Subscribe now to get notified about IU Jharkhand journal updates!

A Study of Customer Satisfaction's and buying preferences towards Retail Stores in and around Guwahati city of Assam

Abstract :

India's retail market is anticipated to grow from US$0.793 billion in 2020 to around US$1.5 trillion by 2030, driven by socio-demographic and economic factors such as urbanization, income growth and the rise of nuclear households. The Indian retail market is largely disorganized. The retail market has grown by around 50 between 2012 and 2020 to its current value of almost 12% of total retail. India's modern retail sector is expected to grow to 18% in GR15 by 2025. Key retail categories (by % organized retail penetration) such as apparel and accessories (18%), consumer electronics (6%), and home and living goods (6%) will lead the rise of organized retail this decade. It can be argued that FDI liberalization would bring quality and discipline to Indian retail, giving consumers more choices and choices. However, customer satisfaction and its various metrics are the key factor in the success of any retail business. Therefore, this document tries to focus on the level of customer satisfaction in organized stores and also to analyze the factors that determine the level of satisfaction.

Keywords :

Organized Retail, Liberalization, Customer satisfaction.1. Introduction

Indian retail business has surfaced united of the foremost dynamic and quick diligence due to the entry of the numerous new players, accounts 10% of national GDP and around 8% of employment rate. India is that the world's fifth-largest transnational destination within the retail house. India stratified seventy 3 within the alignment Conference on Trade and Development' Business-to-Consumer (B2C)E-commerce Indicator 2019. India is that the world's fifth-largest transnational destination in the retail house and hierarchical sixty three in World Bank's Doing Business 2020, making a prominent choice for global retail destination. In FDI Confidence Indicator, India stratified sixteen (after US, Canada, Germany, United Kingdom, China, Japan, France, Australia, Switzerland, and Italy). As per Kearney Research, India's retail business is projected to grow at a slower pace of 9 over 2019-2030, from US$ 779 billion in 2019 to US$ billion by 2026 and overUS$1.8 trillion by 2030. India hierarchical sixty 3 at intervals the globe Bank's Doing Business 2020 publication. India ranked seventy three within the alignment Conference on Trade and Development' Business-to-Consumer (B2C) E-commerce Indicator 2019. India's direct commercialism business would be priced at US$2.14 billion by the tip of 2021. consumer commerce in Asian nation inflated toUS$245.16 billion within the third quarter

of 2020 fromUS$192.94 billion within the alternate quarter of 2020. India is that the fifth-largest and most well- liked retail destination encyclopedically. The country is among the absolute stylish in the world in terms of per capita place of business vacuity. India's retail sector is passing exponential growth with retail development passing not simply in major metropolises and metros, but put together in tier two and three metropolises. Healthy profitable growth, dynamic demographic profile, adding disposable income, urbanization, changing paperback tastes and preferences are variety of the factors driving growth at intervals the unionized retail request in Asian country. Indian on- line grocery request is computable to exceed deals of concerning Rs. whole number (US$3.19 billion) in 2020, witnessing a giant jump of 76 over the former time. in line with India Conditions and analysis (Ind-Ra), domestic union food and grocery retailers are anticipated to increase by 10 year to year basis in FY22, with organized retailers and e-commerce accessible to cash in on the carry on with demand for essentials. India's population is taking to on- line retail big way. By 2024, India's e-commerce business is pre-vision to extend by 84 to US$ 111 billion, driven by mobile shopping, that is projected to grow at 21 annually over posterior four times. In 2020, the foremost common payment ways that on- line were digital hold alls (40), followed by credit cards (15) and dis benefit cards (15). on- line penetration of retail is prognosticated to reach10.7 by 2024 versus4.7 in 2019. In FY21, digital deals at intervals the wholenon-cash retail payments volume inflated to98.5 versus97.0 in FY20. According to data released by the Ministry of Statistics & Programme Implementation (MoSPI), India's Consumer Price Index (CPI) based retail inflation increased to 6.30% in May 2021, up from 4.2% in April 2021 as both food and fuel inflation outpaced expectations. However, the retail inflation eased to 5.3% in August 2021.

