Subscribe now to get notified about IU Jharkhand journal updates!

SEBI'S Dual Approval System for Appointment of Independent Director:

Abstract :

The function of independent directors in boosting business legitimacy and governance is critical. Their participation on corporate boards ensures that decisions are made in a fair and sensible manner. They have no financial interests other than earning sitting fees for attending meetings of the companies on whose boards they serve as independent directors. For better Corporate Governance, the presence of independent directors in a prescribed proportion has become a sine qua non. While India's regulators have made significant headway in enhancing board independence, there is still one key roadblock. Despite the fact that in Indian companies, concentrated shareholding is the norm, independent directors are chosen by a majority of shareholders in the same way as other directors, giving big shareholders great power to handpick the independents. It's high time now for changing the process of appointment of independent directors ensuring that they represent all the stakeholders and not only the promoters of the company. Securities and Exchange board of India keeping in view the interest of small shareholders made recommendation in its consultation paper released in March 2021 regarding dual approval system for appointment of independent directors in India. The present paper focuses on the need of having SEBI'S dual approval system for appointment of independent directors in India.

Keywords :

Independent Director, Securities and Exchange Board of India, Corporate Governance, Promoters.1. Introduction

The office of Independent directors acts as the corner stone of corporate governance in the any country. Corporate governance aims as steering the companies in the correct direction. Success of any company heavily depends upon the quality of decision taken by the board acting on the agency theory. Office of Independent directors serves as the focal point of decision from where quality decision making emanates and they are the one who have no pecuniary interest in the company other than taking their sitting fee. Rule of majority prevails in the company form of organization and in Indian context the independent directors whose presence is required on the board for protecting the interest of minority are appointed basically by the majority shareholders ruled by the promoters of the company. It has been seen in the most of the cases that basic purpose of appointing independent directors gets defeated as the minority shareholders have a very little say in their appointment. Although India has pioneered in setting up a system of passing online proficiency test before adding the name of a person to the data bank of the independent directors but at the same time promoter's role in appointing the independent directors remains very important. Securities and Exchange Board of India in its consultation papers issued in March 2021 clearly mentioned need of adopting the dual approval system as in Israel and other advanced countries.

2. Methodology of study

Study is basically exploratory in nature. The study intends to highlight the necessity for a dual approval process for independent director appointments in India, as stated in the SEBI consultation document released in March 2021.This study is based on data collected from the secondary sources. Data has been collected from the regulatory bodies of the countries included in the study. Relevant books, journals, periodicals, research papers, clippings and excerpts of newspapers, and consultation papers have been referred.

3. Statutory provision regarding board composition in India

Structure and composition of Board Rooms of Indian Companies is governed by the Section 149 of the Companies Act 2013.

As per Section 149 of the Companies Act 2013 every company has to mandatorily appoint an individual as the director of the company. Nature and type of the company decides the number of Individual as directors comprising board. For a Public Limited Company there has to be at least three directors. In case of private companies at least two directors are required and in one Person Company even one director constitutes the valid board. Board of the company can have maximum 15 directors and if it wishes to have more than it can be done by passing special resolution.

4. Statutory Provision regarding Independent Directors in India

Companies Act, 2013

Section 149 (4) of the Companies Act, 2013 explicitly speaks about the listed companies to have at least one – third directors as independent directors. In the same section an indication is about the class or classes of companies in which strength of independent directors will be governed by the central government. Exercising the power vested central government has specified the class or classes of public companies mentioned below in the Companies Rules 4. Companies (Appointment and Qualification of Directors) Rules 2014

Rule 4 of Companies Rules, 2014 dealing with appointment and qualification of director mentions that for classes of companies mentioned below presence of two directors as an independent director is mandatory.

(i) Public Companies having paid up share capital of Rs. 10 crores or more

(ii) Public Companies having turnover of 10 crores or more

(iii) Public Companies having aggregate outstanding loans, debentures and deposits more than 50 crores.

