutual fund investors from Hyderabad, Telangana State which includes employees from different companies and banks etc.,

6.2 Geographical Region: Hyderabad, Telangana State.

6.3 Sample Design: Non-probability-purposive sampling method.

6.4 Sample Size: 200 respondents.

6.5 Sources of data:The study is based on primary data from the field study and secondary data from different sources. Primary data will be collected from the open ended direct-growth ELSS investors of the different companies and banks etc., through structured Questionnaire.

6.6 Period of the Study: To analyze the secondary data, the study considered data pertains to a 15 months period from October 1, 2019, to December 31, 2020.

Note:

• Pre Covid-19 Period – 01-10-2019 to 31-03-2020

• Covid-19 Period – 01-04-2020 to 30-09-2020

• Post Covid-19 Period – 01-10-2020 to 31-12-2020

6.7 Statistical Tools: The research has been used to analyzed by using parametric test like one way ANOVA is to be considered and average, Standard Deviation (SD) and Coefficient of Variation (CV) are also used.

7. Data Analysis & Interpretation

From the above table 1,2 &3 , we can observed that overall BOI ELSS mutual fund is performing better compared to other ELSS mutual funds in terms of more returns, less risk & moderate consistency. The risk-averse investors should consider investment in public sector mutual funds and a right way for all salaried employees to utilize their savings and to get tax benefits.

H1: There is a significant mean difference between Demographics and Satisfaction level

We can see from the table that there is a statistically significant difference between the groups when the p-value is less than 0.05. As a result, the study concluded that the levels of satisfaction based on their demographics are significantly different. Therefore, we must accept the alternative hypothesis.

8. Conclusion

The risk-averse investors should consider investment in public and private sector mutual funds and a right way for all salaried employees to utilize their savings and to get tax benefits. There no chance of default in these funds compared to stock markets. The returns from mutual funds were heavily affected by the Coronavirus epidemic. But history has shown that markets and returns from mutual funds have been steadily strengthened. Having, in this mind this study listed of selected curated public sector mutual funds that have been able to withstand these turbulent times and will rebound stronger and faster once fought against this epidemic.Age, educational qualification, monthly income, and occupation were identified as the demographic factors that have significant mean differences on their level of satisfaction by the study.Satisfaction level improved if mutual fund management takes necessary steps according to the needs of tax saving mutual fund investors based on their demographic factors changes. The result suggests that these are the factors look into by the authorities because of these factors are significantly contribute to the investor’s satisfaction level. On the basis of these results, management ought to provide their members with skill enhancement and a solid orientation program in order to attract more investments from investors into tax-saving mutual funds. The diversity of investors in terms of the demographic factors they possess can also be incorporated into skill training and orientation programs for the purpose of enhancing participants' familiarity with tax-deferred investment vehicles.

9. Suggestions

1. For small, risk-averse, and tax benefits investors BOI ELSS mutual fund is the right choice compared to other tax-saving schemes in selected public sector banks because BOI ELSS Mutual fund providing moderate returns, less risk and less volatility during Covid-19 crisis.

2. The public sector mutual funds provide high returns, less risk, and less volatility than the benchmark during the Covid-19 crisis. This shows that mutual fund markets are more significant for individual investors.

3. The result suggests that the demographic factors like age, educational qualification, occupation, and monthly incomeinvestigate by the authorities because of these demographic factors are significantly contribute to the satisfaction levels of investors. Based on this results management should do skill enhancement and a good orientation programme to their members to get more investments from the investors into the open ended direct-growth ELSS mutual funds.

References

[1] Pastor, L. et al. (2020). Mutual Fund Performance and Flows During the COVID-19 Crisis. NATIONAL BUREAU OF ECONOMIC RESEARCH working paper series. Retrieved from http://www.nber.org/papers/w27551

[2] Aruna, P. (2020). Indian Mutual Funds during COVID pandemic times. Published by Bestow Edutrex International LLP, Mumbai with ISBN: 978-93-90153-04-6, 91-103.

[3] Vijaya, K. M. et al. (2020). Indian Mutual Funds in the Times of Covid-19. Retrieved from https://www.researchgate.net/publication/345893783

[4] Sakshi, T., & Ramesh, C. B. (2019). Impact of Demographic Factors on Investment Attitude of Mutual Fund Investors in Kolkata. International Journal of Business and Management Invention, 8(3-SII), 11-18.

[5] Nittan, A., & Sonia, C. (2019). A Study on Factors Influencing the Choice of Investors and Investor’s Behaviour towards Mutual Funds. Test Engineering and Management, 81(x), 5151-5163.

[6] C. (2020c, August 13). Mutual Funds for Beginners: How to invest in mutual funds : Investment Guide for 2020. Retrieved from https://cleartax.in/s/never-invested-mutual-funds-heres-begin

[7] PersonalFN. (n.d.-c). What Is A Mutual Fund? How Mutual Funds Work? - Mutual Fund Basics Guide. Retrieved August 17, 2020, from https://www.personalfn.com/mutual-fund/what-is-mutual-fund

[8] Karvy Online. (2019c, May 2). ELSS - Know What is ELSS, Its Meaning, Features & Benefits | Karvy Online. Retrieved from https://www.karvyonline.com/knowledge-center/beginner/mutual-funds/what-is-elss

[9] Panigrahi, C. M. A., Mistry, M., Shukla, R., & Gupta, A. (2020). A Study on Performance Evaluation of Equity Linked Saving Schemes (ELSS) of Mutual Funds. NMIMS JOURNAL OF ECONOMICS AND PUBLIC POLICY, 5(1).

[10] Pathak, R. (2018). A Study on Performance Evaluation of ELSS Mutual Funds with Special Reference to Growth Funds. Journal of Emerging Technologies and Innovative Research, 5(5), 312-320.

[11] B. (2019a, October 23). What are the advantages of investing in ELSS? Retrieved from https://economictimes.indiatimes.com/industry/banking/finance/what-are-the-advantages-of-investing-in-elss/articleshow/71727910.cms?from=mdr

[12] C. (2020b, August 11). ELSS vsOther 80C Investments – Why ELSS is the Best Tax Saving Option? Retrieved from https://cleartax.in/s/elss-vs-80c-investments

[13] Wikipedia contributors. (2020c, July 15). Mutual funds in India. Retrieved from https://en.wikipedia.org/wiki/Mutual_funds_in_India