E-Retail has been a boon during the pandemic and according to a report by Bain & Company in association with Flipkart ‘How India Shops Online 2021' the e-retail market is expected to grow to US$ 120-140 billion by FY26, increasing at approximately 25-30% p.a. over the next 5 years.

India's retail industry

By 2025, India will be the third-largest country in terms of its consumption reaching to Rs. 27.95 lakh crore (US $ 400 billion). Adding participation from foreign and private players has given a boost to Indian retail assiduity. Because of its price competitiveness feature, the nation attracts mass retail players to use it as a source basis. Global retailers similar as Walmart, GAP, Tesco and JC Penney are adding their sourcing from India and are moving from third- party buying services to establishing their own wholly possessed/ wholly managed sourcing and buying services in India. The Government of India has introduced reforms to attract Foreign Direct Investment (FDI) in retail assiduity. The Government has approved 51 FDI in multi-brand retail and 100 FDI in single- brand retail under the automatic route, which is anticipated to give a boost to Ease of Doing Business and Make in India schemes, with plans to allow 100 FDI in E-commerce. Accretive FDI inrushes in the retail sector stood atUS$3.61 billion between April 2000 and June 2021. India's retail sector attractedUS$6.2 billion from colorful private equity and adventure capital finances in 2020. According to a report by PGA Labs and Knowledge Capital, investors had put inUS$1.4 billion into D2C companies between 2014 and 2020.

The sector recorded an investment of US$ 417 million in 2020 In October 2021, the RBI blazoned plans for a new frame for retail digital payments in offline mode to accelerate digital payment relinquishment in the country. According to the Ground Zero Series findings of the consulting establishment Red Seer, the retail sector is anticipated to recover 80 of pre-Covid profit by end-2020. India will come a favorable request for fashion retailers on the reverse of a large youthful adult consumer base, adding disposable income and relaxed FDI morals. Numerous fin-tech companies are contending for their presence in original stores. In May 2020, Paytm blazoned a US$ 1 billion fidelity programme and launched online tally services for kirana stores in India. Other fin-tech companies similar as PayNearby, Phonepe, BharatPe and Mswipe introduced different services for small shop possessors, enabling better digital payments and delivery options at these stores. For illustration, Amazon partnered with original stores to give a platform for numerous small shops and merchandisers on its Amazon business. While, Walmart has its own network of 28‘ stylish-priced' stores serving original stores across the country. Flipkart Wholesale, a digital B2B business, blazoned strengthening of its commitment towards growth and substance of kiranas and MSMEs by boosting force chain structure and enhancing employment openings. During the online gleeful trade in October 2020, the Indiane-commerce enterprises - Flipkart, Amazon, Myntra and Snapdeal - together vended goods worthUS$3.1 billion. Increase of online shoppers, pave the way to online request for retail activities in India to be being projected to reach US $ 350 billion in 2030, from a projection of US $ 55 billion in 2021.

Literature review

Das Prasun (2009) reveal that literature on customer satisfaction is voluminous and spans many areas such as marketing, management and accounting. Iacobucci et al. (1994, 1995) provided precise definitions of services quality versus customer satisfaction. They contend that service quality must not be confused with customer satisfaction, however satisfaction is a positive outcome of providing sensible service. Ittner and Larcker (1998) provided empirical proof at the customer, business-unit and firm-level that numerous measures of financial performance (including revenue, revenue modifications, margins, turn over on sales, market price of equity and current earnings) are measured absolutely with customer satisfaction. Sulek et al. (1995) found that customer satisfaction absolutely affects sales per labor hour at a series of 46 retail stores. Anderson et al. (2004) found a positive association between customer satisfaction at the corporate level and Tobin's Q (a long run measure financial performance) for malls and super markets. Babakus et al. (2004) linked customer satisfaction to product and service quality within retail stores and found that product quality had a six important impact on store- level profits.