Regulation 17(1) of SEBI (LODR) regulation, 2015

As per SEBI (LODR) Regulation composition of board of directors of all listed companies shall be as follows

There must be optimum combination of executive and non-executive directors in all listed companies. Al least one of the directors must be women director. Non-executive directors shall comprise not less than 50% of the board. Board of top 500 listed companies to have one independent women director by April 1, 2019 and board of top 1000 Listed company to have one Independent Women Director by April 1, 2020.

If the chairperson of the board is non-executive director in that case at least one third of the board shall comprise of independent directors Independent Directors. Listed entities not having regular non-executive chairperson must have 5o percent directors on its board as Independent Directors.

5. Mode of Appointment of Independent Directors in India.

In the Indian context existing provisions says that Nomination and remuneration committee recommends the name of the proposed candidates accessing the data bank of the independent directors maintained by the Ministry of Corporate Affairs. Recommended names are put before board and then are finally taken before shareholders in the general meeting. In the general meetings shareholders appoint and re appointed independent directors through special resolution.

6. Proposal of the Securities and Exchange Board of India in its consultation paper issued in March 2021.

As mentioned above in the point number 5 the present system of appointment is mostly ruled by the promoters concerning recommendation and approval. Vesting of the appointment and removal powers with promoters hinders the independence of the Independent Directors undermining the ability of taking fare decision specially when interest of the majority shareholders and minority shareholders do not coincide. Keep in view these issues SEBI proposed to adopt dual system of approval in appointment of independent directors.

Proposal says that appointment and re appointment shall be subject to dual approval taken through a single voting process and meeting following two thresholds

i) Approval of Shareholders

ii) Approval by majority of Minority

Removal of Independent directors of listed companies has also been subjected to the dual approval system.