Objectives

- To study the different stores getting preferences before buying from the organized retail outlets.

- To analyze the satisfaction level of the customers.

Research methodology

The survey was carried out among different class of customers who were the regular and occasional buyers in the organized retail stores in Guwahati city, having both - Single Brand retail stores and Multi Brand retail stores. The study comprises of both the retail stores. The primary data is collected through survey method. Required information was collected by filling up a schedule by the respondents. The schedule contains open ended questions and it was simple to the respondents.

Altogether 550 schedules were distributed among the customers/ respondents. However, 500 respondents have provided the required information in systematic and cleared way, the rest numbers of schedules, the information found were mismanaged and some were found missing in various ways. Therefore, the sample size taken in this study was finally 500 for our conveniences. The study was conducted during the period August 2021 to November 2021, for a period of three months.

As all the possible items are considered for research, the sampling method adopted was convenience sampling. For analysis and interpretation, only primary data was used. However for conclusion and recommendations both primary and the secondary data, verbal knowledge and information obtained from respondents were also included. The data collected from these sources were analyzed by using percentage age analysis only. A standard schedule was prepared for the collection of data from various respondents. The schedule was designed in such a way that the aim of collecting essential information for the study would meet the set of objectives.

Analysis and Discussion

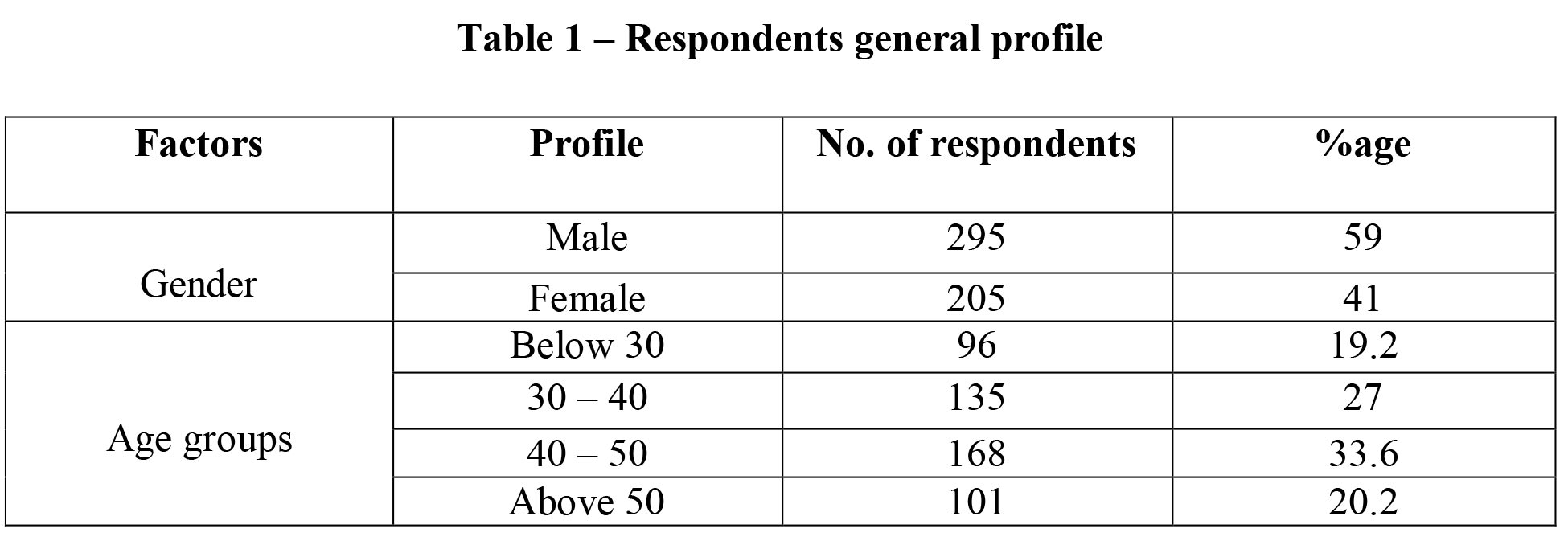

Overall Profile of the Respondents

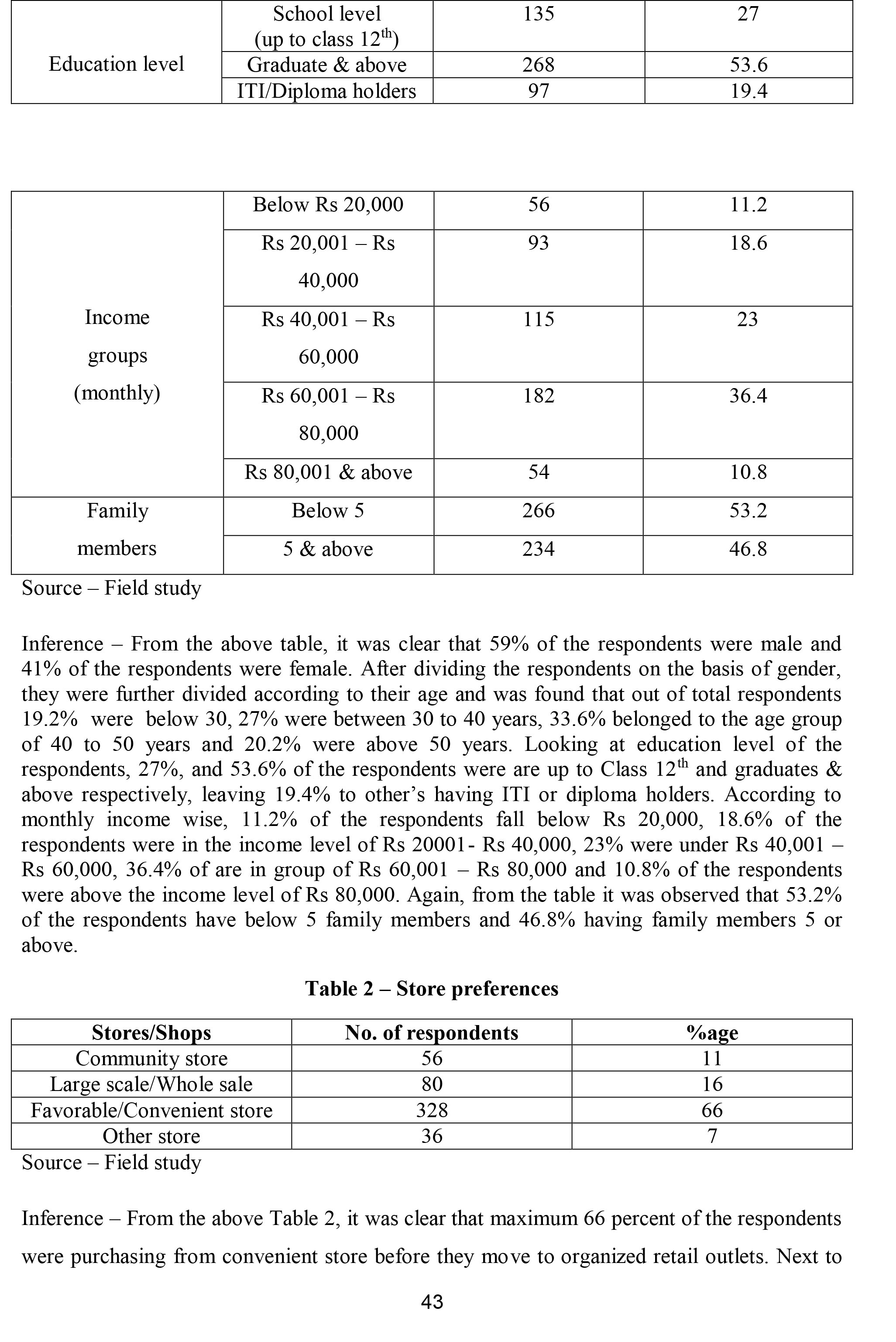

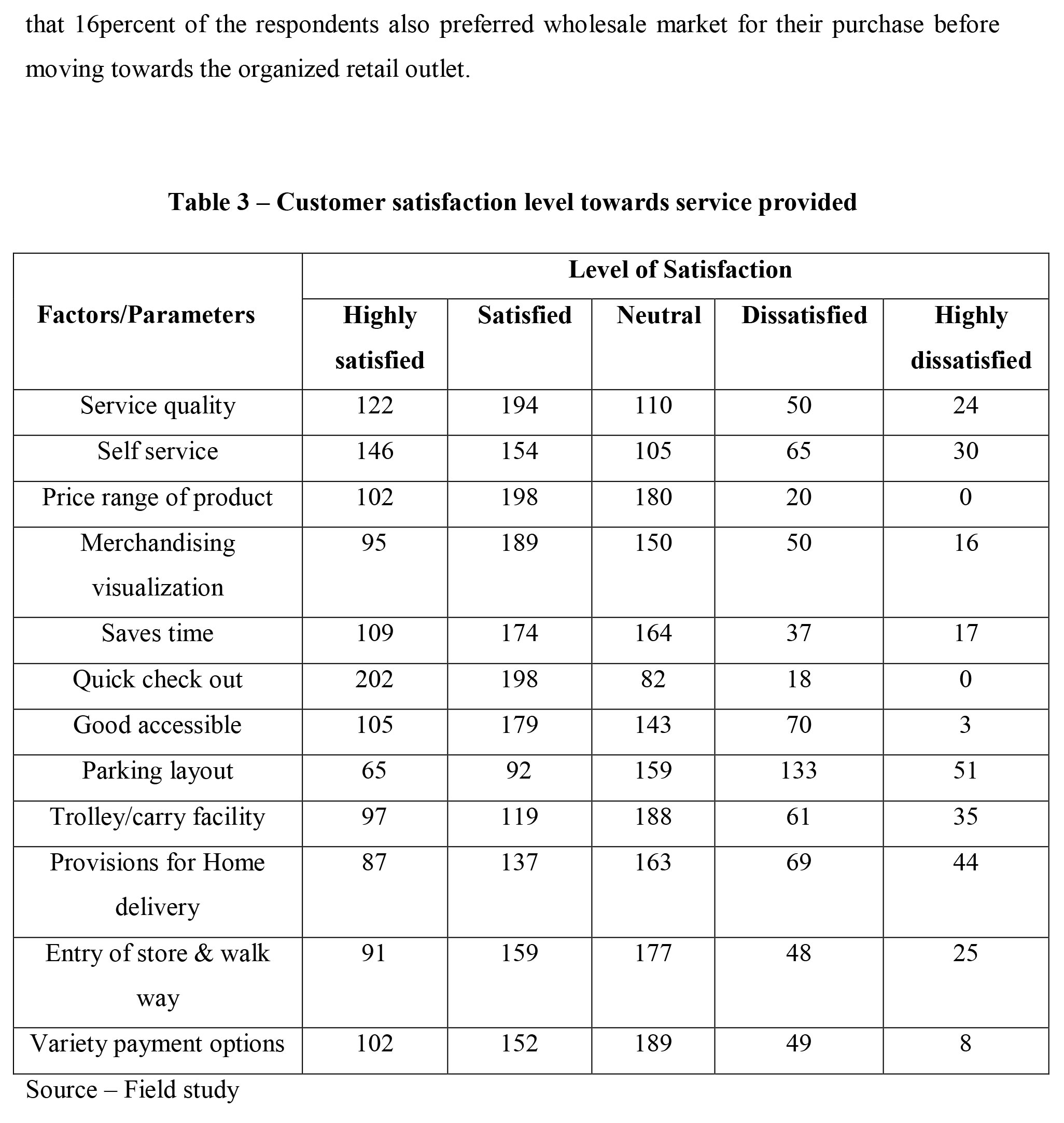

Inference - From the above table it was observed that 194 respondents were satisfied by the service quality and 24 were also dissatisfied with the quality provided. 146 customers were satisfied with the prospect of self service, whereas, 65 and 30 are dissatisfied and highly dissatisfied respectively with the self service prospect. Regarding price range of product 198 were satisfied, but 180 were neutral. 189 were satisfied due to visual merchandizing, whereas 50 were also dissatisfied with it. Respectively, 174 and 164 were satisfied and neutral due to the time saving nature of the organized retail outlet. Moreover, 202 were highly satisfied due to the quick check out procedure whereas 18 were dissatisfied. Again, in an interesting move it was found that 159 were neutral and 133 were dissatisfied by the parking provisions of the stores. Again, 137 were satisfied and 163 are in neutral category in terms of home delivery services of the organized retail stores. Regarding payments options, respectively 152 and 189 of the customers were satisfied and in neutral due to the availability of the different mode of payments available in the organized retail stores.

Findings

The main findings of the study are that, an organized retail outlet provides better quality and avenues for customers, most of the customers were satisfied with the quality of service provided by the organized retail stores in Guwahati. They were satisfied with self service, product price, visual merchandising, provision of home delivery and quick checkout. The customers feel that the store layout that can be easily accessible to find the products. A good number of respondents

were dissatisfied with the parking facility of the organized retail stores and various payments options available with the retail stores.

Conclusion

This study reviews that the customers prefer organized retailing over others types retailing. The establishment of such organized retail stores in Guwahati city had proved to be successful as it fulfilled the needs of the customers. As an expansion, such stores were being established in Guwahati city and other places. Hence, it's significant for such stores to cater to the needs of customer for its long run. Also, most of them were satisfied with the quality of service, price and product range of the goods provided by organized retail stores. Satisfaction of customers in retail service was an important criterion for a marketer to understand for further strategic decision. However, it would have had been better if we could show the relationship/association between the satisfaction level towards quality of services and education level of the customers or correlation of the income level of respondents and their average monthly purchase etc. at the retail stores.

References

- Anderson et al. (2004). Customer Satisfaction and Shareholder Value. Journal of Marketing, Volume: 68 issue: 4, (172-185), retrieved June 6, 2019 from https://doi.org/10.1509/ jmkg.68.4.172.42723.

- Babakus et al. (2004). Linking Perceived Quality and Customer Satisfaction to Store Traffic and Revenue Growth. Decision Sciences, 35(4): (713-737), retrieved June 06, 2019 from https://doi.org/10.18551/rjoas.2017-11.42.

- Das, Prasun, (2009). Prediction of retail sales of footwear using feed forward and recurrent neural networks. Journal of Neural Computing and Applications, May 2007, Volume 16, (4-5). Springer-Verlag.

- Dhar, P.K. (2014). Indian Economy: Its Growing Dimensions, Kalyani Publishers. 15th Enlarged Edition.

- Iacobucci et al. (1994, 1995). Distinguishing Service Quality and Customer Satisfaction: The Voice of the Consumer, Journal of Consumer Psychology, volume 4, Issue 3, (277- 303), retrieved June 07, 2019 from https://doi.org/10.1207/s15327663jcp0403_04.

- Ittner and Larcker, (1998). Performance implications of strategic performance measurement in financial services firms in Accounting, Organizations and Society. Volume 28 (7-8), October-November 2003, (715-741), retrieved June 07, 2019 from https://doi.org/ 10.1016/S0361-3682(03)00033-3

- Kothari,C.R. (2008). Research Methodology: Methods & Techniques, New Age International (p) Ltd. Publishers, 2 nd Edition.

- Sulek et al. (1995). The Impact of a Customer Service Intervention and Facility Design on Firm Performance. Management Science 41(11):1763-1773 · November 1995, retrieved June 03, 2019 from https:// 10.1287/mnsc.41.11.1763.