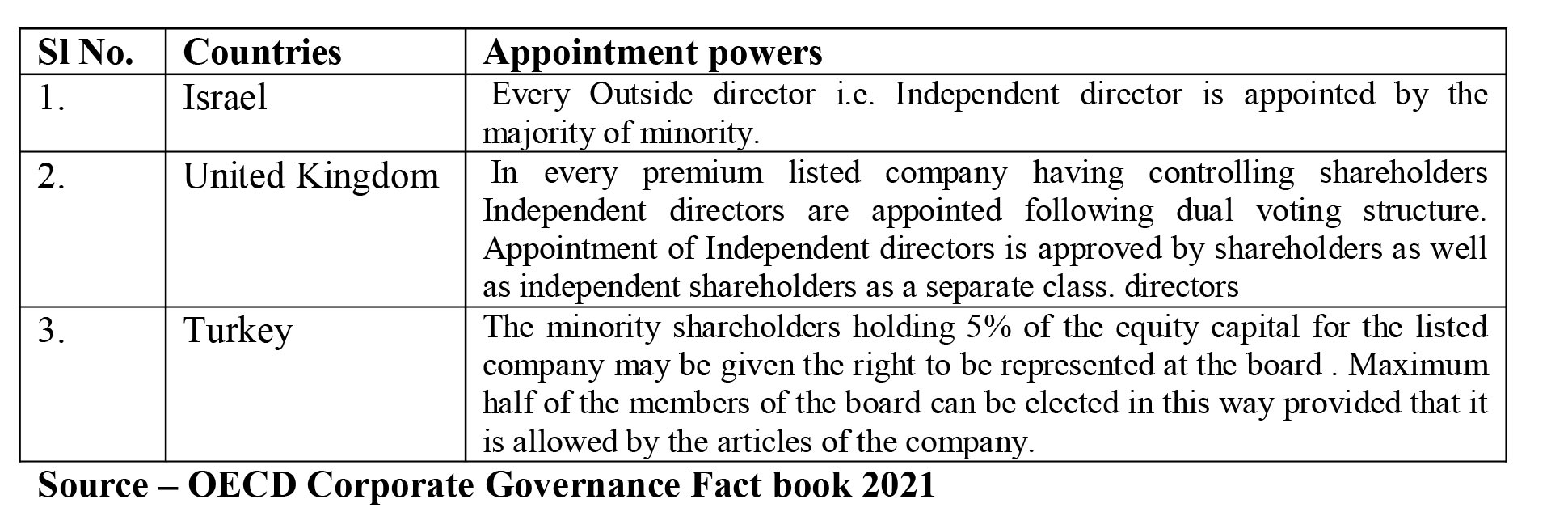

7. Countries having strong minority representation in Independent directors' appointment.

8. Grounds of opposition of dual approval process.

Number of objections has been raised against the dual approval mechanism. The most prominent objection came forward in the form of allegation that this dual approval mechanism actually goes against that majority rule principle which acts as the basic structure of the company law. Secondly it is asserted that giving major chunk of power in the hands of minority will lead to their unjust enrichment as far as power is concerned and they may use it for delaying the process or fulfilling their malafide intension. None of the objection hold water as the company law itself speaks about giving relief to minority in the case of oppression and mismanagement. Giving major chunk of power actually does not take away the power that promoters are having because it speaks of giving rights to minority without diluting the powers of majority.

9. Conclusion

Independent directors play very important role in ensuring corporate democracy. Their presence in the board of the company is basically for protecting the interest of minority shareholders. The expertise they have along with their experience improves and adds value to the decision-making process. In t he present scenario when their appointment and reappointment is basically ruled by the promoters of the company their independence remains under scanner. A very pious recommendation which came from the SEBI was vehemently opposed by the promoters lead to side-tracking and then finally dropping the proposal. It's high time now and SEBI should re-consider the proposal for ensuring fair corporate functioning leading towards an era of good governance in the letter and spirit.

References

1. UmakanthVarottil (2010) Evolution and Effectiveness of Independent Directors in Indian Corporate Governance, Volume 6, Hasting Business Law Journal

2. Nimisha Kapoor, Sandeep Goel (2019) Do diligent independent directors restrain earning management practices? Indian lessons for the global world, volume 4 issue 1, Asian Journal of Accounting Research

3. SupritiMishra (2020) Do Independent Directors Improve Firms Performance? Evidence from India, Global Business Review

4. Prof. (Dr.) G.S. Popli, Miss. RupinaPopli (2015) Corporate Governance and the Role and Responsibility of Board of Directors in India with Special Focus on Independent Directors, Elsevier

5. Companies Bare Act, 2013

6. Companies Rules, 2014

7. https://www.sebi.gov.in/legal/regulations/feb-2017/sebi-listing-obligations-and-disclosure-requirements-regulations-2015-last-amended-on-february-15-2017-_37269.html

8. https://www.oecd.org/corporate/corporate-governance-factbook.htm

9. https://indianexpress.com/article/opinion/columns/tata-mistry-corporate-dispute-nusli-wadia-sebi-appointment-removal-of-independent-directors-7403380/

10. https://www.livemint.com/news/india/sebi-moots-dual-approval-process-for-appointment-of-independent-directors-11614613260284.html

11. https://www.sebi.gov.in/reports-and-statistics/reports/mar-2021/consultation-paper-on-review-of-regulatory-provisions-related-to-independent-directors_49336.html

12. https://www.sebi.gov.in/sebi_data/meetingfiles/jul-2021/1626155485805_1.pdf

13. https://www.independentdirectorsdatabank.in/

14. https://taxguru.in/company-law/dual-approval-independent-director-hopes-ushering-era-shattered.html

15. https://economictimes.indiatimes.com/markets/stocks/news/sebi-plans-dual-approval-for-ind-directors/articleshow/81280779.cms?from=mdr

16. https://vinodkothari.com/2021/07/independent-directors-the-global-perspective/